CyberSource Review

- 06th May, 2025

- | By Linda Mae

- | Reviews

A well-known payment management platform with a broad range of services catered to small and large businesses worldwide is CyberSource. Established in 1994 and purchased by Visa Inc. in 2010, it functions as a Visa solution and has a solid foundation in terms of trust, dependability, and financial infrastructure. Enabling businesses to securely accept payments through online, mobile, and in-store channels is the foundation of its core offerings. CyberSource has increased its footprint to over 190 nations and territories over the years. Its platform helps businesses grow while handling the challenges of compliance, payment security, and fraud prevention. CyberSource mainly targets mid-sized to enterprise-level businesses, in contrast to some payment processors that primarily serve startups and small businesses. Its clientele includes sectors like retail, airlines, hospitality, education, and financial services. Lets read more about CyberSource Review.

What sets CyberSource apart is its modular and flexible architecture. Businesses can choose from a range of services including payment gateway, risk management, and tokenization, integrating only what they need. The company also focuses on helping merchants navigate the nuances of global eCommerce, including cross-border payments, tax compliance, and multi-currency support. Despite being part of a massive financial ecosystem under Visa, CyberSource maintains a degree of independence that allows it to evolve rapidly in response to digital commerce trends. This balance of scale, security, and adaptability makes it a compelling choice for businesses aiming to grow in the digital marketplace.

Core Services and Capabilities | CyberSource Review

CyberSource’s strength lies in its comprehensive suite of services that go beyond simple payment processing. The platform is designed to serve the end-to-end payment lifecycle, including authorization, capture, settlement, and reconciliation. Businesses can process credit cards, debit cards, digital wallets, and even alternative payments like PayPal and Klarna. One of the standout features is CyberSource’s fraud management toolset, which includes machine-learning-powered systems that analyze transaction data to detect and block potentially fraudulent activity. This is particularly beneficial for high-risk industries or those operating at scale. Alongside this, CyberSource provides tokenization services, which replace sensitive card data with tokens, minimizing the risk of data breaches and making recurring billing safer and more compliant.

Its acceptance of multichannel payments is another feature. CyberSource facilitates centralized reporting and unified processing whether consumers pay in-person, via a mobile app, or online. Businesses can preserve uniformity and control over their payment information across all customer touchpoints with the aid of this omnichannel strategy. Additionally, the platform has payment orchestration capabilities that let companies route transactions to the acquiring banks that are most economical or strategically located. This offers additional flexibility and possible financial savings. While enterprise-level organizations are best suited to fully utilize these tools, CyberSource does provide modularity, allowing companies to select the services they need. It is positioned more as a payment infrastructure provider than a simple processor due to the scope and depth of its offerings.

Global Reach and Multi-Currency Support

CyberSource stands out for its robust global infrastructure, making it a preferred solution for businesses with international operations or ambitions. The platform supports payments in over 190 countries and 50+ currencies, offering truly global reach. It also supports localized payment methods in various regions; including SEPA in Europe, iDEAL in the Netherlands, and Alipay in China; which helps improve conversion rates by meeting local customer preferences. One of the key strengths is its ability to support both global and local acquiring. Businesses can work with regional acquiring banks to optimize transaction approval rates, lower fees, and maintain compliance with country-specific regulations. CyberSource also facilitates intelligent transaction routing, which can automatically send payments through the most efficient acquiring partner based on geography or cost.

Additionally, the platform handles dynamic currency conversion (DCC), enabling customers to view prices and pay in their local currency, while merchants still receive settlements in their chosen currency. This improves transparency and trust at checkout, especially for international shoppers. Cross-border eCommerce presents challenges such as fraud risks, compliance complexities, and foreign exchange fees. CyberSource addresses these pain points by integrating its global fraud management and compliance tools into the transaction workflow. However, merchants should still consider regional regulation differences, such as PSD2 in Europe, and may need additional legal guidance despite the platform’s built-in support. For companies planning global expansion, CyberSource’s reach and multi-currency capabilities offer a strong foundation to scale while maintaining operational control.

