The Best QuickBooks Online Integrations and Apps in 2023

- 27th Oct, 2023

- | By max

- | QuickBooks

Effectively managing your finances is crucial for your business, whether for personal or professional endeavors. And it is not an easy task. Luckily, tools like QuickBooks are available, serving as virtual accountant to help you streamline bookkeeping tasks. With QuickBooks, you can regain control of your finances and save valuable time.

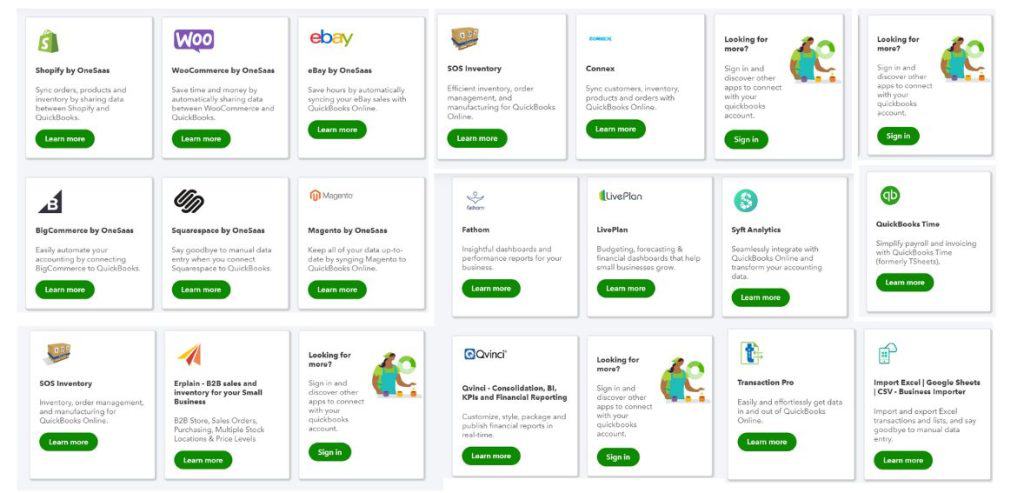

What makes it stand out is its compatibility with over 750 QuickBooks Online integrations and apps, each contributing to your business administration. In this guide, we’ll discuss the 12 top QuickBooks enterprise integrations and QuickBooks apps that offer the most value for your day-to-day operations. Without further delay, let’s explore the 12 best QuickBooks app integrations.

Table of Contents

ToggleWhat Is The Need For QuickBooks Online Integrations?

What makes QuickBooks stand out is its compatibility with over 750 integrations, each contributing to your business administration. In this guide, we’ll discuss the 12 top QuickBooks enterprise integrations and QuickBooks apps that offer the most value for your day-to-day operations. Without further delay, let’s explore the 12 best QuickBooks app integrations.

QuickBooks offers seamless integration with a wide array of applications. Many of these apps streamline manual processes, automating tasks like transferring sales data from your Amazon account to QuickBooks, managing inventory, overseeing projects, and tracking business expenses. They can also empower you to execute additional functions.

In essence, when you link QuickBooks Online with another software solution, you can effortlessly transfer data, whether through automated or manual means, between your QuickBooks account and the connected application, creating a bidirectional synchronization.

Benefits Of QuickBooks Integration

Integrating third-party software platforms with QuickBooks brings significant time savings by eliminating tedious manual data entry tasks. QuickBooks seamlessly integrates with over 750 popular business apps, streamlining your accounting processes and ensuring that all data is consolidated within one central source of truth.

Consequently, users who leverage QuickBooks integrations:

- Save time and resources dedicated to hours of data entry

- Experience less stressful month-end closes

- Enhance the accrual process

- Implement improved operational and financial controls

- Enhance digital approval workflows

Top 8 Integrations Of QuickBooks In 2023

MessageDesk

- Pricing: Starting From $14 per month

MessageDesk serves as a cloud-based SMS text messaging software designed to streamline communication for businesses operating in professional services, field management, and medical sectors. By utilizing this platform, supervisors can effortlessly craft personalized messages using pre-set templates and distribute them to specific contacts or groups, depending on the organization’s needs.

