PayKings Review

- 14th Aug, 2024

- | By Linda Mae

- | Reviews

PayKings is a top payment processing firm that focuses on offering customized solutions for merchants considered high-risk. The company provides various services such as credit card processing, ACH processing, mobile payments, and eCommerce payment gateways. It is recognized for its specialization in handling high-risk accounts, guaranteeing that businesses in sectors like eCommerce, CBD, and adult entertainment have dependable and secure payment options. Let’s dig deeper into the PayKings Review.

Company Background | PayKings Review

PayKings was established with the aim of providing strong payment processing solutions to businesses that are frequently overlooked by traditional financial institutions because of their high-risk characteristics. The company is known for its ability to comprehend the specific difficulties encountered by these merchants and offer tailored solutions to support their success.

It was established to address the growing need for specialized payment processing services in high-risk industries. Over the years, the company has expanded its services and client base, becoming a trusted partner for thousands of businesses. The founders aimed to establish a payment processing firm that not only efficiently processed transactions but also offered valuable assistance to help businesses in high-risk industries.

PayKings’ goal is to support high-risk businesses by offering safe, dependable, and creative payment processing solutions. The company’s goal is to lead the payment processing industry by constantly adjusting to the changing requirements of its customers. PayKings has a vision of a future in which all businesses, no matter their level of risk, can access the financial services necessary for their success.

Key Milestones and Achievements

Establishment and Early Growth: Since its founding, PayKings has focused on building a strong foundation by developing robust payment processing solutions tailored to high-risk industries.

Expansion of Services: The company has continuously expanded its service offerings to include advanced fraud prevention tools, chargeback management, and seamless integration with various eCommerce platforms.

Client Acquisition: PayKings has successfully partnered with thousands of businesses, helping them manage their payment processing needs effectively.

Recognition and Awards: The company has received numerous accolades for its innovative solutions and exceptional customer service, cementing its reputation as a leader in the high-risk payment processing sector.

Technological Advancements: PayKings has invested heavily in technology to enhance its payment processing capabilities, ensuring that clients benefit from the latest advancements in security and efficiency.

PayKings’ dedication to its mission and vision, coupled with its strategic milestones, has established it as a vital player in the payment processing industry, particularly for high-risk businesses.

Services Offered by PayKings

PayKings provides a wide range of services designed to meet the requirements of both standard and high-risk merchants, guaranteeing safe and effective payment processing.

Merchant Accounts

Types of Merchant Accounts Available: PayKings provides a variety of merchant accounts designed to cater to different business needs, including high-risk merchant accounts which are crucial for businesses in industries deemed risky by traditional banks. These accounts support businesses like eCommerce, CBD, and adult entertainment by providing robust payment solutions.

Application and Approval Process: Applying for a merchant account with PayKings is quick and simple. They have a 99% approval rate and do not charge any application or setup fees. Businesses can quickly start accepting payments thanks to an approval process that usually takes around 24 hours. Poor credit and elevated instances of chargebacks are also taken into consideration, allowing for broad access.

Payment Processing Solutions

Credit and Debit Card Processing: PayKings enables merchants to process both credit and debit card transactions seamlessly. This includes support for all major card brands, ensuring customers can pay with their preferred method.

ACH Processing: For businesses that prefer or need to handle direct bank transfers, PayKings offers ACH processing. This service is particularly useful for recurring payments and larger transactions, providing a reliable alternative to card payments.

Mobile Payment Solutions: Businesses can now accept payments through mobile devices using mobile payment processing services. This is perfect for companies that are mobile or want to provide a flexible payment experience to their clients.

eCommerce Payment Gateways: PayKings supports various eCommerce platforms, providing customized payment gateways that integrate easily with online stores. This service includes advanced security features and comprehensive reporting tools to manage transactions effectively.

High-Risk Payment Processing

Explanation of High-Risk Merchant Accounts: High-risk merchant accounts are designed for businesses that traditional banks consider risky due to factors like high chargeback rates, industry regulations, or credit issues. PayKings specializes in these accounts, ensuring that even high-risk businesses can process payments securely and efficiently.

