Wise Review

- 11th Sep, 2024

- | By Linda Mae

- | Reviews

Wise, previously called TransferWise, is a financial technology company established in 2011 with the goal of providing quicker, more affordable, and transparent international money transfers. The company aims to assist individuals and businesses in transferring money across borders without the high fees usually linked to international transfers. It strives to make sure that sending money is both affordable and easy, using advanced technology to enhance user satisfaction. Let’s delve deeper into the Wise Review.

Wise’s goal is to provide clarity in international payments by providing affordable transfers at the mid-market exchange rate, also known as the “real” exchange rate. It stands out from conventional banks by openly showing all fees upfront, instead of charging hidden fees like poor exchange rates and high service fees. This method is popular among individuals and companies seeking affordable options for sending money across borders. It has more than 16 million customers worldwide and handles billions of dollars in transactions annually.

Wise was founded by two Estonian entrepreneurs, Taavet Hinrikus and Kristo Käärmann. The idea for Wise emerged from their personal frustration with the high costs associated with sending money internationally. Hinrikus, living in London but getting paid in euros, had to convert his salary to pounds regularly. At the same time, Käärmann, who lived in Estonia but earned in pounds, needed to exchange money in the opposite direction. They decided to solve this problem by setting up a simple peer-to-peer solution, effectively bypassing the banks. What started as a solution for their own cross-border transfers quickly evolved into a global service that addresses a major pain point for millions.

Over the years, It has grown from being a simple money transfer service into a financial technology leader. It went public on the London Stock Exchange in 2021 under the ticker WISE, solidifying its position as a major player in the financial industry. It now handles transfers across over 70 countries, allowing users to send, receive, and manage money in multiple currencies with low fees.

Wise has fundamentally transformed cross-border payments by utilizing a proprietary infrastructure that minimizes the number of intermediaries involved in processing transactions. This significantly reduces both the cost and the time it takes for money to arrive at its destination. One of the core innovations of Wise is its use of the mid-market exchange rate—the rate you see on Google or Reuters, with no hidden fees baked into the rate. This, combined with transparent upfront pricing, sets Wise apart from traditional banking services, where fees and poor exchange rates often make international transfers expensive.

Furthermore, Wise places importance on quick transactions, with more than 60% of transfers being immediate, arriving at their final destination in under 20 seconds. This quick service is achieved by establishing direct links with banks and payment networks globally, cutting down on the reliance on third-party systems that cause delays. It is also emphasizing scalability by teaming up with big institutions to provide their cross-border payment infrastructure to other financial platforms via its Wise Platform service.

How Wise Works | Wise Review

Wise is designed to make international money transfers simple, affordable, and transparent. Whether you’re sending money for personal reasons or business purposes, It ensures that you can complete your transactions efficiently without hidden fees or inflated exchange rates. Here’s a breakdown of how Wise works, from making a transfer to understanding exchange rates and transaction speeds.

Step-by-Step Process of Making a Transfer with Wise

Create an Account: Users begin by signing up for a Wise account, which can be done via the Wise website or mobile app.

Set Up a Transfer: Once logged in, the user selects the currency they want to send and specifies the amount. Wise will show you how much the recipient will receive based on the mid-market exchange rate, along with a clear breakdown of any fees.

Input Recipient Details: Enter the recipient’s bank details, which include account number and bank name. Alternatively, if the recipient has a Wise account, funds can be transferred directly.

Pay for the Transfer: Users can pay for the transaction via bank transfer, credit card, debit card, or other available methods depending on the country.

Transfer Processing: Once payment is confirmed, It processes the transfer, converting the currency and sending it to the recipient.