With MessageDesk, companies can import and update customer information, as well as export contact lists in CSV format. The software also supports the scheduling of recurring text messages for appointment reminders and other crucial notifications. Additionally, team members can maintain a comprehensive record of past interactions, incorporate custom fields within contacts, and efficiently categorize them using the smart groups feature.

Notably, MessageDesk facilitates seamless QuickBooks online integrations with a range of third-party applications, including QuickBooks Online.

Key MessageDesk Features:

- Two Way Messaging

- Notifications And Alerts

- API

- Auto-Responders

- CRM

- Automated Responses

- Contact Database

- Communication Management

Pros And Cons Of MessageDesk

Pros Of MessageDesk

- Time-Saving Features

- Excellent Customer Service

- Intuitive User Interface

- Effective Automation

- User-Friendly Design

Cons Of MessageDesk

- Sluggish Performance

- High Cost

Method:CRM

- Pricing: $28 to $49 per month

Method:CRM provides businesses with a fully customizable Customer Relationship Management QuickBooks app, seamlessly integrated with all versions of QuickBooks, ensuring efficient lead and customer management.

As a cloud-based CRM, Method:CRM allows access to customer information and insights from anywhere. Its integration with QuickBooks Desktop facilitates automated data synchronization, enabling smooth and streamlined operations. By hosting QuickBooks on the cloud, the entire business process becomes accessible online, ensuring secure, centralized data storage accessible remotely.

Key Method:CRM Features:

- Managing leads effectively

- Streamlined customization processes

- Seamless integration with various applications

- Efficient sales management

- CRM tailored for QuickBooks

Pros And Cons Of Method:CRM

Pros Of Method:CRM

- Intuitive interface

- Well-organized layout

- Intelligent design

- Smooth integration with QuickBooks

- Effective tracking of contacts, leads, and opportunities

Cons Of Method:CRM

- Initial user may find it slightly challenging to navigate

- Limited customization options for users

Connex

- Pricing: Starting From $239 per month

Connex provides advanced QuickBooks automation tailored for ecommerce vendors on platforms like Shopify, ShipStation, or Amazon. Compatible with both QuickBooks Online and Desktop editions, its user-friendly interface ensures accessibility for all. With Rules Engine, users can personalize field mapping in QuickBooks, including product and customer matching. Simplify your QuickBooks reconciliation process with an automated match deposit tool, enabling you to focus on growing your business rather than spending time on manual data entry.

By automating the synchronization of your ecommerce orders and inventory with QuickBooks, Connex streamlines your business management across multiple selling channels from a single dashboard. No more manual synchronization of orders; Connex does the work for you, ensuring your financial reports are always up-to-date.

Key Connex Features:

- Versatile Payment Methods

- Efficient Document Management

- Accelerated Reconciliation

- Simplified Payment Handling

Pros And Cons Of Connex

Pros Of Connex

- User-friendly and smooth operation

- Reliable performance

- Eliminates the need for double-entry

- Prevents overselling

- Flexible in its functionalities

Cons Of Connex

- Issues with API integration

- Dull interface design

Zapier

- Pricing: $20 per month

Zapier serves as a tool that facilitates the connection between various applications to create automated workflows. With the setup of a Trigger and Action, you can smoothly transfer specific data from one application to another. For instance, integrating QuickBooks with Salesforce allows for the automatic recording of new QuickBooks contacts within Salesforce.

Fundbox offers a streamlined application process, swift decisions, and transparent pricing, enabling you to swiftly determine if you qualify for a revolving line of credit. This grants you direct access to the financial resources essential for your business growth.

Key Zapier Features:

- Short-term loans spanning 24 to 52-week repayment periods

- Minimal credit checks and application requirements

- Business lines of credit of up to $150,000 with fewer eligibility prerequisites

Pros And Cons Of Zapier

Pros Of Zapier

- Swift approvals, often within 24 hours

- Short repayment periods

- Simple application procedures with minimal eligibility criteria

Cons Of Zapier

- Requires weekly payments

- Limited to short-term payment terms

QuickBooks Time

- Pricing: $4 per month (Per Person)

QuickBooks Time functions as an application for employee time tracking and scheduling, streamlining the process for employees to log their work hours, clock in and out, and monitor time allocated to specific projects or clients. QuickBooks online integrations with QuickBooks Time ensures automatic synchronization of this data, enhancing the accuracy and efficiency of payroll processing.

