Ecentric Payment Systems Review

- 04th Dec, 2025

- | By Linda Mae

- | Reviews

Ecentric Payment Systems is a South African payments infrastructure provider that focuses on enterprise-scale transaction processing, settlement, and switching. Unlike popular payment providers that primarily compete in the small business, POS, or simple checkout segments, Ecentric sits in the technical backend of the payments ecosystem. Its solutions are designed more for enterprise-grade use cases and complex payment operations rather than traditional merchant onboarding. Lets read more about Ecentric Payment Systems Review.

Today businesses expect payment systems that integrate across online and in-store. Large retailers, fuel stations and chain stores need more than just a terminal or gateway. They need automated settlement, routing logic, redundancy, reconciliation processes and support for new payment rails. Ecentric sits in this space by providing tools that centralise and orchestrate transaction processing.

The company has become a relevant player in the South African payments market given the region’s strong financial infrastructure and multi-acquirer model. More businesses are looking for a single payment provider who can streamline routing and settlement and handle the complexity behind card network authorisation. Ecentric is not a competitor to payment providers for micro businesses but rather the enterprise side of the payments spectrum where reliability and back office automation matters more than just merchant acquisition.

With digital payments growing in importance Ecentric’s environment is becoming more and more important in the broader payments ecosystem. The platform is being adopted across high volume retail environments because it’s infrastructure driven payment processing not consumer focused POS solutions.

Table of Contents

ToggleCompany Background and Market Position | Ecentric Payment Systems Review

Ecentric Payment Systems is part of the Shoprite Group. This gives it credibility and access to retail transaction data, so it can reach further into enterprise payment flows. The company started out to address transaction switching and routing for organisations that couldn’t rely on traditional banking infrastructure alone. Over time it expanded into reconciliation and omni-channel payment support.

Ecentric is well known in South Africa and other African markets for serving large retailers and chain stores. Its core competitive advantage is the infrastructure for payment routing, including the ability to choose multiple acquirers, increase uptime and control processing logic. Many global payment providers focus on front-end tools like terminals, mobile readers or e-commerce checkout platforms. Ecentric has identified an opportunity on the back-end of retail payments where enterprises need redundancy, stability and visibility into every transaction.

The company operates in a niche segment of enterprise payment platforms where the priorities are different: uptime promises, batch settlement, reporting accuracy and corporate wide connectivity. This makes Ecentric more like back-end switches, settlement engines and reconciliation platforms rather than standard merchant services providers.

Given the omni-channel environment in Africa and the growth of digital commerce Ecentric seems well positioned. The enterprise payments space is competitive and being part of the Shoprite ecosystem strengthens its brand. But since Ecentric is focused on enterprise it’s not suited for very small businesses or early stage merchants which is a limitation for companies looking for high flexibility and quick onboarding.

