EBizCharge Review

- 10th May, 2025

- | By Linda Mae

- | Reviews

Century Business Solutions created EBizCharge, a U.S.-based payment processing solution, with the goal of making it easier for companies to take payments. It provides a variety of tools to help businesses manage transactions more effectively and is made to function across industries. EBizCharge is a well-liked choice for businesses that mainly rely on back-end software such as QuickBooks, NetSuite, Microsoft Dynamics, and Sage because of its emphasis on seamless integration with ERP, accounting, and CRM systems. Lets read more about EBizCharge Review.

EBizCharge presents itself as more than just a plug-and-play tool, in contrast to many generic gateways. It provides customized features to improve customer payment experiences, automate accounting entries, and speed up payment collection. Businesses can use the platform to accept credit cards, debit cards, ACH transfers, and eChecks; whether online, in-person, or over the phone.

One of the main attractions of EBizCharge is its attempt to eliminate the friction between invoicing and payment acceptance. For businesses managing recurring payments or B2B transactions, this can lead to faster collections and fewer manual errors. That said, EBizCharge isn’t necessarily a fit for every kind of business. Companies that don’t rely on ERP software or who need out-of-the-box eCommerce features may find more specialized tools elsewhere. Still, for mid-sized to large companies looking to streamline AR processes and reduce payment friction, EBizCharge offers a compelling, integrated option.

Key Features and Functionality

A collection of tools designed to streamline and improve the payment process is provided by EBizCharge. Fundamentally, it provides a strong payment gateway that can take eChecks, ACH payments, and major credit cards. The added value it provides through advanced automation, insightful reporting, and extensive integrations with accounting platforms is what distinguishes it. The secure customer payment portal, which allows companies to allow customers to view and pay invoices online, is one of its most helpful features. This feature cuts down on the amount of time spent chasing payments while also greatly improving cash flow. Additionally, field teams or sales representatives can accept payments remotely thanks to EBizCharge’s mobile processing options.

Real-time transaction monitoring and reporting give users clear visibility into their financials. The dashboard is intuitive and offers exportable data for reconciliation, auditing, or forecasting. Businesses can set up recurring billing schedules, apply surcharges where legally allowed, and offer email payment links. Another area where EBizCharge adds value is in reducing manual entry.

When paired with ERP or accounting systems, payments are automatically posted to open invoices, which reduces data entry errors and saves time. The platform also allows for tokenized card storage, ensuring customers don’t have to re-enter payment details for repeat transactions. While not feature-bloated, EBizCharge packs most of the essential functionality needed for B2B and service-based businesses. However, those in retail or requiring high-volume POS support may find its utility limited without third-party hardware integrations.

Seamless ERP and Accounting Software Integrations | EBizCharge Review

EBizCharge has built its reputation on seamless integration with leading ERP and accounting systems, which is a key differentiator in the crowded payment gateway market. The platform supports native plug-ins for popular software such as QuickBooks, NetSuite, Microsoft Dynamics, SAP Business One, Sage, and Acumatica. These integrations allow users to accept payments directly within their accounting software, reducing the need to switch between applications. For example, businesses using QuickBooks can email invoices that include a “Pay Now” link, with payment status updated in real-time once a transaction is completed. This not only saves administrative time but also minimizes data errors and improves overall accuracy.

Additionally, EBizCharge directly syncs invoice numbers, payment histories, and customer information with the accounting program. This removes the delay that often happens between ledger updates and customer payments. This automation is even more useful in more complicated ERP systems like SAP or NetSuite, particularly for companies that oversee several payment processes.

Notably, EBizCharge manages the majority of the integration process internally and provides customizations to satisfy particular business requirements. To guarantee compatibility and operational effectiveness, their U.S.-based support staff is often involved during the setup stage. Even though the integrations are a plus, businesses that use specialized or specially designed ERP systems might find the process more difficult. Still, for most mainstream platforms, EBizCharge delivers a high level of out-of-the-box functionality with minimal disruption.

