AffiniPay Review

- 24th Mar, 2025

- | By Linda Mae

- | Reviews

AffiniPay is a specialized payment processing solution designed for professionals, with a particular focus on legal firms. Unlike generic payment processors like Stripe or Square, AffiniPay ensures compliance with trust accounting rules, making it a preferred choice for attorneys handling client funds. Its flagship product, LawPay, is widely recognized for simplifying legal payments while maintaining IOLTA compliance. Lets read more about AffiniPay Review.

An extensive examination of AffiniPay’s features, cost, usability, integrations, security, customer service, and overall value proposition is the goal of this review. We’ll look at whether AffiniPay is the greatest option for legal and professional service firms and whether it lives up to its reputation.

It is not always the best option for every company, despite its many benefits, which include personalized payment links, strong security, and smooth integrations with legal software. Its focus on legal professionals may limit its appeal to broader industries, and some businesses may find the fees higher than those of other payment processors.

By the end of this review, you’ll have a clear understanding of whether AffiniPay is worth considering for your business or if a competitor might better suit your needs. This analysis will be unbiased, free from promotional bias, and will focus purely on factual insights.

Company Overview | AffiniPay Review

AffiniPay is a payment processing company designed primarily for law firms and professional service businesses. Unlike traditional payment processors that cater to a broad audience, It specializes in handling transactions in compliance with industry-specific regulations, particularly in the legal sector.

History and Background

AffiniPay was founded in 2005 and has since grown into a trusted payment partner for thousands of law firms and professional service providers. The company’s flagship product, LawPay, is specifically tailored to help lawyers manage client payments while adhering to strict trust accounting and IOLTA compliance. Over the years, It has expanded its offerings to serve architects, accountants, and other professionals who require a secure and compliant payment solution.

Mission and Key Offerings

AffiniPay’s core mission is to provide secure, easy-to-use, and legally compliant payment solutions for professional firms. Its services include:

Credit & Debit Card Processing – Allows firms to accept Visa, Mastercard, American Express, and Discover.

ACH & eCheck Payments – Provides an alternative to card payments with lower processing fees.

Custom Payment Links & Online Invoicing – Enables professionals to send invoices with secure payment options.

Seamless Software Integrations – Works with legal and accounting software such as Clio, MyCase, and QuickBooks.

Industries Served

It supports accountants, financial consultants, architects, and other professionals, but it is most well-known for its support of law firms. Its specialized features, however, might not be needed by companies in other industries, in which case more general payment processors would be a better choice.

How AffiniPay Works

AffiniPay functions as a secure payment processing platform that enables professional service firms to accept payments while maintaining compliance with industry regulations. Its workflow is designed to be simple, efficient, and legally compliant, making it a preferred choice for law firms and other professionals handling client funds.

Payment Processing Workflow

AffiniPay’s system allows businesses to accept payments through credit cards, debit cards, and ACH transfers. The process is straightforward:

Clients receive an invoice with a secure payment link.

Payments are processed through AffiniPay’s system, ensuring compliance with PCI and trust accounting rules.

Funds are deposited directly into the firm’s operating or trust account, depending on the transaction type.

Unlike generic payment processors, It ensures that trust account funds are not commingled with operational funds, a critical requirement for law firms handling client retainers.

Integration with Professional Software

One of AffiniPay’s biggest advantages is its seamless integration with software tools used by law firms and professionals, such as:

Legal practice management platforms (Clio, MyCase, PracticePanther)

Accounting software (QuickBooks, Xero)

CRM and billing tools

This integration automates invoicing, payment reconciliation, and financial tracking, saving businesses time while reducing manual errors.

How Funds Are Handled (IOLTA Compliance for Law Firms)

It keeps trust funds apart from business operating accounts to guarantee IOLTA compliance for law firms. This stops unethical behavior and guarantees that attorneys don’t mix client money with firm profits.

For professionals who need stringent financial oversight, It simplifies payment processing by emphasizing security, compliance, and efficiency.

Key Features of AffiniPay

It stands out from other payment processors due to its specialized features tailored for law firms and professional service providers. These features focus on compliance, security, and convenience, making payment collection more efficient while adhering to industry-specific regulations.

Payment Processing Capabilities

AffiniPay allows businesses to accept credit and debit card payments, ACH transfers, and eChecks. Supported payment types include Visa, Mastercard, American Express, and Discover. The platform provides an instant and secure payment gateway, ensuring that transactions are processed quickly and safely.

