VersaPay Review

- 21st Aug, 2024

- | By Linda Mae

- | Reviews

VersaPay offers top-notch cloud-based services for automating accounts receivable (AR), aiming to change how companies handle their billing and cash collection processes. They provide a range of tools that simplify invoicing, make business-to-business payments easier, and use artificial intelligence to improve cash management. It has become an important company in the financial technology field. Their services help businesses cut down on manual work, boost cash flow, and provide a smooth, customer-focused payment process. Let’s delve deeper into the VersaPay Review.

Company Overview | VersaPay Review

Established in 2006, It started by offering electronic payment services. As it developed, the company shifted its focus to specialize in automating accounts receivable processes. In 2010, VersaPay became a publicly traded company on the TSX Venture Exchange with the stock symbol “VPY,” which was a major step in its development. The company kept advancing, and in 2020, it was bought by Great Hill Partners, a private equity firm based in Boston. This acquisition allowed VersaPay to expand its reach and enhance its product offerings, solidifying its status as a leader in AR automation.

VersaPay is driven by a mission to make AR processes more efficient and collaborative. The company’s core values include a strong commitment to customer success, embracing diversity, and fostering an inclusive workplace culture. VersaPay is particularly dedicated to empowering women in the technology sector, as evidenced by its efforts to address gender disparities and promote women to leadership positions within the company.

VersaPay has earned multiple awards for its innovative solutions and efforts in corporate responsibility. The company was recognized with the 2023 Tech Cares Award from TrustRadius for its strong commitment to gender equality and social responsibility. In 2017, It was named the Canadian Tech Stock of the Year by the TSXV, and its CEO, Craig O’Neill, received the title of TSXV Tech Executive of the Year. Furthermore, VersaPay has been acknowledged as a leader in the IDC MarketScape for global SaaS and cloud-based accounts receivable applications, reinforcing its status as an industry leader.

Key Features of VersaPay

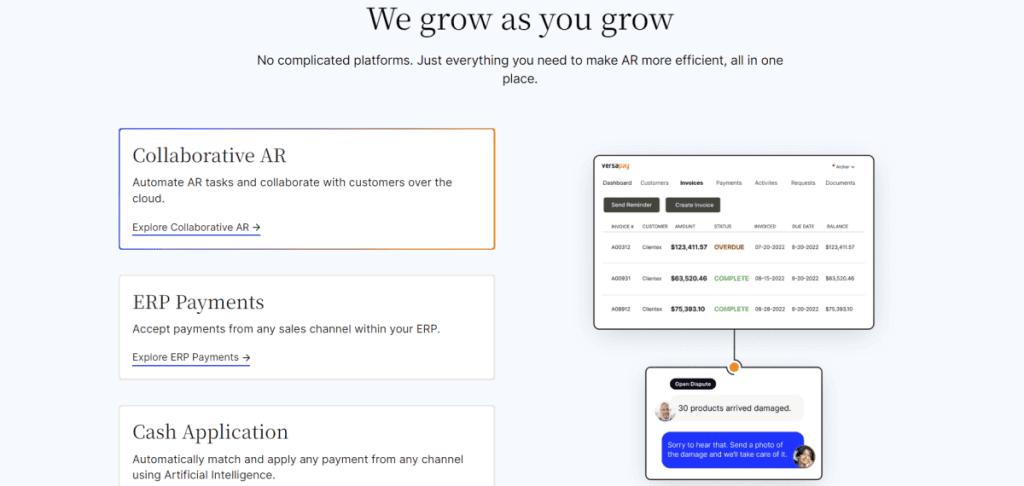

VersaPay is a leader in cloud-based accounts receivable (AR) automation, offering a suite of features designed to streamline the invoicing and payment processes for businesses. Its platform is built to improve efficiency, enhance customer satisfaction, and enable real-time collaboration, making it a powerful tool for modern financial operations.

Cloud-Based Accounts Receivable (AR) Automation

VersaPay’s AR automation process is centered on eliminating manual tasks and speeding up the invoice-to-cash cycle. The cloud-based system automates key AR functions, including invoice generation, payment collection, and cash application. This system helps to make things more accurate and faster, giving finance teams more time to work on important tasks. It uses artificial intelligence to connect payments with invoices, making sure everything is correct and reducing the chance of mistakes. Since VersaPay’s platform is online, companies can check their data from any place, which makes it easier to adapt and grow.

Customer-Centric Payment Portal

The customer-centric payment portal is a standout feature of VersaPay. Designed with the user in mind, the portal offers a clean and intuitive interface that allows customers to view their invoices, make payments, and track their account status with ease. This customer-first approach not only enhances the user experience but also improves payment collection rates, as customers find it easier to manage their obligations. The portal supports multiple payment methods, adding to the convenience and flexibility that customers appreciate.

Real-Time Collaboration

VersaPay’s instant communication tools help companies work closely with their clients to quickly solve payment problems. Using this platform, companies can talk directly to their customers and handle any worries or mistakes right away. This teamwork method cuts down the time needed to fix issues and improves overall customer happiness, since problems are solved quickly and openly.