Exchange Rates and Transparency

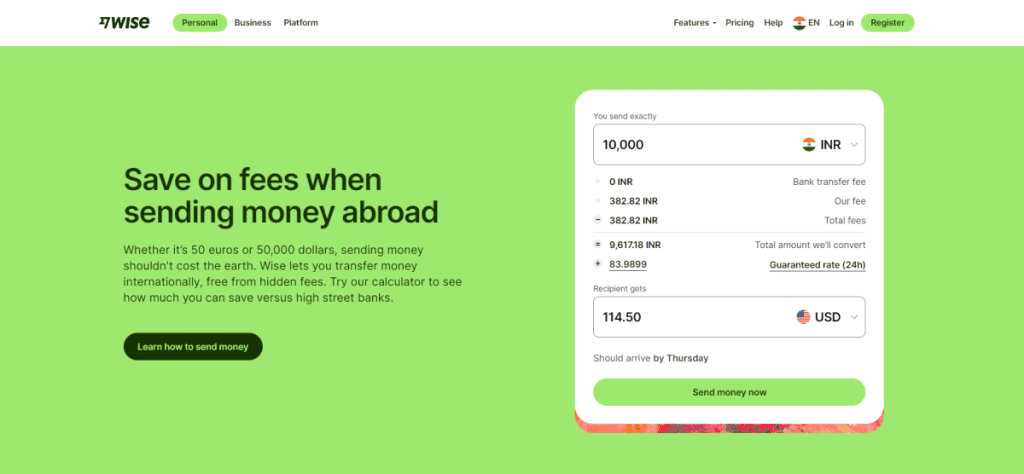

One important aspect of Wise is its utilization of the mid-market exchange rate, known for being the most equitable rate without the added fees commonly imposed by banks. This indicates that users receive the actual exchange rate displayed on financial platforms, guaranteeing complete transparency. It also transparently shows all transfer fees before you confirm, ensuring there are no unexpected costs.

Speed of Transactions and Delivery Times

It is known for its fast transaction processing. Over 60% of its transfers are completed instantly (within 20 seconds). For other transfers, depending on the currencies involved and local banking systems, the processing time can range from a few minutes to 1-2 business days.

Wise Pricing Structure

Wise is known for being one of the most financially efficient options for sending money overseas, mostly because of its clear pricing system. In contrast to traditional banks with hidden fees and poor exchange rates, It prioritizes competitive fees and ensuring users receive the best possible exchange rate. Here is an in-depth examination of Wise’s pricing structure.

Breakdown of Fees: How Much Wise Charges and for What Services

It charges fees based on a combination of the amount being transferred, the currency, and the payment method used. Typically, Wise applies two main fees:

Transfer Fee: This is a small, upfront fee that varies based on the amount being transferred. For example, a percentage-based fee might be around 0.35% to 1.5% of the transfer amount.

Conversion Fee: Wise also charges a fee for currency conversion. This fee is a small percentage of the transaction, often between 0.35% and 2%, depending on the currency pair being exchanged.

It displays the full cost breakdown before confirming the transaction, ensuring there are no hidden fees or surprise charges.

Comparison of Wise Fees with Traditional Banks and Competitors

It is much cheaper when compared to traditional banks. Banks usually impose a service fee and add a margin to the exchange rate, resulting in an extra 3-5% of the total transaction cost. Rivals such as PayPal or Western Union might also charge more for their services and offer less attractive exchange rates. Wise’s utilization of the actual mid-market exchange rate helps users bypass the exaggerated rates imposed by banks and numerous competitors.

Factors Affecting Fees (Destination, Amount, Payment Method)

Several factors influence the final cost of a Wise transfer:

Destination Country: Some countries have higher fees due to banking regulations or infrastructure.

Transfer Amount: Larger transfers often have lower percentage-based fees.

Payment Method: Paying with a bank transfer tends to incur lower fees, while using a credit card may result in higher charges due to processing fees.

Overall, It is praised for its straightforward and affordable pricing structure, which is tailored to suit both personal and business users across a wide range of destinations.

Currencies and Countries Supported

It has positioned itself as a top choice for global money transfers by enabling a wide variety of currencies and countries, catering to users worldwide. Whether you are sending money for personal use or for business purposes, It allows you to send funds to various locations worldwide, with competitive exchange rates. Here is an overview of the currencies and nations Wise assists, along with its worldwide presence.

List of Major Currencies Wise Supports

Wise supports over 50 currencies, enabling users to send and receive money in multiple countries. Some of the major currencies include:

US Dollar (USD)

Euro (EUR)

British Pound (GBP)

Australian Dollar (AUD)

Canadian Dollar (CAD)

Indian Rupee (INR)

Japanese Yen (JPY)

Swiss Franc (CHF)

Chinese Yuan (CNY)

In addition to these, It allows users to convert and hold multiple currencies simultaneously in their Wise accounts, making it easier to manage international payments without needing to open multiple foreign bank accounts.

