Square Terminal Review

- 06th Jan, 2025

- | By Linda Mae

- | Reviews

In this present generation, effective and dependable payment processing is essential for achievement. The Square Terminal is a comprehensive payment solution created to fulfill the requirements of contemporary businesses by simplifying transactions and improving customer interactions. Lets read more about Square Terminal Review.

Developed by Square, a leader in financial services and mobile payment solutions, the Square Terminal combines multiple features into a compact, effective device. It allows businesses to handle various payment methods, such as magnetic-stripe cards, EMV chip cards, and contactless solutions like Apple Pay and Google Pay. This flexibility ensures that businesses can satisfy a wide range of customer preferences.

The device features a 5.5-inch touchscreen display that is both intuitive and user-friendly, facilitating smooth navigation through transactions. Its compact dimensions—approximately 5.6 inches in length, 3.4 inches in width, and 2.5 inches in height—and lightweight design, weighing around 417 grams, make it highly portable and suitable for various business settings, from retail stores to restaurants.

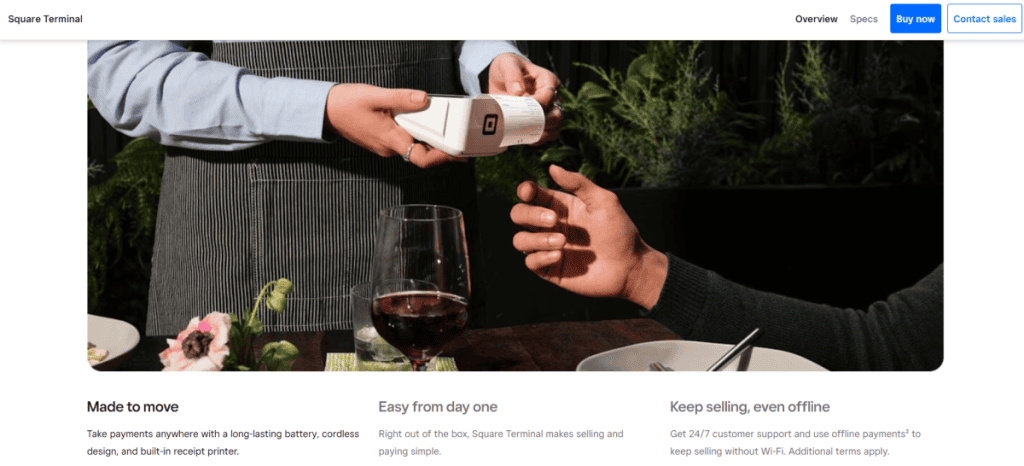

A distinctive feature of the Square Terminal is its built-in thermal printer, enabling businesses to print receipts on the spot, enhancing the efficiency of customer service. The device operates on a rechargeable battery designed to last all day, enabling payment processing either at the checkout or while on the go. Connectivity options include Wi-Fi and Ethernet (with an optional Hub), ensuring reliable access to payment processing services.

Security is a top priority with the Square Terminal. It employs end-to-end encryption and adheres to industry standards to protect sensitive payment information, giving both businesses and customers peace of mind during transactions.

Design and Build Quality | Square Terminal Review

The Square Terminal is a compact and lightweight device designed to facilitate seamless payment processing across various business environments.

Physical Dimensions and Weight

Measuring approximately 5.6 inches in length, 3.4 inches in width, and 2.5 inches in height, and weighing around 417 grams, the Square Terminal is both portable and convenient. Its sleek design allows businesses to easily carry it around the store or use it at a fixed location, catering to diverse operational needs.

Display and Interface

Featuring a 5.5-inch touchscreen, the Square Terminal provides a user-friendly and reactive interface. The high-resolution display guarantees clear visibility, and the touch features enable effortless navigation through menus and transaction procedures. This intuitive interface reduces the learning curve for novice users and improves the overall effectiveness of payment processing.

Durability and Aesthetics

Made with premium materials, the Square Terminal is designed to endure the challenges of everyday business activities. Its durable construction guarantees durability, and the sleek, professional look suits various business environments. The device features sleek lines and a minimalist design that not only boost its visual attractiveness but also showcase the inventive spirit of Square’s product range.

Payment Processing Capabilities

The Square Terminal is a versatile payment processing device designed to accommodate a wide array of payment methods, ensuring businesses can meet diverse customer preferences.

