GDpay Review

- 16th Aug, 2024

- | By Linda Mae

- | Reviews

GDpay is a well-known provider of payment solutions offering a vast array of services designed to cater to various businesses’ needs. Their services include strong solutions such as point-of-sale systems, mobile payments, e-commerce integration, and additional features. Their emphasis on innovation, security, and customer education makes them stand out in the competitive payment processing sector. Let’s delve deeper into the GDpay Review.

Company Background | GDpay Review

GDpay was established with the goal of offering adaptable and trustworthy payment processing options for companies of varying sizes. The company focuses on putting the customer first, making sure that merchants can readily adjust to the evolving electronic payment environment. Throughout the years, GDpay has collaborated with leading industry processors to provide cost-effective and efficient services of high quality.

GDpay was established by Kevin Yox, who brought his extensive experience in the merchant services industry to create a debt-free, self-funded organization. The company’s guiding principles are based on meeting the needs of merchants and resellers, offering customized programs that cater to specific business needs.This approach has allowed GDpay to build a strong reputation and a loyal customer base.

GDpay aims to empower businesses with secure, innovative, and user-friendly payment solutions. Their goal is to become a top player in the payment processing sector through cutting-edge technology and excellent customer service. Their goal is to establish long-lasting connections with clients, agents, and employees by upholding integrity and transparency in all activities.

The leadership team at GDpay includes Kevin Yox, the founder, who has a background in the merchant services industry as an agent, public speaker, author, and website developer. Kevin’s dad, Craig Yox, came on board the company as a managing partner with a wealth of experience in computer service sales and support gained from working at Bell Atlantic, Control Data, and Sun Microsystems. Together, they have built a strong leadership team that focuses on training and supporting new agents, delivering superior customer service, and driving the company’s growth.

Services Offered

GDpay provides a comprehensive suite of payment solutions designed to cater to various business needs, ensuring secure and efficient transaction processing. Here’s an overview of their key services:

Merchant Services

GDpay allows businesses to accept payments through different channels by supporting credit and debit card processing. This consists of standard point-of-sale systems, online terminals, and mobile payment options. Their merchant solutions cater to both physical and virtual purchases, offering flexibility and convenience to businesses of any scale.

Payment Gateway Solutions

GDpay’s payment gateway solutions facilitate secure online payment processing. Their gateways include features like tokenization, fraud scoring, and secure hosted payment pages. These solutions are integrated with major e-commerce platforms and shopping carts, making it easy for businesses to manage online transactions and protect customer data.

Mobile Payments

Businesses can accept mobile payments on the move with GDpay’s solutions. This service comes with a mobile card reader that is encrypted, and a mobile app that can help with tracking inventory, capturing signatures, and sending receipts via email or printing. These attributes are especially advantageous for industries like retail and service that need mobility.

E-commerce Integration

It offers seamless integration with various e-commerce platforms, enabling businesses to accept online payments efficiently. Their e-commerce solutions include tools for managing shopping carts, customer data, and order processing. Additionally, GDpay supports multiple integration options, including APIs, to ensure compatibility with different business systems.

POS Systems

GDpay’s POS systems are equipped with advanced features such as inventory management, sales reporting, and customer loyalty programs. These cloud-based systems run on devices like iPads, offering small to medium-sized businesses powerful tools that were previously only available to larger enterprises. The POS systems support various payment methods, including EMV chip cards and NFC (contactless) payments.

Recurring Billing and Subscription Management

It offers strong recurring billing solutions for companies that provide subscription-based services. Included in these services are automated billing cycles, secure data storage, and real-time reporting. This makes sure that companies can effectively handle subscriptions and keep a steady cash flow.

Features and Benefits

It offers a range of features and benefits designed to ensure secure, efficient, and flexible payment processing for businesses.

Security Features

It is fully PCI compliant, adhering to stringent Payment Card Industry Data Security Standards (PCI DSS). This compliance ensures robust protection of cardholder data through encryption, tokenization, and fraud prevention tools. These security measures help safeguard sensitive information from unauthorized access and cyber threats, providing peace of mind for both businesses and their customers.