Discussion of the Global Reach of Wise: Countries and Limitations

It operates across over 70 countries, offering an efficient and affordable method for sending money globally. The company offers services in North America, Europe, Asia, Australia, as well as select regions in Africa and Latin America. Nevertheless, it may not be accessible to everyone due to certain countries enforcing limitations on currency exchanges and overseas transactions. For example, users might encounter restrictions when transferring funds to nations with stringent financial laws, such as specific areas in the Middle East and Africa.

Additionally, some specific currencies may only allow transfers in one direction, meaning you can send but not receive funds in those currencies. It is transparent about these limitations, and they are clearly communicated to users during the transaction process.

Key Markets Where Wise Excels

It excels in markets where international remittances are common, such as Europe, the United States, and Australia. In regions where traditional banking fees are high, It has managed to capture a significant market share by offering low-cost alternatives. Key markets like the UK and Eurozone are particularly strong for Wise, where it is often the preferred choice for expats, businesses, and freelancers needing to move money across borders efficiently.

Wise Multi-Currency Account

The Wise multi-currency account allows users to easily manage and store numerous currencies all in one convenient location. It is a handy resource for people, freelancers, and companies that often engage in global financial transactions. This account enables users to store and swap more than 50 currencies at actual exchange rates, offering an affordable option for managing finances across borders.

Explanation of How the Wise Multi-Currency Account Works

The Wise multi-currency account enables users to hold balances in different currencies without the need for multiple foreign bank accounts. Users can easily open the account online, after which they can receive, hold, and send money in various currencies. The account provides local bank details (such as a UK sort code or a European IBAN), allowing users to receive payments like a local in certain countries. For example, a user in the UK can receive payments in USD without paying conversion fees, which they can later convert to GBP at their convenience.

Benefits of Having a Multi-Currency Account for Businesses and Individuals

For businesses and individuals involved in international transactions, the Wise multi-currency account offers significant advantages.

For businesses: It simplifies the process of paying international suppliers and receiving funds from clients in different countries. With lower fees and real exchange rates, businesses save on both conversion and transfer fees, boosting their profit margins.

For individuals: Whether they are expats, freelancers, or frequent travelers, users can manage their finances globally, avoid inflated exchange rates, and make payments in the local currency.

How Users Can Hold, Manage, and Convert Currencies

Users are able to maintain balances in various currencies at the same time using the Wise multi-currency account. Handling and exchanging currencies is as easy as a few clicks. Individuals have the option to convert funds between different currencies at the mid-market exchange rate while incurring a minimal and transparent fee. This adaptability gives them the freedom to decide when and how they transfer their money, steering clear of volatility and unfavorable exchange rates.

Currency Exchange Features within the Account

It offers a simple, transparent process for currency conversion. Using the mid-market rate—without hidden markups—users can convert their funds whenever they wish. Additionally, they can set up automatic conversions if they want to convert funds when the exchange rate reaches a certain level, further empowering them to maximize their financial decisions.

Wise for Personal Users vs. Business Users

It serves a broad range of users, from individuals who need to make occasional international transfers to businesses that regularly manage global transactions. With tailored solutions for both personal and business needs, It ensures efficient, transparent, and cost-effective money transfers for everyone.

Personal Use: Everyday Transfers, International Travel, Sending Money to Family

For individuals, Wise is perfect for a range of daily financial requirements. When sending money to family overseas, paying for global services, or making transfers while travelling, It offers a smooth process. Individual customers gain advantages from affordable charges, utilizing actual mid-market exchange rates, and being able to conduct fast and secure transactions. Travelers, for example, have the option to save money on expensive foreign exchange fees by exchanging currency at competitive rates prior to or during their journey. Moreover, Wise is ideal for expatriates or people who send frequent money transfers to family members across borders, as it guarantees that a higher amount of their funds will be received by the recipient with low charges.

Business Use: Payroll, Supplier Payments, Managing International Invoices

For businesses, Wise offers specialized features that cater to the complexity of international payments. Businesses can pay international suppliers, manage payroll for remote workers, and handle cross-border invoices with ease. Wise allows companies to hold and manage multiple currencies, reducing the need for frequent conversions and saving on exchange costs. Furthermore, Wise Business users can make batch payments to employees or suppliers across different countries, simplifying international operations. The platform also integrates with accounting software like Xero, making it easier for businesses to track and manage their finances globally.

Wise Business Account Benefits and Tools

The Wise Business account provides a range of benefits, including the ability to hold over 50 currencies, access local bank details in multiple countries, and convert funds at real exchange rates. Businesses can also issue invoices in foreign currencies, making international operations more straightforward. Additionally, It offers a debit card for business use, enabling companies to spend globally with low fees. The platform’s transparency, ease of use, and cost-effectiveness make it a popular choice for businesses of all sizes that operate internationally.

