Paymill Review

- 05th Sep, 2024

- | By Linda Mae

- | Reviews

Paymill, a PSP established in 2012 in Munich, Germany, provides online payment processing solutions mainly for small and medium-sized enterprises. Targeting flexibility and security, Paymill enables merchants to receive payments directly on their websites, catering to businesses in search of a smooth online payment process. It has been a member of the CYBERservices SA Group since 2016, enhancing its products and expanding its market presence. Let’s delve deeper into the Paymill Review.

Paymill offers various payment options such as credit and debit cards, PayPal, SEPA, and other choices, making it a versatile platform. This extensive selection of payment options allows businesses to serve customers from both local and international markets. It offers simple integration through its REST API, Mobile SDK, and popular e-commerce plugins for platforms such as Shopify and WooCommerce, making it easy and fast for businesses to implement.

Additionally, it is known for its recurring payment capabilities, making it suitable for subscription-based services. Its robust security measures, such as PCI DSS compliance and 3D Secure, ensure that transactions are processed safely, protecting businesses and their customers from fraud.

Paymill is a well-known payment service provider in places such as Germany, Austria, and Switzerland. It is popular throughout Europe and helps businesses in more than 40 countries. Paymill provides user-friendly solutions, including tools to prevent fraud and analyze data, which helps companies handle their payments effectively.

Paymill’s Core Features | Paymill Review

Paymill provides a well-rounded payment gateway solution for businesses of all sizes, offering various features that simplify online payment processing. These features are designed to enhance user experience, improve security, and provide flexibility for developers and merchants alike.

Multi-Currency Support for Global Reach

One of Paymill’s main services is its capability to handle different currencies. This feature helps companies take payments from customers around the globe, which is perfect for businesses that operate worldwide. By supporting multiple currencies, companies can prevent missing out on potential customers because of currency restrictions and can instead grow their business across different countries.

Recurring Payments for Subscription-Based Models

For businesses that rely on recurring billing models, it offers robust support for subscription-based payments. Whether you’re running a membership site, an online service, or a subscription box business, it automates the payment process, ensuring customers are billed periodically without the need for manual intervention. This streamlines business operations and increases customer retention by providing a seamless payment experience.

Top-Notch Security and Compliance

Security is a priority at Paymill. The platform is fully PCI DSS compliant, meaning it adheres to the strict standards required for processing credit card payments securely. It also employs 3D Secure technology, which adds an extra layer of protection for online transactions. This system, provided by Visa and MasterCard, reduces the risk of fraudulent activities by requiring the cardholder to authenticate transactions.

Developer-Friendly API Integrations

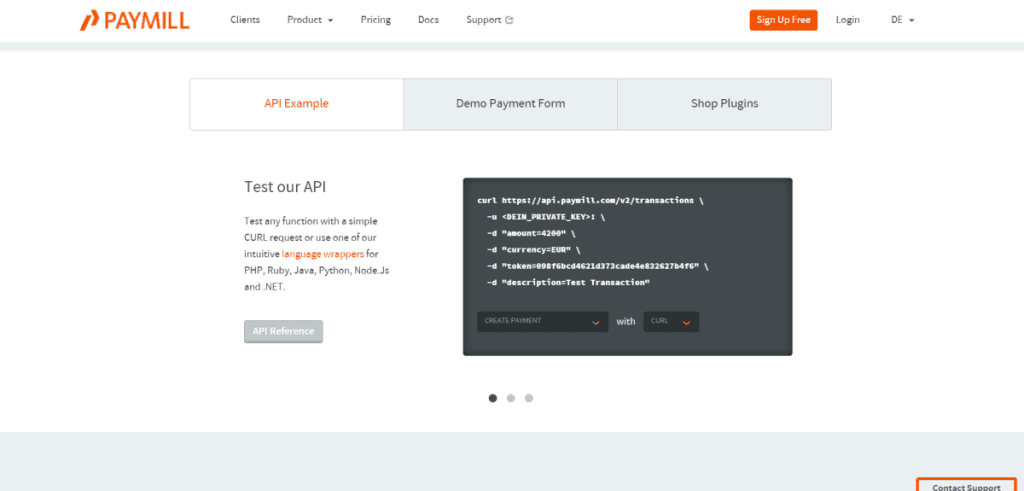

Paymill is renowned for its user-friendly tools designed for developers, especially its versatile API. By utilizing its RESTful API, developers have the ability to seamlessly incorporate Paymill into their own applications and websites, granting them complete management of the payment procedure. The service also provides add-ons for well-known online retail platforms like Shopify, Magento, and WooCommerce, enabling merchants to quickly integrate Paymill without the need for complicated coding.

