QuickPay Review

- 15th Sep, 2025

- | By Linda Mae

- | Reviews

QuickPay is a payment service provider that allows businesses to accept online payments through multiple payment channels. In a digital world where speed and security are key, solutions like QuickPay are the bridge between merchants and customers. It’s used in e-commerce, SaaS, subscription-based industries and service-based companies that need streamlined billing and invoicing. Lets read more about QuickPay Review.

The platform aims to simplify payment collection by supporting different payment methods, currencies and integration options. Merchants can link it to popular e-commerce platforms, accounting tools or use its APIs for custom solutions. For many businesses QuickPay helps to reduce the complexity of handling multiple banks, gateways and fraud prevention by consolidating them into one solution.

But like any payment platform QuickPay is not without its pros and cons. While it delivers reliable transaction processing and many features, businesses need to weigh costs, ease of integration, customer support and global accessibility before adopting it. This review will go deep into QuickPay’s features, usability and overall value for businesses considering to adopt it. The goal is to give a clear picture of what QuickPay does well, where it falls short and which type of businesses will benefit the most.

Table of Contents

ToggleCompany Background and Evolution | QuickPay Review

QuickPay was founded as a payment service provider with the mission to simplify online payment for merchants. Over time the platform has evolved to address the growing demands of online commerce and cross-border trade. Initially it focused on providing a flexible payment gateway solution to small and medium sized businesses but later expanded to serve larger enterprises and platforms that required robust transaction handling.

In its journey QuickPay has kept pace with industry changes such as mobile payments, wallet integrations and stricter compliance frameworks. The ability to adapt quickly has been key to its survival in a market filled with established players and new fintech challengers. QuickPay’s presence today is marked by partnerships with various acquiring banks and technology providers making it relevant and competitive in different markets.

The company also invests in its developer ecosystem as businesses increasingly rely on APIs and automation to scale their operations. Its reputation is built on providing a balance of accessibility for non-technical users and customization for developers. While it may not be as global as some of the industry giants, QuickPay has built credibility in its markets by emphasizing reliability, compliance and transparency. Understanding its background will give context to evaluate if QuickPay fits the needs of different business types and industries.

Core Features and Capabilities

QuickPay has many features to make online transactions and business more efficient. At its core it’s a payment gateway that can handle multiple payment methods and currencies. Features like subscription billing, recurring payments and invoicing tools makes it especially suitable for SaaS and e-commerce businesses that need flexibility in billing cycles.

The platform also integrates with popular e-commerce platforms like Shopify, WooCommerce and Magento so merchants can connect payments without much development work. For businesses with more complex needs QuickPay’s API suite provides advanced customization options like automation of payment flows, real-time transaction updates and custom reporting.

One of the notable features is multi-currency support, businesses can accept payments from global customers and settle transactions in their preferred currency. This reduces conversion costs and makes cross-border sales more accessible. QuickPay also has security features like tokenization, fraud monitoring and strong authentication to protect both merchants and customers.

While the feature set is robust, businesses must assess if all the features align with their operational needs. Some advanced tools may require extra configuration or technical expertise. Overall QuickPay is a versatile solution for businesses that need both ready-made integrations and deeper customization options.

Payment Methods Supported

One of QuickPay’s strengths is the support for many payment methods. In addition to credit and debit cards, the platform allows merchants to accept mobile wallets, direct bank transfers and region-specific payment solutions. This is crucial for businesses that operate across borders where customer preferences can vary greatly.

For example, customers in Europe may prefer direct bank transfers while others rely heavily on digital wallets like Apple Pay or Google Pay. By offering these options QuickPay allows merchants to cater to diverse customer bases without needing separate integrations for each method. Subscription-based businesses can also benefit from features like recurring billing tied to cards or accounts, reducing the friction of repeat payments.

QuickPay also supports alternative payment solutions which are becoming more important in markets with low card penetration. This includes local banking solutions and alternative online transfer options, making it easier for businesses to expand into new regions.

However, availability of certain methods may depend on the merchant’s location or the acquiring banks involved. Businesses must check which methods are available in their operating region. While QuickPay does a good job of covering the most common global options, it may not be as exhaustive as larger providers with deeper global networks. But for most small to medium businesses the range offered is sufficient to meet customer expectations.

