Nochex Review

- 06th Aug, 2024

- | By Linda Mae

- | Reviews

Nochex is a payment service provider based in the UK and was founded in 1999. It offers a variety of solutions for small and medium-sized businesses (SMBs). The company is known for its secure and reliable payment processing solutions, fraud prevention capabilities, and user-friendly services. Nochex mainly deals with e-commerce businesses. It also provides in-store payment systems for brick-and-mortar businesses. Let’s dig deeper into the Nochex Review.

Company Background | Nochex Review

Nochex was founded in Sheffield, UK, in 1999. Initially, the company focused on the UK market as an alternative to PayPal. It became a trustworthy e-payment service by 2001 and was the first alternative payment option on eBay in the UK. After eBay acquired PayPal in 2003, Nochex had to find a new customer base due to the platform restrictions on its usage.

Over time, Nochex expanded its offerings and built a solid reputation for offering secure, affordable payment processing solutions. In 2011, the company launched a partnership initiative that provided incentives for attracting new customers, thereby fueling its expansion. In 2013, Visa and MasterCard selected Nochex to assist in launching their e-wallet services, showcasing its expertise and reliability in the payments sector.

The Nochex headquarters is at Leeds Innovation Centre in Leeds, UK. The company also has another office in Cornelius House, Gelderd Close, Leeds. Martin Greenbank is the CEO of Nochex. Under his guidance, the company has focused on innovation and customer-centric service delivery.

Nochex’s mission is to provide secure, affordable, and efficient payment solutions to small and medium-sized businesses. They wish to make the payment process simpler for clients with fraud prevention tools and top-notch customer support. The company aims to become the leading provider of secure and user-friendly payment services that businesses can trust.

Services and Products

Nochex provides a comprehensive suite of services and products designed to cater to small and medium-sized businesses, particularly in the e-commerce sector. The company’s offerings ensure secure and efficient payment processing, supported by robust fraud prevention tools and user-friendly interfaces.

Merchant Accounts

Nochex’s merchant account services are ideal for businesses for seamless online payment processing. These accounts include advanced fraud screening tools to protect businesses from fraudulent activities. The merchant accounts support major credit and debit cards, making it easier for businesses to handle a variety of payment methods.

Payment Gateway

Nochex provides a secure payment gateway that seamlessly integrates with well-known e-commerce platforms like WooCommerce, Shopify, and Magento. This integration enables companies to effectively manage their online transactions. The Nochex payment gateway is known for its PCI DSS compliance, detailed reporting, and strong fraud prevention tools. It offers customers a smooth and safe checkout process.

Mobile Payment Solutions

Nochex’s mobile payment solutions facilitate payments on the go with a mobile-friendly checkout process suitable for all devices. Customers can complete transactions on a smartphone, tablet, or any other mobile device of their choice. This flexibility is crucial for businesses that cater to customers who prefer mobile shopping.

Telephone Payment Services

Nochex offers secure telephone payment services for business handling telesales or customer service over the phone. These services are equipped with 3D Secure and Address Verification Service (AVS) to enhance security. This feature is particularly useful for businesses that need to take payments over the phone while ensuring the security of their customers’ information.

Invoice Payments

Nochex’s invoice payment service allows businesses to issue invoices and accept payments directly, making it a practical solution for service providers and freelancers. This service streamlines the payment process, ensuring that clients can pay invoices easily and securely.

Recurring Payments

Nochex’s recurring payment solution allows for the automatic establishment and control of recurring payments. It is perfect for businesses that operate on a subscription model. This function makes it easier to handle subscriptions, guaranteeing steady income for companies.

