Fifth Third Processing Solutions Review

- 14th Aug, 2024

- | By Linda Mae

- | Reviews

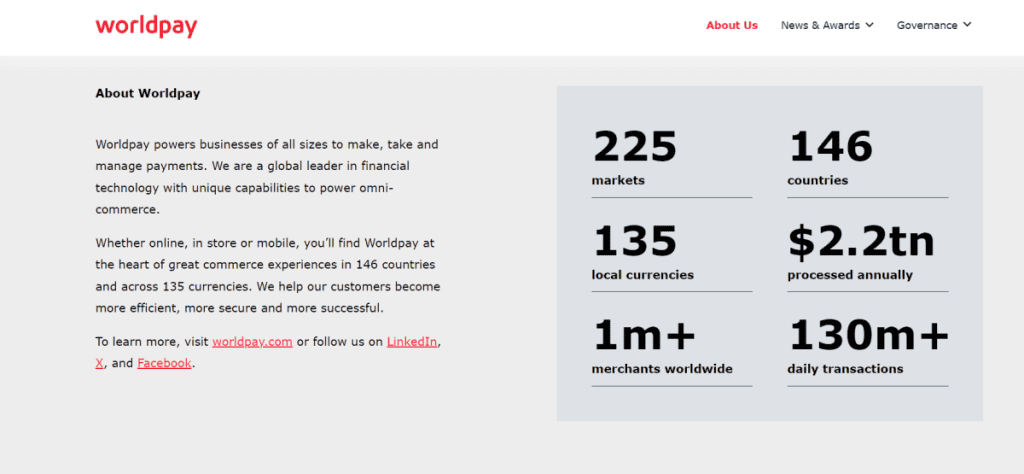

FIS Worldpay, formerly known as Fifth Third Processing Solutions, is a top provider of merchant payment processing services. The company is based in Cincinnati, Ohio, and provides a complete range of payment solutions customized for businesses of any size. Having a strong emphasis on innovation and technology, Fifth Third Processing Solutions is recognized as a trustworthy ally in the payment processing sector. Lets read more about Fifth Third Processing Solutions Review.

Fifth Third Processing Solutions provides a variety of payment processing services, including credit and debit card processing, ACH transactions, mobile payments, and e-commerce solutions. The company serves various sectors, offering secure and efficient transaction processing for its clients. Fifth Third Processing Solutions aims to reduce risks and improve the payment experience for businesses and customers by implementing advanced security measures and complying with industry standards.

Company Background | Fifth Third Processing Solutions Review

Fifth Third Processing Solutions was established in 1971 as a payment network connecting retailers and financial institutions. Over time, it went through different stages, showing the ever-changing characteristics of the payment processing sector. Originally, the company was affiliated with Fifth Third Bank, a prominent regional bank recognized for its creative financial products.

In its early years, Fifth Third Processing Solutions focused on pioneering card payment acceptance, laying the groundwork for its future growth. The company underwent significant changes in the 2000s, including a rebranding to Vantiv, which marked its expansion and increased market presence. In 2018, Vantiv merged with Worldpay, creating one of the largest payment processing companies in the United States.

During its growth, Fifth Third Processing Solutions has reached various significant points, such as creating cutting-edge payment technologies and expanding its range of services. The company was able to strengthen its position in the payment processing industry by utilizing increased resources and expertise through the merger with Worldpay.

The leadership team at Fifth Third Processing Solutions, now part of FIS Worldpay, has played a crucial role in steering the company towards success. Key figures in the company’s history include Charles D. Drucker, who served as the CEO during the transformative years leading up to and following the merger with Worldpay. Under Drucker’s leadership, the company went public and significantly expanded its market share.

Today, the management team continues to focus on innovation and customer-centric strategies, ensuring that Fifth Third Processing Solutions remains at the forefront of the payment processing industry. The company’s commitment to excellence is reflected in its ongoing efforts to develop new technologies and improve service delivery for its diverse client base.

Services Offered

Fifth Third Processing Solutions, which is now part of FIS Worldpay, provides a wide variety of merchant services tailored to accommodate the various needs of businesses. Their range of offerings consists of services for handling credit and debit card transactions, ACH transactions, online commerce solutions, mobile payment options, and point-of-sale (POS) systems. Every service comes with functionalities that improve transaction efficiency, security, and customer satisfaction.

