Newtek Merchant Solutions Review

- 02nd Jul, 2025

- | By Linda Mae

- | Reviews

Newtek Merchant Solutions is a service under the NewtekOne umbrella, a company that supports small to mid-sized businesses with financial and operational tools. While NewtekOne offers services from business lending to cloud hosting and payroll processing, the merchant services division is focused on helping businesses accept, process and manage payments. Lets read more about Newtek Merchant Solutions Review.

Flexible, Newtek Merchant Solutions supports multiple payment types across retail, e-commerce and mobile. It wants to offer merchants a complete processing solution that integrates with other back-end systems and meets industry standards for security and compliance. For businesses already using Newtek’s financial products, the merchant services piece feels like an extension of the overall ecosystem.

Newtek Merchant Solutions may not have the brand recognition of the bigger guys, but it makes up for it with a more personalized experience for small businesses. Their value proposition is integrated support for payments, often bundled with tools to help businesses manage beyond just sales transactions.

Core Payment Processing Capabilities | Newtek Merchant Solutions Review

At the foundation of Newtek Merchant Solutions is its ability to handle credit and debit card transactions. The platform supports major card brands including Visa, Mastercard, American Express, and Discover. Whether a business operates a physical storefront, an online shop, or a mobile-based model, Newtek provides the tools necessary to facilitate secure and efficient transactions.

The company offers standard payment processing features such as batch processing, authorization, and settlement. What makes it functional for small businesses is its ability to scale, allowing merchants to process a few transactions a day or handle higher volumes without drastically changing systems. In addition to traditional swipe and chip card payments, the solution also supports contactless payments, including NFC-enabled methods like Apple Pay and Google Pay.

While the capabilities are solid, Newtek does not position itself as a tech innovator in this space. It relies on industry-standard practices rather than introducing groundbreaking technology. This can be seen as either a drawback or a strength, depending on whether a business prefers tried-and-tested systems or cutting-edge features.

The system is designed to be reliable and stable, focusing more on consistency than on flashy new tools. For many small business owners, that dependability is exactly what they need. The platform aims to be accessible, functional, and adaptable, making it a reasonable option for those seeking payment support without the complexity of enterprise-level systems.

POS Solutions

Newtek offers a variety of POS solutions suited for different business types. These range from countertop terminals to more advanced systems with inventory and employee management capabilities. The POS offerings are primarily designed for small and medium-sized businesses that need reliable in-store solutions with options to scale as they grow.

Most of the hardware Newtek provides is sourced from established third-party manufacturers, ensuring compatibility with common payment methods. These include EMV chip card readers, contactless payment terminals, and touchscreen devices that can be used in quick-service restaurants, retail shops, or service-based industries. Businesses can also choose from wired or wireless options depending on their layout and mobility needs.

On the software side, Newtek POS systems typically include sales tracking, receipt printing, basic reporting, and customer management tools. While they may not be as feature-rich as some all-in-one retail platforms, they offer solid functionality for day-to-day operations. Integration with back-office systems like inventory and accounting tools is possible, though it may require manual configuration or third-party connectors.

Newtek’s POS approach focuses on usability and dependability rather than complexity. For businesses that do not require intricate customization or industry-specific POS features, the solution covers all essential bases. However, those seeking deep vertical integration or specialized retail software may find the offerings limited.