Wise Borderless Debit Card

The Wise Borderless Debit Card offers users a flexible and affordable way to manage their money across borders. With this card, users can spend in multiple currencies, withdraw cash from ATMs worldwide, and make online purchases—all at the real exchange rate without hidden fees. Whether for personal or business use, the Wise debit card provides convenience and cost-saving benefits for international transactions.

Features and Benefits of the Wise Debit Card

The Wise Borderless Debit Card is linked to the user’s account with multiple currencies, allowing them to make purchases in more than 50 currencies using funds from their balance. One of the standout aspects is the incorporation of the mid-market exchange rate, which helps users steer clear of the usual markups imposed by banks and other financial institutions. The card can identify the currency being used, enabling smooth transactions without requiring manual conversions. For travelers, the card is a useful asset, enabling them to bypass the high fees typically imposed for international transactions and currency conversions.

The card is available for both personal and business users, providing an easy way to pay for goods, services, and even supplier invoices abroad.

Costs and Availability

The Wise debit card is available in various countries, including the US, UK, and several European countries. Users typically pay a one-time fee to order the card, which varies depending on the region but is generally around $5 to $10. There are no ongoing monthly maintenance fees, making it an affordable option for frequent travelers or those who manage money across multiple currencies.

ATM withdrawals are also possible, though there are some limits on free withdrawals. Typically, users can withdraw a certain amount for free each month, after which a small percentage-based fee applies.

Security Features and Ease of Use

It prioritizes security by offering features such as two-factor authentication and the ability to freeze or unfreeze the card instantly through the mobile app. Additionally, real-time notifications keep users updated on their spending, making it easier to track expenses. The Wise debit card is contactless, further enhancing its convenience for everyday use.

Security and Regulations

Wise is committed to protecting its users’ data and funds, making security a top priority. The company utilizes robust security protocols, ensuring that users can trust their transactions and personal information are safe. With compliance to global regulatory standards and advanced encryption techniques, It maintains a solid security infrastructure that has garnered the trust of millions worldwide.

How Wise Protects User Data and Funds

Smart uses state-of-the-art encryption to protect user data and financial information. Communication between a user’s device and Wise’s servers is protected with encryption through Transport Layer Security (TLS), which stops unauthorized individuals from accessing sensitive information. Moreover, money sent through Wise is held in distinct accounts, ensuring that customer funds are kept separate from Wise’s own funds for added financial security. This strategy guarantees that if Wise were to encounter financial issues, customer funds would still be secure.

Wise also maintains strict monitoring protocols, tracking transactions for any suspicious activity. This helps identify and prevent potential fraud or misuse, securing users’ money during the transfer process.

Regulatory Compliance and Licenses Wise Holds Globally

As a global financial services provider, It is subject to regulations in the countries where it operates. Wise holds licenses and is regulated by financial authorities around the world, ensuring compliance with local laws. In the UK, It is regulated by the Financial Conduct Authority (FCA), while in the United States, it is registered with FinCEN. In the European Economic Area (EEA), It is regulated by various local authorities depending on the country. These regulatory requirements mandate that Wise follows strict anti-money laundering (AML) protocols, ensuring that all transactions comply with international financial standards.

Two-Factor Authentication and Encryption Standards

To enhance user security, Wise implements two-factor authentication (2FA), which adds an additional layer of protection to user accounts. When logging in or making transactions, users are required to provide a second form of authentication, such as a code sent to their mobile device. This significantly reduces the chances of unauthorized access to accounts.

Additionally, It uses strong encryption standards to protect all transactions and data transfers. Their encryption systems ensure that even if data is intercepted, it remains unreadable to unauthorized parties, thus maintaining the integrity of sensitive financial information.

Customer Support and User Experience

Wise strives to provide its customers with a smooth experience, backed by a robust customer support system. If you are experiencing a problem with a transfer or require help with your account, Wise provides various customer support options and ensures an easy-to-use interface on both its website and mobile app.

Types of Customer Support Available: Chat, Email, Phone

Wise provides a range of support options to cater to users’ needs. The primary method for customer service is through their in-app chat feature and email support. For users dealing with specific issues, such as transfers being delayed or needing further verification, Wise’s chat support is often the quickest way to resolve problems. Additionally, It offers email support for less time-sensitive queries, ensuring that users can communicate their concerns and receive a written response. For certain regions and users facing complex issues, It also offers phone support. However, availability of phone support can vary depending on the location and the nature of the issue.

