Argus Merchant Services Review

- 11th Sep, 2024

- | By Linda Mae

- | Reviews

Argus Merchant Services is a company located in New York that offers payment processing solutions at a reasonable cost and with flexibility. Established in 2014, the company rapidly gained a strong reputation for providing clear, effective, and dependable services specifically designed for small and medium-sized businesses. Argus specializes in assisting a variety of sectors, such as retail and online shopping, by facilitating seamless acceptance of credit, debit, and mobile payments, positioning them as a top choice for merchant services. Lets read more about Argus Merchant Services Review.

The company’s reputation in the industry is strengthened by its inclusion in various prestigious rankings, like the INC. Both the Entrepreneur360 and 5000 rankings showcase their continuous expansion and strong leadership. Argus has received praise for its competitive prices and easy-to-use services, resulting in positive reviews from customers and acknowledgements from leading business platforms.

Company Background and Overview | Argus Merchant Services Review

Founded in 2014, Argus Merchant Services entered the competitive financial technology space with a mission to simplify payment processing for businesses. From the beginning, the company aimed to address common challenges faced by merchants, including hidden fees and complex contract terms. Argus’s mission is centered on providing clear, honest, and flexible solutions that allow businesses to thrive without being bogged down by unnecessary costs.

Under the guidance of Eugene Gold, the Managing Partner, the company carries out its operations successfully by prioritizing customer satisfaction, which has been crucial for Argus. With his leadership, the company has promoted a culture of openness and high quality, guaranteeing top-notch support and service for their merchants.

With over a decade in the merchant services industry, Argus has built extensive expertise, making them a trusted partner for businesses of all sizes. Their consistent appearance on industry lists like INC. 5000 and Entrepreneur360 serves as testament to their success. In addition, the company’s flexible solutions cater to diverse market segments, making them highly adaptable to changing business needs.

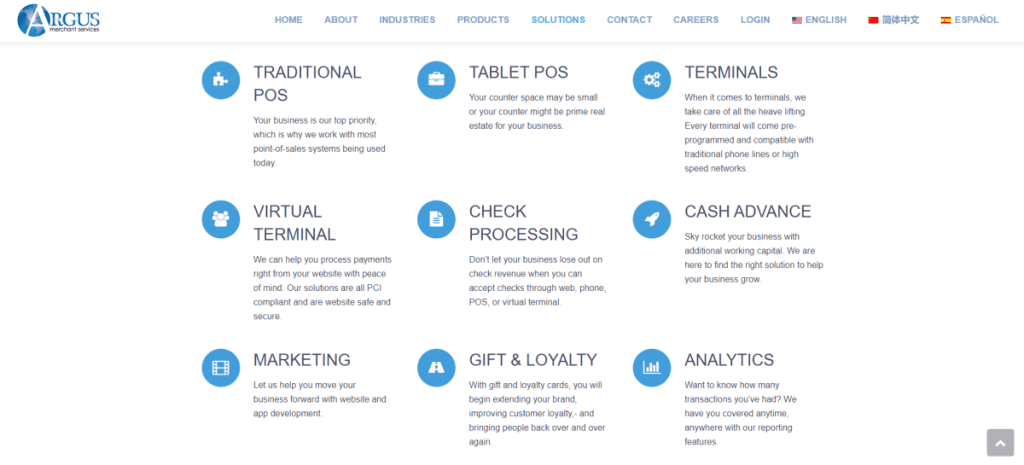

Services Offered by Argus Merchant Services

Argus Merchant Services offers a comprehensive range of solutions designed to streamline payment processing for businesses of all sizes. Their offerings cater to various industries, including retail, e-commerce, and hospitality, providing flexible tools to manage transactions securely and efficiently.