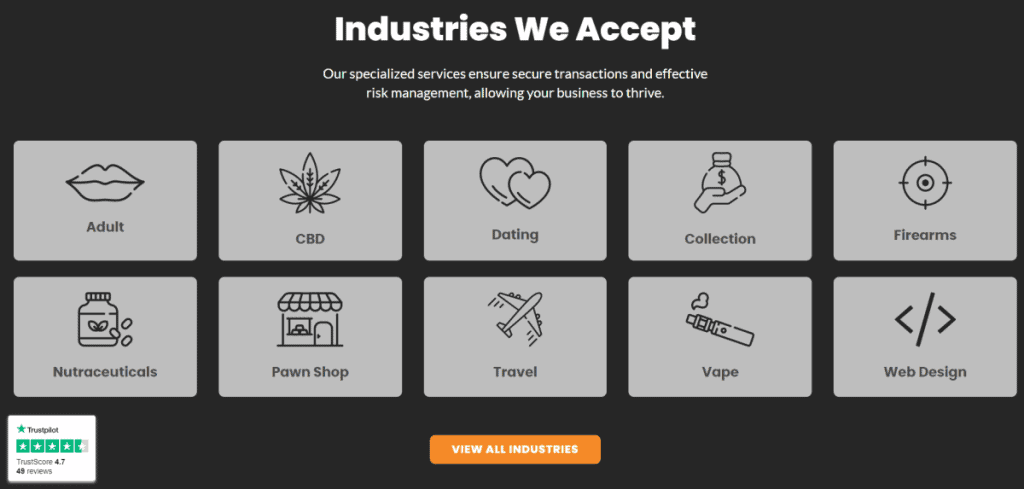

Industries Served: PayKings caters to a variety of high-risk sectors, such as CBD, adult entertainment, firearms, travel, and nutraceuticals. Their skills guarantee customized solutions that fulfill the distinct requirements of every sector.

Benefits for High-Risk Businesses: High-risk businesses benefit from PayKings’ specialized services through enhanced fraud prevention, lower processing fees, and reliable payment processing solutions that help them thrive despite industry challenges.

Chargeback Management

Tools and Strategies Offered by PayKings: PayKings offers comprehensive chargeback management tools that help businesses minimize and manage chargebacks effectively. This includes monitoring transactions for fraud, implementing fraud prevention strategies, and providing resources to dispute chargebacks successfully.

Importance of Chargeback Management: Effective chargeback management is crucial for maintaining a healthy financial status and reducing the risk of account termination. PayKings’ solutions help businesses keep chargebacks under control, ensuring long-term sustainability.

Fraud Prevention Tools

Overview of Security Features: PayKings provides robust fraud prevention tools designed to protect businesses from fraudulent transactions. These tools include real-time transaction monitoring, rules-based fraud detection, and advanced security protocols.

Benefits of Using Fraud Prevention Tools: Utilizing these fraud prevention tools helps businesses reduce the risk of fraud-related losses, maintain customer trust, and ensure compliance with industry regulations. This ultimately leads to smoother operations and a more secure payment environment.

PayKings’ extensive service offerings, particularly for high-risk merchants, make them a valuable partner for businesses needing reliable and secure payment processing solutions

Technology and Integration at PayKings

PayKings provides cutting-edge technology and integration options to simplify payment processing for companies, particularly those in high-risk sectors. Their strong API and developer tools guarantee smooth integration, compatible with different programming languages and platforms. Developers can easily integrate PayKings’ payment solutions into their current systems, improving functionality and efficiency due to this flexibility.

API and Developer Tools: PayKings provides an open API that facilitates easy integration with multiple online and offline tools, including ERP suites, accounting software, CMS platforms, and POS systems. The API is designed to be developer-friendly, offering comprehensive documentation and support for popular programming languages, ensuring a smooth setup process for businesses.

Ease of Integration: The process of integration is simple, reducing downtime and allowing businesses to promptly begin accepting payments. The flexibility of the API permits businesses to tailor their payment processing solutions to suit their individual requirements, whether they operate an online store, a recurring billing service, or any other type of high-risk business.

Supported Programming Languages and Platforms: PayKings supports a wide range of programming languages and platforms, making it compatible with various business systems. This compatibility ensures that businesses can integrate payment processing without significant changes to their existing infrastructure.

Compatibility with eCommerce Platforms: PayKings’ payment gateway is compatible with major eCommerce platforms such as Shopify, WooCommerce, Magento, BigCommerce, and WordPress. This broad compatibility ensures that businesses can choose the best platform for their needs while seamlessly integrating PayKings’ payment processing solutions.

