Gulf Management Systems Review

- 22nd Aug, 2024

- | By Linda Mae

- | Reviews

Gulf Management Systems (GMS) is a reputable payment processing company that has been assisting businesses since it was founded in 1992. Situated in Clearwater, Florida, GMS has established a strong standing by offering customized financial solutions to cater to different industries. Let’s dig deeper into the Gulf Management Systems Review.

At its core, GMS specializes in payment processing services, offering businesses the tools they need to efficiently manage transactions. Some of the services offered are credit card and debit card processing, ACH check transactions, and mobile payments, among other options. Gulf Management Systems also offers POS systems and billing solutions, ensuring businesses have a complete set of tools for managing their financial transactions efficiently.

In addition to standard payment processing, Gulf Management Systems offers specialized services such as recurring billing and subscription management, which are particularly beneficial for businesses with ongoing customer relationships. The company also emphasizes security, ensuring that all transactions are protected through robust data security measures and PCI compliance.

Having more than 30 years of experience, Gulf Management Systems is now a reliable collaborator for businesses in different industries, including retail and healthcare. Their dedication to offering dependable and safe payment options has established them as a preferred option for companies seeking to simplify their financial processes and improve customer satisfaction.

Company Background | Gulf Management Systems Review

Gulf Management Systems (GMS) has a rich history that dates back to its founding in 1992. Established in Clearwater, Florida, the company began with a mission to provide efficient and secure payment processing solutions to businesses of all sizes. Over the years, GMS has evolved significantly, expanding its service offerings and growing its client base across various industries.

The leadership of Gulf Management Systems has played a crucial role in its sustained growth and reputation. At the helm is CEO Charles G. Billone, whose vision and leadership have been instrumental in shaping the company’s direction. Billone’s extensive experience in the financial services industry has helped GMS navigate the complexities of payment processing, allowing the company to stay competitive in a rapidly changing market.

Under Billone’s direction, Gulf Management Systems has continued to hold a solid position in the market, especially in the payment processing sector. The company is renowned for its capacity to serve various industries such as retail, eCommerce, education, healthcare, and nonprofits. The wide range of capabilities has allowed GMS to establish a diverse customer base, spanning from small companies to big corporations, all taking advantage of the customized solutions provided by GMS.

GMS’s reputation in the industry is built on its commitment to providing reliable, secure, and innovative payment processing services. The company’s ability to adapt to the evolving needs of its clients has been a key factor in its long-standing success. As a result, Gulf Management Systems continues to be a trusted partner for businesses looking for comprehensive financial solutions, making it a significant player in the payment processing landscape.

Core Services Offered by GMS

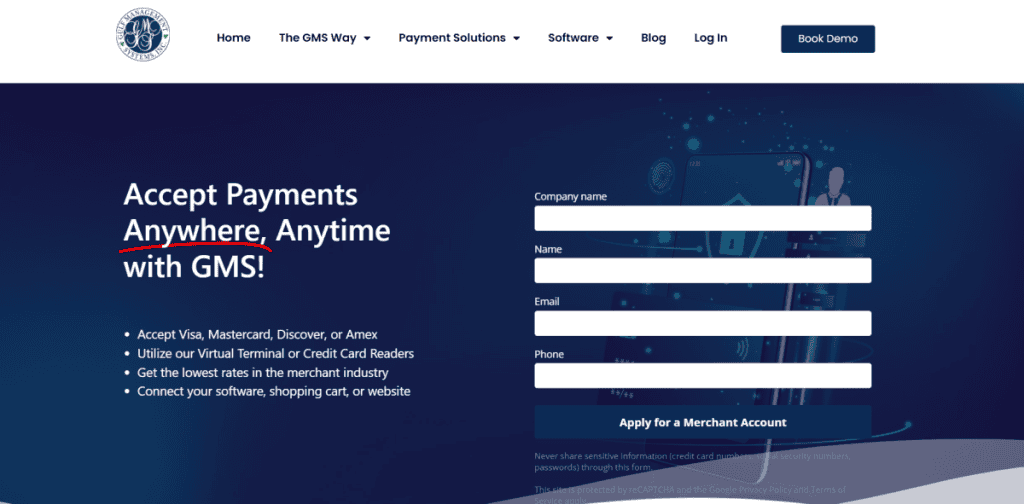

Gulf Management Systems (GMS) provides a comprehensive suite of services designed to meet the diverse payment processing needs of businesses. These services are at the core of what GMS offers, making it a versatile choice for companies seeking reliable and secure financial transaction solutions.