Moreover, the automation of time tracking and payroll procedures reduces the likelihood of errors when calculating employee hours, wages, and taxes. This time-saving process minimizes the need for manual data entry and mitigates the risk of inaccuracies, ultimately saving businesses valuable time and resources.

Furthermore, coupling QuickBooks Time with QuickBooks grants businesses immediate access to real-time insights into employee time and labor expenses. This feature facilitates improved workforce management, enables better control over labor costs, and aids in identifying areas where staffing levels may need adjustments.

Key QuickBooks Time Features:

- Mobile App equipped with GPS functionality

- Streamlined Payroll and Invoicing processes

- Seamless Integration with QuickBooks

- Efficient Job and Shift Scheduling capabilities

- Access to Real-Time Reports for informed decision-making.

Pros And Cons Of QuickBooks Time

Pros Of QuickBooks Time

- Extensive T-sheets functionality

- Automated Data Synchronization

- Easy Report Generation

Cons Of QuickBooks Time

- Clock-Out Problems

- Bug Troubleshooting Challenges

Avalara AvaTax

- Pricing: Starting From $19 per month

Avalara presents businesses with a comprehensive tax automation solution, Avalara AvaTax. This cloud-based platform facilitates tax calculation, filing and remittance of returns, and ensures adherence to document management requirements. It offers an efficient and precise method for managing sales tax compliance.

At times, businesses encounter challenges in calculating sales tax and VAT for their products. Avalara AvaTax provides a secure connection that automates these calculations. When invoice details are entered at the Point of Sale (POS), it generates a QuickBooks file containing verified customer data and applicable tax rates. Subsequently, Avalara AvaTax seamlessly adds the tax as the final item on the invoice.

Key Avalara AvaTax Features:

- Streamlines the process of Sales Tax Calculation

- Simplifies Tax Compliance Procedures

- Reduces the Risk of Audits

- Offers Real-Time Tax Rate Lookup

Pros And Cons Of Avalara AvaTax

Pros Of Avalara AvaTax

- Excellent Customer Service

- Streamlined Tax Filing Process

- Facilitation of Tax Exemptions

- Support for Monthly, Quarterly, and Yearly Submissions

- Simple Setup Process

Cons Of Avalara AvaTax

- High Cost

- Occasional Glitches in Excel Sheets

Expensify

- Pricing: $5 per month (Per Person)

Expensify serves as an efficient expense management for QuickBooks apps, allowing businesses to effortlessly track, record, and handle their expenses both online and offline. With seamless integration with QuickBooks Online, it ensures smooth data transfers and consolidation, minimizing the need for manual intervention.

The platform offers comprehensive capabilities including expense tracking, bill payments, invoice generation, payment collection, travel planning, and corporate credit card management, all consolidated within a single application. Its SmartScan feature enables easy receipt reporting, swift approval, next-day reimbursements, and seamless synchronization with accounting software. Moreover, the Expensify Card facilitates swift expense reporting and corporate card reconciliation, ensuring a hassle-free experience, all at no cost.

Key Expensify Features:

- Convenient receipt scanning

- Hassle-free corporate card reconciliation

- Real-time expense report generation

Pros And Cons Of Avalara AvaTax

Pros Of Expensify

- Streamlines expense tracking

- Effortless receipt tracking with one-click photo scanning

- Automated status reports for convenience

- Simple and user-friendly dashboard interface

Cons Of Expensify

- Difficulty in uploading multiple screenshots for one expense

- Confusing report interface at times

Gusto

- Pricing: Starting From $46 per month

This business management software offers a comprehensive suite of features, including payroll management, onboarding, time tracking, and attendance monitoring, among others. It provides access to a diverse range of insights and reports, enabling businesses to make informed decisions.

Additionally, it facilitates the creation of employee surveys, aiding in the assessment of employee satisfaction and identification of potential areas of improvement within the organization.