Payment Processing Solutions

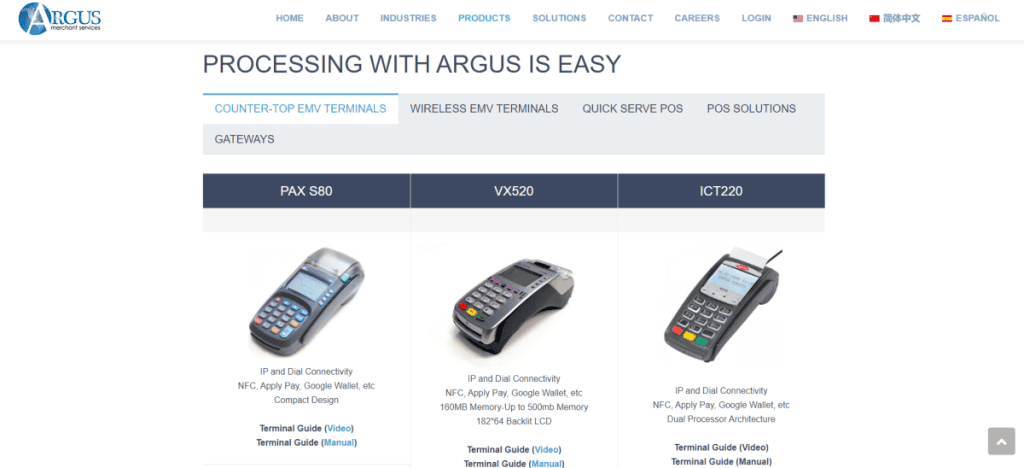

Argus provides businesses with access to multiple payment gateways, allowing them to accept credit cards, debit cards, and mobile payments such as Apple Pay and Google Pay. This wide range of payment options ensures that businesses can cater to the preferences of their customers. Argus’s platform supports secure, fast transactions and helps minimize the risk of fraud. Whether it’s in-store or online, their services are adaptable to different business models and needs.

Their solutions are widely used across industries such as retail, hospitality, and e-commerce, making them suitable for businesses that require a reliable, flexible payment infrastructure.

Point-of-Sale (POS) Systems

Argus Merchant Services offers customizable advanced POS systems for retail and restaurant industries. Their systems consist of both hardware and software that can be customized to meet specific business requirements, allowing for seamless integrations with inventory management systems, customer relationship management (CRM) platforms, and other business tools. Businesses can enhance their operational efficiency and provide customers with a smooth checkout experience, thanks to the flexibility of these systems.

E-Commerce Solutions

For online businesses, Argus provides a suite of e-commerce solutions that integrate easily with popular platforms like Shopify and WooCommerce. Their payment processing features allow e-commerce merchants to securely accept payments from customers worldwide. With seamless integration, businesses can quickly start accepting payments without technical complications.

Mobile Payment Processing

Argus offers solutions specifically designed for small businesses on-the-go. Mobile card readers and easy-to-use mobile applications allow merchants to process payments from virtually anywhere, providing them with the flexibility to serve customers outside traditional storefronts.

Recurring Billing and Subscription Services

Argus provides tools to help businesses that provide subscription-based services automate billing and oversee customer subscriptions. Their system allows businesses to easily manage recurring payments, simplifying customer management and decreasing administrative tasks. These characteristics assist companies in simplifying their money flow while providing convenience to their clients.

Security and Compliance Features of Argus Merchant Services

Argus Merchant Services takes security and compliance seriously, ensuring that merchants and their customers are protected throughout every transaction. The company employs a range of features and best practices to safeguard sensitive information and maintain industry standards, allowing businesses to operate with confidence.

PCI Compliance

Argus ensures that all its merchants comply with the Payment Card Industry Data Security Standards (PCI DSS). This set of standards is essential for any business handling cardholder data, as it establishes strict guidelines for securing sensitive information. Argus supports merchants by providing clear instructions and resources to help them meet these requirements. Additionally, the company’s payment systems are designed to be fully PCI compliant, reducing the burden on merchants and minimizing the risk of data breaches.

Fraud Prevention Tools

Argus Merchant Services employs advanced fraud detection and prevention mechanisms to safeguard businesses from fraudulent activities. The platform includes real-time monitoring tools that track transactions for any unusual activity, allowing for immediate intervention when necessary. These systems work continuously to detect suspicious behavior, reducing the chances of chargebacks and fraud-related losses. In addition, Argus provides comprehensive reporting features, allowing merchants to analyze transaction data and spot trends that might indicate fraudulent behavior.

Data Encryption

Argus increases security by utilizing end-to-end encryption and tokenization. End-to-end encryption guarantees the security of sensitive payment details from start to finish, making it extremely difficult for unauthorized parties to access and exploit the information during the transaction procedure. Tokenization enhances security by substituting sensitive card details with unique identification symbols that are impossible to decode back. This method greatly decreases the possibility of data being stolen and guarantees a safe transaction setting for merchants and their customers.

Pricing and Fee Structure of Argus Merchant Services

Argus Merchant Services offers a variety of pricing plans designed to accommodate businesses of different sizes and needs. Their pricing model typically includes monthly fees, transaction fees, and in some cases, additional costs related to chargebacks or disputes. While their fee structure can vary based on the type of business and transaction volume, Argus offers transparent pricing options to ensure that merchants understand the costs involved.