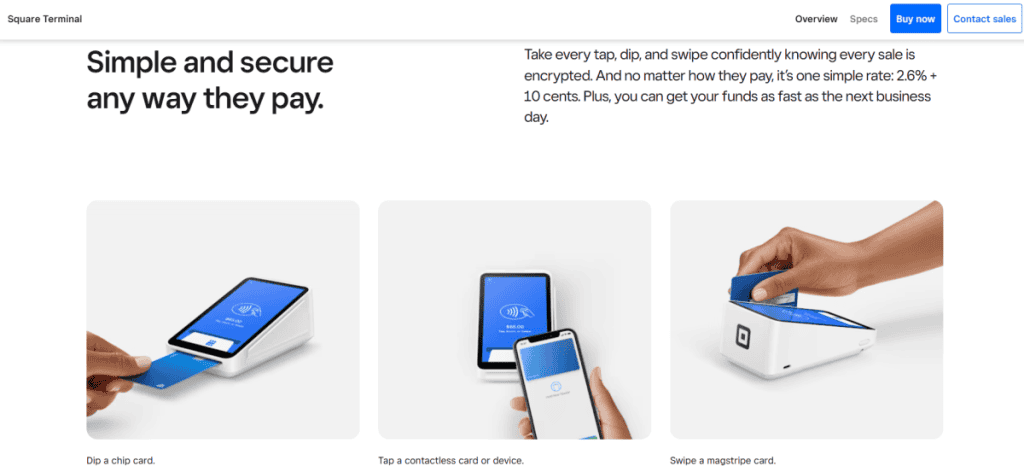

Accepted Payment Methods

Square Terminal supports multiple payment options, including:

Chip Cards: Accepts EMV chip-enabled credit and debit cards, providing enhanced security during transactions.

Magnetic Stripe Cards: Processes traditional swipe cards through the magstripe reader located on the device.

Contactless Payments: Facilitates tap-and-go transactions via NFC technology, supporting mobile wallets like Apple Pay and Google Pay, as well as contactless-enabled cards.

This comprehensive acceptance range ensures that businesses can cater to various customer payment preferences seamlessly.

Transaction Speed and Reliability

Square Terminal is built for quick and dependable transaction processing. The efficient combination of its hardware and software minimizes wait times, enhancing customer satisfaction. The device connects to the internet via Wi-Fi or Ethernet (with a possible Hub), ensuring dependable performance. Additionally, it offers offline capabilities, allowing businesses to handle payments during short internet outages; these transactions are automatically finalized once the connection is restored.

Security Features

Security is paramount in payment processing, and Square Terminal incorporates robust measures to protect sensitive information:

End-to-End Encryption: Encrypts card data from the moment of capture, ensuring information remains secure throughout the transaction process.

PCI Compliance: Adheres to Payment Card Industry Data Security Standards, maintaining a secure environment for handling cardholder data.

Fraud Prevention Tools: Includes features designed to detect and prevent fraudulent activities, safeguarding both the business and its customers.

These security protocols provide peace of mind, ensuring that transactions are conducted safely and in compliance with industry standards.

Software and Integration

The Square Terminal is a versatile device that seamlessly integrates with Square’s ecosystem, enhancing business operations through efficient software and integration capabilities.

Square POS Integration

Square Terminal comes preloaded with Square’s free POS software, providing businesses with a comprehensive suite of tools to manage sales, track customer interactions, and process payments. This integration ensures that all transactions are synchronized in real-time, allowing for accurate sales reporting and inventory management. The intuitive interface simplifies the checkout process, enabling staff to handle transactions swiftly and effectively.

Inventory and Sales Management

Square Terminal, equipped with integrated inventory management capabilities, enables businesses to track stock levels straight from the device. Users can input or modify items, establish categories, and monitor inventory levels in real-time. This feature helps avoid stock shortages and excess inventory, ensuring that ideal inventory levels are preserved. Moreover, the device delivers comprehensive sales reports, presenting information on sales trends, best-selling products, and overall business effectiveness.

Third-Party App Compatibility

Square Terminal allows integration with multiple third-party applications, enhancing its features to address particular business requirements. Via Square’s App Marketplace, companies can link to accounting software including Xero, e-commerce services like WooCommerce, and promotional tools such as Mailchimp. These integrations enable efficient operations by automating the data exchange between systems, lowering manual input, and decreasing mistakes. For example, aligning sales information with accounting applications guarantees precise financial documentation, while connecting with e-commerce sites allows coherent inventory control between online and brick-and-mortar shops.

Pricing and Fees

The Square Terminal is a comprehensive payment processing device designed for businesses seeking an all-in-one solution. Understanding its pricing structure and associated fees is essential for evaluating its suitability for your business operations.

