RentPayment Review

- 23rd Oct, 2024

- | By Linda Mae

- | Reviews

RentPayment is an internet-based platform created to simplify rent payments for tenants and landlords. By providing different payment choices like credit cards, debit cards, ACH transfers, and mobile payments, tenants have a flexible and convenient way to pay their rent. Landlords can take advantage of a convenient dashboard to monitor payments, schedule automated reminders, and manage finances effectively. The main goal of the platform is to make the rent collection process easier while ensuring a secure and transparent system for both landlords and tenants. Let’s delve deeper into the RentPayment Review.

RentPayment, a groundbreaking solution created by MRI Software, has been leading the way in the digital rent payment sector. At first, landlords used conventional practices like checks or cash, which frequently led to issues such as bounced checks, delays, and mistakes in handling. With the rental business adopting more technology, RentPayment upgraded to include electronic transactions, providing safer, more dependable, and quicker payment options. Over the years, RentPayment has broadened its services by introducing mobile apps, automating repeat payments, and connecting with property management systems, catering to both small landlords and larger property management companies.

Importance of Online Payment Solutions for Tenants and Landlords

The rise of online rent payment platforms like RentPayment has brought considerable convenience to both tenants and landlords. For tenants, the ability to make rent payments online or through mobile apps eliminates the need for physical checks or money orders, making the process faster and more efficient. It also provides flexibility, allowing tenants to make payments from anywhere, set up automatic transactions, and avoid late fees.

For landlords, RentPayment guarantees improved cash flow through decreased delays and quicker payment processing. The automated system on the platform helps landlords by tracking payments, sending reminders, and reducing administrative tasks so they can focus on property management instead of collecting rent. Moreover, the secure encryption employed in RentPayment protects the data of both tenants and landlords, minimizing the chances of fraud and providing a clear history of all transactions. This builds trust and guarantees a more seamless rental experience for everyone involved.

Key Features of RentPayment | RentPayment Review

RentPayment is designed to simplify rent transactions by offering a comprehensive set of features for both landlords and tenants. These features aim to enhance convenience, security, and transparency in the payment process.

Multiple Payment Methods (Credit Cards, Debit Cards, e-Checks, ACH): One of RentPayment’s standout features is its support for multiple payment methods, providing flexibility for tenants. Users can pay rent using credit cards, debit cards, e-checks, or Automated Clearing House (ACH) transfers. This wide range of payment options caters to different preferences, making it easier for tenants to meet their rent obligations while giving landlords the flexibility to receive payments through secure channels.

Automated Recurring Payments: RentPayment enables tenants to set up automated recurring payments, ensuring their rent is paid on time each month. This feature reduces the risk of late payments, benefiting both tenants and landlords. Tenants can schedule payments to automatically deduct from their accounts on a set date, eliminating the need to remember each month’s due date, and landlords can enjoy consistent, timely payments.

Mobile App Functionality for Tenants: RentPayment offers a mobile application for iOS and Android devices, allowing tenants to easily handle their rent payments while on the move. Tenants are able to check their payment history, establish regular payments, and get instant notifications using the app, which helps them effectively handle their finances on their smartphones.

Payment Reminders and Notifications: To further reduce late payments, RentPayment offers payment reminders and notifications. Tenants receive alerts before rent is due, as well as confirmations once the payment has been processed. These reminders help ensure tenants stay on top of their financial obligations while keeping landlords informed of incoming payments.

Secure and Encrypted Transactions: RentPayment places a high importance on security. The system employs sophisticated encryption and complies with Payment Card Industry Data Security Standards (PCI DSS) to safeguard sensitive financial data. This strong security level protects landlords and tenants from fraud and identity theft, ensuring peace of mind for everyone.

Integration with Property Management Software: RentPayment seamlessly integrates with various property management software platforms. This integration allows landlords and property managers to automate rent collection, track payments, and manage tenant information in one place. It reduces manual administrative tasks and ensures that rental data is easily accessible and organized.