Key Gusto Features:

- Efficient 401(k) tracking for seamless financial management

- Direct deposit capabilities for convenient payment processing

- E-Verify/I-9 forms to streamline the onboarding process

- Electronic form management for enhanced administrative efficiency

- Check printing functionality for easy financial transactions

- Employee database management for comprehensive personnel oversight

- Employee handbook creation for standardized company policies

- Deduction management for seamless financial record-keeping

Pros And Cons Of Gusto

Pros Of Gusto

- Outstanding customer service for reliable support

- Cost-effective model for efficient budget management

- Free trial options for risk-free exploration

- Reminder and alert functionalities for improved task management

Cons Of Gusto

- Limited customization options for tailored configurations.

ACCTivate!

- Pricing: Starting From $666 per month

This comprehensive inventory management software, designed as a supplement to QuickBooks, stands out as one of the most advanced and adaptable solutions in its category.

Integrated seamlessly with QuickBooks, it offers a wide array of high-end features, including real-time collaboration among users, instant visibility of changes, efficient project tracking, and much more. ACCTivate! empowers the accounts department with simplified control over various inventory-related tasks and activities.

Key ACCTivate Features:

- Advanced barcoding software for streamlined inventory management

- Efficient management of bills of materials, kitting, and assemblies

- Comprehensive tracking of inventory task activities

- Effective catch weight management for precise weight monitoring

- Robust credit management for enhanced financial control

- Customer management functionalities for improved customer relations

- Dropshipping software for efficient order fulfillment

Pros And Cons Of ACCTivate

Pros Of ACCTivate

- Real-time data availability for prompt decision-making

- Centralized data management for enhanced accessibility and organization

- Transparent processes for improved accountability and oversight

- Easy setup for quick implementation and use

- Free trial options for risk-free exploration and assessment

Cons Of ACCTivate

- Certain permissions are restricted, limiting certain user controls

- Lack of vendor control for comprehensive vendor management

- Considered expensive compared to alternative solutions

Synder

- Pricing: Starting From $48.80 per month

Synder is an intuitive platform that accurately reflects the cash flow of your business, tracking the movement of funds from your payment gateway or e-commerce store to your bank account. By seamlessly synchronizing individual sales and expense transactions into your clearing account, it ensures a comprehensive overview of your financial activities.

When payouts occur, Synder efficiently manages the transfer process from the clearing to the checking account, providing a streamlined accounting experience.

Key Synder Features:

- Real-time analytics and reporting for immediate insights

- Automated accounting and reconciliation for hassle-free management

- Quick and efficient invoicing capabilities

- Seamless import of online payments for comprehensive tracking

- Intelligent data categorization for organized financial records

Pros And Cons Of Synder

Pros Of Synder

- User-friendly interface for easy navigation and operation

- Customization options for tailored financial management

- Value for money with comprehensive features and benefits

- Social media integration for enhanced connectivity and outreach

- Dedicated customer service for reliable support and assistance

Cons Of Synder

- Initial setup may be challenging for some users

- Lack of a free version for trial or basic usage

- Navigation within the platform can be complex and tricky at times.

SmartVault

- Pricing: $28 to $56 per month

SmartVault specializes in the efficient storage of documents, catering specifically to the needs of accountants. Its seamless QuickBooks online integrations allows for easy attachment of various documents, from quotations to invoices, providing a convenient and organized experience.

Notably, the platform prioritizes the security of these documents, ensuring that sensitive information remains protected at all times. SmartVault’s strong security measures contribute to its reputable standing in the industry.

Key SmartVault Features:

- Effortless online document storage for easy access and retrieval

- Secure file sharing ensuring data confidentiality

- Customizable client portal for personalized branding

- Convenient document request list for streamlined communication

- Integrated eSignature feature for efficient document processing

Pros And Cons Of SmartVault

Pros Of SmartVault

- AI-enabled capabilities for enhanced functionality

- Robust security protocols ensuring the safety of stored data

- Compatibility with iOS devices for flexible usage

- User-friendly interface facilitating seamless navigation

Cons Of SmartVault

- Editing documents can be challenging and may require additional effort

- Customer service may not always meet expectations, leading to potential issues with support.