Trust Accounting Compliance (IOLTA & ABA Rules)

Maintaining adherence to American Bar Association and IOLTA regulations is essential for legal practices. To avoid possible ethical transgressions, It makes sure that client trust funds are never mixed with operating funds. Funds are automatically separated into the proper accounts by the system.

Integration with Legal and Professional Software

It integrates with popular legal, accounting, and billing software, including:

Clio, MyCase, PracticePanther (legal practice management)

QuickBooks, Xero (accounting)

CRM and invoicing tools

This integration enables professionals to send invoices, track payments, and reconcile accounts effortlessly.

Security & PCI Compliance

AffiniPay is PCI Level 1 compliant, ensuring that all transactions are encrypted and secure. The platform also includes:

Tokenized payments to protect cardholder data

Fraud detection tools to reduce chargebacks

Secure online payment portals for clients

Custom Payment Links & Online Invoicing

Users can generate custom payment links that allow clients to pay invoices securely. These links can be shared via email, text, or embedded on a website, making it easy for customers to submit payments without logging into a portal.

4.6 Recurring Payments & Installment Plans

AffiniPay supports automated recurring billing and installment payment plans, which are useful for firms offering subscription-based services or large retainers.

With these features, It provides a seamless, secure, and legally compliant payment solution, making it an excellent choice for professionals who require specialized financial oversight.

Pricing & Fees

Although AffiniPay has a transparent pricing structure, not all businesses will find it to be the most economical choice. Its fees can be a little higher because of its specialized features and legal compliance capabilities, but they are generally comparable to those of other premium payment processors.

Breakdown of Processing Fees

AffiniPay does not charge setup fees or monthly subscription fees, which makes it attractive for businesses that prefer a pay-as-you-go model. The primary costs come from transaction processing fees, which are as follows:

Credit & Debit Card Payments: Typically 2.95% + $0.20 per transaction

ACH & eCheck Payments: Usually $2 per transaction, making it a cost-effective option for high-value payments

Chargeback Fees: It may charge a dispute fee if a chargeback occurs, though exact amounts vary

Monthly or Hidden Fees

Although AffiniPay has no hidden fees, such as monthly maintenance fees, PCI compliance fees, or long-term contract obligations, businesses that need premium integrations or customized payment features may incur additional costs.

How AffiniPay Compares on Pricing

Compared to competitors:

Stripe: Charges 2.9% + $0.30 per transaction, making it slightly cheaper but lacking AffiniPay’s legal compliance tools.

Square: Offers 2.6% + $0.10 per transaction, but is more retail-focused and doesn’t cater to legal professionals.

PayPal: Typically 3.49% + $0.49 per transaction, making it more expensive for legal professionals.

Is AffiniPay Worth the Cost?

For law firms and professionals needing trust accounting compliance and security, It justifies its pricing. However, for general businesses without these requirements, a cheaper processor might be a better fit.

Ease of Use & User Experience

AffiniPay’s platform is efficient and easy to use because it was created with law firms and professional service providers in mind. Although it has advanced compliance features, the user interface is still simple and easy to use.

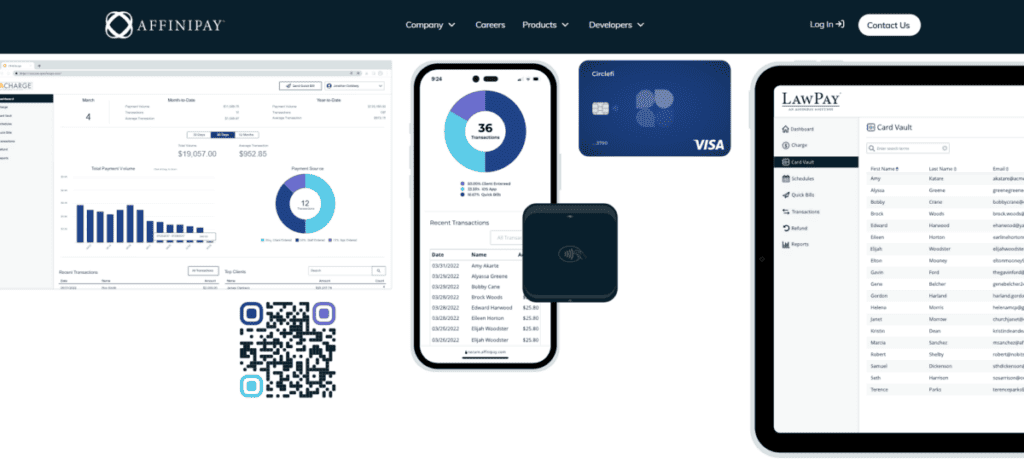

Platform Interface and Dashboard

AffiniPay features a clean and modern dashboard where users can:

View real-time transaction data

Track pending and completed payments

Generate custom payment links

Manage client accounts and invoices

The dashboard is designed to be clutter-free, making it easy for professionals who may not be tech-savvy to navigate the platform without a steep learning curve.

