Fidelity Payment Services Review

- 03rd Sep, 2024

- | By Linda Mae

- | Reviews

Fidelity Payment Services is a reputable company in the field of handling payments, known for providing various payment options to companies across different sectors. Founded in 1996 by Benjamin Weiser, the firm initially focused on supplying local businesses with reliable equipment and software for processing credit cards. Over time, Fidelity has expanded its services significantly, growing into one of the leading providers of electronic payments in North America. The company aims to simplify payment procedures for businesses while ensuring high levels of security and effectiveness. Lets read more about Fidelity Payment Services Review.

Fidelity Payment Services is located in Brooklyn, New York, and helps many different clients across North America. It stands out in the market because it can adapt to the fast-changing world of payment technology. The company focuses on new ideas and solutions that put the customer first, which has helped it become strong in the competitive field of payment processing. Fidelity wants to help businesses by using new payment technologies that make things run better, cost less, and make customers happier.

Company Background | Fidelity Payment Services Review

Fidelity Payment Services has a history that shows how it has grown and changed in a constantly changing industry. Starting in 1996, the company started as a small operation offering simple tools for processing credit cards. Over time, it has become a significant company that provides many different payment services. The company’s growth has been helped by smart investments and partnerships, which have allowed it to offer more services and improve its technology.

A significant milestone in the company’s history was its recapitalization by PSG, a leading growth equity firm, in May 2022. This investment, along with support from existing investors like H.I.G. Growth Partners, has positioned Fidelity Payment Services for continued expansion and innovation. The company’s proprietary platform, Cardknox, exemplifies its commitment to providing robust and flexible payment solutions tailored to the needs of businesses in various industries.

The group in charge at Fidelity Payment Services, headed by the two main bosses, Benjamin Weiser and David Ilowitz, includes skilled experts who have a lot of knowledge in handling payment systems and running businesses. Their ideas and plans have been very important in making the company successful and keeping its good name for being dependable and taking care of customers.

Services and Solutions Offered

Fidelity Payment Services offers a wide range of payment processing solutions designed to meet the diverse needs of businesses across various industries. Their services are known for their flexibility, security, and user-friendly interfaces, allowing businesses to manage transactions efficiently, whether in-store, online, or on-the-go.

Overview of Payment Processing Solutions: Fidelity Payment Services provides an integrated platform that supports various payment methods, including credit and debit cards, ACH transfers, and mobile wallets. Their solutions are built to handle high transaction volumes while maintaining fast processing speeds and ensuring transaction security. The platform is designed to be highly customizable, enabling businesses to tailor the payment process to their specific operational needs.

Point of Sale (POS) Systems: Fidelity provides sophisticated Point of Sale (POS) systems designed for both small businesses and large enterprises. These systems come with functions like inventory management, tracking customer data, and providing real-time reporting. The POS solutions are created to easily connect with other tools for business management, offering a complete solution for overseeing sales, customer engagement, and business activities all in one interface.

E-commerce Payment Gateways: For online businesses, Fidelity Payment Services provides robust e-commerce payment gateways that ensure secure and efficient online transactions. These gateways support various payment methods and currencies, making them ideal for businesses operating on a global scale. The gateways are also equipped with fraud detection and prevention features to protect businesses and customers from unauthorized transactions.

Mobile Payment Solutions: In response to the growing demand for mobile payment options, Fidelity offers solutions that allow businesses to accept payments via smartphones and tablets. These mobile payment solutions are designed to be user-friendly and secure, providing customers with a convenient way to make payments while on the move.

Security Features and Fraud Prevention: Fidelity Payment Services considers security a high priority. The company uses advanced encryption technologies, tokenization, and follows PCI DSS standards to safeguard sensitive payment data. Their fraud prevention measures consist of instant monitoring, alerts for transactions, and customizable security features, all aimed at reducing the possibility of fraud and guaranteeing the security of all transactions.

Industry-Specific Solutions

Fidelity Payment Services recognizes that businesses in different industries have unique needs when it comes to payment processing. To address these diverse requirements, Fidelity offers industry-specific solutions that are tailored to meet the operational demands of sectors such as retail, hospitality, and healthcare. These specialized solutions are designed to provide businesses with the tools they need to optimize payment processes, enhance customer experiences, and improve overall efficiency.