Credit and Debit Card Processing: Fifth Third Processing Solutions provides robust credit and debit card processing services, allowing businesses to accept all major card brands. The system supports both EMV chip cards and contactless payments (NFC), ensuring secure and fast transactions. This service is ideal for retailers, restaurants, and service providers looking to streamline their payment processes.

ACH Processing: ACH (Automated Clearing House) processing is a cost-effective solution for businesses that handle large volumes of payments, such as subscription services and utility companies. This service facilitates direct bank transfers, reducing transaction fees compared to card payments. ACH processing is beneficial for recurring billing and bulk payment transactions.

E-commerce Solutions: The company provides cohesive e-commerce solutions that facilitate online transactions. This consists of payment gateways and virtual terminals, ensuring safe online transactions. These tools are created to assist online businesses in handling sales, processing payments effectively, and guarding against fraud.

Mobile Payment Solutions: Fifth Third Processing Solutions’ mobile payment options enable businesses to accept payments on the go. This service is particularly useful for mobile vendors, delivery services, and pop-up shops. The mobile payment solutions are compatible with smartphones and tablets, offering flexibility and convenience.

Point-of-Sale (POS) Systems: The POS systems provided by Fifth Third Processing Solutions are designed to cater to various business needs. These systems come with advanced features such as inventory management, employee scheduling, and sales reporting. They support both traditional and smart terminals, which include touchscreens and integrated business applications.

Detailed Description of Each Service

Features

Credit and Debit Card Processing: Supports EMV and NFC payments, real-time authorization, and settlement.

ACH Processing: Direct bank transfers, lower transaction costs, automated recurring billing.

E-commerce Solutions: Secure payment gateways, fraud protection, seamless integration with shopping carts.

Mobile Payment Solutions: Compatibility with iOS and Android, easy setup, secure transactions.

POS Systems: Touchscreen interfaces, integrated business management tools, customizable hardware options.

Benefits

Credit and Debit Card Processing: Enhances customer convenience, increases sales, and reduces fraud.

ACH Processing: Cost-effective, efficient for bulk payments, and reduces processing times.

E-commerce Solutions: Expands market reach, protects against online fraud, and improves customer experience.

Mobile Payment Solutions: Increases payment flexibility, supports remote sales, and improves customer service.

POS Systems: Streamlines business operations, provides real-time insights, and enhances overall efficiency.

Use Cases

Credit and Debit Card Processing: Ideal for retail stores, restaurants, and service-based businesses.

ACH Processing: Suitable for subscription services, utilities, and B2B transactions.

E-commerce Solutions: Best for online retailers, digital services, and marketplaces.

Mobile Payment Solutions: Perfect for food trucks, pop-up shops, and delivery services.

POS Systems: Beneficial for multi-location retailers, restaurants, and businesses with extensive inventory needs.

Fifth Third Processing Solutions offers a variety of services to help businesses efficiently handle payments, in a secure and convenient manner, guaranteeing a seamless transaction experience for merchants and customers alike.

Technology and Innovation

Fifth Third Processing Solutions, now part of FIS Worldpay, leverages advanced technology and innovative solutions to deliver comprehensive payment processing services. Their technology stack is designed to integrate seamlessly with various business systems, ensuring efficient and secure transaction processing.

Fifth Third Processing Solutions employs a robust technology stack that includes payment gateways, virtual terminals, and mobile payment solutions. These technologies support both in-person and online transactions, providing flexibility and scalability for businesses of all sizes.

Innovations and Proprietary Technologies

The company is recognized for its unique developments that improve the payment processing experience. Their intelligent terminals integrate classic payment processing with innovative functions like inventory control and staff scheduling, aiding companies in simplifying operations. These intelligent terminals come with spacious color touchscreens and business apps designed for different business requirements.

Integration Capabilities with Other Business Systems

Fifth Third Processing Solutions ensures easy integration with existing business systems, allowing for a seamless flow of transactions and data. Their payment gateways and virtual terminals can be integrated with numerous e-commerce platforms and point-of-sale systems, providing a unified payment solution that enhances operational efficiency.

Security Measures and Compliance

Security is a paramount concern for Fifth Third Processing Solutions. They implement stringent security measures to protect sensitive cardholder data and ensure compliance with industry standards. This includes the use of advanced encryption technologies and robust fraud prevention mechanisms.

PCI DSS Compliance

In order to ensure security, Fifth Third Processing Solutions adheres to the standards of the Payment Card Industry Data Security Standard (PCI DSS). This guideline includes twelve fundamental criteria that guarantee the security of cardholder information. Some of these measures are having firewalls, using encryption, implementing secure access controls, and conducting frequent vulnerability assessments. Adhering to PCI DSS reduces the likelihood of data breaches and guarantees the secure handling of sensitive information.

