Stripe Review

- 07th Aug, 2025

- | By Linda Mae

- | Reviews

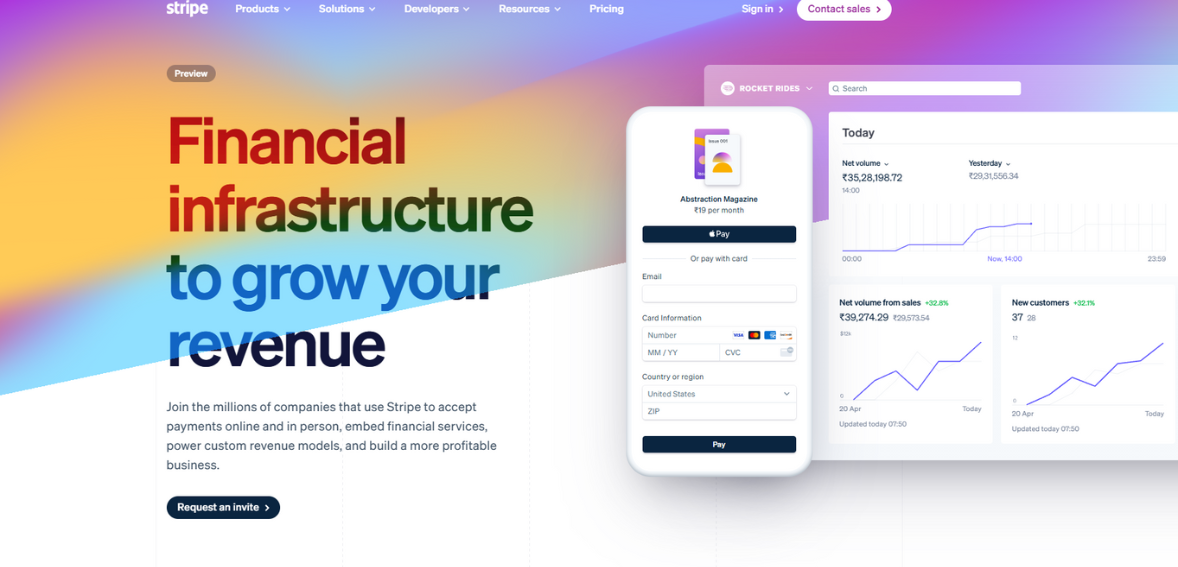

Stripe is one of the most popular payment infrastructure platforms in the world. It helps businesses accept online payments, automate financials and build commerce solutions. Founded in 2010 it quickly became popular with developers due to its well documented APIs and fast setup. Stripe has since grown into a full fledged ecosystem that powers online transactions for millions of businesses from solo entrepreneurs to large enterprises. Lets read more about Stripe Review.

What sets Stripe apart is that it evolves. It started as a simple card processor and now offers subscription billing, fraud detection, virtual card issuance and embedded banking. This allows businesses to grow with Stripe as their business gets more complex. The company operates in over 45 countries and supports transactions in over 135 currencies making it perfect for global commerce.

But Stripe isn’t perfect. While it’s easy for developers, non technical users will face a learning curve. And while Stripe has a lot of functionality, some features are only available in specific regions. But for businesses looking for a customizable, cloud first solution with a forward thinking roadmap, Stripe is a great choice.

Table of Contents

ToggleCore Payment Processing Features | Stripe Review

At its heart Stripe is a payment gateway that lets merchants accept payments online through many methods. It supports all major credit and debit cards as well as digital wallets like Apple Pay and Google Pay. Stripe processes billions of dollars a year and is known for being reliable, scalable and fast payouts.

The platform supports card-not-present transactions natively and has PCI compliant tokenization. So sensitive cardholder data is protected during each transaction. Businesses can process one time purchases, offer tipping, manage complex order flows, and even run split payments or donations all through Stripe’s API or its hosted interfaces.

Stripe is also fast. Payments are processed in real time and payouts to US bank accounts are usually 2 business days. Instant payouts are available for a fee. And the platform supports local payment methods like SEPA Direct Debit, Alipay and iDEAL so it’s a good option for businesses with international customers. While Stripe’s pricing is straightforward (2.9% + 30¢ per card transaction in the US), it’s not always the lowest for high volume merchants. And there are occasional account holds when Stripe’s risk algorithms flag unusual activity.

