CardConnect Review

- 04th May, 2025

- | By Linda Mae

- | Reviews

Founded in 2006, CardConnect has become a recognized name in the payment processing industry, particularly for businesses seeking integrated and secure transaction solutions. Headquartered in Pennsylvania and later acquired by First Data (now part of Fiserv) in 2017, CardConnect has built a reputation for offering innovative payment technologies. Despite its acquisition, CardConnect continues to operate with a distinct identity, maintaining a focus on flexible, secure payment solutions for merchants of various sizes. Lets read more about CardConnect Review.

CardConnect specializes in solutions that are designed not just to process payments but to enhance business operations through integrations with ERP systems and various eCommerce platforms. Its proprietary tools, such as CardPointe, offer merchants a comprehensive view of their transactions and account activities, with an emphasis on data protection through tokenization and encryption technologies.

While CardConnect brings many strengths to the table, it’s not without challenges. Customer feedback highlights both positive experiences and concerns related to pricing transparency and customer support. As with any service provider, businesses should carefully evaluate whether CardConnect’s offerings align with their specific needs. This review will take a closer look at its features, pricing, integrations, customer service, and suitability for different types of businesses to offer a balanced perspective.

Key Features and Services | CardConnect Review

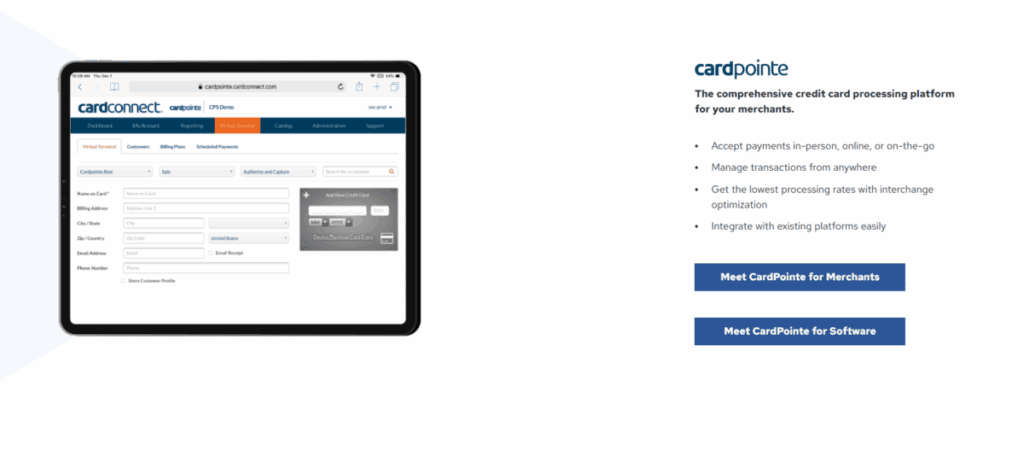

CardConnect offers a robust suite of services aimed at streamlining payment acceptance and improving transaction security. One of its core offerings is the CardPointe platform, which allows businesses to view real-time transactions, manage chargebacks, and generate reports through a user-friendly dashboard. This cloud-based solution supports both desktop and mobile access, helping businesses stay connected wherever they operate.

Another major feature is its Clover POS integration. Through its partnership with Clover, CardConnect provides merchants access to a wide range of point-of-sale systems that cater to retail, food service, and professional service industries. These systems come with customizable software options that allow businesses to tailor functionality to their unique needs.

Security is another cornerstone of CardConnect’s services. They incorporate point-to-point encryption (P2PE) and tokenization to protect sensitive cardholder data. This focus on security is particularly beneficial for industries like healthcare, where regulatory compliance is critical.

In addition to payment processing, CardConnect offers ERP integrations, most notably with SAP, allowing large enterprises to connect payment functions directly with their back-end systems. It also provides APIs for developers who need customized payment solutions.

Overall, CardConnect’s features are designed to serve a wide range of business models, making it a flexible choice. However, smaller businesses may find some features more complex than necessary, depending on their technical capabilities.

Pricing and Fees

Understanding CardConnect’s pricing can be a little complex because it varies based on the business size, industry, and specific needs. In general, CardConnect does not openly publish a standard fee schedule on its website, which can make initial cost comparisons challenging for prospective customers.

