Ingenico Review

- 22nd Jun, 2025

- | By Linda Mae

- | Reviews

Ingenico is a long-standing name in the global payment technology industry, known primarily for its wide range of card-present solutions. Established in France in the 1980s, the company has evolved from being a hardware-focused terminal provider into a broader payment ecosystem player. Today, Ingenico is active in over 170 countries and supports millions of transactions daily across retail, hospitality, transportation, and banking sectors. Lets read more about Ingenico Review.

Ingenico’s reputation has been shaped by its deep integration into physical payment environments, particularly through its robust and secure terminals. It was part of Worldline until 2023, and while its business model has shifted over the years, Ingenico continues to play a significant role in enabling merchants to accept payments with reliability and speed.

The company is often associated with in-store payment innovation, but it has also expanded into supporting omnichannel commerce and digital transformation initiatives. Its devices are used by small businesses as well as enterprise-scale retailers, largely because of the modularity and compliance built into their platforms.

Ingenico excels at bridging the gap between digital and physical payments, in contrast to more recent fintech entrants that only concentrate on software or online commerce. Because of this, it is more than just a payment processor; it is a vital infrastructure provider. Although there are competitors, its name is trusted by companies that require scalable, reliable payment acceptance for a variety of use cases.

Ingenico’s Product Suite: Hardware and Beyond | Ingenico Review

Ingenico’s product portfolio is extensive and purpose-built to cater to a variety of transaction environments. Its hardware lineup spans several terminal families such as Lane, Move, Desk, and the newer Android-based Axium series; each tailored to specific merchant needs. From compact countertop devices to portable wireless options and unattended self-service kiosks, the variety is one of Ingenico’s biggest differentiators.

What stands out about Ingenico’s approach is its emphasis on both performance and security. Terminals come with features like EMV chip support, NFC for contactless payments, and robust encryption protocols. The Axium line, powered by Android OS, reflects a shift toward modern, app-driven commerce. These devices are built for more than just payments; they can also support loyalty programs, value-added services, and analytics.

Beyond hardware, Ingenico also offers software solutions such as estate management, terminal configuration tools, and APIs for integration with merchant platforms. These software layers are essential for large-scale retail environments where uptime, updates, and diagnostics must be remotely managed.

The goal of Ingenico’s holistic strategy is to lessen merchant ecosystem fragmentation. Instead of depending on several suppliers for integration, servicing, and terminals, merchants have access to all of the Ingenico ecosystem’s resources. However, companies that require highly customised setups or prefer open platforms may find their flexibility limited by this integrated approach.

Overall, Ingenico’s suite is engineered to deliver stability, security, and scale. However, its reliance on proprietary hardware and tightly coupled software may be a consideration for businesses exploring alternative, more agile systems.

Payment Security and Compliance Standards

Security has always been a core focus for Ingenico, and the company has consistently met industry standards for payment protection. All Ingenico terminals comply with PCI PTS standards, which cover physical device security, encryption, and cardholder data protection. This ensures that terminals are resistant to tampering and secure during transactions.

The company supports advanced encryption models, including E2EE, which helps protect data as it moves from the card reader to the payment processor. This is especially important in retail environments where a breach at any point in the data flow can have serious consequences. Ingenico also works with acquirers and processors to implement P2PE solutions, adding another layer of security that reduces PCI compliance scope for merchants.

Tokenization is another feature present in Ingenico’s architecture. By replacing sensitive card data with non-sensitive equivalents, tokenization minimizes the risk of data theft and fraud. This feature is critical in omnichannel environments where a customer’s payment details may be used across in-store, mobile, and online channels.

Ingenico’s emphasis on security is also evident in its Android-based terminals, which often receive security patches and additional software checks. Even though Ingenico’s technology is safe, it needs to be used in conjunction with appropriate merchant-side procedures, so companies need to continue being proactive in upholding compliance throughout the payment ecosystem.

In short, Ingenico provides a strong security foundation. Its long-standing compliance with global standards reinforces its role as a trusted partner for secure payment acceptance in high-risk or high-volume settings.

