National Bankcard Review

- 07th Sep, 2025

- | By Linda Mae

- | Reviews

National Bankcard is a well known merchant services provider in the US serving small businesses, e-commerce merchants and larger enterprises that need secure payment processing. With so many providers out there it can be hard to tell one from another. National Bankcard has built their reputation on offering a wide range of solutions to simplify transactions and give businesses the tools to accept payments efficiently. This review takes a closer look at the company’s services, highlighting strengths and weaknesses to guide decision-making. Lets read more about National Bankcard Review.

Instead of focusing on marketing claims, this review looks at National Bankcard’s history, pricing, hardware, security standards, customer support and overall usability. By breaking down each major component of their services businesses can see how it compares to other providers and if the features are worth the cost. For businesses looking for a payment processor transparency and reliability are as important as competitive rates. National Bankcard has some good things to offer but also some areas to be cautious about.

Table of Contents

ToggleCompany Overview and Background | National Bankcard Review

National Bankcard has been in the payments industry for years, providing merchants with credit card processing and point-of-sale solutions. They position themselves as a one-stop shop, helping businesses navigate the complex payment networks without having to deal with multiple vendors. Their client base includes brick-and-mortar retailers, restaurants, e-commerce stores and mobile service providers so they are flexible across industries.

The financial technology landscape has changed a lot in the last 10 years with a focus on digital payments, mobile acceptance and integrated platforms. National Bankcard has kept up by moving from traditional terminal processing to online gateways and mobile payment support. This means businesses of all sizes can find a solution, whether they need countertop hardware, an e-commerce cart plug-in or a portable reader.

One thing that appeals to new clients is the company’s attempt to balance established reliability with new technology. While some competitors only target startups or large corporations, National Bankcard markets themselves to a wide range. This can be helpful but also means they may not always be the best fit for highly niche businesses. Understanding their broad market position gives context to the details of their services below.

Core Services Offered

National Bankcard’s core services are all about getting businesses to accept payments fast and securely. At the heart of the company is credit and debit card processing for Visa, Mastercard, American Express and Discover. Beyond card acceptance the company offers check processing, gift card programs and loyalty solutions. These additional services give businesses more revenue streams and customer retention.

For physical storefronts National Bankcard provides POS systems and countertop terminals. These are designed for industries like restaurants and retail where high volume and fast checkout is key. For online businesses the company’s e-commerce payment gateway provides integration with major platforms, recurring billing and fraud detection tools.

Mobile acceptance is another key service, allowing businesses to take payments via smartphone or tablet with portable readers. This is great for service providers, delivery businesses and merchants at trade shows or temporary locations. And National Bankcard has reporting and analytics tools so merchants can track sales, monitor chargebacks and see trends.

Overall the breadth of services shows the company is trying to cover all bases rather than focus on one channel. This is good for businesses that want flexibility across online and offline. But it also means the depth of specialization may vary with some services having more advanced features than others.

Payment Gateway and Online Solutions

E-commerce continues to grow, and National Bankcard provides merchants with a dedicated payment gateway that connects online stores to secure processing networks. The gateway supports recurring billing, tokenization for customer data, and shopping cart integration with widely used platforms. For businesses selling subscriptions or digital goods, recurring billing can streamline operations by reducing the need for manual invoicing.

Fraud prevention tools are included, helping businesses detect suspicious transactions before they are finalized. While these features are not unique to National Bankcard, having them bundled is valuable for merchants concerned about chargebacks or fraudulent orders. The gateway also provides reporting dashboards, giving insights into transaction history, settlement times, and customer activity.

Another aspect worth noting is compatibility. Many merchants look for processors that can easily connect with WooCommerce, Shopify, Magento, and other e-commerce platforms. National Bankcard offers this support, but integration may still require technical setup or developer assistance depending on the complexity of the store. While not a deal-breaker, it can be a consideration for smaller businesses without in-house technical staff.

The payment gateway is functional and provides the expected features, though it does not necessarily stand out with groundbreaking innovation. Merchants evaluating it should consider whether the available tools are sufficient for their needs compared to more specialized e-commerce processors.