Payment Gateway and API Integration

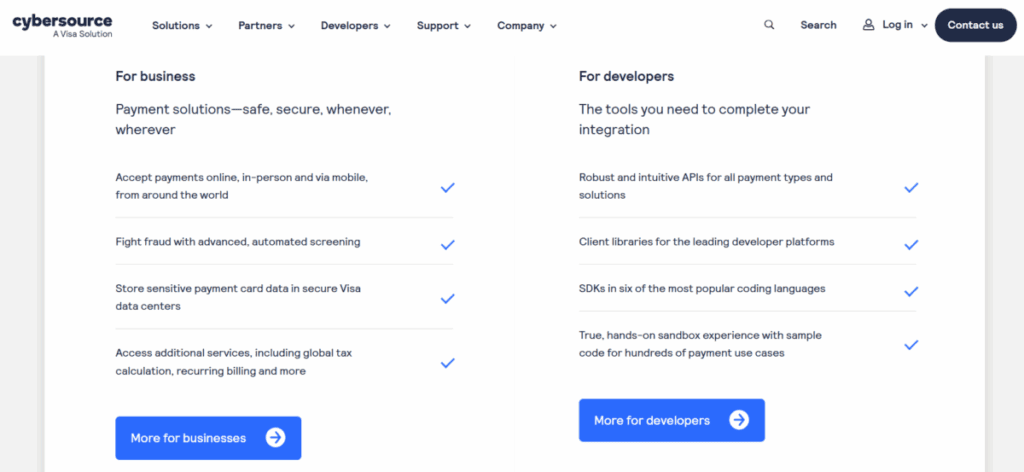

CyberSource provides a stable and developer-friendly payment gateway that gives businesses the freedom to incorporate payment processing into their systems, apps, and websites. Its well-documented API architecture, which supports fraud rules, tokenization, and custom payment flows, is one of its main advantages. Comprehensive instructions, SDKs in several languages (Java, PHP, Python, etc.), and testing sandbox environments are all available for the RESTful APIs. CyberSource offers plug-and-play solutions for well-known eCommerce platforms like Shopify, Magento, WooCommerce, and BigCommerce in addition to APIs. Businesses that want quicker deployment without requiring custom development can benefit from these integrations.

The platform supports a wide variety of payment types, including recurring billing, subscription models, split payments, and digital wallets like Apple Pay and Google Pay. This gives businesses a broad toolkit to design the kind of checkout experience that matches their business model and customer expectations. CyberSource also offers flexible integration modes such as hosted checkout pages, in-app SDKs, or direct API calls, allowing businesses to balance security with control over the user interface. Hosted forms are ideal for faster PCI compliance, while full API control offers maximum flexibility. That said, the platform does have a steeper learning curve compared to simpler competitors like Square or Stripe. Businesses with limited technical resources may need third-party developer support. Still, for organizations with complex payment needs or global operations, CyberSource’s integration capabilities are comprehensive and well-suited to customization.

Security and Compliance Standards

Security is a cornerstone of CyberSource’s offerings, and it is backed by Visa’s global infrastructure, which brings a high level of credibility. The platform is fully PCI-DSS compliant, which is a minimum requirement for any payment gateway provider. This ensures that customer data is processed, stored, and transmitted securely. CyberSource also uses tokenization, a process where sensitive card details are replaced with non-sensitive equivalents (tokens), significantly reducing the risk of data breaches. This is especially useful for businesses with recurring billing models or those storing customer payment details for future use.

To further mitigate risks, CyberSource supports 3-D Secure authentication (including 3DS2), which adds an extra layer of security during online transactions. This not only protects against unauthorized use but also helps businesses comply with regulations like Strong Customer Authentication (SCA) under PSD2 in Europe. The company provides built-in tools for transaction risk analysis, address verification systems (AVS), and device fingerprinting, allowing merchants to spot suspicious behavior before the transaction is completed. These tools are configurable, offering flexibility for businesses to adjust security thresholds based on their own risk appetite. From a compliance standpoint, CyberSource also assists merchants in navigating evolving regulations like GDPR, CCPA, and global anti-fraud directives. While these tools are robust, it’s important to note that ultimate compliance responsibility still lies with the merchant, and proper internal policies are essential. In summary, CyberSource delivers enterprise-grade security features suitable for businesses that prioritize data protection and regulatory compliance.

Fraud Management with Decision Manager

One of the most cutting-edge fraud detection tools available and a key differentiator for the platform is CyberSource’s Decision Manager. It uses data from more than 68 billion transactions processed yearly, machine learning, and artificial intelligence algorithms to detect and stop fraud in real time. Decision Manager gives merchants the ability to design unique fraud rules, set thresholds, and test possible effects through simulations, in contrast to other payment gateways’ basic fraud filters. The tool evaluates risk scores using more than 300 data elements per transaction, such as purchase history, IP geolocation, and device intelligence. Additionally, it gains access to global transaction patterns and fraud indicators through Visa’s data network.

Merchants can fine-tune fraud controls based on their business model, region, or product type, which helps reduce false positives; a common issue that can lead to lost sales. The system also supports manual review queues, helping teams investigate borderline transactions instead of rejecting them outright. Another useful feature is the case management system, where businesses can track and resolve disputes or chargebacks more efficiently. Reporting tools allow merchants to monitor performance over time and adjust rules accordingly. While highly powerful, Decision Manager may be more than what a small business needs, both in complexity and cost. However, for medium to large enterprises that face significant fraud exposure, it’s a valuable asset that can protect revenue while improving operational efficiency.