Supported Payment Methods

Paymill offers a broad range of payment methods, making it a versatile solution for businesses looking to provide flexible payment options for their customers. Whether you run a small business targeting local customers or a large-scale operation with a global reach, it ensures that transactions can be completed using the payment methods that your customers prefer.

Credit and Debit Card Payments

As one of the most common and widely used payment methods, it supports major credit and debit cards, including Visa, MasterCard, and American Express. This allows businesses to accept payments from customers worldwide, as credit cards remain one of the most popular forms of online payment. The platform also supports local debit cards in some regions, providing additional flexibility for businesses that target specific markets.

Direct Debits and Bank Transfers

If you like to pay straight from your bank account, it lets you do that with direct debit payments. This is really handy for companies that have things like monthly subscriptions or regular payments, because customers can arrange for money to be taken out of their bank accounts automatically. Paymill works with SEPA, which helps businesses in Europe, because it makes it easier to send money between different countries in the EU.

Alternative Payment Methods

In addition to traditional payment methods, it also supports alternative digital wallets such as PayPal, which is commonly used for its convenience and security. With the rise of e-wallets and mobile payment options, businesses can cater to a growing segment of customers who prefer to pay without using credit cards or bank transfers. It also offers support for international payment options, making it easier for businesses to accept payments from customers across various regions.

Ease of Integration

Paymill is designed with ease of integration in mind, making it a popular choice among developers and businesses that seek a smooth, customizable payment gateway. With its flexible API and extensive resources, Paymill simplifies the process of setting up an online payment system for a wide variety of platforms.

Overview of Paymill’s API and Ease of Use

Paymill’s RESTful API is highly regarded for its easy-to-use nature and adaptability. It enables developers to effortlessly incorporate payment features into websites and apps using only a few lines of code. The API offers management of different parts of the payment procedure like handling transactions, refunds, and subscriptions. The documentation is organized and easy to understand, allowing developers with limited experience in payment gateway integrations to access it. The simplicity of use lowers the time needed to implement, enabling businesses to quickly start accepting payments.

Developer Documentation and Resources

One of the key advantages of using Paymill is the detailed developer documentation and support resources provided. The documentation covers everything from basic integration to more advanced features like handling recurring payments and customizing the checkout process. It also provides a sandbox environment for developers to test their integration before going live, ensuring that any potential issues are caught early. Additionally, support forums and customer service options are available to help developers troubleshoot any challenges they may encounter during the integration process.

Plugins for Popular Platforms

For businesses that use popular e-commerce platforms like Shopify, WooCommerce, or Magento, Paymill offers pre-built plugins. These plugins are simple to install and enable Paymill to be up and running with minimal effort, without the need for custom coding. This convenience is particularly useful for smaller businesses that may not have a dedicated development team.

Customization Options for Checkout Processes

Customization is a key feature of Paymill’s service. Businesses can completely adjust the checkout process to fit their brand’s look and feel and how they want customers to interact with it. The API gives full control over the appearance and actions of the checkout, whether it’s part of a website or a standalone form. This adaptability means that companies can keep a uniform brand experience during the payment process.

Pricing Structure

Paymill follows a straightforward and transparent pricing model, making it appealing for businesses of all sizes. The platform offers competitive rates, with transaction fees that are generally in line with other payment service providers in the market. Paymill’s pricing structure is designed to accommodate both small businesses and larger enterprises, allowing flexibility based on transaction volumes and business needs.

Overview of Paymill’s Pricing Model

Paymill has a pricing system based on each transaction. Companies pay a small part of the transaction amount and a set fee for every payment made. There are no initial fees or secret charges, which makes it a good choice for businesses that don’t want to spend a lot of money at the start. For companies that handle many transactions, it provides special pricing plans that can be adjusted to fit particular needs.

In addition to transaction fees, Paymill charges a small monthly fee, which covers access to its full range of features, including fraud prevention and security measures like 3D Secure. This pricing structure ensures that businesses only pay for the services they need, with the option to scale up as their operations grow.

Transaction Fees and Other Associated Costs

Paymill’s fee for regular transactions is 2.95% + €0.28 per transaction for European cards and 3.45% + €0.28 for international cards. This pricing model is on par with other payment gateways, particularly for companies serving customers in the EU. Direct debit transactions supported by SEPA come with a 1% fee, which is advantageous for companies dealing with high amounts of domestic bank transfers.

There is also a monthly fee that starts at €19.95 for basic plans, which includes essential features like fraud detection and PCI compliance. This subscription fee can increase depending on the volume of transactions and additional services a business may need.

Comparison with Competitors’ Pricing

When compared to competitors like Stripe and PayPal, Paymill’s pricing is competitive, especially for European-based transactions. Stripe offers similar pricing but charges slightly higher for international card transactions. Paymill’s support for local payment methods and its low direct debit fees provide an edge for businesses focusing on European markets. PayPal, while popular, tends to have slightly higher fees and less flexibility for businesses handling recurring payments or subscription models.