Encryption and Fraud Prevention

To further enhance security, Fifth Third Processing Solutions employs strong encryption protocols for all transactions. This ensures that cardholder data is protected during transmission and storage. Additionally, their fraud prevention systems are designed to detect and prevent unauthorized transactions, reducing the risk of fraud and ensuring the integrity of the payment process.

By integrating cutting-edge technology with comprehensive security measures, Fifth Third Processing Solutions provides businesses with reliable and secure payment processing services that meet the highest industry standards.

Pricing and Fee Structure

Fifth Third Processing Solutions offers a variety of pricing models tailored to the needs of different businesses, ensuring transparency and competitiveness within the industry. Understanding their fee structure is crucial for businesses to manage costs effectively.

Transparent Pricing Model

Fifth Third Processing Solutions uses various pricing models, such as interchange-plus, flat-rate, and tiered pricing. The interchange-plus model stands out for its transparency by passing on interchange rates from card networks along with a set markup from the processor. This model enables companies to clearly understand the cost of each transaction.

Breakdown of Fees

Transaction Fees: Transaction fees are a significant component of the overall cost. These fees vary based on the type of card and transaction method. For instance, interchange fees for credit card transactions typically range from 1.15% to 3.30%, depending on the card network and transaction details. Debit card transactions generally incur lower fees compared to credit cards.

Monthly Fees: Monthly fees may include charges for account maintenance, statement fees, and access to payment gateways. These fees are typically standard across the industry but can vary based on the services included.

Setup and Cancellation Fees: Fifth Third Processing Solutions may charge a one-time setup fee for new accounts, covering the initial configuration and integration of their payment systems. Additionally, there may be early termination fees if a business decides to cancel the service before the contract term ends. These cancellation fees can range from $250 to $495, depending on the contract specifics.

Comparison with Industry Standards

Compared to industry standards, Fifth Third Processing Solutions’ pricing is competitive, particularly with the interchange-plus model, which is favored for its transparency and fairness. However, businesses should be mindful of the potential complexity in predicting costs due to the fluctuating interchange rates. The flat-rate and tiered pricing models provide more predictability but may not always offer the lowest costs for high-volume or high-value transactions.

Customer Support

Fifth Third Processing Solutions offers strong customer support services tailored to serve their wide range of clients. Their system of support guarantees customers with prompt and efficient help via various communication avenues.

The company provides extensive customer support to assist businesses in quickly and efficiently resolving issues. Their experienced support team is equipped to address a range of queries, including technical issues and account management.

Availability and Accessibility

Fifth Third Processing Solutions boasts 24/7 support, ensuring that businesses can access help at any time. This around-the-clock availability is crucial for companies that operate outside of regular business hours or have urgent issues that need immediate attention.

24/7 Support

The 24/7 support service includes multiple contact methods, providing flexibility and convenience. Whether it’s late at night or during a holiday, businesses can count on receiving support whenever needed.

Multiple Channels (Phone, Email, Chat)

Fifth Third Processing Solutions offers support through various channels, including phone, email, and chat. This multi-channel approach allows customers to choose the most convenient method for them. Phone support is ideal for urgent issues, while email and chat provide more flexibility for non-urgent inquiries.

Customer Service Quality

The quality of customer service at Fifth Third Processing Solutions is reflected in their response times and resolution effectiveness. They are committed to providing quick and accurate responses to all customer queries.

Response Times

The company prioritizes rapid response times to minimize downtime for businesses. Customers can expect prompt answers, whether they are contacting support via phone, email, or chat.

Resolution Effectiveness

Fifth Third Processing Solutions aims for high efficiency in problem-solving, striving to resolve issues in the initial contact whenever feasible. This method saves time and improves customer satisfaction by offering quick and efficient solutions.

Customer Feedback and Reviews

Fifth Third Processing Solutions has garnered a range of feedback from various sources, reflecting both positive experiences and common complaints.

Summary of Customer Feedback from Various Sources

Customer feedback for Fifth Third Processing Solutions is mixed, with users praising some aspects of the service while highlighting significant areas for improvement. This feedback comes from diverse sources, including customer review platforms and forums.