Payment Gateway Features Customization Options: PayKings provides businesses with a wide range of customization choices for their payment gateway, enabling them to personalize the checkout process to align with their brand and customer needs. This involves payment pages that can be customized, support for different payment methods, and the capability to process complicated transactions.

Reporting and Analytics: The payment gateway also includes robust reporting and analytics features. Businesses can access detailed transaction reports, monitor payment trends, and gain insights into customer behavior. This data-driven approach helps businesses make informed decisions, optimize their payment processes, and improve overall efficiency.

Pricing and Fees

PayKings offers competitive and transparent pricing structures designed to cater to both high-risk and low-risk merchants. Their pricing models and fee structures aim to provide flexibility and value, ensuring that businesses can manage their payment processing costs effectively.

Transparent Pricing Structure

PayKings utilizes an interchange-plus pricing model, which is often favored for its transparency and predictability. This model involves a base rate plus a markup, allowing businesses to clearly see the components of their fees. This setup is particularly beneficial for high-risk merchants, who often face variable rates with other providers.

Overview of Pricing Models

The primary pricing models offered by PayKings include:

Flat Rate: A single percentage rate applied to all transactions, simplifying fee calculations.

Interchange-Plus: A base rate set by the card networks plus a small, consistent markup. This model offers greater transparency and potential cost savings compared to flat rates.

Subscription-Based: A monthly fee covering all transactions up to a certain volume, providing cost predictability.

Comparison with Competitors

In comparison to other high-risk payment processors, PayKings is known for its competitive pricing and transparency regarding fees. Despite the complicated pricing models and hidden fees of other competitors, PayKings provides transparent pricing without any surprises. Their competitive rates, which can be as low as 2.49% for eligible merchants, are comparable to others in the industry and are frequently lower than the rates of high-risk processors, which could be as high as 4.99%.

Additional Fees

Despite the competitive base rates, merchants should be aware of potential additional fees, which may include:

Chargeback Fees: Costs associated with handling disputed transactions.

Monthly Fees: While not always disclosed upfront, some merchants may incur monthly account maintenance fees.

PCI Compliance Fees: Fees related to maintaining compliance with payment card industry standards.

Batch Fees: Fees for processing batches of transactions, typically applied daily.

Early Termination Fees: Applicable if a merchant terminates their contract early.

Overall, PayKings’ transparent pricing and competitive fee structure make it a viable option for high-risk merchants seeking reliable and cost-effective payment processing solutions.

Customer Support

PayKings is dedicated to providing exceptional customer support, ensuring that businesses can resolve issues promptly and effectively. Their range of support channels, quick response times, and high-quality customer service have garnered positive feedback from users.

Support Channels

PayKings offers multiple support channels to cater to different client needs, including phone support, email support, and live chat. These channels provide direct access to customer service representatives who can assist with a variety of issues. Additionally, PayKings maintains a comprehensive online knowledge base and a support ticket system for self-service and more detailed troubleshooting.

Response Times

Fast response times are a key feature of PayKings’ customer service. Typically, the company aims to answer inquiries within a short time frame, guaranteeing prompt resolution of issues. The presence of live chat boosts their ability to respond quickly, enabling real-time help with solving issues.

Customer Service Quality

Customer feedback on PayKings’ customer service is generally positive. Many users appreciate the helpfulness and professionalism of the support team. Testimonials highlight the quick resolution of issues and the knowledgeable support staff. This commitment to quality service helps maintain high customer satisfaction and fosters long-term client relationships.

User Experience at PayKings

PayKings is designed with user experience at the forefront, ensuring that businesses can seamlessly integrate and utilize their payment processing services. From the initial setup to daily operations, PayKings focuses on making the process as intuitive and efficient as possible.

Onboarding Process

PayKings offers a simplified onboarding procedure aimed at helping companies start operating swiftly. Setting up the account and integrating it is simple, enabling merchants to begin processing payments quickly. The company provides guided tutorials and detailed instructions to assist users in easily navigating the setup process. This simplicity in getting started guarantees that merchants can concentrate on fundamental business tasks without being weighed down by technical challenges.

User Interface

The design and usability of PayKings’ dashboard and tools are geared towards user-friendliness. The interface is clean, intuitive, and easy to navigate, making it simple for users to access essential features and manage their accounts. Key functionalities such as transaction monitoring, reporting, and account settings are easily accessible, which enhances the overall user experience. The interface is designed to accommodate users of all technical levels, ensuring that even those with limited technical expertise can use it effectively.

