Adyen Review

- 22nd Mar, 2025

- | By Linda Mae

- | Reviews

Adyen is a leading global payment processor known for its robust infrastructure, advanced fraud prevention, and seamless omnichannel capabilities. Founded in 2006 in the Netherlands, Adyen has positioned itself as a premium solution for businesses seeking a unified payment platform that supports various payment methods, including credit and debit cards, digital wallets, and local payment systems. Lets read more about Adyen Review.

Businesses in today’s digital landscape require payment solutions that are fast, secure, and adaptable to global markets. Adyen meets these needs by providing a single, end-to-end platform for payment processing, risk management, and data analytics that does not rely on third-party intermediaries. Adyen, unlike many traditional processors, offers direct access to card networks and local payment providers, lowering transaction costs and improving dependability.

Company Background and Global Presence | Adyen Review

Adyen was founded in 2006 in Amsterdam by a team of payment industry experts, including Pieter van der Does and Arnout Schuijff. The company’s name, which means “Start Over” in Surinamese, reflects its mission to redefine payment processing by eliminating outdated banking systems and intermediaries. Unlike traditional payment processors that rely on a patchwork of third-party services, Adyen built its own proprietary infrastructure, allowing merchants to accept payments globally with minimal friction.

Expansion and Market Reach

Over the years, Adyen has expanded its operations across Europe, North America, Asia-Pacific, and Latin America, serving some of the world’s largest companies, including Uber, Netflix, Spotify, and eBay. Its global presence makes it an attractive option for businesses looking to scale internationally while maintaining a seamless payment experience.

Adyen possesses acquiring licenses for prominent card networks such as Visa, Mastercard, and American Express, allowing it to process payments directly without dependence on external banks. This lowers expenses and accelerates transaction speed, providing a competitive advantage over numerous conventional payment processors.

Industry Presence

Adyen primarily caters to large enterprises and fast-growing businesses, although its scalable technology can also support mid-sized companies. Its industry reach spans retail, hospitality, travel, digital services, and e-commerce, making it a versatile payment solution.

With a strong global footprint and a reputation for innovation, Adyen continues to be a preferred choice for businesses looking for a seamless, cross-border payment processing experience.

Adyen’s Payment Processing Solutions

Adyen provides a complete range of payment processing solutions aimed at businesses of every size, especially those functioning in various markets. In contrast to conventional processors needing distinct integrations for online, in-store, and mobile payments, Adyen offers one platform that consolidates all transactions. This guarantees improved reporting, reduced expenses, and smooth customer experiences across various sales channels.

In-Store, Online, and Omnichannel Payments

Adyen supports various payment environments, including:

Online Payments: Secure transactions for e-commerce businesses through APIs, hosted payment pages, and direct integrations with platforms like Shopify, Magento, and WooCommerce.

In-Store Payments: Supports POS terminals with contactless, chip, and PIN functionality, making it ideal for retailers and hospitality businesses.

Omnichannel Capabilities: Enables businesses to link online and in-store transactions, offering seamless payment experiences (e.g., buy online, return in-store).

Supported Payment Methods

Adyen processes a wide range of payment methods, including:

Credit and debit cards (Visa, Mastercard, AMEX, Discover)

Digital wallets (Apple Pay, Google Pay, PayPal, Alipay)

Local payment options (iDEAL, Sofort, WeChat Pay, UPI)

Integration and Developer-Friendly Tools

Adyen offers robust APIs, SDKs, and plugins, allowing businesses to integrate payments easily into websites, mobile apps, and POS systems. This developer-first approach makes it a strong choice for companies seeking customization and flexibility.

How Adyen Stands Out from Competitors

Adyen competes with leading payment processors such as Stripe, PayPal, Square, and Worldpay, yet it stands out due to its unique infrastructure, worldwide presence, and solutions tailored for enterprises. In contrast to numerous rivals that depend on external banks for payment processing, Adyen establishes direct links with card networks and local payment providers, lowering transaction expenses and enhancing reliability.

Unique Selling Points

Adyen offers several key differentiators that set it apart from other payment processors:

End-to-End Payment Processing: Unlike Stripe and PayPal, which rely on third-party banks for acquiring, Adyen manages everything in-house, leading to faster settlements and fewer transaction failures.

Interchange++ Pricing Model: Instead of a flat-rate pricing structure like Square or PayPal, Adyen uses Interchange++ pricing, which is often more transparent and cost-effective for high-volume merchants.

Customizable Fraud Prevention: Adyen’s RevenueProtect system provides AI-driven fraud detection, reducing chargebacks without blocking legitimate transactions.