Reporting, Analytics, and Dashboard Usability

CyberSource provides a feature-rich merchant portal with performance analytics, transaction tracking, and real-time reporting. With granular filters and customizable views, the dashboard was created with enterprise users in mind. Metrics like transaction volume, approval and refund rates, and fraud activity can all be examined by merchants. The reporting system offers customizable reports in addition to pre-made templates. In addition to helping merchants reconcile financial transactions, this gives them information about payment patterns by device, region, and payment method. Reconciliation reports, chargeback summaries, and daily batch settlement reports can all be exported in CSV and XML formats.

CyberSource’s interface is functional but leans more toward utility than modern aesthetics. While intuitive for experienced operators, newer users might face a learning curve. It does, however, provide a central view for monitoring activity across multiple payment channels and geographies, which is a significant advantage for global merchants. The platform also includes alerts and notifications for failed transactions, chargebacks, or high-risk activity. This helps businesses respond quickly and reduce revenue leakage. Additionally, analytics can be used to inform business decisions, such as adjusting fraud rules or optimizing acquiring banks. One potential limitation is that smaller businesses may find the reporting tools too complex or excessive for their needs. However, for enterprises that depend on data to make operational decisions, CyberSource delivers a high level of visibility and control.

Pricing Structure and Fee Transparency

CyberSource does not publicly list a standardized pricing model on its website, which can make cost estimation difficult for new users. Instead, pricing is generally customized based on business size, transaction volume, risk profile, and geographic reach. This model is typical for enterprise-focused platforms but may be a hurdle for smaller businesses seeking quick comparisons. Standard pricing usually includes a setup fee, monthly gateway fees, and transaction-based charges (often a percentage plus a fixed amount per transaction). Additional fees may apply for services like fraud management, tokenization, or cross-border processing. Businesses also need to consider acquirer fees, especially when using their own merchant accounts. This lack of transparency might be off-putting for some merchants, especially those used to the flat, upfront pricing models offered by Stripe, PayPal, or Square. However, in exchange, CyberSource provides a tailored pricing approach that can offer cost efficiencies for high-volume or high-risk merchants.

It’s important for businesses to negotiate contracts carefully and ask for a complete fee breakdown before onboarding. This should include hidden costs such as chargeback fees, refund processing charges, and minimum monthly commitments. Ultimately, while CyberSource may not be the most cost-effective option for all merchants, its pricing can be competitive for those with complex needs that justify the platform’s advanced features.

Customer Support and Onboarding Experience

CyberSource offers multiple support channels, including phone, email, live chat (in some regions), and a robust developer portal. The quality of support is generally good, especially for enterprise customers who receive access to dedicated account managers and technical specialists. The onboarding process varies by business type and integration method. For businesses using pre-built plugins, setup can be relatively quick; typically within a day or two. For those opting for full API integration, onboarding may involve several steps: sandbox testing, compliance checks, and system validation. CyberSource provides documentation and developer tools to ease this process, though some technical support may still be required.

While the Developer Center is more comprehensive and contains code samples, API references, and SDKs, the Help Center offers articles, user manuals, and troubleshooting guides. However, some resources may be too complex or dispersed for non-technical users due to the platform’s enterprise focus. Although customer service availability may differ by location, CyberSource has a comprehensive support system because of Visa’s global reach. Nevertheless, some users have reported delays in response times during busy times or in different time zones. For companies that have internal IT or development teams, the support and onboarding process is generally excellent. Smaller retailers may need more time to catch up or external technical assistance.

Pros and Cons of Using CyberSource

Pros:

Enterprise-grade infrastructure backed by Visa

Excellent global coverage and multi-currency support

Powerful fraud prevention via Decision Manager

Flexible API and plugin integrations

Highly configurable features for large or complex businesses

Cons:

Lack of pricing transparency

May be too complex for small businesses

Dashboard and reporting tools have a learning curve

Setup and integration can require technical expertise

Not every company is a good fit for CyberSource. Although its features are powerful, they are complicated enough that they might not be appropriate for people looking for a plug-and-play system. Nonetheless, it continues to be one of the best choices for businesses seeking a worldwide payment infrastructure that is scalable, secure, and adaptable.

FAQs

Q1. Is CyberSource suitable for small businesses or startups?

A: While CyberSource offers robust features, it’s generally more suitable for mid-sized to large enterprises. Smaller businesses may find it overly complex and might prefer simpler, flat-fee solutions.

Q2. How long does it take to integrate CyberSource?

A: Integration time depends on the method used. Plugin-based setups can be completed in a day, while full API integration may take one to three weeks, depending on complexity.

Q3. What distinguishes CyberSource from platforms like Stripe or Authorize.Net?

A: CyberSource stands out for its advanced fraud tools (Decision Manager), global reach, and Visa-backed infrastructure. It’s better suited for businesses with international operations and complex risk management needs.