PayPal Here Review

- 25th Oct, 2024

- | By Linda Mae

- | Reviews

PayPal Here is a mobile point-of-sale system created by PayPal for small businesses to conveniently receive payments through a smartphone or tablet. Merchants have the ability to accept payments on the go by using a portable card reader connected to their mobile devices through PayPal Here, providing flexibility for businesses. PayPal Here is designed to suit diverse needs, whether a business is based in traditional retail spaces or non-traditional settings such as pop-up shops, food trucks, or markets. Let’s delve deeper into the PayPal Here Review.

Small and medium-sized businesses looking for a convenient, cost-effective, and adaptable payment option are the main users of PayPal Here. This is particularly attractive to businesses that need mobility, such as market vendors, freelancers, and service providers like photographers or event managers. For traditional retailers with physical stores, it provides a convenient option to standard POS systems, particularly when used with a tablet or mobile device within the store.

PayPal Here is also a valuable tool for businesses that need to accept payments in various locations, such as consultants, delivery services, or personal trainers. It enables these professionals to easily collect payments in real-time without the need for fixed hardware setups, offering a streamlined approach to mobile transactions.

In a highly competitive mobile POS market, PayPal Here stands out due to its integration with PayPal’s broader ecosystem. While rivals such as Square and Stripe dominate the space with user-friendly POS solutions, PayPal Here differentiates itself by leveraging the brand’s strong global presence and extensive user base. PayPal’s established reputation as a trusted payment processor gives it an edge, especially for businesses that already utilize PayPal for online payments.

Its ability to process various payment methods such as credit and debit cards, contactless payments, and PayPal is another significant benefit. The versatility of PayPal Here, along with easy access to PayPal’s financial services and worldwide customer base, makes it a strong and dependable option for businesses seeking flexible payment systems.

Setting Up PayPal Here

Setting up PayPal Here is designed to be straightforward, ensuring small businesses can quickly start accepting payments. Whether you’re on an iOS or Android device, the process is simple and doesn’t require advanced technical knowledge.

Step-by-Step Setup Process

To get started with PayPal Here, users first need to download the PayPal Here app, available on both the App Store (for iOS) and Google Play (for Android). Once downloaded, users can log in using an existing PayPal account or create a new one. For new users, setting up an account involves providing basic business information and verifying identity and bank details.

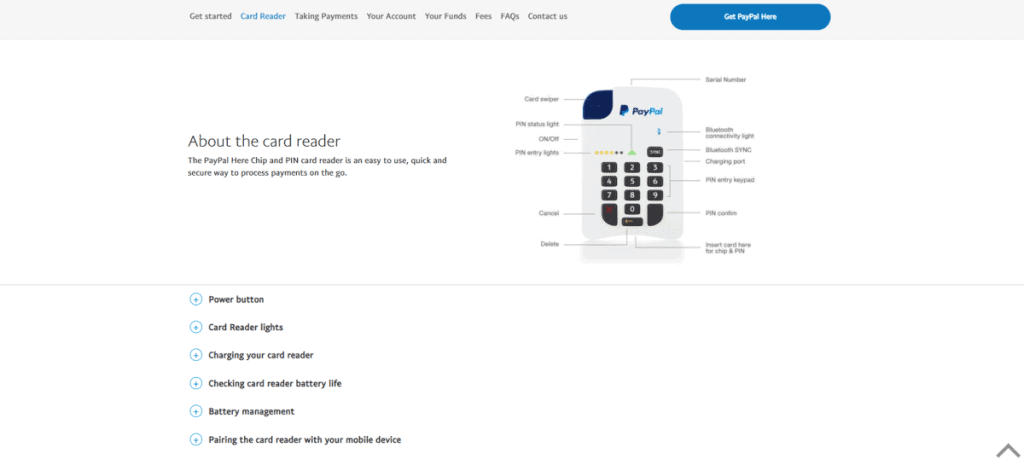

Once you have logged in to the app, the subsequent action is to connect the hardware. PayPal Here provides various hardware choices, like card readers, that link to your mobile device through Bluetooth. After connecting the device, users can start accepting payments using the app. The application enables users to control inventory, monitor sales, and generate digital receipts, transforming it into more than just a payment tool.

Device Compatibility (iOS and Android)

PayPal Here is compatible with both iOS and Android devices. It works on most smartphones and tablets, including the latest models from Apple, Samsung, and other major brands. The app itself is optimized for mobile screens and allows for easy navigation through its menus and features.

