1st National Processing Review

- 22nd Aug, 2024

- | By Linda Mae

- | Reviews

1st National Processing is a well-known company in the payment processing sector, recognized for offering custom solutions to cater to the requirements of different types of businesses. The company is known for providing transparent and competitive pricing, which is especially attractive to SMEs and high-risk industries. Let’s delve deeper into the 1st National Processing Review.

Brief Overview of the Company | 1st National Processing Review

Established with the goal of making payment processing easier for businesses of every size, 1st National Processing has always prioritized providing dependable and secure services. The business is based in Orem, Utah and functions as an authorized ISO and MSP of Avidia Bank and Chesapeake Bank. Their dedication to being open and providing great customer service has enabled them to remain a prominent player in the market, leading to their inclusion in the prestigious Inc. 5000 list of rapidly expanding corporations.

1st National Processing offers a wide array of services designed to cater to diverse business needs. These include:

Payment Processing: The core of their offerings, including credit and debit card processing, ACH, and eCheck processing, suitable for both low-risk and high-risk industries.

Point of Sale (POS) Systems: Strong and versatile POS solutions, such as Clover Station, that effortlessly blend with current business operations.

Mobile Payment Solutions: Designed for businesses that require on-the-go payment processing, with mobile POS systems compatible with both iOS and Android devices.

E-Commerce Solutions: Comprehensive online payment gateways that support various integrations, including partnerships with Authorize.net, enabling businesses to accept payments through their websites securely.

Merchant Cash Advances: Customized financial options designed to offer expedited access to funding for businesses, aiding in the efficient management of cash flow.

1st National Processing aims to empower businesses through the offering of cost-effective, clear, and dependable payment processing services. Their goal is to create enduring connections with their customers through providing tailored solutions that cater to the specific requirements of every company. They aspire to become the top payment processing ally for businesses throughout North America, assisting them in flourishing and succeeding in a digital economy that is constantly evolving.

Service Offerings

1st National Processing offers a comprehensive suite of services tailored to meet the diverse needs of businesses across various industries. Their service offerings are designed to provide seamless and efficient payment processing, whether for brick-and-mortar stores, online businesses, or mobile operations.

Payment Processing Solutions

1st National Processing specializes in credit and debit card processing, providing businesses with the ability to accept all major card brands, including Visa, MasterCard, and American Express. Their payment processing solutions are tailored to both low-risk and high-risk merchants, ensuring a wide range of industries can benefit from their services. Additionally, they offer ACH and eCheck processing, which provides a secure and reliable method for handling electronic payments and direct bank transfers. This flexibility allows businesses to cater to customers who prefer using bank accounts over credit cards.

