Credit Card Processing Specialists Review

- 16th Sep, 2024

- | By Linda Mae

- | Reviews

CCPS is a well-known provider in the payment processing sector, providing a wide range of services to assist businesses of varying sizes. CCPS is dedicated to helping merchants by offering trustworthy payment solutions, aiming to streamline transaction processes so businesses can concentrate on their main activities. Lets read more about Credit Card Processing Specialists Review.

Established in 2010, CCPS has expanded to cater to more than 1,000 current customers in different sectors. Included in its offerings are conventional credit card processing, mobile payment choices, virtual terminals, as well as POS systems, all supported by strong round-the-clock customer service. CCPS is highly respected for its capacity to provide competitive pricing, transparent rates, and smooth integration with business systems. This makes it an appealing option for both small businesses and large enterprises.

The company’s mission is to provide businesses with the tools and services needed to process transactions efficiently, regardless of their size or industry. CCPS is also committed to maintaining high levels of security, ensuring that all its services meet the latest PCI DSS compliance standards. This focus on safety, paired with flexible solutions, underlines its dedication to client satisfaction and operational excellence.

Beyond its core payment processing services, CCPS offers value-added features like mobile payment solutions, loyalty and gift card programs, and international payment capabilities. These services are particularly beneficial for businesses that operate in various sectors, such as retail, e-commerce, and hospitality.

Services Offered by Credit Card Processing Specialists | Credit Card Processing Specialists Review

Credit Card Processing Specialists (CCPS) offers a comprehensive range of services aimed at helping businesses efficiently manage their payment processes. Below is an in-depth look at the key services they provide:

Credit Card Processing Services

CCPS’s primary service revolves around credit card processing, allowing businesses to receive payments through different credit card options. This service facilitates secure and prompt transactions by accepting both traditional and chip-enabled cards while adhering to industry standards. Companies experience advantages such as affordable transaction fees, fast settlement times, and easy-to-use interfaces for collecting payments.

E-Commerce Payment Solutions

For online businesses, CCPS offers robust e-commerce payment solutions. These services allow merchants to accept payments through their websites, ensuring secure transactions via integration with leading shopping carts and payment gateways. By providing fraud protection features and compliance with PCI DSS standards, CCPS helps businesses safely manage online transactions and maintain customer trust. The platform also supports recurring billing, ideal for subscription-based models.

Point-of-Sale (POS) Systems and Hardware Support

CCPS offers different point-of-sale (POS) systems designed for retail, hospitality, and service sectors. These systems are created to be personalized, catering to various types of businesses. From simple credit card terminals to sophisticated systems with inventory tracking capabilities, CCPS guarantees smooth transaction management for businesses. The hardware includes installation and continued assistance to guarantee efficient functioning and reduce downtime.

Mobile Payment Options

For businesses on the go, CCPS offers mobile payment solutions. Using mobile card readers and smartphone applications, merchants can accept payments from anywhere, providing flexibility for service providers, tradespeople, and businesses that operate in multiple locations. Mobile payments ensure quick processing while maintaining security standards, offering businesses a convenient way to expand their payment capabilities.

Virtual Terminals and Online Payment Gateways

A standout feature of CCPS’s offerings is the virtual terminal, which allows merchants to accept payments through a web-based interface without the need for physical hardware. This service is ideal for businesses that handle transactions over the phone or through email. Additionally, CCPS provides online payment gateways, which integrate seamlessly with business websites, enabling secure online transactions for customers and reducing the risk of fraud.