Comparison with Stripe, PayPal, and Square

Stripe: While Stripe is developer-friendly, Adyen is often the preferred choice for enterprises due to its direct acquiring capabilities and wider international support.

PayPal: PayPal is easier to set up, but it lacks the advanced analytics, customizability, and competitive pricing that Adyen offers.

Square: Square is ideal for small businesses, whereas Adyen is better suited for global merchants with high transaction volumes.

Proprietary Technology and Features

Adyen’s unified platform eliminates the need for multiple payment providers, reducing complexity and improving efficiency. Its custom reporting, machine learning-driven fraud prevention, and omnichannel support make it a top choice for businesses prioritizing scalability and reliability.

Pricing and Fee Structure

Adyen’s pricing model is unique compared to many payment processors, as it follows an Interchange++ pricing structure instead of a flat-rate model. This means businesses are charged based on the interchange fees set by card networks, a small processing fee from Adyen, and additional assessment fees. While this structure is often more cost-effective for high-volume businesses, it can be complex and unpredictable for smaller merchants who prefer fixed-rate pricing.

In contrast to payment processors such as Stripe and PayPal, which impose a fixed percentage fee for each transaction, Adyen’s approach fluctuates based on the type of card, geographical region, and the volume of transactions. For instance, Visa and Mastercard transactions generally involve interchange fees ranging from 0.2% to 2.5%, in addition to Adyen’s processing charge of 0.10% for each transaction. Global payments, especially those that require currency exchange, may incur increased expenses owing to cross-border charges and foreign exchange premiums.

Adyen does not charge setup fees, monthly subscriptions, or account maintenance fees, making it appealing for businesses that want to avoid recurring costs. However, merchants need to be aware of additional fees such as chargeback handling, payout fees for certain currencies, and higher rates for alternative payment methods like Alipay and iDEAL.

For companies handling large transaction volumes, Adyen’s pricing approach is typically clearer and more economical than that of flat-rate rivals. Nonetheless, small enterprises with low sales figures might consider it more uncertain and challenging to handle compared to a simple fixed-rate fee model. This positions Adyen as a more suitable choice for businesses that can manage fluctuating transaction fees instead of those looking for a universal solution.

Security and Compliance

Security is a critical factor in payment processing, and Adyen has built a robust infrastructure to ensure compliance with global security standards. The company is PCI DSS Level 1 compliant, the highest security certification for payment processors, ensuring that all transactions meet the strictest industry standards. Unlike some competitors that rely on third-party security solutions, Adyen manages its own end-to-end encryption and tokenization to protect customer data from potential breaches.

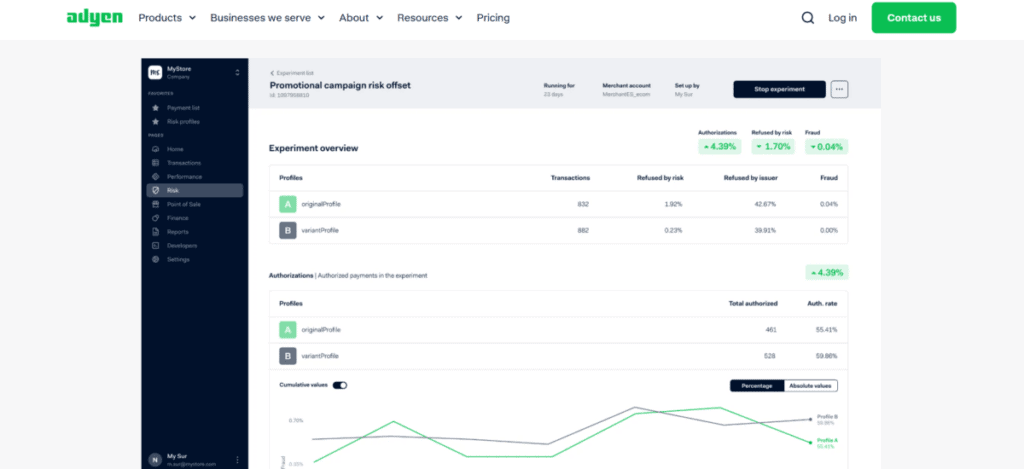

A key aspect of Adyen’s security framework is RevenueProtect, an innovative fraud detection system that utilizes machine learning and behavioral analytics to recognize and stop fraudulent transactions. Rather than relying on strict rule-based fraud filters, Adyen’s system adjusts dynamically, enabling companies to lower false declines while preventing questionable activities. This makes it especially advantageous for businesses functioning in high-risk sectors where fraud attempts occur more often.

