PayPoint Review

- 14th Aug, 2024

- | By Linda Mae

- | Reviews

PayPoint is well-known for its broad offering of services that meet the needs of both customers and businesses, making it a top choice for payment processing solutions. Since its establishment in 1996, PayPoint has developed into a major player in the payment sector, enabling smooth transactions and offering creative payment options. Lets read more about PayPoint Review.

Company Background | PayPoint Review

PayPoint was established to assist people in topping up gas and electricity on their prepaid meters in nearby convenience stores. Over time, the company has broadened its services to encompass a range of payment options. Important moments in PayPoint’s growth include its 2004 debut on the London Stock Exchange and the introduction of the PayPoint One terminal, which combines card transactions, a point-of-sale tablet, and cloud-based administrative tools.

PayPoint has continually adapted to the changing payment landscape, introducing services such as mobile top-ups, bill payments, and even the ability to purchase lottery tickets. The company’s partnership with Lloyds Bank Cardnet for merchant services has further solidified its position in the market.

Currently, PayPoint manages around 740 million transactions every year and caters to more than 6,000 businesses. PayPoint’s robust range of services and dedication to staying ahead in technology have helped the company establish a solid foothold in the payment processing sector, aiding businesses of all sizes in handling their transactions with ease.

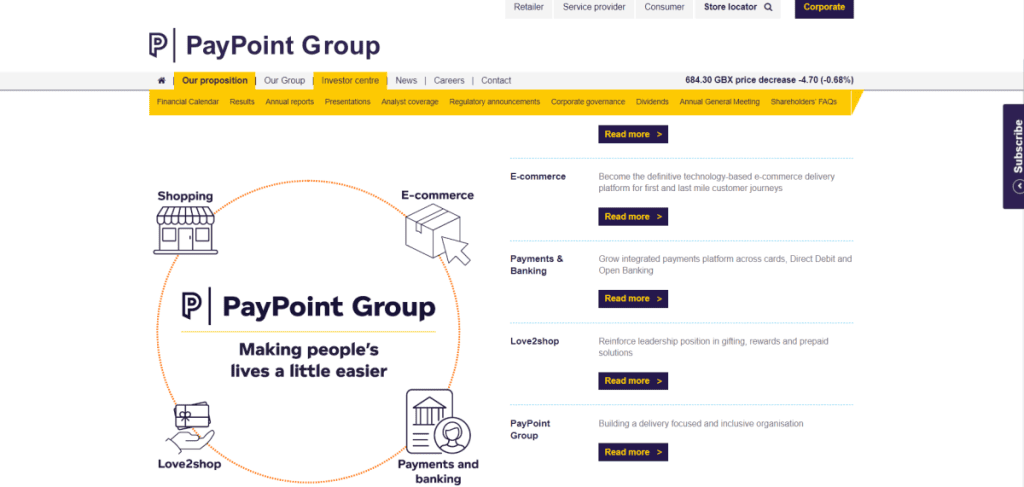

Services Offered

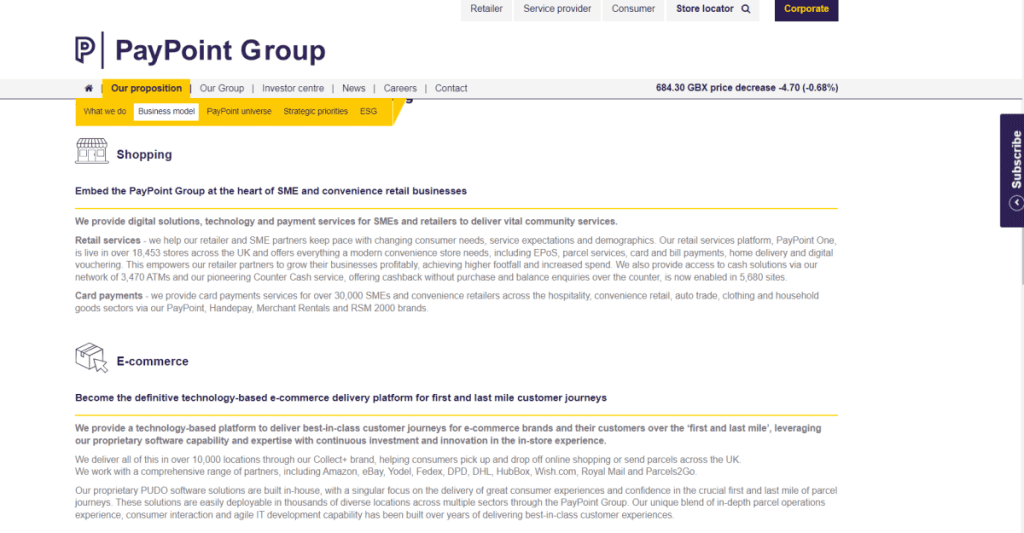

PayPoint offers a comprehensive range of services designed to streamline payment processes for businesses and consumers. Their solutions encompass various methods of payment processing, the versatile PayPoint One terminal, and multiple consumer services.