Monthly Fees, Transaction Fees, and Hidden Costs

Argus Merchant Services provides several pricing plans, each with its own monthly fee and transaction rates. The company offers both flat-rate and interchange-plus pricing models. Flat-rate pricing is a simple model where merchants pay a fixed percentage per transaction, making it easy to predict costs. Interchange-plus pricing, on the other hand, is more complex but often more cost-effective for larger businesses. This model breaks down fees into the interchange fee set by credit card networks, plus a fixed markup from Argus. Merchants should be aware of potential hidden costs, such as additional fees for certain transactions or services, including chargebacks and refunds.

Contract Terms

Argus usually asks merchants to sign a contract, whose duration may differ based on the chosen plan. Contracts are typically adaptable, enabling merchants to adjust their plans to meet changing business needs. Nevertheless, early termination fees might be enforced in the event that a company chooses to end the agreement before its completion. Merchants should thoroughly examine the contract terms to prevent any surprise expenses if they decide to end the service prematurely.

Additional Charges

In addition to standard transaction fees, Argus may impose extra fees for specific situations. For instance, there may be charges for processing chargebacks, issuing refunds, or managing payment disputes. Businesses that lease POS equipment from Argus may also incur equipment leasing fees or maintenance costs, depending on the terms of their contract.

Customer Support and Service of Argus Merchant Services

Argus Merchant Services places significant emphasis on customer support to ensure businesses receive timely assistance when needed. Whether a small business owner or a high-volume merchant, Argus aims to provide robust customer service through multiple channels and dedicated resources.

Availability

Argus Merchant Services offers 24/7 customer support via phone, email, and live chat, allowing businesses to resolve issues or get answers to their questions at any time. This round-the-clock availability is especially beneficial for businesses that operate outside standard business hours or across different time zones. For high-volume merchants, Argus provides dedicated account managers, offering personalized service and direct points of contact to resolve specific issues more quickly.

Response Time and Effectiveness

Argus is recognized for its quick and efficient service in terms of response times. Typically, inquiries receive quick responses, with the majority of issues being resolved in a matter of hours. Quick resolutions are given top priority by the company, especially for critical issues, such as those impacting payment processing, in order to reduce disruptions to the business. Shop owners are pleased with the company’s prompt handling of problems and consistent communication.

Support for Setup and Integration

Argus provides comprehensive onboarding support to ensure that new merchants can smoothly integrate their payment processing systems. This includes personalized training sessions for merchants unfamiliar with payment processing software. Additionally, Argus offers technical assistance for system integration, ensuring that their POS and e-commerce solutions work seamlessly with a business’s existing infrastructure. This level of support is especially beneficial for businesses transitioning from another provider or those implementing a POS system for the first time.

Ease of Use and User Experience of Argus Merchant Services

Argus Merchant Services is designed to offer a seamless user experience for businesses of all sizes. The platform focuses on simplicity and efficiency, ensuring that merchants can easily manage their payment processing needs without any unnecessary complexity.

Merchant Dashboard and Reporting

Argus Merchant Services is characterized by its notable merchant dashboard. The dashboard is user-friendly and simple to navigate, enabling users to oversee and control their transactions instantly. Merchants have the ability to promptly retrieve important performance metrics, examine transaction records, and create personalized reports. These reports address important areas such as sales, returns, and disputes, allowing businesses to understand their financial performance better. The design of the dashboard is user-friendly, making it easy for business owners to efficiently manage their operations without technical expertise or extensive training.

The reporting tools are also highly customizable. Merchants can tailor reports to meet their specific needs, whether it’s tracking daily sales, monitoring refund requests, or analyzing chargeback data. This flexibility allows businesses to make informed decisions based on accurate, up-to-date information.

POS and Mobile App Interface

Argus Merchant Services provides a user-friendly point-of-sale (POS) system and mobile app that simplify the checkout process. The POS systems are designed with ease of use in mind, featuring intuitive layouts that make it easy for employees to learn and operate. The mobile app is also well-regarded for its smooth functionality, allowing businesses to accept payments on-the-go without any technical hurdles. Whether it’s processing credit card payments or managing customer data, the app’s interface is simple and streamlined, ensuring a hassle-free experience.

Reputation and Customer Reviews of Argus Merchant Services

Argus Merchant Services has built a solid reputation within the payment processing industry, particularly for small to medium-sized businesses. The company is often praised for its competitive pricing, customer support, and reliable payment processing solutions. However, as with any service provider, Argus has received a mix of positive and critical feedback, depending on the individual experiences of its clients.