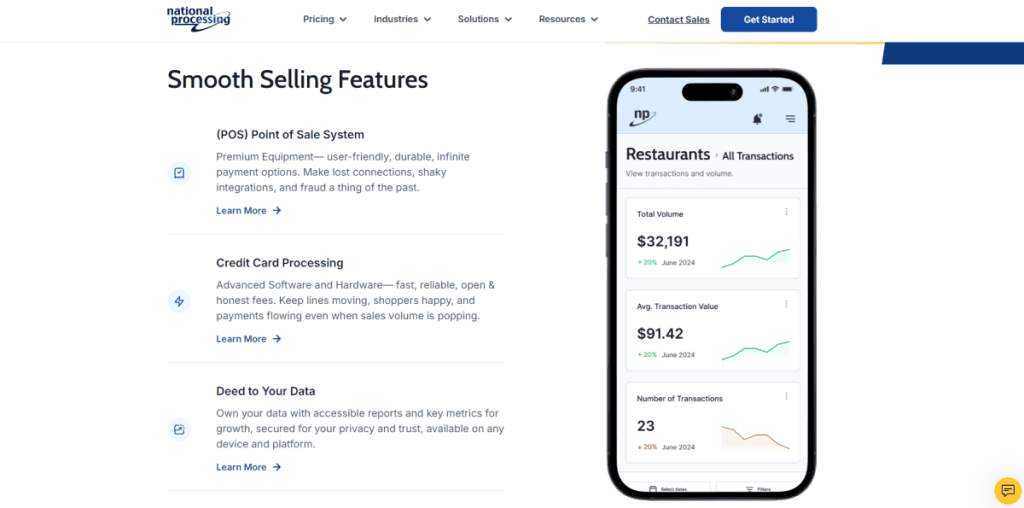

Point of Sale (POS) Systems

1st National Processing provides a range of point-of-sale systems tailored to fit the specific requirements of various businesses. They offer sophisticated systems such as Clover Station, which work smoothly with current business setups. These POS systems come with features such as inventory tracking, sales monitoring, and staff management tools, offering a complete package for handling daily business activities. Their compatibility ensures that businesses can readily add these systems to their current technology without any issues.

Mobile Payment Solutions

For businesses that require on-the-go payment processing, 1st National Processing provides mobile payment solutions compatible with both iOS and Android devices. These mobile solutions allow businesses to process payments anywhere, making them ideal for industries such as food delivery, retail, and event management. The mobile payment features include support for contactless payments and integration with various mobile apps, ensuring smooth transactions and enhanced customer convenience.

E-Commerce Solutions

1st National Processing supports online businesses through its e-commerce solutions, offering secure payment gateways that integrate with popular platforms like WooCommerce and Shopify. These gateways are equipped with robust security features, including encryption and fraud prevention tools, to ensure that online transactions are safe and secure.

Merchant Cash Advances

Besides handling payments, 1st National Processing also provides businesses with quick cash advances. This is helpful for companies that need money fast for their day-to-day activities or to grow. The process to apply is simple, and whether you qualify depends on how much your business sells. This makes it easy for many businesses to get the money they need to manage their finances better.

Pricing and Fee Structure

1st National Processing is known for its transparent and competitive pricing models, which are designed to cater to businesses of varying sizes and industries. Understanding their pricing and fee structure is crucial for businesses to make informed decisions when choosing a payment processor.

Overview of Pricing Models

1st National Processing offers two primary pricing models: flat-rate pricing and interchange-plus pricing. The flat-rate pricing model is straightforward, where businesses pay a fixed percentage per transaction, regardless of the card type or transaction amount. This model is ideal for businesses that prefer simplicity and predictability in their processing fees.

The interchange-plus pricing model, on the other hand, is more detailed and transparent. It involves paying the actual interchange rate (set by the card networks) plus a small markup determined by 1st National Processing. This model is often favored by businesses with higher transaction volumes, as it can result in lower overall costs compared to flat-rate pricing.

Detailed Fee Breakdown

1st National Processing offers a detailed list of the different charges for its services. The cost of each transaction changes based on the pricing plan selected, and interchange-plus is usually cheaper for companies that handle a lot of transactions. Besides transaction fees, companies also pay monthly fees that include keeping the account active and getting help from customer service. These monthly fees are usually small, so their services are affordable for small and medium-sized businesses.

Chargeback fees are also part of the cost structure, which applies when a customer disputes a transaction. While chargeback fees are standard across the industry, 1st National Processing offers competitive rates in this area as well.

Comparison with Competitors

When compared to other payment processors, 1st National Processing stands out for its transparency. The company is upfront about its pricing and does not impose hidden fees, a practice that sets it apart from many competitors. Additionally, the disclosure of terms and conditions is clear and concise, ensuring that businesses fully understand what they are agreeing to before signing up. This level of transparency helps build trust and confidence among their clients, making 1st National Processing a reliable choice for payment processing needs.

Contract Terms

1st National Processing offers a range of contract terms that are designed to provide businesses with flexibility while ensuring clear guidelines for both parties. Understanding these contract terms is essential for businesses to make informed decisions and avoid potential pitfalls.

Contract Length and Termination

1st National Processing typically offers month-to-month contracts, which is a significant advantage for businesses that prefer not to be tied down to long-term commitments. This flexibility allows businesses to test the service without the pressure of a lengthy contract. However, for those who opt for free equipment provided by the company, a longer contract term might be required, often ranging from one to three years.