Stripe Checkout and Payment Links

Stripe offers low-code tools such as Stripe Checkout and Payment Links, which allow businesses to start accepting payments without writing complex code. These features are particularly helpful for startups, nonprofits, and event organizers who need quick, secure ways to handle transactions.

Stripe Checkout is a prebuilt, hosted payments page that handles payment authentication, card validation, localization, and even fraud detection. It supports subscriptions, coupons, upsells, and digital wallets; all while ensuring compliance with PCI and SCA regulations. For developers, integrating Stripe Checkout is as simple as a few lines of code, and for non-developers, it requires minimal setup.

Payment Links, on the other hand, allow users to generate a custom payment URL that can be shared via email, chat, or embedded on a website. There’s no need for a shopping cart or backend system. This makes it perfect for service providers, consultants, and anyone offering one-time services. Both tools are mobile-optimized and compatible with global payment methods, supporting a smooth checkout experience across devices and locations. These features make Stripe a viable option even for merchants who don’t want to invest heavily in custom development.

That said, Stripe Checkout’s customization is limited compared to fully bespoke frontends. Businesses that require a branded checkout flow with deep UI control may need to build a solution using the Stripe Elements library instead.

Subscription Billing Capabilities

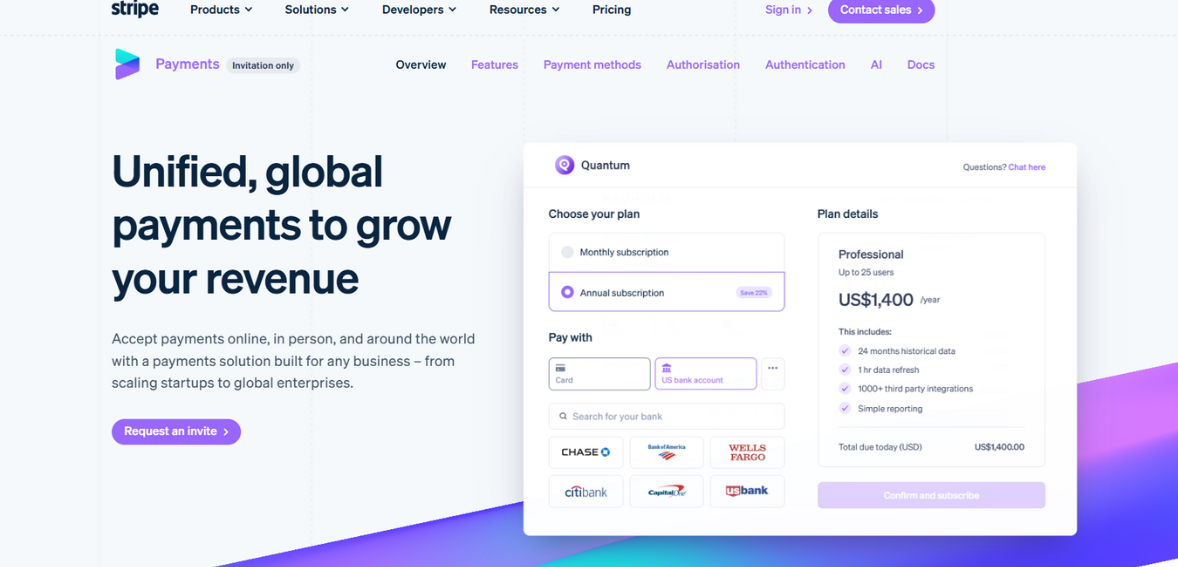

Stripe Billing is one of the platform’s most robust features, allowing businesses to manage recurring payments with significant flexibility. It caters to a wide range of subscription models; fixed, tiered, metered, and usage-based. This makes it well-suited for SaaS platforms, memberships, digital services, and even physical subscription boxes.

Setting up a subscription through Stripe Billing is relatively straightforward. Businesses can define products, plans, and pricing tiers in the Stripe Dashboard or via API. Features like automatic invoicing, proration, trial periods, coupon codes, and revenue recognition help automate the entire billing lifecycle. Stripe also supports Smart Retries, which intelligently reschedules failed payments, and offers built-in support for email reminders and dunning management. These tools help reduce churn and improve customer retention.

