Chyp Credit Card Processing Review: Rates, Fees, Complaints and Lawsuits

- 20th Jul, 2023

- | By max

- | Uncategorized

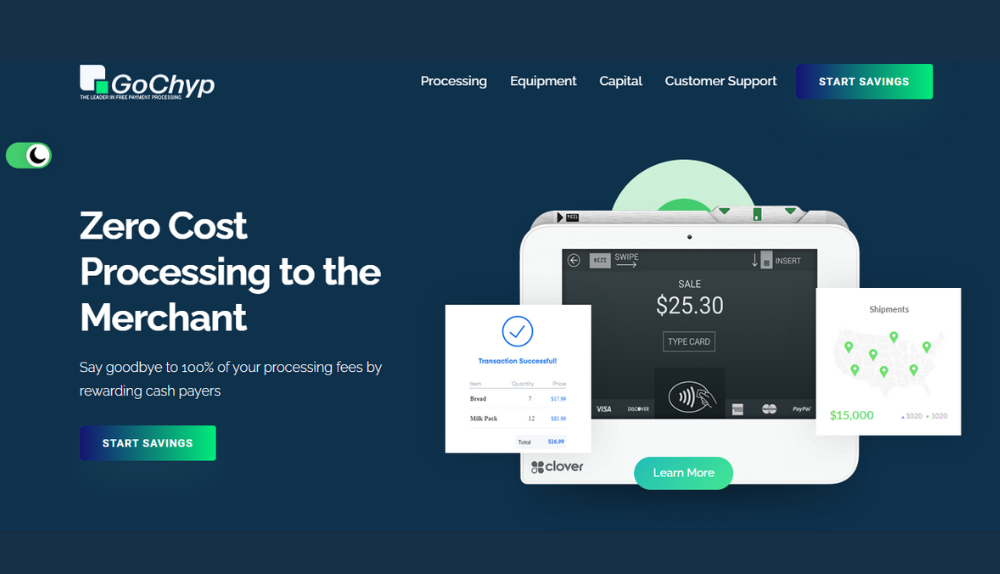

With the rise of eCommerce, businesses of all sizes increasingly rely on credit card processing to keep up with transactions. Chyp Credit Card Processing is one such service that comes in to facilitate the payment process for merchants and customers alike. Various features and integrations make this service attractive to different businesses, from small startups to larger companies.

This Chyp Credit Card Processing review will explore different dimensions and analyze how it can help businesses decide if it is the right choice.

Chyp Credit Card Processing Review: Services and Features

The company offers the following array of services and features.

Payment Processing

Chyp Credit Card processing offers different features, making it an attractive business choice. It is easy to set up and use and provides secure credit card transactions with competitive rates. However, one notable downside is the need for more access to instant deposits – money deposited via Chyp takes several days to be credited to your account. It can be inconvenient if your business needs to access funds quickly.

Point-of-Sale (POS) Systems

Chyp provides POS systems for customer transactions. The user-friendly system allows businesses to input payments quickly, but there are reports of the software having bugs and glitches. It creates a seamless experience for customers, but using the software can pose challenges for business owners who need to be tech-savvy. Additionally, there needs to be more customer support available within the system itself.

E-Commerce Gateway

The company provides an industry-leading e-commerce gateway with features that make it easy to accept and manage credit card payments. The gateway allows merchants to store customer information, create custom payment forms securely, and track transaction activity. However, it also requires a high-end security package that can be expensive for some merchants. Additionally, the setup process is somewhat complex and may require assistance from a technical expert. Thus, merchants might look for alternate options.

Mobile Payment Solutions

Chyp offers a mobile payment solution that aids merchants in the easy management of daily business activities. It is done by processing payments quickly and securely. Though the system is easy to use, the interface could be more intuitive and user-friendly.

With reviews indicating that Chyp’s mobile payment solutions can be unreliable, this may not be the best choice for businesses that need to process payments on the go. While it provides some convenience, the service is prone to outages and slowdowns, which can cause frustration to both customers and merchants. Furthermore, customer support is limited and needs considerable improvement when using this option.

EMV Compliant

Chyp’s payment processing services are EMV-compliant, supporting chip card transactions. However, the company does not provide additional features related to fraud prevention and other security-related measures. Additionally, it can be difficult to troubleshoot any issues related to a chip card transaction.

Contactless Readers

It also provides contactless readers for customers, thus allowing them to pay with their phones or other devices. It is convenient for businesses to process payments without handling cash or cards. While the company’s contactless readers are reliable and easy to use, there have been reports of outages and slowdowns when utilizing this feature. Another drawback is that customer support is limited when using this option.