Integration and Developer Tools

Integration flexibility is a major factor for merchants choosing a payment provider, and QuickPay performs reasonably well in this area. For non-technical users, the platform provides pre-built plugins for widely used e-commerce platforms such as Shopify, WooCommerce, and Magento. These plugins simplify setup, enabling merchants to start accepting payments quickly with minimal effort.

For businesses with more complex requirements, QuickPay offers a comprehensive API suite. These APIs allow developers to build customized payment flows, integrate with accounting or ERP systems, and manage transactions programmatically. Documentation is generally detailed and accessible, providing examples for different programming environments. QuickPay also supports webhook functionality, which ensures real-time updates on transaction events such as successful payments, refunds, or chargebacks.

Another advantage is its compatibility with multiple programming languages, giving developers flexibility in how they implement the solution. This makes QuickPay suitable not only for small businesses but also for larger enterprises looking to build tailored solutions around their payment systems.

While integration is relatively smooth, some merchants may find the learning curve steep if they lack technical expertise. In such cases, reliance on external developers or QuickPay’s support may be necessary. Overall, QuickPay strikes a balance between plug-and-play convenience for smaller merchants and robust developer tools for businesses requiring customization.

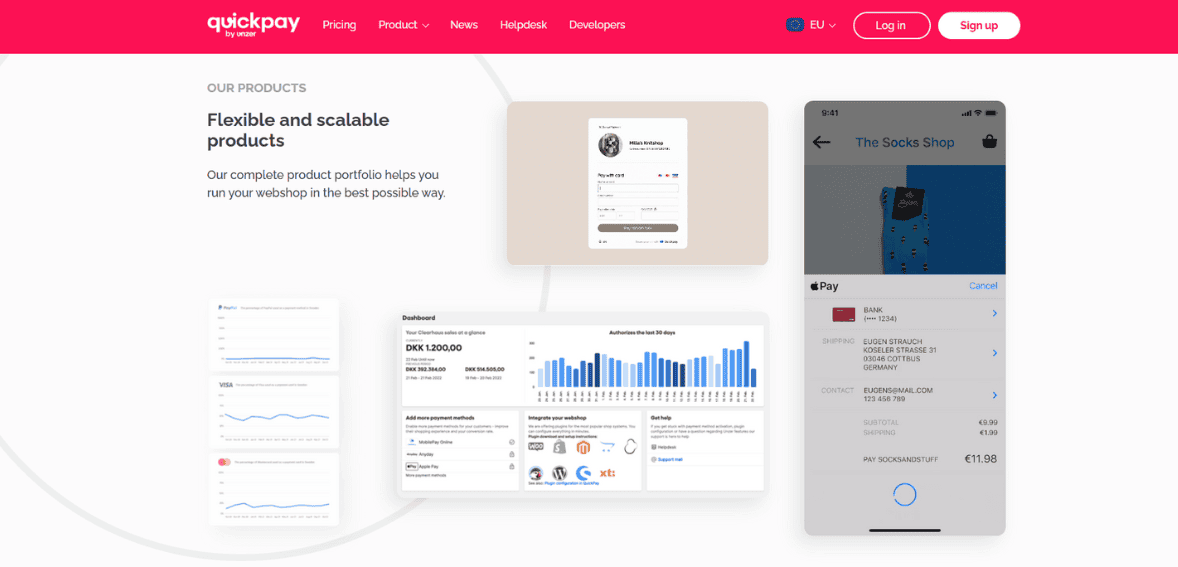

User Interface and Dashboard Experience

QuickPay’s dashboard is designed to provide merchants with a centralized view of their transactions, payouts, and customer activity. The interface is straightforward, offering easy navigation for daily tasks such as viewing payment history, generating invoices, and managing subscriptions. For businesses with frequent transactions, the dashboard’s clear layout helps reduce administrative burden.

Reports and analytics are integrated into the dashboard, giving merchants visibility into sales trends, chargebacks, and settlement times. Export functions allow this data to be transferred into accounting systems for reconciliation. The design emphasizes usability, making it possible for merchants without technical expertise to manage essential tasks effectively.

Customizable notifications and alerts further enhance the experience, ensuring that merchants are immediately informed of payment issues or unusual activity. This can be particularly useful for businesses handling high transaction volumes, where timely responses are critical.