Solutions Tailored for Different Industries: In the retail sector, Fidelity Payment Services offers solutions that streamline the checkout process, manage inventory, and track customer behavior. Their retail-focused tools include advanced Point of Sale (POS) systems that integrate with loyalty programs and customer relationship management (CRM) platforms, enabling retailers to offer personalized shopping experiences and build stronger customer relationships.

Fidelity offers payment solutions specifically tailored for the hospitality sector, capable of managing hotel operations such as room reservations, dining orders, and event coordination. These solutions are incorporated into a unified platform that enables hospitality establishments to smoothly handle every aspect of their operations, from front-desk tasks to back-end financial management. The adaptability of the system allows for customization to suit the particular requirements of small boutique hotels or large hotel chains.

In the healthcare sector, Fidelity Payment Services offers secure payment processing solutions that comply with industry regulations such as HIPAA. These solutions are designed to handle the unique billing and payment needs of healthcare providers, including patient co-pays, insurance payments, and payment plans. The systems also integrate with electronic health records (EHR) systems, ensuring that financial and patient data are managed efficiently and securely.

Customization and Integration Options: Fidelity understands that no two businesses are the same, which is why they offer a high degree of customization across all their solutions. Businesses can tailor Fidelity’s payment systems to align with their specific workflows, ensuring that the solutions fit seamlessly into their existing operations. Additionally, Fidelity’s platforms are designed to integrate with a wide range of third-party software, including accounting systems, CRM platforms, and industry-specific management tools. This flexibility allows businesses to create a cohesive and efficient ecosystem that supports their unique operational needs.

Technology and Innovation

Fidelity Payment Services has established itself as a leader in the payment processing industry by consistently using advanced technology and innovative ideas. The company shows its commitment to technological advancements by offering unique software solutions designed to provide seamless, secure, and efficient payment processing for businesses of all sizes. Fidelity’s dedication to innovation allows it to stay ahead of industry trends and continuously improve its services to meet the evolving needs of its customers.

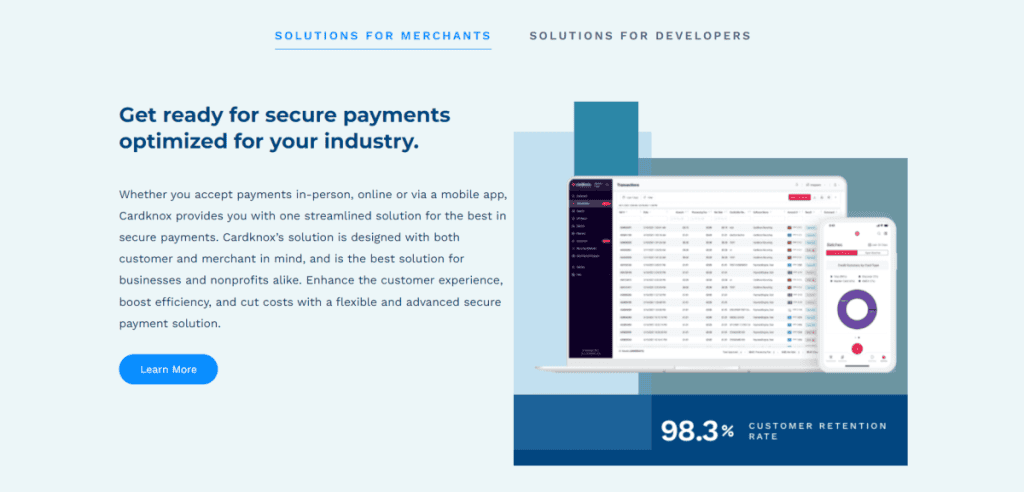

Proprietary Technology and Software Offerings: At the core of Fidelity’s technology offerings is its proprietary payment gateway, Cardknox. This platform is a versatile and robust solution that supports omni-channel payment processing, enabling businesses to accept payments in-store, online, and via mobile devices with ease. Cardknox is designed to be highly customizable, allowing businesses to tailor the payment experience to their specific needs. The platform also integrates with a wide range of Point of Sale (POS) systems, e-commerce platforms, and mobile applications, making it a flexible solution for businesses across various industries.