Another key aspect of Adyen’s compliance strategy is its strong authentication protocols, including 3D Secure 2.0, which adds an extra layer of protection for online transactions. This security feature helps businesses comply with PSD2 regulations in Europe, which require additional authentication steps for digital payments.

Adyen guarantees that merchants stay compliant with international data protection regulations like GDPR and CCPA, providing tools for securely managing customer data in accordance with local privacy laws. Its proactive stance on security and compliance makes it a trustworthy option for companies aiming to protect their transactions and reduce risks linked to fraud and data breaches.

User Experience and Dashboard Functionality

Adyen offers a well-structured and intuitive dashboard designed to cater to both technical users and business owners who need a streamlined way to manage payments. Unlike many traditional payment processors that have cluttered or outdated interfaces, Adyen’s dashboard is modern, responsive, and feature-rich, providing merchants with real-time insights into their transactions, revenue trends, and risk management.

The dashboard enables companies to monitor payments, process refunds, handle chargebacks, and assess sales performance with extensive customization options. A key feature is the integrated reporting system that brings together transactions from various sales channels, including online, in-store, and mobile. This is especially advantageous for companies that function internationally or maintain an omnichannel presence, as it removes the requirement for various dashboards or external reconciliation tools.

Although the user interface is very effective, Adyen’s dashboard may be daunting for smaller companies or those unfamiliar with payment processing. Its comprehensive features and reporting tools are more appropriate for organizations that need advanced analytics and in-depth transaction analysis. Companies lacking a specific finance or development team might experience a more challenging learning curve than simpler options such as Stripe or Square.

For developers, Adyen provides an API-first approach, making it easy to integrate custom payment flows with third-party systems. Businesses that require tailored payment solutions will appreciate the flexibility, but those looking for plug-and-play simplicity might prefer alternatives with pre-built, user-friendly integrations.

Merchant Support and Customer Service

Customer support is a crucial aspect of any payment processor, and Adyen takes a business-oriented approach to merchant support. Unlike companies like PayPal and Stripe, which offer direct support to businesses of all sizes, Adyen primarily caters to mid-sized and large enterprises, meaning its customer service model is structured differently.

Adyen offers assistance via email, telephone, and a specialized customer portal, though the availability of live support varies based on the merchant’s account classification. Merchants with high sales volumes and enterprise clients get prioritized support from dedicated account managers, whereas smaller businesses might experience longer response times. In contrast to certain rivals, Adyen lacks 24/7 live chat, which may hinder businesses that require prompt support beyond typical business hours.

A key advantage of Adyen is its extensive documentation and self-service resources. The firm provides a comprehensive knowledge base, developer resources, and API documentation, facilitating businesses in resolving typical problems independently without requiring direct assistance. This developer-centric strategy is advantageous for firms with internal tech personnel but might not suit smaller enterprises that need direct customer support.

Merchants generally praise Adyen’s reliability and minimal downtime, meaning fewer support requests are needed in the first place. However, when issues do arise, some businesses report that getting timely resolutions can be a challenge, particularly for those without enterprise-level contracts.

Adyen for Enterprises vs. Small Businesses

Adyen is primarily designed for mid-sized to large enterprises, but it also offers solutions for small businesses. However, whether it’s the right choice depends largely on a business’s transaction volume, technical capabilities, and global reach. Unlike Square or PayPal, which cater to small businesses with simple pricing and easy setup, Adyen is more complex, making it a better fit for businesses that require advanced payment processing capabilities.

Adyen offers tailored payment solutions, direct acquiring, worldwide payment acceptance, and advanced analytics for enterprise businesses. Major corporations gain advantages from its Interchange++ pricing, which tends to be more economical for firms with substantial transaction volumes. Moreover, companies receive dedicated account managers, prioritized customer support, and fraud prevention tools customized for their unique requirements. This positions Adyen as a strong option for global companies, rapidly expanding e-commerce brands, and organizations with intricate payment needs.

For small businesses and startups, Adyen’s benefits are less clear-cut. While it doesn’t charge monthly fees or require long-term contracts, its pricing structure can be confusing, and the lack of a flat-rate model may make costs unpredictable. Additionally, the setup process requires more technical knowledge, which might not be ideal for businesses looking for a quick and easy payment solution. Many small businesses find platforms like Stripe, Square, or PayPal more accessible due to their simpler interfaces, transparent pricing, and hands-on support.