Payment Processing: GMS excels in offering a variety of payment processing services, catering to different business models. Their ACH check transaction service allows businesses to process payments directly from customers’ bank accounts, which is particularly useful for recurring payments and large transactions. GMS offers strong options for credit and debit card processing, making sure that businesses can receive payments from all key card networks. With the rise in popularity of digital currencies, GMS has incorporated the processing of cryptocurrencies into its services, enabling businesses to receive payments in Bitcoin and other digital currencies. Additionally, GMS supports mobile payments and online payments, making it easy for businesses to offer their customers flexible payment options, whether they are shopping in-store or online.

Recurring billing and subscription services are another critical feature provided by GMS. These services are particularly beneficial for businesses that operate on a subscription model, enabling them to automate billing cycles and manage customer subscriptions efficiently.

Billing and Invoicing: Gulf Management Systems offers advanced billing and invoicing solutions that are designed to streamline the payment process for businesses. Their online invoicing capabilities allow businesses to send invoices to customers digitally, reducing the time and effort associated with traditional paper invoicing. GMS also offers seamless integration with mobile payment solutions, ensuring that businesses can manage invoicing and payments from a single platform. Recurring billing options are also available, allowing businesses to automate the billing process for ongoing services.

Point of Sale (POS) Solutions: GMS provides a range of Point of Sale (POS) solutions, essential for businesses that require in-person payment processing. Their POS equipment supports EMV processing, ensuring compliance with modern payment security standards. Additionally, GMS offers contactless NFC support, enabling businesses to accept payments from digital wallets and other contactless payment methods, which are becoming increasingly popular.

Security Features: Ensuring security is paramount for GMS, and they provide numerous features to safeguard businesses and their clientele. GMS guarantees that all payment processing meets PCI compliance, following the most stringent payment security standards. They also offer strong data security measures and tools for preventing payment fraud, protecting businesses from possible threats and maintaining the authenticity of all transactions.

Pricing, Fees, and Contract Terms

Gulf Management Systems (GMS) employs a tiered pricing model for its payment processing services. This model categorizes transactions into different pricing tiers based on factors such as the type of card used, transaction method, and associated risk. The tiered pricing structure typically includes a qualified rate for standard transactions, a mid-qualified rate for transactions that involve certain types of rewards cards or manually entered data, and a non-qualified rate for higher-risk transactions, such as those involving corporate cards or non-swiped transactions.

Rates and Fees: The specific rates that businesses can expect to pay vary depending on the transaction type. For example, swipe rates, which apply to transactions where the card is physically present and swiped through a terminal, generally range from 1.00% to 4.99%. Keyed-in rates, which are used for transactions where the card information is manually entered, also fall within this range but may lean towards the higher end due to the increased risk. Mobile payment rates and virtual terminal rates are similarly structured, with variability depending on the specific payment scenario.

Although Gulf Management Systems provides competitive rates, it lacks full transparency regarding its fees. Certain fees are not revealed at the beginning, like the PCI compliance fee, a common cost for upholding data security measures. Furthermore, GMS has the option to charge an early termination penalty, the amount of which may differ depending on the terms of the agreement. Businesses could find these hidden fees worrisome since they have the potential to increase the total expenses of utilizing GMS’s services.

Contract Terms: GMS offers flexible contract terms, with the length and specifics often varying depending on the client’s needs. Contracts may include terms that allow for early termination but often at the cost of a variable fee. This flexibility in contract length can be advantageous for businesses that require a more tailored approach to their payment processing needs.

Comparison with Industry Standards: Compared to industry standards, GMS’s pricing and contract terms are relatively average. While the tiered pricing model is common among payment processors, the lack of transparency regarding certain fees is a point of concern for some businesses. Additionally, the variable nature of contract terms is fairly typical, though the potential for early termination fees is something businesses should be aware of when considering GMS as their payment processing partner.