Innovations in Payment Processing: Fidelity Payment Services is dedicated to advancing innovation within the payment processing industry. Integrating advanced security features like tokenization and encryption into their payment platforms is one of the key innovations. These characteristics are created to safeguard delicate customer information when making transactions, minimizing the chances of fraud and maintaining adherence to industry regulations. Moreover, Fidelity has integrated real-time reporting and analytics into its systems, offering businesses valuable insights into their transaction data and aiding in making informed decisions.

How Fidelity Stays Ahead of Industry Trends: To keep up with the latest in the industry, Fidelity Payment Services constantly watches for new advancements in payment technology and adjusts its services to match. The company puts money into studying and creating new technologies to improve its services, like blockchain, artificial intelligence for catching fraud, and ways to pay without touching anything. Fidelity’s forward-thinking approach to new ideas means it can provide its customers with the most up-to-date and dependable ways to handle payments, helping them stay ahead in a fast-moving market.

Pricing and Contract Terms

Fidelity Payment Services offers a range of pricing models tailored to meet the diverse needs of businesses across various industries. Understanding the cost structure and contract terms is essential for businesses considering their services. Fidelity’s pricing and contract terms are designed to be competitive while offering flexibility and transparency.

Detailed Breakdown of Pricing Models: Fidelity Payment Services provides a variety of pricing options, including tiered pricing, interchange-plus pricing, and flat-rate pricing models. Each model is designed to cater to different business sizes and transaction volumes. The tiered pricing model typically involves a fixed rate for different types of transactions, such as qualified, mid-qualified, and non-qualified transactions. The interchange-plus model, on the other hand, is more transparent, with businesses paying the actual interchange rate plus a fixed markup. Flat-rate pricing offers a simple, predictable rate, making it easier for small businesses to budget their processing costs.

Contract Length, Fees, and Early Termination Clauses: Businesses should keep in mind the usual contract duration of one to three years when finalizing an agreement with Fidelity Payment Services. It’s crucial to understand that these agreements might have fees for ending them early should a company choose to terminate the agreement before it is supposed to end. Fidelity’s fees for ending a contract early typically align with what is common in the industry, though they may differ based on the contract’s specific terms. Furthermore, businesses need to be aware of potential extra charges, such as monthly service fees, PCI compliance fees, and chargeback fees.

Comparison with Industry Standards: Compared to industry standards, Fidelity Payment Services’ pricing is competitive, especially when considering the level of service and technology provided. The company’s interchange-plus pricing model is particularly appealing to larger businesses that process a high volume of transactions, as it offers greater transparency and the potential for cost savings. However, the presence of early termination fees is a common practice in the industry, and businesses should carefully review contract terms to ensure they align with their operational needs.

Customer Support and Service

Customer support is very important for any service that handles payments, and Fidelity Payment Services really cares about giving good and dependable help to its customers. They make sure that businesses can get assistance whenever they need it, which helps to reduce time when things aren’t working and fixes problems quickly.

Overview of Customer Service Channels: Fidelity Payment Services offers multiple customer service channels, including phone support, email, and live chat. This multi-channel approach allows businesses to choose the most convenient method for reaching out, whether they need immediate assistance via phone or prefer the convenience of email or chat for less urgent inquiries. The company also provides a comprehensive online support portal where users can access resources such as FAQs, user guides, and troubleshooting tips, further enhancing the support experience.

Availability and Responsiveness: Fidelity is recognized for its internal customer service teams that are accessible round the clock to help customers. The 24/7 availability is especially beneficial for companies that work outside of regular business hours or in various time zones. Fidelity’s support team is frequently praised by clients for being quick and efficient in addressing issues. The company’s dedication to being transparent and communicating effectively ensures that customers are informed during the resolution process, leading to lower frustration and increased overall satisfaction.

User Experience and Satisfaction Ratings: User experience with Fidelity Payment Services’ customer support is generally positive, with many clients highlighting the professionalism and knowledge of the support staff. Satisfaction ratings for Fidelity’s customer service are consistently high, reflecting the company’s dedication to providing a supportive and user-friendly experience. Fidelity’s strong reputation in customer care is attributed to its use of various support channels, quick service, and well-informed staff. Providing this level of support is essential for nurturing lasting relationships with clients and making sure their payment processing requirements are fulfilled with minimal interruption.

Pros and Cons

It is crucial to consider both the strengths and possible disadvantages of Fidelity Payment Services when assessing its compatibility with your business requirements.

