MSH Merchant Services Review

- 05th Aug, 2024

- | By Linda Mae

- | Reviews

MSH Merchant Services is a well-known payment processing firm that provides various electronic payment solutions to businesses of any size nationwide. The company focuses on credit card processing and accepts popular credit cards like Visa, Mastercard, American Express, and Discover. Moreover, MSH offers services for cashing checks, Electronic Benefits Transfer, loyalty cards, and Automated Teller Machine services. Lets read more about MSH Merchant Services Review.

Company Background | MSH Merchant Services Review

MSH Merchant Services was founded to address the diverse payment processing needs of merchants. The company operates as an Independent Contractor Sales Organization and collaborates with multiple payment processors to offer customized solutions for various industries, such as retail, hospitality, healthcare, and petroleum sectors. MSH’s collaborative approach allows the company to provide a range of services for efficient and secure payment transactions for its clients.

MSH Merchant Services is headquartered in Westlake, Ohio, specifically located at 29299 Clemens Rd. Unit 1-N. From this base, the company extends its expert processing services nationwide. The strategic location in Ohio allows MSH to effectively serve businesses across the country, ensuring that merchants have access to reliable and innovative payment processing solutions. The company’s primary operations focus on delivering seamless and secure payment processing services, enabling merchants to accept various forms of payments effortlessly.

Services and Features

MSH Merchant Services offers a comprehensive suite of payment processing solutions designed to meet the needs of businesses across various industries. Below is an overview of the primary services and features provided by MSH Merchant Services.

Payment Services

MSH Merchant Services facilitates secure payment processing for all major credit cards, including Visa, Mastercard, American Express, and Discover. The simple signup process allows merchants to set up their payment systems and start accepting payments as quickly as possible. The flexibility to accept payments both online and in-person ensures that businesses can cater to their customers’ preferences, enhancing the overall shopping experience.

Check and EBT Services

MSH Merchant Services also provides solutions for accepting check payments and Electronic Benefits Transfer services. Merchants can offer more payment methods with the integration of these options, catering to customers who prefer using checks or EBT. This service eliminates the need for separate accounts for check payments, streamlining the payment process for businesses.

Loyalty Cards

MSH Merchant Services provides loyalty card programs to help businesses foster customer loyalty. Merchants can track how much customers spend, offer discounts, and reward them for repeat purchases.. Loyalty cards can also be used to send promotions and manage rewards programs, providing an effective way to maintain customer engagement and satisfaction.

ATM Services

MSH Merchant Services offers ATM services that allow merchants to provide additional convenience to their customers. It helps facilitate cash withdrawals and accepts all major debit cards and PIN-based cards. These ATM services can prove beneficial in retail environments where customers may need cash access.

Rates and Fees

MSH Merchant Services offers a range of payment processing solutions, but its pricing structure and associated fees present several challenges for potential clients.

Unclear Pricing Structure: One of the major issues with MSH Merchant Services is the lack of public information about their rates and fees. The absence of a detailed breakdown of costs on its website makes it challenging for merchants to understand the financial commitments involved. This lack of transparency can lead to unexpected charges, which can be a major concern for businesses managing tight budgets. For instance, processing rates can vary widely from 1.00% to 4.99%, depending on the transaction type and volume.

Sparse Information: In addition to unclear pricing, there is limited information available about the specific services offered by MSH Merchant Services. The website does not provide detailed descriptions or comparisons, making it challenging for potential clients to evaluate and compare their options with other payment processors. This lack of detailed information can hinder businesses from making informed decisions about their payment processing needs.

Undisclosed Equipment Lease Terms: MSH Merchant Services also fails to disclose the terms regarding equipment leases. While they might offer low upfront rates for leasing equipment, the overall cost and any additional fees remain ambiguous. For example, merchants might find themselves locked into long-term leases with high monthly payments, which can significantly increase the overall cost of using the service.

Undisclosed Termination Fee: Another area of concern is the undisclosed termination fee. Without clear information on how much it costs to terminate a contract early, merchants may face significant financial penalties if they decide to switch providers. This hidden fee can be a substantial burden for businesses seeking flexibility in their payment processing arrangements. Early termination fees can sometimes range from several hundred to thousands of dollars, depending on the contract terms.

