Authorize.Net Review

- 05th Apr, 2025

- | By Linda Mae

- | Reviews

Authorize.Net is a long-standing player in the online payment processing space, operating since 1996. Now owned by Visa, the company has carved out a reputation as one of the most reliable and secure payment gateways for businesses of all sizes. Its core service is to enable merchants to accept credit card and electronic check payments through their websites, over the phone, or even in person with compatible POS systems. Lets read more about Authorize.Net Review.

Many eCommerce and service-based companies have found Authorize.Net to be a reliable solution over time, especially those that prioritize robust security protocols and adaptable payment processes. The platform, which is currently used by over 430,000 merchants, is appealing due to its combination of strong features and extensive compatibility with shopping carts, merchant accounts, and third-party tools.

The adaptability of Authorize.Net is among its most noteworthy features. Authorize.Net enables users to bring their own merchant account if they so desire, in contrast to certain contemporary processors that combine merchant accounts and payment gateways. As an alternative, they provide a comprehensive solution that combines merchant and gateway services, which may be useful for startups.

While it isn’t the flashiest or most modern-looking platform on the market, it has stood the test of time by focusing on security, reliability, and wide-ranging compatibility. In a market full of fast-growing fintech startups, Authorize.Net continues to serve as a trusted backbone for merchants who prioritize functionality and control over trendiness.

Key Features at a Glance | Authorize.Net Review

Authorize.Net comes packed with a broad array of features, making it more than just a basic payment gateway. At its core, it enables merchants to accept credit and debit cards, digital payments, and eChecks online, over the phone, or in person. One of its biggest strengths is the flexibility it provides businesses to accept payments through multiple channels.

Some standout features include Advanced Fraud Detection Suite, recurring billing capabilities, customer information management, and hosted payment forms for easier PCI compliance. It also supports invoicing and email billing, which is especially useful for service-based businesses or freelancers.

Developers benefit from its API-driven architecture, which supports custom integrations and enables businesses to tailor the platform to specific workflows. Businesses can also access tools for managing subscriptions and analyzing transaction data through detailed reporting features.

Another key advantage is the support for third-party integrations; Authorize.Net works with over 140 different shopping carts, CRM systems, and accounting platforms. While it may lack some modern bells and whistles, the depth and reliability of its features make it a trusted solution for businesses with complex payment needs.

Ease of Use and User Interface

When it comes to ease of use, Authorize.Net is a mixed bag. The platform is functional and highly reliable, but it does have a learning curve; especially for users unfamiliar with payment processing or setting up merchant accounts. The interface isn’t the most modern, and compared to newer competitors, it may feel a bit dated.

Nevertheless, navigation becomes fairly simple once users get used to the system. Transaction information, customer profiles, reports, and account settings are all accessible through the merchant dashboard. Although everything is well-organized, some of the options might not be fully accessible without technical expertise.

Authorize.Net has worked to simplify the onboarding process. To assist new users in getting started, there is a setup wizard, thorough help documentation, and a committed support staff. However, compared to rivals like Square or Stripe, users seeking a plug-and-play, ultra-intuitive experience may find it more complex.

In terms of mobile accessibility, the platform does offer mobile SDKs and an app, though again, these aren’t as polished as newer mobile-first solutions. Ultimately, Authorize.Net prioritizes functionality over visual appeal, and for many businesses, that’s a worthwhile trade-off.

Integration and Compatibility

One of the biggest selling points of Authorize.Net is its impressive compatibility with a wide range of third-party services. Whether you’re using a custom-built eCommerce store or a popular platform like Shopify, WooCommerce, BigCommerce, or Magento, Authorize.Net has ready-to-use plugins or API support to make integration seamless.

The gateway supports integration with over 140 shopping carts, and it plays well with CRMs, accounting software, ERP systems, and various shipping and tax calculators. Businesses with existing tech stacks rarely encounter issues when adding Authorize.Net to their workflow.

Developers appreciate the extensive documentation and SDKs available in multiple languages, including Java, PHP, Ruby, and .NET. REST and SOAP APIs allow for custom functionality, which gives merchants complete control over checkout experiences, customer data handling, and backend workflows.

For physical retail, Authorize.Net integrates with multiple point-of-sale systems and card readers, offering a consistent experience across channels. Although some hardware integrations may require third-party solutions, the flexibility of the platform allows it to accommodate unique business needs without forcing you into proprietary ecosystems.

Payment Processing Options

Authorize.Net supports a variety of payment types, giving businesses a flexible range of options for collecting money. It handles credit and debit cards, eChecks (ACH payments), and digital wallets like Apple Pay, Google Pay, and PayPal.

The virtual terminal, which enables merchants to manually enter card information for phone or mail orders, is one of the most alluring offerings. Service providers and small businesses that deal with remote payments will find this especially helpful.

Additionally, it facilitates customer information management and subscription billing, allowing for the safe storage of payment information for loyal clients. This is perfect for gyms, SaaS companies, and any other business that provides recurring services.

