PayJunction Review

- 07th Mar, 2025

- | By Linda Mae

- | Reviews

PayJunction is a payment processing company that provides businesses with a range of solutions to accept and manage transactions efficiently. Known for its emphasis on transparency, security, and innovation, PayJunction has positioned itself as a reliable alternative to traditional merchant service providers. The company caters to businesses of all sizes, offering a combination of payment terminals, virtual processing solutions, and automation tools to streamline financial transactions. Lets read more about PayJunction Review.

Founded in 2000, PayJunction has built a strong presence in the payment processing industry over the past two decades. Headquartered in California, the company has grown by focusing on ethical business practices, cutting-edge technology, and customer-centric services. Unlike many processors that lock merchants into long-term contracts with hidden fees, PayJunction follows an interchange-plus pricing model, ensuring cost transparency.

One of PayJunction’s most notable features is its ZeroTouch Terminal, a contactless payment system that improves security and does away with paper receipts. Businesses can easily integrate payment processing without requiring a lot of technical know-how thanks to the company’s No-Code Payments Integration®. PayJunction is renowned for its PCI Level 1 security compliance, which guarantees that companies can process payments while upholding the strictest data security guidelines.

With a reputation for reliable service, transparent pricing, and a commitment to sustainable, paperless transactions, PayJunction has gained traction among merchants seeking a modern and ethical payment processor. This review will take an in-depth look at its offerings, pricing, security, customer support, and overall value to businesses.

Product and Service Offerings | PayJunction Review

PayJunction provides a comprehensive suite of payment processing solutions tailored to businesses of all sizes. The company supports a variety of payment methods, including credit and debit card transactions, as well as ACH payments. By offering both in-person and remote payment solutions, PayJunction enables businesses to process transactions securely and efficiently. Its interchange-plus pricing model ensures transparency, making it a competitive choice for merchants looking for a straightforward cost structure.

One of the standout aspects of PayJunction’s offering is its hardware solutions. The ZeroTouch Terminal is designed to facilitate contactless payments, reducing the need for paper receipts and enhancing transaction security. This terminal allows businesses to store digital signatures, further streamlining payment acceptance while reducing environmental impact. In addition to the ZeroTouch Terminal, PayJunction also offers a Portable Terminal, which provides mobility for businesses that require on-the-go payment processing, such as service providers and delivery businesses.

PayJunction offers a Virtual Terminal, which enables transactions to be processed via a web-based interface without the need for physical hardware, for companies that prefer virtual payment solutions. Additionally, companies that wish to incorporate payments into their current systems without requiring a lot of development work can do so more easily with its No-Code Payments Integration®. Additionally, PayJunction helps e-commerce companies by providing hosted checkout options and safe online payment processing solutions.

Pricing Structure

The interchange-plus pricing model, which PayJunction uses, is regarded as one of the most open pricing schemes in the payment processing sector. Interchange-plus pricing gives merchants a clear breakdown of processing fees, in contrast to flat-rate pricing, which can result in higher costs for companies with higher transaction volumes. In addition to a small, predefined markup, this model guarantees that businesses are charged the actual interchange rate established by card networks. Businesses are able to know exactly how much they are spending on each transaction thanks to this degree of transparency.

For credit and debit card processing, PayJunction’s transaction fees vary based on the type of card used and the nature of the transaction (card-present or card-not-present). ACH transactions are also supported, and they come with their own fee structure, typically lower than credit card processing rates. Businesses can choose to process ACH payments as a cost-effective alternative, especially for recurring billing or high-ticket transactions.

One aspect that businesses should consider is the monthly fee for low-volume merchants. PayJunction charges a $35 monthly fee for businesses that process less than $10,000 per month in transactions. While this fee may be a drawback for smaller businesses, it is offset by the absence of additional charges that many competitors impose.

PayJunction maintains a transparent pricing policy with no hidden fees. Unlike many processors, it does not charge PCI compliance fees, gateway fees, or early termination fees. This straightforward approach makes PayJunction an appealing choice for businesses seeking a fair and predictable cost structure.

