Volt Payments Review

- 20th Aug, 2024

- | By Linda Mae

- | Reviews

Volt Payments is an innovative fintech company focused on providing real-time payment processing solutions between accounts. The company’s new strategy involves using open banking to facilitate quick, smooth transactions on different platforms. Volt Payments plans to transform the way businesses process transactions by consolidating different payment systems into one unified gateway, resulting in faster, more secure, and efficient transactions. Lets read more about Volt Payments Review.

Company Background | Volt Payments Review

Volt Payments was founded in 2019 with a specific goal: to utilize open banking in order to revolutionize the payments industry. The company experienced fast growth, obtaining substantial funding from various rounds, such as a $23.5 million Series A and a $60 million Series B. This investment has driven the company’s global expansion and innovation in product offerings.

The foundation of Volt Payments traces back to its founders’ extensive experience in the fintech sector. Tom Greenwood, who held the position of CEO, brought extensive expertise gained during his tenure at IFX Payments, where he made significant contributions to the advancement of embedded finance solutions. With him at the helm, Volt Payments efficiently gathered a group of experienced professionals and rolled out its main platform by the end of 2020. The company’s initial growth was marked by strategic partnerships and the successful deployment of its technology across various regions, including Europe and Brazil.

Volt Payments is dedicated to establishing a worldwide network for instantaneous payments, allowing companies to conduct transactions effortlessly and safely across international boundaries. The company aims to lead in offering real-time payment solutions, shaping the future of digital commerce with innovation and technology. Volt’s goal is to make the payment process easier and better for both merchants and consumers by offering a unified and flexible platform.

Volt Payments’ leadership team is composed of industry veterans with extensive experience in fintech and payments.

Tom Greenwood, CEO, is a seasoned fintech entrepreneur with over 20 years of experience. He is responsible for the strategic direction and international expansion of the company.

Steffen Vollert, COO, oversees the development of Volt’s open payments platform and manages the tech team. His background includes significant roles at Adyen, where he contributed to global POS rollouts.

Jordan Lawrence, CGO, focuses on global sales and marketing strategies. He has over two decades of experience in the payments industry.

Services Offered

Volt Payments offers a comprehensive range of services designed to cater to the diverse needs of businesses in the modern financial landscape. These services are built to ensure efficiency, security, and seamless integration, making Volt Payments a preferred choice for many merchants.

Payment Processing Solutions

Volt Payments offers strong systems for handling different kinds of transactions, making sure companies can manage payments easily and well. This covers both internet and physical store payments, allowing businesses to give their customers a smooth and easy payment process.

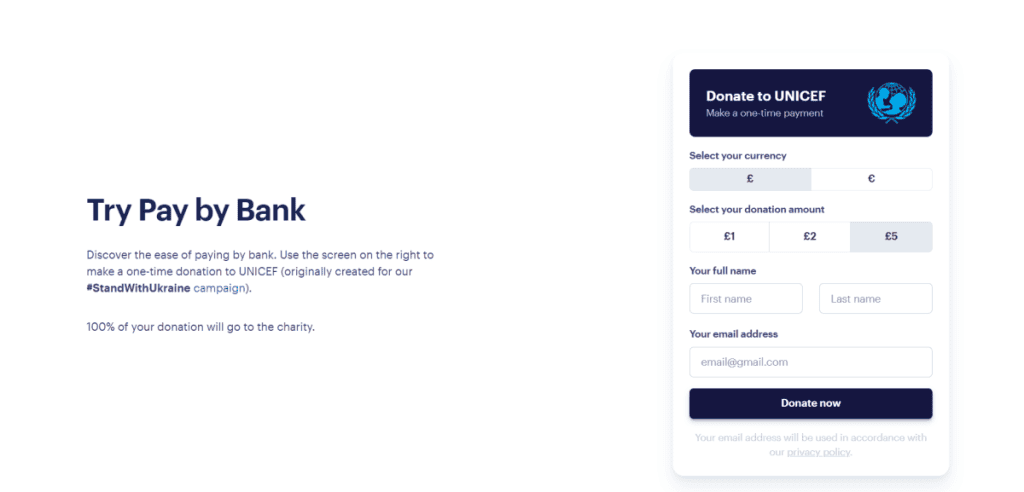

Mobile Payment Options

In an increasingly mobile-first world, Volt Payments offers mobile payment solutions that allow businesses to accept payments via smartphones and tablets. These solutions are designed to be user-friendly and secure, providing customers with the convenience of paying through their mobile devices.

E-commerce Payment Solutions

For online businesses, Volt Payments offers specialized e-commerce payment solutions. These solutions support various payment methods, including credit and debit cards, and integrate easily with popular e-commerce platforms. This ensures that online merchants can provide a secure and efficient checkout process for their customers.