Unclear PCI Compliance Charges: The lack of disclosed charges for PCI compliance is a problem for merchants using MSH Merchant Services. PCI compliance is crucial for protecting customer data and ensuring secure transactions. However, if the costs associated with compliance are not transparent, merchants may incur additional, unexpected expenses. These charges can sometimes be as high as $100 to $200 annually, which can add to the overall operational costs for businesses.

In summary, while MSH Merchant Services provides a variety of payment processing solutions, the lack of transparency in their pricing and fee structure can pose significant challenges for merchants. Businesses considering MSH Merchant Services should seek detailed information and clarification on all potential costs to make well-informed decisions and avoid unforeseen financial burdens.

Contract Terms

Businesses must understand the contract terms of the company to avoid any unforeseen costs and complications in the future. MSH Merchant Services, like many in the industry, has specific terms and conditions that merchants should be aware of before committing.

Standard Contract Length: MSH Merchant Services typically requires merchants to sign a standard contract that usually spans several years, often three years. These contracts frequently include automatic renewal clauses, which means that unless the merchant provides notice within a specific period before the end of the term, the contract will automatically renew for another term. This renewal period can sometimes catch merchants off guard, binding them to additional years of service unless they are diligent about termination deadlines.

Early Termination Fees: One of the critical aspects of MSH Merchant Services contracts is the early termination fee. If a merchant decides to end the contract before the agreed term, they may face substantial penalties. These fees can range from a few hundred to several thousand dollars, depending on the terms outlined in the contract. This is a significant consideration for businesses that may foresee changes in their processing needs or potential dissatisfaction with the service. Compared to industry standards, these fees can be relatively high, reinforcing the need for merchants to thoroughly review and understand the termination conditions.

Equipment Lease Agreements: MSH Merchant Services also includes equipment lease agreements as part of their contracts. The terms and conditions of these leases often lack transparency, leaving merchants uncertain about the total costs involved. Typically, these agreements require merchants to lease point-of-sale terminals and other necessary equipment for the duration of the contract. The responsibilities of the merchant include maintaining the equipment and covering any additional fees that might arise from the lease. Understanding the full financial implications of these lease agreements is crucial for avoiding unexpected expenses.

Service Level Agreements (SLAs): Service Level Agreements (SLAs) provided by MSH Merchant Services outline the expected performance and uptime of their services. These agreements ensure that merchants can rely on a certain level of service quality and availability. SLAs typically cover aspects such as transaction processing times, system uptime, and customer support response times. Having a clear SLA is essential for businesses to understand the reliability of the service and to have recourse in case the service levels are not met.

While MSH Merchant Services offers a range of beneficial features, it is vital for merchants to carefully review and understand the contract terms, including the standard contract length, early termination fees, equipment lease agreements, and SLAs. This due diligence can help businesses avoid unexpected costs and ensure that they select a payment processing provider that aligns with their operational needs.

Customer Support and Sales Approach

It is crucial for potential clients to understand the customer support and sales tactics offered by MSH Merchant Services. Here’s a detailed look at these aspects:

Sales Approach: MSH Merchant Services has received mixed reviews about its sales tactics, with reports indicating the use of aggressive sales strategies. Prospective customers have reported feeling pressured into signing contracts quickly without fully understanding the terms and conditions. This aggressive approach can lead to issues with transparency of fees and features. Customers have also reported that representatives haven’t provided clear information about service costs, which has led to unexpected costs. This lack of transparency can make it challenging for businesses to make informed decisions about their payment processing needs.

Customer Support: MSH Merchant Services has received an A+ rating from the Better Business Bureau (BBB) for its customer support. The company has a positive reputation for resolving customer issues. Despite this high rating, customer support can be improved, as some customers have reported slow response times and difficulties in resolving issues.

The company provides multiple support options, including a general customer service number, a support form on their website, and an email contact. However, the effectiveness and efficiency of these support channels have been questioned by some users. For instance, while the BBB rating suggests a good overall performance, individual experiences with customer support can vary significantly, with some customers expressing frustration over the lack of timely assistance.

MSH Merchant Services has a strong BBB rating and provides several support channels. However, its aggressive sales tactics and transparency issues with fees and features can be an issue for potential customers. Businesses must carefully consider and review the terms and conditions and understand the fees to avoid any issues in the future. It is also advisable to evaluate the customer support experiences of other users to get a more comprehensive view of what to expect.