Overall Reputation in the Industry

Argus Merchant Services is known for offering strong payment processing solutions that prioritize flexibility and affordability. Numerous small businesses praise the company for providing affordable services with no hidden charges. Argus’s positive reputation in the industry can also be attributed to its easy-to-use platform and reliable support system. High-volume merchants especially value having dedicated account managers on hand, as it assists them in swiftly and effectively resolving any issues that may arise.

Positive feedback from customers often highlights Argus’s easy-to-use platform, seamless integration with existing systems, and transparent pricing. On the other hand, some complaints mention occasional issues with service responsiveness during peak times, along with a few reports of hidden fees or complexities in contract terms that weren’t initially clear.

Ratings Across Review Platforms

On popular review platforms like Trustpilot and the Better Business Bureau (BBB), Argus Merchant Services has generally favorable ratings. Customers consistently rate the company high for its ease of use, efficient transaction processing, and attentive customer service. Small businesses often emphasize how Argus helps them streamline their operations with minimal hassle.

However, larger merchants sometimes express frustration with limitations in scalability and occasional technical issues, especially during high transaction volumes. Complaints are relatively rare but often focus on perceived delays in customer support response times or difficulties in navigating the contract terms.

In general, Argus Merchant Services has a good image, especially among small to medium-sized businesses who prioritize cost-effectiveness and easiness in payment processing options. The company’s ratings indicate overall contentment but highlight the significance of thoroughly examining contract terms and possible fees.

Competitors and Alternatives of Argus Merchant Services

Argus Merchant Services operates in a highly competitive space, offering similar services to many other merchant service providers. While it has carved out a niche for itself by focusing on transparent pricing and robust customer support, several competitors offer comparable solutions with their own unique strengths. Understanding how Argus compares to its competitors is key for businesses evaluating their payment processing options.

Comparison with Other Merchant Service Providers

When compared to other leading merchant service providers such as Square, PayPal, and Stripe, Argus stands out for its dedicated account management, which is particularly beneficial for high-volume merchants. Argus also offers more traditional pricing structures like interchange-plus, which may be more cost-effective for businesses with large transaction volumes, compared to the flat-rate pricing models favored by competitors like Square.

Many small businesses value Argus’s emphasis on transparency in fees and contracts as one of its main strengths. Nevertheless, Argus’s system may not be as scalable for certain merchants when compared to more technology-driven rivals like Stripe, which is known for its developer-friendly APIs and worldwide payment solutions. Furthermore, Square provides a wider variety of hardware and software integrations for point-of-sale systems, giving it an advantage in flexibility for retail and hospitality businesses.

Why Argus May Be a Better Choice for Specific Business Types

Argus is often a better choice for small to mid-sized businesses that value personalized customer service and straightforward pricing. Its dedicated account managers and 24/7 customer support make it an ideal option for merchants who need hands-on assistance with payment processing, particularly in industries like retail, hospitality, and e-commerce. Businesses that prioritize simple integration and a high level of customer support will find Argus more tailored to their needs compared to competitors focused primarily on tech innovation.

Available Alternatives

For businesses considering alternatives, there are several options to explore. Providers like PayPal and Square offer user-friendly, flat-rate pricing models that are excellent for small businesses and startups looking for simplicity and ease of setup. Stripe is ideal for tech-savvy businesses needing advanced customization options and global payment support. For larger enterprises, providers like First Data and Worldpay offer more extensive solutions, including advanced fraud protection and broader hardware integrations.

When it comes to pricing, Square and PayPal offer competitive rates for small transactions, whereas Stripe and Argus offer more tailored pricing options for businesses with larger transaction volumes. The level of customer service differs among these providers, with Argus and Square receiving acclaim for their reactive assistance, while Stripe is more oriented towards developers, providing robust technical resources instead of direct support.

Final Verdict

Argus Merchant Services provides a trustworthy and clear payment processing solution, especially designed for small to medium-sized businesses. With its competitive pricing, dedicated support, and flexible integrations, it is a great choice for individuals in need of a simple service. In general, Argus offers value by keeping things simple, offering robust customer support, and prioritizing clear fee structures.

FAQs

What types of businesses does Argus Merchant Services support?

Argus Merchant Services caters to a variety of sectors such as retail, restaurants, e-commerce, and service-based companies. They provide options for payment processing, POS systems, and mobile payments for merchants of all sizes.

Does Argus Merchant Services provide a free trial?

No, Argus Merchant Services does not offer a free trial. However, they provide comprehensive product demos and walkthroughs to help prospective customers understand the platform before committing.

Are there any hidden fees with Argus Merchant Services?

While Argus aims for pricing transparency, additional fees may apply for chargebacks, refunds, and equipment leasing. Reviewing contract terms carefully is recommended to avoid unexpected costs.