For companies with more complex needs, Stripe offers advanced features like integration with NetSuite, QuickBooks, and revenue analytics via Stripe Sigma. Additionally, Billing integrates seamlessly with Stripe Tax, allowing automatic tax collection based on location and product type.

On the downside, Stripe Billing might feel overwhelming to users with basic subscription needs. Some advanced features are locked behind additional fees or require a developer’s involvement to implement fully. But for growing businesses that want to future-proof their subscription operations, Stripe Billing offers a scalable and highly configurable solution.

Developer-Focused APIs and Customization

Stripe’s foundation is built on clean, developer-friendly APIs. It gained early adoption thanks to its simple onboarding process, elegant documentation, and quick implementation time. Developers can easily integrate Stripe into websites, mobile apps, and backends using a range of supported SDKs; available in languages like JavaScript, Python, Ruby, PHP, and Java.

One of the biggest advantages of using Stripe is the level of control it provides. Unlike plug-and-play gateways, Stripe allows for complete customization of payment flows using Stripe Elements or its REST APIs. This is ideal for businesses looking to tailor the checkout process or embed payments into complex workflows, such as multi-vendor platforms or on-demand marketplaces.

The platform also supports webhooks and real-time event triggers, allowing applications to respond to payment events like successful charges, refunds, or failed invoices. Tools like the Stripe CLI and test mode further streamline the development and debugging experience.

For businesses with in-house technical teams, Stripe provides the flexibility to create nearly any payment experience. However, the same flexibility can become a hurdle for users without technical resources. For those users, Stripe ecosystem of pre-built integrations (Shopify, WooCommerce, Squarespace, etc.) can help bridge the gap.

Support for Global Payments

Stripe supports payments in over 135 currencies and operates in more than 45 countries, making it a solid option for international businesses. The platform automatically handles currency conversion, displays localized checkout pages, and supports popular regional payment methods; like Bancontact in Belgium, Alipay in China, and Giropay in Germany.

Merchants can choose to settle payments in their local currency or the customer’s currency, depending on their preferences and Stripe’s regional availability. Stripe also allows configuration of multi-currency bank accounts via its Treasury product or integration with third-party services. For global SaaS platforms or ecommerce brands, Stripe’s global support minimizes the friction often associated with cross-border transactions. It complies with local regulations like PSD2 in Europe and offers built-in tools for Strong Customer Authentication and VAT/GST handling through Stripe Tax.

Despite its impressive reach, Stripe is not available in every country, and some features are region-locked. Businesses operating in regions where Stripe has limited support may need to consider alternatives or use Stripe in conjunction with local payment processors.

Stripe Connect for Marketplaces and Platforms

Stripe Connect is tailored for platforms and marketplaces that need to onboard third-party sellers, service providers, or vendors. It handles the complexity of splitting payments, managing compliance, and ensuring global tax and KYC regulations are met.

With Connect, platforms can facilitate payments between buyers and sellers using either Standard, Express, or Custom accounts; each offering different levels of control and responsibility. Businesses like gig economy apps, crowdfunding platforms, and event marketplaces can use Stripe Connect to handle everything from one-time transactions to recurring payouts.

One key feature of Stripe Connect is its ability to manage automated payouts. Funds can be split and distributed instantly, with built-in tax form generation, identity verification, and even global currency support. For developers, the APIs are robust but can be complex, especially when implementing advanced workflows or dealing with multiple countries and tax jurisdictions. Still, the flexibility it offers is hard to match.

That said, businesses must be prepared for the compliance responsibilities that come with Connect. Stripe helps with onboarding and KYC, but the platform owner remains responsible for ensuring the correct setup. Despite the technical complexity, Connect remains a leading solution for businesses aiming to build payment-enabled ecosystems.

Fraud Prevention with Stripe Radar

Stripe Radar is Stripe’s built-in fraud detection system, designed to help businesses detect and prevent fraudulent transactions in real time. It uses machine learning models trained on billions of global transactions to evaluate the risk of each payment attempt.