Early Termination Fees

Typically, businesses that terminate a long-term contract early are charged an early termination fee (ETF). The typical ETF price is approximately $295, which is quite prevalent in the sector. Still, there is some flexibility provided by 1st National Processing. In case of a business shutting down or changing ownership, the ETF might be canceled. Furthermore, in the event that the company is unable to match or surpass a rival’s pricing, businesses may also have the option to leave without facing the fee.

Renewal Policies

Automatic renewal policies are often in place with payment processing contracts, and 1st National Processing is no exception. Contracts may automatically renew at the end of the term unless the business opts out. The company typically provides a window before the contract’s end date during which businesses can choose to opt out of renewal without penalty.

Flexibility and Negotiation

1st National Processing is known for being relatively flexible in its contract terms. Businesses can often negotiate the terms of their agreement, including the length of the contract and specific fees. This flexibility extends to customization, where businesses can tailor the contract to better suit their operational needs, ensuring that the service aligns with their specific business requirements.

Customer Support and Service Quality

1st National Processing places a strong emphasis on providing high-quality customer support, understanding that reliable service is crucial for businesses that depend on smooth payment processing. The company offers multiple channels of support to ensure that their clients can easily access assistance whenever needed.

Availability of Support Channels

1st National Processing offers different types of support options such as phone assistance, email assistance, and live chat. These choices enable businesses to select the most suitable way for them to receive assistance. Phone assistance is offered throughout regular business hours, giving direct and immediate help for urgent matters. Email support is perfect for inquiries that are not time-sensitive, as responses are usually given within a reasonable amount of time. Moreover, the live chat option provided by the company presents a convenient solution for addressing problems quickly, particularly for individuals who do not want to speak on the phone.

Quality of Support

The quality of customer support at 1st National Processing is generally regarded as high. The company is known for its prompt response times, ensuring that businesses can resolve issues quickly and continue their operations without significant interruptions. Their support staff is well-trained and possesses the technical expertise needed to address a wide range of issues, from basic account inquiries to more complex technical problems.

Client Onboarding Experience

The onboarding process with 1st National Processing is designed to be smooth and efficient. New clients typically find the setup process to be straightforward, with clear instructions and assistance provided every step of the way. The company offers a variety of training materials and resources to help businesses get up and running quickly. This includes detailed documentation, video tutorials, and access to knowledgeable support staff who can guide clients through the initial setup and configuration of their payment processing systems.

Security and Compliance

1st National Processing prioritizes the security and compliance of its payment processing services, ensuring that businesses can handle transactions safely and meet industry standards. By adhering to strict security protocols and compliance measures, the company provides a reliable foundation for businesses to process payments with confidence.

PCI Compliance

One of the key aspects of 1st National Processing’s security framework is its adherence to PCI DSS (Payment Card Industry Data Security Standard) requirements. PCI DSS is a set of security standards designed to protect cardholder data and ensure secure payment processing. All companies that deal with, work on, or keep credit card details must follow these rules. 1st National Processing’s dedication to following the PCI rules means they meet all the important standards. This helps companies avoid fines and keep their customers’ private information safe.

Data Encryption and Security Protocols

1st National Processing employs advanced data encryption and security protocols to safeguard transaction data. The company uses robust encryption methods, such as SSL (Secure Sockets Layer) and TLS (Transport Layer Security), to protect data in transit. These encryption techniques ensure that sensitive information, such as credit card details, is securely transmitted between the customer, the merchant, and the payment processor, reducing the risk of data breaches.

Protection Against Data Breaches

To better guard against data leaks, 1st National Processing uses several security steps, such as firewalls, systems that spot unwanted intrusions, and checks on security done regularly. These steps help find and stop people from getting into payment information without permission, keeping businesses and their customers safe from possible dangers.

Fraud Prevention Tools

1st National Processing also offers a range of fraud prevention tools to help businesses minimize the risk of fraudulent transactions. These tools include features such as address verification services (AVS), card verification value (CVV) checks, and real-time transaction monitoring. The effectiveness and accuracy of these tools are critical in identifying and preventing fraudulent activities, thereby reducing chargebacks and financial losses for businesses.