Speed of Transactions

GDpay prides itself on the speed and reliability of its transaction processing. With advanced technology and efficient infrastructure, It ensures that transactions are completed quickly, minimizing wait times and enhancing the customer experience. This speed is crucial for businesses that handle a high volume of transactions and need to maintain smooth operations.

Multi-Currency Support

GDpay provides businesses with the ability to accept payments in multiple currencies, making it suitable for those operating internationally. This functionality assists companies in serving customers from around the world, widening their market share, and streamlining the challenges of international transactions. It also helps in offering a smooth shopping experience for global customers.

User-Friendly Interface

GDpay’s user-friendly interface is designed to make payment processing simple and straightforward. The intuitive design ensures that both business owners and employees can navigate the system with ease, reducing the learning curve and minimizing errors. The interface provides easy access to essential features and real-time reporting, allowing businesses to manage their transactions efficiently.

Customization Options

GDpay understands that each business has unique needs, which is why they offer extensive customization options. Businesses can tailor the payment processing solutions to fit their specific requirements, whether it’s customizing the checkout process, integrating with existing systems, or adding specific features like loyalty programs and recurring billing. This flexibility ensures that GDpay’s solutions can grow and adapt alongside the business.

Pricing and Fees

GDpay provides a versatile pricing system to meet different business requirements, mainly using an interchange-plus model. The pricing model is viewed as clearer than tiered pricing because it distinguishes interchange fees paid to card-issuing banks from the markup added by GDpay. The interchange-plus model guarantees merchants pay the lowest rates possible, determined by the real cost of processing transactions.

Monthly Fees

GDpay charges a monthly fee of $6.95. This fee covers account maintenance and access to their comprehensive suite of payment processing services. Additionally, businesses may incur a monthly gateway fee of $24.95 if they utilize GDpay’s payment gateway services.

Transaction Fees

The transaction fees with GDpay vary depending on the type of transaction. Swiped transactions typically incur fees ranging from 1.00% to 4.99%, while keyed-in transactions also fall within this range. These rates reflect the interchange-plus pricing model, ensuring that fees are kept transparent and competitive.

Additional Fees

GDpay has a setup fee of $49.95 and an annual PCI compliance fee of $49.95 to ensure that businesses adhere to security standards. While GDpay does not impose early termination fees, there may be additional costs such as batch processing fees and equipment leasing fees, which merchants should consider when signing up.

Comparison with Competitors

GDpay stands out from other payment processors due to its clear interchange-plus pricing model and absence of early termination charges, giving it a competitive edge. Yet, certain rivals may provide reduced monthly charges or no setup fees, which may be more appealing to small businesses or startups. When selecting a payment processor, merchants need to evaluate these factors and take into account their individual requirements.

Overall, GDpay provides a comprehensive and transparent pricing structure that aligns well with industry standards, making it a reliable option for businesses looking for secure and efficient payment processing solutions.

Contract Terms

It offers flexible contract terms designed to cater to the needs of various businesses. Their standard contracts typically span three to five years, depending on the specific agreement. The three-year contracts are usually associated with First Data and First American Payment Systems, while five-year contracts are often linked with First Data (Fiserv) and TSYS.

Contract Length

The typical contract lengths for GDpay range from three to five years. This duration is designed to provide stability and ensure that businesses can fully utilize GDpay’s services and technology over an extended period. Longer contracts might come with additional benefits or lower fees, making them an attractive option for some businesses.

Early Termination Fees

One of the main benefits of GDpay is its approach to early termination charges. Normally, It does not have early termination fees, unlike numerous other payment processors, which is a major advantage. Nevertheless, there are instances where businesses in Arkansas under the TSYS contract may be subject to a $50 early termination fee. This flexibility enables businesses to review their choices without facing significant penalties.

Conditions for Contract Renewal

GDpay’s contracts typically include automatic renewal clauses. This means that unless a business explicitly cancels the contract before the end of the term, it will automatically renew under the same conditions. It is crucial for businesses to review the renewal conditions and communicate with GDpay if they wish to renegotiate terms or discontinue the service.

