Bambora Review

- 12th Aug, 2024

- | By Linda Mae

- | Reviews

Bambora, currently under the Worldline brand, is a major player in the payment processing sector. Bambora was founded in 2015 in Stockholm, Sweden, through the merger of multiple financial service firms, such as Beanstream and IP Payments. This merger was intended to establish a strong, worldwide payment service provider, serving businesses of every size. Lets read more about Bambora Review.

Company Background | Bambora Review

Bambora was established by Johan Tjärnberg with the goal of streamlining payment procedures for merchants around the globe. The company rapidly grew its services by purchasing other payment processing companies to improve its abilities and market coverage.

In 2020, Bambora was acquired by Ingenico Group, which later merged with Worldline. This integration enabled Bambora to take advantage of Worldline’s vast resources and technology, strengthening its position in the global market.The rebranding to Worldline in 2021 marked a significant milestone, combining Bambora’s innovative approach with Worldline’s established reputation in the payments industry.

Bambora has reached many important goals since its establishment, such as expanding quickly into global markets and creating advanced payment solutions. The company’s innovation and dedication to security have been acknowledged through its attainment of PCI DSS compliance and incorporation of cutting-edge fraud prevention tools.

Under the leadership of CEO Johan Tjärnberg, Bambora has maintained a strong focus on growth and innovation. The management team, comprised of experienced professionals in the payments industry, continues to drive the company’s strategic vision and operational excellence, ensuring Bambora remains at the forefront of payment technology.

Products and Services

Bambora provides a range of products and services aimed at streamlining payment processing for businesses of any size. They customize their solutions to fit the requirements of different industries, offering secure and effective payment options.

Overview of Product Offerings

Bambora’s product offerings include robust payment gateways, Point of Sale (PoS) solutions, mobile payment options, online payment processing, recurring billing, subscription management, and invoice payment solutions. These products are designed to streamline transactions and enhance the customer experience.

Payment Gateways

Bambora’s payment gateways offer a safe and dependable platform for handling online transactions. These gateways enable businesses to accommodate a worldwide customer base by offering various payment methods and currencies. The smooth integration with different e-commerce platforms allows merchants to easily begin accepting payments fast.

Point of Sale Solutions

Bambora’s PoS solutions are designed for retail environments, allowing businesses to accept payments in-store efficiently. These systems are compatible with various hardware and offer features like inventory management and sales tracking, providing a comprehensive solution for retail operations.

Mobile Payment Options

With Bambora’s mobile payment options, businesses can accept payments via smartphones and tablets. This flexibility is ideal for mobile businesses and on-the-go transactions, providing a convenient and secure payment method for customers.

Online Payment Processing

Bambora provides secure online payment processing solutions for e-commerce businesses to facilitate transactions on their websites. These solutions come with advanced security features such as encryption and fraud detection, guaranteeing the safety of merchants and customers alike.

Recurring Billing and Subscription Management

For businesses offering subscription services, Bambora provides tools for recurring billing and subscription management. This feature automates the billing process, reducing administrative work and ensuring timely payments from customers.

Invoice Payment Solutions

Bambora’s invoice payment solutions allow businesses to send invoices with integrated payment options. Customers can pay directly through the invoice, streamlining the payment process and improving cash flow.

Supported Payment Methods

Bambora offers a variety of payment options to accommodate the different requirements of its customers. Credit and debit cards, ACH transactions, mobile wallets such as Apple Pay and Google Pay, and contactless payments like Swish, Vipps, Mobile Pay, and Masterpass are all part of this category. This flexibility allows businesses to provide customers with their desired payment choices, improving the overall transaction process.

Bambora’s extensive product and service offerings provide businesses with the tools they need to manage payments effectively and securely, making it a trusted partner in the payment processing industry.

Features and Benefits

Bambora offers a range of features designed to provide secure, efficient, and versatile payment processing solutions for businesses. These features not only enhance security but also improve integration, reporting, and international capabilities.

Security Features

Bambora places a strong emphasis on security, ensuring that all transactions are protected through robust measures. The platform is PCI compliant, adhering to the highest standards for credit card processing. End-to-end encryption ensures that data is secure from the point of entry to the final destination, protecting sensitive information during transmission. Moreover, tokenization exchanges sensitive card information with distinct tokens, decreasing the likelihood of data breaches. It utilizes sophisticated fraud prevention techniques, including ACI ReD Shield, to protect transactions through real-time detection and mitigation of fraudulent activities.

