Soar Payments Review

- 26th Aug, 2024

- | By Linda Mae

- | Reviews

Soar Payments is a payment processing company located in Houston that focuses on offering high-risk merchant accounts. Founded in 2015, the company rapidly established itself in the payments sector by targeting businesses usually considered “high-risk.” This encompasses sectors like CBD, firearms, nutraceuticals, and digital streaming, which frequently encounter challenges in obtaining dependable payment processing services because of their inherent risks.

Soar Payments provides an extensive range of services designed for different levels of risk, such as low, medium, and high-risk merchant accounts. Their offerings include credit card processing, ACH and eCheck processing, payment gateways, and chargeback protection, all customized for the specific requirements of high-risk businesses. The company is best recognized for its speedy underwriting process, usually finalizing approvals in 24 hours, enabling businesses to begin processing payments without much delay. Lets read more about Soar Payments Review.

Company Background | Soar Payments Review

Soar Payments was founded with a clear mission: to deliver industry-leading payment solutions for hard-to-place merchants. Since its inception, the company has expanded its services beyond high-risk accounts to include mid and low-risk merchants, reflecting its commitment to serving a diverse client base. The company’s headquarters in The Woodlands, Texas, reflects its roots in “Texas Hospitality,” a value that underscores its customer service approach.

Soar Payments aims to offer dependable, safe, and effective ways to handle payments for businesses, no matter how risky they might be. They are proud of being open with their customers, though they could be clearer about their prices. Still, Soar Payments is well-respected in its field because it works with businesses that many other payment services won’t touch.

Soar Payments primarily targets businesses in sectors that are typically underserved by traditional financial institutions. This includes industries with higher regulatory scrutiny or those prone to higher chargebacks. By focusing on these markets, Soar Payments has established itself as a go-to provider for businesses that need specialized support in managing their payment processing needs.

Service Offerings of Soar Payments

Soar Payments has positioned itself as a leading provider of payment processing services, particularly for businesses that fall under the “high-risk” category. The company offers a range of tailored services designed to meet the specific needs of these industries, ensuring that even the most challenging businesses can securely and efficiently process payments.

Overview of High-Risk Merchant Account Services

Soar Payments focuses on helping businesses that are considered high-risk get the payment processing they need. These businesses often have trouble getting traditional payment methods because of their industry, like those selling CBD products, guns, health supplements, or offering subscription services. Soar Payments gives these businesses a way to safely accept credit card payments, even if other banks might be more likely to turn them down.

Detailed Analysis of Payment Processing Solutions

Soar Payments offers a robust set of payment processing solutions designed to handle the unique challenges faced by high-risk merchants. Their services include traditional credit card processing, ACH (Automated Clearing House) transactions, and eCheck processing. These solutions are integrated with top-tier payment gateways such as Authorize.Net, NMI, and USAePay, allowing businesses to seamlessly manage transactions across various platforms. Additionally, the company supports a wide range of payment methods, including EMV, NFC, and mobile payments, ensuring that businesses can offer flexible payment options to their customers.

Additional Services: Chargeback Protection, Payment Gateways, etc.

One of the standout features of Soar Payments is its chargeback protection services, which are crucial for high-risk industries prone to higher chargeback rates. The company partners with Chargeback.com to provide an integrated service known as Chargeback Armor, which includes features such as fraud detection, chargeback alerts, and representment services to help businesses mitigate the risk of chargebacks and minimize financial losses.

Industry-Specific Services

Soar Payments provides specialized services designed for the specific requirements of high-risk industries. Businesses in industries such as nutraceuticals, firearms, or CBD receive unique assistance to help them navigate regulatory and operational hurdles. This personalized method guarantees that every company receives the most appropriate and efficient payment processing solutions to support their growth in their specific markets.

High-Risk Merchant Specialization

Soar Payments is a prominent provider of payment processing solutions tailored specifically for high-risk merchants. Their specialization in this area allows them to offer services to businesses that often face challenges in securing reliable payment processing due to the perceived risks associated with their industries.

