Costco Merchant Services Review

- 29th Jan, 2025

- | By Linda Mae

- | Reviews

Costco is a globally recognized brand, best known for its wholesale membership-based retail model that delivers value to both businesses and individuals. With a reputation built on competitive pricing and quality products, Costco has consistently expanded its services beyond traditional retail to cater to the diverse needs of its customers. Among its lesser-known ventures is Costco Merchant Services, an offering designed to provide businesses with affordable payment processing solutions. Lets read more about Costco Merchant Services Review.

Launched as part of its broader business services, Costco Merchant Services aims to simplify the complexities of payment processing while maintaining the brand’s hallmark value proposition—cost-effectiveness. By leveraging its buying power and established partnerships with major payment processors, Costco positions itself as a trusted intermediary for small to medium-sized businesses looking to streamline their transaction processes without incurring exorbitant fees.

The primary target audience for Costco Merchant Services includes small business owners who are either existing Costco members or seeking to reduce operational costs in areas such as payment processing. Retailers, restaurants, service providers, and e-commerce merchants can particularly benefit from Costco’s solutions, as the services are tailored to handle high transaction volumes efficiently while minimizing fees. Additionally, businesses that value transparency and prefer working with a well-established brand are drawn to Costco Merchant Services for its no-nonsense approach to pricing and contract terms.

In essence, Costco Merchant Services extends the brand’s ethos of affordability and trustworthiness to the realm of payment solutions, making it an appealing option for cost-conscious entrepreneurs.

Features of Costco Merchant Services | Costco Merchant Services Review

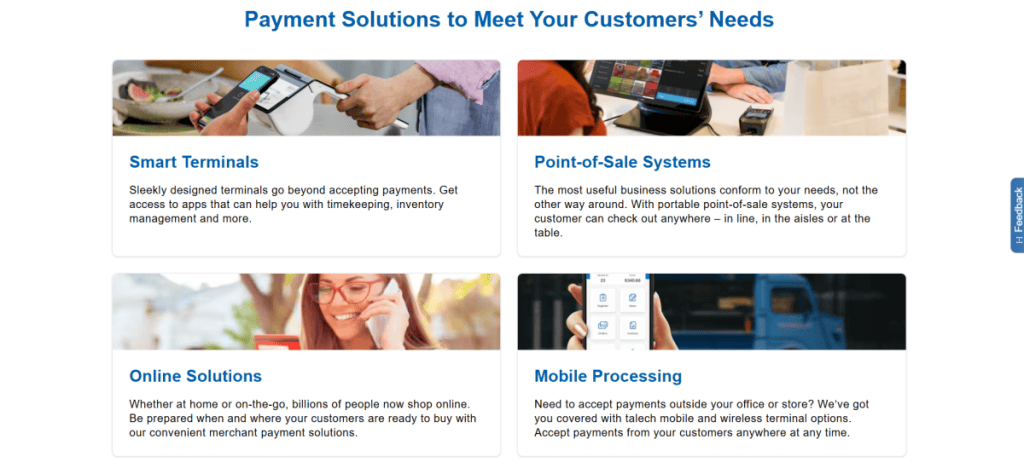

Costco Merchant Services provides a range of solutions designed to meet the needs of small to medium-sized businesses. Its core offerings include payment processing, point-of-sale (POS) systems, and e-commerce integrations, all of which are geared toward simplifying transactions and improving operational efficiency.

Payment Processing is at the heart of Costco Merchant Services. Businesses can accept payments from major credit and debit card providers, including Visa, Mastercard, American Express, and Discover. With transparent pricing and competitive transaction rates, Costco aims to reduce the financial burden on businesses, particularly for Costco Executive Members, who receive additional discounts on processing fees.

Point-of-Sale (POS) Systems offered by Costco are designed to provide businesses with robust tools for managing transactions. These systems cater to industries like retail, hospitality, and food services, offering features such as inventory management, sales reporting, and multi-location support. The POS systems integrate seamlessly with Costco’s payment processing services, ensuring smooth operation.

For online businesses, Costco provides e-commerce payment solutions that integrate with popular platforms such as Shopify, WooCommerce, and BigCommerce. These integrations allow businesses to securely process online payments, including options for recurring billing and subscription services. Additionally, Costco’s payment gateway ensures transactions are secure, reliable, and compliant with industry standards.

Mobile Payment Options enable businesses to accept payments on the go. With mobile card readers and contactless payment capabilities, including support for Apple Pay and Google Pay, businesses can offer customers greater flexibility and convenience.

These features collectively position Costco Merchant Services as a versatile solution for modern businesses seeking affordability and efficiency.

Pricing and Fee Structure

One of the standout features of Costco Merchant Services is its transparent pricing model, designed to provide clarity and cost savings for businesses. Costco primarily offers an interchange-plus pricing structure, which is widely regarded as a fair and transparent model in the payment processing industry. This structure separates the interchange fee (set by card networks like Visa and Mastercard) from the processor’s markup, ensuring businesses understand exactly what they are paying for.