Accessibility (Desktop & Mobile)

It is cloud-based, allowing users to access their accounts from any device with an internet connection.

The desktop experience is fully optimized for quick navigation.

The mobile experience, while functional, is not as robust as some competitors like Square or Stripe, which offer dedicated mobile apps.

Onboarding & Setup Process

Getting started with AffiniPay is relatively simple:

Sign up online and provide business details.

Connect bank accounts (including trust accounts for legal professionals).

Start processing payments after verification.

It also offers personalized onboarding assistance, particularly for law firms needing help with trust accounting setup.

Learning Curve

For the majority of users, the platform is plug-and-play; however, professionals who are unfamiliar with trust accounting compliance may need to invest more time in learning the IOLTA-compliant payment flows.

Overall User Experience

Overall, AffiniPay balances functionality and ease of use well, though it may lack some of the intuitive mobile-first features offered by mainstream processors.

Security & Compliance

Security and compliance are two of AffiniPay’s strongest areas, making it a preferred payment processor for law firms and professional service providers that handle sensitive financial transactions. The platform ensures that payments are processed securely while maintaining compliance with trust accounting regulations and PCI standards.

PCI Compliance & Data Encryption

The highest certification level under the PCI DSS is PCI Level 1, which AffiniPay satisfies. This lowers the possibility of fraud and data breaches by guaranteeing that every transaction is tokenized and encrypted. Because the platform employs end-to-end encryption, credit card information is never kept in a manner that leaves it open to cyberattacks.

Fraud Prevention & Risk Management

AffiniPay incorporates multiple layers of fraud prevention, including:

Tokenized transactions to protect customer payment information.

AI-powered fraud detection tools to flag suspicious activities.

Chargeback prevention mechanisms that help businesses resolve disputes efficiently.

These features help law firms and other professionals mitigate the risk of unauthorized transactions and fraudulent chargebacks.

Trust Accounting Compliance

A key differentiator of AffiniPay is its compliance with IOLTA and ABA guidelines. The system automatically ensures that client funds are kept separate from operational funds, preventing ethical violations and accounting errors.

With robust security measures and strict regulatory compliance, AffiniPay provides professionals with a secure, compliant, and reliable payment processing solution.

Customer Support & Service

AffiniPay provides dedicated customer support to assist businesses with payment processing, trust accounting compliance, and technical issues. The company offers support through phone, email, and an online help center, ensuring that users can get assistance when needed.

Professionals in the United States will find phone support convenient as it is available during regular business hours. Although there isn’t round-the-clock assistance, the team is renowned for knowing how to process legal payments and trust accounting rules, which is very beneficial for law firms. There is also email support, though response times might differ based on how complicated the problem is.

AffiniPay has a detailed help center that includes FAQs, step-by-step guides, and troubleshooting articles. Additionally, it offers webinars and training sessions to help businesses better understand payment processing and financial compliance.

Customer feedback on support is generally positive, with many users praising the team’s expertise in legal and professional service payments. However, some customers report delays in responses for non-urgent issues, particularly via email. While AffiniPay provides strong customer support, the lack of 24/7 availability may be a drawback for businesses that require immediate assistance outside of standard hours.

Pros and Cons of AffiniPay

AffiniPay is a specialized payment processor designed for law firms and professional service providers. While it offers several advantages, it may not be the best fit for all businesses. Below is a balanced evaluation of its strengths and weaknesses.

Pros

Designed for professional service firms – AffiniPay is built specifically for law firms, accountants, and consultants, ensuring compliance with industry regulations.

Trust accounting compliance – The platform separates client trust funds from operational funds, preventing ethical violations.

Seamless integrations – Works well with legal practice management software (Clio, MyCase), accounting tools (QuickBooks, Xero), and CRM platforms.

Strong security measures – Offers PCI Level 1 compliance, tokenized transactions, fraud detection, and data encryption, ensuring secure transactions.

No long-term contracts – Users are not locked into lengthy agreements and can cancel anytime without early termination fees.

User-friendly interface – The dashboard is intuitive and easy to navigate, making payment processing simple for professionals.

Cons

Limited to professional services – Businesses in retail, e-commerce, or high-risk industries may find AffiniPay unsuitable.