Flexible Payment Options

It supports a wide range of payment methods, including credit cards, ACH transfers, and wire payments. This flexibility ensures that businesses can cater to the diverse preferences of their customers. Additionally, the platform seamlessly integrates with multiple payment gateways, enabling businesses to process payments efficiently and securely across various channels. This multi-faceted approach to payment processing not only improves cash flow but also reduces the complexity associated with managing multiple payment systems.

Technology and Integration

VersaPay’s technology infrastructure is designed to provide seamless integration with existing business systems while ensuring robust security and compliance. This section explores the platform’s API capabilities, ERP compatibility, and security measures, which are critical to its effectiveness and reliability.

API Capabilities

It offers a comprehensive suite of API functionalities that allow businesses to integrate its accounts receivable automation tools into their existing systems with ease. The APIs are designed to facilitate data exchange between VersaPay and other software applications, enabling real-time synchronization of invoices, payments, and customer data. This smooth connection means that companies can use VersaPay’s strong tools without changing how they currently work. VersaPay’s adaptable programming interfaces also let companies adjust the setup to fit their particular requirements, whether they need to link with customer relationship management systems, accounting programs, or specially made apps.

ERP Compatibility

It has a key advantage because it works well with big business management systems like SAP, Oracle, and Microsoft Dynamics. It’s built to connect smoothly with these systems, making sure all money-related information is correctly shared between them. This connection means no more typing in data by hand, which lowers the chance of mistakes and helps save time for people who handle finances. By automating the flow of data between VersaPay and ERP systems, businesses can achieve greater efficiency in their accounts receivable processes. The ability to integrate smoothly with industry-leading ERPs makes VersaPay a versatile solution for companies of all sizes.

Security and Compliance

Security is a top priority for VersaPay, and the platform is equipped with advanced data protection measures to safeguard sensitive information. VersaPay complies with stringent industry regulations, including the Payment Card Industry Data Security Standard (PCI-DSS), which ensures that all payment data is handled securely. The platform employs encryption, tokenization, and other security protocols to protect data both in transit and at rest. Additionally, VersaPay undergoes regular security audits and assessments to maintain its compliance with industry standards. These measures provide businesses with peace of mind, knowing that their financial data is secure and that they are meeting all necessary regulatory requirements.

User Experience

VersaPay is designed with a strong focus on delivering an exceptional user experience, making it accessible and efficient for businesses of all sizes. The platform’s user-friendly interface, combined with its customization options, ensures that users can navigate and utilize the system effectively according to their specific needs.

Ease of Use

The VersaPay user interface is easy to use and neatly arranged, helping users quickly locate the features and tools they need. The main screen gives a simple summary of important information, like unpaid invoices and payment progress, making it simple for users to handle their billing processes. The menus and choices are clearly marked, which makes it easier for new users to get started. Feedback from users shows that VersaPay is highly liked for being straightforward and effective, which makes it simple for teams to start using it in their daily work. Users especially like that they can do complicated tasks, like creating invoices and matching payments, without needing a lot of technical know-how.

Customization Options

VersaPay offers a range of customizable features that allow businesses to tailor the platform to their specific needs. Users have control over various settings and configurations, enabling them to adjust the system to match their business processes. This flexibility includes options to customize invoice templates, payment reminders, and reporting tools, ensuring that the platform aligns with the unique workflows of different organizations. Additionally, VersaPay allows for the integration of custom fields and data points, which can be configured to meet industry-specific requirements. This level of customization not only enhances usability but also ensures that the system can evolve alongside the business as its needs change.

Overall, VersaPay’s focus on user experience, through ease of use and robust customization options, makes it a versatile and valuable tool for businesses looking to optimize their accounts receivable processes. The positive feedback from users underscores the platform’s ability to deliver a smooth and effective experience, contributing to its strong reputation in the market.

Pricing and Plans

VersaPay offers a flexible pricing structure designed to cater to businesses of various sizes and needs. The platform’s pricing is typically customized based on the specific requirements of each client, such as the number of users, volume of transactions, and the level of features required. This approach allows businesses to pay only for the services they need, making VersaPay an accessible solution for both small businesses and larger enterprises.

Overview of Pricing Structure

VersaPay’s pricing is structured around a subscription model, where clients pay a monthly or annual fee based on the features they choose to utilize. The pricing tiers are typically segmented by the level of automation and integration capabilities offered. For instance, basic plans might include core features such as invoicing and payment processing, while more advanced plans offer enhanced capabilities like real-time collaboration, advanced analytics, and deeper ERP integrations. Custom quotes are often provided after an initial consultation, ensuring that the pricing aligns with the specific needs and goals of the business.

Detailed Breakdown of Pricing Tiers

Though VersaPay’s pricing details are not always publicly disclosed, typical plans might include a basic tier that covers essential AR automation features, a mid-tier plan that adds more robust reporting and customer management tools, and a premium tier that includes comprehensive ERP integration and advanced security features. Each plan is designed to scale with the business, allowing users to upgrade as their needs evolve.