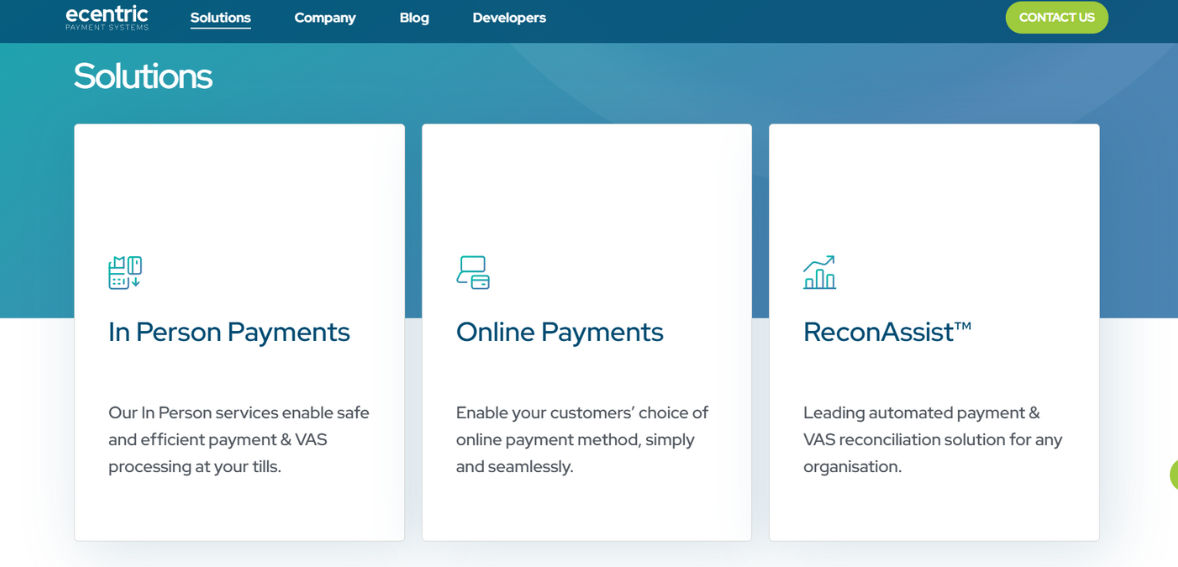

Core Payment Solutions Overview

Ecentric bundles several core services that support enterprise-grade transaction flows. These include switching, routing, settlement, reconciliation, fraud controls, and payment reporting. Unlike payment gateways that offer lightweight merchant tools, Ecentric provides a technical infrastructure layer that connects retailers, banks, and networks.

Its core services include:

Payment Switching: Ecentric routes transactions to financial institutions, enabling multi-bank and multi-acquirer environments.

Reconciliation: Large volumes of transactions go through automated reconciliation workflows to avoid manual matching.

Settlement: The system manages daily financial settlement across banks, branches, and retail locations.

Omni-channel Payments: Ecentric supports both online and physical store payments.

Fraud Controls and Compliance: The company includes security and compliance systems to manage transaction risk.

A key differentiator is the focus on payment visibility, allowing businesses to track every transaction. The platform seems built for high-scale transaction flows where processing speed and error reduction are crucial. Settlement and reconciliation solutions are especially important for enterprise and multi-location environments that require automated financial workflows rather than manual adjustments.

Overall, Ecentric’s product suite aligns more with core payment infrastructure than traditional merchant services. It addresses the operational layers that businesses require after the transaction has been captured, such as routing, settlement, and reporting. This framing positions the company as a technical partner in the enterprise payments space rather than a simple POS or gateway provider.

In-Store Payment Processing Capabilities

One of Ecentric’s strengths is in-store retail payments. Retailers need a highly available system that processes large numbers of transactions throughout the day. Card payments, PIN authentication, inventory systems, and POS software all need synchronous communication. Ecentric offers switching capabilities that route transactions without relying on a single acquirer. The ability to integrate multiple banks gives businesses redundancy and potential cost efficiencies.

Reliability is a crucial benefit here. A few seconds of downtime can become costly for a business processing thousands of transactions per hour. Ecentric emphasizes stability and performance as critical areas of focus. The switching engine is designed to maintain uptime and consistent latency, two of the most important requirements in brick-and-mortar retail.

The company also offers multi-channel routing that connects terminals and POS integrations into the core platform. This functionality gives large retailers or fuel chains greater centralized control. Instead of each location independently connecting to a gateway or acquirer, the switching layer synchronizes and routes transactions across their network.

Ecentric supports a variety of card payments, POS environments, and retail use cases. Its enterprise orientation makes it less relevant for small merchants who simply require a standalone POS terminal. Businesses with multi-branch infrastructure benefit more from the system’s payment processing logic and routing control.

Online and Omni-Channel Payments

The move toward omni-channel payments has increased the demand for payment systems that connect online checkouts, in-store purchases, loyalty solutions, and alternative payment methods. Ecentric supports e-commerce transactions and digital payments through its unified platform. The goal is to create a single view of the customer transaction, regardless of channel.

For retailers, using separate solutions for online and in-store creates challenges during reconciliation and reporting. With omni-channel buying models such as buy-online-pickup-in-store becoming more common, payment providers must support consistent routing and settlement across environments. Ecentric enables retailers to connect online networks and card processors and route transactions consistently.