Explanation of High-Risk Merchant Services

High-risk merchant services cater to businesses that are typically deemed too risky by traditional financial institutions. These businesses often face higher chargeback rates, legal complexities, or regulatory scrutiny, making them less attractive to standard payment processors. Soar Payments steps in by offering customized solutions that mitigate these risks while still providing the essential services needed to process payments securely. This includes offering specialized merchant accounts that accommodate the unique needs and challenges of high-risk industries.

Industries Served

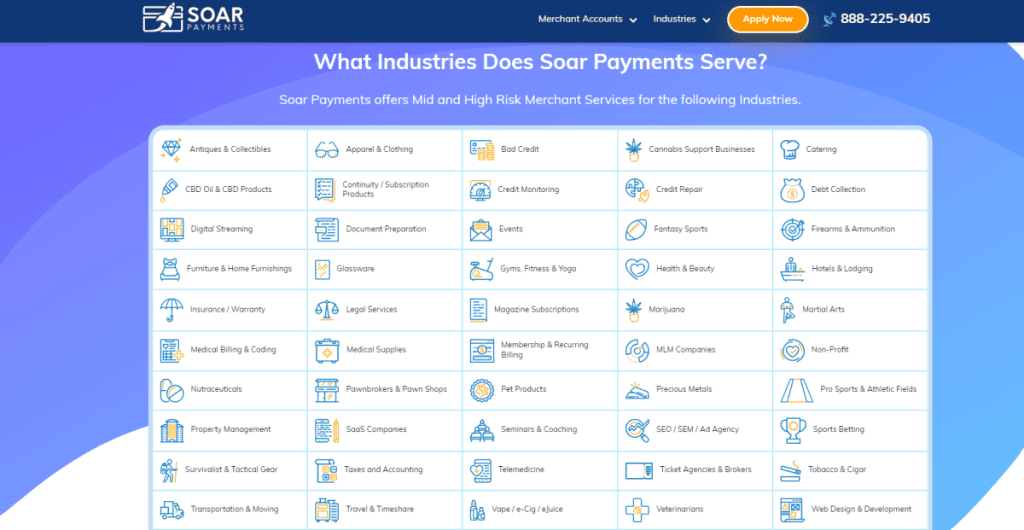

Soar Payments serves a wide array of industries, many of which are categorized as high-risk due to various factors like legal concerns, high chargeback ratios, or regulatory oversight. Some of the key industries they serve include:

Firearms and Ammunition: Businesses in this sector often struggle with payment processing due to the stringent regulations and public scrutiny associated with firearms sales.

CBD and Cannabis Support Businesses: The changing legal environment surrounding cannabis products categorizes these companies as high-risk, making it challenging to secure conventional payment processing.

E-commerce: Certain e-commerce businesses, particularly those dealing with subscription services or high-ticket items, face higher risks of chargebacks and fraud, necessitating specialized processing services.

Nutraceuticals and Supplements: This industry often faces challenges due to the potential for high chargebacks and regulatory issues, making it a prime candidate for high-risk merchant accounts.

Risk Management Strategies

Soar Payments utilizes various strategies to efficiently handle the risks linked with high-risk industries. The services they provide include real-time alerts and fraud prevention tools to reduce the negative effects of chargebacks on a company’s earnings. Furthermore, their collaborations with leading payment gateways offer enhanced security measures like encryption and tokenization, guaranteeing secure processing of all transactions. These methods aid businesses in both handling and diminishing the dangers linked with operating in high-risk industries, enabling them to concentrate on expansion and customer contentment.

Application and Approval Process

Soar Payments has streamlined the application and approval process to cater to high-risk merchants who often face hurdles in securing payment processing solutions. Their process is designed to be efficient and transparent, allowing businesses to quickly get up and running with a merchant account.

Step-by-Step Guide to Applying for a Merchant Account

The application process for a Soar Payments merchant account begins with filling out an online application form on their website. This form requires basic business information, such as the business name, industry, estimated monthly processing volume, and contact details. Once submitted, Soar Payments conducts an initial assessment to determine the risk level associated with the business. If the business is deemed eligible, the application moves to the next stage, where more detailed documentation is required.

Documentation and Requirements

To complete the application, Soar Payments requires a range of documentation to verify the legitimacy and financial stability of the business. This typically includes:

A valid government-issued ID of the business owner

Business license or incorporation documents

Recent bank statements (typically the last three months)

A voided check from the business bank account

A processing history, if available (for businesses that have previously accepted payments)

These documents help Soar Payments assess the risk and ensure compliance with regulatory requirements.

