Spark Pay Review

- 13th Aug, 2024

- | By Linda Mae

- | Reviews

In the current digital age, it is essential for businesses looking to create a strong online presence to choose the appropriate e-commerce platform. Spark Pay is an online store management solution created by Capital One, providing a range of tools to assist businesses in efficiently running their e-commerce operations. This analysis examines Spark Pay in depth, discussing its background, characteristics, intended users, and overall performance. Lets read more about Spark Pay Review.

Capital One introduced Spark Pay as a powerful e-commerce and payment processing platform. Originally designed as a mobile payment app, Spark Pay has transformed to provide a wide range of online payment options and tools for managing stores, making it a suitable option for small to medium-sized businesses looking to grow their online presence.

History and Background of the Company | Spark Pay Review

Established as an offshoot of Capital One, Spark Pay commenced with a concentration on mobile payment solutions. Throughout time, it has increased its abilities to cover a full e-commerce system, aiding various businesses in handling their online shops. Even though Spark Pay has stopped offering mobile payment services, it has still managed to expand by offering merchants advanced technology features and digital solutions to improve customer experience and operational efficiency.

Spark Pay is designed to be a user-friendly e-commerce platform that caters to both new businesses and established ones looking to scale. It allows users to create and customize online stores, manage products and inventory, and process payments seamlessly. The platform supports multiple storefronts, making it ideal for businesses with diverse product lines or target markets.

Spark Pay boasts a variety of features tailored to meet the needs of modern e-commerce businesses. These include customizable design templates, mobile commerce optimization, and a robust marketing toolkit with SEO tools and social media integration. The platform also offers advanced product management capabilities, including inventory tracking, product reviews, and wish lists. Spark Pay offers tools for handling orders, including instant shipping rates, tax computations, and recovering abandoned shopping carts. Its payment processing options facilitate various gateways and guarantee PCI compliance, ensuring safe transactions for merchants and customers alike.

Spark Pay is most appropriate for small to medium-sized businesses in need of a flexible e-commerce solution. Its ability to support multiple stores and its wide range of marketing tools make it ideal for businesses wanting to handle various product lines or reach diverse customer demographics through one platform. Whether you are just starting out or looking to grow your existing business, Spark Pay offers the flexibility and features needed to succeed in the competitive online marketplace.

Features and Capabilities

Spark Pay is designed to meet the diverse needs of e-commerce businesses by offering a robust set of features and capabilities. From storefront customization to comprehensive marketing tools, Spark Pay provides everything needed to manage an online store effectively.

E-commerce Platform

Storefront Customization Options: Spark Pay offers a variety of storefront customization options to suit different business needs. Users can choose from multiple design templates and customize them to reflect their brand’s identity. The platform’s intuitive design tools make it easy to tailor the look and feel of your store, ensuring a unique and professional appearance.

Template Designs and Customization: The platform offers a vast array of templates that can be personalized in great detail. This involves changing designs, colors, typography, and incorporating unique images and logos. This flexibility enables companies to build a coherent and visually attractive online image that matches their brand’s aesthetics.

Mobile Commerce Capabilities: With mobile commerce becoming increasingly important, Spark Pay ensures that all its templates are mobile-responsive. This means your store will look great and function well on smartphones and tablets, providing a seamless shopping experience for customers on the go.

Product Management

Adding and Managing Products: Adding and managing products on Spark Pay is straightforward. The platform provides an intuitive interface where users can easily add product details, images, and variants. This makes it simple to keep your product catalog up-to-date and organized.

Inventory Management Tools: Spark Pay includes robust inventory management tools that help you track stock levels in real-time. This feature ensures that you can manage your inventory efficiently, reducing the risk of overselling and keeping customers informed about product availability.

Product Reviews and Wish Lists: Customer engagement is enhanced with features like product reviews and wish lists. These tools allow customers to leave feedback on products and save items they are interested in, which can help drive sales and improve customer satisfaction.