As long as the company is headquartered in the United States, Canada, the United Kingdom, or Australia, international payments are accepted. To guarantee compatibility with foreign cards and currencies, merchants must consult their merchant account provider.

While not every niche or geographic market will find it perfect, Authorize.Net handles the essentials of payment processing quite well, especially for businesses looking for a comprehensive, stable solution with flexible payment types.

Security and Fraud Prevention Tools

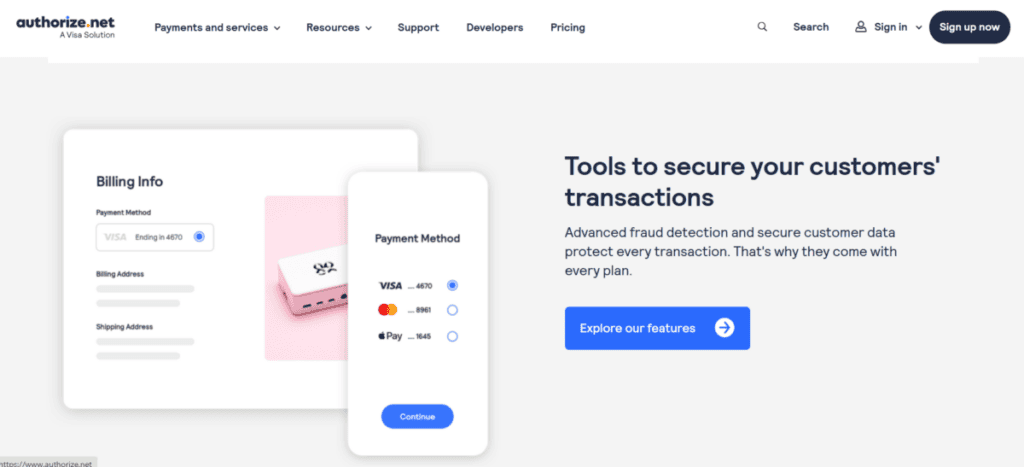

Authorize.Net takes security seriously, offering multiple layers of protection to safeguard both merchants and customers. All transactions are encrypted and PCI DSS compliant, ensuring that sensitive payment information is never stored or transmitted in an unsecured format.

One of its most powerful features is the Advanced Fraud Detection Suite, which includes customizable filters to block suspicious transactions, flag unusual patterns, and limit potentially fraudulent activity. Filters can be adjusted based on geographic location, transaction velocity, amount thresholds, and more.

Tokenization and CVV validation are also supported to protect customer data during and after checkout. With tokenization, card numbers are replaced with unique identifiers, reducing the risk of data breaches.

In addition, Authorize.Net offers tools like IP address blocking, daily velocity checks, and email notifications for high-risk activity. These features are especially useful for online merchants with a high volume of transactions or those operating in industries prone to fraud.

While the setup of these tools may require some technical understanding, the protection they offer makes Authorize.Net a highly secure option in today’s digital payment landscape.

Pricing and Fee Structure

Although Authorize.Net’s pricing structure is fairly simple, depending on how you sign up, it may be a little confusing. The Payment Gateway Only plan, which costs $25/month plus $0.10 per transaction and $0.10 daily batch fee, is an option if you already have a merchant account.

Pricing for those seeking a gateway + merchant account all-in-one solution is 2.9% + $0.30 per transaction, with no setup costs. This model, which is similar to rivals like Square and Stripe, is perfect for companies looking for a more simple, integrated solution.

Depending on the volume and features utilized (such as fraud detection or recurring billing), additional services like eCheck processing may incur additional incidental fees. These fees are typically $0.75 per eCheck.

While not the cheapest option out there, Authorize.Net offers good value considering its feature set and reliability. Businesses should be aware of the fee structure and determine whether the flexibility of bringing your own merchant account is worth the slightly more complex pricing.

Customer Support and Service Quality

Customer support is an area where Authorize.Net performs relatively well. They offer 24/7 phone support, email assistance, and an extensive online knowledge base. There’s also a support portal with how-to articles, setup guides, and troubleshooting FAQs.

Businesses report generally positive experiences with support staff, especially when it comes to resolving technical or account-related issues. However, some users have noted long wait times during peak hours, and not every support rep has deep technical knowledge, especially for more complex API-related queries.

Authorize.Net also provides dedicated account managers for higher-volume merchants, which can make a big difference in terms of personalized support. For smaller merchants, the forums and documentation often suffice to resolve basic issues.

The online community and developer support pages are useful for those doing their own integrations. Although the user interface and terminology might feel dated, the support resources help bridge that gap.

Overall, Authorize.Net provides dependable support that meets the needs of most businesses, but users looking for instant live chat support or ultra-fast response times may find the experience more traditional than modern.

Recurring Billing and Subscription Management

One of the main advantages of Authorize.Net is recurring billing. Businesses can set up recurring payments for subscription-based services using the Automated Recurring Billing tool. ARB simplifies billing cycles for subscription box companies, gym owners, and SaaS providers.