Hardware Options and Costs

PayPal Here offers several hardware options, tailored to different business needs:

PayPal Chip and Swipe Reader: This compact card reader accepts chip cards and magnetic stripe cards. It’s a cost-effective solution, typically priced around $24.99.

PayPal Chip and Tap Reader: This reader is perfect for businesses wanting to take NFC payments alongside chip and magnetic stripe cards. The cost is around $59.99.

Accessories: Optional accessories, like charging stands, are available to create a more stable, in-store setup.

These hardware options offer flexibility for businesses, allowing them to choose based on their specific payment processing needs.

Pricing and Fees | PayPal Here Review

PayPal Here offers a straightforward pricing model, which is attractive to small businesses seeking transparency in their payment processing costs. While the platform is free to download and set up, the core costs come from transaction fees and any additional hardware businesses may need.

Transaction Fees (Swiped, Keyed, and Online Transactions)

PayPal Here charges different transaction fees depending on how the payment is processed:

Swiped or Chip/Contactless Transactions: These card-present transactions incur a standard fee of 2.7% per transaction. This applies to payments made through swiping a card, inserting a chip, or using a contactless method like Apple Pay.

Keyed-in Transactions: When entering card details manually, such as in phone or remote orders, the fee goes up to 3.5% with an additional fixed fee of $0.15 per transaction. This increased rate is a result of the higher risk linked to transactions where the card is not physically present.

Online Payments: If a business processes payments online via PayPal Here, the fee structure follows PayPal’s online fee schedule, generally around 2.9% plus $0.30 per transaction, depending on the type of business and transaction volume.

Cost of Additional Hardware

To use PayPal Here, businesses may need to purchase card readers, which are priced affordably:

The Chip and Swipe Reader is available for approximately $24.99, which handles basic card-present transactions.

The Chip and Tap Reader, which allows businesses to accept chip cards and contactless payments (like Apple Pay and Google Pay), is priced around $59.99.

PayPal also offers accessories such as charging stands and cash drawer integration for those seeking a more professional setup, but these are optional.

Comparisons with Competitors’ Pricing

In comparison to Square, PayPal Here’s transaction fees are almost the same, with Square charging 2.6% plus $0.10 for swiped transactions, slightly lower than PayPal. Stripe and other competitors provide similar pricing but concentrate more on online and e-commerce payment services. Even with slight discrepancies, PayPal Here’s fees are comparable to those found in the industry.

Hidden Fees

One of PayPal Here’s strengths is its transparency—there are no monthly fees, setup fees, or hidden costs. Businesses only pay when they process a transaction. However, users should be aware of the higher fees for manually keyed-in or cross-border transactions, which can add up if a large portion of their sales fall under these categories.

Features Overview

PayPal Here offers a comprehensive set of features tailored for small businesses, ensuring they can manage payments, track inventory, and analyze sales effortlessly. It integrates both hardware and software solutions to provide a seamless experience for business owners on the go.

Card Reader Options and Their Specifications

PayPal Here provides multiple card reader options to suit various business needs:

Chip and Swipe Reader: This basic model handles chip and magnetic stripe cards. It connects to your mobile device via Bluetooth and is portable and easy to use.

Chip and Tap Reader: This reader provides support for chip cards, magnetic stripe, and NFC payments such as Apple Pay and Google Pay, making it ideal for businesses looking for contactless payment options. It is small and created for fast, safe transactions. Both devices provide cost-effective and effective solutions for businesses looking to accept various payment methods, giving them flexibility.

Payment Types Supported (Credit, Debit, Contactless, and More)

PayPal Here supports a wide range of payment options, including:

Credit and Debit Cards: Accepts major cards like Visa, MasterCard, American Express, and Discover.

Contactless Payments: Supports tap-to-pay systems, including Apple Pay, Google Pay, and Samsung Pay.

PayPal Payments: Customers can also pay directly via their PayPal accounts, adding an extra layer of convenience.

This versatility ensures that businesses can accept payments from nearly any customer, regardless of their preferred method.

Inventory Management Tools

PayPal Here includes built-in inventory management tools that allow businesses to track their stock in real time. Users can create and organize product lists, monitor stock levels, and update inventory directly from the app. This feature is especially useful for small businesses that need simple, streamlined inventory tracking without additional software.

Reporting and Analytics Features

The app also offers robust reporting and analytics tools. Business owners can access sales reports, track transaction history, and monitor performance over time. These insights can help identify peak sales periods, popular products, and other important trends, enabling more informed business decisions.