Marketing Tools

SEO Tools: Spark Pay comes equipped with powerful SEO tools to help your store rank higher in search engine results. This includes customizable meta tags, keyword recommendations, and other features designed to improve your store’s visibility online.

Social Media Integration: The platform enables smooth integration with key social media platforms, making it simple to market products and engage with your followers. This could potentially drive more customers to your store and enhance sales.

Promotional Tools and Campaigns: Spark Pay offers a range of marketing tools to assist in executing successful promotional campaigns. This consists of promo codes, temporary promotions, and email marketing functions that aid in drawing in and keeping customers.

Payment Processing

Supported Payment Methods: Spark Pay supports a wide range of payment methods, including major credit cards and digital wallets like PayPal and Apple Pay. This flexibility ensures that customers can choose their preferred payment option, enhancing their shopping experience.

Mobile Payment Solutions: The platform additionally offers mobile payment options, simplifying the process for customers to conduct transactions using their smartphones. This is especially beneficial for companies aiming at a tech-savvy mobile audience.

Security Features (PCI Compliance): Security is a top priority for Spark Pay. The platform is PCI compliant, ensuring that all transactions are secure and customer data is protected. This helps build trust with your customers and protects your business from potential security breaches.

Order Management

Order Fulfillment Options: Spark Pay offers comprehensive order fulfillment options, including real-time shipping rate calculations from carriers like UPS and FedEx. This ensures that customers receive accurate shipping costs and can choose their preferred shipping method.

Real-Time Shipping Rates and Tax Calculations: The platform automatically calculates real-time shipping rates and applicable taxes, providing a seamless checkout experience for customers. This helps reduce cart abandonment and improves customer satisfaction.

Abandoned Cart Recovery: Spark Pay includes tools to recover abandoned carts, such as automated email reminders. This feature can help you reclaim lost sales by encouraging customers to complete their purchases.

Analytics and Reporting

Sales and Traffic Reports: The platform provides detailed sales and traffic reports, giving you valuable insights into your store’s performance. This data can help you make informed decisions and optimize your marketing strategies.

Customer Insights: Spark Pay’s analytics tools offer information on customer behavior, assisting in comprehending their preferences and purchasing patterns. This data can help customize your marketing strategies and enhance customer interaction.

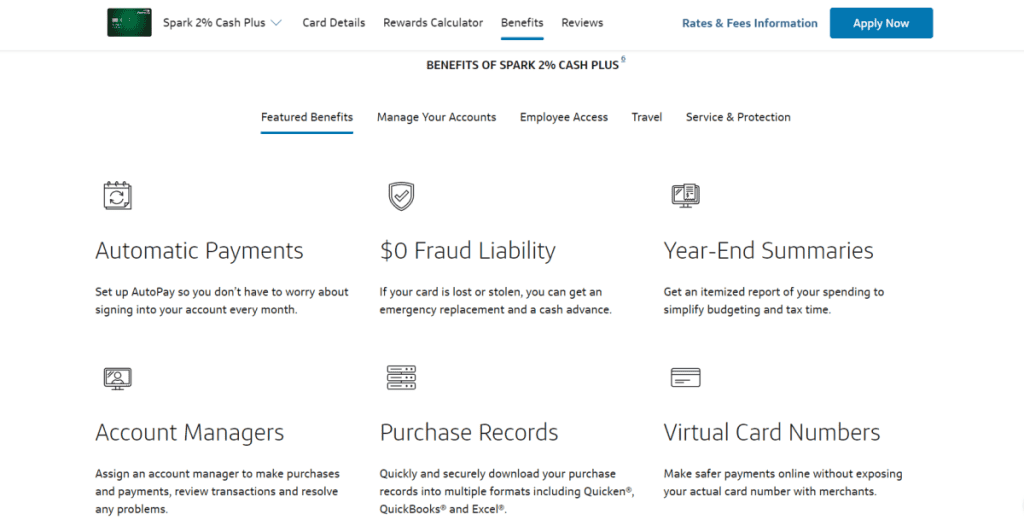

Integration with Third-Party Tools (e.g., QuickBooks): For businesses that use additional tools like QuickBooks for accounting, Spark Pay offers seamless integration. This ensures that all your business data is synchronized, making it easier to manage your finances and operations.