Point of Sale (POS) Systems

Volt Payments has developed POS systems that specifically serve the requirements of retail establishments. These systems offer different payment options and include functions like inventory control, sales monitoring, and customer relations management. The POS systems are user-friendly and can be tailored to suit the unique requirements of various businesses.

ACH Processing

Automated Clearing House (ACH) processing is another key service offered by Volt Payments. This service allows businesses to handle direct bank transfers efficiently, making it ideal for recurring payments and large transactions. ACH processing is a cost-effective alternative to traditional payment methods and offers enhanced security features.

Recurring Billing

For companies that use a subscription-based system, Volt Payments provides ways to handle regular billing. These methods make the billing process automatic, which helps guarantee that money is received when it’s due and lessens the paperwork for the company. Regular billing also makes it easier for customers by giving them a smooth way to pay.

Security and Fraud Prevention

Security is a top priority for Volt Payments. The company employs advanced security measures to protect transactions and prevent fraud. This includes encryption technologies, secure data storage, and real-time fraud detection systems. By prioritizing security, Volt Payments ensures that businesses and their customers can transact with confidence.

Technology and Innovation

Volt Payments stands out in the fintech industry due to its cutting-edge technology and innovative features, which are designed to streamline payment processes and enhance user experience.

Volt Payments utilizes cutting-edge open banking technology to enable instant, account-to-account payments. The system is constructed on a sturdy and flexible infrastructure that guarantees top-notch performance and dependability. Important technologies include API connectivity, enabling smooth integration with different banking and payment systems, and cloud-based services offering flexibility and scalability.

Innovations and Unique Features

One of Volt Payments’ most notable innovations is its “super gateway,” which unifies multiple payment systems into a single, cohesive platform. This gateway supports instant transactions and provides comprehensive real-time reporting and analytics. Additionally, Volt Payments offers a unique fraud prevention tool, “Circuit Breaker,” which uses advanced algorithms and machine learning to detect and prevent fraudulent activities in real-time. The platform also includes features like intelligent routing, which optimizes payment flows to enhance conversion rates and reduce transaction costs.

Integration Capabilities with Other Systems

Volt Payments stands out for its capacity to seamlessly integrate with different systems, making it a versatile option for businesses. The platform enables businesses to easily manage payments across various channels by integrating with popular e-commerce platforms, POS systems, and ERP software. Utilizing APIs guarantees that the integration process is seamless and effective, reducing the necessity for extensive technical modifications.

User Experience

Volt Payments places a strong emphasis on user experience, ensuring that both merchants and customers benefit from an intuitive and efficient payment process.

Interface and Usability

The platform boasts a clean, user-friendly interface designed to make payment processing straightforward and efficient. The intuitive layout allows users to navigate through various features effortlessly, reducing the learning curve and enhancing overall usability. This ease of use extends across both desktop and mobile interfaces, ensuring a consistent and accessible experience for all users.

Customer Support and Service

Volt Payments is dedicated to offering excellent customer service. They provide various support choices, such as round-the-clock customer service, personal account managers, and extensive online help materials. These materials include thorough FAQs, user manuals, and problem-solving advice, which assist users in solving problems swiftly and effectively. The support staff is recognized for their quick response and professional knowledge, offering prompt and efficient help to handle any issues.

Merchant Dashboard and Tools

The merchant dashboard is one of Volt Payments’ standout features. It provides merchants with a comprehensive suite of tools to manage their payment processing needs effectively. The dashboard includes real-time transaction monitoring, detailed reporting and analytics, and customizable settings to tailor the platform to specific business needs. Additionally, it offers tools for managing recurring billing, handling refunds, and detecting potential fraud, giving merchants complete control over their payment operations.

Pricing and Contract Terms

Volt Payments is known for offering competitive pricing and flexible contract terms that cater to the needs of various businesses. Their transparent approach to pricing ensures that merchants understand the costs involved without hidden surprises.

Pricing Structure and Fees

Volt Payments uses a simple pricing plan that works for businesses of all sizes and with different amounts of sales. Usually, the price has a set amount you pay each month and extra fees for each sale you make. The cost for each sale depends on how many sales you make and what kind of sales they are, like paying with a credit card, direct bank transfers, or using a phone to pay. This way of setting prices lets businesses pick a plan that matches what they need and how much they can spend.

Contract Length and Terms

Volt Payments offers flexible contract terms, ranging from month-to-month agreements to longer-term contracts. This flexibility allows businesses to choose the contract length that best suits their operational needs. The company does not impose strict long-term commitments, providing an option for businesses to start with a short-term contract and later transition to a longer-term agreement as they become more comfortable with the service.

