Moolah Review

- 10th Aug, 2024

- | By Linda Mae

- | Reviews

Moolah is a leading player in the payment processing sector, committed to providing smooth and safe transaction options. It is especially recognized for its specific services that meet a range of business requirements, from small businesses to big corporations. Moolah’s unique method and focus on customer needs have established it as a trustworthy option for companies looking for effective payment processing services. Let’s dig deeper into the Moolah Review.

Company Background | Moolah Review

Moolah was founded with the goal of making payment processing easier for businesses. Its beginning was motivated by the necessity to offer a clear and affordable solution in a sector frequently troubled by hidden charges and convoluted pricing systems. Throughout the years, Moolah has developed, consistently incorporating cutting-edge technologies to improve its service offerings.

The leadership team at Moolah consists of experienced professionals who have a lot of knowledge in the financial and payment processing industries. Key personnel including Darrin Ginsberg, Mark Rasmussen, and Kevin Weel lead the company with valuable expertise and strategic insight. Their guidance has played a crucial role in guiding Moolah towards expansion and creativity.

Moolah is headquartered in Capistrano Beach, California. This strategic location supports its operations and allows it to effectively serve clients across various regions. The company also maintains a robust online presence, providing support and services through its website and customer service channels. By having both a physical and online presence, Moolah can serve a diverse range of companies, from small local shops to large multinational corporations.

Features and Services

Moolah provides a wide variety of features and services designed to meet the various requirements of businesses, guaranteeing secure and effective payment processing. Here is a detailed examination of the main characteristics that Moolah offers.

Secure Transactions

Moolah places a strong emphasis on security to protect sensitive payment information. The platform utilizes advanced encryption measures to secure data during transactions, preventing unauthorized access. Additionally, Moolah follows PCI compliance, meeting the strict guidelines established by the Payment Card Industry Data Security Standard in order to protect cardholder information. This adherence guarantees that companies utilizing Moolah can rely on the platform to uphold strong security measures and safeguard their clients’ data.

Multi-Currency Support

To facilitate international transactions, Moolah offers multi-currency support, allowing businesses to accept payments in various currencies. This feature is particularly beneficial for companies that operate globally, as it simplifies handling international transactions and managing exchange rates. Moolah ensures accurate and transparent currency conversions, which helps businesses provide a seamless payment experience for their international customers.

Mobile Payments

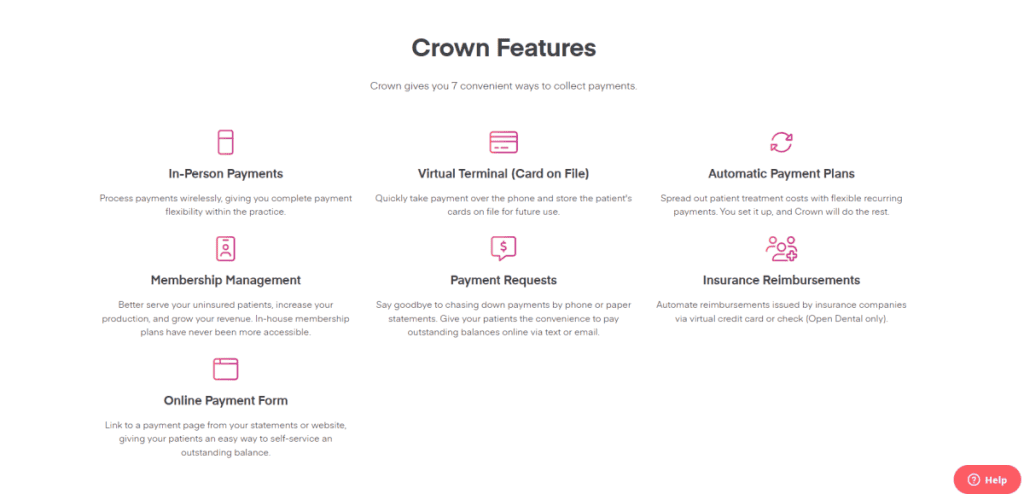

Moolah’s mobile payment solutions enable businesses to process transactions on-the-go. The mobile app is designed to integrate seamlessly with various mobile devices, providing flexibility and convenience. This feature allows businesses to accept payments anywhere, enhancing customer experience and expanding sales opportunities beyond traditional brick-and-mortar stores.

