Deft Payment Systems Review

- 06th Feb, 2025

- | By Linda Mae

- | Reviews

Deft Payment Systems is a merchant services provider offering payment processing solutions for businesses across various industries. The company provides a range of services, including credit and debit card processing, e-check and ACH payments, mobile transactions, and integrated payment gateways. By catering to both traditional and high-risk merchants, Deft Payment Systems positions itself as a versatile payment processing partner for businesses with unique needs. Lets read more about Deft Payment Systems Review.

A key characteristic of Deft Payment Systems is its focus on customized solutions. In contrast to standard payment processors, Deft provides specialized payment solutions tailored to specific industries, featuring exclusive kiosks, payroll services, and gift card offerings. This makes it a compelling choice for companies seeking more than merely conventional credit card processing.

The company also prioritizes security and compliance. Deft Payment Systems guarantees secure transaction processing for merchants and their customers through strong encryption standards, PCI compliance, and fraud detection methods. The company’s method for managing risk is especially helpful for high-risk vendors, who frequently have difficulty locating trustworthy and cost-effective payment processing options.

In addition to its technical capabilities, Deft Payment Systems provides customer support via multiple channels, offering assistance with setup, integration, and troubleshooting. While the company presents a compelling suite of features, it’s essential to analyze its pricing, contract terms, user experience, and customer reviews to determine whether it truly delivers on its promises. This review will provide a comprehensive, unbiased assessment of Deft Payment Systems to help businesses make an informed decision.

Company Background | Deft Payment Systems Review

Founding and History

Deft Payment Systems was established with the goal of providing businesses with reliable and secure payment processing solutions. While specific details about its founding, such as the exact year and key founders, are not widely available, the company has positioned itself as a provider of both traditional and high-risk merchant services. Over the years, Deft Payment Systems has expanded its offerings to cater to businesses across various industries, from retail and e-commerce to more complex sectors like CBD, tech support, and debt consolidation.

A crucial strategy for the company has been adjusting to the changing payment environment. As e-commerce and digital transactions have grown, Deft Payment Systems has integrated online payment gateways, mobile processing, and ACH payments to enable businesses to receive payments in various formats. The company has created tailored solutions for various industries, including gift and loyalty card programs, to improve customer engagement for merchants.

Mission and Core Values

Deft Payment Systems operates with a mission to provide secure, flexible, and cost-effective payment processing solutions to businesses of all sizes. The company emphasizes customer-centric services, security, and innovation as its core values.

Customer Focus – Providing tailored payment solutions to meet the unique needs of different industries.

Security and Compliance – Ensuring transactions are protected through PCI compliance and encryption technologies.

Innovation – Staying ahead of market trends by offering new and advanced payment solutions.

Leadership and Management Team

Details regarding the leadership team of Deft Payment Systems are not extensively found in public documents. Nonetheless, it is thought that the organization is guided by experts skilled in fintech, payment solutions, and risk assessment. Their proficiency in managing high-risk merchants indicates a team knowledgeable about intricate financial regulations and compliance obligations. The management’s approach focuses on providing competitive pricing models, strategies for risk reduction, and committed customer support.

Services Offered

Deft Payment Systems provides a range of payment processing solutions tailored to meet the needs of businesses across various industries. From traditional credit card processing to specialized services for high-risk merchants, the company aims to deliver flexible and secure payment options.