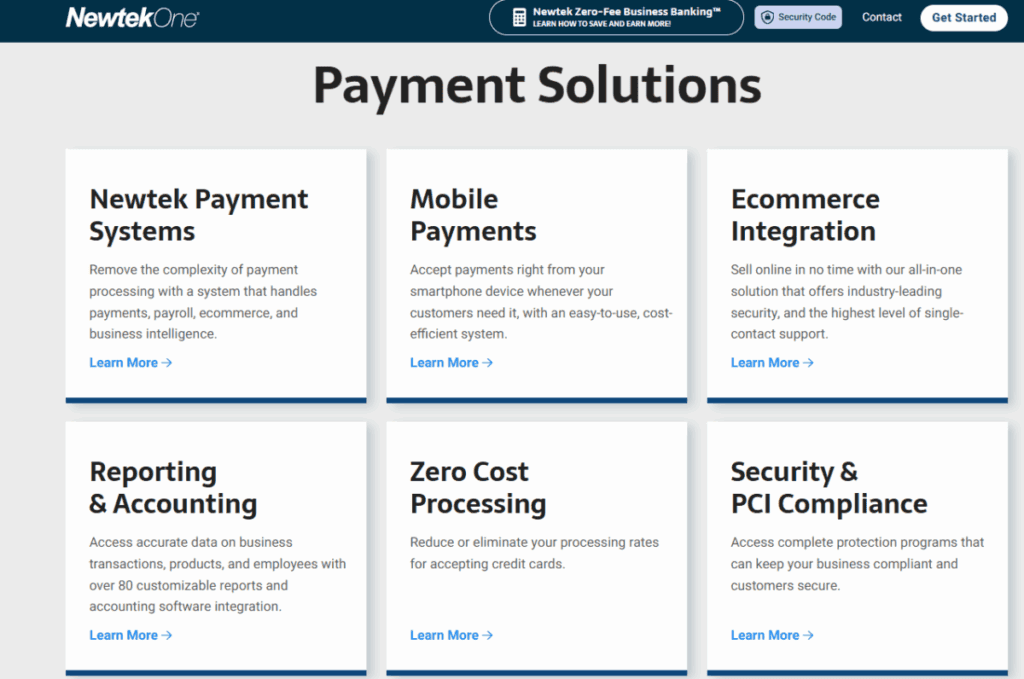

E-Commerce and Online Payment Tools

Newtek Merchant Solutions has many tools to support online businesses and e-commerce transactions. These include virtual terminals, hosted payment pages and payment gateway integrations. For merchants in the digital space these allow you to take payments via websites, online stores and remote billing systems.

The virtual terminal is great for businesses that take orders over the phone or via email. You can manually enter card details through a secure web interface, it’s a great option for service based businesses. The hosted payment page is another key tool that allows customers to complete a purchase through a secure branded checkout page without you having to handle sensitive data.

Newtek also has integration options with popular e-commerce platforms, but the range of supported platforms may not be as extensive as larger payment service providers. If you’re using WooCommerce or Magento you may need technical assistance or plugins to get everything working smoothly.

Security is built into these tools, encrypted transaction handling and PCI compliant processes. The e-commerce features are functional and cover the basics but are not designed to compete with high end online retail platforms. If you need deeply customised checkouts, advanced subscription management or built in fraud analysis you may need to supplement Newtek’s tools with 3rd party services.

Mobile Payment Support

With the shift toward mobility in commerce, Newtek has developed tools to help businesses accept payments on the go. This includes mobile card readers and smartphone-compatible solutions that connect via Bluetooth or headphone jack. These tools are geared toward small merchants, service providers, and field-based businesses that require flexibility.

Mobile readers provided by Newtek typically support swipe, chip, and contactless payments. They pair with mobile apps that enable users to input transaction details, email receipts, and access basic transaction history. The interface is simple and user-friendly, intended for quick setup and ease of use.

The mobile solutions are especially helpful for vendors at pop-up markets, mobile service professionals, or tradespeople who process payments at customer locations. While they may not offer all the features of a full POS system, they provide enough functionality to handle common payment scenarios without tethering the merchant to a fixed terminal.

One limitation is that the mobile ecosystem does not appear as robust as dedicated mobile-first platforms. For example, advanced reporting, inventory sync, or deep CRM integration may be limited. Still, for small businesses that prioritize portability and simplicity, Newtek’s mobile payment options deliver reliable performance.

Invoicing and Recurring Billing

Invoicing and recurring billing are important for businesses with ongoing customer relationships or service-based models. Newtek Merchant Solutions offers basic tools to help merchants send invoices, receive payments, and manage automated billing cycles. These features are especially valuable for consultants, subscription-based businesses, and professional service providers.

The invoicing system allows businesses to create branded invoices, send them via email, and receive payments through embedded payment links. Payments can be made via credit or debit card, and once completed, both the merchant and customer receive confirmation.

Recurring billing tools enable businesses to set up automated charges on a weekly, monthly, or custom schedule. This is particularly useful for membership services, installment payments, or any model built around consistent revenue collection. The system can store card details securely for future billing, helping reduce friction and payment delays.