Value for Money

When comparing VersaPay to competitors in the accounts receivable automation space, the platform is often seen as offering good value for money, especially for businesses that require robust integration with existing ERP systems. The return on investment (ROI) is typically high, as businesses can reduce the time and cost associated with manual AR processes, improve cash flow, and enhance customer satisfaction through better payment experiences. In comparison to similar platforms, VersaPay’s customizable pricing and comprehensive feature set make it a competitive choice for companies looking to optimize their financial operations.

Customer Support

VersaPay is committed to providing reliable and accessible customer support, ensuring that users can quickly resolve any issues they encounter. The platform offers multiple support channels, including phone, email, and live chat, allowing customers to choose the method that best suits their needs. These options provide flexibility and ensure that users can get the help they need in a timely manner.

Support Channels

VersaPay’s customer support team is available through various channels, including phone, email, and live chat. This variety ensures that customers can reach out in the way that is most convenient for them, whether they prefer the immediacy of a phone call or the simplicity of live chat. The availability of these multiple support options reflects VersaPay’s dedication to ensuring a seamless experience for its users.

Response Times

People who use VersaPay usually say they are happy with how quickly the platform responds. The support team is quick to help, usually answering within a few hours, and often solving issues by the end of the day. This quick turnaround is crucial for businesses that rely on VersaPay’s services for critical financial operations, as it minimizes downtime and ensures smooth operation.

Knowledge Base and Resources

In addition to direct support, VersaPay offers a comprehensive knowledge base filled with documentation, tutorials, and webinars. These resources are designed to help users get the most out of the platform, providing guidance on everything from initial setup to advanced features. The availability of such extensive resources demonstrates VersaPay’s commitment to empowering its users through self-service options, further enhancing the overall customer experience.

Pros and Cons

VersaPay offers a range of features that can greatly benefit businesses, but it also has some areas where improvements could be made.

Strengths

Automation Efficiency: VersaPay excels in automating accounts receivable processes, such as invoicing, payment collection, and cash application. This automation not only saves time but also reduces the potential for human error, making the entire process more efficient and reliable.

Seamless Integration: The platform’s ability to integrate seamlessly with major ERP systems like SAP, Oracle, and Microsoft Dynamics is a significant advantage. This integration allows for smooth data synchronization, eliminating the need for manual data entry and reducing the risk of discrepancies.

Customer-Centric Design: VersaPay’s customer portal is user-friendly and designed to enhance the customer experience. The portal provides customers with easy access to their account information and payment options, which can lead to faster payments and improved cash flow.

Weaknesses

Pricing Transparency: One of the areas where VersaPay could improve is in the transparency of its pricing structure. The need for custom quotes based on individual business needs can make it difficult for potential customers to assess the cost upfront.

Limited Advanced Features: While VersaPay offers a robust set of tools for AR automation, some users have noted that the platform could benefit from more advanced analytics and reporting features. These enhancements could provide deeper insights and more comprehensive financial management capabilities.

Overall, VersaPay is a strong choice for businesses looking to automate their accounts receivable processes, but there are opportunities for the platform to further enhance its offerings and address some of its current limitations.

Comparison with Competitors

When comparing VersaPay to other accounts receivable (AR) automation solutions, it stands out for several key reasons. VersaPay offers robust automation features that are on par with, if not superior to, many of its competitors. One of its main strengths is its seamless integration with major ERP systems like SAP, Oracle, and Microsoft Dynamics, which is a significant advantage for businesses that rely heavily on these platforms.

VersaPay’s unique selling points (USPs) include its customer-centric payment portal, which provides an intuitive and user-friendly experience. This portal not only facilitates faster payments but also improves customer satisfaction, a feature that sets VersaPay apart from other AR solutions that may not prioritize the end-user experience as effectively. Additionally, VersaPay’s focus on real-time collaboration between businesses and their customers is another USP that enhances the resolution of payment issues more quickly and efficiently than many competing platforms.

However, in comparison to some competitors, VersaPay could improve its transparency in pricing and expand its advanced reporting and analytics features. Despite these areas for growth, VersaPay remains a strong contender in the AR automation market, particularly for businesses seeking a solution that integrates well with existing systems and prioritizes customer experience.

Conclusion

VersaPay offers robust AR automation with seamless ERP integration, user-friendly customer portals, and real-time collaboration. It’s ideal for mid-to-large-sized businesses seeking efficiency and improved customer interactions. While pricing transparency could improve, the platform’s strengths make it a strong choice for companies looking to optimize their financial operations.

FAQs

What is the implementation process for VersaPay?

The implementation process for VersaPay typically involves an initial consultation, followed by system integration, data migration, and user training. The timeline and complexity depend on the specific requirements of the business.

How does VersaPay ensure data security and compliance?

VersaPay ensures data security through encryption, tokenization, and compliance with industry standards like PCI-DSS. Regular security audits and updates further protect sensitive information.

Can VersaPay handle international payments?

Yes, VersaPay supports international payments, allowing businesses to transact across borders with multiple currencies, making it suitable for global operations.