Instabill Review

- 15th Jan, 2025

- | By Linda Mae

- | Reviews

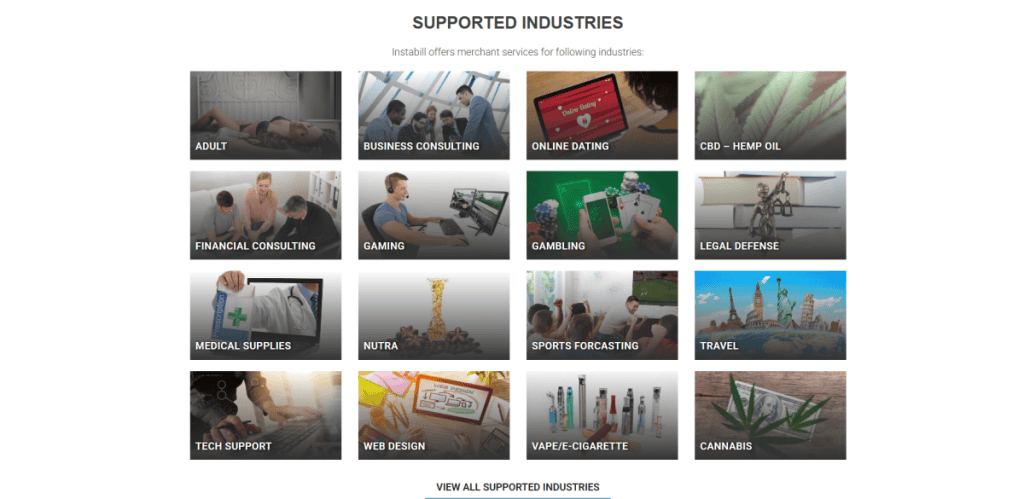

Instabill is a well-established payment solutions provider known for its focus on high-risk merchant accounts and offshore payment processing. In an industry where businesses in certain sectors struggle to obtain reliable merchant services, Instabill has carved out a niche by offering tailored solutions for these high-risk enterprises. Founded in 2001, Instabill has gained a reputation for providing secure and dependable services, catering to merchants across a variety of industries such as adult entertainment, online gambling, pharmaceuticals, CBD, travel, and more. Lets read more about Instabill Review.

High-risk enterprises frequently encounter challenges in obtaining conventional banking services due to the nature of their activities, elevated chargeback ratios, or regulatory complications. This is where Instabill comes into play, providing a connection between high-risk merchants and acquiring banks. With years of experience, Instabill establishes itself as a trustworthy ally for companies seeking to manage the challenges of high-risk merchant services.

Company Background | Instabill Review

Instabill was founded in 2001 with the goal of providing payment processing solutions to businesses that fall into high-risk categories. Headquartered in Portsmouth, New Hampshire, the company has built strong partnerships with acquiring banks worldwide, enabling it to offer both domestic and offshore merchant accounts. Over the years, it has expanded its services and now caters to businesses in over 100 countries.

A major distinction for Instabill is its emphasis on high-risk sectors. Although conventional financial institutions frequently avoid these sectors, it has welcomed them by creating a solid infrastructure and nurturing connections with banks that are open to collaborating with high-risk merchants. This strategy has enabled the company to expand consistently and build a strong reputation in the sector.

Instabill’s management team brings decades of experience in the payment processing industry, which has helped the company stay ahead of market trends and regulatory changes. Their expertise in navigating complex international banking regulations and compliance requirements has made Instabill a trusted partner for many high-risk businesses. Additionally, the company’s commitment to providing personalized service through dedicated account managers has contributed to its success.

Despite being a relatively small player compared to some of the larger payment processors, it has managed to maintain a strong foothold in the high-risk merchant services space. Its ability to adapt to changing industry dynamics and consistently deliver quality service has been key to its longevity.