User Experience

RentPayment aims to provide a seamless user experience for both tenants and landlords, ensuring ease of use and efficiency across the platform. Whether managing payments or tracking rent collection, the platform is designed to make the process simple and intuitive for all users.

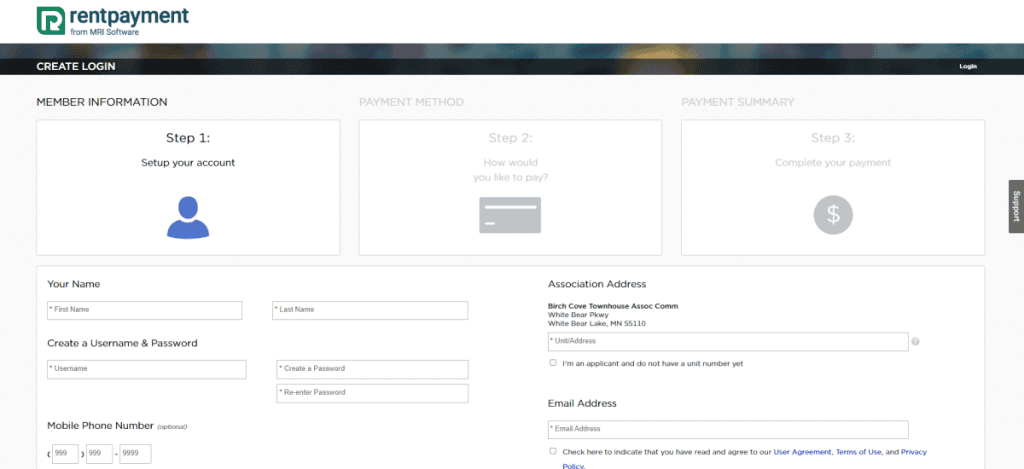

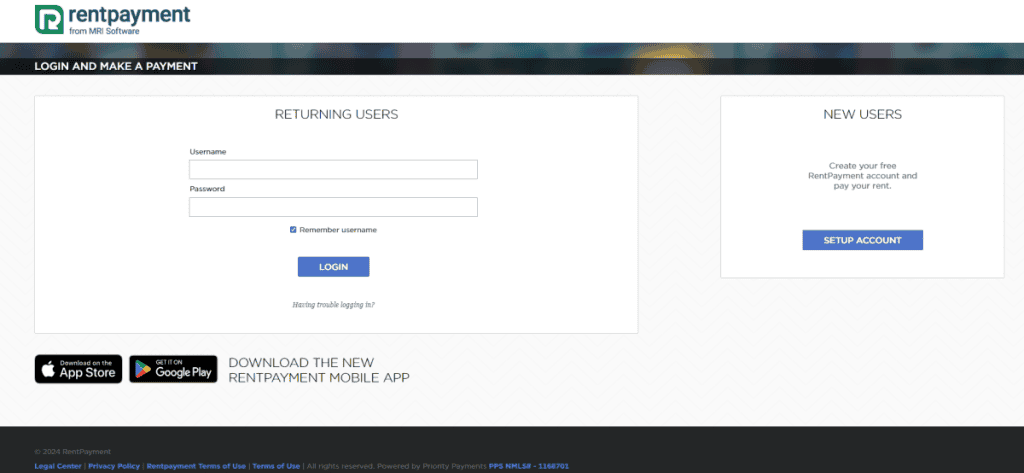

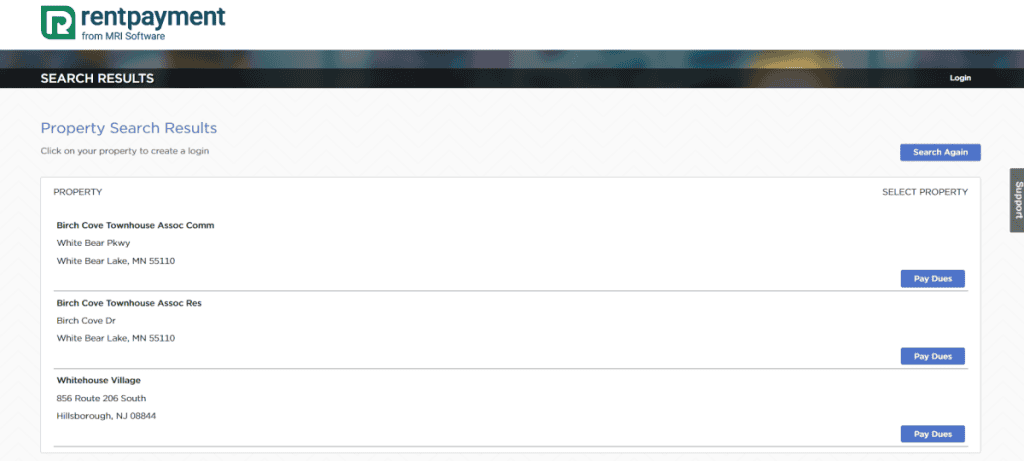

Tenant-Side Experience: For tenants, RentPayment offers a straightforward and user-friendly experience. Setting up payments is easy, with tenants able to choose from multiple payment methods such as credit cards, debit cards, or ACH transfers. The sign-up process is quick, and once an account is created, tenants can easily manage their payment schedules.

The platform provides access to in-depth transaction records, enabling tenants to examine previous payments whenever they want. This level of transparency helps with maintaining records and guaranteeing timely payments. RentPayment offers flexibility, enabling users to switch payment methods as necessary, making it convenient for tenants with different payment preferences.

Landlord/Property Manager-Side Experience: For landlords and property managers, RentPayment provides robust features that simplify rent collection and financial management. The dashboard functionality allows landlords to track payments in real time, making it easy to see which tenants have paid and who may be overdue. This helps landlords stay on top of their cash flow with minimal effort.

One of the key features for property managers is payment reconciliation. RentPayment automatically matches incoming payments with outstanding balances, reducing the need for manual tracking and ensuring accuracy. The simplicity of the interface allows landlords to quickly find the information they need, without overwhelming them with unnecessary details.