Frequency, billing amounts, start dates, and trial periods are all customizable by merchants. By charging clients automatically on time, the system eliminates the need for manual billing. When used in combination with the Customer Information Manager, you can safely store payment information and give repeat customers a smooth checkout process.

Reporting tools allow you to track active subscriptions, failed transactions, and cancellations. There’s also flexibility in pausing or editing existing subscriptions, which is a feature not always offered by competitors.

However, the interface for managing subscriptions isn’t the most intuitive and may require a bit of exploration. While it’s effective and reliable, it lacks the slick UX of newer platforms like Stripe Billing.

Nonetheless, for businesses that need powerful and secure recurring billing tools, Authorize.Net delivers a dependable solution.

Mobile and In-Person Payment Capabilities

Authorize.Net isn’t just for online businesses. It offers tools for accepting payments in person, including a VPOS and mobile app. The mobile SDKs allow developers to build custom mobile payment experiences, while the VPOS system enables brick-and-mortar stores to accept card payments using a compatible card reader.

The solution works well for businesses that need a unified backend for both online and in-person payments. It’s particularly useful for service providers who visit customers on-site, like contractors or consultants.

However, the mobile app and in-person features aren’t as polished or user-friendly as those offered by Square or Shopify POS. There’s more setup involved, and you may need to source hardware from third-party providers.

Still, Authorize.Net’s flexibility and ability to sync all payment activity into a single dashboard make it a practical choice for multi-channel businesses that want centralized control.

Reporting and Analytics Tools

A variety of analytics and reporting tools are offered by Authorize.Net to assist merchants in monitoring and evaluating their transactions. The platform provides insights that assist businesses in making data-driven decisions, ranging from daily transaction summaries to in-depth analysis of payment trends.

Chargebacks, failed payments, settlement batches, sales volume, and recurring billing can all produce reports. Users can alter the date range, payment methods, and client segments using filters.

You can arrange for regular reports to be sent to you via email, and all reports can be exported in CSV format. These tools are accurate and useful, but they lack the visual appeal of more recent platforms.

For businesses that need more robust analytics, Authorize.Net’s API allows the integration of external BI tools or dashboards. This flexibility is appreciated by developers and enterprises who want more than just basic reports.

Overall, the reporting is comprehensive enough for most businesses, even if the interface isn’t as modern as some may prefer.

Reliability and Uptime

Authorize.Net is known for its rock-solid reliability. It boasts an impressive uptime track record, which is critical for businesses that can’t afford interruptions in payment processing. The platform’s infrastructure is built for scalability, so whether you’re handling a few dozen transactions or thousands per day, performance remains stable.

The gateway uses multiple data centers and redundant systems to ensure continuous operation. Any scheduled maintenance is communicated in advance, and outages are extremely rare.

Merchants who have used the platform for years consistently report positive experiences when it comes to uptime and overall dependability. Even under heavy transaction loads, the system performs efficiently without slowdowns or lags.

In an industry where downtime can translate to lost sales, Authorize.Net provides peace of mind with a system that simply works when it needs to.

Who Should Use Authorize.Net?

Established small to medium-sized enterprises, expanding e-commerce websites, service providers, and subscription-based businesses are the ideal candidates for Authorize.Net. Businesses that don’t mind a slightly higher learning curve and seek a dependable, adaptable, and secure payment infrastructure will find it useful.

Businesses that use custom-built websites or have unique workflows and need a highly configurable gateway will find it especially useful. The modular design of the platform is also advantageous to businesses that wish to use their own merchant account.

For solopreneurs or microbusinesses seeking a fast, cutting-edge setup with little configuration, it might not be the ideal choice. Plug-and-play systems like Square or PayPal might be simpler to implement in those situations.

Pros and Cons Summary

Pros:

Long-standing reputation for reliability and security

Supports multiple payment types and channels

Excellent fraud detection tools

Works with third-party merchant accounts

Highly customizable via API

Cons:

User interface feels outdated

Not ideal for beginners without technical help

Monthly fee adds cost for low-volume merchants

Limited support for multi-currency without add-ons

Authorize.Net may not be trendy or beginner-friendly, but it’s a powerhouse for businesses that want control, security, and stability from their payment provider.

FAQs

Q1: Is Authorize.Net suitable for small businesses or startups?

Yes, but only if the business expects moderate to high transaction volume or needs advanced features like fraud detection or recurring billing. The monthly fee may not be cost-effective for very small startups.

Q2: Does Authorize.Net support international transactions?

Authorize.Net supports international card payments but requires the business to be based in select countries (like the U.S., Canada, U.K., or Australia). Multi-currency support depends on your merchant account provider.

Q3: Can Authorize.Net be used with a third-party merchant account?

Yes. One of Authorize.Net’s key advantages is the ability to integrate with an existing merchant account. Alternatively, users can opt for an all-in-one solution offered directly by Authorize.Net.