POS Systems and Hardware Options

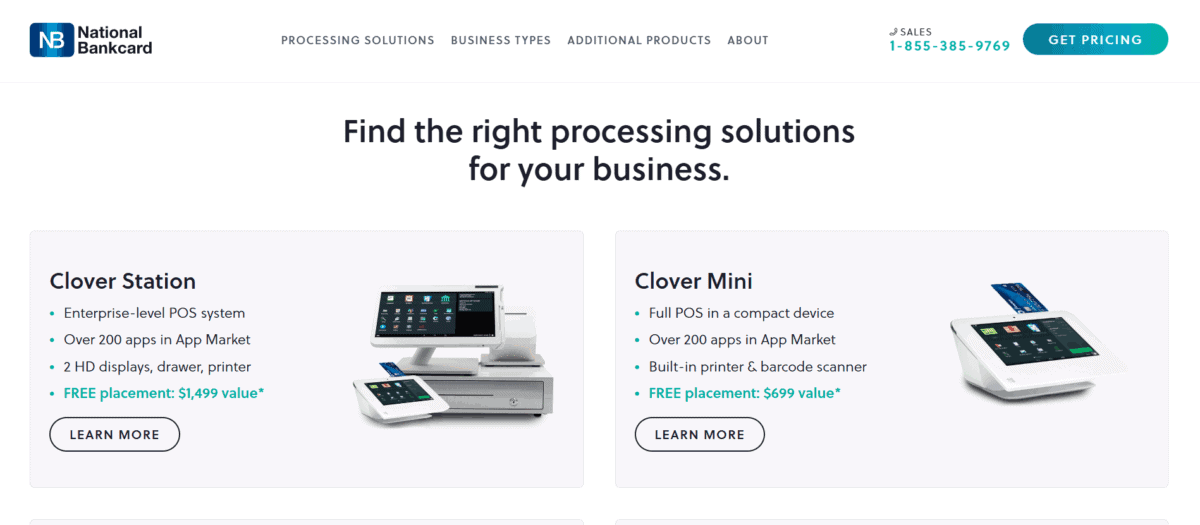

Point-of-sale systems remain at the heart of in-person business operations, and National Bankcard provides several hardware choices. Traditional countertop terminals are available for businesses that want simple swipe, chip, or tap acceptance. These terminals are reliable and familiar to most staff, making training straightforward. For more complex needs, the company offers integrated POS systems with inventory tracking, staff management, and sales reporting.

Restaurants can access systems designed to handle multiple orders, tipping, and table management. Retailers may prefer POS units with barcode scanning and receipt printing. For mobile businesses, portable terminals and wireless readers provide flexibility to accept payments outside of a fixed location. The variety ensures that businesses can match equipment to their specific workflows.

Hardware reliability is critical because downtime directly impacts revenue. National Bankcard supplies hardware from established manufacturers, reducing the risk of malfunctions, though ongoing support and replacement policies can vary. Merchants should clarify warranty coverage and potential rental fees before committing.

While the equipment options are comprehensive, some competing providers now emphasize all-in-one smart terminals with advanced touchscreen interfaces. National Bankcard’s catalog includes both modern and traditional devices, but its emphasis is on proven reliability rather than cutting-edge innovation. Businesses must decide whether they value stability over novelty when selecting hardware.

Mobile and Contactless Payments

As consumers increasingly expect speed and convenience, mobile and contactless payments have become essential. National Bankcard provides merchants with mobile card readers compatible with smartphones and tablets. These readers support EMV chip cards and NFC contactless payments such as Apple Pay and Google Pay. For businesses that operate on the move; delivery services, home repair providers, or pop-up retailers; this feature makes a notable difference.

The company also offers apps that connect mobile devices to its processing network. Through the app, merchants can manage transactions, view basic reporting, and issue refunds. While the features may not be as advanced as some standalone mobile POS providers, they provide enough functionality for small businesses to handle daily operations.

Contactless acceptance has become more relevant in the wake of consumer demand for safer, touch-free payment options. National Bankcard’s support for NFC payments ensures businesses are not left behind. However, it is important to note that advanced mobile POS ecosystems with inventory or employee management tools may require third-party solutions, since National Bankcard’s app focuses primarily on transaction processing.

In summary, mobile and contactless features enhance flexibility but may not replace full POS systems for businesses with complex requirements. For merchants seeking straightforward mobile acceptance, the company’s tools are practical and sufficient.