Mobile App Review (Tenant and Property Manager Perspectives): RentPayment’s mobile application improves the user experience for both renters and property owners. Tenants have the ability to submit payments, schedule automatic transactions, and get alerts via the app, giving them the freedom and authority to manage their rent efficiently. The app offers landlords up-to-date information on rent payments and allows them to easily manage tenant payments while on the move. Both groups of users enjoy the ease of handling everything directly from their mobile devices.

Pricing and Fees

RentPayment offers a pricing structure designed to cater to both landlords and tenants, with fees varying based on the type of payment method used. Its competitive pricing model ensures flexibility, but like any payment platform, it’s important to understand the potential costs involved.

Pricing Structure for Landlords: For landlords, RentPayment typically charges based on the number of transactions or properties managed. The platform may offer different subscription tiers depending on the scale of operations. Larger property management companies handling multiple units can access more tailored pricing packages, while smaller landlords can expect standard transaction fees that cover the use of RentPayment’s services, including payment processing and integration with property management software. In some cases, landlords can pass on the cost of transaction fees to tenants, though this may depend on local laws and landlord practices.

Fee Structure for Tenants (Credit Card Fees, ACH, e-Check Options): Tenants are charged fees by RentPayment depending on the payment method selected. Credit card transactions typically involve a service charge that can vary between 2.5% and 3% of the overall payment. This is a common occurrence with credit card transactions because of the associated processing expenses. ACH payments, which move money directly from a bank account, are frequently less expensive, with reduced fees or no fees in certain situations. E-checks work in the same way as ACH transfers and generally have similar fee schedules. Tenants should have knowledge of these choices when determining how to make their rent payments.