Payment Processing Solutions

PayPoint provides robust payment processing solutions that cater to a wide array of needs. They support credit card processing for major brands including Mastercard, Visa, and American Express, ensuring that merchants can accommodate customers’ preferred payment methods. It also supports contactless payments with Apple Pay and Android Pay, in addition to standard credit card transactions, enabling fast and secure payments. The business also backs online and mobile payments, offering a flexible and contemporary method for managing transactions in the digital era.

PayPoint One Terminal

The PayPoint One terminal is a versatile and feature-rich device designed to enhance business operations. It is available in three packages: Base, Core, and Pro.

Base Package:

Ideal for existing merchants

Weekly rental cost: £10

Includes essential business services, a POS tablet, integrated card payments, and cloud-based administrative tools

Core Package:

Suited for both new and existing merchants

Weekly rental cost: £15 for existing merchants, £20 for new merchants

Adds EPOS Core functionalities, expedited product scanning, customizable promotions, shelf label generation, and a complimentary cash drawer

Pro Package:

Aimed at new merchants seeking advanced functionalities

Weekly rental cost: £30

Offers comprehensive reporting, mobile inventory management, batch printing of shelf edge labels via the mobile app, and integrated ordering and supplier management tools

Consumer Services

PayPoint’s consumer services are extensive and designed to provide convenience and accessibility. They allow customers to pay bills, transfer money, and top up their mobiles at various outlets. Additionally, it enables the purchase of lottery tickets and parking payments, offering a wide range of everyday services. The CollectPlus service further enhances consumer convenience by allowing them to send and receive goods through local stores, simplifying the process of handling online shopping returns and deliveries.

Overall, PayPoint’s suite of services provides businesses and consumers with versatile, efficient, and secure payment solutions, reinforcing its position as a leading provider in the payment processing industry.

Pricing and Fees

Businesses must grasp the importance of comprehending PayPoint’s services pricing and fees when evaluating their solutions. PayPoint has a versatile pricing structure that caters to different business requirements by working in collaboration with Lloyds Bank Cardnet.

Transparency of Pricing and the Role of Lloyds Bank Cardnet

PayPoint collaborates with Lloyds Bank Cardnet to manage and set fees for merchant accounts. This partnership ensures that merchants receive competitive and transparent pricing. However, the exact details of the pricing structure are not always fully disclosed on PayPoint’s website. Merchants usually have to discuss their transaction rates, contract duration, and monthly fees directly with Lloyds Bank Cardnet. This configuration seeks to offer customized pricing solutions that match the individual requirements of each merchant, although it may also lead to some differences and a lack of clear upfront pricing.

Weekly Rental Costs for PayPoint One Terminal Packages

PayPoint offers its PayPoint One terminal in three distinct packages: Base, Core, and Pro. Each package is priced based on the features and services provided:

Base Package:

Designed for existing merchants

Weekly rental cost: £10

Includes essential business services, a POS tablet, integrated card payments, and cloud-based administrative tools

Core Package:

Suitable for both new and existing merchants

Weekly rental cost: £15 for existing merchants, £20 for new merchants

Adds EPOS Core functionalities, expedited product scanning, customizable promotions, shelf label generation, and a complimentary cash drawer

Pro Package:

Targeted at new merchants seeking advanced functionalities

Weekly rental cost: £30

Offers comprehensive reporting, mobile inventory management, batch printing of shelf edge labels via the mobile app, and integrated ordering and supplier management tools

Discussion on Additional Fees

Apart from the weekly rental costs for the PayPoint One terminal, merchants should be aware of potential additional fees. These can include:

Early Termination Fees: If a merchant decides to end their contract before the agreed term, they may incur early termination fees. These fees can vary based on the remaining contract duration and specific terms agreed upon with Lloyds Bank Cardnet.

PCI Compliance Fees: Ensuring compliance with Payment Card Industry (PCI) standards is essential for maintaining the security of card transactions. Merchants may be required to pay PCI compliance fees to cover the cost of meeting these security standards.

Businesses can make better decisions about integrating their payment solutions by grasping these aspects of PayPoint’s pricing and fees. Although Lloyds Bank Cardnet provides competitive rates, it is crucial for merchants to discuss and define all possible expenses in advance.

Customer Experience

Understanding the customer experience with PayPoint provides valuable insights into the company’s performance and service quality. Reviews from users and employees reveal a broad spectrum of opinions, highlighting both strengths and areas for improvement.