Positive Reviews

Many customers appreciate the wide range of services offered by Fifth Third Processing Solutions, including their robust payment processing options and comprehensive support. The company’s advanced technology and reliable transaction processing are frequently highlighted as strengths. Some users have also mentioned satisfaction with the customer support team’s responsiveness and the convenience of their 24/7 availability.

Common Complaints

Nonetheless, Fifth Third Processing Solutions has also garnered a significant amount of criticism. Frequent problems consist of costly cancellation charges and lack of transparency regarding contract terms. Clients have shown annoyance due to funds being held back and additional fees being charged unexpectedly. Furthermore, the intricacy of their pricing system and the absence of clarity concerning fees have been sources of dispute. Several users have complained about facing challenges with customer support, pointing out slow responses and ineffective solutions.

Analysis of Customer Satisfaction

The overall customer satisfaction with Fifth Third Processing Solutions appears to be varied. While the company excels in providing a wide array of services and maintaining strong technological infrastructure, the execution in terms of customer relations and transparency needs improvement.

Strengths

Comprehensive Service Offering: The wide range of payment processing solutions meets diverse business needs.

Technological Advancements: The use of advanced technology ensures efficient and secure transaction processing.

24/7 Customer Support: Availability of support at all times is a significant advantage for businesses operating beyond standard hours.

Areas for Improvement

Transparency in Pricing: Clearer communication regarding fees and contract terms is necessary to build trust.

Resolution Effectiveness: Enhancing the efficiency and effectiveness of customer support could improve user satisfaction.

Contract Terms: Revisiting the structure and terms of contracts, particularly around cancellation fees, could alleviate many customer concerns.

In summary, while Fifth Third Processing Solutions offers valuable services supported by advanced technology, addressing transparency and improving customer service could significantly enhance overall customer satisfaction.

Pros and Cons

Fifth Third Processing Solutions presents a range of advantages and disadvantages that prospective clients should weigh prior to selecting their services. Here is a fair assessment of the advantages and disadvantages from different reviews and sources.

Pros

Comprehensive Range of Services: Fifth Third Processing Solutions provides a wide array of services including credit and debit card processing, ACH transactions, e-commerce solutions, mobile payments, and POS systems. This extensive service offering makes it a versatile choice for businesses of all sizes and industries.

Advanced Security Features: The company places a strong emphasis on security, employing advanced encryption and fraud prevention measures to protect sensitive data. Compliance with PCI DSS standards further ensures that transactions are secure and meet industry regulations.

Strong Customer Support: Fifth Third Processing Solutions is dedicated to offering prompt and efficient help with customer support available around the clock through various channels including phone, email, and chat. This guarantees that companies can quickly address problems, reducing downtime.

Competitive Pricing: The company’s competitive pricing models, including interchange-plus pricing, offer transparency and potentially lower costs for businesses. This makes their services accessible to a wide range of clients.

High Customer Satisfaction: Many customers report high levels of satisfaction with the reliability and efficiency of the payment processing services provided by Fifth Third Processing Solutions. The company’s commitment to maintaining strong client relationships contributes to positive feedback.

Cons

Potentially Complex Fee Structure: Some users have noted that the fee structure can be complex and difficult to understand. This can lead to confusion and unexpected charges if not carefully managed.

Lengthy Contract Terms: Fifth Third Processing Solutions typically requires long-term contracts, which can include early termination fees. This can be a drawback for businesses looking for more flexibility.

Integration Challenges with Some Systems: There have been reports of challenges when integrating Fifth Third Processing Solutions with certain business systems. These integration issues can cause delays and additional costs for businesses.

In conclusion, although Fifth Third Processing Solutions provides a strong and secure variety of payment processing services, potential clients should thoroughly evaluate the intricacy of the fee system, the dedication needed for lengthy contracts, and possible integration obstacles.

Competitive Analysis

Fifth Third Processing Solutions, now operating under FIS Worldpay, competes with several major players in the payment processing industry. To understand its market position, it’s essential to compare it with key competitors, assess its strengths and weaknesses, and highlight its unique selling points.

Comparison with Major Competitors

Fifth Third Processing Solutions rivals Square, PayPal, and Stripe, which are other major payment processors. Although these rivals provide similar services, they possess distinctive pros and cons. Square is famous for its user-friendly interface and simplicity for small businesses, whereas Stripe is well-known for its developer-friendly API and strong e-commerce integrations.

Strengths and Weaknesses

Strengths:

Comprehensive Service Offering: Fifth Third Processing Solutions provides a wide range of payment services including credit and debit card processing, ACH transactions, and mobile payments, catering to businesses of all sizes.