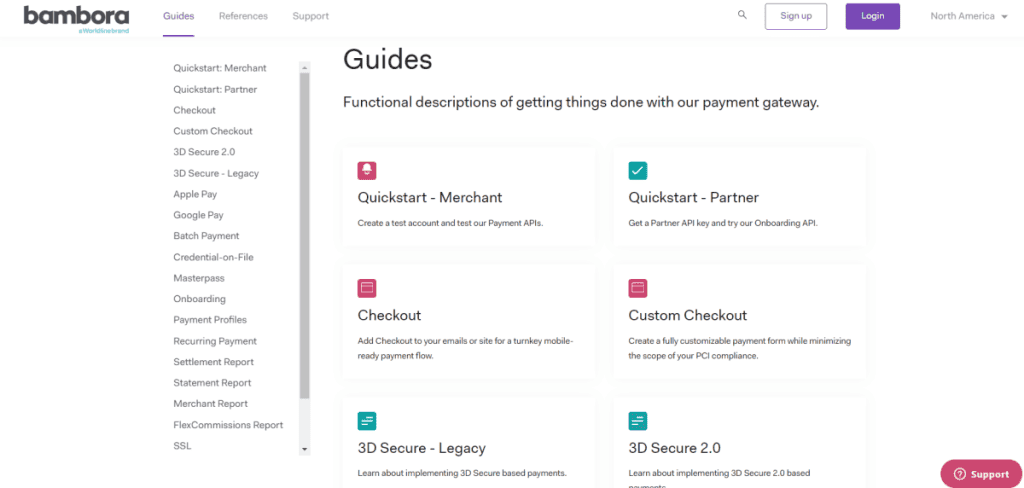

API and Software Integration

Bambora’s API and software integration capabilities make it easy for businesses to incorporate payment processing into their existing systems. The platform supports seamless integration with popular e-commerce platforms like Magento, WooCommerce, and OpenCart, enabling businesses to quickly set up and manage payments. The APIs are designed to be user-friendly, providing detailed documentation and support to ensure smooth implementation.

Reporting and Analytics

Bambora offers in-depth reporting and analytics tools that provide businesses with important insights into their transactions. The dashboard and reporting tools provide a concise summary of payment activities, assisting businesses in tracking performance and recognizing patterns. These analysis features empower businesses to make educated choices and enhance their payment procedures.

International Capabilities

Bambora’s international capabilities allow businesses to operate globally with ease. The platform supports multi-currency transactions, enabling businesses to accept payments in various currencies. Automatic currency conversion further simplifies the process, ensuring that customers can pay in their preferred currency while businesses receive payments in their desired currency. These features make it an ideal solution for businesses looking to expand their reach internationally.

Pricing and Fees

Bambora provides various pricing options to meet different business requirements, such as pay-as-you-go and personalized enterprise pricing. Businesses have the freedom to select a pricing model that suits their transaction volumes and specific needs.

Pricing Models

Pay-as-you-go: This model is ideal for small to medium-sized businesses with lower transaction volumes. It allows merchants to pay per transaction without the burden of long-term contracts or high monthly fees. This model typically includes a flat rate per transaction, making it straightforward and easy to manage.

Custom Enterprise Pricing: Bambora provides personalized pricing solutions for big companies with increased transaction volumes. These are customized to address the unique requirements of the company, offering better rates and extra functionalities to assist with intricate payment needs.

Detailed Fee Structure

Bambora’s fee structure includes several components:

Transaction Fees: For card-present transactions, the fee is usually lower than for card-not-present transactions. This distinction helps businesses manage costs based on how they process payments.

Setup Fees: There is often a one-time fee for setting up the payment processing system.

Monthly Fees: Depending on the pricing model, there may be monthly fees associated with maintaining the service.

Chargeback Fees: Businesses are charged a fee for handling chargebacks, which covers the administrative costs associated with these disputes.

Contract Terms

Bambora offers month-to-month agreements, providing businesses with the flexibility to switch or cancel services without long-term commitments. There are no early termination fees, making it a risk-free option for businesses to try the service and see if it meets their needs.