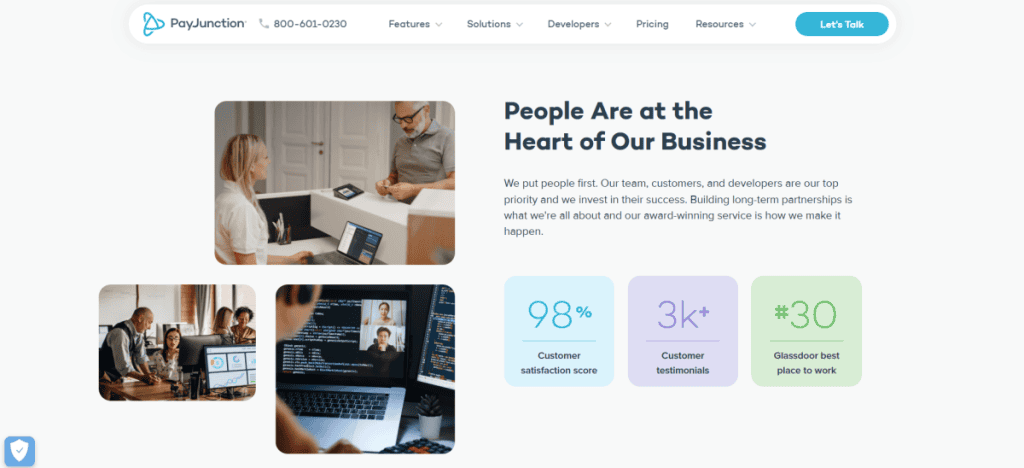

Customer Support and Satisfaction

PayJunction offers multiple support channels to assist merchants with their payment processing needs. The company provides phone support, ensuring that businesses can speak directly with a representative for immediate assistance. In addition, a ticketing system allows merchants to submit inquiries online and receive responses in an organized manner. PayJunction also maintains a comprehensive knowledge base, which includes detailed articles, guides, and FAQs that help users troubleshoot common issues and understand the platform’s features. This self-service resource is beneficial for businesses that prefer finding quick answers without waiting for direct assistance.

The majority of merchants’ reviews of PayJunction’s support service are positive, with many praising the team’s professionalism and promptness. The experienced agents who help with onboarding, integration, and troubleshooting have received high marks from users. The company’s hands-on approach, where support agents assist businesses with setup procedures and effectively resolve technical issues, reflects its dedication to customer service.

One of the standout aspects of PayJunction’s support is its lack of outsourced customer service, which means businesses receive assistance directly from knowledgeable, in-house professionals. This is a key differentiator from many competitors that rely on third-party call centers.

While most reviews indicate a high level of satisfaction, some users have reported occasional delays in response times during peak hours. However, the general sentiment is that PayJunction offers reliable, high-quality customer support. The combination of phone, online, and self-service support options ensures that businesses can get the help they need in a timely manner.

Security and Compliance

PayJunction places a strong emphasis on security and compliance, ensuring that businesses can process payments while protecting sensitive customer data. The company is PCI Level 1 compliant, which is the highest standard of security in the payment processing industry. This compliance means that PayJunction adheres to strict regulations set by the PCI DSS, ensuring that businesses using its services are operating within a secure environment. Maintaining PCI Level 1 compliance helps protect businesses from potential data breaches and fraud-related liabilities.

To further enhance security, PayJunction employs encryption and tokenization to safeguard payment information. Encryption ensures that payment data is securely transmitted, preventing unauthorized access during transactions. Tokenization replaces sensitive cardholder information with a randomly generated token, meaning that actual card details are never stored on a merchant’s system. This reduces the risk of data exposure in the event of a security breach.

The likelihood of fraud and unauthorized transactions is greatly reduced by these advanced security measures. Because PayJunction manages compliance and risk mitigation on their behalf, businesses can take advantage of these protections without having to handle security protocols themselves. By facilitating contactless transactions and digital signatures, the company’s ZeroTouch Terminal further improves security by eliminating the need to handle actual cards and receipts.

By implementing robust security measures and adhering to PCI Level 1 compliance, PayJunction provides businesses with a reliable and secure payment processing solution. These protections ensure both merchants and customers can conduct transactions with confidence, minimizing security risks in the payment process.

Integration and Compatibility

PayJunction offers a range of integration options that allow businesses to seamlessly incorporate its payment processing solutions into their existing systems. One of its key strengths is its full-stack API, which provides developers with the flexibility to create custom payment solutions. This API enables businesses to integrate PayJunction’s services directly into their software, POS systems, and customer management platforms. With well-documented API resources, businesses can efficiently build and deploy payment functionalities without unnecessary complexity.

For businesses that require payment processing without extensive coding, PayJunction’s No-Code Payments Integration® offers an alternative solution. This feature allows companies to integrate payments into their systems without the need for advanced technical expertise, making it a convenient option for merchants who want a straightforward setup.

Additionally, PayJunction is made to work with third-party software, so companies can integrate it with accounting programs, CRM tools, and e-commerce platforms. By keeping financial management, sales tracking, and payment processing all in one cohesive system, this degree of compatibility helps businesses streamline operations.

The ease of implementation is another notable advantage. Unlike some processors that require complex onboarding processes, PayJunction’s integration options are designed to be user-friendly. Businesses can connect their systems without facing unnecessary delays, ensuring that payment processing is up and running quickly.

By providing robust API access, no-code integration, and broad software compatibility, PayJunction ensures that businesses can implement payment solutions that fit their specific needs while maintaining operational efficiency.

User Experience and Interface

PayJunction offers a well-designed and intuitive interface that enhances the overall user experience for businesses. Its dashboard provides merchants with a centralized platform to manage transactions, track sales, and access key payment data. The clean and organized layout ensures that users can quickly navigate through various functions without facing a steep learning curve. From processing payments to issuing refunds and managing customer records, all essential tools are easily accessible from the dashboard.