Employee Reviews and Workplace Environment

Potential employees and clients can gain insight by understanding the workplace environment and job opportunities provided by MSH Merchant Services.

Job Opportunities

MSH Merchant Services markets itself primarily through its website, offering detailed information about its services and career opportunities. There is limited evidence of the company using independent sales agents extensively, which suggests that their marketing strategy might rely more on direct engagement through online channels rather than third-party sales forces. This approach can help maintain control over brand messaging and customer interactions, although it might limit the reach compared to a broader network of independent agents.

Marketing Strategy

The company’s marketing strategy involves the use of its website and partnering with ISOs and MSPs. However, the specifics of these partnerships and the effectiveness of these collaborations are unclear. This strategy has an influence on the overall reach and effectiveness of their marketing efforts and the way potential clients and employees view the company.

Employee Satisfaction and Transparency

Employee reviews of MSH Merchant Services indicate a mixed but generally positive working environment. On platforms like Glassdoor and Indeed, employees often mention a supportive workplace with good team collaboration and reasonable work-life balance. However, some reviews point out areas where the company could improve, such as clearer communication regarding job expectations and more competitive compensation packages.

Transparency within the company is another area where feedback varies. While some employees feel well-informed and supported, others suggest that there could be better clarity and openness regarding company policies and career advancement opportunities. MSH Merchant Services can become a more attractive place to work and improve employee satisfaction and retention by addressing these concerns.

MSH Merchant Services offers job opportunities primarily through direct marketing on their website and partnerships. While employee satisfaction is generally positive, there are areas for improvement in transparency and communication. Prospective employees should consider these factors and seek further information during the interview process to ensure alignment with their career expectations and goals.

Legal Issues and Industry Reputation

It is crucial for businesses to understand the legal standing and industry reputation of MSH Merchant Services before opting for the company’s services. This section will delve into the company’s legal history, current standing, and potential future risks.

Lawsuits and Fines

MSH Merchant Services has maintained a relatively clean legal record with no major lawsuits or fines reported against them. This absence of significant legal issues suggests a level of compliance with industry standards and regulatory requirements. Maintaining a clean legal record helps build trust and credibility among clients, which is crucial in the competitive field of payment processing.

Current Legal Standing and History

MSH Merchant Services enjoys an A+ rating from the Better Business Bureau (BBB), which reflects positively on their customer service and business practices. This high rating indicates that the company has successfully resolved customer complaints and maintained good business practices. Additionally, the lack of complaints filed against MSH Merchant Services further supports their strong standing in the industry.

Potential Risks for Future Regulatory Scrutiny

While MSH Merchant Services currently has a good reputation, it is important for businesses to remain vigilant about potential future risks. The payment processing industry is subject to increasing regulatory scrutiny, particularly concerning data security and compliance with Payment Card Industry Data Security Standard (PCI DSS) requirements. As regulations evolve, MSH Merchant Services will need to continuously update their compliance measures to avoid potential fines and legal challenges.

Due to the ever-changing regulatory landscape, payment processors are constantly at risk of being affected by new laws or regulations. Businesses need to keep up with changes in the law that may impact MSH Merchant Services and make sure their own procedures are in line with up-to-date compliance standards.

MSH Merchant Services has a strong legal standing with no significant lawsuits or fines and an excellent BBB rating. However, businesses should remain aware of the evolving regulatory landscape and the potential risks of future scrutiny. This proactive approach can help mitigate any unexpected legal or compliance issues that may arise.