Omnichannel Capabilities and Digital Integration

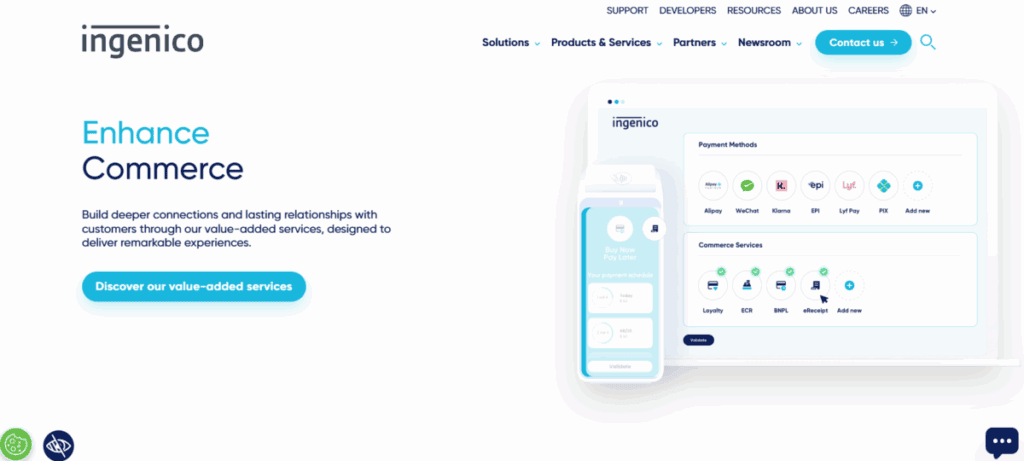

As payment ecosystems grow increasingly interconnected, Ingenico has responded with tools designed to enable seamless omnichannel experiences. Its platforms are capable of bridging in-store, online, and mobile payments through unified APIs and cloud-based services, giving merchants more control over how and where they accept payments.

Ingenico’s cloud estate management system, for instance, allows businesses to monitor, configure, and update their terminals remotely. This is essential for large merchants operating across multiple locations. The ability to push software updates and receive diagnostic data without manual intervention supports operational continuity and reduces maintenance costs.

In terms of digital integration, Ingenico supports a suite of developer tools that allow third-party integration with loyalty platforms, CRMs, and eCommerce systems. This is particularly useful for businesses looking to merge their in-store and online channels into a cohesive experience. Support for SDKs and APIs makes it easier for developers to build custom workflows or connect payment data with analytics dashboards.

By allowing merchants to run commerce apps in addition to payment processing, the Android-powered Axium series expands on these capabilities. Real-time inventory checks and counter-upselling are both supported by this flexibility. Ingenico’s dedication to integration and unification is clear, despite the fact that it does not move as quickly as some pure software companies. However, some retailers might find that innovation is happening more slowly than on startup-led platforms, especially when it comes to data-driven personalisation or AI-driven analytics.

Overall, Ingenico’s omnichannel focus is a valuable asset for businesses prioritizing unified commerce across physical and digital touchpoints.

Industry-Specific Solutions and Vertical Focus

Ingenico’s strength lies not only in its technology but in its ability to tailor solutions for specific industries. The company has long served verticals such as retail, hospitality, transportation, financial services, and healthcare, each with unique payment requirements and challenges. In retail, Ingenico’s terminals support high-speed processing, integration with POS systems, and value-added services like gift cards or loyalty apps. For quick-service restaurants or convenience stores, mobile terminals from the Move series enable line-busting or curbside payment collection.

In hospitality, features like tipping, dynamic currency conversion, and seamless integration with property management systems make Ingenico a practical choice for hotels and resorts. For transportation and parking systems, Ingenico offers rugged, unattended terminals designed for 24/7 outdoor use. The company also supports banking and fintech services through secure, PIN-entry devices and interfaces for ATM or kiosk deployment. In healthcare, Ingenico solutions help facilitate copayments and billing in patient-facing environments, with emphasis on privacy and compliance.