Customizable Receipts and Sales Tracking

With PayPal Here, users have the option to personalize receipts that can be sent to customers via email or text message. This customization entails the addition of business logos and personalized messages. Furthermore, the app has a built-in feature for tracking sales, enabling entrepreneurs to easily access previous transactions, issue refunds, or resend receipts.

Security Features

Security is a top priority for PayPal Here, ensuring that both businesses and customers feel safe when processing payments. With multiple layers of protection, PayPal Here provides peace of mind through advanced security technologies and industry-standard compliance measures.

Data Encryption and Fraud Protection

PayPal Here employs robust data encryption to protect sensitive information during transactions. Every time a payment is processed, the data is encrypted to ensure that card details and personal information are securely transmitted between devices and PayPal’s servers. This encryption helps safeguard against unauthorized access or interception of data, reducing the risk of fraud.

To add an extra layer of protection against fraudulent transactions, PayPal Here comes with built-in automated fraud detection systems. These systems detect any possible risks by constantly monitoring transactions and taking necessary preventative measures in real-time. This ongoing surveillance assists companies in preventing fraudulent transactions, which could result in chargebacks and financial harm.

Compliance with PCI Standards

PayPal Here is fully compliant with the Payment Card Industry Data Security Standard (PCI-DSS). This is an industry-standard framework designed to ensure that businesses securely handle cardholder information during transactions. PCI compliance is essential for protecting payment data and reducing the risk of breaches. PayPal Here’s PCI compliance means businesses using the platform can trust that they are meeting all required security protocols when processing payments.

Secure Login and Customer Data Safety

PayPal Here incorporates several features to enhance login security and customer data protection. Users can enable two-factor authentication (2FA) for additional protection. With 2FA, a second form of verification (such as a one-time code sent via SMS) is required in addition to the password, significantly improving account security.

Additionally, customer data is securely stored and protected under PayPal’s strict privacy policies. PayPal Here ensures that no sensitive information, such as card numbers or personal details, is stored on the card reader or mobile device, minimizing the risk of data breaches if the device is lost or stolen.

User Interface and Experience

PayPal Here’s user interface is designed with simplicity and ease of use in mind, making it accessible for small businesses that may not have much technical expertise. Whether you’re using the app for the first time or as an experienced user, the layout and features ensure a smooth experience for processing payments and managing your business.

App Design and Ease of Use

The design of the PayPal Here app is straightforward and user-friendly, focusing on usability and simplicity. It can be accessed on iOS and Android gadgets, featuring a touchscreen-friendly design. Users can easily begin using the app with minimal setup time due to its simple layout. Primary features such as payment acceptance, refund issuance, and sales report viewing are clearly visible on the main screen, reducing the necessity to navigate through menus. The app’s popularity among small business owners is largely due to its simplicity, providing quick and easy access to essential functions.

Navigation Through Key Features

Navigating through PayPal Here’s key features is seamless, with users able to switch between payment options, inventory management, and reporting tools without any hassle. The main menu organizes all important features—like tracking sales, issuing invoices, and customizing receipts—making it easy for businesses to manage their operations in real time. Payment processing is especially fast, with clear prompts guiding users through card swipes, chip insertions, or contactless payments, ensuring minimal interruptions during transactions.

Customer Support Integration Within the App

One of the app’s highlights is the integration of customer support within the platform. Users can access support directly through the app, whether through FAQs, help documentation, or connecting to live customer support via chat or phone. This feature is valuable for resolving issues quickly, as it reduces the need for users to search for external support options.

User Reviews and Feedback on Functionality

User feedback regarding the functionality of PayPal Here is mostly positive, particularly noting its ease of use and the convenience of having various payment options available. Users value the app’s ease of use, especially for mobile and small businesses. Nevertheless, a few users have observed sporadic problems with connectivity when making payments, particularly in regions with poor internet reception. However, its user base has given the app high ratings for its overall functionality and reliability.

Transaction Speed and Reliability

PayPal Here is designed to deliver fast and reliable payment processing, which is essential for businesses handling multiple transactions daily. From swiping cards to tapping contactless payments, the speed at which transactions are completed can significantly impact customer satisfaction, and PayPal Here performs well in this area.

Speed of Processing Payments

One of the standout features of PayPal Here is its quick transaction processing. Payments made through the app, whether by swiping a card, inserting a chip, or using contactless methods, are processed in just a few seconds. The speed helps reduce wait times at checkout, providing a smooth customer experience. Once the payment is authorized, the funds are quickly transferred to the merchant’s PayPal account, usually within minutes, giving businesses faster access to their money.