Ultimately, Adyen is an excellent choice for businesses that need scalability and international payment support. However, for smaller businesses without in-house technical expertise, the platform may be too complex and difficult to manage efficiently.

Settlement Speed and Fund Payouts

One of the most important factors for businesses when choosing a payment processor is how quickly they can access their funds. Adyen offers flexible payout schedules, but the exact settlement time depends on the merchant’s location, the payment method used, and the bank involved. Unlike some competitors that offer instant payouts for an additional fee, Adyen follows a more structured settlement process.

For the majority of transactions, Adyen processes fund settlements within two business days, making it quicker than conventional payment processors, yet not as prompt as certain services such as Square or PayPal, which facilitate instant transfers. For global transactions or payments processed through alternative payment methods (like iDEAL, Alipay, or bank transfers), settlement durations may be longer, ranging from three to seven days because of currency conversion processes and banking rules.

Adyen allows businesses to customize their payout schedules, offering options for daily, weekly, or monthly settlements, depending on what best suits their cash flow needs. However, some merchants have reported that certain high-risk industries or businesses with irregular transaction patterns may experience longer holding periods or additional security reviews, which could delay payouts.

Unlike processors that require businesses to manually transfer their funds, Adyen offers automated payouts, which ensures merchants receive their money without having to request withdrawals manually. This feature is particularly beneficial for businesses that process large volumes of transactions and need a streamlined cash flow process.

Adyen’s Integration with Other Tools

Adyen is known for its developer-friendly and highly customizable payment solutions, making it a strong choice for businesses that need seamless integration with existing software and platforms. Unlike many traditional payment processors that require workarounds or third-party services, Adyen provides direct integrations with e-commerce platforms, point-of-sale systems, ERP software, and custom-built applications.

For online businesses, Adyen backs prominent e-commerce platforms such as Shopify, Magento, WooCommerce, BigCommerce, and Salesforce Commerce Cloud. These integrations enable merchants to receive payments straight from their websites without requiring extensive coding. Nonetheless, configuring Adyen might still demand some technical skills since the platform isn’t as easy to use as rivals such as Stripe or Square.

Developers benefit from Adyen’s thoroughly documented APIs and SDKs, simplifying the creation of tailored payment processes, automating reporting, and linking Adyen to internal systems. This degree of personalization is especially beneficial for large enterprises that need customized payment solutions, like subscription billing, dynamic pricing, or multi-currency transactions.

Beyond e-commerce, Adyen integrates with ERP and CRM systems like SAP, Microsoft Dynamics, and Oracle, enabling businesses to streamline financial management and customer insights. Additionally, Adyen supports POS systems, allowing brick-and-mortar stores to connect their in-store payments with their online sales for a true omnichannel experience.

While Adyen’s integrations are extensive, they may not be as beginner-friendly as other solutions, making it a better fit for businesses with dedicated developers or IT teams rather than small businesses looking for a simple out-of-the-box payment solution.

Pros and Cons of Using Adyen

Adyen is a powerful payment processing solution, but like any platform, it comes with both advantages and drawbacks. While it is widely regarded as an industry leader, businesses must carefully evaluate whether it aligns with their specific needs.

Pros of Using Adyen

One of Adyen’s biggest strengths is its transparent and competitive pricing model. Unlike providers that charge a flat rate, Adyen’s Interchange++ pricing structure can result in lower costs for businesses with high transaction volumes. Additionally, there are no setup fees, monthly fees, or long-term contracts, making it a flexible solution for businesses of different sizes.

Another benefit is Adyen’s worldwide presence and support for multiple currencies. It allows businesses to receive payments in more than 150 currencies and accommodates various local payment options, making it perfect for global sellers. In contrast to numerous payment processors that depend on external acquiring banks, Adyen handles transactions directly, which aids in lowering costs and accelerating settlements.

Adyen’s security features and fraud protection tools are another major benefit. The RevenueProtect system uses machine learning to detect fraudulent transactions without blocking legitimate ones, minimizing chargebacks while ensuring smooth customer experiences.

Cons of Using Adyen

Despite its strengths, Adyen may not be the best choice for every business. The complexity of its pricing model can make it difficult for small businesses or those with low transaction volumes to predict costs. Unlike Square or PayPal, which offer simpler flat-rate pricing, Adyen’s structure may require businesses to carefully analyze interchange fees to determine the actual cost of processing transactions.

Another limitation is the required technical setup and the learning curve involved. Although Adyen offers comprehensive documentation and user-friendly APIs, companies lacking dedicated IT personnel may encounter greater challenges with integration than they would with plug-and-play options such as Stripe or Square. Furthermore, Adyen’s customer service focuses on enterprise clients, implying that smaller companies might not get the same degree of attention as larger corporations.