Payment Processing Solutions

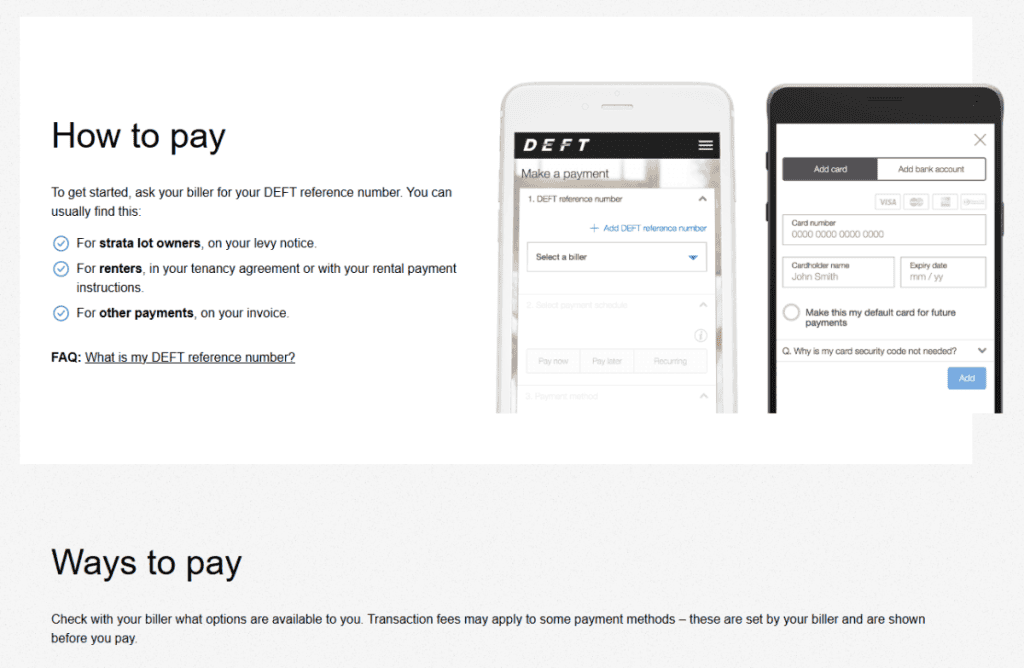

Credit and Debit Card Processing – Deft Payment Systems enables businesses to accept major credit and debit cards, including Visa, MasterCard, American Express, and Discover. The company provides both swiped and keyed-in transaction processing for in-store, online, and mobile payments.

E-check and ACH Transactions – To accommodate businesses that require direct bank-to-bank transfers, Deft Payment Systems supports e-check and ACH payments. These options are particularly useful for recurring billing, high-ticket transactions, and subscription-based businesses.

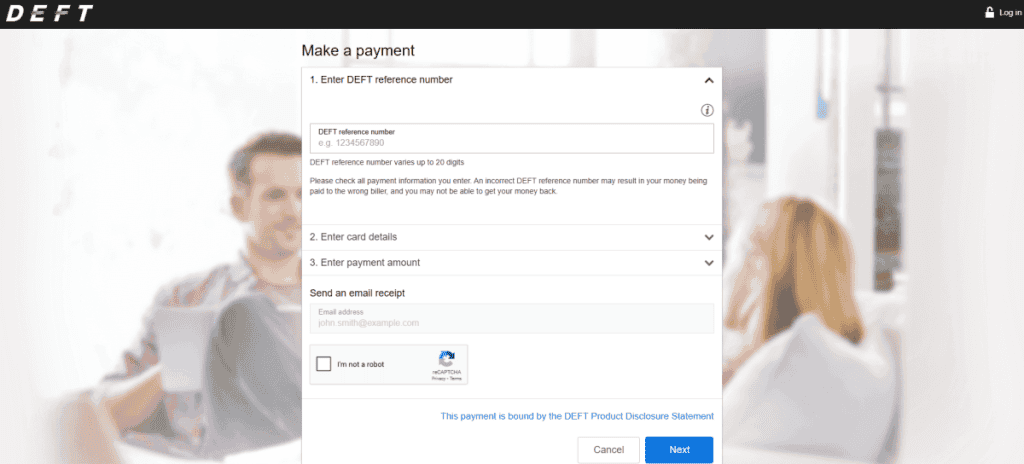

Mobile and Online Payment Gateways – Businesses can integrate Deft’s online payment gateway to accept payments through e-commerce platforms. Mobile payment solutions allow merchants to process transactions using smartphones or tablets, enhancing payment flexibility for businesses operating in remote or mobile environments.

Value-Added Services

Gift and Loyalty Card Programs – Deft Payment Systems provides customizable gift and loyalty card programs to help businesses enhance customer engagement and retention.

Payroll Services – The company offers payroll processing solutions, making it easier for businesses to manage employee payments efficiently.

Lead Generation Assistance – Some merchants, particularly those in high-risk industries, can benefit from Deft’s lead generation support, designed to help them find and retain customers.

Proprietary Kiosks for Specialized Payments – Deft Payment Systems provides self-service kiosks tailored for industries that require automated payment solutions, such as bill payments or ticketing.

Product Fulfillment Support – Businesses that require assistance with inventory management and order fulfillment can leverage Deft’s integrated solutions, streamlining operations alongside payment processing.

By offering both core payment solutions and additional business support services, Deft Payment Systems positions itself as a comprehensive provider for merchants seeking more than just transaction processing.

Target Markets

Deft Payment Systems caters to a wide variety of businesses, accommodating both standard-risk and high-risk merchants. Its capability to offer payment processing solutions for sectors that frequently have difficulty locating dependable service providers makes it a versatile option in the payments sector.