Recurring Billing

Moolah’s recurring billing feature is indispensable for businesses that provide subscription-based services. It enables businesses to establish automated recurring payments, guaranteeing that customers receive regular bills without the need for manual involvement. This functionality boosts cash flow and improves customer satisfaction through a seamless payment process.

Fraud Detection

Moolah employs advanced fraud detection tools to protect businesses from fraudulent activities. The platform uses real-time fraud monitoring to detect and mitigate suspicious transactions promptly. By leveraging sophisticated algorithms and machine learning techniques, Moolah can identify potential fraud patterns and take preventive measures, thereby ensuring secure transactions for both businesses and customers.

Customizable Invoices

Moolah provides a strong invoicing system that enables businesses to generate and personalize invoices based on their requirements. This function enables compatibility with commonly used accounting programs, making financial management more efficient. Personalized invoices assist businesses in upholding a professional reputation and guaranteeing the clarity and accuracy of billing details.

Real-Time Reporting

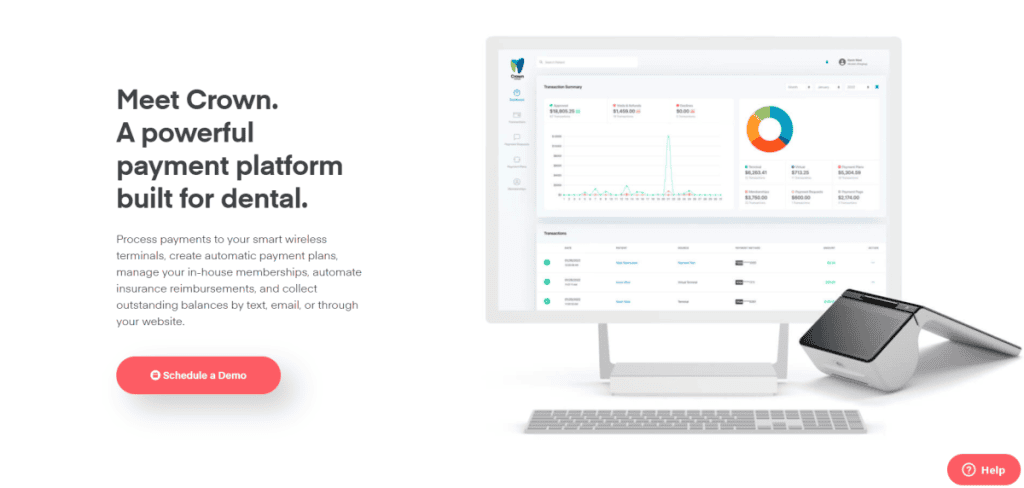

The real-time reporting feature in Moolah provides businesses with access to various types of reports that help track financial performance. These reports offer insights into transaction histories, sales trends, and other critical metrics. Real-time data enables businesses to make informed decisions quickly, enhancing operational efficiency and strategic planning.

API Integration

Moolah provides extensive API integration capabilities, allowing businesses to seamlessly incorporate its payment solutions into their existing systems. The available APIs are designed to be user-friendly, ensuring that integration is straightforward and efficient. This flexibility helps businesses customize their payment processing workflows to suit their unique requirements.

Chargeback Management

Managing chargebacks may present difficulties, however Moolah provides resources to manage disputes and chargebacks efficiently. The platform offers support for businesses to decrease chargebacks by pinpointing and resolving the underlying issues. Effectively managing chargebacks is crucial for maintaining financial stability and enhancing customer relationships.

Virtual Terminal

Moolah’s virtual terminal is a versatile feature that enables businesses to process payments remotely. This functionality is particularly useful for companies that need to take payments over the phone or via mail order. The virtual terminal supports various payment methods, providing a flexible solution for different business models.

Customer Data Management

Moolah ensures secure storage and management of customer data, adhering to data privacy regulations. The platform’s robust data protection measures help businesses maintain customer trust and comply with legal requirements. Effective customer data management also enhances marketing efforts by providing valuable insights into customer behavior.

E-commerce Integration

Moolah integrates seamlessly with popular e-commerce platforms, enhancing the functionality of online stores. This compatibility allows businesses to manage their online transactions efficiently and offer a smooth checkout experience for customers. E-commerce integration is essential for businesses looking to optimize their online sales channels.