Customer Support

It is known for its robust customer support, ensuring that businesses have access to help whenever they need it. Their customer support is available 24/7, providing businesses with round-the-clock assistance for any issues that may arise. This continuous support is crucial for businesses that operate beyond regular business hours, ensuring that any problems can be addressed promptly.

Availability (24/7 Support, Business Hours)

GDpay offers 24/7 customer support, which includes both domestic phone support during business hours and offshore technical support after hours. This ensures that customers can always reach a support representative, no matter the time of day.

Support Channels (Phone, Email, Live Chat)

It offers phone, email, and a contact form on their website as support channels. While live chat is not mentioned, the provided channels are enough to manage different customer queries. Clients have the option to either contact the toll-free number for instant help or utilize email for issues that are not as pressing.

Quality of Support (Response Times, Expertise)

GDpay’s customer support is highly rated for its quality. Customers have reported that the response times are quick, and the support representatives are knowledgeable and helpful. The company prides itself on educating its clients, which means that support staff are well-trained to provide detailed and accurate information.

Customer Feedback and Reviews

Customer feedback for GDpay’s support services is generally positive. Reviews highlight the company’s commitment to excellent customer service, with many customers noting the prompt and efficient handling of their issues. The high ratings on various review platforms reflect GDpay’s dedication to maintaining strong customer relationships and providing reliable support.

Integration and Compatibility

GDpay stands out for its ability to seamlessly integrate with and be compatible with a wide range of platforms, making it a flexible option for businesses of any size. Their solutions are crafted to seamlessly integrate with well-known e-commerce platforms, allowing businesses to adopt GDpay’s services without making extensive changes to their current systems.

Compatibility with Various Platforms

GDpay is compatible with a wide range of e-commerce platforms, including Shopify, WooCommerce, Magento, and more. This compatibility ensures that businesses using these platforms can easily integrate GDpay’s payment processing solutions. By supporting these major platforms, GDpay enables merchants to offer smooth and secure transactions to their customers, enhancing the overall shopping experience.

API Documentation and Ease of Integration

GDpay offers detailed API documentation to assist developers with integrating their systems. The APIs are created to be easy for users, with straightforward guidance and illustrations that streamline the configuration process. Businesses can easily adopt GDpay’s payment solutions, leading to faster implementation and reduced technical challenges in setting up payment processing, resulting in minimal downtime.

Third-Party Software Compatibility

In addition to e-commerce platforms, GDpay is compatible with various third-party software applications. This includes accounting software like QuickBooks, CRM systems, and other business management tools. This broad compatibility allows businesses to integrate GDpay with their existing software ecosystem, ensuring that payment data flows seamlessly between different systems and improving operational efficiency.

User Experience

GDpay is committed to providing an exceptional user experience, ensuring that businesses can easily manage their payment processing needs through intuitive and powerful tools.

Ease of Setup and Onboarding

The setup and onboarding process of GDpay is created to be simple and easy-to-use. Businesses can easily begin with only a minimal amount of technical expertise necessary. The process of onboarding involves providing users with explicit guidance and assistance for navigating each stage, starting from setting up their account to incorporating payment systems. This guarantees that companies can start receiving payments smoothly with no major delays or complications.