Pricing and Fees

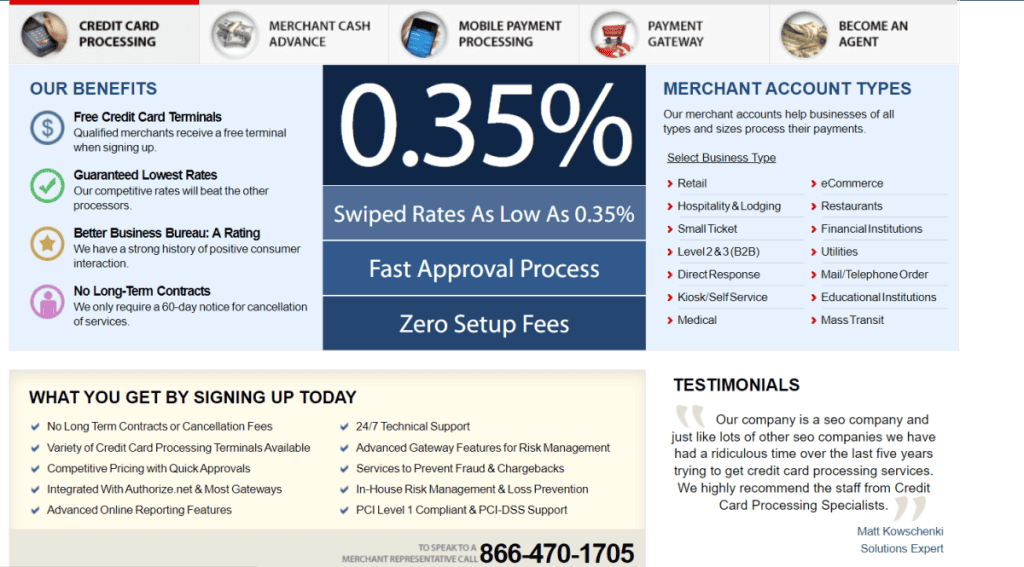

Credit Card Processing Specialists provides different pricing models tailored to accommodate different business requirements. The two main choices are interchange-plus pricing and tiered pricing. The interchange-plus model is commonly viewed as the more transparent option, since it enables businesses to view the specific interchange fees established by credit card networks like Visa and Mastercard, as well as a slight markup imposed by the processor. Businesses with a high volume of transactions prefer this model as it offers clear cost breakdowns.

In contrast, the tiered pricing model simplifies the fee structure by categorizing transactions into different tiers (e.g., qualified, mid-qualified, and non-qualified). Each tier is associated with a set fee. While this approach is easier to understand, it can sometimes result in higher overall costs, particularly for businesses that process a large number of non-qualified transactions. The lack of transparency in tiered pricing may also make it harder for merchants to know what they are being charged for each transaction.

Credit Card Processing Specialists imposes different fees on top of transaction expenses. These fees might encompass monthly expenses for services such as customer assistance and account oversight. Businesses might also face additional expenses such as PCI compliance fees, charges for renting equipment for point-of-sale (POS) terminals, and fees for using virtual terminals. Furthermore, certain companies might require renting or buying equipment, which could result in substantial initial or continuous expenses.

Another critical consideration is cancellation fees. While some processors offer month-to-month contracts, Credit Card Processing Specialists may require longer-term agreements with penalties for early termination. Merchants should carefully review their contract terms to understand the potential financial implications of canceling their service early.

Supported Industries

Credit Card Processing Specialists offers services designed to cater to a wide range of industries, including retail, restaurants, e-commerce, and service-based businesses. These sectors benefit from flexible payment options, such as point-of-sale (POS) systems, mobile payment solutions, and e-commerce gateways. Whether a business operates online or offline, the company provides the tools necessary to handle transactions efficiently.

Credit Card Processing Specialists customizes solutions to meet the distinctive needs of businesses in particular industries. In the restaurant sector, customized POS systems are provided to optimize operations, enhance transaction efficiency, and seamlessly integrate with other business management tools. In the same way, retail companies can gain advantages by utilizing inventory management capabilities that are combined with payment processing systems, which can improve operational efficiency.

One of the standout offerings is the company’s support for high-risk merchant accounts. These accounts are designed for businesses deemed higher risk by traditional payment processors due to factors such as elevated chargeback rates or the nature of the products and services they offer. Industries that typically fall into this category include CBD, nutraceuticals, adult entertainment, and debt services. Businesses in these sectors often struggle to find reliable payment processing, but Credit Card Processing Specialists helps by offering high approval rates and customized pricing solutions that reflect the risk involved.

Overall, the company ensures businesses, including those in high-risk industries, have access to secure and reliable payment solutions, enabling them to manage their operations and grow despite the complexities of their industry. This adaptability makes Credit Card Processing Specialists a suitable option for a broad spectrum of businesses.

Ease of Use and Setup Process

Credit Card Processing Specialists provides a user-friendly platform that simplifies the process for businesses to get started with payment processing. Below are key aspects that outline the ease of use and setup experience.