Transaction fees vary depending on the type of card and transaction, but Costco Executive Members enjoy reduced rates compared to regular members. While exact percentages may fluctuate based on processing volume, businesses often find Costco’s rates competitive, particularly for high-volume transactions. In addition to per-transaction fees, there are monthly account fees and potentially other charges, such as for PCI compliance or statement processing, but these are typically lower than industry averages.

Costco’s pricing model often results in significant savings compared to competitors, especially for small to medium-sized businesses with moderate to high transaction volumes. This affordability is a direct result of Costco’s ability to negotiate better rates with payment processors, passing those savings on to its members.

Membership is a key factor in accessing these benefits. Businesses must be Costco members to use the service, with Executive Members receiving additional discounts. While this creates an added expense for non-members, the savings on payment processing fees often offset the membership cost, making it an attractive option for cost-conscious entrepreneurs seeking a trusted partner.

Hardware and Software Options

Costco Merchant Services offers a robust selection of hardware and software options designed to cater to the diverse needs of businesses across industries. These solutions include credit card machines, POS systems, and software integrations that ensure seamless operations for both in-store and online businesses.

Hardware offerings include reliable and user-friendly credit card machines and POS systems. The credit card machines support a variety of payment methods, including chip cards, magnetic stripe cards, and contactless payments such as Apple Pay and Google Pay. These machines are designed to provide quick and secure transactions, making them ideal for fast-paced environments like retail and hospitality. For businesses seeking advanced capabilities, Costco’s POS systems are a comprehensive solution.

The POS systems available through Costco come with a range of features tailored to enhance operational efficiency. Key functionalities include inventory management, which allows businesses to track stock levels in real time, and customer management, enabling businesses to store and analyze customer data to improve service and marketing efforts. These systems also provide detailed sales reporting and multi-location management, making them suitable for growing businesses.

On the software side, Costco Merchant Services provides solutions that are compatible with various third-party tools and platforms. For e-commerce businesses, Costco offers integrations with popular platforms like Shopify, WooCommerce, and BigCommerce, ensuring streamlined payment processing and order management. The software also supports PCI compliance and data security, giving businesses confidence in the safety of their transactions.

Ease of Use and Setup

Costco Merchant Services is designed with ease of use in mind, making it accessible for small to medium-sized businesses looking to streamline their payment processing. The onboarding process for new users is straightforward and well-supported. Once a business signs up for Costco Merchant Services, the setup process is guided by a dedicated support team, which assists in selecting the right hardware, configuring software, and integrating the service with existing business systems. This hands-on approach ensures that even business owners with minimal technical expertise can get started quickly.

The user interface of Costco’s hardware and software is intuitive and user-friendly. Credit card machines and POS systems come with simple interfaces that are easy to navigate, even for first-time users. The POS systems are equipped with touchscreen functionality and customizable menus, allowing businesses to tailor the system to their specific operational needs. Features like inventory tracking, customer data management, and sales reporting are accessible with just a few taps, ensuring a seamless experience for employees.

For brick-and-mortar businesses, setup involves minimal hardware installation, with most devices being plug-and-play. The support team assists with initial configurations to ensure everything runs smoothly. Online businesses benefit from seamless integration with e-commerce platforms like Shopify and WooCommerce. The payment gateway is easy to implement, with step-by-step guidance provided for setup.

Customer Support and Reliability

Costco Merchant Services offers dependable customer support and reliability, which are essential for businesses that rely on seamless payment processing. The availability of customer service, however, may vary depending on the payment processor partnered with Costco. While Costco itself provides assistance for general inquiries, most technical support is handled by Elavon, its primary payment processing partner. This support is generally available 24/7 via phone, ensuring businesses can address critical issues at any time. Additional support channels, including email and live chat, may also be offered, though availability may depend on the specific service tier.

User feedback on responsiveness and issue resolution is mixed, with many customers praising the quick response times and knowledgeable support team. However, some users report occasional delays in resolving more complex issues, which can be a drawback for businesses operating in time-sensitive environments. It is worth noting that Costco’s strong reputation for customer service extends to its merchant services, giving users confidence in the overall quality of support.

In terms of reliability, Costco Merchant Services performs well. The systems offer high uptime, ensuring uninterrupted transaction processing for both in-store and online businesses. The transaction speeds are competitive, allowing businesses to handle customer payments quickly and efficiently. Additionally, the hardware and software solutions are built to handle high transaction volumes without compromising performance, making them suitable for businesses with peak activity periods.

Pros and Cons

Pros: Costco Merchant Services offers several compelling advantages, making it an attractive choice for small to medium-sized businesses:

Competitive Pricing: With its interchange-plus pricing model and discounts for Costco Executive Members, businesses can enjoy cost-effective payment processing with transparent fees. This affordability is especially beneficial for high-volume merchants.

Brand Trust: Costco’s reputation as a reliable and customer-focused brand extends to its merchant services, providing peace of mind for businesses seeking a trustworthy provider.