Pricing and Fees Structure

Pricing remains one of the most important considerations when selecting a payment processor. National Bankcard, like many traditional providers, does not always advertise clear rates on its website. Instead, pricing can vary based on business type, volume, and risk category. Merchants may encounter tiered pricing or interchange-plus options, though availability depends on negotiation and the specifics of the account.

Common fees include transaction charges, monthly service fees, PCI compliance fees, and potentially gateway costs for online transactions. In some cases, merchants have reported early termination fees tied to long-term contracts. This lack of uniform transparency can be frustrating for small businesses that want straightforward numbers.

On the positive side, larger merchants processing high volumes may be able to negotiate competitive rates that reduce per-transaction costs. National Bankcard also occasionally offers equipment placement programs, which can lower upfront costs but may involve monthly leasing fees.

The key takeaway is that pricing is not one-size-fits-all. Businesses considering National Bankcard should carefully review contracts, ask about interchange-plus availability, and clarify whether termination fees apply. While the company may offer competitive options, the variability makes it important to evaluate total costs over the full contract period rather than focusing only on advertised rates.

Security and Compliance

Security in payment processing is essential for protecting sensitive customer data. National Bankcard emphasizes PCI DSS compliance, ensuring merchants follow the Payment Card Industry’s standards. The company provides tools for secure data transmission, including encryption and tokenization, which help reduce the risk of breaches.

Fraud prevention measures are also included, with alerts and filters that flag potentially suspicious activity. Chargeback management is another feature, allowing businesses to respond promptly to disputes and reduce financial losses. While these tools are not unique to National Bankcard, they reflect industry standards that businesses should expect from any reputable provider.

For online merchants, additional measures such as AVS and CVV verification are supported, which add layers of protection against unauthorized card use. These safeguards are particularly valuable for e-commerce stores facing higher fraud risks compared to in-person transactions.

Overall, National Bankcard’s security offerings align with industry expectations, but they are not necessarily distinctive compared to competitors. Businesses can feel confident that baseline compliance is met, though those requiring advanced fraud detection or specialized risk management may need supplementary services.

Integrations and API Support

Modern businesses rely on integrations to keep their operations running smoothly, and National Bankcard provides API options for connecting payment processing with third-party software. This can include shopping carts, accounting platforms, and CRM tools. By linking systems, businesses can automate data flows, reducing manual work and improving accuracy.

For example, integrating with accounting software allows sales data to update automatically, saving time on bookkeeping. Similarly, connecting to CRM tools helps businesses track customer purchases and loyalty program activity. National Bankcard’s API documentation provides flexibility, though merchants may need developer assistance for custom setups.

On the e-commerce side, plug-and-play integrations with platforms like Shopify or WooCommerce reduce setup time. While these integrations are useful, they may not always provide the advanced customization that larger enterprises expect. Businesses should assess whether the available tools match their operational needs or if more complex solutions are necessary.

In short, integration support is adequate for most small and mid-sized businesses, but highly technical companies with specific workflows may need to explore additional development resources. National Bankcard delivers the essentials without necessarily offering a cutting-edge developer ecosystem.

Customer Support and Reliability

Customer support can often make or break the relationship between a business and its payment processor. National Bankcard provides phone, email, and sometimes live chat support channels. Support availability is typically around the clock, though merchant experiences vary. Some report quick response times and knowledgeable staff, while others cite delays or difficulties resolving billing disputes.

Reliability of the processing network is another factor. Downtime can directly impact revenue, and National Bankcard leverages established banking networks to minimize disruptions. Most merchants experience stable performance, though isolated issues may occur, as with any provider.

One potential drawback is that small businesses sometimes feel overlooked compared to higher-volume clients. Larger merchants often have dedicated account representatives, while smaller merchants may need to rely on general support lines. This can create inconsistent service levels depending on account size.

Ultimately, National Bankcard’s support is functional but not without mixed reviews. Businesses that prioritize responsive customer service should evaluate how quickly issues are resolved and whether dedicated representatives are included in their plan. Reliability is generally strong, but ongoing support quality should be part of the decision-making process.

Pros of Using National Bankcard

National Bankcard’s main advantages include its broad service portfolio, which allows businesses to manage both in-person and online transactions under one provider. The availability of POS systems, mobile readers, and an online gateway means flexibility across different business models. Security measures meet industry standards, giving merchants peace of mind about data protection.