Hardware Cost

Starting in January 2025, the price of the Square Terminal is set at $299, not including taxes and fees. For companies looking to distribute the cost, Square provides financing alternatives, enabling monthly payments of $27 for a year. Moreover, to improve connectivity and the integration of accessories, an optional Hub can be purchased for $39, enabling Ethernet links and the connection of peripherals such as cash drawers and barcode scanners.

Transaction Fees

Square employs a transparent fee structure for processing payments:

In-Person Transactions: For payments processed through the Square Terminal, a fee of 2.6% plus $0.10 per transaction applies.

Manually Entered Transactions: When card details are entered manually, the fee is 3.5% plus $0.15 per transaction.

Afterpay Transactions: For businesses offering Afterpay as a payment option, a fee of 6% plus $0.30 per transaction is charged.

These rates are straightforward, with no hidden charges, enabling businesses to predict costs accurately.

Additional Costs

While the Square Terminal includes essential features without monthly fees, certain accessories and advanced functionalities may incur extra expenses:

Accessories: Beyond the optional Hub ($39), businesses might consider additional peripherals such as countertop mounts or belt clips to enhance the device’s utility. Prices for these accessories vary based on the specific requirements.

Advanced POS Features: Square offers its standard POS software at no cost; nonetheless, customized POS systems designed for retail, dining, or appointment-driven businesses could incur subscription charges. For example, Square for Retail and Square for Restaurants provide enhanced features across various pricing levels, which need to be examined to find the ideal match for your business requirements.

To sum up, the Square Terminal offers an affordable option with transparent pricing and charges. The upfront hardware investment, together with consistent transaction fees and optional upgrades or software enhancements, enables companies to tailor the system to their operational needs and financial limitations.

User Experience

The Square Terminal is designed to offer businesses a seamless and efficient user experience, from initial setup to daily operations, complemented by robust customer support.

Setup and Installation

Setting up the Square Terminal is straightforward, requiring minimal technical expertise. Upon unboxing, users can power on the device by holding the power button for three seconds. The device typically comes pre-charged, allowing for immediate setup. Users are guided through connecting to a Wi-Fi network or, with the optional Hub, an Ethernet connection. The intuitive on-screen prompts facilitate account sign-in or creation, enabling businesses to commence transactions promptly.

Daily Operation

In everyday use, the Square Terminal’s intuitive interface improves operational efficiency. The interactive touchscreen and user-friendly navigation simplify the checkout process, decreasing transaction durations and enhancing customer satisfaction. The device’s mobility enables staff to process payments anywhere on the business premises, enhancing operational flexibility. Moreover, the integrated receipt printer and the ability to process multiple payment options, such as contactless payments, enhance a smooth customer experience.

Customer Support

Square offers extensive customer support for Terminal users, featuring round-the-clock help available through phone, email, and chat. This 24/7 support guarantees that any operational problems can be resolved quickly, reducing possible disruptions. Moreover, Square provides a comprehensive online Support Center that includes articles, tutorials, and FAQs to help users troubleshoot and enhance their experience with the Terminal.

Pros and Cons

The Square Terminal is a versatile payment processing device that offers a range of benefits and some considerations for businesses.

Advantages

Portability: Weighing approximately 417 grams and featuring a compact design, the Square Terminal is easily portable, allowing businesses to accept payments anywhere within their premises or on the go.

Ease of Use: The device boasts an intuitive touchscreen interface, making it user-friendly for both staff and customers. Its straightforward setup process enables businesses to start accepting payments quickly.

Comprehensive Payment Acceptance: Square Terminal supports various payment methods, including EMV chip cards, magnetic stripe cards, and contactless payments like Apple Pay and Google Pay, meeting diverse customer preferences.

All-in-One Functionality: Equipped with a built-in receipt printer and preloaded with Square’s POS software, the Terminal consolidates multiple functions into a single device, reducing the need for additional hardware.

Transparent Pricing: Square offers clear and predictable transaction fees, with no hidden costs or long-term contracts, allowing businesses to manage expenses effectively.

Disadvantages

Connectivity Dependence: While the Terminal operates over Wi-Fi and offers an offline mode, consistent internet connectivity is essential for real-time transaction processing and accessing certain features. Businesses in areas with unreliable internet may experience challenges.

Transaction Fees for High-Volume Sales: Although Square’s transaction fees are straightforward, businesses with high sales volumes may find that these costs accumulate considerably over time, potentially impacting their profit margins.