This flexible and transparent pricing structure makes it an attractive option for businesses looking for a reliable payment processing solution with clear and manageable costs.

Customer Support and Service

Bambora is recognized for delivering strong customer support and service, guaranteeing that businesses can receive prompt and effective assistance. The company provides numerous customer service channels to cater to different preferences and needs.

Customer Service Channels

Phone Support: Bambora provides phone support during business hours, allowing merchants to speak directly with a support representative. This channel is beneficial for resolving urgent issues that require immediate attention.

Email Support: Bambora provides email support for inquiries that are not as time-sensitive. Merchants have the option to send in-depth inquiries or issues and anticipate a timely reply. This choice is beneficial for more intricate problems that may necessitate in-depth explanations.

Live Chat: Bambora also offers live chat support on their website, providing real-time assistance for quick questions or troubleshooting. This channel is particularly useful for merchants who need immediate help but prefer not to use the phone.

Availability and Response Times

Bambora’s customer support is praised for its availability and prompt response times. Phone and live chat support are typically available during business hours, ensuring that merchants can get help when they need it. Email support responses are generally prompt, with most inquiries addressed within 24 hours. The efficiency and reliability of Bambora’s support team contribute to overall merchant satisfaction.

Merchant Feedback and Satisfaction

Merchants have provided positive feedback on Bambora’s customer support, indicating a high level of satisfaction. The support team is frequently praised for their expertise, assistance, and quick response times. The glowing reviews showcase Bambora’s dedication to delivering top-notch customer service, establishing it as a trusted ally for companies in need of dependable payment processing services.

Pros and Cons

Bambora offers a variety of benefits and some drawbacks that potential users should consider.

Strengths of Bambora

Competitive Pricing: Bambora provides competitive pricing models that cater to businesses of different sizes, particularly benefiting small to medium-sized enterprises with its pay-as-you-go model. This flexibility makes it accessible for businesses with varying transaction volumes.

Robust Security Measures: Security is a strong point for Bambora. The company ensures PCI compliance, employs end-to-end encryption, and utilizes tokenization to protect sensitive data. Additionally, advanced fraud prevention tools like ACI ReD Shield help mitigate risks associated with online transactions.

Wide Range of Supported Payment Methods: Bambora offers a wide range of payment options, such as credit and debit cards, ACH transfers, and well-known mobile wallets like Apple Pay and Google Pay. It also enables cashless payments using platforms such as Swish, Vipps, Mobile Pay, and Masterpass.

Flexible Integration Options: Bambora offers flexible integration options with its API, making it easy to integrate with existing systems. It supports popular e-commerce platforms such as Magento, WooCommerce, and OpenCart, ensuring a seamless setup process.

Weaknesses of Bambora

Lack of Transparent Public Pricing: One of the main drawbacks of Bambora is the lack of transparent public pricing. Potential customers must contact the company to get detailed pricing information, which can be inconvenient and time-consuming.

Setup Fees: Bambora charges setup fees, which might be a barrier for smaller businesses or startups that are sensitive to initial costs. These fees can add up, making the initial investment higher.

Long-term Equipment Lease Terms: Another disadvantage includes the extended lease periods for equipment. Merchants could become stuck in extended agreements for payment terminals and other equipment, restricting flexibility and driving up overall expenses.

Understanding these pros and cons can help businesses make an informed decision about whether Bambora is the right payment processing solution for their needs.

Competitor Comparison

Bambora faces competition from Stripe, PayPal, and Square in the payment processing industry. All of these rivals have unique strengths and weaknesses, and analyzing them against Bambora can offer useful perspectives for companies selecting a payment processing option.

Stripe: Stripe is known for its developer-friendly API, which allows for seamless integration and extensive customization. It supports a wide range of payment methods and currencies, making it ideal for businesses with complex payment needs. However, Stripe’s pricing can be higher for smaller transactions, and its support primarily relies on documentation and online forums, which might not be sufficient for all users.

PayPal: PayPal is a well-known brand worldwide, known for its user-friendly interface and extensive popularity. It offers different payment options, such as online payments, invoicing, and PoS systems. PayPal, on the other hand, charges higher fees than other processors, and its account holds and freezes have stirred up controversy among users.