Wide Range of Services: Costco offers a comprehensive suite of solutions, including payment processing, POS systems, e-commerce integrations, and mobile payment capabilities, covering the needs of both in-store and online businesses.

Ease of Use: The intuitive hardware and software make it easy for businesses to set up and operate, even with minimal technical knowledge.

Dedicated Support: 24/7 customer service ensures that businesses have access to help when needed, minimizing downtime and operational disruptions.

Cons: Despite its strengths, Costco Merchant Services has some limitations:

Membership Requirement: Businesses must be Costco members to access these services, which adds an upfront cost, especially for non-Executive Members who may not benefit from the best pricing.

Limited Advanced Features: While the offerings are sufficient for many businesses, advanced tools like in-depth analytics, marketing integrations, or tailored industry-specific solutions may be lacking.

Third-Party Dependency: Costco partners with Elavon for payment processing, which means some aspects of the service, such as technical support or contract terms, are controlled by the processor rather than Costco directly.

Mixed User Feedback: Some customers report delays in issue resolution or challenges with contract transparency, which may be a concern for businesses needing consistent service quality.

Costco Merchant Services is ideal for cost-conscious businesses seeking reliable, straightforward payment solutions, though it may not meet the needs of those requiring advanced features or customization.

Comparison with Competitors

Costco Merchant Services competes with well-established payment processing providers like Square, PayPal, and Stripe, each offering distinct strengths and limitations. While Costco focuses on affordability and transparency, its competitors often emphasize advanced features and seamless integrations.

Pricing Comparison: Costco’s interchange-plus pricing model is highly competitive, especially for Costco Executive Members who receive additional discounts. This can result in significant savings compared to flat-rate models like Square and PayPal, which charge higher per-transaction fees (typically around 2.6%–2.9% + $0.30). Stripe also offers interchange-plus pricing but may not provide the volume discounts available through Costco. Businesses processing high transaction volumes often find Costco more cost-effective.

Feature Comparison: Competitors like Square and PayPal excel in their feature-rich ecosystems, offering advanced POS systems, robust analytics, and integrations with marketing tools. Stripe leads in e-commerce capabilities, with its developer-friendly API allowing deep customization. In contrast, Costco’s hardware and software focus on essential functions, which may lack the advanced tools needed for businesses requiring detailed analytics or industry-specific features.

Ease of Use: Square and PayPal offer highly intuitive platforms with minimal setup, making them ideal for small businesses and startups. Costco’s solutions are also user-friendly, but the initial setup and onboarding may require more involvement due to its reliance on Elavon as a partner.

Unique Selling Points: Costco stands out for its cost-effectiveness, trusted brand reputation, and membership benefits. However, it lags behind competitors in offering customizable solutions, innovative features, and comprehensive customer analytics, which are often critical for tech-driven or rapidly growing businesses.

Who Should Use Costco Merchant Services?

Costco Merchant Services is best suited for small to medium-sized businesses that prioritize cost-effective and reliable payment processing solutions. Its competitive pricing, straightforward setup, and essential features make it an excellent choice for businesses looking to streamline operations without incurring high fees.

Ideal Businesses and Industries: Retail stores, restaurants, service-based businesses, and e-commerce merchants are among the industries that can benefit most from Costco Merchant Services. Brick-and-mortar businesses requiring dependable credit card machines and POS systems will find Costco’s hardware easy to use and well-suited to daily operations. Additionally, online merchants can take advantage of Costco’s e-commerce payment solutions, which integrate with platforms like Shopify and WooCommerce, making it a solid choice for businesses with a digital presence. Mobile payment capabilities also make it suitable for professionals who operate on the go, such as contractors, freelancers, and pop-up vendors.

Suitability for Small Businesses vs. Large Enterprises: Costco’s services are particularly well-suited for small and medium-sized businesses, thanks to its transparent pricing and membership-based discounts, especially for Executive Members. For small businesses processing a moderate to high volume of transactions, the cost savings can be significant compared to competitors like Square or PayPal.

However, large enterprises with complex needs may find Costco Merchant Services less suitable. Its lack of advanced features, such as in-depth analytics, multi-location support, or extensive customization, may not meet the demands of larger organizations with diverse operations.

Final Verdict

Costco Merchant Services excels in offering affordable, transparent pricing and reliable payment solutions, making it ideal for cost-conscious small to medium-sized businesses. While it lacks advanced features and customization, its trusted brand and straightforward services make it a solid choice for businesses seeking value and simplicity in payment processing.

FAQs

What types of businesses benefit most from Costco Merchant Services?

Costco Merchant Services is ideal for small to medium-sized businesses, including retail stores, restaurants, service providers, and e-commerce merchants, especially those processing moderate to high transaction volumes and seeking cost-effective payment solutions.

Does Costco Merchant Services offer flexible contract options?

Costco partners with Elavon for payment processing, and contract terms may vary. Businesses should carefully review agreements for flexibility, early termination fees, and other conditions.

Are there hidden fees or charges not disclosed upfront?

Costco is known for transparency, but additional charges like PCI compliance or statement fees may apply. Reviewing all terms is recommended.