Standard-Risk Merchants

E-commerce Businesses – Online merchants require seamless payment processing with secure gateways, fraud protection, and multi-currency support. Deft Payment Systems provides these features, allowing businesses to accept credit/debit card payments and ACH transactions.

Retail Establishments – Brick-and-mortar stores benefit from Deft’s POS solutions, mobile payment options, and integration with inventory management systems. The company supports businesses ranging from small boutiques to large retail chains.

High-Risk Merchants

Deft Payment Systems focuses on catering to high-risk sectors—companies that encounter greater scrutiny from conventional banks and payment processors because of regulatory hurdles, chargeback threats, or financial instability.

CBD and Hemp Product Vendors – Many payment processors avoid working with CBD businesses due to evolving regulations. Deft Payment Systems provides solutions tailored to this industry, ensuring compliance while enabling smooth transactions.

Credit Repair Agencies – Given the potential for chargebacks, credit repair businesses often struggle to find processors. Deft supports these businesses with secure payment options.

Tech Support Services – Online tech support companies face fraud concerns, making them high-risk. Deft Payment Systems offers chargeback mitigation tools to help these businesses.

Adult Entertainment Industry – Businesses in this space require discreet, secure processing. Deft Payment Systems provides specialized merchant accounts that cater to their needs.

Debt Consolidation Firms & Payday Loan Providers – These businesses deal with financial services that often carry a high chargeback rate. Deft offers secure payment solutions designed to mitigate fraud and disputes.

Travel Agencies – The travel industry is prone to cancellations and disputes, increasing financial risk. Deft provides secure payment gateways and fraud prevention measures.

Dietary Supplement Companies – Supplements are often classified as high-risk due to potential regulatory issues. Deft Payment Systems accommodates these businesses with customized payment solutions.

Real Estate Seminar Organizers & Insurance-Related Programs – These industries often involve high-ticket transactions and recurring payments, making them susceptible to chargebacks. Deft Payment Systems offers tailored processing solutions to address these risks.

By serving both conventional and high-risk businesses, Deft Payment Systems appeals to a broad spectrum of merchants, offering industry-specific solutions to meet diverse payment processing needs.

Pricing and Contract Terms

Understanding the pricing and contract details of Deft Payment Systems is crucial for companies evaluating its services. The company’s pricing model changes depending on elements like the merchant’s sector, transaction volume, and risk assessment. Although Deft Payment Systems doesn’t reveal precise rates to the public, businesses can typically anticipate the following based on industry norms.

Transaction Rates

Swiped Rates – Merchants accepting in-person payments through a POS system or card reader typically receive lower transaction rates. Swiped transactions are considered lower risk due to the physical card being present. While exact percentages are not disclosed, swiped rates usually range between 2.3% and 2.9% per transaction, depending on card type and merchant category.

Keyed-In Rates – Transactions where card details are manually entered tend to have higher rates due to the increased risk of fraud and chargebacks. Keyed-in transactions typically range between 3.1% and 3.5% per transaction, though specific pricing depends on business type and volume.

Fees

Early Termination Fees – Deft Payment Systems may charge an early termination fee if a merchant cancels their contract before the agreed-upon term ends. These fees can vary depending on the contract terms but may range from $250 to $500 or be based on liquidated damages.

PCI Compliance Fees – Ensuring compliance with PCI DSS is mandatory, and Deft Payment Systems likely charges an annual PCI compliance fee, typically ranging from $99 to $150 per year.

Equipment Lease Terms – Merchants who require physical terminals or POS systems may need to lease equipment from Deft Payment Systems. Equipment leases often involve long-term commitments, sometimes three to four years, with non-cancelable terms. Monthly lease fees vary but can range between $20 and $60 per device.

Contract Length and Terms

Deft Payment Systems’ contracts are often customized based on a merchant’s industry and risk profile. While some standard-risk businesses may receive month-to-month agreements, high-risk merchants might be required to sign multi-year contracts (typically 3 to 5 years) with automatic renewal clauses.

Understanding these pricing components is essential prior to enrollment, since certain expenses—particularly early termination fees and equipment leasing contracts—can accumulate considerably over time. Companies need to carefully examine their contract terms and negotiate whenever possible to guarantee they are receiving the best offer.

Application and Onboarding Process

Deft Payment Systems follows a structured application and onboarding process designed to accommodate both standard-risk and high-risk merchants. While the approval process varies depending on the nature of the business, the company aims to provide a seamless experience from application to activation.