Transparency and Hidden Fees

Transparency is a cornerstone of Volt Payments’ pricing philosophy. The company prides itself on providing clear and upfront information about all fees and charges. There are no hidden fees, and all costs are disclosed at the outset. This includes detailed information on setup fees, transaction fees, and any additional charges that might apply. Volt Payments’ commitment to transparency helps build trust with merchants, ensuring they are fully aware of the financial aspects of their payment processing services.

Reliability and Performance

Volt Payments excels in providing reliable and high-performance payment processing solutions, ensuring that businesses can handle transactions efficiently and with minimal disruption.

Transaction Speed and Reliability

One notable aspect of Volt Payments is its emphasis on quick and trustworthy transactions. The platform uses advanced technology to enable instant, account-to-account payments. This guarantees that transactions are completed with minimal delay, ensuring a smooth process for merchants and customers alike. The strong framework of Volt Payments reduces delays, helping transactions complete swiftly and accurately, improving efficiency.

Downtime and Maintenance

Volt Payments prioritizes uptime and system availability, understanding that any downtime can significantly impact business operations. The company employs advanced monitoring and maintenance protocols to ensure continuous service availability. Regular maintenance is scheduled during off-peak hours to minimize disruption, and any potential issues are addressed proactively. This commitment to reliability means that businesses can trust Volt Payments to be available when they need it, without worrying about unexpected outages.

Performance Metrics

Volt Payments maintains high standards for performance, regularly tracking and optimizing various metrics to ensure optimal service delivery. Key performance indicators include transaction success rates, processing times, and system response times. The company uses these metrics to continually refine and enhance its platform, ensuring that it remains at the forefront of the industry. By focusing on these performance metrics, Volt Payments can provide a reliable and efficient service that meets the needs of its diverse clientele.

Security Measures

Volt Payments prioritizes security to ensure that transactions are safe and secure for both businesses and their customers. The company implements several advanced security measures to protect sensitive information and prevent fraud.

Compliance with Industry Standards (PCI-DSS)

Volt Payments follows the Payment Card Industry Data Security Standard (PCI-DSS), which is a group of security rules made to make sure that businesses handling, storing, or sending credit card data keep a safe environment. Following PCI-DSS means taking strong security steps, like setting up firewalls, using encryption, and doing regular security checks. This commitment makes sure that Volt Payments follows the top security rules in the payment business.

Encryption and Data Protection

To safeguard sensitive data, Volt Payments employs advanced encryption technologies. All transaction data is encrypted both in transit and at rest, ensuring that it is protected from unauthorized access. The use of strong encryption algorithms helps to secure data against potential breaches, providing peace of mind to businesses and their customers. Additionally, Volt Payments implements secure data storage solutions to further protect sensitive information.

Fraud Detection and Prevention Systems

Volt Payments has strong fraud detection and prevention systems in place to safeguard against fraudulent activities. The “Circuit Breaker” tool from the company utilizes cutting-edge algorithms and machine learning to observe transactions live and detect questionable actions. This proactive strategy enables Volt Payments to identify and stop fraud before it negatively affects businesses. The system has capabilities like automatic notifications and in-depth reporting, allowing businesses to swiftly respond to any possible fraudulent activities.

Customer Feedback and Reputation

Volt Payments has garnered a range of customer feedback that highlights both its strengths and areas for improvement. By examining reviews from various sources, we can gain a comprehensive understanding of the company’s reputation.

Customer reviews for Volt Payments are generally positive, with many users praising the platform’s efficiency, reliability, and innovative features. Merchants appreciate the seamless integration and real-time payment capabilities that the platform offers. Additionally, the intuitive interface and robust customer support are frequently highlighted as significant advantages.

Common Praises and Complaints

Volt Payments is frequently praised for its fast transaction handling and user-friendly design. Companies also appreciate the platform’s strong security features and advanced systems for catching fraud, which provide reassurance when handling sensitive financial data. Many customers also like the clear pricing and the ability to adjust contract conditions.

However, some customers have reported issues with initial setup and integration, citing that the process can be complex for those who are not technically inclined. A few users have mentioned occasional delays in customer support response times, although these instances appear to be relatively rare.

Reputation in the Industry

In the area of financial technology, Volt Payments is recognized for its innovative ways of managing transactions. The firm specializes in employing open banking technology to provide immediate, direct-from-bank account payment choices, positioning it as a leading company in this sector. Professionals in the field commend Volt Payments for its robust security measures and seamless compatibility with other systems, which aids in preserving its positive image among businesses and financial professionals.