Timeframes for Approval

The timeframe for approval varies depending on the complexity of the business and the risk level. For most high-risk merchants, Soar Payments aims to provide a pre-approval decision within 24 to 48 hours of submitting the application. Once pre-approved, the full underwriting process can take an additional three to five business days. This quick turnaround time is particularly beneficial for businesses that need to start processing payments as soon as possible.

Underwriting Process

Soar Payments’ underwriting process includes a comprehensive examination of the provided paperwork and the financial background of the business. The risk level is assessed by underwriters considering factors like industry, chargeback history, and financial stability. For businesses at high risk, this procedure involves a thorough evaluation of possible liabilities and adherence to regulations. After the underwriting process finishes, the company will either be approved with customized terms based on its risk level or rejected for being too risky.

Pricing and Fees

Soar Payments offers a variety of pricing options tailored to the needs of high-risk merchants. However, like many payment processors in the high-risk sector, the company’s pricing structure is not fully transparent on its website, necessitating a more in-depth understanding of the potential costs involved.

Transparent Overview of Pricing Structure

The pricing structure at Soar Payments is designed to be flexible, accommodating the unique risk profiles of different businesses. For low-risk merchants, Soar Payments typically offers an interchange-plus pricing model, which is more transparent and competitive. However, for mid to high-risk merchants, the pricing can vary significantly based on the industry and specific risk factors. The lack of publicly available pricing details means that potential clients need to engage with the company directly to receive a customized quote.

Breakdown of Fees

Soar Payments’ fee structure includes several key components:

Transaction Fees: For high-risk merchants, transaction fees typically start around 2.49% per transaction, although this rate can vary based on the industry and the specific risk profile.

Setup Fees: Although Soar Payments typically does not have an initial application fee, setup fees may be incurred based on the intricacy of the account setup.

Monthly Gateway Fees: For mid to high-risk merchants, the gateway fee is $15 per month plus $0.25 per transaction. For low-risk merchants, this fee is reduced to $10 per month plus $0.10 per transaction.

Chargeback Fees: High-risk merchants face a chargeback fee of $45 per instance, which is higher than the industry average, reflecting the elevated risk associated with these accounts.

Monthly Minimum Fee: Soar Payments requires a monthly minimum fee of $25, ensuring that the processor recoups a baseline revenue from each account.

Comparison with Industry Standards

Soar Payments’ fees are quite competitive in the high-risk processing industry when measured against industry norms. The fees for transactions and gateways each month are comparable to those of other high-risk processors. Nonetheless, the chargeback fee is relatively high, a typical feature of high-risk accounts because they are more prone to disagreements.

Potential Hidden Costs to Consider

While Soar Payments provides a solid range of services, merchants should be aware of potential hidden costs. These may include fees for PCI non-compliance, early termination, and additional charges for services like chargeback protection. For example, the early termination fee for high-risk accounts can be as high as $495, which could be a significant cost if a business decides to switch processors before the end of the contract term. Therefore, it’s crucial for merchants to carefully review their contracts and discuss any potential fees with Soar Payments before signing up.

Payment Gateway and Integrations

Soar Payments provides a variety of payment gateway options to ensure that businesses, particularly those in high-risk industries, can process transactions securely and efficiently. Their focus on flexible and reliable integration options makes it easier for businesses to connect their payment systems with existing e-commerce platforms and customer relationship management (CRM) systems.

Overview of Payment Gateway Options

Soar Payments offers several robust payment gateway solutions, including popular options like Authorize.Net, NMI (Network Merchants, Inc.), and USAePay. These gateways are known for their reliability and comprehensive features, such as secure payment processing, recurring billing, and extensive reporting capabilities. These gateways support a wide range of payment methods, including credit cards, debit cards, ACH payments, and eChecks, making them versatile for various business needs.