Customer Support and Setup

Gulf Management Systems (GMS) offers a customer support and setup experience designed to be straightforward and user-friendly, making it easier for businesses to integrate their payment processing solutions. GMS offers clients thorough guides and resources to assist them in starting the setup process, which is well-documented. Furthermore, the company provides live online assistance for customers to get real-time support during the setup process. This can be especially advantageous for companies that require assistance setting up their payment systems or resolving any initial problems.

Availability and Quality of Customer Support: GMS provides customer support primarily through domestic phone support during standard business hours. This ensures that clients can reach a representative during the workday for any immediate concerns or questions. The support team is trained to handle a variety of issues, from technical support related to payment processing equipment to inquiries about billing and account management. While the phone support is generally appreciated by clients, some have noted that the availability of support outside regular business hours could be improved, particularly for businesses that operate beyond typical 9-to-5 schedules.

Ease of Implementation and User Experience: The implementation of GMS’s services is generally considered smooth and user-friendly. The company’s payment processing solutions are designed to integrate easily with existing systems, reducing the time and effort required to get up and running. The thorough documentation from GMS covers hardware setup and software configuration, enhancing the user experience. Businesses frequently discover that they are able to initiate payment processing promptly, with little interference to their daily activities.

Reviews on Customer Service Responsiveness: Customer feedback on GMS’s service responsiveness is mixed. Many users appreciate the knowledgeable and helpful nature of the support staff, especially during the initial setup. However, some clients have expressed concerns about the speed of response, particularly during peak times or for more complex issues. While Gulf Management Systems strives to provide efficient support, there are occasional reports of delays or the need for follow-up calls to resolve certain problems.

Customer Feedback and Reputation

Gulf Management Systems (GMS) has garnered a mixed reputation based on customer feedback across various review platforms. Online reviews and ratings offer a snapshot of the experiences businesses have had with GMS, reflecting both the strengths and areas where the company could improve.

Analysis of Online Reviews and Ratings: GMS has received varied ratings across platforms such as the Better Business Bureau (BBB), Google, and Yelp. On the BBB, GMS holds an A+ rating, which indicates a strong commitment to resolving customer complaints. However, it’s important to note that while the company has a good rating, it is not BBB accredited, and there have been a few customer complaints related to billing and service issues. On Google, GMS has received positive reviews, with customers praising the efficiency of their services, although the number of reviews is relatively limited. Yelp has fewer reviews, making it harder to draw comprehensive conclusions from that platform.

Common Complaints and Praises: Customers generally appreciate the range of services offered by GMS, particularly the variety of payment processing options and the flexibility in contract terms. A lot of customers have commended the company for its easy-to-use systems and smooth integration with current business practices. Nevertheless, typical grievances consist of problems concerning billing, such as unanticipated charges or challenges in comprehending the fee arrangement. Some users have also noted that the service may be difficult to navigate, particularly for businesses that are less experienced with payment processing technologies. Additionally, while customer service is often described as helpful, there have been occasional reports of slow response times during peak periods.

Summary of Customer Satisfaction and Areas for Improvement: Overall, customer satisfaction with GMS is moderate, with many businesses finding value in the services provided but also encountering areas of frustration. The company excels in offering a comprehensive suite of payment processing solutions, but transparency regarding fees and improved customer support response times are areas where GMS could enhance its offerings. To maintain and improve its reputation, GMS might consider addressing these common concerns more proactively, ensuring that customers feel fully supported and informed throughout their partnership.

Pros and Cons of Gulf Management Systems

Pros

Wide Range of Payment Processing Options: GMS offers a comprehensive suite of payment processing services, including ACH check transactions, credit and debit card processing, mobile payments, and cryptocurrency processing. This versatility allows businesses across various industries to choose the payment methods that best suit their operational needs, making GMS a flexible option for companies of all sizes.

Support for Multiple Industries and Business Types: GMS caters to a wide range of sectors such as retail, eCommerce, healthcare, education, and nonprofits. Businesses across various industries can receive customized solutions that meet their specific needs and obstacles due to the extensive support available. If you are operating a small business or overseeing a large corporation, GMS has solutions that can be tailored to suit different types of business settings.