User Reviews

Customer feedback on PayPoint is mixed, with users sharing both positive and negative experiences across various review platforms.

Common Praises: Numerous customers value the dependability of PayPoint’s services, frequently mentioning the limited periods of inactivity as a notable benefit. The company’s wide range of services, such as bill payments, mobile top-ups, and easy payment solutions, are well received. Users also praise PayPoint for its simple setup process and the effectiveness of its technical support team, which is frequently lauded for quickly solving problems.

Common Complaints: Despite the positive feedback, there are notable complaints about PayPoint’s customer service. Some users report difficulties in reaching support representatives and experiencing slow response times. Issues with accounting errors and discrepancies in billing are also mentioned, causing frustration among merchants. Additionally, the long contract durations and high cancellation fees are frequent points of criticism, with some users feeling trapped in lengthy agreements without flexible exit options.

Employee Feedback

Employee reviews from platforms like Glassdoor and Indeed provide a glimpse into the internal workings of PayPoint.

Pros: Employees often highlight the positive work environment and the company’s supportive culture. The opportunities for professional growth and development within PayPoint are frequently mentioned as significant benefits. Many employees appreciate the collaborative atmosphere and the company’s commitment to innovation in the payment processing industry.

Cons: Some employees mention issues with management quality and communication as potential drawbacks. Reports indicate that new hires are receiving insufficient training, resulting in challenges with job performance and customer interactions. Moreover, there are employees who believe that the workload can become too much at certain times, due to the high expectations and pressure to achieve goals.

Overall, while PayPoint excels in providing reliable payment solutions and fostering a supportive work environment, it faces challenges in customer service responsiveness and management practices. Addressing these issues could enhance both user satisfaction and employee morale, contributing to the company’s continued growth and success.

Pros and Cons

When evaluating PayPoint, it is essential to consider both its strengths and weaknesses. This balanced view helps businesses make informed decisions about whether PayPoint’s services align with their needs.

Pros

Reliable Payment Processing with Minimal Downtime: One of the standout features of PayPoint is its reliability. Users frequently praise the system for its consistent performance and minimal downtime. This reliability is crucial for businesses that rely on uninterrupted payment processing to maintain customer satisfaction and operational efficiency.

Comprehensive Service Offerings for Both Merchants and Consumers: PayPoint offers a variety of services for merchants and consumers. Merchants are provided with strong payment processing options, such as credit card transactions, contactless payments, and online payments. Moreover, the PayPoint One terminal bundles offer a range of features designed for diverse business requirements. PayPoint enables consumers to conveniently and easily pay bills, top up mobile phones, send money, buy lottery tickets, and make parking payments, improving access and convenience.

Flexible and Scalable Solutions for Businesses of All Sizes: PayPoint’s solutions are designed to be flexible and scalable, making them suitable for businesses of all sizes. Whether a small retailer or a large enterprise, PayPoint offers packages and services that can grow with the business. The variety of terminal packages (Base, Core, and Pro) allows businesses to choose the level of service that best fits their current requirements and upgrade as needed.

Cons

Issues with Customer Service and Support: Despite its strengths, PayPoint faces criticism regarding customer service and support. Some users report difficulties in reaching support representatives and experiencing slow response times. This can be particularly frustrating for businesses that need timely assistance to resolve payment processing issues.

Lack of Detailed Pricing Information on the Website: Another frequent issue is the limited availability of specific pricing details on PayPoint’s website. Many times, prospective clients must discuss pricing directly with Lloyds Bank Cardnet, resulting in inconsistency and a lack of clear pricing information upfront. It can be difficult for businesses to compare PayPoint’s products and services with those of competitors.

Long Contract Durations and High Cancellation Fees: PayPoint’s long contract durations and high cancellation fees are additional points of contention. Some users feel constrained by lengthy agreements, and the financial penalties for early termination can be significant. This lack of flexibility may deter some businesses from committing to PayPoint’s services.

In conclusion, while PayPoint excels in providing reliable, comprehensive, and scalable payment solutions, it must address customer service, pricing transparency, and contract flexibility to enhance its overall user experience.

Comparison with Competitors

In the payment processing sector, PayPoint rivals Square, PayPal, and Worldpay as major competitors. It is crucial for businesses to assess and compare the unique strengths and weaknesses of each competitor in order to determine the most suitable one for their requirements.

Square

Strengths:

Pricing Transparency: Square is known for its clear and transparent pricing model, with no hidden fees. This makes it easier for businesses to understand their costs upfront.

Ease of Use: Square’s payment processing solutions are user-friendly and designed for quick setup, making it an excellent choice for small businesses and startups.

Comprehensive Features: Square offers a wide range of features, including POS systems, online payments, invoicing, and inventory management.