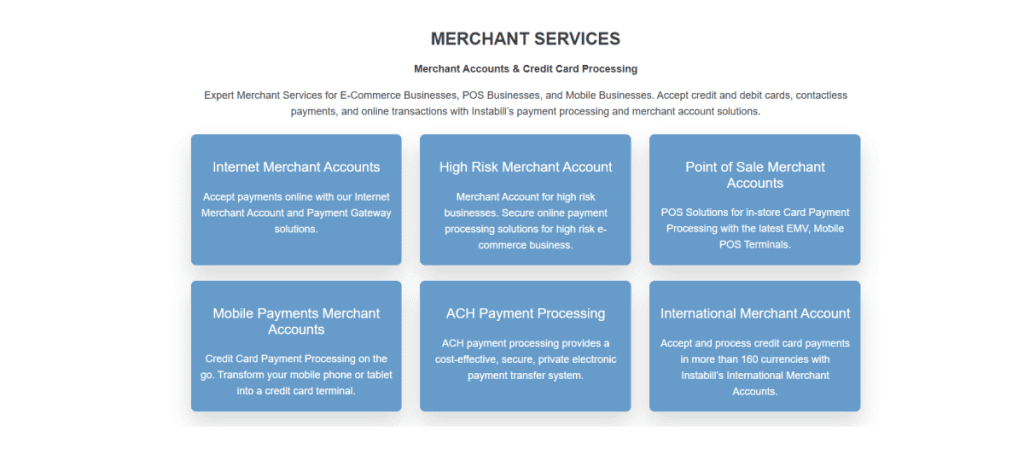

Core Services Offered by Instabill

High-Risk Merchant Accounts

Instabill specializes in providing high-risk merchant accounts for businesses that are typically turned away by conventional financial institutions. High-risk businesses include those in industries such as online gaming, adult entertainment, nutraceuticals, and travel. These businesses often face higher chargeback rates, regulatory scrutiny, and industry-specific risks, making it difficult for them to secure payment processing services.

Instabill collaborates with a network of both domestic and international banks that are prepared to support high-risk accounts. Instabill enables businesses to diversify their payment processing and minimize the risk of service interruptions by providing both domestic and offshore options. This is especially crucial for high-risk merchants because losing a merchant account can significantly affect cash flow and operations.

Credit Card Processing Solutions

Credit card acceptance is critical for most businesses, especially those operating online. Instabill provides comprehensive credit card processing solutions that support major card networks, including Visa, MasterCard, American Express, and Discover. The company’s solutions are designed to handle high transaction volumes while ensuring security and compliance.

In addition to traditional credit card processing, Instabill also offers support for alternative payment methods, which can help businesses expand their customer base. These include e-wallets, ACH transfers, and direct debit solutions. By offering multiple payment options, Instabill ensures that businesses can cater to a global audience.

Payment Gateway Integration

Instabill offers a dependable and secure payment gateway that integrates effortlessly with the majority of e-commerce platforms. The gateway accommodates various currencies, making it perfect for companies with a global clientele. Safety is a primary concern, and the gateway complies with PCI-DSS standards, guaranteeing the protection of sensitive customer information.

The payment gateway also offers advanced features such as recurring billing, fraud detection, and chargeback management. These features are particularly useful for high-risk businesses, as they help mitigate the risks associated with processing payments in volatile industries.

Offshore Merchant Services

For businesses looking to expand their reach globally, offshore merchant accounts can provide significant benefits. Instabill offers offshore merchant services that enable businesses to process payments in multiple currencies and access international markets. Offshore accounts also come with the advantage of lower tax burdens and reduced regulatory requirements in certain jurisdictions.

By partnering with banks in regions such as Europe, Asia, and the Caribbean, Instabill provides businesses with a range of options to choose from. This flexibility allows businesses to find the best fit for their needs and optimize their payment processing operations.

Application and Approval Process

Instabill has a well-defined application and approval process designed to cater specifically to high-risk merchants. Unlike traditional financial institutions, which may have rigid requirements and lengthy approval timelines, Instabill offers a more streamlined approach to ensure that high-risk businesses can start accepting payments quickly.

The application process starts with an initial consultation where companies share essential details about their activities, such as the type of industry, anticipated monthly sales volume, and target geographic areas. Using this preliminary information, Instabill assesses the risk profile of the business and pairs it with an appropriate acquiring bank from its vast network.

Once a preliminary match is made, businesses are required to submit additional documentation, such as:

Business registration certificates

Bank statements (typically for the last three to six months)

Processing history (if applicable)

Valid identification of business owners

After the documentation is reviewed, Instabill works closely with the acquiring bank to finalize the approval. The entire process typically takes anywhere from one to three weeks, depending on the complexity of the business and the responsiveness of the merchant. Factors that may influence the approval timeline include the nature of the business, regulatory considerations, and the completeness of the submitted documentation.

A significant aspect of Instabill’s approach is the customized support offered by its account managers. Every merchant is allocated a specific account manager who assists them during the application procedure, addresses inquiries, and aids in solving any problems that may occur. This degree of assistance can be especially advantageous for high-risk companies that might not be well-versed in the complexities of merchant account applications.

Overall, Instabill’s application and approval process is designed to be transparent, efficient, and accommodating, making it an attractive option for businesses in need of high-risk payment solutions.

Pricing and Fees

Pricing is a vital factor for any company assessing a payment processor, and high-risk merchant accounts usually incur greater fees than standard accounts. Instabill’s pricing model is customized according to the unique requirements and risk assessments of its clients, resulting in fees that can differ considerably among merchants.