Limited Customization: The device is designed to work seamlessly within Square’s ecosystem, which may limit integration with certain third-party applications or existing systems that some businesses use.

Hardware Investment: The initial cost of the device, priced at $299, may be a consideration for small businesses or startups with limited budgets, despite available financing options.

Comparison with Competitors

The Square Terminal is a versatile payment processing device that stands out in the market. To understand its position, it’s helpful to compare it with similar products like the Square Reader and the Clover Flex.

Square Terminal vs. Square Reader

Features: The Square Terminal is an all-in-one device with a built-in receipt printer and touchscreen interface, capable of processing payments independently. In contrast, the Square Reader is a compact card reader that connects to a smartphone or tablet to process payments, lacking its own display or printer.

Use Cases: The Terminal is ideal for businesses requiring an independent solution that relies on no additional hardware, suitable for both countertop and mobile uses. The Reader is more appropriate for mobile businesses or those that already possess devices to link it to, offering enhanced mobility at a lower cost.

Pricing: The Square Terminal is priced at $299, reflecting its comprehensive features. The Square Reader is more budget-friendly, with prices starting at $49, making it accessible for small businesses or those just starting out.

Square Terminal vs. Clover Flex

Features: Both devices are portable and support various payment methods, including chip, swipe, and contactless payments. The Square Terminal includes a built-in receipt printer and operates with Square’s POS software. The Clover Flex also offers a receipt printer and runs on Clover’s POS system, which provides access to a wide range of apps for additional functionalities.

Pricing: The Square Terminal is available for $299, while the Clover Flex usually has a higher price, generally about $499 or more, depending on the provider and any additional features or services included.

Usability: Both devices are designed for ease of use with intuitive touchscreens. The Square Terminal’s integration with Square’s ecosystem offers seamless access to various business tools. The Clover Flex provides flexibility through its app market, allowing businesses to customize the device with features tailored to their specific needs.

Ideal Business Types

The Square Terminal is a versatile payment processing device that caters to various business types, offering tailored features to enhance operational efficiency and customer service.

Small to Medium-Sized Retailers

For small to medium-sized retail businesses, the Square Terminal provides a compact and user-friendly solution for managing sales transactions. Its all-in-one design integrates payment processing and receipt printing, streamlining the checkout process and reducing the need for multiple devices. The device’s portability allows retailers to assist customers anywhere in the store, enhancing the shopping experience. Additionally, the integrated POS software offers inventory management and sales tracking features, enabling retailers to monitor stock levels and analyze sales data effectively.

Restaurants and Cafes

In the food service sector, the Square Terminal provides considerable benefits by enabling ordering and payment transactions at the table. Employees can take orders straight at the table, minimizing mistakes and enhancing service efficiency. The device’s capacity to accommodate different payment methods, such as contactless options, meets a variety of customer preferences. Its portability guarantees that payments are handled quickly at the customer’s site, improving convenience and satisfaction. Additionally, the Terminal’s connection with Square for Restaurants offers tailored functionalities like menu handling and table arrangement, enhancing restaurant efficiency.

Service-Based Businesses

Service-oriented companies, including salons, repair shops, or consulting agencies, can take advantage of the Square Terminal’s effective payment processing features. The device enables professionals to process payments on-site, whether at a client’s location or in their own facilities. Its polished and professional appearance boosts the business’s reputation, while its user-friendly nature facilitates swift transaction handling, enabling service providers to concentrate on providing top-notch services. Moreover, the Terminal’s combination with scheduling appointments and invoicing functionalities simplifies administrative work, enhancing overall business effectiveness.

Conclusion

The Square Terminal provides a mobile, easy-to-use, and all-inclusive payment solution perfect for different types of businesses. Boasting seamless POS integration, strong security features, and compatibility with various payment options, it is a notable asset. In general, it’s a valuable investment for companies looking for effective, contemporary payment processing solutions.

Frequently Asked Questions

Can Square Terminal operate without an internet connection?

Yes, Square Terminal can process offline transactions, which are queued and processed once the device reconnects to the internet. However, it’s important to note that offline payments are not immediately authorized, and there is a risk they may fail if the payment method is declined when the device goes back online.

Is the Square Terminal compatible with other POS systems?

Square Terminal is primarily designed to work seamlessly with Square’s ecosystem. While it may not directly integrate with other POS systems, it offers robust features that can serve as a standalone solution for many businesses.

What accessories are available for Square Terminal?

Accessories include the Square Terminal Hub for connecting additional hardware like cash drawers or barcode scanners, receipt paper rolls, and countertop mounts to enhance functionality and convenience.