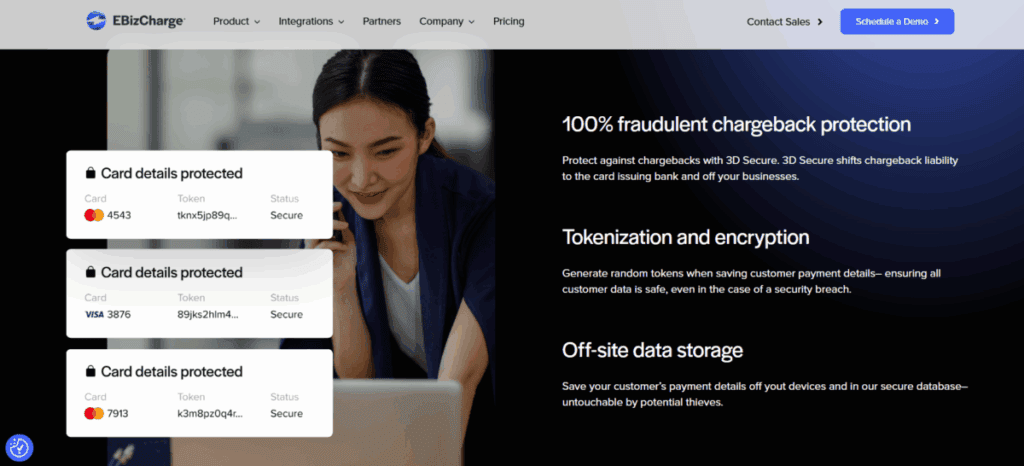

Security and Compliance Standards

Security is a critical concern for any payment processor, and EBizCharge takes it seriously. The platform is PCI-DSS compliant, which is the gold standard for secure payment handling. This ensures that all data transmitted through its systems is encrypted, stored securely, and regularly monitored for vulnerabilities. EBizCharge also uses tokenization and EMV-compatible technology to protect sensitive payment information. Tokenization replaces card details with non-sensitive identifiers, making it nearly impossible for hackers to retrieve useful data even if a breach occurs. This is especially important for businesses that store payment methods for recurring billing or subscriptions.

In addition to protecting cardholder data, EBizCharge includes built-in fraud prevention tools. Features like AVS, CVV verification, and customizable transaction limits help mitigate fraudulent transactions. Users can also monitor suspicious activity in real-time through the admin dashboard. Another advantage is the secure customer vault, which allows businesses to store customer payment credentials safely while staying within PCI scope.

This is ideal for organizations that handle repeat transactions or ongoing client billing. EBizCharge also helps businesses handle chargebacks with features that make it easier to gather transaction evidence and dispute claims. While it doesn’t eliminate chargebacks entirely, it provides the tools and documentation businesses need to respond effectively. Overall, EBizCharge meets industry expectations for data security and may even exceed them in some areas. For companies concerned with compliance, it offers a reliable and well-documented infrastructure.

Ease of Use and User Experience

Despite its wide feature set and technical integrations, EBizCharge manages to remain user-friendly. Its interface is clean and intuitive, with clearly labeled navigation and accessible tools even for non-technical users. This is particularly beneficial for small to mid-sized businesses that may not have dedicated IT or accounting teams. The onboarding process is structured but not overwhelming. Once the initial integration is complete, users are guided through a dashboard walkthrough, helping them understand transaction flows, invoice tracking, and reporting features. Training resources such as video tutorials, documentation, and customer support further reduce the learning curve.

In reality, the platform’s ease of use is evident in routine tasks. It only takes a few clicks to create a payment link, process a refund, or view transaction history. Because of the admin panel’s degree of customization, businesses can set user permissions and view only the data that is important to them. Although supported, mobile functionality is a little less extensive than that of the web dashboard.

That being said, the mobile app is a useful tool for service teams or sales representatives who must handle payments while on the road. One possible disadvantage is that the reporting tools might seem a little simplistic to power users or companies that require advanced analytics. Nonetheless, EBizCharge offers a dependable, responsive, and seamless experience for normal daily operations.

Payment Processing Capabilities

EBizCharge supports a wide range of payment methods, making it flexible enough for both B2B and service-driven industries. It processes major credit and debit cards, ACH payments, eChecks, and integrates email pay links and recurring billing for flexible collections. One of the most helpful features is its ability to attach a payment link to digital invoices.

Customers can click and pay instantly through a secure portal, significantly reducing the delay between invoice issuance and payment receipt. For businesses with recurring clients, saved payment methods simplify billing cycles and reduce the need for repeated outreach. ACH payment acceptance is a strong point, especially for B2B transactions where customers prefer bank-to-bank transfers over credit cards. These transactions generally come with lower fees, which is a financial plus.

Recurring billing and automatic payment reminders help businesses stay on top of due payments, reducing aging receivables. EBizCharge also supports partial payments and installment options, which can be configured within the ERP system it integrates with. On the downside, the system is more focused on backend operations and less on retail or front-end POS support. For businesses needing advanced retail checkout systems or hardware POS solutions, EBizCharge may need to be paired with other vendors. Overall, its processing capabilities are strong for what it’s designed to do; streamline invoicing and AR management rather than serve as a retail-first tool.

Pricing Structure and Transparency

EBizCharge follows a flat-rate pricing model, which is often more predictable for businesses compared to interchange-plus structures. This means that businesses pay a consistent rate for each transaction, regardless of the card type or issuing bank. For many SMBs, this simplifies budgeting and reduces the complexity of monthly billing. While flat-rate pricing is easy to understand, it’s not always the most cost-effective option; especially for businesses with high transaction volumes or those that process a large number of debit cards.