Customer Support and User Experience

Paymill places a strong emphasis on providing effective customer support and creating a user-friendly experience for its customers. With various support channels and a well-designed user interface, the platform ensures that users can get help when needed and navigate the system with ease.

Overview of Paymill’s Customer Support Channels

Paymill offers customer support through multiple channels, including email, phone, and live chat. The availability of these options allows users to reach out for assistance in the way that suits them best, whether it’s quick troubleshooting via chat or more detailed inquiries over email. Phone support is available for more pressing or complex issues, ensuring that users can resolve critical payment-related problems in real-time.

Availability of Support Documentation, Guides, and FAQs

Paymill not only offers direct customer assistance but also offers a variety of online resources such as documentation, user guides, and FAQs. These resources are created to assist users in independently navigating the platform, providing detailed guidance for integrating, processing payments, and resolving issues. The extensive developer documentation is a significant benefit for technical teams creating custom integrations. The FAQ section receives consistent updates and addresses a variety of frequently asked questions concerning pricing, setup, and features.

User Experience: From Onboarding to Daily Use

Paymill is known for its intuitive onboarding process, which allows businesses to get started quickly. The platform’s clean and user-friendly interface ensures that users can easily set up their accounts, integrate payment methods, and start processing transactions. For developers, the ease of integration with Paymill’s API is highly praised, as it simplifies the process of adding payment functionality to websites and applications.

Daily use of Paymill is smooth and efficient, with features like recurring billing and detailed transaction analytics being easily accessible from the dashboard. The platform’s performance and reliability are also noted by users, who appreciate the consistent service and minimal downtime.

Customer Feedback and Overall User Satisfaction

Customer feedback for Paymill is generally positive, with users frequently highlighting the platform’s ease of use, comprehensive documentation, and responsive customer support. Businesses particularly appreciate the flexibility offered by the API and the ability to customize payment processes. However, some users have noted that support response times can occasionally vary depending on the issue and channel used. Overall, user satisfaction is high, especially for small to medium-sized businesses looking for an efficient and secure payment gateway.

Paymill’s Global Reach

Paymill’s extensive global reach is one of its key advantages, making it an ideal solution for businesses that target international markets. As a payment gateway, Paymill operates in more than 40 countries, with a particular focus on European markets. Its ability to process payments in multiple currencies and offer region-specific payment methods gives businesses the flexibility to reach a diverse customer base.

Countries and Regions Where Paymill is Operational

Paymill is very popular in Europe, particularly in places like Germany, Austria, and Switzerland, where it is one of the top choices for handling payments. But Paymill is not just limited to these countries; it helps businesses all over Europe and in many other parts of the world with their payment needs. The service can handle more than 100 different types of money, making it simple for companies to take payments from customers anywhere in the world. This wide range of supported currencies helps businesses grow in other countries without having to worry about problems with different currencies or payment methods.

Suitability for Businesses Targeting International Markets

For businesses looking to expand their operations globally, it offers a comprehensive solution that simplifies international payment processing. With support for a variety of payment methods such as credit and debit cards, direct debits, and popular alternative methods like PayPal and SEPA, Paymill ensures that businesses can cater to customers’ preferences in different regions. This makes Paymill a suitable choice for e-commerce businesses, subscription-based services, and any company with an international customer base.

Cross-Border Transaction Fees and Exchange Rate Management

Paymill offers competitive fees for cross-border transactions, which makes it a popular choice for businesses that work with customers from different countries. The fee for European cards is 2.95% plus €0.28, whereas international cards have a fee of 3.45% plus €0.28. These costs are similar to those of other leading payment processors, enabling companies to manage global transactions without incurring high expenses. Furthermore, Paymill offers resources for handling currency exchange rates, aiding companies in reducing risks related to currency conversion and guaranteeing efficient payment processing in various markets.

Security and Compliance

Security and compliance are central to Paymill’s offering, making it a trusted choice for businesses that need robust protection for online transactions. With a range of advanced security measures and adherence to stringent regulatory standards, it ensures that businesses and their customers are protected from data breaches, fraud, and other cyber threats.

Explanation of Security Measures

Paymill employs several layers of security to safeguard transaction data. One of the key measures is data encryption, which protects sensitive information during transmission between the customer, the merchant, and Paymill’s servers. This encryption uses secure protocols like HTTPS and SSL, ensuring that credit card information and personal details are never exposed to unauthorized parties.

In addition to encryption, Paymill has built-in fraud detection mechanisms. These tools analyze transactions in real time, flagging suspicious activity that may indicate fraudulent behavior. With features like 3D Secure (Verified by Visa and MasterCard SecureCode), Paymill adds an extra layer of protection for online payments, requiring customers to authenticate their transactions, further reducing the risk of fraud.