Charity Payments

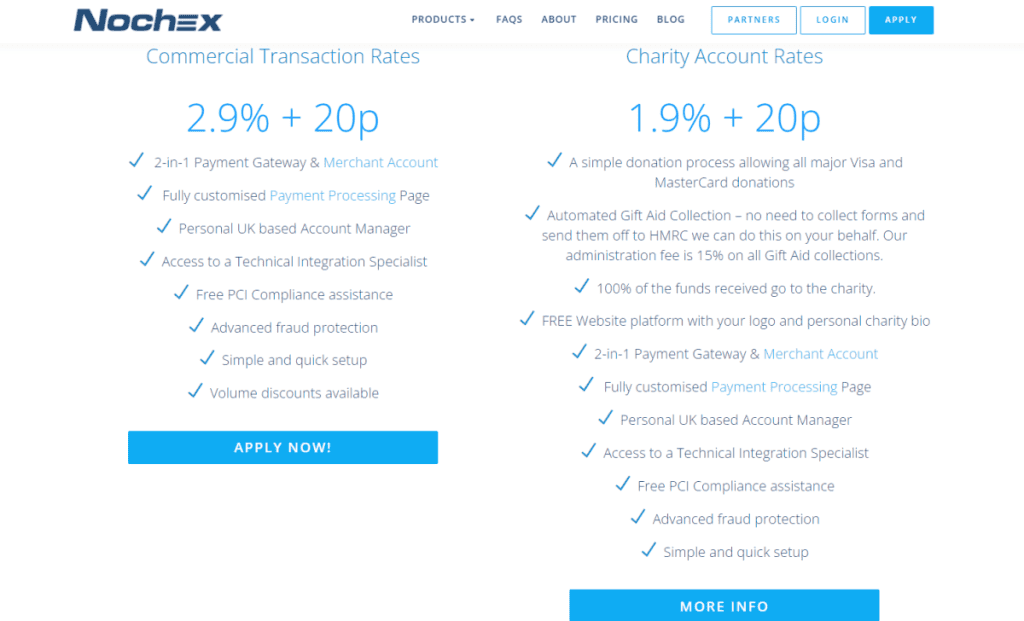

Nochex offers special rates for non-profits and charities, making it cost-effective for these organizations to handle donations. The platform supports one-off donations as well as recurring donations, providing flexibility for donors and stability for charitable organizations.

Nochex’s range of services and products provide secure, efficient, and user-friendly payment processing solutions for diverse business needs.

Pricing and Fees

Nochex offers a straightforward pricing structure designed to cater to small and medium-sized businesses. Many businesses find Nochex an attractive option due to its transparent pricing model and no hidden fees.

Transaction Fees: Nochex charges a standard transaction fee of 2.9% + 20p per transaction. This rate applies to most transactions and is competitive within the industry, especially for businesses processing less than £50,000 per year. This fee structure allows businesses to predict their costs and manage their finances more effectively.

Setup Fees: Some services offered by Nochex have a one-time setup fee of £50. This fee is applicable for setting up services such as the payment gateway and merchant accounts. The setup fee ensures that businesses can quickly get their payment processing systems up and running with minimal upfront costs.

No Monthly or Annual Fees: One of the significant advantages of using Nochex is the absence of monthly or annual fees. This feature is particularly beneficial for small businesses and startups that need to manage their expenses carefully. Without recurring fees, businesses can enjoy the flexibility and scalability of Nochex’s services without worrying about ongoing costs.

Additional Costs: While Nochex’s basic pricing is transparent, businesses must be aware of the additional costs in the form of chargebacks and additional security features. Chargeback fees are standard in the industry and are imposed when a transaction is disputed by a customer. Additionally, businesses may opt for enhanced security features to further protect against fraud, which could incur extra costs.

Comparison with Competitors: Nochex provides competitive pricing when compared to other major payment service providers, like Stripe, PayPal, Square, and WorldPay. Stripe, for example, charges 2.9% + 30 cents per transaction, and PayPal’s standard rate is similar at 2.9% + 30 cents. Square offers a slightly different structure with a fee of 2.75% per swipe for card-present transactions. WorldPay, on the other hand, has a more complex fee structure that varies based on the type of transaction and volume.

In summary, Nochex provides a cost-effective solution for payment processing with transparent fees and no hidden costs. Its pricing model is particularly suitable for small and medium-sized businesses looking for reliable and affordable payment services.

Security and Fraud Prevention

Nochex places a strong emphasis on security and fraud prevention to protect businesses and their customers against potential threats. The company’s comprehensive approach to security builds trust and confidence among its users.

Nochex employs several advanced fraud prevention tools to safeguard transactions. Among the most notable are 3D Secure and Address Verification Service (AVS).

3D Secure: This is an additional layer of security for online credit and debit card transactions. It requires cardholders to complete an extra verification step with the card issuer, ensuring that the transaction is legitimate and reducing the risk of fraud.

Address Verification Service (AVS): AVS helps verify the billing address provided by the cardholder against the address on file with the card issuer. This step adds an extra measure of validation to prevent fraudulent transactions.

These tools can protect the merchant and the customer by detecting and preventing unauthorized transactions.

