2Checkout Review

- 04th Feb, 2025

- | By Linda Mae

- | Reviews

2Checkout is a globally recognized payment processing platform that enables businesses to accept online payments from customers worldwide. Founded in 2006, it has grown into a robust solution catering to merchants in over 200 countries and territories. The platform is designed to support a variety of business models, including e-commerce, digital services, and subscription-based offerings, making it a versatile choice for businesses looking to expand internationally. Lets read more about 2Checkout Review.

One of 2Checkout’s standout features is its ability to process multiple currencies and payment methods, including credit and debit cards, PayPal, and alternative payment options. This flexibility allows businesses to offer localized checkout experiences, improving conversion rates and customer satisfaction. Additionally, its extensive global reach makes it particularly attractive for companies looking to sell digital goods, software, and SaaS products to an international audience.

In 2020, 2Checkout was acquired by Verifone, a well-known name in the payment solutions industry. This acquisition strengthened its capabilities by integrating with Verifone’s extensive payment infrastructure. The platform now operates under the Verifone umbrella, benefiting from its security, compliance, and innovation in payment technology.

In addition to payment processing, 2Checkout offers companies advanced tools like fraud prevention, tax and compliance oversight, and subscription billing. Its intuitive interface and automated features assist merchants in optimizing their operations while ensuring security and adherence to international regulations.

Even with its extensive features, 2Checkout faces some difficulties. Certain users indicate elevated transaction fees and periodic account holds, which may pose issues for businesses functioning with narrow profit margins. Nonetheless, for businesses in need of a globally integrated, comprehensive payment solution, 2Checkout continues to be a powerful player in the competitive payment processing landscape.

Company Background | 2Checkout Review

2Checkout was founded in 2006 as an online payment processing solution aimed at helping businesses accept digital payments globally. Over the years, it has evolved into a comprehensive e-commerce payment platform, supporting multiple currencies, payment methods, and business models. Initially gaining traction among small and mid-sized online merchants, 2Checkout expanded its services to accommodate SaaS providers, digital goods sellers, and global enterprises.

A significant milestone in 2Checkout’s history occurred in 2020 when it was acquired by Verifone, a leading provider of POS and payment solutions. This acquisition integrated 2Checkout’s digital commerce capabilities with Verifone’s extensive payment infrastructure, allowing businesses to access a more seamless, secure, and globally connected payment ecosystem. Under Verifone’s ownership, 2Checkout has continued to expand its offerings, focusing on global payment processing, fraud prevention, tax and compliance management, and subscription billing.

The acquisition brought both advantages and challenges. On the positive side, Verifone’s resources and industry expertise enhanced 2Checkout’s security and compliance capabilities, making it a more reliable solution for international merchants. However, some long-time users have reported changes in service structure, including revised pricing models and customer support challenges post-acquisition.

At present, 2Checkout maintains a strong standing in the payment processing industry, especially among companies that function on a global scale. It is commonly utilized by software firms, SaaS vendors, and digital content creators because of its robust international payment features. Nevertheless, it competes against major players such as PayPal, Stripe, and Adyen, which provide comparable features along with different pricing models and integration options.

Although there are mixed opinions about its transaction fees and account approval process, 2Checkout continues to be a well-regarded entity in the payment sector, appreciated for its broad international reach, various payment methods, and compliance management resources.

Key Features and Services

2Checkout offers a range of features designed to facilitate online payments, manage subscriptions, enhance security, and provide data-driven insights for businesses operating globally.

Payment Processing

2Checkout offers a variety of payment methods, such as credit and debit cards (Visa, Mastercard, American Express, Discover, JCB, etc.), PayPal, and several alternative payment solutions based on the region. Thanks to its worldwide presence, the platform allows companies to process payments in more than 200 countries and regions, accommodating over 100 currencies and various localized payment options to enhance conversion rates.

Subscription Management

For businesses offering subscription-based services, 2Checkout provides recurring billing solutions that allow merchants to automate payments and manage customer subscriptions effortlessly. Users can customize billing cycles, trial periods, and pricing structures to fit different business models. The platform also includes dunning management tools, which help recover failed transactions and reduce involuntary churn.