That said, while the dashboard is functional and reliable, it may lack the advanced analytics or visually rich interfaces offered by some larger competitors. For businesses seeking in-depth data visualization or predictive insights, additional tools may be required. Nevertheless, the interface is sufficient for most small to mid-sized businesses, providing an intuitive environment that balances simplicity with essential functionality.

Security and Compliance Measures

Security is a top priority in payment processing, and QuickPay incorporates several measures to ensure transactions remain secure. The platform complies with PCI DSS standards, which are mandatory for handling cardholder data. By maintaining this compliance, QuickPay provides assurance that sensitive information is encrypted and processed securely.

Tokenization is another layer of protection, replacing sensitive card details with tokens during transactions. This reduces the risk of data exposure in the event of a breach. QuickPay also uses SSL encryption for data in transit, safeguarding customer information during online transactions.

Fraud detection and monitoring tools are built into the platform, enabling merchants to identify suspicious activity before it escalates. Features such as velocity checks, IP monitoring, and strong customer authentication help mitigate risks. Compliance with regulations such as PSD2 in Europe further strengthens its security framework, particularly around authentication for online payments.

However, merchants must remember that security is a shared responsibility. While QuickPay provides the infrastructure, businesses must also implement best practices such as updating software, securing accounts, and educating staff. Overall, QuickPay delivers a robust set of compliance and security measures that align with industry standards, making it a trustworthy option for businesses seeking reliable protection for customer data.

Pricing and Fee Structure

QuickPay’s pricing model is designed to be transparent, though costs can vary depending on the payment methods used and the merchant’s geographic location. Typically, fees include a fixed transaction charge plus a percentage of the transaction value. This structure is common across the industry, making it easier for businesses to compare QuickPay with other providers.

Merchants may also encounter additional fees for specific services such as chargebacks, refunds, or international transactions. These costs should be factored into financial planning, particularly for businesses operating with thin margins. Subscription-based pricing plans may also be available, offering businesses a predictable monthly fee in exchange for lower per-transaction costs.

One advantage of QuickPay is its relatively straightforward pricing transparency compared to some competitors that bundle hidden fees into their agreements. Clear breakdowns help merchants anticipate expenses without unwelcome surprises. That said, businesses with high transaction volumes should negotiate carefully to ensure favorable rates.

While QuickPay may not always offer the lowest fees, its balance of functionality and pricing makes it competitive for small to medium-sized businesses. Larger enterprises processing significant volumes may find better rates with bigger providers, but for many merchants, QuickPay delivers a fair and manageable pricing structure.

Merchant Support and Customer Service

Customer support is an essential factor for businesses managing critical payment infrastructure. QuickPay provides multiple support channels, including email, live chat, and documentation resources. Response times are generally prompt, with support staff available to guide merchants through both technical and operational queries.

The platform also offers a detailed knowledge base with documentation, FAQs, and integration guides. This self-service option is valuable for merchants who prefer to troubleshoot independently or need immediate assistance outside support hours.

That said, the quality of support can vary based on plan tiers or geographic location. Businesses operating in regions with limited support coverage may find response times slower. In addition, while QuickPay offers competent technical support, it may not provide the same level of consultative assistance as larger providers with dedicated account managers.

For small and medium-sized businesses, QuickPay’s support is generally sufficient, covering both initial setup and ongoing issues. Enterprises requiring hands-on account management may need to assess whether the support framework meets their expectations. Overall, QuickPay strikes a balance between accessibility and responsiveness, offering merchants reliable assistance when needed.

Performance and Reliability

Performance and uptime are critical in payment processing, as downtime can directly impact sales and customer trust. QuickPay emphasizes reliability, with its infrastructure designed to handle high transaction volumes and maintain consistent availability. Merchants report generally stable performance, with minimal service interruptions.

Transaction processing speeds are competitive, ensuring payments are confirmed quickly and customers experience minimal delays during checkout. This is particularly important for e-commerce businesses, where slow transaction approvals can lead to abandoned carts.

QuickPay also supports scalable infrastructure, meaning businesses can continue using the platform as their transaction volumes grow. This scalability makes it suitable not only for startups but also for established businesses expecting future expansion.

Despite these strengths, no provider is entirely immune to outages or technical glitches. Businesses relying on QuickPay should have contingency plans, such as backup gateways, to minimize risks. Overall, QuickPay’s performance is strong, with stability and speed that meet industry standards. For most merchants, its reliability will be more than adequate, though larger enterprises may still prefer providers with global-scale redundancy.