PCI DSS Compliance: Nochex adheres completely to the requirements of the Payment Card Industry Data Security Standard (PCI DSS). PCI DSS consists of security standards aimed at guaranteeing a secure environment for companies that handle credit card information. Complying to these standards is essential in order to avoid data breaches and guarantee the safe management of cardholder information.

By adhering to PCI DSS, Nochex demonstrates its commitment to maintaining the highest levels of security. This compliance helps in minimizing the risk of data breaches and provides assurance to merchants and customers that their data is handled securely.

Customer Trust and Confidence: The company’s robust security measures have significantly improved customer trust and confidence. Businesses using Nochex can reassure their customers that their payment information is protected by state-of-the-art security protocols. This trust is critical for businesses, as it can influence customer loyalty and repeat business.

Customer Support

Nochex is renowned for its strong customer support, which is a significant factor in its appeal to small and medium-sized businesses. The company emphasizes providing excellent service to ensure that users can efficiently manage their payment processing needs without undue hassle.

UK-Based Customer Service: Nochex’s customer support stands out because it is located in the UK. This support from nearby areas is especially advantageous for businesses in the UK because it guarantees immediate assistance in the same time zone, making communication faster and more efficient. Having an understanding of local business practices and regulations also improves the level of support offered.

Channels of Support: Nochex offers multiple channels through which customers can seek assistance, including phone and email. These channels provide flexibility for businesses to reach out in the manner that is most convenient for them. The availability of phone support means that issues can be resolved in real-time, which is crucial for urgent matters. Email support, on the other hand, allows for detailed queries and responses that can be referred back to as needed.

Customer Service Quality and Responsiveness: Nochex is well-regarded for its quality and responsive customer support service. The support team has a professional and helpful approach to address customer issues promptly. This responsiveness is vital for maintaining smooth business operations, especially when dealing with payment processing where delays can impact cash flow and customer satisfaction.

User Reviews on Support Experience: Nochex has received mixed user reviews on its support experience but are majorly positive. Many users are appreciative of the prompt and efficient handling of queries and knowledgeable support staff. Some reviews highlight how customer support went above and beyond to resolve issues, indicating exceptional service. However, some users are dissatisfied with the unresolved issues and delayed response times.

Overall, Nochex’s customer support is a significant strength of the company. The UK-based service, combined with multiple support channels and a generally positive reputation for quality and responsiveness, makes Nochex a reliable choice for businesses looking for dependable payment processing support.

User Experience

Nochex provides straightforward and hassle-free payment processing solutions with the aim of providing a seamless and efficient user experience for businesses. Its intuitive interface and easy integration with various business software contribute significantly to its appeal among small and medium-sized enterprises.

Ease of Use and Interface Design: Nochex is praised for its user-friendly interface that makes the payment processing experience simpler. The intuitive design of the platform allows users to navigate through its features seamlessly. Businesses can quickly set up their accounts and start processing payments with minimal technical knowledge. The clean and organized layout of the dashboard helps users monitor transactions, manage their accounts, and access reports with ease.

Integration with Business Software: One of Nochex’s key strengths is its ability to integrate seamlessly with popular e-commerce platforms such as WooCommerce, Shopify, and Magento. This integration capability ensures that businesses can incorporate Nochex into their existing systems without significant disruptions. Additionally, Nochex offers APIs and plugins that facilitate smooth integration with other business software, making it a versatile option for a wide range of applications.

User Feedback and Reviews: User feedback on Nochex is generally positive, highlighting its ease of use and reliable performance. Many users appreciate the straightforward setup process and the simplicity of managing transactions through the platform. Reviews often mention the efficiency of Nochex’s fraud prevention tools, which provide an added layer of security for both merchants and customers. However, some users have reported occasional issues with account verification and customer support responsiveness, though these are relatively infrequent.

Nochex excels in providing a reliable user experience due to its simplicity, strong integration features, and overall favorable user responses. These features make it a reliable option for companies seeking to improve their payment processing systems.

Contract Terms

Nochex provides flexible and transparent contract terms that cater to the needs of small and medium-sized businesses. The company’s straightforward contract structure reduces the minimizing complexity and financial risk for its clients.

Contract Length: One of the notable features of Nochex’s service is the absence of long-term contracts. Businesses are not locked into lengthy agreements, which allows for greater flexibility. Nochex operates on a month-to-month basis, enabling businesses to use the service as long as it meets their needs without any long-term commitment.