Reputation and Customer Feedback

1st National Processing has garnered a mixed reputation within the payment processing industry, with a range of customer reviews and feedback that reflect both positive and negative experiences. This mix of feedback is not uncommon in the payment processing sector, where customer experiences can vary widely depending on specific business needs and expectations.

Customer Reviews and Testimonials

The overall attitude observed in customer feedback about 1st National Processing tends to be positive, especially in respect to their clear pricing and dependable service. Numerous businesses value the clear fee system and the company’s dedication to reducing mysterious charges. Testimonials frequently emphasize the user-friendly nature of their payment processing systems and the assistance provided by their customer support team.

However, some reviews also point to areas of concern. Common complaints include issues with contract terms, particularly early termination fees, and occasional challenges in customer service response times. While these concerns are noted, they seem to be less frequent compared to the overall positive feedback the company receives.

Industry Reputation

Within the payment processing industry, 1st National Processing holds a respectable position, especially among small to medium-sized businesses. The company is recognized for its transparency and its focus on providing cost-effective solutions for a wide range of industries. This reputation is further bolstered by their inclusion on the Inc. 5000 list of fastest-growing companies, which is a significant accolade in the business world.

Awards and Recognitions

Although 1st National Processing does not boast many industry awards, its steady performance and high customer satisfaction have established its reputation as a trustworthy payment processing provider. The company’s commitment to transparency and excellent customer service has set it apart from rivals in a busy market.

Social Media Presence

1st National Processing maintains an active social media presence, engaging with customers and providing updates on services and industry trends. Their activity on platforms like LinkedIn and Facebook helps them stay connected with their customer base and address any concerns or inquiries in real-time. This engagement also allows them to showcase customer testimonials and success stories, further enhancing their reputation.

Pros and Cons

Advantages of Using 1st National Processing:

Competitive Pricing: 1st National Processing is known for its transparent and cost-efficient pricing structures. The company provides flat-rate and interchange-plus pricing choices, which can assist businesses in cutting transaction costs, especially those with large transaction volumes.

Wide Range of Services: The company provides a comprehensive suite of payment processing solutions, including credit and debit card processing, ACH and eCheck processing, and mobile payment options. They also offer advanced POS systems that integrate seamlessly with existing business infrastructures, making it easier to manage sales and operations.

Strong Security Measures: 1st National Processing guarantees strong security by following PCI standards, using high-level data encryption, and employing effective fraud prevention methods. These steps safeguard businesses and their customers against security threats and fraudulent actions.

Drawbacks:

Potential for Hidden Fees: While 1st National Processing is generally praised for its transparency, there have been instances where customers encountered unexpected fees, such as early termination fees or specific service charges. It’s crucial for businesses to thoroughly review the contract terms to avoid surprises.

Lengthy Contract Terms: Businesses that utilize complimentary equipment promotions may be subject to lengthy contract terms, typically lasting between one to three years. Those looking for flexibility may face restrictions if the business cancels the contract before it ends, as early termination fees could be imposed.

In summary, 1st National Processing offers competitive pricing, a broad range of services, and strong security, making it a solid choice for many businesses. However, potential hidden fees and lengthy contract terms are important considerations for those evaluating this payment processing provider.

Conclusion

1st National Processing is a reliable option for small to medium-sized businesses looking for transparency, with competitive pricing, a variety of services, and robust security measures. Nevertheless, it’s important for companies to thoroughly examine contract conditions in order to prevent any unexpected additional charges. Great options for companies seeking to save money could be Square or PayPal.

FAQs

What is the typical contract length with 1st National Processing?

1st National Processing typically offers month-to-month contracts, providing flexibility for businesses. However, longer contracts of up to three years may apply if free equipment is provided.

How does 1st National Processing ensure data security?

The business uses PCI DSS compliance, advanced encryption protocols, and fraud prevention tools to secure sensitive payment information and prevent breaches.

Are there any hidden fees associated with their services?

While 1st National Processing is known for transparency, some customers have reported unexpected fees, such as early termination charges, highlighting the need for careful contract review.