Pros of Using QuickPay

QuickPay offers several advantages that make it attractive to businesses across different industries. Its support for multiple payment methods ensures customers can pay through their preferred channels, reducing friction at checkout. Multi-currency functionality further broadens its appeal for businesses operating internationally.

Integration options are another major strength, with both plug-and-play solutions for popular platforms and robust APIs for custom needs. This makes QuickPay versatile enough to cater to both small businesses with limited technical expertise and larger enterprises seeking advanced customization. Security and compliance are strong points, with adherence to PCI DSS and features like tokenization and fraud detection tools. The platform also maintains a reputation for reliability, with stable transaction processing and scalable infrastructure that grows with business demands.

Transparent pricing and accessible customer support further enhance its appeal, particularly for small to mid-sized businesses seeking a dependable solution without excessive complexity. While it may not have the brand recognition of some global giants, QuickPay has carved out a niche as a flexible, reliable, and merchant-friendly option in the payment solutions market.

Cons and Limitations

While QuickPay has many strengths, it also comes with certain limitations that businesses must consider. One of the primary drawbacks is its limited global reach compared to larger providers like Stripe or PayPal. While QuickPay supports multiple currencies and payment methods, some region-specific options may not be available.

Another limitation is pricing competitiveness for high-volume enterprises. While its fees are reasonable for small to mid-sized businesses, larger companies processing millions in transactions might secure better rates with global providers offering economies of scale.

The user dashboard, while functional, may lack the advanced analytics and visualization features some businesses need for data-driven decision-making. Merchants seeking deep insights into customer behavior may need to supplement with third-party analytics tools.

Customer support, although generally responsive, may not provide the same level of dedicated account management that larger enterprises expect. Businesses requiring tailored support may find QuickPay’s service more transactional than consultative.

Finally, QuickPay’s brand recognition is limited outside its core markets, which may affect its perceived reliability for businesses aiming to build customer trust in new regions. These limitations do not diminish its value for many businesses but highlight areas where merchants must align expectations before adoption.

Best Use Cases and Ideal Business Types

QuickPay is best suited for small to medium-sized businesses looking for a flexible and straightforward payment processing solution. E-commerce stores benefit from its wide range of integrations with popular platforms, enabling them to quickly launch and manage online sales. Subscription-based businesses, including SaaS providers, can take advantage of recurring billing and invoicing features to simplify customer payments.

Service-based businesses also find QuickPay useful for managing invoices and accepting payments through multiple methods. Its support for alternative payment solutions and multi-currency transactions makes it particularly appealing for businesses expanding internationally without investing heavily in infrastructure.

While large enterprises may find limitations in pricing competitiveness and global scale, QuickPay still serves as a reliable secondary gateway or niche provider for specific markets. Startups and SMEs, in particular, value QuickPay’s balance between affordability, flexibility, and ease of use. Ultimately, QuickPay is an ideal choice for businesses that prioritize straightforward setup, reliable performance, and a balance between plug-and-play functionality and customizable integration options. It is not the most advanced global provider, but it delivers consistent value within its target market.

Final Verdict

QuickPay is a dependable payment service provider offering flexibility, security, and ease of use. With support for multiple currencies and payment methods, it suits businesses serving diverse customers, while developer tools and API integrations support advanced needs. Its transparent pricing, scalable infrastructure, and compliance with security standards add value. Reliable dashboards and customer support meet most merchant needs, though large enterprises may find its analytics and tailored services lacking. QuickPay’s main limitations are global reach and competitiveness for high-volume businesses. Still, its accessibility and consistent performance make it a strong choice for small to mid-sized businesses seeking affordable payment processing.

FAQs

Q1. Is QuickPay suitable for small businesses as well as large enterprises?

Yes, QuickPay is designed to cater to businesses of different sizes. While small businesses can benefit from its plug-and-play integrations, larger enterprises may leverage its advanced APIs and multi-currency support.

Q2. How does QuickPay ensure transaction security?

QuickPay follows strict PCI DSS compliance standards, uses advanced encryption methods, and includes fraud monitoring tools to keep transactions and customer data safe.

Q3. What industries benefit the most from QuickPay?

QuickPay is well-suited for e-commerce retailers, subscription-based SaaS providers, marketplaces, and businesses that require global payment acceptance across different currencies.