Termination Fees: Nochex does not impose early termination fees, which is a significant advantage for businesses. This policy ensures that businesses can opt-out of the service without incurring additional costs if their needs change or if they find a better solution elsewhere. The absence of termination fees reduces the financial risk associated with trying out Nochex’s services.

Transparency in Terms: Nochex is dedicated to being transparent in its contract terms. The company makes all fees and terms transparent from the start, guaranteeing that businesses understand the costs completely. This level of transparency aids businesses in preventing unforeseen fees and improving financial management. Businesses must carefully review these terms to fully grasp their agreement with Nochex.

Merchant Obligations: To maintain their account status, merchants are required to comply with Nochex’s fraud prevention and security measures. This includes adhering to the company’s guidelines for transaction processing and data protection. Compliance with these measures is crucial for minimizing fraud risks and maintaining the security of both the business and its customers.

Dispute Resolution: Nochex has a structured process for resolving disputes, which is supported by their customer service team. In the event of a disagreement or issue, merchants can reach out to Nochex’s support for assistance. The customer support team plays a critical role in handling disputes, ensuring that they are resolved promptly and fairly. This process is designed to protect the interests of both the merchant and the customer, maintaining trust in Nochex’s services.

Pros and Cons

Nochex offers a range of features and benefits that cater to small and medium-sized businesses. However, like any service, it has its strengths and weaknesses. Here is a balanced look at the pros and cons of using Nochex.

Pros

Ease of Use

Nochex is designed with simplicity in mind, making it easy for businesses to set up and manage their payment processing. The user-friendly interface allows even those with limited technical knowledge to navigate the system efficiently, monitor transactions, and access detailed reports.

Diverse Payment Options

Nochex offers different payment options such as online, mobile, and phone transactions. This adaptability allows businesses to meet various customer preferences, improving the overall shopping experience. Having the capability to take major credit and debit cards expands the range of potential customers.

Robust Fraud Prevention

Security is a top priority for Nochex. The platform uses advanced fraud prevention tools such as 3D Secure and Address Verification Service (AVS) to protect businesses from fraudulent transactions. This robust security framework helps build trust with customers and reduces the risk of financial loss due to fraud.

Excellent Customer Support

The UK-based customer support offered by Nochex is highly valued by its users. The support team is known for being responsive and helpful, providing assistance through phone and email. This level of support ensures that any issues or queries are addressed promptly, contributing to a smoother user experience.

No Monthly Fees

The absence of monthly or annual fees is an appealing aspect of Nochex. It is a cost-effective solution for small businesses and startups. They only have to pay for the transactions and don’t have to worry about recurring charges.

Cons

Transaction Fees for High Volumes

Nochex’s transaction fees are competitive. However, businesses with high transaction volumes can find it expensive. The standard fee is 2.9% + 20p per transaction, which might become significant for larger businesses processing many transactions.

Limited Global Reach

Nochex primarily serves UK-based businesses. Companies with a significant international customer base can find this a limitation. Businesses looking to expand globally may need to look for additional payment processing options as this can be a constraint.

Limited Integrations

Although Nochex integrates well with major e-commerce platforms like WooCommerce, Shopify, and Magento. However, compared to larger payment service providers, the integration options with other business software are fewer. Businesses that rely on diverse software ecosystems might find this as a limitation.

No Multi-Currency Support for Certain Services

Nochex supports transactions primarily in GBP, which can be a drawback for businesses dealing with international customers. The lack of multi-currency support means that customers from other countries might face additional conversion fees, which can discourage international sales.

In conclusion, Nochex is a robust and user-friendly payment processing solution ideal for small and medium-sized businesses, particularly in the UK. However, businesses with high transaction volumes or international ambitions may need to consider these potential limitations when choosing Nochex.

Market Position and Competitors

Nochex holds a distinct position in the payment processing industry, focusing mainly on small and medium-sized businesses in the UK. Nochex stands out from major competitors like Stripe, PayPal, Square, and WorldPay because of its personalized solutions for UK businesses and strong local customer service.

Comparison with Major Competitors

Stripe: Known for its developer-friendly platform and extensive global reach, Stripe offers a wide range of integration options and supports multiple currencies. However, Stripe’s complexity might be overwhelming for smaller businesses.

PayPal: PayPal, a top player in the online payment industry, offers a user-friendly system that is widely accepted globally and provides additional services such as small business funding. Small businesses may find its elevated transaction fees to be a disadvantage.

Square: Ideal for small businesses, Square offers a comprehensive suite of services including point-of-sale systems, online payments, and invoicing. It is particularly strong in the US market but less prominent in the UK.