Reliability and Performance

PayKings takes pride in its consistency and efficiency, with strong uptime stats and reliable performance metrics. The platform is designed to efficiently manage high transaction volumes, reduce downtime, and allow businesses to process payments smoothly without any breaks. This trustworthiness is essential to uphold customer confidence and guarantee efficient business processes. Performance metrics are constantly observed to enhance the efficiency and responsiveness of the system, delivering a reliable payment processing solution for businesses of any size.

Regulatory Compliance

PayKings is committed to maintaining the highest standards of regulatory compliance, ensuring that both the company and its clients adhere to all necessary regulations and industry standards. This commitment to compliance helps protect businesses and their customers from potential risks and liabilities.

PCI Compliance

Compliance with PCI DSS is essential for any business that deals with credit card transactions. PCI compliance guarantees that sensitive cardholder data is securely handled, stored, and transmitted, reducing the chances of data breaches and fraud. PayKings prioritizes PCI compliance, offering merchants tools and resources for meeting these strict requirements. PayKings ensures their clients’ payment processing systems are PCI DSS compliant through secure payment gateways and regular security audits.

Importance of PCI Compliance

PCI compliance is essential for safeguarding sensitive customer data and maintaining trust in the payment process. Non-compliance can lead to significant financial penalties and damage to a business’s reputation. Ensuring PCI compliance helps prevent data breaches, which can have severe consequences for both merchants and customers.

Other Regulatory Considerations

In addition to PCI compliance, PayKings adheres to other regulatory standards to provide comprehensive security and compliance solutions. This includes compliance with anti-money laundering (AML) regulations and Know Your Customer (KYC) requirements. These regulations are designed to prevent financial crimes and ensure that businesses are operating within legal frameworks. PayKings supports merchants by offering solutions that facilitate compliance with these additional regulatory requirements, further protecting businesses from potential legal and financial risks.

Pros and Cons of PayKings

Strengths

Unique Selling Points: PayKings stands out in the payment processing industry due to its specialization in high-risk merchant accounts. This focus allows them to offer tailored solutions for businesses in industries such as CBD, adult entertainment, and eCommerce, which are often underserved by traditional payment processors. Their expertise in navigating the complexities of high-risk transactions is a significant advantage.

Key Advantages Over Competitors: PayKings’ extensive range of services, such as credit card processing, ACH processing, mobile payments, and eCommerce payment gateways, is one of their main strengths. They also offer reliable tools for managing chargebacks and preventing fraud, particularly important for businesses deemed high-risk. Furthermore, PayKings is recognized for its clear pricing model and competitive fees, which frequently rival those of other high-risk payment providers. Their easy-to-use interface and excellent customer support add to their attractiveness.

Weaknesses

Areas for Improvement: While PayKings excels in many areas, there are a few aspects where they could improve. For instance, some users have noted that the setup and integration process, although generally smooth, can be complex for businesses with less technical expertise. Providing more detailed onboarding support and resources could help alleviate these issues.

Common User Complaints: One frequent issue reported by users is the occasional delays in customer service response times, especially during busy times. Although their customer service is typically lauded for its excellence, enhancing response times could boost overall user satisfaction. Some merchants have pointed out the possibility of facing increased fees when using high-risk processors, but they believe it is worth it due to the extra risks and services offered.

Overall, PayKings’ strengths in handling high-risk transactions, combined with their comprehensive service offerings and competitive pricing, make them a strong contender in the payment processing industry. However, addressing areas of complexity in setup and enhancing customer support response times could further solidify their reputation.

Conclusion

PayKings stands out for offering strong payment solutions for industries at high risk, with expertise in full services and competitive prices. Although there is room for improvement in onboarding and support response times, it is still the preferred option for high-risk merchants. Potential users will discover it to be a trustworthy and beneficial companion.

FAQs

What industries does PayKings specialize in?

PayKings specializes in high-risk industries including eCommerce, CBD, and adult entertainment.

How does PayKings handle chargebacks?

PayKings offers comprehensive chargeback management tools to help merchants minimize and manage chargebacks effectively.

Is PayKings PCI compliant?

Yes, PayKings ensures that all merchants are PCI compliant to protect sensitive payment information.