Additional Service Fees for Expedited Payments or Processing: RentPayment offers the option for expedited payments or same-day processing, which can be useful for tenants who need to make a payment quickly to avoid late fees. However, these expedited services often come with additional costs, depending on the urgency of the payment and the method used. Tenants and landlords should review these extra fees before opting for faster processing times.

Comparison to Competitors in the Market in Terms of Pricing: When compared to other rent payment platforms, RentPayment’s fees are competitive. Some competitors may offer lower or no fees for ACH transfers but charge similarly for credit card transactions. Platforms like Zelle or Venmo may offer free peer-to-peer transfers but lack the additional property management features that RentPayment provides. In contrast, platforms like AppFolio and Cozy offer similar pricing structures but may differ in terms of features and scalability for larger landlords.

Security and Compliance

RentPayment places a strong emphasis on security and regulatory compliance to protect both landlords and tenants during the rent payment process. The platform integrates several advanced security protocols to ensure that sensitive financial information is protected, while also maintaining compliance with industry standards and regulations.

Security Protocols: Data Encryption and PCI Compliance: One of the core aspects of RentPayment’s security infrastructure is its use of data encryption. The platform employs industry-standard encryption technologies to protect sensitive information during transmission, ensuring that personal and financial data remains secure. In addition to encryption, RentPayment complies with the Payment Card Industry Data Security Standards (PCI DSS), a set of security protocols established to safeguard cardholder information. This compliance ensures that RentPayment meets the highest standards for handling credit card transactions, reducing the risk of data breaches.

Handling of Personal Information: RentPayment also takes the protection of personal information seriously. Personal data, such as names, bank account numbers, and addresses, are stored securely and used solely for the purpose of processing rent payments. The platform implements stringent access controls to ensure that only authorized personnel have access to sensitive information, further protecting users from potential identity theft or unauthorized access.

Fraud Protection Mechanisms: Fraud prevention is a key concern for both tenants and landlords, and RentPayment integrates robust fraud protection mechanisms to address this. The platform monitors transactions for suspicious activities, flags potentially fraudulent transactions, and uses multi-factor authentication to verify user identities. These measures help prevent unauthorized payments and mitigate risks associated with fraud, offering peace of mind to both parties.

Compliance with Federal and State Regulations: RentPayment ensures its services adhere to federal and state financial regulations and data privacy laws. This involves following the rules set out in the Gramm-Leach-Bliley Act (GLBA) as well as other laws controlling the gathering and utilization of financial data. RentPayment reduces the chances of legal problems for landlords and ensures that tenants’ information is managed in compliance with the law by following these regulations.

Risk Management for Property Managers: For property managers, RentPayment provides tools to manage risks associated with rent collection. The platform’s secure and automated processes reduce the chance of payment delays or disputes. Additionally, its tracking and reporting features allow landlords to monitor payments in real-time, reducing the risk of missed payments and improving overall financial management. These risk management features ensure that landlords can efficiently oversee multiple properties without compromising on security.

Customer Support

RentPayment offers a variety of customer support options to ensure that both tenants and landlords receive timely assistance when needed. Their support services are designed to address a range of issues, from technical problems to payment queries, making it easier for users to resolve issues quickly and efficiently.

Availability and Types of Support (Phone, Email, Chat): RentPayment provides multiple avenues for users to contact support, including phone, email, and live chat options. This multi-channel approach ensures that users can choose the method that works best for them, whether they prefer speaking directly to a representative over the phone or using email for non-urgent queries. The live chat feature is particularly useful for getting quick answers without having to wait on hold, making it a convenient option for users who need real-time assistance.

Response Time and Effectiveness of the Support Team: RentPayment’s customer support team is recognized for its promptness, providing fast responses to the majority of questions received. Short wait times are typically experienced for phone support, with a proficient team that resolves issues quickly. Email replies, although not instant, are usually dealt with in 24-48 hours. The live chat feature is very efficient for addressing urgent matters, often resolving problems instantly. Users often express a high level of satisfaction regarding the speed at which their issues are resolved, although response times can differ depending on the number of inquiries.