Fraud Prevention

Security is a priority for 2Checkout, which includes PCI DSS Level 1 compliance to ensure secure payment processing. It also utilizes AI-driven fraud detection tools to monitor transactions in real time, minimizing chargebacks and fraudulent activities. Additionally, it offers 3D Secure authentication to enhance security for card transactions.

Integration and Compatibility

2Checkout works with more than 120 eCommerce platforms, such as Shopify, WooCommerce, Magento, and BigCommerce. It also offers a RESTful API, allowing developers to create tailored integrations and streamline workflows. The presence of plugins and SDKs guarantees seamless integration in various business settings.

Reporting and Analytics

The platform offers detailed transaction reports, sales insights, and subscription analytics to help merchants track revenue and customer behavior. The dashboard provides a user-friendly interface for monitoring key performance metrics, making it easier for businesses to optimize their payment processes and improve financial decision-making.

Pricing Structure

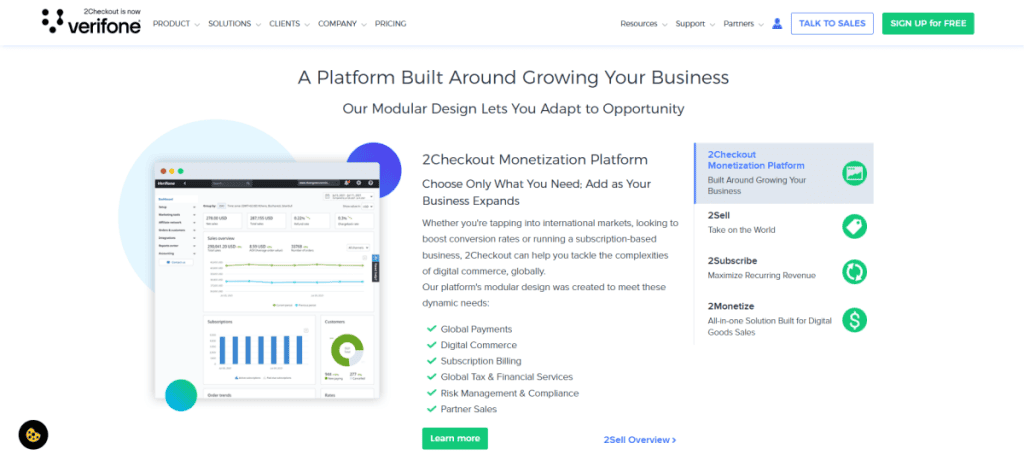

2Checkout offers a tiered pricing model with three main plans: 2Sell, 2Subscribe, and 2Monetize, each catering to different business needs.

2Sell: Designed for businesses selling physical and digital products globally, this plan has a transaction fee of 3.5% + $0.35 per sale.

2Subscribe: Geared toward businesses with subscription-based models, this plan includes recurring billing and automated subscription management at 4.5% + $0.45 per sale.

2Monetize: A more advanced plan for digital goods, software, and SaaS businesses, featuring global tax and compliance management along with payment processing at 6.0% + $0.60 per sale.

Additional Costs

Beyond the base transaction fees, 2Checkout applies several additional charges:

Chargeback Fees: If a transaction is disputed by the customer, merchants face a $20 chargeback fee per incident, which aligns with many industry competitors.

Cross-Border Fees: Transactions processed in a different currency or country may incur a 2-3% additional fee, depending on the location.

Wire Transfer Fees: Merchants withdrawing funds via wire transfer may encounter extra processing fees, which vary by country and bank.

Comparison with Industry Standards

When compared to rivals such as Stripe (2.9% + $0.30 for every transaction) and PayPal (3.49% + a fixed fee for each transaction), 2Checkout’s starting rates are relatively higher, especially for businesses dealing with subscriptions and digital products. The absence of a flat-rate pricing structure and extra cross-border charges can render it less economical for companies with substantial transaction volumes. Nevertheless, for businesses requiring international tax compliance, multi-currency functionality, and comprehensive fraud protection, 2Checkout’s pricing could be warranted.

While the pricing structure offers flexibility, potential users should evaluate their sales volume and international operations to determine whether 2Checkout is the most cost-efficient choice for their business.