Typically, CardConnect uses interchange-plus pricing, a model many merchants prefer because of its transparency compared to flat-rate systems. However, the final rates and fees can depend on the negotiations during the contract setup phase. Businesses may also encounter monthly account fees, gateway fees for using the CardPointe platform, PCI compliance fees, and early termination fees if they wish to exit the contract early.

Some users have reported that while CardConnect offers competitive rates, certain ancillary fees can add up over time. These include costs for equipment leasing, particularly when opting for Clover POS hardware, and potential service or maintenance charges.

It’s worth noting that pricing can be significantly better for businesses processing higher volumes of transactions. It representatives often customize quotes based on expected transaction volume, card mix, and industry type.

In summary, while CardConnect may offer good value for businesses that negotiate well and require secure integrations, smaller businesses and startups should carefully review all potential fees to avoid surprises later on.

CardPointe Platform Deep Dive

The CardPointe platform is one of CardConnect’s standout offerings. It is a cloud-based payment solution designed to give businesses a centralized location to manage all aspects of their payment processing. Merchants can use it to view real-time transaction activity, generate detailed reporting, and monitor account settlements.

One of the platform’s most useful features is the virtual terminal, which allows businesses to accept card-not-present payments directly through a secure online interface. This is ideal for remote billing, invoicing, and phone orders. Additionally, the CardPointe mobile app enables on-the-go transaction management, making it a strong option for businesses operating outside a traditional storefront.

The platform places a strong emphasis on security, providing built-in tokenization and point-to-point encryption capabilities that safeguard sensitive payment data. These features help businesses remain PCI compliant without needing to handle cardholder data directly.

Another strength of CardPointe is its intuitive user interface. Even businesses without dedicated IT teams often find it relatively easy to navigate. It offers a customizable reporting dashboard, which makes it easier for merchants to track performance and monitor key metrics over time.

While CardPointe offers a wide range of features, businesses that need complex, large-scale reporting or specialized integrations may still require additional support or customization. However, for many small to medium-sized businesses, it covers most operational needs effectively.

Security and Compliance

Security is one of the areas where CardConnect distinguishes itself from many other payment processors. Its solutions are built with data protection in mind, combining point-to-point encryption (P2PE), tokenization, and full PCI compliance support.

Point-to-point encryption ensures that cardholder data is immediately encrypted at the point of entry and remains encrypted until it reaches CardConnect’s secure environment. This significantly reduces the chances of data interception during a transaction.

Tokenization is another important security feature offered. Rather than storing actual card numbers, CardConnect replaces them with unique tokens, minimizing the risk of data breaches. This process not only protects customers but also helps businesses reduce their PCI scope, simplifying compliance efforts.

It also assists merchants in maintaining PCI DSS (Payment Card Industry Data Security Standard) compliance. The company provides tools, resources, and support to help businesses complete their annual PCI assessments, a crucial step for avoiding costly non-compliance penalties.

Moreover, CardConnect’s security features extend to its ERP and eCommerce integrations, meaning businesses can maintain high levels of data protection across multiple platforms.

While CardConnect’s security features are robust, some small businesses may find the PCI compliance process complex initially. However, the added security benefits are well worth the learning curve.

Integration and Compatibility

CardConnect shines when it comes to integration and compatibility with various business systems. One of its biggest advantages is its ability to integrate seamlessly with major ERP systems like SAP, Oracle, and Microsoft Dynamics. These integrations allow enterprises to embed payment processing directly within their core business operations, saving time and reducing errors.

In the eCommerce space, CardConnect offers plugins for popular platforms like Magento, WooCommerce, and Shopify. These plugins help merchants quickly add secure checkout capabilities without the need for complex development work.

For businesses needing custom solutions, it provides robust APIs. Developers can access detailed documentation and sandbox environments to build integrations that meet unique business needs.

Another useful aspect of CardConnect’s ecosystem is its compatibility with Clover POS systems. Clover offers a wide range of hardware options, from simple mobile card readers to full-scale countertop terminals, providing merchants with flexible choices.

Despite the strong integration capabilities, it’s important to note that setup and implementation can sometimes require technical support, especially for more complex ERP integrations. CardConnect offers onboarding assistance, but businesses should plan for a potential ramp-up period to ensure a smooth transition.

Overall, it is a strong choice for businesses seeking flexible, future-proof payment integrations across both online and offline environments.

Customer Support and Service

Customer support is a crucial factor in evaluating any payment processor, and CardConnect’s track record here is mixed. The company provides multiple support channels, including phone, email, and live chat. For urgent issues, merchants can contact support 24/7, which is an important consideration for businesses that operate beyond regular hours.