Offline Functionality and Syncing Data

PayPal Here also provides an offline mode that is especially handy for businesses in areas with unreliable internet access. When not connected online, the app enables merchants to still accept payments. All pending transactions will be synced and processed automatically once the device reconnects to the internet. This functionality is extremely beneficial for companies that function in temporary or mobile settings, like pop-up shops or outdoor activities, where internet access may be sporadic.

Reliability of Connection with Mobile Devices

The reliability of PayPal Here in maintaining a stable connection with mobile devices is another strong point. The card reader connects to smartphones or tablets via Bluetooth, and for most users, this connection remains steady during transactions. However, some users have reported occasional issues with the Bluetooth pairing, which can lead to delays in processing payments. Regular software updates from PayPal have helped minimize these issues, ensuring that the app and hardware work smoothly together.

Performance in High-Traffic Scenarios

PayPal Here also performs well in high-traffic environments, such as busy retail locations or events with high transaction volumes. Its ability to handle multiple transactions in quick succession without slowing down makes it a reliable choice for businesses with fluctuating customer traffic. The platform’s capacity to handle numerous transactions without bottlenecks helps prevent long checkout lines, even during peak hours.

Customer Support

PayPal Here provides different customer support options so that businesses can efficiently address issues as they come up. By offering phone, email, and live chat support, PayPal Here strives to promptly help users facing issues with their payment systems.

Available Support Channels (Phone, Email, Live Chat)

PayPal Here provides multiple channels for customer support, including:

Phone Support: For urgent issues, users can contact PayPal’s customer support through phone services. PayPal offers specific phone lines for merchants, ensuring that business-related concerns are handled by knowledgeable agents.

Email Support: Businesses can also reach out via email for less urgent matters or for documentation of their issue. Email responses typically take longer but are useful for more complex questions or situations that require a detailed explanation.

Live Chat: For immediate, non-phone support, PayPal Here offers live chat, which is accessible through the app or PayPal’s website. This option is particularly convenient for users who prefer not to call and need quick resolutions without leaving the platform.

Response Times and Availability (24/7 or Limited Hours)

PayPal Here’s customer support is available 24/7 for phone inquiries, offering round-the-clock assistance for urgent issues that might arise at any time. Live chat and email services are generally available during business hours, though exact times may vary depending on the region. Users often report quick response times when using the phone or live chat, while email support can take up to 24-48 hours for a full resolution.

Quality of Support Based on Customer Reviews

Customer opinions on the support services provided by PayPal Here vary. Numerous customers commend the fast and effective telephone assistance, frequently mentioning skilled representatives who efficiently solve problems. Live chat is also valued for its quick response time and ease of use. Nevertheless, certain users have complained about delays in receiving responses through email or being placed on hold during busy periods. Moreover, although the support agents are usually helpful, some users have experienced challenges in getting complex issues resolved promptly.

Overall, PayPal Here offers solid customer support with multiple channels, ensuring businesses can access help when they need it. While there are occasional complaints about wait times, the 24/7 availability and range of support options are valuable features for users.

Comparing PayPal Here to Competitors

PayPal Here operates in a highly competitive mobile point-of-sale (mPOS) market, with major competitors like Square, Clover, and Stripe vying for the attention of small and medium-sized businesses. Each of these systems offers unique features, which makes it important to understand how PayPal Here stacks up against them.

Key Competitors (Square, Clover, etc.)

Square: Square is one of the most well-known mPOS systems, offering a range of hardware options, including free basic card readers and advanced terminals. Square also has a comprehensive app that supports various payment methods, inventory management, and employee management tools, making it highly versatile for different business types.

Clover: Clover is famous for its variety of hardware options that can be customized, ranging from simple card readers to complete point-of-sale systems. It provides a wide range of integrations with other business tools, making it a great option for businesses in need of advanced, scalable solutions.

Stripe: Stripe focuses on online payments and integrations, though it does offer an mPOS system for in-person transactions. Stripe is often favored by developers and larger e-commerce businesses due to its customizable payment processing features.

What Makes PayPal Here Stand Out?

PayPal Here distinguishes itself primarily through its integration with the broader PayPal ecosystem. Businesses that already use PayPal for online payments can seamlessly integrate PayPal Here for in-person sales, creating a unified payment platform. Additionally, PayPal’s global presence and strong brand recognition give it an edge, particularly for businesses with international customers. PayPal Here also supports a wide range of payment methods, including credit and debit cards, contactless payments, and PayPal account payments, adding to its flexibility.