Regulatory Compliance

Paymill adheres to multiple important regulatory frameworks to guarantee its services align with industry norms for safeguarding data and securing transactions. The platform is completely certified with PCI-DSS (Payment Card Industry Data Security Standard), a vital necessity for businesses handling credit card transactions. Being PCI-DSS certified means Paymill adheres to the top standards in handling cardholder data, reducing the chances of breaches or theft.

Furthermore, it adheres to the GDPR (General Data Protection Regulation), which is crucial for businesses that are based in Europe. This guarantees that customer data is handled in compliance with European privacy regulations, providing assurance to merchants and consumers about the management of their personal data.

Handling Chargebacks and Fraud Prevention

Paymill takes a proactive approach to managing chargebacks and preventing fraud. The platform’s fraud detection tools monitor transactions for red flags, such as unusual spending patterns or mismatches between payment details and customer information. When a chargeback occurs, Paymill provides clear guidelines for businesses to dispute and resolve the issue efficiently.

Pros and Cons of Using Paymill

Advantages of Choosing Paymill

Simplicity and Ease of Use: One of the biggest strengths of Paymill is its user-friendly interface and straightforward integration process. The platform offers flexibility through its RESTful API, which makes it easy for developers to customize payment workflows. For non-technical users, Paymill also provides plugins for popular platforms like Shopify, WooCommerce, and Magento, which further simplifies integration.

Global Support: Paymill works in more than 40 countries and can handle over 100 different types of money. This makes it a great choice for companies wanting to grow in other countries. With its ability to handle different currencies, businesses can easily serve customers from various parts of the world.

Recurring Payments: For subscription-based businesses, Paymill’s ability to handle recurring payments is a significant advantage. This feature automates the billing process, allowing businesses to charge customers at regular intervals without manual intervention.

Security: Paymill focuses on safety by following the PCI DSS rules and using 3D Secure, which helps keep transactions safe from scams. These features make sure that both companies and customers are kept safe during online purchases.

Limitations or Drawbacks

Pricing for International Transactions: While Paymill offers competitive pricing for European markets, its international transaction fees are relatively higher than some of its competitors. For example, international cards incur a fee of 3.45% + €0.28 per transaction, which could add up for businesses processing a high volume of cross-border payments.

Limited Reach Outside Europe: Even though Paymill works with companies in more than 40 countries, it mostly concentrates on the European market. Companies that are not in Europe or those aiming for areas outside Europe might find other payment systems better for what they need.

Customer Support: Some users have reported slower response times, particularly when using email support. While Paymill offers various support channels like email, phone, and chat, there is room for improvement in terms of response speed, especially for complex or urgent issues.

Who Would Benefit Most from Using Paymill

Small to Medium-Sized Businesses: Paymill is an excellent option for small and medium-sized businesses, particularly those operating in European markets. Its simplicity, flexibility, and support for multiple currencies make it suitable for growing businesses with international customers.

Subscription-Based Services: Businesses that depend on regular billing will see advantages from Paymill’s strong subscription payment characteristics. Automating billing procedures is particularly beneficial for SaaS platforms, membership sites, and similar types of businesses.

E-commerce Platforms: Paymill is also ideal for e-commerce businesses, thanks to its seamless integration with platforms like WooCommerce, Shopify, and Magento. Its flexibility and ease of use make it a strong choice for online retailers looking to offer a wide range of payment options to their customers.

In general, Paymill’s attractiveness lies in its simplicity, global accessibility, and security features, making it a favorable option for businesses in Europe in need of a reliable and safe payment gateway. Nevertheless, businesses managing a large number of global transactions should thoroughly evaluate the related expenses.

Final Verdict and Recommendations

Paymill is a flexible payment gateway that is easy to use and suitable for small to medium-sized businesses, especially those in Europe. Its valuable option for e-commerce and subscription-based models is due to its strong security features, global reach, and ease of integration. Paymill is strongly advised for businesses looking for ease and adaptability.

FAQs

What payment methods does Paymill support?

Paymill supports a variety of payment methods, including major credit cards like Visa and MasterCard, direct debits through SEPA, and alternative payment options such as PayPal and Apple Pay. This variety makes it versatile for businesses catering to different customer preferences.

How much does Paymill charge per transaction?

Paymill charges different fees for different ways of paying. If you use a credit card, the fees are usually higher. But if you use direct debit, the fees might be lower. The exact fees can change depending on where you are and how much you spend.

Is Paymill suitable for international businesses?

Yes, Paymill is well-suited for international businesses with multi-currency support and cross-border transaction facilitation, making it ideal for global e-commerce operations.