Radar automatically blocks high-risk payments and can trigger additional checks like 3D Secure when needed. Businesses can also create custom rules to define their fraud thresholds or take manual action on suspicious payments. For example, a rule could block transactions from specific IP ranges or flag unusually high-value purchases for review.

The system adapts over time, getting smarter as it encounters new fraud patterns. Stripe also shares global intelligence across its entire user base, so if a card is flagged on one platform, it helps protect others too. Radar is included with all Stripe accounts, but an upgraded version, Radar for Fraud Teams, offers more granular controls, insights, and rule customization. This premium tier is useful for larger businesses with complex risk management needs.

While no fraud system is perfect, Radar offers a powerful layer of protection that integrates seamlessly into Stripe ecosystem. It reduces the need for third-party fraud solutions and is particularly valuable for ecommerce sites where chargebacks and fraud disputes are common.

Financial Services: Issuing, Treasury, and Atlas

Stripe ecosystem extends beyond payment processing into modern financial services through products like Stripe Issuing, Stripe Treasury, and Stripe Atlas. These offerings are part of Stripe’s broader mission to become the financial infrastructure for internet businesses.

Stripe Issuing allows platforms to create, manage, and distribute physical or virtual payment cards. This is especially useful for gig platforms, employee expense programs, or neobanks looking to control how funds are spent. Issuing includes real-time authorization control, spending limits, and transaction monitoring, making it highly customizable.

Stripe Treasury, built in partnership with banks like Goldman Sachs, offers banking-as-a-service capabilities. Businesses can hold funds, make ACH transfers, earn interest, and embed banking features directly into their apps. It’s ideal for platforms that want to act as financial intermediaries or offer embedded finance solutions to their users.

Stripe Atlas simplifies company incorporation, banking, and tax filing for international entrepreneurs looking to start a U.S.-based business. With a flat fee, Atlas helps register a Delaware C-Corp, open a U.S. bank account, and issue stock to founders.

These tools differentiate Stripe from typical payment processors. However, access to Issuing and Treasury is limited by region and regulatory constraints. Additionally, these services are more suited to tech-savvy platforms rather than small retailers or freelancers. But for startups building in the fintech space or platforms with embedded finance goals, these services can be powerful enablers of growth.

Ease of Use and Onboarding

It is often praised for its user-friendly setup, especially for businesses with development resources. Creating an account is quick, and the onboarding process guides users through identity verification, bank account linking, and first transaction setup. The Stripe Dashboard is clean, responsive, and packed with useful insights.

The dashboard offers a bird’s-eye view of transactions, customer behavior, subscription statuses, and payout schedules. It includes helpful visualizations and filterable reports that even non-technical users can understand. Users can also manage disputes, create coupons, issue refunds, or monitor failed payments; all from the dashboard.

For developers, the API keys and webhooks are easy to generate and test. Stripe’s documentation is often considered among the best in the fintech space, with plenty of examples, quick-start guides, and a dedicated testing environment. However, for small business owners with little or no coding experience, Stripe’s flexibility can feel like overkill. Many basic tasks still require some technical understanding or the use of third-party tools. This is where competitors like Square or PayPal may feel more intuitive out of the box.

Still, with pre-built integrations (e.g., with Shopify, Wix, and WordPress), it remains accessible to a broad audience, particularly those who plan to scale their operations or need deeper customization over time.

Pricing and Fee Structure

It has a transparent and predictable pricing model which is great for many businesses especially in the early stages. The standard pricing for online card transactions in the US is 2.9% + 30¢ per transaction which is in line with industry averages. ACH direct debit is 0.8% per transaction, capped at $5. There are no setup fees, monthly fees or hidden fees for core payment processing. Instead Stripe charges add-on fees for advanced features. For example Stripe Billing has extra charges if you go over the included invoice limits. Stripe Radar’s advanced version also has an extra cost.

International transactions have an extra 1% cross-border fee and 1% if currency conversion is required. This is a big factor for businesses with global customers as these fees can add up fast. Instant payouts to debit cards are 1% extra with a minimum fee of 50¢. And dispute or chargeback fees are $15 per incident although this may be refunded if the dispute is resolved in your favor.