Point of Sale (POS) Integration

The integration of POS allows Moolah to link with diverse POS systems, making it a great option for retail stores. This integration aids in streamlining in-person purchases and enhances operational processes. Businesses can simplify their payment processing and inventory management by integrating POS systems with Moolah.

ACH Payments

Moolah supports Automated Clearing House (ACH) payments, providing a cost-effective alternative to traditional payment methods. ACH transactions enable direct bank transfers, which can reduce transaction fees and enhance convenience for both businesses and customers. This feature is particularly useful for recurring payments and large transactions.

Batch Processing

The batch processing feature allows businesses to handle multiple transactions simultaneously, improving efficiency and saving time. This capability is especially beneficial for companies with high transaction volumes, as it streamlines the payment processing workflow and reduces administrative overhead.

Tokenization

Moolah uses tokenization to protect payment data by substituting sensitive details with special identifiers or tokens. This process greatly decreases the likelihood of data breaches and improves security for merchants. Tokenization aids businesses in safeguarding their clients’ payment details and adhering to data security laws.

Pricing Structure

Moolah’s pricing structure is designed to be straightforward and transparent, catering to the needs of various business types. It offers competitive transaction fees, clear monthly minimum fees, and ensures no hidden costs, making it an appealing choice for many merchants.

Transaction Fees

Moolah charges a flat transaction fee of 2.69% plus $0.29 per transaction. This rate is relatively competitive when compared to industry averages, which can range between 2.7% to 3.5% plus additional cents per transaction. This straightforward pricing helps businesses easily predict their processing costs without any surprise charges.

Monthly Minimum Fees

For different types of accounts, Moolah has set specific monthly minimum fees to maintain affordability while ensuring robust service. E-commerce accounts are charged a minimum fee of $19.95 per month, making it accessible for small online businesses. In-store accounts, which often require more resources and support, have a higher minimum fee of $99.95 per month. This tiered structure ensures that businesses only pay for the services that match their operational scale and needs.

Hidden Fees

One of Moolah’s significant advantages is its commitment to transparency in pricing. Unlike many other payment processors that may have hidden fees, Moolah clearly states all associated costs upfront. This approach eliminates unexpected charges, allowing businesses to manage their finances more effectively and build trust in their payment processing partner.

By maintaining competitive rates, clear minimum fees, and a transparent pricing model, Moolah stands out as a reliable and cost-effective option for businesses of all sizes.

User Experience

Moolah provides a straightforward experience that streamlines payment processing for businesses of any size. The design prioritizes simplicity, allowing even those with minimal technical expertise to easily navigate the platform.

Ease of Use

The user interface of Moolah is clean and intuitive, allowing users to navigate through different features without any confusion. The dashboard is well-organized, making it easy to access transaction histories, generate reports, and manage accounts. The setup process is straightforward, with clear instructions provided at each step, ensuring businesses can get started quickly and efficiently without the need for extensive IT support.

Customer Reviews

Customer feedback on Moolah is predominantly positive. Users frequently highlight the platform’s reliability, straightforward pricing, and comprehensive feature set. The transparent pricing model is particularly appreciated, as it helps businesses manage their budgets without worrying about unexpected costs. However, some users have reported occasional technical issues and delays in customer support responses. Despite these minor setbacks, the overall consensus is that Moolah delivers a solid, dependable service that meets the needs of most businesses.

Customer Support

Moolah prides itself on providing robust customer support to ensure smooth and efficient service for its users. The company offers multiple support channels, ensuring that help is always accessible when needed.

Support Channels

Moolah offers customer support through various channels, including phone, email, live support, and ticketing systems. This multi-channel approach ensures that users can choose their preferred method of communication to resolve any issues or inquiries promptly.

Availability

Customer support is available 24/7, providing round-the-clock assistance to businesses regardless of their operating hours. This continuous availability is crucial for addressing urgent issues that could impact business operations, particularly for those operating across different time zones.

Quality of Support

User experiences with Moolah’s customer service are generally positive. Many users have praised the helpfulness and professionalism of the support staff. The response times are typically quick, with most issues being resolved effectively. However, some users have reported occasional delays during peak times, but these instances appear to be exceptions rather than the norm. Overall, Moolah’s customer support is considered reliable and effective, contributing to high levels of customer satisfaction.