Interchange-plus models can sometimes yield lower fees, depending on the mix of card types and ticket sizes. EBizCharge is fairly transparent with its pricing information and doesn’t charge setup or cancellation fees, which is a positive. However, specific rates are typically only disclosed after a consultation, so businesses need to engage with a sales rep to get exact quotes.

In addition, there are no long-term agreements or monthly minimums, which makes it a more flexible choice than conventional merchant accounts. Since the majority of payments are handled digitally, equipment costs are typically not a consideration. Understanding the add-ons is one area where users should exercise caution. Get a thorough breakdown because some features, such as surcharge tools or additional integrations, may incur additional fees. In conclusion, depending on the size of the company and the type of transaction, EBizCharge may not always have the lowest prices, but it does have clear and competitive pricing.

Customer Support and Service Quality

Customer support is one of EBizCharge’s strong suits. The company offers U.S.-based support, available through phone, email, and live chat. Support staff are generally knowledgeable, especially in assisting with ERP and accounting software integrations, which can often be the most technically demanding aspects of the platform. What sets EBizCharge apart is the personal onboarding support many customers receive. During setup, the company typically assigns a dedicated rep to walk businesses through the process, ensuring that integrations and settings align with their workflow.

In addition to direct support, EBizCharge offers a robust knowledge base, video tutorials, and documentation to help users troubleshoot issues on their own. Webinars and training sessions are also available periodically, which can be particularly helpful when onboarding new staff or expanding usage. That said, some users have reported longer wait times during peak hours, particularly in live chat. Email responses are generally prompt but can vary depending on complexity.

The lack of 24/7 support might be a concern for companies operating in different time zones or dealing with critical payment issues outside business hours. Still, in most cases, users report a positive experience with support. The team’s familiarity with both payments and accounting systems is a valuable asset, making the troubleshooting process smoother and more efficient.

Strengths and Potential Limitations

EBizCharge stands out for its tight ERP/accounting integrations, secure infrastructure, and ease of use for AR workflows. Businesses that rely on QuickBooks, NetSuite, Sage, or Microsoft Dynamics benefit greatly from the embedded payment processing, reduced data entry, and real-time invoice syncing. Its focus on B2B and service-based industries is evident in features like ACH acceptance, tokenized billing, and recurring payments.

The platform supports multi-user environments and allows for detailed permission settings, making it suitable for growing teams. However, EBizCharge may not be the best fit for every business. Those in retail or eCommerce requiring built-in POS systems, real-time inventory sync, or extensive checkout customization might find it less versatile. Similarly, small businesses without complex AR needs might be able to get by with simpler, more cost-effective solutions.

The website’s unclear pricing is another drawback, which may be problematic for budget-conscious companies. In contrast to platforms that provide instant sign-up and plan comparisons, the consultative sales process could feel like a barrier. All things considered, EBizCharge excels at simplifying payments in well-known back-office settings. For companies that want automation, control, and security without compromising user experience, it’s a great option.

Final Verdict: Is EBizCharge Worth It?

EBizCharge fulfills its primary goal of making payment acceptance easier and more efficient for companies that depend significantly on accounting and ERP systems. It offers substantial benefits to businesses aiming to decrease manual procedures and increase collections speed thanks to features like tokenized storage, secure invoice links, and ACH support. Large and mid-sized B2B companies particularly benefit from its deep integrations and automation features. The support staff is informed and provides guided implementation, which reduces the possibility of errors, and the user experience is intuitive.

However, it isn’t a one-size-fits-all solution. Retailers or small eCommerce businesses might find it too feature-heavy or specialized. The flat-rate pricing is transparent but may not be the most cost-effective for every transaction profile. In conclusion, EBizCharge is a strong contender for businesses focused on backend efficiency and accounts receivable optimization. If your business revolves around invoicing, ERP software, and client billing; this platform deserves serious consideration.

FAQs

Q1: Is EBizCharge compatible with eCommerce platforms like Shopify or WooCommerce?

EBizCharge does offer some level of integration with eCommerce platforms, but it is primarily optimized for ERP and accounting software. For businesses heavily reliant on eCommerce, specialized gateways may offer more tailored features.

Q2: How does EBizCharge help reduce chargebacks and fraud?

The platform includes fraud detection tools such as AVS, CVV checks, and tokenization. It also helps gather documentation for chargeback disputes, making the response process more efficient.

Q3: Can small businesses benefit from EBizCharge, or is it more suited for enterprise-level companies?

While EBizCharge is designed with complex workflows in mind, small businesses using platforms like QuickBooks can still benefit; especially if they want automation and integrated payment solutions.