Overall Stripe’s pricing is fair and easy to understand but not always the cheapest for high volume or low margin businesses. Enterprise level businesses may qualify for custom pricing but this requires negotiation and volume commitments. Stripe is great for businesses looking for a scalable solution not those looking for the lowest fees.

Customer Support and Documentation

Stripe offers customer support through email and chat, with phone support available for certain account tiers. Most standard users rely on the in-app chat and knowledge base to resolve issues. Response times vary, with simple queries typically answered within a few hours and more complex cases taking longer.

The platform’s documentation is a standout feature. It’s thorough, well-organized, and constantly updated. Whether you’re a developer looking to integrate a webhook or a finance manager trying to understand a payout report, Stripe’s docs usually have a clear answer. There’s also a developer community, GitHub libraries, and sample projects to accelerate implementation.

Despite the solid self-service resources, customer support can feel limited in urgent situations. Some users have reported challenges reaching live representatives or resolving account freezes, especially when flagged by automated risk systems. It has made efforts to improve support by offering Premium Support packages for enterprise clients, which include guaranteed response times and dedicated technical account managers. But for small and midsize businesses, the default support options may occasionally fall short of expectations.

That said, Stripe’s proactive alerts, detailed error messages, and automated guidance often help users resolve issues independently. For many, the strong documentation offsets the need for constant handholding.

Limitations and Challenges

Stripe is a modern payments leader but it has its limitations. The most common one is account stability. It uses automated risk models to monitor transactions and accounts can get flagged or frozen if activity is deemed suspicious. This can be super frustrating for small businesses or nonprofits without a financial buffer.

Another challenge is its limited availability in certain regions. It is not yet available in many countries in Africa, the Middle East and parts of Asia. Businesses in unsupported countries either can’t use Stripe or have to set up foreign entities, often through Stripe Atlas which may not be feasible for everyone. For non-technical users, the platform can be overwhelming. While tools like Checkout and Payment Links reduce the need for coding, full use of Stripe ecosystem still requires developer involvement. So Stripe is less beginner friendly than plug and play platforms.

There are also feature gaps to consider. While Stripe has invoicing, it’s basic compared to standalone invoicing software. In-person POS functionality via Stripe Terminal is still developing and limited to certain geographies. Lastly, Stripe’s pricing structure; especially cross-border and add-on fees; can get expensive if not monitored closely. While it’s powerful and flexible, It is best for businesses with technical direction and global ambitions.

Ideal Business Types for Stripe

Stripe’s flexibility makes it suitable for a wide range of business models, but it particularly shines in digital-first and tech-driven environments. SaaS companies benefit immensely from Stripe Billing, its metered usage tracking, and subscription management tools. Ecommerce businesses appreciate the support for global payment methods and easy integration with platforms like Shopify.

Marketplaces and gig platforms can leverage Stripe Connect to handle split payments and onboard sellers. Meanwhile, nonprofits and education platforms can use Stripe’s Payment Links and Checkout pages for quick donation setups. Freelancers and solopreneurs with basic invoicing needs can use Stripe Invoicing or payment links, although other platforms might offer more convenience out of the box. For these users, It is a great long-term option if they expect to grow and want full control over their payments stack.

Fintech startups, embedded finance platforms, and apps with complex money movement needs will find Stripe Issuing, Treasury, and Radar invaluable. These tools enable neobanks, lending apps, and expense management platforms to scale with fewer regulatory and technical burdens. That said, traditional brick-and-mortar stores or restaurants may find Square or Clover more suitable, especially if in-person sales dominate their revenue. Overall, it is ideal for global, online, and API-first businesses looking for flexibility, scalability, and innovation in their payments infrastructure.

FAQs

Q1: Can Stripe be used by businesses outside the United States?

Yes. Stripe supports over 45 countries including the UK, Australia, India, and Canada. However, feature availability can vary depending on local regulations.

Q2: How secure is Stripe for handling sensitive payment data?

Stripe is PCI DSS Level 1 certified and uses encryption, tokenization, and machine learning-based fraud detection (Radar) to protect customer data.

Q3: Does Stripe support in-person payments?

Yes. Through Stripe Terminal, businesses in select countries can accept in-person card payments using Stripe-approved hardware and APIs.