Customer Reviews on Support Quality: Customer reviews regarding RentPayment’s support quality are generally positive. Many users appreciate the professionalism of the support team and the clarity of the information provided. However, like any service, there are occasional complaints about delays in response times during peak periods or more complex issues requiring multiple follow-ups. Despite this, the majority of users find the support team to be knowledgeable and helpful in resolving their concerns.

Resources Such as FAQ Sections, Knowledge Bases, and Guides: In addition to direct support, RentPayment provides a comprehensive FAQ section and a knowledge base that covers a wide range of topics. These resources are especially helpful for users who prefer to troubleshoot issues on their own. The FAQ section addresses common questions about setting up payments, managing accounts, and understanding fees. For more in-depth assistance, guides and articles provide step-by-step instructions on using the platform’s various features, making it easier for both new and existing users to navigate the system.

Pros of RentPayment

RentPayment is a robust platform that offers a range of advantages for both landlords and tenants, making the rent collection and payment process more streamlined and efficient. With features designed to enhance convenience and automation, RentPayment is a popular choice for property management.

Convenience for Both Landlords and Tenants: One of the most significant benefits of RentPayment is the convenience it offers to both landlords and tenants. Landlords can manage rent collection from anywhere with ease, while tenants can make payments without needing to mail checks or make in-person visits. This online system allows for seamless transactions that fit the busy schedules of both parties, eliminating the need for paper-based processes and manual record-keeping.

Automated, Recurring Payments for Hassle-Free Rent Collection: The automated, recurring payment option on the platform is a significant selling factor. Tenants have the option to establish regular payments so that their rent is automatically covered every month without needing to intervene manually. This not only reduces the chance of late payments but also provides landlords with assurance that rent will be received promptly. Automation greatly decreases administrative work for both parties and guarantees landlords a steady cash flow.

Variety of Payment Options: RentPayment provides tenants with a variety of payment methods, including credit cards, debit cards, ACH transfers, and e-checks. This flexibility allows tenants to choose their preferred payment method, catering to different financial preferences. For landlords, offering multiple payment options increases the likelihood of on-time payments by accommodating the diverse needs of tenants.

User-Friendly Mobile App: RentPayment’s mobile app is another standout feature. It allows both tenants and landlords to manage their transactions on the go. Tenants can make payments, view their transaction history, and set up recurring payments from their smartphones, while landlords can track payments and receive notifications in real-time. The app’s intuitive design ensures that users, regardless of tech-savviness, can easily navigate and utilize its features.

Reliable Customer Service Support: RentPayment offers reliable customer service to help resolve any issues that may arise. The platform provides support through various channels, including phone, email, and live chat, ensuring users can get assistance whenever needed. This level of support helps users resolve problems quickly, improving the overall experience and reducing frustration.

Cons of RentPayment

While RentPayment offers numerous benefits, it’s important to acknowledge some of the potential drawbacks associated with the platform. These cons may affect both tenants and landlords depending on their specific needs and payment preferences.

Transaction Fees for Tenants (Especially Credit Card Payments): One of the main drawbacks of RentPayment is the transaction fees that tenants may face, particularly when using credit cards. Credit card payments typically incur fees ranging from 2.5% to 3% of the transaction value. While ACH transfers or e-checks often have lower or no fees, the cost of using credit cards can add up over time, making it less attractive for tenants who prefer this payment method. This added cost may deter tenants from utilizing certain payment options, leading to potential inconvenience.

Limited International Payment Support: RentPayment currently caters primarily to U.S.-based property managers and tenants, offering limited support for international payments. This can pose a challenge for landlords with properties in multiple countries or tenants who wish to pay from foreign bank accounts. For landlords managing international properties, the lack of global payment options means they may need to look for alternative solutions that better support cross-border transactions.

Possible Delays in Processing Payments During Weekends or Holidays: Another drawback is the possibility of payment processing delays, especially during weekends or holidays. Although RentPayment’s automated systems make transactions more efficient, payments made on weekends may require additional time to appear in landlords’ accounts. This postponement could interfere with landlords’ income and tenants should be careful with payment timing to prevent late fees from processing delays.