User Experience

An effortless and user-friendly experience is crucial for every payment processing platform. 2Checkout strives to offer a simple onboarding experience, an easy-to-use dashboard, and attentive customer support, although user opinions differ.

Onboarding Process

Creating an account with 2Checkout entails a multi-step registration procedure that necessitates businesses to provide key information, such as company information, payment options, and compliance papers.

Approval is not instant—merchant accounts must undergo a verification process, which can take anywhere from a few hours to several days, depending on the business type and risk level.

Some users have reported delays or requests for additional documentation, particularly for high-risk industries or international merchants.

Dashboard and Interface

2Checkout provides a clean, structured dashboard that allows users to manage transactions, subscriptions, and reports easily.

The interface is designed to be user-friendly, with clear navigation menus and access to key business insights.

Merchants can track sales, refunds, chargebacks, and revenue trends directly from the dashboard.

Some users feel the dashboard lacks the modern UI/UX design seen in competitors like Stripe or Square.

Customer Support

Reliable customer support is crucial when dealing with payment processing issues, and 2Checkout offers multiple communication channels.

Support is available through phone, email, and live chat, though response times can vary.

Enterprise users often receive quicker assistance, while smaller businesses sometimes report delays or difficulty reaching support representatives.

The knowledge base and FAQs are available, but some users find the documentation insufficient for resolving complex issues.

Pros and Cons

Similar to any payment processing system, 2Checkout possesses both advantages and disadvantages. Although it performs well in global payment acceptance, subscription management, and security, it also entails increased transaction fees and possible account-related issues.

Advantages

2Checkout provides several benefits that make it a strong choice for businesses operating internationally.

Global Payment Acceptance – Supports payments in over 200 countries and 100+ currencies, making it ideal for businesses looking to expand globally.

Comprehensive Subscription Management – Offers recurring billing, flexible subscription plans, and dunning management, making it well-suited for SaaS and subscription-based businesses.

Robust Security Features – Maintains PCI DSS Level 1 compliance, AI-driven fraud detection, and 3D Secure authentication, ensuring secure transactions and minimizing chargeback risks.

Multiple Payment Methods – Accepts credit/debit cards, PayPal, and various local alternative payment methods, improving customer conversion rates.

Tax and Compliance Management – Automatically handles global taxes, VAT, and regulatory compliance, reducing the burden on businesses selling internationally.

Disadvantages

Despite its benefits, 2Checkout has some drawbacks that businesses should consider.

Higher Transaction Fees Compared to Competitors – Charges between 3.5% to 6.0% + $0.35 to $0.60 per transaction, which is higher than Stripe (2.9% + $0.30) and PayPal (3.49% + fixed fee).

Reports of Held Funds and Account Terminations – Some users have experienced account holds, frozen funds, or sudden terminations, particularly for businesses flagged as high-risk.

Limited Support for High-Risk Industries – Businesses in high-risk sectors (e.g., adult content, gaming, financial services) may struggle to get approved or face stricter restrictions.

Customer Support Concerns – Some merchants report slow response times and difficulty resolving disputes, particularly for smaller businesses.

While 2Checkout is a powerful tool for global merchants, businesses should carefully evaluate its pricing and policies before committing.

Customer Feedback and Reviews

2Checkout has received a mix of positive and critical reviews from users across various platforms, reflecting both its strengths and challenges.

Summary of User Reviews

On platforms such as Gartner Peer Insights, TrustRadius, and GetApp, users value 2Checkout for its reliability, security attributes, and international presence. Numerous companies emphasize their capacity to manage international payments effectively, with some claiming that fraud prevention systems have safeguarded them from chargebacks and conflicts. The platform is also noted for its strong API and abundance of features, making it a favored option for SaaS and subscription-oriented companies. Nevertheless, typical issues involve account freezes, slow fund withdrawals, and difficulties with customer service.

Common Praises

Many users commend 2Checkout’s global reach, allowing businesses to accept payments in multiple currencies and payment methods across over 200 countries. The feature-rich platform, including subscription management, automated billing, and tax compliance tools, is frequently highlighted as a key advantage. Additionally, fraud prevention and security measures such as AI-driven risk management and 3D Secure authentication receive positive feedback from merchants who have successfully avoided fraudulent transactions.