Pricing and Plans

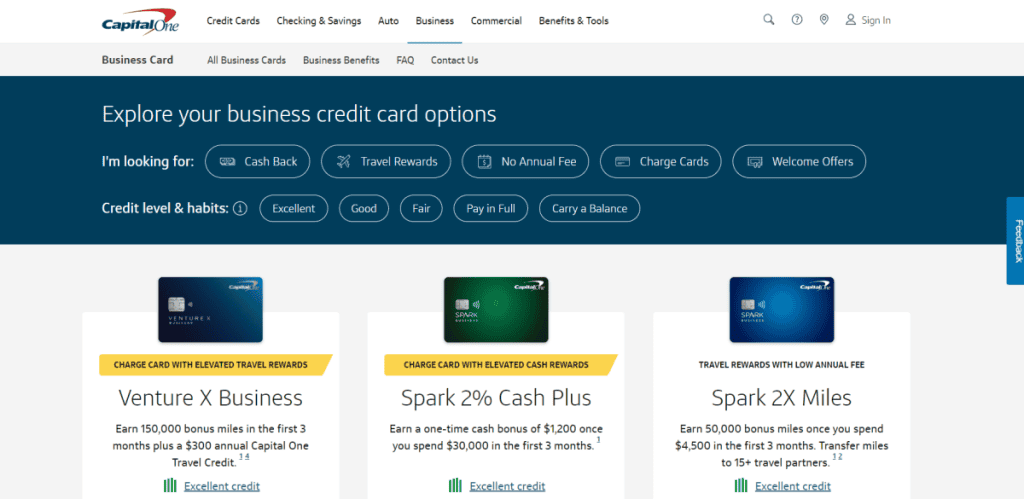

Spark Pay offers two primary pricing plans designed to cater to different business needs: the Go Plan and the Pro Plan. Each plan provides a variety of features, enabling merchants to choose the one that best fits their operational requirements and budget.

Overview of Available Pricing Plans

Go Plan (Pay-As-You-Go): The Go Plan is a flexible option ideal for businesses that prefer not to commit to a monthly fee. This plan operates on a pay-as-you-go basis, charging merchants a small fee per transaction. This can be particularly beneficial for startups or businesses with fluctuating sales volumes, as it allows them to manage costs more effectively based on actual usage.

Pro Plan (Monthly Fee): On the flip side, the Pro Plan is designed for companies that have steady sales and want fixed monthly expenses. This plan involves a set monthly charge that includes a certain number of transactions, offering lower per-transaction costs than the Go Plan. This option is perfect for established companies seeking extensive features and reduced transaction expenses in the long run.

Detailed Breakdown of Fees

Transaction Fees: Under the Go Plan, transaction fees are typically higher due to the absence of a monthly fee. Merchants are charged a percentage of each sale, plus a small fixed fee per transaction. For instance, swiped transactions may incur a fee of 2.65% + $0.05, while keyed-in transactions might be charged at 3.7% + $0.05. In contrast, the Pro Plan offers reduced rates, such as 1.9% + $0.05 for swiped transactions and 2.8% + $0.05 for keyed-in transactions.

Chargeback Fees: Both plans include chargeback fees, which are costs associated with disputed transactions. Spark Pay typically charges around $15 per chargeback, a standard fee aimed at covering the administrative costs of handling disputes.