Billbeez

- Pricing: $28 to $56 per month

Billbeez integration for QuickBooks offers a comprehensive platform for managing your clients’ invoices online, providing a real-time financial overview with notifications for any outstanding bills. The system streamlines the process of locating invoices, facilitating smoother bill payments for your clients. By centralizing data, Billbeez reduces the need for excessive emails and phone calls, ensuring that all parties have access to the same information.

Empower your clients with greater control and a deeper understanding of their financial status, giving your business a competitive advantage. Billbeez prioritizes the security of financial data, adhering to the highest industry standards for data security and fraud protection.

Key Billbeez Features:

- Efficient sending of bills and receipts for seamless communication

- Controlled approval processes for smooth workflow management

- Support for multi-currency transactions for global accessibility

- Receipt management for organized financial tracking

- Spend control features for efficient expense management

- Convenient attachment options for enhanced document management

Pros And Cons Of Billbeez

Pros Of SmartVault

- AI-enabled capabilities for enhanced functionality

- Robust security protocols ensuring the safety of stored data

- Compatibility with iOS devices for flexible usage

- User-friendly interface facilitating seamless navigation

Cons Of SmartVault

- Editing documents can be challenging and may require additional effort

- Customer service may not always meet expectations, leading to potential issues with support.

How To Select The Best QuickBooks Integrations?

Before selecting QuickBooks add-on integrations, it’s crucial to consider several key factors that can impact your business’s accounting efficiency. These factors will help you make informed decisions that align with your company’s growth and operational needs.

Scalability: As your business expands, the add-on integrations you choose must accommodate the growing volume of data seamlessly. It’s important to assess whether the chosen integration can handle the expected surge without significantly increasing costs or requiring premium plans for essential functionalities.

Price: Opting for cost-effective spend management solutions is a common preference among businesses. Evaluating the value for money provided by the add-on integration application is essential. Consider factors such as your company’s size, location, required features, customization options, and support levels to determine the overall price.

Multi-Currency Functionality: In today’s global market, many businesses conduct transactions in multiple currencies. Ensuring that your QuickBooks add-on supports multi-currency functionality is vital for facilitating international trade and seamless financial operations across different currencies.

Industry-Specific Functionality: Each business has unique accounting and bookkeeping requirements based on its industry and operational processes. It’s essential to identify the specific needs of your business and select an add-on integration that caters to those requirements. For instance, if your company frequently involves travel management, look for QuickBooks integration that supports travel management software to streamline the process for your staff.

Conclusion

In the ever-evolving landscape of financial management, the integration of QuickBooks with various third-party applications has become an indispensable asset for businesses. With a plethora of options available, businesses can streamline their accounting processes, enhance efficiency, and gain valuable insights for informed decision-making.

The importance of selecting the right QuickBooks integration cannot be overstated. Scalability, pricing, multi-currency functionality, and industry-specific features are pivotal considerations when choosing the best-suited integration for your business needs. By carefully assessing these factors and selecting the appropriate add-on, businesses can pave the way for seamless financial management, improved productivity, and sustainable growth in the dynamic marketplace of 2023.

Frequently Asked Question

The cost of QuickBooks apps varies based on the specific software version you choose. For a single user license of the QuickBooks Desktop app, the price ranges between $250 and $400, with additional fees for any add-ons or extra features. If your business has multiple users, QuickBooks provides an Enterprise plan for up to 30 users, starting at approximately $1,700 annually.

On the other hand, the QuickBooks Online app is available from just $20 per month, offering 24/7 customer support and a mobile app for convenient business management on the go.

QuickBooks boasts an extensive array of integrations with various software. This includes accounting and financial applications, inventory management tools, payroll services, tax filing solutions, customer relationship management (CRM) software, e-commerce platforms, and other enterprise applications.

These integrations empower business owners to handle their financials using QuickBooks while leveraging the features provided by third-party software.

QuickBooks apps cater to a diverse range of users, including small business owners, accountants, bookkeepers, nonprofit organizations, freelancers, consultants, startups, and entrepreneurs. Whatever your role, QuickBooks has solutions to streamline and manage your financial tasks efficiently.