Challenges with Integration in Smaller Property Management Systems: For smaller property management companies or individual landlords, RentPayment’s integration with their existing systems may present challenges. Although RentPayment integrates well with larger property management platforms, landlords managing fewer properties might find that the system is not as easy to incorporate into their existing workflows. The platform’s more robust features may seem excessive for smaller operations, and the cost of implementing RentPayment could outweigh the benefits for landlords with only a handful of tenants.

Competitor Comparison

When evaluating RentPayment against its competitors, several platforms stand out in the rent payment space, including Zelle, Cozy, and AppFolio. Each of these platforms offers unique advantages and disadvantages, depending on the needs of landlords and tenants.

Zelle: Zelle is a popular peer-to-peer payment service that allows users to send money directly between bank accounts. Its primary advantage is that transactions are typically free and almost instantaneous. However, Zelle lacks the more robust property management features that RentPayment offers, such as automated rent collection, tenant tracking, and integration with property management software. Additionally, Zelle does not provide any formal tracking system for rent payments, making it less suitable for landlords managing multiple properties or seeking detailed records.

Cozy: Cozy is another well-known platform designed specifically for landlords and tenants. Like RentPayment, Cozy offers ACH payments, but it does not charge tenants a fee for using ACH transfers, making it a more cost-effective option for tenants. Cozy also provides tools for managing rental applications and tenant screening. However, it falls short in terms of payment flexibility, as it doesn’t allow credit card payments, which RentPayment does. RentPayment’s ability to process payments through multiple channels, including credit cards and debit cards, gives it an edge for tenants who prefer those methods.

AppFolio: AppFolio is a thorough property management platform designed for big property management companies. It contains a broader variety of functions, including accounting tools, maintenance management, and marketing capabilities, as well as rent collection. Nevertheless, AppFolio’s cost tends to be higher and may not be suitable for smaller landlords overseeing fewer properties. In comparison, RentPayment offers a less rigid and cost-effective option for landlords of any scale, particularly those who do not need all the services provided by AppFolio.

Advantages and Disadvantages of Using RentPayment Over Others: RentPayment’s biggest advantage over competitors like Zelle and Cozy is its flexibility in payment options and its ability to integrate with larger property management systems. While Zelle offers free, quick payments, it lacks the necessary features for effective property management. Cozy offers free ACH payments, but RentPayment stands out by offering credit card payment options, which can be beneficial for tenants seeking additional payment flexibility. Compared to AppFolio, RentPayment offers a simpler, more affordable solution for smaller landlords.

Differentiating Factors: Ease of Use, Features, and Pricing: RentPayment is known for its ease of use, offering a user-friendly platform that works well for both tenants and landlords. The platform’s variety of payment options, including credit card and ACH, and its strong integration with property management software make it a flexible solution for landlords of varying sizes. Pricing-wise, RentPayment’s fees are competitive, particularly in comparison to platforms like AppFolio, which is more expensive due to its additional features.

Final Verdict

RentPayment provides landlords and tenants with a dependable, versatile, and easy-to-use platform. It is most suitable for landlords who oversee various properties or tenants who want easy payment methods such as credit cards and ACH transfers. Overall, it comes highly recommended for streamlining rent payments, offering strong features and competitive pricing.

FAQs

Can I pay my rent using a credit card on RentPayment?

Yes, RentPayment allows tenants to use credit cards for rent payments, but a service fee may apply, depending on the card type used.

Is RentPayment secure for handling sensitive financial information?

Yes, RentPayment uses industry-standard encryption and is PCI compliant, ensuring that all transactions are secure and data is protected.

Are there any fees associated with paying rent through RentPayment?

Yes, while ACH payments often have lower fees or may be free, using credit or debit cards typically incurs a transaction fee, which varies based on the payment method chosen.