WorldPay: A leading UK payment processor, WorldPay supports a vast range of payment methods and currencies. It is well-suited for large enterprises but can be complex and costly for smaller businesses.

Unique Selling Points of Nochex

Nochex differentiates itself with robust fraud prevention tools, transparent pricing with no monthly fees, and exceptional UK-based customer support. Its ease of integration with popular e-commerce platforms and straightforward interface further enhance its appeal.

Market Niche and Target Audience

Nochex primarily targets small and medium-sized businesses in the UK, especially those operating in the e-commerce sector. Its cost-effective solutions and local support make it an attractive option for startups and smaller enterprises looking for reliable and secure payment processing without the complexity and higher costs associated with larger providers.

Customer Reviews and Testimonials

Nochex has received varied user feedback. The reviews on TrustPilot, Google Reviews, and Reviews.io provide an overview of customer satisfaction. Nochex has received a predominantly positive reception – an average of 4 out of 5 stars across these platforms.

Common Praises: Many customers praise Nochex’s ease of use and simple interface. Users are appreciative of the straightforward setup process and the seamless integration with popular e-commerce platforms like WooCommerce and Shopify. Its major strengths include strong fraud prevention measures and 3D Secure and AVS tools. The absence of monthly fees and affordable services further enhances the appeal of Nochex.

Common Complaints: Despite the overall positive feedback, some users have expressed concerns. Common complaints include issues with account verification and occasional delays in customer support response times. A few users have reported difficulties in resolving disputes and issues with withheld funds, which can be frustrating for businesses relying on consistent cash flow. Additionally, some merchants have noted that Nochex’s transaction fees can become costly for high-volume transactions.

Detailed Analysis of User Feedback: A detailed analysis of user feedback reveals that while Nochex is highly regarded for its ease of use, security features, and cost-effectiveness, there are areas for improvement in customer service and dispute resolution processes. Most users, especially small to medium-sized businesses in the UK, appear content with the service. Nevertheless, the suggestions indicate that Nochex needs to improve its support systems in order to quickly resolve the occasional problems mentioned by its customers.

Alternatives to Nochex

There are multiple choices similar to Nochex on the market, each providing distinct characteristics, pricing models, and support choices to meet various business requirements.

Stripe: Known for its extensive developer-friendly features and seamless integration options, Stripe supports a wide range of payment methods and currencies. It is ideal for businesses looking for customization and global reach.

PayPal: A well-established global payment platform, PayPal offers simplicity and broad acceptance. It supports multiple currencies and provides additional services like business loans and invoicing.

Square: Square offers a wide range of services, such as point-of-sale systems, online payments, and invoicing. Small businesses find it highly favored for its simplicity and comprehensive solutions.

WorldPay: A leading payment processor in the UK, WorldPay offers robust support for various payment methods and currencies. It is well-suited for larger enterprises but can be complex and expensive for smaller businesses.

Comparative Analysis

Features: Stripe excels with its extensive APIs and customization options. PayPal is renowned for its user-friendly interface and global reach. Square combines POS systems with online payments, making it versatile for different business models. WorldPay offers comprehensive payment solutions but may lack the flexibility and simplicity that smaller businesses require.

Pricing: Stripe and PayPal charge similar transaction fees (around 2.9% + 30p). Square offers competitive rates, especially for in-person transactions (2.75% per swipe). WorldPay’s pricing is more variable and can be higher due to additional fees.

Support: PayPal and Square are known for their robust customer support. Stripe offers excellent developer support through extensive documentation and forums. WorldPay provides comprehensive support but may not be as accessible for smaller businesses.

Recommendations Based on Business Needs

Small to Medium-Sized Businesses: Square or PayPal might be ideal due to their ease of use and comprehensive support.

Businesses with High Customization Needs: Stripe is the best choice for its flexibility and developer-friendly tools.

Large Enterprises: WorldPay can offer the extensive features and support required by larger operations but may come at a higher cost.

In conclusion, the best alternative to Nochex depends on the specific needs and scale of your business. Evaluating features, pricing, and support will help you choose the most suitable payment service provider.

Conclusion

Nochex provides a secure payment processing solution that is user-friendly and perfect for small to medium-sized businesses in the UK. Despite limited global reach, it stands out with transparent pricing, strong fraud prevention, and great customer support. When selecting Nochex, potential users need to think about the amount of transactions and desire for multi-currency support.