Secure Transactions

When it comes to credit card processing, security is of paramount importance. Regardless of the company or system you use, there is always the possibility of a data breach. Chyp uses advanced encryption and tokenization technologies to protect all sensitive information during transmission and storage.

However, there are reports of credit card numbers being stolen from Chyp’s servers. Most complaints stem from insecure transactions occurring due to user negligence. Thus, merchants should keep this point in mind before signing up.

Chyp Credit Card Processing Review: BBB Rating

Chyp Credit Card Processing has an A+ rating with the Better Business Bureau (BBB). However, there have been some customer complaints about their customer support and processing fees. They also have a few negative reviews online. Thus the rating has dropped to a B.

Different factors like customer complaints, reviews, and ratings are considered when determining the BBB rating. Therefore, customers should be aware of the nature of their complaints and ratings before signing up for services with Chyp Credit Card Processing.

Negative reviews and ratings can result from the customer experience dealing with Chyp Credit Card Processing.

Lawsuits and Fines

There have been no recent reports of the company regarding any lawsuits or fines for its services. Moreover, the FTC has not issued any warnings or penalties in this regard. Merchants should not overlook that the company processes credit card payments on behalf of its customers. Certain risks are associated with this service, such as a customer’s data being stolen or compromised.

Thus, merchants must remain vigilant about their credit card processing activities, as there have been cases where similar companies have faced significant penalties. They should review their credit card processing agreements and policies carefully to avoid potential issues.

Complaints

While Chyp Credit Card Processing has numerous strengths, it has its share of complaints. Following are some of the most commonly cited complaints from customers:

Equipment On Lease

One of the main drawbacks associated with Chyp Credit Card Processing is that merchants have to lease the required equipment. It could be expensive for a small business, as they would have to pay an upfront cost for leasing the equipment and a monthly fee for using it. Additionally, if the merchant cancels their account or switches providers, they may still need to pay a fee to return the equipment.

Deceptive Telemarketing

Merchants have also complained about being misled by Chyp’s telemarketers. Customers have reported that salespeople often make misleading or false promises during their calls to encourage them to sign up for services. It is essential to ask questions and get all the details before committing to any service with Chyp Credit Card Processing. Moreover, customers should be aware of suspicious activity and never disclose personal or financial information.

Ambiguous Fee Structure

Customers have also expressed their frustration about the unclear fee structure. It is easy to receive a statement outlining the charges without understanding what services they are being charged for. To avoid additional fees, customers should take the time to review their statements and contact Chyp’s customer service team if there are any discrepancies or issues with understanding the fee structure.

Unsatisfactory Customer Support

From dealing with equipment problems to assisting customers with their accounts, Chyp Credit Card Processing’s customer service team has been criticized for not providing satisfactory support. Customers have complained about lengthy wait times and long lines when attempting to get assistance from the customer service team. Thus, customers should be prepared to set aside some time if they are going to contact the customer service team.

Issues in PCI Compliance

Chyp Credit Card Processing is not immune to PCI (Payment Card Industry) compliance issues. Merchants using Chyp have reported that the company requires them to provide more information than necessary in order to be compliant. It can create an additional burden for merchants already trying to meet PCI standards. Businesses setting up services with Chyp should be aware of the PCI requirements and ask questions if anything needs to be corrected.

The Problem in Account Closure

Another issue customers have encountered with Chyp Credit Card Processing is the difficulty in closing their accounts. With the company’s policy of closing the accounts upon request, customers have needed help to stop their services with Chyp. It has been reported that many customers have had to make multiple requests before their accounts were finally closed without any additional charges. Thus, customers should be aware of this policy and take the necessary steps to ensure their account is closed upon request.

High Cancellation Fees

Merchants who attempt to cancel their services with Chyp Credit Card Processing may be subject to high cancellation fees. Customers have reported that the company charges excessive fees for cancelling their accounts early. Customers should review their contracts before signing to avoid additional costs and ask questions if anything needs clarification.

Sub-Standard Sales Team

Chyp has also been criticized for its sub-standard sales team. Customers have reported that salespeople often need to be more knowledgeable about the company’s products and services, which can lead to confusion when deciding what is right for them. Negative reviews have pointed out that customers may end up signing up for services they don’t need. Finding knowledgeable salespeople and asking questions if something seems wrong is important.

Conclusion

This Chyp Credit Card Processing review suggests that the service could be improved in certain areas, such as customer service and transaction fees. These drawbacks may not outweigh the benefits of using Chyp for credit card processing. For those who decide to use Chyp, it is wise to read the terms and conditions carefully to ensure that all fees are understood.

Furthermore, customers should be aware of any customer service issues they may encounter while using the service. Finally, comparing Chyp with other payment processors is important to ensure it offers the best value for their business needs.