Pros and Cons

Volt Payments offers a range of benefits and a few challenges that potential users should consider when evaluating their payment processing options.

Pros

Real-Time Payment Processing: Volt Payments excels in providing real-time, account-to-account payment processing, which ensures fast and efficient transactions for businesses and their customers.

User-Friendly Interface: The platform boasts an intuitive and easy-to-navigate interface, making it accessible for users of varying technical expertise.

Robust Security Measures: Volt Payments prioritizes security with compliance to PCI-DSS standards, advanced encryption, and proactive fraud detection systems, providing a safe transaction environment.

Flexible Contract Terms: The company offers various contract lengths, including month-to-month options, giving businesses the flexibility to choose terms that best suit their needs.

Comprehensive Customer Support: Volt Payments is known for its dedicated customer support, offering 24/7 assistance and various resources to help users resolve issues quickly.

Integration Capabilities: The platform integrates seamlessly with major e-commerce platforms, POS systems, and ERP software, allowing for efficient payment processing across different business systems.

Cons

Initial Setup Complexity: Some users have reported that the initial setup and integration process can be complex, especially for those who are not technically inclined.

Occasional Customer Support Delays: While customer support is generally robust, there have been occasional reports of delays in response times, which can be frustrating for users needing immediate assistance.

Learning Curve for Advanced Features: Although the basic interface is user-friendly, there is a learning curve associated with the platform’s more advanced features and tools, which may require additional time and training.

Limited Transparency in Pricing for Some Users: Despite a general commitment to transparency, some users have indicated that the detailed breakdown of fees and charges can be confusing or not immediately clear during the initial stages.

Overall, Volt Payments offers a strong suite of features and benefits that make it a competitive option in the payment processing industry, though some areas could be improved to enhance the overall user experience.

Competitor Comparison

Volt Payments is in competition with several big companies in the payment processing field, each providing unique features and services. Knowing how Volt compares to these competitors can assist businesses in making a well-informed choice.

Comparison with Major Competitors

Volt Payments competes with companies like Stripe, PayPal, and Square, which are well-established in the market. While these competitors offer a range of payment solutions, Volt differentiates itself with its focus on real-time, account-to-account transactions powered by open banking technology. This focus allows Volt to provide faster transaction speeds and lower costs compared to traditional card-based payment systems.

Unique Selling Points

Volt Payments stands out for its ability to process payments in real-time and its sophisticated fraud detection tool known as “Circuit Breaker.” The strong advantage of the platform is its ability to seamlessly integrate with different e-commerce platforms and POS systems, enabling businesses to incorporate Volt into their existing infrastructure. Volt’s dedication to security, including adherence to PCI-DSS regulations and strong encryption, distinguishes it from numerous rivals.

Strengths and Weaknesses Relative to Competitors

Strengths:

Speed and Efficiency: Volt’s real-time payment processing offers significant advantages in transaction speed compared to competitors like PayPal, which often relies on traditional banking processes.

Security Measures: Volt’s advanced security protocols and fraud detection systems provide a higher level of protection compared to some competitors, ensuring safer transactions.

Flexibility: The platform’s flexible contract terms and transparent pricing structure offer more adaptability for businesses than some of its more rigid competitors.

Weaknesses:

Initial Setup Complexity: Compared to competitors like Square, which is known for its straightforward setup process, Volt Payments can be more complex to integrate initially.

Customer Support Delays: While generally robust, Volt’s customer support has occasionally been reported to have slower response times compared to the highly praised support services of Stripe.

In summary, Volt Payments holds several advantages in speed, security, and flexibility, making it a strong contender in the payment processing industry. However, potential users should consider the initial setup complexity and occasional support delays relative to its competitors.

Conclusion

Volt Payments provides secure and flexible payment processing that is both strong and real-time. Its innovative characteristics and smooth integrations make it a strong option. Potential users should take into account the complexity of its installation, but they will gain from its effectiveness and protection. In general, Volt Payments is a dependable option for contemporary enterprises.

FAQs

What types of businesses can benefit from Volt Payments services?

Volt Payments services are ideal for a wide range of businesses, including e-commerce retailers, brick-and-mortar stores, subscription-based services, and any business requiring efficient, real-time payment processing.

How secure are transactions processed through Volt Payments?

Transactions processed through Volt Payments are highly secure, utilizing advanced encryption, PCI-DSS compliance, and real-time fraud detection systems to protect sensitive data and prevent fraud.

What kind of customer support does Volt Payments offer?

Volt Payments offers comprehensive customer support, including 24/7 assistance, dedicated account managers, and extensive online resources such as user guides and FAQs to help resolve any issues promptly.