Onboarding Process

The process of getting started is created to be simple and easy to understand. The majority of companies can finish the registration and account setup process in just a few days. It requires providing essential business details, such as tax IDs and financial paperwork, to authenticate the account. The company guarantees a seamless and guided process, catering to businesses with simple technical needs.

Integration with Existing Business Systems

One of the significant strengths of Credit Card Processing Specialists is its ability to integrate smoothly with a variety of existing business systems. Whether you use a popular POS system, an e-commerce platform, or accounting software, the platform ensures compatibility. This means that businesses don’t have to overhaul their existing systems, making the transition to Credit Card Processing Specialists seamless and hassle-free.

User Interface and Backend Functionality

The platform features an intuitive user interface that is easy for both owners and employees to navigate. Merchants can access the backend to view real-time sales data, transaction history, and customizable reports. The system also offers robust chargeback management and fraud prevention tools, making it easy to monitor and control all aspects of payment processing without being overwhelming for users.

Training and Support

Credit Card Processing Specialists offers full training and customer assistance during the setup phase. Their team is ready to help with setting up hardware, integrating software, and resolving any troubleshooting issues that may arise. Continued assistance is also provided, allowing businesses to sustain seamless operations after the initial setup.

Customer Support

Credit Card Processing Specialists provides a robust customer support system to ensure businesses receive help when they need it. Their support infrastructure is available 24/7, which is critical for businesses that may encounter issues outside regular working hours. Whether it’s a technical glitch or a transaction inquiry, their round-the-clock service is designed to minimize downtime and keep operations running smoothly.

Types of Support Offered

The company provides different support choices, which include around-the-clock customer service. Businesses can contact support agents through phone, email, or live chat. Dedicated account managers are also provided for bigger accounts to offer personalized service. This guarantees that companies with more intricate requirements or greater transaction volumes can benefit from having a single and reliable point of contact to resolve issues quickly. Moreover, they offer a self-service portal that enables businesses to handle routine tasks like monitoring transaction histories and generating reports without the need to reach out to support.

Response Times and Efficiency

One of the standout aspects of Credit Card Processing Specialists’ customer service is their swift response times. Businesses can typically expect quick resolutions, especially when dealing with urgent technical issues. The company understands that delays in processing can directly affect sales and customer satisfaction, so they prioritize immediate response and efficient problem-solving. This promptness helps businesses avoid prolonged downtime and ensures continued transaction processing without disruptions.

Support Channels

Credit Card Processing Specialists provides various support channels like phone, email, and live chat for easy communication with businesses. Their self-service portal provides a range of resources, including FAQs and detailed guides, for individuals who like to troubleshoot by themselves, aiding businesses in resolving minor issues without assistance.

Security and Compliance

When it comes to security, Credit Card Processing Specialists takes significant measures to protect both merchants and their customers. Their compliance with the Payment Card Industry Data Security Standard (PCI DSS) ensures that sensitive cardholder information is processed, stored, and transmitted securely. PCI DSS is a set of security requirements that businesses handling card transactions must follow to prevent data breaches. Compliance with these standards is mandatory and helps merchants avoid penalties while safeguarding their customers’ data.

Fraud Detection and Prevention Tools

Credit Card Processing Specialists utilizes strong fraud detection and prevention tools to recognize and alleviate risks immediately. These tools are crucial for identifying doubtful behavior, unauthorized entry, or possible breaches. Through constant transaction monitoring and analysis, they can promptly detect anomalies, thus stopping fraud in its tracks. Additional security measures like firewalls and multi-layered authentication contribute to improved security, decreasing the risk of fraud incidents.

Encryption and Tokenization Methods

To secure data during transactions, Credit Card Processing Specialists utilizes encryption and tokenization methods. Encryption ensures that any data transmitted during a transaction is unreadable by unauthorized parties. Meanwhile, tokenization replaces sensitive data with unique identifiers (tokens), rendering it useless if intercepted. These methods protect cardholder data both during transit and while at rest, offering an additional layer of security to merchants and customers alike.

Chargeback Protection and Dispute Resolution

Handling chargebacks can be a significant challenge for businesses, and Credit Card Processing Specialists provides chargeback protection and dispute resolution services to address these concerns. Their tools help merchants track and manage disputes efficiently, ensuring that issues are resolved quickly and fairly. These services not only reduce the financial impact of chargebacks but also help businesses maintain strong customer relationships by resolving conflicts promptly.