Weaknesses:

Limited Scalability: While Square is ideal for small businesses, it may not be as suitable for larger enterprises with more complex needs.

Customer Support: Some users have reported issues with Square’s customer support, particularly regarding response times.

PayPal

Strengths:

Brand Recognition: PayPal is a globally recognized brand, which can enhance customer trust and confidence in using its payment processing services.

Versatility: PayPal supports a wide range of payment methods, including credit cards, bank transfers, and PayPal balances, both online and offline.

Security: PayPal is known for its strong security measures, offering robust fraud protection and buyer/seller protections.

Weaknesses:

Fees: PayPal’s fees can be higher compared to other providers, especially for international transactions and currency conversions.

Account Holds: Some users have experienced account holds or limitations, which can disrupt business operations.

Worldpay

Strengths:

Scalability: Worldpay offers scalable solutions suitable for businesses of all sizes, from small merchants to large enterprises.

Global Reach: With a presence in multiple countries, Worldpay supports a wide array of currencies and payment methods, making it ideal for international businesses.

Comprehensive Features: Worldpay provides extensive features, including advanced analytics, fraud prevention, and customizable payment solutions.

Weaknesses:

Complex Pricing: Worldpay’s pricing structure can be complex and less transparent, requiring businesses to negotiate rates and terms.

Customer Support: Some users have reported challenges with Worldpay’s customer support, citing slow response times and difficulty resolving issues.

PayPoint’s Position

Strengths:

Reliability: It is praised for its reliable payment processing with minimal downtime, ensuring consistent performance for businesses.

Comprehensive Services: It offers a broad range of services for both merchants and consumers, including bill payments, mobile top-ups, and lottery ticket purchases.

Scalability: PayPoint provides flexible and scalable solutions, accommodating businesses of various sizes and needs.

Weaknesses:

Customer Service: PayPoint faces criticism for its customer service, with reports of slow response times and difficulties in reaching support representatives.

Pricing Transparency: Like Worldpay, PayPoint’s pricing information is not fully disclosed on its website, leading to potential variability and a lack of upfront clarity.

Contract Flexibility: Long contract durations and high cancellation fees are common complaints, potentially limiting business flexibility.

In essence, although PayPoint provides dependable and thorough services, businesses need to take into account its customer service issues and lack of pricing transparency. Businesses can determine the most suitable payment processing solution for their unique requirements and preferences by assessing PayPoint against similar competitors such as Square, PayPal, and Worldpay.

Security and Compliance

Security and compliance are critical aspects of payment processing, and PayPoint takes these responsibilities seriously to protect its clients and their customers.

Overview of Security Measures

PayPoint utilizes strong security measures to guarantee the safety of transactions and data. Key components consist of rigorous fraud screening and compliance with PCI DSS standards. Fraud screening aids in identifying and stopping unauthorized transactions, protecting merchants and consumers against possible fraud. PCI compliance guarantees that PayPoint upholds strict security criteria established by the payment card industry, safeguarding cardholder information while it is being transmitted and stored.

Importance of Compliance in Payment Processing

Ensuring adherence to payment processing rules is crucial for upholding trust and security in financial transactions. It ensures the security of cardholder data by following industry best practices through PCI DSS standards. Ensuring compliance is essential to prevent data breaches and uphold the integrity of the payment processing system, ultimately safeguarding businesses from financial and reputational harm.

How PayPoint Ensures Data Security for Its Clients

It employs various tactics to uphold data security for its customers. This consists of securing sensitive information through encryption, conducting frequent security assessments, and consistently monitoring their systems for weaknesses. The company offers secure payment gateways and utilizes advanced technologies for real-time identification and prevention of potential threats. By upholding strict security measures, PayPoint enables its customers to concentrate on their main business activities without concerns about data security threats.

Conclusion

PayPoint shows consistent strong performance and dependability, providing broad and flexible payment solutions that are appropriate for businesses of any size. Its strong service options and low downtime make it an attractive option for numerous merchants. Nevertheless, prospective customers should take into account the quality of customer service and the transparency of pricing prior to making a decision.

FAQs

What types of businesses can benefit the most from PayPoint’s services?

PayPoint’s services are ideal for small to medium-sized businesses, particularly those in retail and convenience sectors. Its flexible, scalable solutions and consumer services like bill payments and mobile top-ups suit diverse operational needs.

How does PayPoint ensure the security of transactions?

PayPoint uses strong security measures such as thorough fraud screening and adherence to PCI DSS standards. These protocols guarantee the security of all transactions, safeguarding the data of both merchants and customers.

What are the main challenges users face with PayPoint?

Common issues include customer service responsiveness and complex pricing structures. Solutions include seeking clarification on fees during negotiations and using PayPoint’s online resources for support.