Comparisons with Competitors

Moolah is in competition with various well-known payment processors like Card Z3N, UniPay Gateway, and Maxpay. It is crucial to compare the competitors’ features and pricing models side by side to find the best fit for businesses, as each one offers a variety of options.

Top Competitors

Card Z3N, UniPay Gateway, and Maxpay are Moolah’s primary competitors. Each of these companies provides robust payment processing solutions, but their features and pricing differ, impacting their overall value proposition.

Feature Comparison

Moolah offers a comprehensive suite of features, including secure transactions, multi-currency support, mobile payments, recurring billing, fraud detection, customizable invoices, real-time reporting, API integration, chargeback management, virtual terminals, and customer data management.

Card Z3N offers a wide range of features, with a particular emphasis on preventing fraud and implementing multiple layers of security protocols. UniPay Gateway stands out for its wide range of customization choices and advanced integration features, making it ideal for companies with specific requirements. Maxpay is renowned for its extensive worldwide coverage and robust assistance with global transactions, making it perfect for globally operating businesses.

Strengths and Weaknesses

Moolah’s strengths lie in its user-friendly interface, transparent pricing, and excellent customer support. However, some users report occasional technical glitches and delays in support response times. Card Z3N’s strong security measures are a significant advantage, but it may be more complex to set up. UniPay Gateway’s customization options are a strength, but it can be more expensive. Maxpay’s international support is a major plus, but it may lack some of the advanced fraud detection features found in Moolah and Card Z3N.

Pricing Comparison

Moolah’s pricing is competitive, with a flat rate of 2.69% plus $0.29 per transaction, and monthly minimum fees of $19.95 for e-commerce accounts and $99.95 for in-store accounts. This structure is relatively straightforward compared to some competitors, which may have more complex pricing models with various additional fees. Card Z3N and UniPay Gateway generally offer higher transaction fees but provide more advanced features that might justify the cost for certain businesses. Maxpay’s pricing varies significantly based on transaction volume and geographic regions but tends to be higher for international transactions.

Value for Money Analysis

Moolah provides great bang for your buck, especially for small to medium-sized companies in need of a clear and simple pricing structure. While other companies may offer more advanced or specialized functions, Moolah’s mix of strong features, user-friendliness, and competitive prices positions it as a serious competitor in the payment processing sector.

Pros and Cons

Moolah is a strong contender in the payment processing industry, offering a range of features that cater to various business needs. However, like any service, it has its advantages and drawbacks.

Pros

Competitive Transaction Fees: Moolah charges a flat rate of 2.69% plus $0.29 per transaction, which is relatively competitive compared to industry averages. This transparent pricing structure helps businesses predict their costs without hidden fees, making financial planning more straightforward.

Comprehensive Feature Set: Moolah offers a wide range of features, such as secure transactions, support for multiple currencies, mobile payments, recurring billing, fraud detection, customizable invoices, real-time reporting, and API integration. These characteristics guarantee that businesses can efficiently and effectively handle their payment processing requirements.

Strong Customer Support: Moolah offers robust customer support through multiple channels, including phone, email, live chat, and tickets. The 24/7 availability ensures that businesses can get assistance whenever needed, which is crucial for maintaining smooth operations.

Cons

Higher Monthly Minimum Fees for In-Store Accounts: One of the notable drawbacks is the higher monthly minimum fee for in-store accounts, which stands at $99.95. This cost can be a burden for smaller businesses with lower transaction volumes, making it less accessible for some.

Limited Presence in Certain Regions: The main target market for Moolah’s services is the United States, which could restrict its value for companies in different areas. Businesses with a global reach may have to seek out more payment processors if they require coverage in other markets due to their limited international presence.

Overall, Moolah offers a robust set of features and competitive pricing, making it an excellent choice for many businesses. However, the higher fees for in-store accounts and limited regional presence are factors to consider when evaluating its suitability for your specific needs.

Conclusion

Moolah provides a strong payment processing solution with competitive transaction fees, a wide range of features, and excellent customer support. Although in-store accounts have higher monthly minimum fees and limited regional coverage, it is still a great option for businesses looking for dependable and effective payment services.