While these features work well for basic use cases, they lack the depth and automation seen in more advanced subscription billing platforms. For instance, features like proration, metered usage, or multi-tier plan management may not be available out of the box.

Still, Newtek’s invoicing and recurring payment features are easy to use and effective for small businesses that want to streamline payment collection without deploying a complex billing system. For those with straightforward needs, this aspect of Newtek’s offering is a solid convenience.

Integration with Business Management Tools

Integration is a big deal when choosing a payment solution especially if you use multiple software tools to run your business. Newtek Merchant Solutions has limited but meaningful integration options to connect with business management systems like accounting software, CRM and inventory tracking tools.

Common integrations are syncing payment data with QuickBooks or exporting transaction history for reconciliation. If you’re a user of NewtekOne’s broader service ecosystem and also use Newtek’s payroll, lending or business insurance services, the integration experience is more seamless. But compared to more open platforms, Newtek’s third-party integration capabilities are limited. They don’t have an app marketplace or public APIs that allow deep customization. This may not be ideal for businesses with complex workflows or niche software environments.

For basic stuff like syncing sales data with financial software or importing customer records for marketing use, Newtek is fine. But businesses with more advanced data or automation needs may find themselves having to manually bridge systems or invest in middleware tools. The integration is best for small to mid-sized businesses that use standard business tools and don’t need extensive customization. It provides enough connectivity to avoid data silos so merchants can have a complete picture of their business.

Security and Compliance Measures

Security is a central concern for any business accepting electronic payments. Newtek Merchant Solutions adheres to industry-standard security practices to protect both merchants and customers from data breaches and fraudulent transactions. The company ensures PCI DSS compliance, which is required for businesses that handle credit card data.

The platform uses encryption and tokenization to secure transaction information. These techniques help protect sensitive cardholder data by converting it into unreadable codes during transmission and storage. This reduces the risk of data exposure even if a system is compromised. Newtek also implements fraud detection measures, including AVS and CVV verification, as well as tools that monitor suspicious activity. While it does not claim to offer proprietary fraud prevention technology, it uses well-established tools that are considered effective in reducing risk.

Compliance support is also available, helping merchants navigate their responsibilities under PCI requirements. For small businesses that may not have dedicated IT or security staff, this assistance can be particularly valuable.

Overall, Newtek provides a secure environment for processing payments, focusing on reliability and industry conformity. Businesses with heightened security needs may want to supplement these features with external monitoring or advanced fraud tools, but for most merchants, Newtek’s default security measures are likely sufficient.

Reporting and Analytics Dashboard

A good payment platform should not just process transactions, but also provide insights into business performance. Newtek Merchant Solutions includes a reporting dashboard that gives merchants access to key data such as daily sales, transaction history, chargebacks, and deposit timelines.

The dashboard is relatively straightforward, designed for users who may not be tech-savvy. It allows filtering by date ranges, payment types, and locations, making it easier to identify trends or spot discrepancies. Basic graphs and summaries help visualize performance without the need to export data into spreadsheets.

Reporting features can also support accounting, tax preparation, and inventory planning by offering detailed transaction records. However, these reports are primarily operational in nature and may lack predictive or advanced analytical capabilities. For businesses that require deep business intelligence tools or real-time data sync across departments, Newtek’s dashboard may seem limited. It offers functionality that is sufficient for tracking sales and cash flow, but not enough for detailed financial modeling or customer behavior analysis.

Still, the inclusion of a clean, functional reporting interface adds value to the overall merchant experience. For small to mid-sized businesses focused on core financial performance, this tool provides the visibility they need to make informed decisions.

Customer Support and Service Structure

Customer support plays a critical role in the overall experience of using a payment processor. Newtek Merchant Solutions offers support through phone and email, with service availability during standard business hours. While 24/7 support may not always be available, the company emphasizes personalized attention and US-based assistance.

Support quality is generally considered adequate by small business users, especially those who value working with a provider that offers consistent points of contact. This can be a contrast to larger providers where merchants may face long wait times or need to explain their issue to multiple representatives. In addition to direct support, Newtek provides some online resources such as guides, FAQs, and troubleshooting documentation. However, its knowledge base is not as extensive or searchable as those from tech-focused providers.