Common Complaints

Despite its benefits, users report issues with account management, such as sudden account terminations or withheld funds, which can be frustrating for businesses. Customer support responsiveness is another frequent complaint, with some users finding it difficult to get timely assistance for urgent issues. Additionally, 2Checkout’s fee structure is considered higher than competitors like Stripe and PayPal, making it less cost-effective for some merchants.

2Checkout’s Responsiveness to Feedback

2Checkout proactively interacts with user input, addressing issues regarding fund holds, account approvals, and delays in customer support. The company recognizes the necessity for more stringent verification procedures to avert fraud and maintain compliance, yet it has faced criticism for occasionally failing to offer comprehensive explanations for account restrictions. Although it strives to tackle issues, a portion of users believe that the replies could be more clear and compassionate.

Competitor Comparison

2Checkout operates in a competitive payment processing market alongside industry leaders like PayPal, Stripe, and Shopify Payments. Each platform offers unique features and pricing models, making them suitable for different business types.

Comparison with PayPal, Stripe, and Shopify Payments

PayPal is one of the most widely used payment processors, offering ease of use, buyer protection, and broad customer trust. However, PayPal’s transaction fees (3.49% + fixed fee per sale) are similar to 2Checkout’s pricing but can be higher for international transactions. Unlike 2Checkout, PayPal is more commonly used for peer-to-peer payments and has a less customizable checkout experience.

Stripe is known for its developer-friendly API, lower fees (2.9% + $0.30 per transaction), and advanced integrations. It offers strong customization options, making it ideal for businesses with tech expertise. However, Stripe’s global reach is not as extensive as 2Checkout’s, and it does not provide built-in tax and compliance management for international merchants.

Shopify Payments is tailored for Shopify store owners, integrating seamlessly with the platform while avoiding third-party transaction fees. Unlike 2Checkout, Shopify Payments has no additional fees for Shopify merchants, but it lacks the global payment flexibility and subscription management features that 2Checkout offers.

Differentiating Features and Pricing

2Checkout distinguishes itself with its extensive global presence, accommodating over 100 currencies and localized payment options across more than 200 nations. Moreover, its subscription management features surpass those of PayPal and Shopify Payments, rendering it an appealing choice for SaaS and digital product enterprises. Nonetheless, 2Checkout’s costs (ranging from 3.5% to 6.0% per transaction) are typically more expensive than the standard rates of Stripe and PayPal, which may be a disadvantage for companies with large transaction volumes.

Suitability for Various Business Types

Best for global merchants: 2Checkout’s multi-currency support and compliance tools make it ideal for international sellers.

Best for subscription-based businesses: With automated billing and dunning management, 2Checkout is a strong choice for SaaS and digital services.

Not ideal for high-risk industries: Unlike PayPal and some Stripe-supported processors, 2Checkout is more restrictive on high-risk businesses, leading to potential account holds.

Conclusion

2Checkout serves as a robust payment processor for international enterprises and subscription-oriented models, providing multi-currency capabilities, fraud prevention, and tax compliance resources. Nonetheless, elevated fees, worries about account holds, and varying customer support feedback could be disadvantages. Companies requiring global access and subscription oversight will gain advantages, but budget-conscious sellers ought to evaluate other options.

FAQs

What types of businesses benefit most from using 2Checkout?

2Checkout is ideal for global eCommerce businesses, SaaS providers, and subscription-based services that require multi-currency support and automated recurring billing. It is especially useful for digital goods, software sales, and international merchants needing tax compliance and fraud protection tools.

How does 2Checkout handle international transactions and currencies?

2Checkout supports 100+ currencies and payments in over 200 countries, offering localized payment methods and automatic currency conversion. It also manages international taxes and compliance to simplify cross-border transactions.

What are the contract terms and cancellation policies?

2Checkout operates on a pay-as-you-go model, meaning no long-term contracts. Merchants can cancel at any time, but withdrawal of funds and account closure may require verification and compliance checks.