Strong Security Features and Compliance: Security is a top priority for GMS, which is evident in its compliance with PCI standards and the robust data security measures it implements. These features help protect businesses from fraud and data breaches, providing peace of mind that sensitive financial information is handled securely. The company’s emphasis on maintaining high security standards is particularly appealing to businesses that handle large volumes of transactions or sensitive customer data.

Cons

Lack of Transparency in Pricing: One of the main drawbacks of Gulf Management Systems is the lack of transparency in its pricing structure. While the company offers competitive rates, many of the fees are not disclosed upfront, which can lead to unexpected costs for businesses. This opacity in pricing can be a significant drawback, especially for small businesses with tight budgets that need to plan their expenses carefully.

Potentially Complex Service Offerings: Although Gulf Management Systems offers a variety of services, this can also have drawbacks. The variety of services available can be daunting, especially for companies who are not as knowledgeable about technology or payment processing. It may take more time and effort than expected to navigate through the different options and determine which services are essential for your business.

Mixed Customer Reviews Regarding Support and Service Delivery: Customer feedback on GMS is mixed, with some clients praising the company for its comprehensive services and others expressing frustration over customer support and service delivery. Issues such as slow response times and difficulties in resolving billing disputes have been noted by some users, indicating that there is room for improvement in the customer service department. This inconsistency in customer experiences can be a concern for businesses that rely on prompt and efficient support.

Comparison with Competitors

When comparing Gulf Management Systems (GMS) with other payment processing companies in the industry, several factors highlight its position in the market. GMS offers a robust range of payment processing services, including ACH transactions, credit and debit card processing, and cryptocurrency support, which places it on par with many of its competitors. However, there are specific areas where GMS distinguishes itself, as well as areas where competitors might have an advantage.

How GMS Stacks Up Against Competitors: Gulf Management Systems competes directly with other established payment processors like Square, Stripe, and PayPal. While these competitors are well-known for their user-friendly interfaces and broad accessibility, GMS holds its own by offering a more tailored approach, particularly for businesses in specialized industries like healthcare, education, and nonprofits. GMS’s ability to cater to specific sectors with customized solutions gives it an edge over some of the more generic offerings from its competitors.

Unique Selling Points of GMS: Gulf Management Systems stands out from its competitors with its wide variety of payment options, such as cryptocurrency support, which sets it apart in the market. Furthermore, GMS offers robust security features and adherence to compliance standards, including PCI compliance and advanced tools for preventing fraud. The emphasis on security is especially attractive to companies dealing with confidential financial data, distinguishing Gulf Management Systems from rivals who do not prioritize this aspect as much.

Areas Where Competitors Might Have an Edge: Despite its strengths, Gulf Management Systems faces stiff competition in several areas. For instance, competitors like Square and Stripe are known for their transparency in pricing, offering clear and upfront information about fees, which GMS lacks. This lack of pricing transparency can be a significant disadvantage for GMS, especially when compared to competitors that make their pricing models easy to understand for businesses of all sizes.

Additionally, Gulf Management Systems may be overshadowed by some competitors in the realm of customer support. PayPal and Stripe are known for their round-the-clock responsive and efficient customer service, receiving praise, while GMS’s support availability is more restricted, possibly causing frustration for customers in need of instant help.

Conclusion

Gulf Management Systems provides a comprehensive range of payment processing services, excellent security capabilities, and assistance for different sectors. Despite its standout flexibility and protection features, prospective users need to take note of its vague pricing and varied customer service feedback. Gulf Management Systems is appropriate for companies looking for thorough, secure payment options, but it is advised to carefully evaluate its pricing model.

FAQs

What industries does Gulf Management Systems primarily serve?

Gulf Management Systems serves a wide range of industries, including retail, eCommerce, healthcare, education, and nonprofits. Their versatile payment solutions are designed to meet the needs of businesses of all sizes across these sectors.

Are there any setup fees for starting with GMS?

GMS does not explicitly disclose setup fees upfront, so it’s recommended to inquire directly with them for detailed information on account setup costs and any potential initial fees.

What kind of customer support can clients expect from GMS?

Clients can expect domestic phone support during business hours. While GMS provides knowledgeable assistance, some users report mixed experiences with response times and availability outside regular hours.