While Ecentric includes online processing capabilities, it is not positioned as a dedicated e-commerce gateway like global SaaS-oriented platforms. Instead, its focus remains on enterprise grade online payments, where integration with settlement and back-office systems matters most. The strength lies in unified payment operations instead of checkout customization.

This reflects a structural choice in Ecentric’s positioning: rather than offering developer-friendly merchant onboarding experiences, it focuses on scalable routing for enterprises already processing large transaction volumes. The omni-channel tools are an extension of this strategy.

Payment Switching and Transaction Routing

Ecentric’s switching engine is one of its most important strengths. The ability to route transactions across acquirers and networks allows retailers to optimize authorizations and reduce potential declines.

Many enterprise retailers prefer not to rely on a single acquiring bank because it introduces risk. Switching enables:

Redundancy

Better Performance

Cost Efficiencies

Reliability

By routing transactions across multiple banks, retailers can also reduce downtime. The routing logic can include fallback scenarios, performance monitoring, and control of routing rules. This infrastructure allows businesses to dictate where and how transactions should be processed rather than relying on default banking infrastructure.

For large businesses, routing flexibility is a compelling advantage. It allows them to negotiate fees, diversify acquirer partnerships, and improve authorization rates. Switching is also valuable from a risk and performance standpoint. However, this setup requires more technical integration and may not be suitable for small or early-stage businesses.

Overall, Ecentric’s switching engine is a defining feature that differentiates it from many payment processors. It underlines the company’s focus on high-availability and enterprise infrastructure rather than small business merchant services.

Security, Compliance, and Fraud Prevention

Security is a central requirement in payments, and Ecentric includes several features aligned with PCI compliance, tokenization, and encryption. The company is focused on enterprise-level risk prevention rather than personal identity verification or lightweight fraud filters.

Fraud controls are designed to assist large transaction flows, particularly where the volume of traffic increases risk. Compliance ranges from PCI standards to regulatory requirements for transaction processing. Tokenization and encryption ensure secure card handling and help retailers avoid storing sensitive cardholder details.

Because Ecentric operates inside the enterprise financial systems of major retailers, its role in maintaining secure routing and risk prevention is significant. It serves as a gateway between financial networks and merchant systems, which requires rigorous compliance.

The security tools are effective for enterprises but may be over-engineered for small merchants or startups. Businesses looking for full-stack fraud solutions for e-commerce may find alternatives more suitable. However, for retailers who already have internal fraud controls and require security across switching and settlement engines, the company provides strong compliance and risk management workflows.

Settlement, Reporting, and Reconciliation Tools

Reconciliation and settlement are key enterprise pain points. Large organizations that operate multiple locations, merchant IDs, or acquirers need automated matching between transactions and settlement records. Ecentric offers reconciliation and reporting tools that automate financial workflows. Settlement services help centralize transaction reporting and ensure retailers receive accurate settlement files. Reconciliation workflows remove the need for manual financial matching and reduce accounting risk. Merchants can track settlement timing, identify discrepancies, and generate batch reports.

These systems work well for enterprises with complex financial operations but require technical onboarding and integration. Reporting tools are designed for high-visibility financial control, which is where Ecentric is strongest. Businesses with multi-bank transaction volumes benefit from central reporting dashboards and batch processing. The advantage here is clear: automation reduces human errors and operational overhead for large companies. On the downside, the platform may not be low maintenance for smaller businesses, requiring setup time and integration work.

Integration and Developer Capabilities

Ecentric supports integration into enterprise systems, including POS platforms, banking institutions, and e-commerce platforms. APIs, SDKs, and documentation allow businesses to connect with the processing engine. However, the focus is less on frictionless merchant onboarding and more on infrastructure deployment. Technical teams within enterprises can customize routing flows, settlement files, and reconciliation formats. This flexibility is useful for retailers with internal IT teams who want more control over payments infrastructure.

Compared to developer-focused platforms designed for startups, Ecentric is concentrated on enterprise-grade integrations rather than universal developer simplicity. This profile suits retailers and large corporations but may be a hurdle for businesses without engineering resources. The key takeaway is that Ecentric delivers strong connectivity for enterprise systems but is not a plug-and-play solution for basic merchant onboarding. It is designed for organizations that want infrastructure control rather than quick setup.