Reviews of the Overall User Experience: Website and Mobile App Interface

Both the website and mobile app user interface of Wise have received extensive praise for their simple and easy-to-use design. The mobile application enables users to easily handle their accounts in different currencies, conduct overseas transfers, and monitor their transactions. The app’s simple design and easy-to-use menu guarantee that users can locate information swiftly, whether they want to transfer funds or monitor exchange rates. Likewise, the Wise platform is created to ensure transparency in all transactions, showing users a breakdown of costs and comparisons of exchange rates before they finalize any transfer.

Common Issues and Wise’s Response Time

While Wise generally receives positive reviews, some common issues include delays in transfer processing and problems with identity verification. These are typical concerns in financial services, especially with international transactions that require stringent regulatory checks. However, Wise’s response time to such issues is generally prompt, with most complaints being resolved within a few business days. The chat and email support teams are well-regarded for their responsiveness, helping users resolve problems efficiently. For time-sensitive issues, Wise’s real-time support ensures that customers are not left waiting for long, helping maintain its reputation for providing dependable customer service.

Pros and Cons of Using Wise

Wise is a popular choice for international money transfers, offering a range of benefits but also presenting some limitations. For many users, It is a highly effective solution, though there are certain situations where it may not be the ideal choice. Here’s a breakdown of its key advantages and disadvantages.

Advantages: Cost, Speed, Transparency, Ease of Use

Cost: One of the most significant advantages of Wise is its cost-effectiveness. The platform uses the real mid-market exchange rate without hidden markups, unlike traditional banks that often inflate exchange rates. Users pay a low, upfront fee that is clearly displayed before confirming a transfer, making the pricing structure transparent.

Speed: Wise is famous for its speedy processing times. More than 60% of transfers are processed immediately, resulting in the recipient receiving them in seconds. Even if transactions are not immediate, the majority are completed within 1-2 business days, which is quicker than a lot of traditional transfer methods.

Transparency: It excels in transparency. The platform shows users the exact amount of fees charged and the real exchange rate being applied before the transfer is made. This level of clarity is uncommon in the financial industry, where hidden fees and unclear rates are the norm.

Ease of Use: Both the Wise website and mobile app are user-friendly, with an intuitive design that simplifies the process of setting up and managing transfers. Whether you’re an individual or a business, the interface makes it easy to navigate through different features like holding currencies, making payments, or checking exchange rates.

Disadvantages: Availability in Certain Countries, Fee Structure Complexity

Availability in Certain Countries: Wise operates in over 70 countries, but its services are not available everywhere. Some countries have restrictions, limiting the availability of certain currencies or transfer options. This can be a drawback for users who need to send money to or from countries where Wise is not fully operational.

Fee Structure Complexity: Even though Wise is open about its fees, the format may still be difficult to understand. Costs differ based on the currency, destination, and chosen payment method. Some individuals might have difficulty determining the exact amount they will be billed, especially when working with more obscure currency pairs.

Situations Where Wise is Most Beneficial and Where It May Not Be Ideal

Most Beneficial: Wise is ideal for individuals and businesses making regular international transfers, especially in major currencies like USD, EUR, and GBP. It’s also a great option for travelers and expats who need to manage multiple currencies. For businesses, Wise’s ability to hold and convert currencies at low fees makes it an excellent choice for managing international payrolls and invoices.

Not Ideal: In countries with restricted availability, It might not be the most suitable choice for users. In addition, individuals who make very small transfers may discover that the fixed fees, although minimal, are not as competitive as other platforms that provide free options for small amounts. Likewise, clients seeking intricate financial services like loans or credit will not be able to access them through Wise.

FAQs

What currencies can I transfer using Wise?

Wise supports over 50 currencies, including USD, EUR, GBP, AUD, CAD, and many others, making it easy to send money internationally across various regions.

How long does it take for Wise transfers to be delivered?

Most transfers are delivered instantly or within a few hours. However, depending on the destination and currency, transfers can take up to 1-2 business days.

Does Wise charge a monthly fee for holding a multi-currency account?

No, Wise does not charge any monthly maintenance fee for holding a multi-currency account. Users only pay when converting or transferring funds.