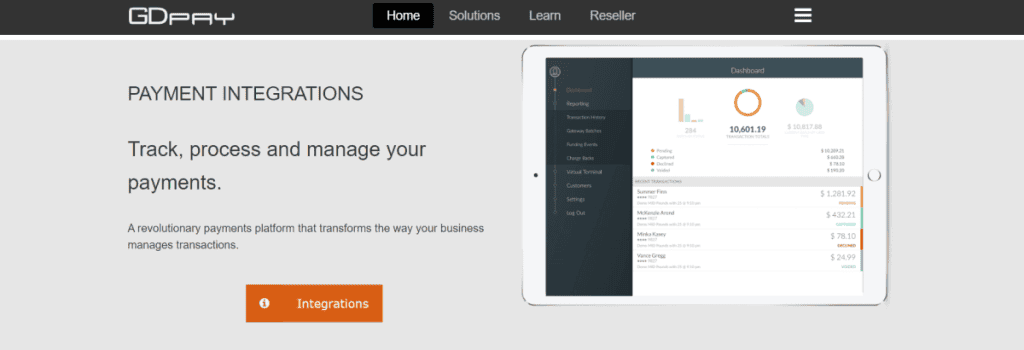

Dashboard and Reporting Tools

The GDpay dashboard is comprehensive and easy to navigate, offering a centralized location for businesses to manage their payment processing. It includes a variety of reporting tools that provide detailed insights into transaction history, sales trends, and customer behavior. These reports can be customized to meet specific business needs, enabling users to track key performance indicators and make informed decisions. The dashboard’s real-time data updates ensure that businesses always have the most current information at their fingertips.

Mobile App Functionality

GDpay also provides a strong mobile application that expands its features to both smartphones and tablets. The application enables businesses to conduct transactions while mobile, monitor sales, and oversee inventory. Functions like capturing signatures, sending email receipts, and supporting multiple devices improve the versatility and convenience of mobile payments. The app is created to be easy for users to use, making it accessible for people with little technical knowledge. This feature is especially advantageous for companies in fast-changing sectors like retail and service.

Pros and Cons

GDpay offers a variety of strengths and some areas that could be improved, making it a solid option for many businesses while also presenting some challenges.

Strengths of GDpay

Transparent Pricing: GDpay uses an interchange-plus pricing model, which is known for its transparency and fairness. This helps businesses understand exactly what they are paying for, without hidden fees.

No Early Termination Fees: Unlike many competitors, GDpay does not charge early termination fees for most of its contracts, providing flexibility and reducing the risk for businesses if they need to switch providers.

Comprehensive Security: GDpay is PCI compliant and offers robust security features such as tokenization and point-to-point encryption, which help protect sensitive customer data and reduce the risk of fraud.

Versatile Payment Solutions: The company offers a variety of payment options, such as credit cards, debit cards, mobile payments, and e-commerce solutions, to cater to different business requirements.

Strong Customer Support: GDpay is praised for its customer service, which includes 24/7 support and multiple channels of communication, ensuring that businesses can get help whenever they need it.

Areas for Improvement

Setup Fees: GDpay charges a setup fee, which can be a barrier for small businesses or startups with limited budgets.

Monthly Fees: The accumulated monthly account maintenance and gateway charges may bring up the overall cost of GDpay, potentially making it pricier than some competitors.

Long-term Contracts: Some of GDpay’s contracts are long-term, which might not be ideal for businesses that prefer more flexibility.

Public Pricing Transparency: While the pricing model is transparent, detailed pricing information is not always readily available on the website, which can make it difficult for businesses to quickly assess the cost.

Equipment Leasing: The non-cancelable equipment lease can be a disadvantage, particularly if businesses prefer to own their equipment outright or find better deals elsewhere.

In general, GDpay is a dependable payment processing provider with various strong points, particularly in security and customer service, although there are also areas for enhancement in order to cater to a broader array of businesses.

Conclusion

GDpay is a dependable payment processor for different business types, offering clear pricing, strong security, and excellent customer support. Nevertheless, some people may find the setup fees and lengthy contracts to be disadvantages. In general, GDpay is a good fit for companies in need of thorough and safe payment options with great assistance.

FAQs

What is the pricing structure of GDpay?

GDpay utilizes an interchange-plus pricing structure, which provides clarity by differentiating interchange charges and the processor’s markup. A monthly fee, setup fee, and different transaction fees are all part of the charges. Furthermore, most contracts do not incur early termination fees, allowing businesses to have flexibility.

How secure are transactions with GDpay?

Transactions with GDpay are highly secure due to their PCI compliance, tokenization, and point-to-point encryption. These measures help protect sensitive customer data and prevent fraud, ensuring a secure payment processing environment.

Does GDpay support international payments?

Yes, GDpay supports international payments with multi-currency support. This allows businesses to accept payments in various currencies, facilitating global transactions. Additional fees may apply for currency conversion and international transactions.