Another key advantage is the speed at which businesses can access funds. PayPal Here offers near-instantaneous access to funds within the PayPal account, compared to competitors like Square, which may have longer transfer times to bank accounts.

Weaknesses Compared to Others

Although PayPal Here has many advantages, it also has some disadvantages in comparison to its rivals. For instance, Square provides a wider selection of hardware options, such as complimentary basic card readers, whereas PayPal Here charges for its hardware individually. Square offers better pricing for businesses with a high number of swiped transactions, making it a more affordable option.

Clover’s system offers more scalability and customization than PayPal Here, which may be limiting for larger businesses or those that require more complex integrations. Additionally, PayPal Here lacks some of the advanced business management features that systems like Square and Clover provide, such as extensive employee management or advanced reporting options.

Pros and Cons of Using PayPal Here

PayPal Here has earned its place as a convenient mobile point-of-sale solution for small and medium-sized businesses, offering many advantages. However, like any platform, it has its strengths and weaknesses that businesses need to consider before adopting it as their primary payment solution.

List of Strengths

Global Recognition: PayPal is a globally recognized and trusted brand, which can be a significant advantage for businesses. Customers are often more comfortable making payments through a platform they know, adding an extra layer of trust to transactions.

Ease of Use: PayPal Here is known for its simple and user-friendly interface. The app is intuitive, making it easy for business owners and employees to process payments quickly, manage sales, and navigate essential features without a steep learning curve.

Wide Range of Payment Options: The platform allows for various payment methods such as credit and debit cards, contactless payments (such as Apple Pay and Google Pay), and payments through PayPal accounts. This adaptability simplifies the process for companies to meet various customer inclinations.

Integration with PayPal Ecosystem: One of PayPal Here’s key advantages is its seamless integration with PayPal’s broader ecosystem. Businesses can manage both online and in-person payments in one place, simplifying their financial operations.

Instant Access to Funds: Merchants using PayPal Here can access funds almost instantly in their PayPal account, which can be beneficial for cash flow, unlike some competitors who take longer to transfer funds to bank accounts.

List of Weaknesses

Higher Fees for Certain Transactions: While PayPal Here’s fees for swiped transactions are competitive (2.7%), its fees for manually keyed-in transactions are relatively high at 3.5% plus $0.15 per transaction. This can be costly for businesses that process many card-not-present payments.

Limited Hardware Options: Compared to competitors like Square, which offers a variety of hardware options, PayPal Here’s hardware selection is more limited. Businesses looking for a wider range of devices, such as advanced POS terminals, may find PayPal Here lacking.

Not Ideal for Larger Businesses: Although PayPal Here is effective for small businesses and mobile configurations, it may lack sufficient capabilities for bigger enterprises with more intricate requirements. Rivals such as Clover provide advanced features for businesses needing more customization and scalability in their solutions.

Limited Advanced Business Features: Unlike some competitors, PayPal Here lacks certain advanced business management features such as comprehensive employee management tools or in-depth analytics. This may be a drawback for businesses looking for a more all-in-one solution.

Overall, PayPal Here is a solid choice for businesses seeking simplicity, flexibility, and global recognition. However, businesses with higher transaction volumes or more complex operational needs may want to consider alternatives with more robust features and lower fees for certain transactions.

Conclusion

To sum up, PayPal Here provides a versatile and easy-to-use mobile payment option for small and medium-sized companies. Due to its worldwide reputation, variety of payment methods, and seamless integration with the PayPal system, it is a reliable option for mobile vendors and service providers. Nevertheless, enterprises with greater requirements may look for more advanced functionalities in other places.

FAQs

What types of businesses benefit most from PayPal Here?

PayPal Here is ideal for small and medium-sized businesses that need a mobile payment solution, such as market vendors, food trucks, freelancers, and service providers. It works well for businesses that require flexibility in processing payments both on the go and in-store.

Does PayPal Here support multiple currencies and international transactions?

Yes, PayPal Here supports multiple currencies and allows businesses to process international transactions, making it suitable for businesses that serve customers across borders.

How does PayPal Here handle chargebacks and disputes?

PayPal Here offers tools for merchants to manage chargebacks and disputes, including fraud detection systems and a resolution center where disputes can be handled directly within the PayPal ecosystem.