CardConnect also offers a self-service portal with FAQs, documentation, and troubleshooting guides. This can help businesses quickly resolve minor issues without needing to wait for human assistance.

That said, some users report challenges with customer service, particularly around billing disputes, early termination fees, or delays in response time. Experiences vary significantly based on the account manager assigned and the complexity of the support issue.

Businesses that require personalized onboarding or ERP integration assistance typically receive better support, but smaller merchants sometimes feel that their issues are not prioritized. This inconsistency is not unique to CardConnect but is worth noting, particularly for smaller businesses that may not have in-house technical expertise.

In general, businesses that work closely with a dedicated account manager tend to have better experiences. Setting clear expectations during the setup phase and establishing a direct line of communication with a CardConnect representative can help ensure smoother interactions.

Pros and Cons of Using CardConnect

Every payment solution has strengths and weaknesses, and CardConnect is no exception. Among its notable advantages is its strong focus on security, offering tokenization and point-to-point encryption as standard features. Its integration capabilities, particularly with major ERP systems and popular eCommerce platforms, are another significant plus.

CardConnect’s CardPointe platform is user-friendly and packed with useful features for transaction management, reporting, and mobile access. Larger businesses, in particular, can benefit from the platform’s flexibility and scalability.

On the downside, pricing transparency could be improved. Without clear public pricing information, prospective customers must request quotes and be prepared to negotiate fees carefully. Additionally, customer service experiences are inconsistent, with some businesses reporting challenges getting timely support for complex issues.

Equipment costs, especially related to Clover POS leases, can also add up if not carefully managed. Merchants should review contract terms thoroughly before committing.

In conclusion, CardConnect is a powerful, feature-rich solution ideal for businesses that prioritize security and need strong integration capabilities. However, it may require a closer review of pricing and support conditions before signing a contract.

Ideal Businesses for CardConnect

CardConnect’s broad range of features makes it suitable for a variety of businesses, but it particularly shines for mid-sized to large enterprises that require secure transactions, detailed reporting, and integration with back-end systems like SAP or Oracle.

Industries that benefit the most include healthcare, education, retail, and B2B services, where security and compliance are crucial. Healthcare businesses, for instance, need to meet stringent data protection standards, and CardConnect’s tokenization features can simplify this requirement.

eCommerce businesses can also benefit from CardConnect’s secure gateway integrations and mobile processing capabilities. Companies that sell across multiple channels — online, mobile, and in-person — will find the flexibility of CardConnect’s tools particularly valuable.

However, very small businesses and startups with minimal transaction volumes might find CardConnect’s fee structure less competitive compared to simpler, flat-rate processors like Square or PayPal.

Ultimately, it is best suited for growing businesses that can take full advantage of its security features, customization options, and system integrations to scale efficiently.

Final Verdict: Is CardConnect Worth It?

CardConnect offers a strong, secure, and flexible payment processing solution for businesses that need more than just basic transaction support. Its CardPointe platform, security protocols, and integration capabilities stand out in a crowded market, making it an attractive option for businesses seeking long-term, scalable solutions.

However, the lack of transparent pricing, the possibility of miscellaneous fees, and the variability of customer support experiences mean that businesses should conduct careful due diligence before committing. Businesses willing to invest time in understanding their contract terms and leveraging CardConnect’s strengths will likely find it a worthwhile partner.

In summary, it is a good fit for mid-sized to large businesses prioritizing security, ERP integration, and scalable solutions, while smaller merchants might find other processors more immediately accessible and cost-effective.

FAQs

1. Is CardConnect suitable for small businesses?

While CardConnect offers robust features, it may be better suited for mid-sized and large businesses. Small businesses might find more value in processors with simpler, flat-rate pricing models unless they need advanced security and integration capabilities.

2. How does CardConnect ensure secure transactions?

CardConnect uses tokenization, point-to-point encryption (P2PE), and PCI DSS compliance measures to protect sensitive payment data during and after transactions, reducing the risk of breaches and simplifying compliance requirements for merchants.

3. What is the CardPointe mobile app, and how can it help merchants?

The CardPointe mobile app enables businesses to monitor transactions, process payments, and manage account activities on the go. It is particularly useful for merchants who need flexible, real-time access to their payment data outside of a traditional office or storefront environment.