Application Procedures

The application process begins with businesses submitting key information, including company details, processing history, estimated transaction volumes, and industry classification. Merchants may need to provide additional documentation such as business licenses, bank account details, tax identification numbers, and past processing statements (if applicable).

For high-risk companies, the application procedure might necessitate additional documentation, such as compliance records and evidence of risk mitigation strategies to fulfill regulatory requirements.

Underwriting Process

Deft Payment Systems performs a thorough underwriting process to assess the merchant’s business model, financial stability, and chargeback risks. The underwriting team evaluates factors such as industry risk level, processing history, and compliance with payment regulations.

High-risk merchants might need additional scrutiny, which could involve assessing the company’s chargeback policies, refund practices, and methods for resolving customer disputes. Certain companies might be required to maintain a reserve fund or a rolling reserve to handle possible chargebacks.

Expected Timelines for Approval

Approval times depend on the risk category of the merchant. Standard-risk businesses can expect approvals within 24 to 48 hours, while high-risk merchants may experience a longer process, ranging from three to seven business days, depending on the complexity of the application and additional requirements.

Support During Setup

After approval, Deft Payment Systems offers onboarding assistance to aid merchants in integrating payment solutions into their current infrastructure. This involves support for establishing POS systems, integrating payment gateways for online stores, and maintaining PCI compliance. Merchants usually have the option to reach customer support via phone, email, or an online portal for help and technical guidance.

Customer Support and Service

Customer support is a crucial aspect of any payment processing provider, as merchants need timely assistance with transactions, technical issues, and account management. Deft Payment Systems offers multiple support options, but the quality of service can vary based on customer experiences.

Availability and Responsiveness

Deft Payment Systems provides customer support during standard business hours, and some merchants report access to 24/7 support for urgent issues. The responsiveness of the team appears to depend on the complexity of the inquiry, with basic troubleshooting and account-related queries being handled more quickly than dispute resolutions or chargeback-related issues.

Dedicated Account Management

For merchants handling larger transaction volumes or working in high-risk sectors, Deft Payment Systems might designate a dedicated account manager. This offers companies a centralized contact for questions regarding payment processing, contract conditions, and account modifications. Nonetheless, certain clients observe discrepancies in account management, experiencing delays in response times when addressing intricate issues.

Support Channels (Phone, Email, Online Portal)

Merchants can access customer support via phone, email, and an online portal. Phone support is typically the fastest way to get immediate assistance, while email and the online portal allow businesses to submit tickets for non-urgent issues. However, some users have reported longer-than-expected wait times for email responses.

Client Feedback on Support Quality

Client feedback regarding Deft Payment Systems’ support services are varied. Certain merchants commend the company for its informative and attentive representatives, whereas others mention delays in addressing disputes and billing questions. Merchants categorized as high-risk, specifically, experience prolonged resolution times because of extra compliance inspections.

Security and Compliance

Security and compliance are critical components of any payment processing service, and Deft Payment Systems implements various measures to ensure transactions remain secure and adhere to industry standards. The company follows best practices in data encryption, fraud prevention, and regulatory compliance to protect both merchants and their customers.

Data Encryption Standards

Deft Payment Systems uses end-to-end encryption and tokenization to secure payment transactions. These technologies help prevent unauthorized access to sensitive cardholder data by replacing real card information with encrypted tokens during processing. Additionally, the company likely employs 256-bit SSL encryption to secure online payment gateways, reducing the risk of data breaches and cyberattacks.

PCI Compliance

The PCI DSS is a compulsory security framework that payment processors are required to adhere to in order to safeguard cardholder data. Deft Payment Systems asserts it is PCI-compliant, guaranteeing that its systems adhere to the necessary security standards. Nevertheless, vendors are frequently accountable for upholding their own PCI compliance, which may involve additional fees and regular security updates. Companies utilizing Deft Payment Systems need to verify if assistance with PCI compliance is provided or if they are required to handle it on their own.

Fraud Detection and Prevention Measures

Deft Payment Systems employs various fraud prevention tools to safeguard transactions. These may include:

Real-time transaction monitoring to detect suspicious activity.

Address Verification Service to match billing addresses with cardholder records.

Chargeback mitigation tools to help merchants dispute fraudulent claims.

Multi-factor authentication for secure account access.

While these measures enhance security, high-risk merchants may still face additional scrutiny, rolling reserves, or delayed settlements as part of the company’s risk management strategy.