Common fees associated with Instabill’s services include:

Account Setup Fees

Most high-risk merchant account providers charge an upfront fee to cover the cost of setting up the account. Instabill’s setup fees are generally competitive, but they may vary depending on the complexity of the account and the industry in which the business operates.

Transaction Fees

Transaction fees are generally stated as a percentage of every sale, in addition to a set fee for each transaction. For accounts deemed high-risk, these fees typically exceed those for low-risk accounts, indicating the extra risk taken on by the acquiring bank. Instabill collaborates with its banking partners to provide competitive rates; however, merchants can anticipate transaction fees between 3% and 5%, based on their industry and processing history.

Monthly Maintenance Fees

Instabill charges a monthly maintenance fee to cover the ongoing costs of account management and support. This fee is usually fixed and is designed to provide merchants with access to customer support and account management services.

Chargeback Fees

Chargebacks pose a frequent challenge for high-risk merchants, and most acquiring banks impose a fee for every chargeback handled. Instabill’s fees for chargebacks align with industry norms, generally falling between $20 and $50 for each chargeback. The company provides chargeback management services to assist merchants in minimizing the occurrence and effects of chargebacks.

Other Fees

Depending on the specific needs of the business, Instabill may charge additional fees for services such as recurring billing, multi-currency processing, and fraud prevention tools. It is important for merchants to carefully review their contract and ask for a detailed breakdown of all applicable fees before signing up.

While Instabill’s fees may be higher than those of standard payment processors, this is to be expected given the nature of high-risk merchant accounts. Overall, the company’s pricing is competitive within the high-risk payment processing industry, and its transparent approach to pricing helps merchants avoid unexpected costs.

Customer Support

Customer support is a vital component of any payment processing service, especially for high-risk merchants who may encounter complex issues related to transactions, chargebacks, and compliance. Instabill places a strong emphasis on providing high-quality customer support, which is evident in its dedicated account management model.

Merchants collaborating with Instabill receive a dedicated account manager who serves as their main contact person. This tailored method guarantees that merchants obtain reliable and knowledgeable support during their interactions with the business. Account managers possess a deep understanding of the complexities involved in high-risk payment processing and are adept at addressing various inquiries, from technical problems to strategic guidance on handling chargebacks and minimizing transaction risks.

Instabill offers multiple support channels, including phone, email, and live chat. The availability of phone support is particularly beneficial for merchants who require immediate assistance. Additionally, the company’s support team is available during business hours to address urgent concerns.

User feedback on Instabill’s customer support is generally positive, with many merchants praising the responsiveness and professionalism of the support staff. The dedicated account manager model is frequently highlighted as a key advantage, as it allows merchants to build a relationship with a knowledgeable support representative who understands their business needs.

However, some users have reported occasional delays in response times, particularly during peak periods. While this is not uncommon in the industry, it is an area where Instabill could potentially improve by expanding its support team or extending support hours.

In general, Instabill’s customer support stands out, especially for high-risk merchants who gain from the tailored assistance offered by specialized account managers. The organization’s dedication to customer satisfaction is clear in its support framework, which aims to assist merchants in effectively handling the difficulties of high-risk payment processing.

Final Verdict

Instabill stands out as a reliable and experienced provider of high-risk merchant accounts and payment processing solutions. Its ability to cater to businesses in challenging industries, combined with a strong network of domestic and offshore banking partners, makes it a valuable option for merchants seeking specialized services. The company’s personalized customer support, flexible payment options, and robust payment gateway are significant advantages that set it apart from competitors.

Nonetheless, Instabill does have its drawbacks. The elevated fees linked to high-risk accounts and the periodic delays in customer support responses are aspects where the company can enhance its service. Furthermore, merchants need to recognize the possibility of fluctuating prices depending on their risk profile and sector.

Overall, for businesses that operate in high-risk sectors and require a dependable partner to handle their payment processing needs, Instabill is a strong contender. While there are areas for improvement, the company’s extensive experience and commitment to supporting high-risk merchants make it a worthwhile choice.

FAQs

Q1: What types of businesses are eligible for an Instabill merchant account?

Instabill primarily serves high-risk businesses that may face challenges in obtaining merchant accounts from traditional financial institutions. These include industries such as online gaming, adult entertainment, CBD, pharmaceuticals, travel, and nutraceuticals.

Q2: How long does it typically take to get approved for an Instabill merchant account?

The approval process usually takes one to three weeks, depending on the complexity of the business and the completeness of the documentation provided. Instabill’s dedicated account managers work closely with merchants to ensure a smooth and efficient application process.

Q3: Are there any upfront costs associated with opening an account with Instabill?

Yes, Instabill typically charges an account setup fee, which may vary depending on the nature of the business and the level of risk involved. Merchants are advised to request a detailed breakdown of all fees before signing up to ensure transparency.