Security Features: The company’s strong emphasis on security, with advanced encryption and fraud prevention measures, ensures secure transactions.

Customer Support: Available 24/7 through various channels, their customer support is a strong point, ensuring businesses can get assistance whenever needed.

Market Position: As part of FIS Worldpay, it benefits from the backing and resources of a major financial technology firm, enhancing its market presence and capabilities.

Weaknesses:

Complex Fee Structure: Customers often find the fee structure complicated and not as transparent as some competitors.

Lengthy Contracts: The requirement for long-term contracts with significant early termination fees can be a deterrent for businesses looking for more flexibility.

Integration Issues: There have been reports of challenges integrating their systems with certain business applications, which can create operational hurdles for some businesses.

Unique Selling Points

Fifth Third Processing Solutions distinguishes itself through its comprehensive range of services and advanced security features. The company’s ability to handle a high volume of transactions securely makes it particularly attractive to larger enterprises and businesses that require robust security measures. Additionally, the support from FIS Worldpay allows it to offer competitive pricing models, which can be beneficial for businesses looking to manage costs effectively.

Market Position and Reputation

Fifth Third Processing Solutions maintains a robust position in the competitive market, especially within the mid-to-large business sector. Its dependable track record and wide range of services have established it as a reputable provider in the payment processing field. Nevertheless, the company is challenged by strong competition from Square and Stripe, who are more adaptable and open about their pricing, and are preferred by smaller companies and new businesses for their simplicity and transparent fees.

Overall, Fifth Third Processing Solutions is well-regarded for its robust services and security, making it a strong contender in the payment processing market despite some areas needing improvement.

Contract Terms

Fifth Third Processing Solutions, now operating as FIS Worldpay, has contract terms designed to meet the needs of various businesses, but they come with specific conditions that merchants should understand.

Overview of Contract Terms

Fifth Third Processing Solutions typically requires merchants to sign a three-year contract. This contract includes an automatic renewal clause, which means that at the end of the initial term, the contract will automatically renew for an additional year unless either party provides notice of non-renewal within a specified timeframe.

Length of Contracts

The standard contract length is three years. This long-term commitment may be beneficial for businesses seeking stability and consistency in their payment processing services. However, it’s important for businesses to be aware of the commitment required and the implications of early termination.

Cancellation Policies and Fees

An important feature of the agreement with Fifth Third Processing Solutions is the early termination charge. If a company chooses to end the agreement early, they must pay an early termination fee between $250 and $495 based on contract details and how far they are into the term. This fee is adjusted based on time, so the termination fee decreases as the business approaches the end of the contract.

Renewal Terms and Conditions

Contracts with Fifth Third Processing Solutions automatically renew for an additional year unless the merchant provides a written notice of non-renewal within the required period, typically 60 to 90 days before the contract’s expiration. This automatic renewal clause ensures continuity of service but also requires merchants to be proactive if they decide to switch providers.

Understanding these contract terms is crucial for businesses to avoid unexpected fees and to plan effectively for their payment processing needs. By being aware of the length of contracts, cancellation policies, and renewal terms, businesses can make informed decisions when entering into an agreement with Fifth Third Processing Solutions.

Conclusion

Fifth Third Processing Solutions provides a wide variety of payment processing services with advanced security measures and excellent customer assistance. Despite having a complicated fee arrangement and lengthy contracts, their strong service options and market position make them a reliable option for bigger companies. Potential users need to consider the advantages of complete solutions in comparison to the difficulties that contract terms and integration issues may bring.

FAQs

What is the setup process for Fifth Third Processing Solutions?

The onboarding and setup process involves contacting a sales representative, who will guide you through contract agreements, account setup, and integration with your existing systems. The process is designed to be smooth, with support provided at each step to ensure your payment solutions are fully operational.

How does Fifth Third Processing Solutions ensure transaction security?

Fifth Third Processing Solutions employs advanced security measures, including end-to-end encryption and fraud prevention protocols. Compliance with PCI DSS standards ensures that all transactions are secure, protecting sensitive cardholder information from potential threats.

What industries can benefit the most from Fifth Third Processing Solutions?

Fifth Third Processing Solutions offers tailored solutions for various industries, including retail, hospitality, healthcare, and e-commerce. Each industry-specific solution is designed to meet the unique payment processing needs of these sectors, enhancing operational efficiency and customer satisfaction.