User Experience and Interface

Deft Payment Systems aims to provide a streamlined and intuitive payment processing experience for businesses of all sizes. Its platform includes a merchant dashboard, integration capabilities, and customization options designed to improve operational efficiency. However, the overall user experience can vary based on the specific needs of the merchant and the complexity of their payment processing requirements.

Ease of Use of Payment Platforms

Deft Payment Systems provides a fairly intuitive interface for handling transactions, tracking sales, and viewing reports. The POS systems, virtual terminals, and online gateways are created to be user-friendly, even for individuals with little technical knowledge. Companies can swiftly handle transactions, set up automatic payments, and view customer payment history with just a few clicks. Nonetheless, several merchants have indicated that specific advanced functionalities require a learning curve, especially for high-risk businesses involved in chargeback management.

Integration Capabilities with Existing Systems

A key advantage of Deft Payment Systems is its compatibility with multiple e-commerce platforms, accounting software, and CRM systems. The payment gateway facilitates integration with well-known platforms such as Shopify, WooCommerce, and QuickBooks, allowing merchants to optimize their operations. Nevertheless, high-risk enterprises might encounter extra integration demands or compatibility constraints, based on regulatory standards in the industry.

Merchant Dashboard Features

The merchant dashboard provides essential insights, including real-time transaction monitoring, sales reports, and chargeback tracking. Merchants can also view settlement times and manage refunds through the dashboard. Some users appreciate the clarity of the reporting tools, while others note that the interface could be more modern and customizable.

Customization Options

Deft Payment Systems enables companies to tailor specific aspects of their payment processing, including branded checkout interfaces, recurring billing frameworks, and fraud protection features. Nonetheless, the degree of customization might vary based on the merchant’s sector and transaction volume.

Pros and Cons

Similar to any payment processing service, Deft Payment Systems possesses both advantages and disadvantages. Although it provides a wide array of services and serves high-risk enterprises, merchants should weigh possible disadvantages before enrolling.

Advantages of Using Deft Payment Systems

Support for High-Risk Merchants – One of Deft Payment Systems’ standout features is its willingness to work with high-risk industries, including CBD, credit repair, and adult entertainment, which many traditional processors avoid.

Diverse Payment Solutions – The company provides various payment processing options, including credit and debit card transactions, e-checks, ACH payments, mobile and online gateways, and proprietary kiosks.

Integration with E-commerce and Business Software – Deft Payment Systems supports integrations with platforms like Shopify, WooCommerce, and QuickBooks, making it convenient for businesses to sync payment data with their existing systems.

Fraud Protection and Security Features – The company offers encryption, PCI compliance, real-time transaction monitoring, and chargeback prevention tools to enhance payment security.

Value-Added Services – In addition to payment processing, Deft Payment Systems offers payroll services, gift and loyalty programs, and lead generation assistance, making it a comprehensive business solution.

Potential Drawbacks or Limitations

Lack of Transparent Pricing – The company does not publicly disclose its rates, making it difficult for businesses to compare costs upfront. High-risk merchants may face higher transaction fees and rolling reserves.

Potential for Long-Term Contracts – Some merchants report multi-year agreements with early termination fees, which can be costly if a business wants to switch providers.

Customer Support Inconsistencies – While some businesses receive responsive service, others report delays in resolving disputes, chargebacks, and technical issues.

Equipment Leasing Costs – Merchants needing POS terminals may have to enter long-term, non-cancelable lease agreements, which can be expensive.

Conclusion

Deft Payment Systems provides a variety of payment options, especially advantageous for high-risk merchants. Although it offers robust security features, integrations, and additional services, worries about pricing clarity, contract conditions, and customer support remain. Companies must thoroughly examine contract specifics prior to making a commitment to guarantee it meets their requirements.

FAQs

What types of businesses does Deft Payment Systems serve?

Deft Payment Systems supports both standard-risk and high-risk businesses, including e-commerce, retail, CBD, credit repair, tech support, travel agencies, and dietary supplements. It specializes in industries often rejected by traditional processors.

Are there any setup or application fees?

Deft Payment Systems does not charge setup or application fees, making it an accessible option. However, merchants should review contract terms for potential monthly service fees, PCI compliance fees, and other costs.

How does Deft Payment Systems ensure the security of transactions?

The company uses 256-bit encryption, PCI compliance protocols, real-time fraud detection, and chargeback prevention tools to protect payment data and reduce financial risks.