Supported Integrations with E-Commerce Platforms and CRMs

Soar Payments excels in its ability to seamlessly integrate with various e-commerce platforms and CRM systems. Soar Payments provides payment gateways that work with popular e-commerce platforms such as Shopify, WooCommerce, Magento, and BigCommerce. This compatibility allows businesses to easily establish and begin accepting online payments without facing major technical obstacles. Moreover, the gateways have the capability to be linked with CRM platforms like Salesforce, HubSpot, and Zoho, enabling companies to enhance the management of customer interactions and purchase information.

Ease of Integration and Setup Process

The integration process with Soar Payments’ gateways is designed to be user-friendly, even for businesses without extensive technical expertise. The setup typically involves straightforward steps, including selecting the appropriate gateway, configuring settings in the e-commerce platform or CRM, and testing the integration to ensure everything works smoothly. Soar Payments provides detailed documentation and support to assist businesses throughout the setup process, minimizing downtime and ensuring a quick start to payment processing.

API and Developer Resources

For businesses with specific needs or those looking to build custom integrations, Soar Payments offers extensive API and developer resources. These APIs are well-documented and allow developers to create custom payment solutions that can be tailored to the unique requirements of their business. The available resources include guides, sample code, and technical support, making it easier for developers to integrate Soar Payments’ services into existing systems or create new, innovative payment solutions.

Customer Support and Service

Soar Payments places a strong emphasis on providing robust customer support and service, recognizing that businesses in high-risk industries often require quick and reliable assistance. Their customer support infrastructure is designed to be accessible and responsive, ensuring that merchants can get the help they need when they need it.

Overview of Customer Support Channels

Soar Payments provides various customer support options to help their customers. These options consist of phone support, email, and live chat, to accommodate various preferences and requirements. Merchants can usually access phone support during normal business hours, enabling them to communicate directly with a representative. Email support is available for individuals who favor written communication or have non-urgent questions, with responses usually provided within one working day. The live chat feature is especially helpful for fast inquiries or instant help, providing instant communication with a customer service representative.

Availability and Response Times

The availability of customer support at Soar Payments is generally aligned with standard business hours. While specific response times can vary, the company is known for its promptness, particularly through its live chat and phone support channels. Email responses, while slightly slower, are usually returned within 24 hours, ensuring that even more complex issues are addressed in a timely manner. The support team is knowledgeable about the high-risk payment processing industry, which helps in resolving issues efficiently and effectively.

Quality of Support and Customer Satisfaction

The quality of support provided by Soar Payments is highly regarded by many of its clients. The support staff is well-trained and familiar with the challenges faced by high-risk merchants, allowing them to offer tailored advice and solutions. Customer satisfaction is generally high, with many users appreciating the personalized attention and the proactive approach taken by the support team to resolve issues. The company’s commitment to customer service is reflected in the positive feedback they receive, particularly regarding the professionalism and expertise of their support representatives.

Additional Resources: Knowledge Base, FAQs, Tutorials

Soar Payments provides a variety of self-service resources in addition to assisting customers directly. The information they provide consists of various articles, guides, and FAQs intended to assist merchants with resolving common issues on their own. Assistance through tutorials is also offered for setting up payment gateways, managing accounts, and other technical aspects of their services. These resources are especially beneficial for merchants who want to address issues independently or require help outside of normal support hours.

Security and Compliance

Soar Payments prioritizes security and compliance, recognizing the critical importance of protecting sensitive data and maintaining adherence to industry standards. This focus is particularly essential for high-risk merchants who often operate in industries with heightened regulatory scrutiny.

Overview of Security Features

Soar Payments employs a range of security features to safeguard transaction data and protect against breaches. One of the key security measures is PCI DSS (Payment Card Industry Data Security Standard) compliance, which ensures that the company adheres to rigorous guidelines for processing, storing, and transmitting credit card information. PCI compliance is essential for minimizing the risk of data breaches and ensuring that merchants can securely handle payment information.

Additionally, Soar Payments uses encryption technologies to protect sensitive data during transmission. This includes SSL (Secure Sockets Layer) encryption, which ensures that all data transferred between the merchant’s website and the payment gateway is securely encrypted, reducing the risk of interception by unauthorized parties.