Industry-Specific Solutions

Ecentric focuses on several enterprise verticals:

Retail

Fuel and convenience

E-commerce

Large enterprises

Corporate payment processing

The platform is most commonly used in retail environments, especially where there are multiple branches and high transaction volume. Fuel stations are another major market where uptime and routing are critical. Multi-branch enterprises also use the system because it supports routing across locations and banking networks. The company is not targeted at micro-merchants, hospitality startups, or single-location businesses. Instead, its focus is on multi-site infrastructure, payment routing, and settlement. Its vertical strength reinforces its enterprise specialization and differentiates it from universal payment processors.

Ease of Use and Platform Reliability

Ecentric is built for reliability and uptime rather than simplified onboarding. Enterprise retailers require stable systems to support large transaction streams daily. The platform includes redundancy, routing rules, and performance monitoring tools that ensure uptime. The usability profile is more suitable for businesses with technical capacity to manage payment infrastructure. It is not a lightweight platform but rather an engineering-driven solution. The company prioritizes processing stability, enterprise monitoring, and settlement control.

Because of this, the learning curve may be higher for teams familiar with traditional payment processors. The advantage is better visibility and control but with more operational management compared to small business-oriented solutions. The reliability is one of the major strengths. Retailers and enterprises benefit from routing control and settlement tools that minimize operational issues. The need for specialization is a potential trade-off.

Customer Support and Service Quality

Customer support for enterprise platforms often involves dedicated account management, specialized integration teams, and SLAs. Ecentric appears to follow this model. Support focuses more on onboarding, routing configuration, system monitoring, and troubleshooting. This is well-aligned with enterprise needs where downtimes are costly.

Large organizations expect support that covers integration, settlement operations, and technical performance. The platform’s customer support is therefore oriented towards engineering communication and financial workflows. Small merchants expecting help with POS setup or simple checkout issues may find enterprise service models excessive. The support ecosystem seems appropriate for enterprises but may not fit businesses in need of basic onboarding support.

Pricing and Fee Transparency

Pricing is not publicly available, which is typical in enterprise payments. Businesses must request custom pricing based on acquirer, routing logic, transaction volume, and settlement requirements. While this model offers flexibility, it also makes comparison difficult. Some merchants may prefer fixed pricing plans. Hidden fees are unlikely given enterprise transparency models, but the lack of public pricing does create uncertainty. Multi-acquirer routing can reduce processing costs, but hardware and integration expenses may apply. Pricing is complex and varies based on the infrastructure required, so small businesses may find it expensive.

Pros and Cons of Ecentric Payment Systems

Pros

Built for enterprise scale

Excellent switching and routing capabilities

Strong reconciliation and settlement tools

High reliability and uptime

Suitable for retailers and multi-location enterprises

Cons

Not designed for small merchants

Integration may require technical resources

Pricing transparency could be improved

Focus on back-office systems, not consumer POS

Conclusion

Ecentric Payment Systems occupies a clear niche in the payments industry. It is not a traditional POS or gateway business. Instead, it provides infrastructure for enterprise transaction processing, routing, and settlement. Its strongest capabilities lie in switching, reconciliation, and enterprise payment routing. For retailers and large organizations that need to operate multiple acquirers or manage high-volume payments, Ecentric is well-positioned. However, businesses without complex enterprise requirements or those needing lightweight onboarding may find simpler merchant solutions more practical. Ecentric excels where payment routing and settlement centralization matter most. As the payments ecosystem continues evolving towards omni-channel commerce, Ecentric remains a meaningful player in the enterprise retail market.

FAQs

Q1. Is Ecentric suitable for small businesses?

Ecentric is primarily designed for enterprise-level and multi-location retailers. Smaller merchants may find the platform too complex or costly, and simpler POS systems may be better suited.

Q2. Does Ecentric support both in-store and online payments?

Yes, the platform supports both channels, with a focus on unified payment routing and reconciliation across environments.

Q3. What makes Ecentric different from typical payment processors?

Its biggest differentiator is enterprise routing and switching, which allows retailers to use multiple acquirers, maintain uptime, and centralize settlement workflows.