Pros:

Comprehensive Solutions: Fidelity provides a variety of payment processing options, such as advanced POS systems, e-commerce gateways, and mobile payment choices. This adaptability allows it to be used by companies in different sectors, from retail to healthcare.

Security: Fidelity gives top importance to transaction security by using advanced technologies like encryption and tokenization, as well as complying with PCI DSS standards. These actions safeguard confidential information, minimizing the chance of unauthorized activities and maintaining adherence to industry guidelines.

Customer Support: One of the standout features of Fidelity is its reliable customer service. With 24/7 availability through multiple channels—phone, email, and live chat—businesses can quickly resolve issues, minimizing downtime and operational disruptions.

Customization: Fidelity’s options are very flexible, enabling companies to customize their payment systems to meet their unique operational requirements. This adaptability is especially advantageous for companies with specific needs or those seeking to align with current systems.

Cons:

Complex Pricing Structure: While Fidelity offers various pricing models, some businesses might find the pricing structure complex and difficult to navigate. Understanding the different tiers, fees, and contract terms requires careful attention, which can be challenging for smaller businesses without dedicated financial expertise.

Contract Terms: Fidelity usually has contracts that last between one and three years and could have charges for ending the contract early. Long-term contracts and possible early termination fees may be a disadvantage for companies that value flexibility.

Lack of Transparency in Additional Fees: Some users have reported that additional fees, such as monthly service charges and PCI compliance fees, can be higher than anticipated. This lack of upfront transparency might lead to dissatisfaction among businesses, particularly those operating on tight margins.

Customer Feedback and Reputation

Fidelity Payment Services has a good reputation in the payment processing industry, serving a diverse customer base who values the company’s strong services and quick support. Yet, like all service providers, customer feedback includes both positive and negative comments, offering important information about the overall user experience.

General Customer Sentiment: Overall, customer sentiment towards Fidelity Payment Services is positive, particularly regarding the company’s reliability and security features. Many businesses commend Fidelity for its comprehensive payment solutions that cater to various industries, highlighting the ease of use and the flexibility of their systems. The company’s emphasis on security, including encryption and PCI compliance, is often noted as a significant advantage, especially for businesses handling sensitive financial data.

Overview of Reviews and Ratings on Various Platforms: Fidelity Payment Services has received positive ratings on various review platforms. Trustpilot and the Better Business Bureau (BBB) have given the company high ratings, indicating customer approval of their services. Customers often comment on the efficiency of Fidelity’s payment processing tools and the level of professionalism exhibited by their support teams. Nevertheless, a few reviews highlight occasional challenges in grasping the pricing system, which may be viewed as a minor disadvantage.

Commonly Reported Issues and Praises: Among the most commonly reported praises for Fidelity Payment Services is their exceptional customer support. Many users appreciate the 24/7 availability and the knowledgeable staff who assist with troubleshooting and resolving issues promptly. The positive aspect of the company being able to integrate with different business management systems is often highlighted, allowing businesses to streamline their operations effectively.

Some customers have raised issues about the pricing model’s complexity and undisclosed additional fees when they first signed the contract. These issues underscore the significance of carefully examining contract terms and requesting detailed explanations of potential expenses prior to making a commitment.

Conclusion

Fidelity Payment Services provides a wide variety of safe and customizable payment processing options, backed by excellent customer support and cutting-edge technology. Despite its complicated pricing, Fidelity is a solid option for businesses in need of dependable and adaptable payment solutions. Potential users should thoroughly examine contract conditions before making any commitments.

FAQs

What industries does Fidelity Payment Services cater to?

Fidelity Payment Services caters to various industries, including retail, hospitality, healthcare, and e-commerce. Their industry-specific solutions are designed to meet the unique needs of each sector, offering tailored features like inventory management for retail and secure billing for healthcare.

Are there any hidden fees with Fidelity Payment Services?

Fidelity Payment Services aims for transparency in its pricing. While they provide detailed pricing models, some users have noted the need to carefully review contract terms to fully understand potential fees like PCI compliance and early termination charges.

How does Fidelity Payment Services handle data security?

Fidelity employs robust security measures, including encryption, tokenization, and strict PCI DSS compliance. These safeguards are designed to protect sensitive payment data and prevent unauthorized access, ensuring that businesses can process transactions securely.