The company’s fraud prevention and chargeback tools also provide valuable safeguards for businesses that face higher risk. For merchants processing larger volumes, the potential to negotiate lower rates can make the service cost-effective. Integration support with major platforms and accounting systems further streamlines daily operations.

Another benefit is the company’s longevity in the payments space. Businesses often prefer established providers that have proven reliability, and National Bankcard’s history gives it credibility. For merchants looking for a balance of traditional reliability and modern functionality, the company can be an appealing choice.

Cons and Limitations

Despite its advantages, National Bankcard has several drawbacks that businesses should weigh carefully. The most commonly reported issue is pricing transparency. Many merchants prefer upfront interchange-plus pricing, but National Bankcard’s contracts can include tiered models or additional fees that are not obvious during the sales process.

Another limitation is the possibility of long-term contracts with early termination penalties. This can make it difficult for small businesses to switch providers if they are dissatisfied. While equipment options are varied, leasing programs may involve extra costs that accumulate over time.

Customer support feedback is mixed, with some smaller merchants feeling that their concerns do not receive the same level of attention as larger clients. Additionally, while the company provides the essential tools for online processing, it does not necessarily stand out in terms of innovative features compared to newer fintech competitors.

For these reasons, businesses should thoroughly review contracts and clarify terms before signing. The service may suit those who value stability, but it may not be ideal for merchants seeking the most transparent or innovative solutions.

Ideal Business Types for National Bankcard

National Bankcard is designed to serve a wide range of industries, making it suitable for both traditional and digital businesses. Brick-and-mortar retailers and restaurants benefit from its POS systems and hardware, which support fast checkout, tipping, and inventory tracking. Mobile businesses such as delivery services and on-site contractors can take advantage of its mobile payment options, ensuring they can accept payments wherever work takes them.

E-commerce merchants also find value in the online gateway and recurring billing tools, which are useful for subscription models or digital sales. Professional service providers, such as medical offices or legal practices, may appreciate the company’s reporting tools and fraud protection features.

While National Bankcard offers flexibility, it may be most beneficial to small-to-mid-sized businesses that want a balance of in-person and online processing without investing heavily in custom systems. Enterprises with highly specific technical requirements may find more tailored solutions with specialized providers. Ultimately, National Bankcard’s strength lies in its ability to serve general business needs across industries rather than focusing on one niche.

Competitor Comparison

When comparing National Bankcard to other providers, certain differences stand out. Some competitors, particularly newer fintech companies, offer flat-rate or interchange-plus pricing with greater transparency, appealing to merchants who value simplicity. Others may emphasize advanced POS ecosystems with features beyond what National Bankcard provides.

However, National Bankcard competes effectively by offering a wide range of services under one roof. Its established presence and industry experience contrast with newer providers that may still be proving reliability. For businesses that want a traditional provider with both physical and online processing, National Bankcard is a reasonable option.

The trade-off comes down to priorities: if transparency and innovation are top concerns, competitors may have an edge. If stability and comprehensive offerings are more important, National Bankcard remains a contender.

Final Verdict

National Bankcard offers a full range of merchant services, including card processing, POS systems, and online gateways. It stands out for flexibility across industries, strong security, and integration with common platforms. Larger merchants may secure better rates, while smaller businesses benefit from established multi-channel systems. However, pricing transparency and restrictive contracts can be concerns, along with varied customer support and equipment leasing issues. Though less innovative than fintech competitors, it provides reliability and breadth of service. With careful contract review, it can be a stable solution for many businesses seeking traditional reliability with modern functionality.

FAQs

Q1. Is National Bankcard suitable for small businesses just starting out?

Yes, National Bankcard provides entry-level solutions for small businesses, but new merchants should review pricing structures and contract terms carefully to avoid unexpected fees.

Q2. Does National Bankcard support e-commerce integrations with popular platforms?

Yes, National Bankcard’s payment gateway works with widely used e-commerce platforms like Shopify, WooCommerce, and Magento, making it accessible for online sellers.

Q3. Are there cancellation fees with National Bankcard?

Depending on the contract, early termination fees may apply. Merchants are advised to confirm these details in writing before signing an agreement.