Pros and Cons of MSH Merchant Services

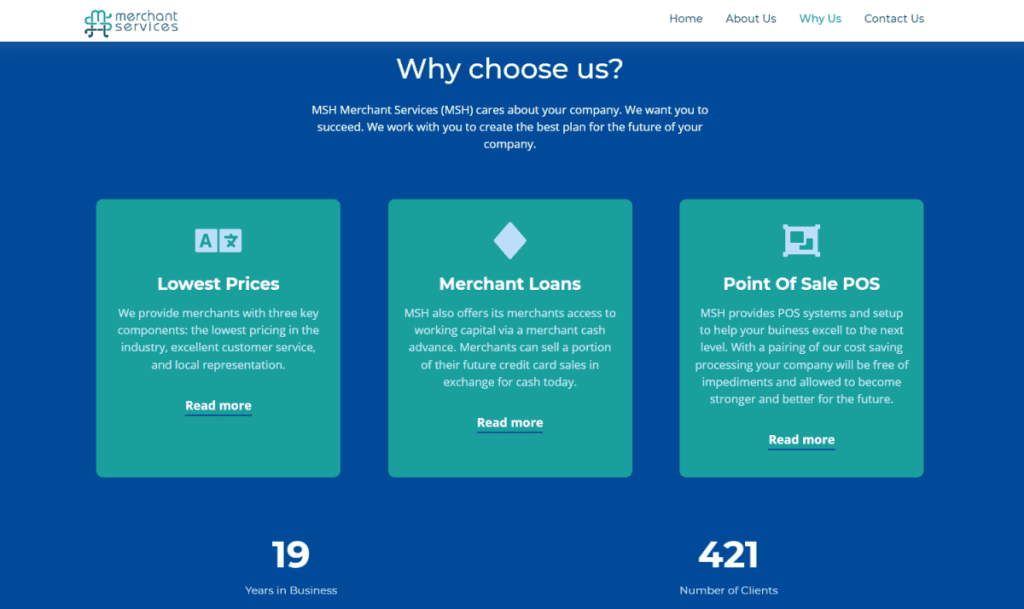

It is important to take into account both the benefits and possible drawbacks when assessing MSH Merchant Services. This well-rounded perspective can assist companies in making informed choices about whether this payment processor aligns with their requirements.

Pros

Wide Range of Payment Processing Options: MSH Merchant Services offers a variety of payment processing solutions, including credit card processing, check payments, and Electronic Benefits Transfer (EBT) services. This wide range ensures that businesses can cater to different customer preferences, enhancing overall customer satisfaction.

Loyalty and ATM Services: MSH offers loyalty card programs that enable companies to incentivize returning customers and foster loyalty with special offers and discounts. Furthermore, their ATM services allow businesses to provide cash withdrawal choices, especially helpful in retail settings.

A+ BBB Rating with Minimal Complaints: The company maintains an A+ rating from the Better Business Bureau (BBB), indicating a high level of customer satisfaction and effective resolution of complaints. This rating reflects well on their commitment to customer service and reliability.

Flexible Solutions for Various Industries: MSH Merchant Services offers tailor-made payment solutions that cater to various industries such as retail, hospitality, and healthcare, meeting their specific requirements. Their versatility allows them to be a suitable option for numerous businesses.

Cons

Lack of Transparency in Pricing and Contract Terms: One of the main criticisms of MSH Merchant Services is the lack of transparency regarding their pricing and contract terms. They do not publicly disclose their rates, fees, or contract details, which can lead to unexpected charges and make it difficult for businesses to fully understand their financial commitments.

Reports of Aggressive Sales Tactics: MSH Merchant Services representatives have reportedly used aggressive sales tactics. Certain clients have experienced being coerced into agreeing to contracts before receiving complete information, resulting in unhappiness and possible future problems.

Limited Information on Website: The company’s website provides limited information about the services offered and the specifics of their pricing structure. This lack of detailed information can make it challenging for potential customers to compare MSH Merchant Services with other payment processors.

Potential Hidden Fees (Termination, PCI Compliance): MSH Merchant Services has been noted for potentially having hidden fees, including early termination fees and charges related to PCI compliance. These undisclosed fees can add up and significantly impact the overall cost of using their services, making it crucial for businesses to seek clarity before signing any agreements.

Businesses should be careful about the potential for hidden fees and the lack of transparent pricing, although MSH Merchant Services offers various payment processing options and has a strong BBB rating. It is recommended to carefully examine all the terms of the contract and obtain in-depth information in order to prevent any unexpected expenses.

Conclusion

MSH Merchant Services provides thorough payment processing options and excels in various services and customer reward programs. Nonetheless, the absence of clarity in pricing and contract terms is a disadvantage. In general, the company holds a solid industry stance with an A+ BBB rating, which makes it a suitable choice for numerous businesses.