Higher transaction fees – Compared to Stripe or Square, AffiniPay’s pricing is slightly higher, which may not be cost-effective for all businesses.

No dedicated mobile app – While mobile-friendly, the platform lacks a standalone mobile app for managing payments on the go.

Limited international support – AffiniPay primarily serves U.S.-based businesses, making it less suitable for global operations.

No 24/7 customer support – Support is only available during business hours, which may not be convenient for all users.

While AffiniPay excels in legal compliance and security, businesses outside of professional services may find other payment processors more versatile.

How AffiniPay Compares to Competitors

AffiniPay faces competition from a number of well-known payment processors, such as PayPal, Square, and Stripe. Although it is intended for legal firms and professional service providers, other platforms might provide more features, more extensive industry support, and cheaper costs. Below is a comparison of AffiniPay with its main competitors.

AffiniPay vs. Stripe

Stripe is a versatile payment processor widely used in e-commerce, SaaS, and technology businesses. It offers customizable APIs, advanced reporting, and global payment support. However, it lacks trust accounting compliance, making it unsuitable for law firms.

AffiniPay is better for law firms and professional service providers.

Stripe is better for e-commerce, online platforms, and global businesses.

Fees: AffiniPay (2.95% + $0.20) vs. Stripe (2.9% + $0.30).

AffiniPay vs. Square

Square is ideal for retail and small businesses that need POS hardware, invoicing, and payment processing. Unlike AffiniPay, Square lacks trust accounting compliance and legal software integrations.

AffiniPay is better for law firms needing compliance features.

Square is better for brick-and-mortar businesses requiring in-person payments.

Fees: AffiniPay (2.95% + $0.20) vs. Square (2.6% + $0.10).

AffiniPay vs. PayPal

Although PayPal is popular for peer-to-peer payments and online transactions, professional services find it less appealing due to its limited legal integrations and higher transaction fees.

AffiniPay is better for law firms needing trust accounting compliance.

PayPal is better for online businesses and international transactions.

Fees: AffiniPay (2.95% + $0.20) vs. PayPal (3.49% + $0.49).

Who Should Use AffiniPay?

It is designed for law firms and professional service providers that require secure payment processing with compliance features. While it excels in industries that need trust accounting and financial oversight, it may not be the best fit for all businesses.

Best-Suited Industries

Law Firms – AffiniPay’s IOLTA and ABA compliance ensures that client funds remain separate from operational accounts, making it ideal for attorneys.

Accounting & Financial Services – CPAs and financial consultants benefit from secure invoicing, ACH payments, and seamless integrations with QuickBooks and Xero.

Consultants & Professional Services – Businesses that require custom payment links, automated billing, and secure client transactions will find AffiniPay useful.

Medical & Healthcare Practices – Some healthcare professionals use AffiniPay for HIPAA-compliant payment processing and recurring billing.

Who May Not Benefit?

E-commerce & Retail Businesses – Platforms like Stripe, Square, or PayPal offer better solutions for online stores, point-of-sale transactions, and international sales.

High-Risk Businesses – It does not cater to industries with high chargeback rates or businesses requiring offshore payment processing.

Global Businesses – Since AffiniPay primarily serves U.S.-based professionals, businesses with international customers may face limitations.

Final Verdict: Is AffiniPay Worth It?

For legal firms and professional service providers who require safe, legal payment processing with trust accounting assistance, It is a great option. Businesses outside of these sectors, however, might find more affordable and flexible options like Square or Stripe. The cost is justified by its specialized features for professionals who need to comply with the law.

FAQs

Does AffiniPay support international transactions?

AffiniPay primarily serves U.S.-based businesses and does not support international transactions. While some payment processors like PayPal and Stripe offer global payment acceptance, It is designed for domestic professional service firms that require trust accounting compliance and legal-specific payment solutions. Businesses with clients outside the U.S. may need to consider an alternative provider.

Is there a contract or early termination fee?

AffiniPay does not require users to sign long-term contracts, and there are no early termination fees. This flexibility allows businesses to use the service on a month-to-month basis without being locked into an agreement. Unlike some payment processors that charge cancellation penalties, It provides a transparent pricing structure with no hidden fees.

Can I use AffiniPay for a non-legal business?

Yes, AffiniPay can be used by accountants, consultants, financial advisors, and healthcare providers. However, it is best suited for law firms and professional service businesses that need compliance-focused payment solutions. If you run a retail, e-commerce, or high-risk business, platforms like Stripe, Square, or PayPal may offer more suitable features and lower fees.