Fraud Detection and Prevention Tools

In order to strengthen security even more, Soar Payments provides strong fraud detection and prevention tools. These features, such as real-time transaction monitoring, fraud filters, and risk scoring, are built into the payment gateway. Merchants can prevent fraudulent activity by taking pre-emptive measures with the help of the system, which identifies suspicious transactions using predetermined criteria. Furthermore, Soar Payments works with partners such as iSpyFraud to offer sophisticated fraud detection services that can detect and prevent fraudulent transactions before they affect the merchant’s profits.

Compliance with Industry Regulations

Compliance with industry regulations is another critical aspect of Soar Payments’ operations. In addition to PCI compliance, the company ensures that its services meet the requirements of various financial regulations, particularly those relevant to high-risk industries. This includes adhering to anti-money laundering (AML) laws, Know Your Customer (KYC) requirements, and other relevant regulatory standards. By staying compliant, Soar Payments helps merchants avoid legal pitfalls and ensures that their payment processing activities are conducted within the bounds of the law.

Risk Mitigation Strategies

Soar Payments employs several risk mitigation strategies to protect both the company and its merchants. These strategies include thorough underwriting processes that assess the risk level of each merchant before account approval. For high-risk merchants, the company implements additional safeguards, such as higher reserve requirements and more stringent transaction monitoring, to mitigate potential risks associated with higher chargeback rates or regulatory challenges. These risk management practices help to maintain the stability of the payment processing system and protect merchants from unforeseen financial losses.

Pros and Cons of Soar Payments

Strengths of Soar Payments:

High-Risk Specialization: Soar Payments excels in providing tailored solutions for high-risk industries, such as CBD, firearms, and nutraceuticals. Their deep understanding of these sectors allows them to offer payment processing services that address the unique challenges these businesses face, such as higher chargeback rates and stricter regulatory scrutiny.

Quick Approval Process: The efficiency of its application and approval process is well-known by the company. Merchants can obtain pre-approval in 24 to 48 hours, while full account approval is usually completed in three to five business days. This quick response time is especially advantageous for high-risk companies that require immediate payment processing to start.

Comprehensive Security Features: Soar Payments offers robust security measures, including PCI compliance, encryption, and advanced fraud detection tools. These features help protect businesses from data breaches and fraudulent transactions, which are critical concerns for high-risk industries.

Areas for Improvement:

Lack of Transparent Pricing: One of the most significant drawbacks of Soar Payments is the lack of transparent pricing on their website. Potential customers must contact the company directly to receive a customized quote, which can be time-consuming and may lead to uncertainty about potential costs. Additionally, some fees, such as those for chargebacks and early termination, are higher than industry averages.

Limited Availability: Soar Payments mainly caters to businesses in the U.S., which restricts their ability to serve international merchants. This limitation could pose a major impediment for companies that are currently operating or considering global expansion.

Comparison with Competitors:

Pricing Transparency: Compared to some competitors, Soar Payments could improve in the area of pricing transparency. Other payment processors in the high-risk space, such as Durango Merchant Services, provide more detailed pricing information upfront, which can make the decision-making process easier for potential clients.

Global Reach: While Soar Payments offers excellent services for U.S.-based high-risk merchants, competitors like PayKings and PaymentCloud also cater to international businesses, providing them with a broader market reach.

To sum up, Soar Payments is a formidable competitor in the high-risk payment processing sector, providing tailored services and a speedy approval procedure. Still, they can improve their service by increasing transparency in pricing and broadening their presence in global markets.

Conclusion

Soar Payments provides a reliable option for merchants with high-risk factors by offering customized services, strong security measures, and expedited approval procedures. Although there are some disadvantages like unclear pricing and restricted global presence, American companies in competitive sectors still find the service to be highly beneficial in terms of value. Individuals looking for specialized high-risk payment processing solutions should take into consideration Soar Payments.

FAQs

Q1: What types of businesses does Soar Payments support?

Soar Payments specializes in high-risk industries, supporting businesses in sectors such as CBD, firearms, nutraceuticals, e-commerce, and subscription services, among others.

Q2: How does Soar Payments handle chargebacks?

Soar Payments provides robust chargeback management tools, including real-time alerts and fraud prevention features, to help merchants manage and reduce chargebacks effectively.

Q3: What are the contract terms and cancellation policies?

Soar Payments usually provides contracts that last for two years and automatically renew. If the agreement is terminated before its completion, a fee of up to $495 could be imposed.