Who Should Use Adyen?

Adyen is a powerful and scalable payment processor, but it’s not the right fit for every business. While its enterprise-grade features, global payment support, and advanced fraud protection make it a strong choice for certain companies, others may find it too complex or costly for their needs. Understanding which businesses benefit the most from Adyen can help determine whether it’s the right solution.

Best Fit for Adyen

Adyen is a superb option for large companies and rapidly growing businesses that need multi-currency transactions, global payment assistance, and integrated omnichannel features. Firms functioning in various nations, like international e-commerce brands, airlines, and subscription services, will greatly benefit from Adyen’s capability to directly acquire payments and provide localized payment choices.

Businesses that process high transaction volumes can also take advantage of Adyen’s Interchange++ pricing, which is often more cost-effective than flat-rate payment models. Large retailers, hospitality businesses, and marketplaces handling millions in transactions will benefit from Adyen’s ability to lower processing fees and improve settlement times.

Additionally, tech-savvy businesses with in-house development teams will find Adyen’s customizable API and integration capabilities appealing. Companies that want to build custom payment workflows, automate reporting, or develop advanced fraud prevention systems will appreciate the flexibility Adyen provides.

When Adyen May Not Be the Best Fit

Smaller businesses or startups that process low transaction volumes may struggle with Adyen’s pricing complexity and lack of flat-rate simplicity. Unlike PayPal or Square, which offer transparent pricing and easy onboarding, Adyen’s variable fees and technical setup can be overwhelming for those without dedicated IT resources.

Furthermore, businesses looking for instant payouts, 24/7 live customer assistance, or simple plug-and-play payment systems may find Stripe, PayPal, or Square more user-friendly. Adyen’s customer service is enterprise-focused, which means that smaller businesses may not receive the same degree of assistance as large-volume merchants.

Conclusion & Final Verdict

Adyen has established itself as a leading payment processor, offering a highly scalable, secure, and globally integrated solution. Unlike many competitors, it provides direct acquiring capabilities, multi-currency support, and advanced fraud protection, making it a top choice for large enterprises and businesses with international operations.

A major advantage of Adyen is its transparent Interchange++ pricing structure, which can be economically beneficial for merchants with high sales volumes. The platform features powerful APIs and tools that are friendly for developers, enabling companies to tailor payment flows, automate tasks, and integrate smoothly with their current systems. Moreover, Adyen’s omnichannel features make it an excellent choice for companies aiming to integrate their online, in-person, and mobile payment processes.

FAQs

1. Is Adyen suitable for small businesses?

Adyen is primarily designed for mid-sized to large enterprises that require scalable and customizable payment processing. While small businesses can technically use Adyen, it may not be the most practical choice due to its complex pricing structure and technical integration requirements. Unlike providers like Square or PayPal, which offer flat-rate pricing and easy onboarding, Adyen’s Interchange++ model can be difficult to manage for businesses that process low transaction volumes. Additionally, customer support is more tailored to enterprise clients, meaning smaller businesses may experience longer response times. If a business prioritizes ease of use, predictable costs, and hands-on support, other options might be more suitable.

2. How does Adyen handle chargebacks and disputes?

Adyen provides businesses with tools to manage chargebacks and minimize fraud-related losses. Through its RevenueProtect system, Adyen employs machine learning and AI-driven fraud detection to flag potentially fraudulent transactions before they occur. However, when a chargeback does happen, merchants can manage disputes through Adyen’s dashboard, where they can submit evidence and track dispute resolutions. Adyen follows the standard chargeback process dictated by card networks like Visa and Mastercard, meaning merchants still need to actively respond to disputes within the required timeframe. While Adyen’s fraud protection helps reduce chargebacks, businesses should still have strong dispute resolution practices in place.

3. Can I integrate Adyen with my existing e-commerce store?

Yes, Adyen supports seamless integration with major e-commerce platforms, including Shopify, WooCommerce, Magento, and BigCommerce. Businesses can use pre-built plugins for these platforms or integrate Adyen’s API for a fully customized payment experience. Unlike some payment processors that offer quick plug-and-play integrations, Adyen’s setup may require technical expertise, especially for businesses that want custom checkout flows, subscription billing, or multi-currency processing. For companies with in-house developers or IT teams, Adyen’s extensive documentation and API support make integration straightforward. However, businesses looking for a no-code payment solution may find Stripe or PayPal easier to implement.