One of the standout features of PayJunction’s platform is its reporting tools and real-time monitoring capabilities. Businesses can generate detailed reports that provide insights into transaction history, sales trends, and payment performance. These reports can be customized to suit different business needs, helping merchants analyze financial data and make informed decisions. Real-time monitoring ensures that businesses can keep track of transactions as they happen, reducing the risk of errors and fraudulent activities.

PayJunction prioritizes mobile accessibility in addition to its web-based dashboard, enabling businesses to handle transactions from any location. The platform is designed to work well on a variety of devices, such as smartphones, tablets, and PCs. Merchants have complete control over their payment processing operations, whether they are handling payments while on the go or remotely reviewing sales data. A consistent and intuitive experience is guaranteed by the smooth device integration.

With its intuitive interface, powerful reporting tools, and mobile-friendly design, PayJunction provides a smooth and efficient payment management experience, making it easy for businesses to stay on top of their financial operations.

Pros and Cons

PayJunction offers several advantages that make it a strong option for businesses seeking a reliable payment processor.

Transparent Pricing – PayJunction follows an interchange-plus pricing model, ensuring businesses have clear visibility into transaction costs. There are no hidden fees, no PCI compliance fees, no gateway fees, and no early termination fees, making it a cost-effective choice for merchants who prioritize straightforward pricing.

No Long-Term Contracts – Unlike many competitors that require multi-year agreements, PayJunction offers month-to-month service, allowing businesses to cancel or switch providers without facing penalties. This flexibility is particularly beneficial for businesses that do not want to be locked into restrictive terms.

Strong Security Measures – PayJunction is PCI Level 1 compliant and employs encryption and tokenization to protect sensitive payment data. These security features help reduce the risk of fraud and unauthorized access, ensuring that transactions remain safe for both businesses and customers.

Quality Customer Support – Businesses have access to phone support, a ticketing system, and a comprehensive knowledge base. Unlike some competitors that outsource support, PayJunction provides in-house customer service, ensuring knowledgeable and responsive assistance.

However, PayJunction does have some potential drawbacks.

Monthly Fees for Low-Volume Businesses – Merchants processing less than $10,000 per month are subject to a $35 monthly fee, which may be a drawback for small businesses or seasonal operations.

Limited Hardware Options – While PayJunction provides high-quality ZeroTouch and Portable Terminals, its range of hardware solutions is not as extensive as some competitors, particularly those offering full-scale POS systems.

Despite these limitations, It remains a strong choice for businesses that value transparent pricing, security, and reliable customer support.

Competitor Comparison

PayJunction competes with several major payment processors, including Square and Clover, both of which offer comprehensive payment solutions for businesses. While all three companies provide essential payment processing services, they differ significantly in pricing structures, contract terms, hardware options, and security features.

Pricing and Contracts – PayJunction follows an interchange-plus pricing model, which provides more transparency than Square’s flat-rate pricing. Square charges a fixed percentage per transaction, which can be convenient but may lead to higher costs for businesses with large transaction volumes. Clover offers tiered pricing, which can vary based on the service provider. Unlike Clover, which often requires long-term contracts through resellers, It operates on a month-to-month basis, providing greater flexibility.

Hardware Options – In addition to touchscreen registers and handheld terminals, Square and Clover offer a wider range of POS hardware tailored to the restaurant and retail industries. The ZeroTouch and Portable Terminals from PayJunction, on the other hand, emphasize contactless transactions and digital receipts. Businesses seeking a simplified, environmentally friendly payment solution might favor PayJunction, while those needing advanced POS features might find Square or Clover a better fit.

Security Features – PayJunction is PCI Level 1 compliant and emphasizes security through tokenization and encryption. While Square and Clover also adhere to security standards, PayJunction’s ZeroTouch Terminal provides an extra layer of protection by eliminating the need for physical receipts, reducing the risk of fraud.

Businesses that prioritize transparent pricing, flexible contracts, and strong security features may find PayJunction a better choice. However, companies needing a broader range of POS hardware and built-in industry-specific tools may benefit from Square or Clover.

Conclusion

PayJunction is a great option for companies looking for a dependable payment processor because it provides flexible contracts, robust security, and transparent pricing. It is perfect for companies that prioritize cost transparency, security, and digital-first payment solutions because of its ZeroTouch Terminal, interchange-plus pricing, and PCI Level 1 compliance, even though it lacks a wide range of hardware options.

Frequently Asked Questions

Does PayJunction require long-term contracts?

No, PayJunction operates on a month-to-month basis, meaning businesses are not locked into long-term contracts. Merchants can cancel the service anytime without facing early termination fees, providing greater flexibility compared to competitors that require multi-year commitments.

Are there any monthly fees for low-volume businesses?

Yes, businesses processing less than $10,000 per month are subject to a $35 monthly fee. While this may be a drawback for small businesses, PayJunction offsets it by eliminating other common charges such as PCI compliance and gateway fees.

What customer support options are available?

PayJunction offers phone support, a ticketing system, and a knowledge base. Unlike many competitors that outsource support, PayJunction provides in-house customer service, ensuring knowledgeable and efficient assistance.