Terminal and Card Reader Costs: Spark Pay provides affordable card readers and terminals for businesses in need of physical payment processing equipment. A simple card reader is priced at around $13, whereas more sophisticated credit card terminals cost about $99. These gadgets are crucial for face-to-face transactions and enable companies to provide a smooth payment process for their clients.

Comparison with Competitors

When compared to competitors like Shopify and Square, Spark Pay’s pricing structure is competitive but distinct. Shopify, for example, offers tiered pricing plans with varying features and transaction fees, often bundled with additional e-commerce tools. Square provides a simpler fee structure with no monthly fees but higher transaction costs, appealing to small businesses and individuals.

Businesses that are not keen on committing to monthly fees find Spark Pay’s Go Plan appealing for its flexibility, while established businesses are drawn to the Pro Plan for its lower transaction costs and wide range of features. By using this double strategy, Spark Pay can cater to a diverse array of merchants, ranging from new businesses to experienced online retailers.

In conclusion, Spark Pay’s pricing plans are designed to offer flexibility and value, making it a viable option for various business models and sizes. By understanding the specifics of each plan and comparing them with competitors, businesses can make informed decisions to optimize their payment processing strategy.

User Experience

Spark Pay is designed to provide an intuitive and efficient user experience, making it accessible for businesses of various sizes. Here’s a closer look at the different aspects of its user experience, including ease of use, customer support, and customer feedback.

Ease of Use

User Interface Design and Navigation: Spark Pay features a clean and straightforward user interface, making it easy for users to navigate through the platform. The dashboard is designed to provide quick access to essential tools and functionalities, allowing users to manage their stores efficiently. The layout is intuitive, with clearly labeled sections and a logical flow, which reduces the learning curve for new users.

Onboarding Process: The process of getting started with Spark Pay is seamless and easy for users. Users who are new are given instructions on how to set up their account by following a series of steps that involve adding items, personalizing their online store, and configuring payment methods. This structured method guarantees that even individuals with basic technical understanding can efficiently start their online shop.

Customer Support

Support Channels (Phone, Email, Live Chat): Spark Pay offers multiple support channels to assist users with any issues they might encounter. These include phone support, email support, and live chat. The availability of these channels ensures that users can get help promptly and through their preferred method of communication.

Responsiveness and Quality of Support: The responsiveness of Spark Pay’s customer support is generally rated positively. Users have reported that support representatives are knowledgeable and helpful, providing clear and effective solutions to their problems. However, some users have noted that response times can vary, with live chat often being the fastest way to get immediate assistance.

Customer Feedback

Positive Testimonials: Many users appreciate the platform’s ease of use and comprehensive feature set. Positive testimonials often highlight the intuitive interface, the range of customization options, and the effective customer support. Users also value the flexibility of the pricing plans, which cater to businesses of different sizes and sales volumes.

Common Complaints and Issues: Even though there has been positive feedback, there are some users who have experienced problems with the platform. Frequent issues consist of technical malfunctions and customer support response delays. Some users have expressed frustration with the way chargebacks and funds are managed, citing cases where funds were delayed for long periods. These problems point out potential areas for improvement in Spark Pay to increase overall user satisfaction.

In summary, Spark Pay provides a generally positive user experience with its intuitive design and helpful customer support. However, addressing the common complaints and ensuring consistent support response times could further enhance user satisfaction.

Pros and Cons of Spark Pay

Pros

Scalability and Growth Potential: Spark Pay is designed to accommodate businesses as they grow. Its infrastructure supports scalability, allowing businesses to expand their operations without switching platforms. This is particularly beneficial for small to medium-sized businesses looking for a long-term solution that can grow with them.

Comprehensive Marketing Toolkit: One of Spark Pay’s standout features is its extensive marketing toolkit. It includes SEO tools, social media integration, and promotional campaign features. These tools help businesses enhance their online visibility, attract more customers, and run effective marketing campaigns without needing additional third-party services.