Reputation and Customer Feedback

Credit Card Processing Specialists has a mixed reputation based on online reviews and customer feedback. While some users appreciate their transparent pricing and solid customer support, others have expressed concerns about hidden fees and unexpected charges.

General Sentiment from Online Reviews and Ratings

The company has received a mix of positive and negative reviews across different platforms. Some clients praise the ease of use and responsive customer service, particularly for smaller businesses that need quick setup and reliable transaction processing. However, several reviews indicate concerns over hidden fees, such as PCI compliance and gateway charges, which can frustrate merchants. Although the company does not have a Better Business Bureau (BBB) rating, it generally maintains a neutral standing in the industry.

Positive and Negative Customer Experiences

Customers value the flexible contract terms, such as the absence of early termination fees, which enable them to cancel services without facing hefty financial consequences. Moreover, certain customers emphasize the promptness of the customer service team, which effectively deals with inquiries. Nevertheless, there have been concerns raised about the lack of clarity in pricing, as merchants have cited instances of being billed higher fees than anticipated. Some also brought up problems with fund holds and delayed payments, which could have a negative effect on cash flow.

Industry Reputation and Awards

While Credit Card Processing Specialists has not won any significant industry awards, the company is generally recognized for providing adequate payment solutions for small and medium-sized businesses. Its use of independent sales agents has raised some concerns, as this model can sometimes lead to misleading sales practices. Nonetheless, the company has managed to avoid major lawsuits or legal actions, which suggests that it is viewed as a reliable processor within the payment industry.

Comparison to Competitors

When comparing Credit Card Processing Specialists to other major players in the industry, the company holds its own but has some distinct pros and cons. It’s crucial to look at how it stacks up against industry leaders in terms of pricing models, customer service, and unique features.

How Credit Card Processing Specialists Stack Up Against Industry Leaders

Credit Card Processing Specialists offers competitive pricing but lacks the transparency found in some top-tier competitors like Helcim or Square. While it may appeal to small and mid-sized businesses due to its flexible contracts and lack of early termination fees, companies like Square and Stax stand out for their flat-rate pricing and subscription models that offer more straightforward cost structures, particularly for businesses with predictable sales volumes.

On the other hand, Helcim provides a pricing structure based on interchange-plus without any monthly charges, which is particularly advantageous for companies processing a large number of transactions. Credit Card Processing Specialists faces challenges with customer support due to its limited resources, while its competitors offer stronger support infrastructures with live chat and round-the-clock availability.

Unique Selling Points and Differentiators

One of the most significant selling points for Credit Card Processing Specialists is its lack of cancellation fees and flexible contracts. This makes it a good fit for businesses that want to avoid long-term commitments. Additionally, it offers high-risk merchant account support, which makes it appealing for businesses in industries that might struggle to find reliable processors.

Unlike Square, which focuses heavily on POS solutions for retail and restaurants, Credit Card Processing Specialists also caters to a broader range of industries, including those considered high-risk, which many competitors shy away from.

Pros and Cons Relative to Competitors

Pros:

No early termination or cancellation fees

Support for high-risk industries

Flexible contract terms

Cons:

Limited customer support compared to competitors like Helcim and Stax

Less transparent pricing, with potential hidden fees

Lacks comprehensive POS hardware options found in competitors like Square or Clover

In conclusion, Credit Card Processing Specialists provides adaptable options for companies that prioritize contract flexibility and support for high-risk accounts, though it may not fully meet the needs of those requiring clear pricing and strong support features.

Final Verdict

Credit Card Processing Specialists provides adaptable agreements and assistance for high-risk merchants, which is perfect for small to medium-sized businesses. It excels in its absence of early termination penalties and specialized solutions for various industries. Nevertheless, prospective users need to evaluate the pricing model thoroughly because of the lack of clear fees.

FAQs

What contract terms should I be aware of when signing up with Credit Card Processing Specialists?

Credit Card Processing Specialists offers flexible contracts with no early termination fees, but it’s important to carefully review any potential monthly charges and hidden fees.

Is Credit Card Processing Specialists suitable for high-risk businesses?

Yes, Credit Card Processing Specialists caters to high-risk industries, making it a suitable choice for businesses that may have difficulty obtaining processors.

How long does it take to get set up with Credit Card Processing Specialists?

The setup process typically takes a few days, depending on the business’s documentation and requirements.