Square: Square offers a comprehensive suite of payment solutions, particularly excelling in PoS systems for retail and hospitality businesses. Its transparent pricing and lack of monthly fees make it attractive for small businesses. However, Square’s international support is limited compared to Bambora and other global processors.

Strengths and Weaknesses Relative to Competitors

Strengths: Bambora stands out with its robust security measures, competitive pricing models, and a wide range of supported payment methods. Its flexible integration options with popular e-commerce platforms and comprehensive API support provide a seamless setup experience. Bambora’s focus on security, including PCI compliance and advanced fraud prevention, adds a layer of trust and reliability that is crucial for businesses.

Weaknesses: In contrast to its competitors, Bambora does not have easily accessible public pricing, potentially posing a challenge for businesses seeking upfront cost clarity. Small businesses or startups may also be discouraged by setup fees and lengthy equipment lease terms if they prefer lower initial investments and greater flexibility.

Overall, while Bambora offers strong security and versatile integration options, potential customers need to weigh these benefits against the lack of transparent pricing and potential setup costs when comparing it to Stripe, PayPal, and Square.

Legal and Compliance Considerations

Bambora places a strong emphasis on legal and compliance considerations to ensure that its services adhere to industry regulations and provide robust data protection.

Compliance with Industry Regulations (e.g., GDPR)

Bambora complies with various industry regulations, including the General Data Protection Regulation (GDPR), which governs data protection and privacy in the European Union. Compliance with GDPR ensures that Bambora processes personal data lawfully, transparently, and for legitimate purposes. This adherence to strict regulatory standards helps businesses mitigate legal risks and maintain customer trust.

Data Protection and Privacy Policies

Bambora has put in place thorough data protection and privacy policies to protect sensitive information. These measures consist of end-to-end encryption and tokenization to safeguard payment data while it is being transmitted and stored. Bambora decreases the chance of data breaches and unauthorized access by transforming sensitive information into secure tokens. Regular security audits are also carried out by the company to maintain compliance with data protection standards.

Incident Management and Communication During Outages

Bambora has established robust incident management protocols to handle potential security breaches and operational disruptions. These protocols involve immediate detection, assessment, and response to incidents, minimizing the impact on business operations. In the event of an outage or security incident, It communicates transparently with affected merchants, providing real-time updates and guidance on mitigating risks. This proactive approach to incident management and clear communication helps businesses maintain continuity and trust during critical situations.

User Reviews and Testimonials

Bambora has received a mix of user reviews and testimonials from various sources, reflecting both positive experiences and some areas for improvement.

Summary of User Reviews from Various Sources

In general, Bambora is valued for its dependable payment processing services, robust security features, and extensive support system. Users have pointed out the effectiveness of managing transactions and the seamless integration of Bambora’s solutions with current systems.

Common Positive Feedback

Many users praise Bambora for its competitive pricing and flexible payment options, which are particularly beneficial for small to medium-sized businesses. The security measures, including PCI compliance and advanced fraud prevention tools, are frequently mentioned as strong points. Customers also appreciate the range of supported payment methods, from credit and debit cards to mobile wallets and ACH transactions. Additionally, Bambora’s customer support receives positive remarks for being responsive and helpful, with multiple channels available for assistance.

Common Complaints and Issues

Despite the positive feedback, some users have noted a few drawbacks. One common complaint is the lack of transparent public pricing, which can make it difficult for potential customers to gauge costs upfront. Costs associated with installation and extended rental contracts are highlighted as drawbacks, especially for small companies operating on limited funds. There are users who have raised worries regarding intermittent delays in customer support response times during busy times. In addition, there have been a few cases of technical difficulties during the integration process, but they are seen as rare occurrences and not the usual.

In summary, while Bambora is well-regarded for its robust security, versatile payment options, and effective customer support, potential users should be aware of the initial setup costs and seek clarity on pricing to make an informed decision.

Conclusion

Bambora provides affordable rates, strong security measures, and flexible payment choices, making it a great choice for small to medium-sized companies. Some may be discouraged by setup fees and long-term leases, but the service in general is dependable. Potential users should assess their individual requirements and ensure transparency in pricing before making a decision.