Multi-Store Functionality: Spark Pay allows for the supervision of numerous storefronts through a singular account. This function is perfect for companies that work under multiple brands or focus on various markets. It streamlines the handling of multiple product lines and customer segments, offering a consolidated answer for intricate business activities.

Integration with Social Media and Other Platforms: The platform integrates seamlessly with major social media networks and other online platforms. This integration allows businesses to easily promote their products, interact with customers, and expand their reach across different digital channels. It enhances marketing efforts and provides a cohesive online presence.

Cons

Limited Range of Design Templates: Despite its robust features, Spark Pay offers a limited range of design templates. This can be a drawback for businesses looking for extensive customization options to create a unique online store. The available templates might not meet the diverse aesthetic needs of all businesses.

Support for International Payments: Spark Pay’s support for international payments is somewhat limited. This can be a significant limitation for businesses aiming to sell globally. Issues with international transactions can hinder the expansion into overseas markets and affect customer satisfaction.

Expensive Overage Fees: Users have stated that Spark Pay may result in hefty overage charges, which are fees imposed when usage surpasses the limits specified in the selected plan. These costs can accumulate rapidly, causing the platform to become more costly than expected, especially for companies with fast expansion or high volume of transactions.

Software and Equipment Malfunctions Reported by Users: There have been reports of software glitches and malfunctions with the payment processing equipment provided by Spark Pay. Issues such as system crashes and hardware failures can disrupt business operations and negatively impact the customer experience. Addressing these technical challenges is crucial for maintaining reliable service.

Comparison with Competitors

When comparing e-commerce platforms, it’s essential to understand how each one caters to different business needs. Here’s a look at how Spark Pay stacks up against Shopify, BigCommerce, and Square.

Spark Pay vs. Shopify

Shopify is a well-established e-commerce platform known for its user-friendly interface and extensive range of features. It offers a robust POS system that integrates seamlessly with online stores, making it a strong contender for businesses with both online and offline sales. Shopify’s extensive app marketplace and built-in payment processing with Shopify Payments provide merchants with flexibility and convenience. On the other hand, Spark Pay provides full payment solutions but does not have the same wide range of apps and advanced POS features as Shopify. Although Shopify can be pricier, its extensive range of features and integrations frequently make the expense worthwhile for numerous businesses.

Spark Pay vs. BigCommerce

BigCommerce is known for its rich built-in features and scalability, making it a suitable choice for businesses expecting rapid growth. Unlike Spark Pay, which focuses on simplicity and core functionalities, BigCommerce offers extensive product management options, including variants and detailed SKU management. BigCommerce does not charge transaction fees, which can be a significant advantage over Spark Pay’s fee structure. However, Spark Pay’s user interface is generally considered more straightforward and easier for small businesses and startups to navigate.

Spark Pay vs. Square

Square stands out for its comprehensive suite of tools that cater to both online and offline sales, including a highly acclaimed POS system. Square’s payment processing capabilities are integrated across its platform, offering seamless transitions between in-person and online transactions. This incorporation makes Square especially appealing to small businesses and retailers. On the other hand, Spark Pay offers strong online payment options but lacks the same integration for in-person transactions. Square has an advantage over Spark Pay because of its wider array of business management tools including payroll and employee management, making it an appealing choice for businesses seeking a comprehensive solution.

Each platform has its strengths, with Shopify excelling in feature variety and app integrations, BigCommerce in scalability and built-in features, and Square in comprehensive business tools and POS integration. Spark Pay, while solid in payment processing, may lack some advanced features offered by these competitors.

Conclusion

Spark Pay provides a platform with rich features that can easily expand and is ideal for small to medium-sized businesses. Its extensive marketing capabilities, ability to operate multiple stores, and user-friendly interface are major benefits. Nevertheless, it is restricted by a small selection of design templates and lack of support for international payments. In general, Spark Pay is a reliable option for businesses aiming to expand, but prospective users should evaluate their individual requirements and potential additional expenses beforehand.