The onboarding process typically includes a walkthrough of system setup and usage, which can be helpful for first-time users. This kind of hands-on assistance adds value, especially for businesses that are not familiar with payment infrastructure. While it may not provide instant or round-the-clock service, Newtek’s support approach is rooted in human interaction and dependability. For merchants who prefer working with a provider that prioritizes relationships over automation, this is a strong point.

Pricing Transparency and Fee Structure

Newtek’s pricing structure is not fully transparent online, which can be a drawback for businesses seeking immediate cost comparisons. Like many traditional payment processors, pricing is often customized based on business type, transaction volume, and risk category.

Fees typically include a combination of interchange fees, monthly service charges, statement fees, and potential equipment lease costs. Some merchants may be offered flat-rate pricing, while others may be placed on a tiered or interchange-plus model. Without public rates, potential customers must contact a representative for a quote, which can make upfront evaluation difficult.

There is also the possibility of contract commitments or early termination fees, depending on the specific agreement. Businesses considering Newtek should review contracts carefully and ask direct questions about hidden costs, minimums, or fee escalations. That said, some users appreciate the ability to negotiate customized terms based on their specific needs. In this sense, pricing can be flexible, but also variable and less predictable. For price-sensitive merchants or those used to self-service signup models, the lack of upfront clarity may be a hurdle.

Ultimately, pricing is an area where Newtek could improve its transparency to better align with modern expectations. Competitive pricing is possible, but merchants should be prepared to do due diligence before signing on.

Pros and Cons of Newtek Merchant Solutions

Newtek Merchant Solutions has a range of benefits that make it appealing to small and mid-sized businesses. One of the main advantages is its connection to the broader NewtekOne ecosystem, which allows merchants to bundle services such as lending, insurance, and payroll. This can reduce administrative complexity and provide a more unified approach to business management.

The platform also emphasizes customer service, which is a strength for merchants who prefer having a reliable point of contact. The payment processing tools themselves are dependable, and the mobile and recurring billing features meet the needs of many small businesses.

However, the platform is not without its drawbacks. Integration capabilities are limited, especially for businesses that want to deeply connect their payment data with other systems. The lack of publicly available pricing makes it difficult to compare options or budget effectively. The absence of advanced features like machine learning fraud detection or predictive analytics may also be a downside for larger or more digitally mature businesses.

Overall, Newtek is best suited for businesses that value simplicity, stability, and human support. It may not be ideal for those seeking cutting-edge technology or highly customizable features.

Ideal Business Types for Newtek

Newtek Merchant Solutions is geared towards small to mid-sized businesses across many industries. Retail stores, service providers and small online businesses will love the simple tools and bundled support. Invoicing and recurring billing makes it good for consultants, healthcare and membership based businesses.

Businesses already using other Newtek services will benefit the most as everything is integrated. Those looking for a one stop shop for business services may find value in consolidating payments with lending or payroll under one provider. But businesses with highly technical requirements like complex e-commerce or enterprise sales teams may find Newtek limited. Same with high risk industries that require specialized underwriting or compliance.

Newtek is best for businesses that value reliability, ease of use and personal support over technical complexity or brand name. It fills a niche for those who want practical solutions without the hassle of managing overly complex systems.

Final Verdict

Newtek Merchant Solutions offers a reliable, easy-to-use platform with mobile support, recurring billing, and basic e-commerce tools. It stands out for personalized service and ecosystem integration but lacks pricing transparency and advanced integrations. Ideal for businesses prioritizing stability and human support over flashy tech, Newtek delivers solid payment processing fundamentals.

FAQs

Q1: Does Newtek Merchant Solutions support high-risk businesses?

Newtek generally focuses on standard-risk industries. Businesses in high-risk sectors may need to contact the company directly to explore eligibility and underwriting options.

Q2: Can I use Newtek with my existing e-commerce platform?

Yes, Newtek supports integrations with popular e-commerce platforms, but compatibility may vary. Merchants may need to work with technical support to ensure smooth setup.

Q3: Is there a long-term contract with Newtek?

Contract terms can vary. Some merchants may be offered month-to-month agreements, while others may face longer commitments with early termination fees. Always confirm the details before signing.