The versatility of Ingenico’s software and hardware configurations is what makes it unique. Although there are some restrictions on how open or customisable the platforms are, merchants can usually select the features they require. Despite supporting a wide range of industries, Ingenico’s ecosystem still favours large businesses or high-volume operations over micro-merchants.

In summary, Ingenico’s industry-specific approach provides merchants with targeted functionality, but this comes with a degree of platform rigidity that might not suit every business model.

Global Reach and Regional Support

Ingenico operates on a truly global scale, with a presence in more than 170 countries and support for multiple currencies and languages. Its international reach has helped the company become a preferred terminal provider for multinational retailers, payment service providers, and acquiring banks.

One of Ingenico’s major advantages is its ability to offer region-specific hardware configurations and certifications. For example, it supports local card schemes in countries like India, Brazil, and China while also facilitating global acceptance through Visa, Mastercard, and Amex. This flexibility is especially useful for businesses with international branches or cross-border operations.

Ingenico’s partner network includes ISVs, systems integrators, and financial institutions, which helps extend its regional support capabilities. These partners handle installation, maintenance, and troubleshooting, reducing response times and ensuring local compliance. In addition, Ingenico provides localized support documents and updates, ensuring that software patches or compliance changes meet regulatory requirements in different markets. This is crucial for keeping operations secure and up to date.

However, partner involvement and geographic location can affect the quality of support. Some regions may encounter delays because of their reliance on outside distributors or resellers, while others have strong infrastructure and quick service. All things considered, Ingenico’s worldwide infrastructure is reliable and strong. It is a scalable solution for companies growing into new areas because it can serve both local merchants and global brands, but consistency in partner-driven support is still something to keep an eye on.

Innovation and Technology Ecosystem

Ingenico has steadily expanded its innovation footprint, especially in recent years with the adoption of Android OS in its Axium product line. This shift reflects a broader trend in payment terminals; moving from fixed-function devices to multipurpose smart devices capable of running apps and integrating with broader business systems.

The Axium series is a clear example of Ingenico’s effort to blend traditional payment functionality with modern retail experiences. These Android terminals allow merchants to install business applications directly onto the device, enabling features like order management, inventory control, customer surveys, and CRM updates at the point of sale.

The company is also investing in cloud-based services, terminal-as-a-service models, and open APIs to create a more agile ecosystem for developers and merchants. This is a step toward creating more adaptive, software-driven payment environments while still maintaining the robust hardware standards Ingenico is known for.

However, Ingenico’s rate of innovation is more measured than that of rapidly expanding fintech companies. It prioritises compliance and long-term dependability over promoting experimental features. Large corporations and regulated environments benefit greatly from this cautious approach, but tech-forward startups may find it restrictive.

In essence, Ingenico is innovating but with caution. It emphasizes stability and scalability over trend-driven features, which suits many enterprise-level businesses but may leave smaller merchants or agile developers looking elsewhere.

Usability, Interface, and Customer Experience

Ingenico terminals are generally well-regarded for their ergonomic design, durability, and user-friendly interfaces. Devices feature tactile keypads, clear touchscreens, and intuitive navigation menus, which help streamline the checkout process for both customers and staff.

Newer terminals, especially those in the Axium range, come with vibrant displays, Android-based interfaces, and responsive touch controls. These improvements help merchants provide a more modern payment experience while also allowing integration with custom apps, branding elements, and customer interaction tools.

From the merchant’s side, configuration and use are relatively straightforward. Many Ingenico devices are plug-and-play, with pre-loaded settings for common payment methods. Remote estate management tools further reduce the burden of setup and updates, allowing changes to be pushed centrally across fleets of terminals.

Priority is also given to the customer experience. Ingenico devices are effective and accessible to a broad range of users due to their contactless payment methods, multilingual support, and quick transaction times. These elements are important in settings like retail or hospitality, where customer satisfaction is directly impacted by transaction time and ease of use.

That said, some older models still in circulation may lack the responsiveness or visual appeal expected in today’s retail landscape. Also, the proprietary nature of some device settings can limit how much merchants can customize workflows or displays. Overall, It balances user experience with industrial-grade reliability, but there’s room to enhance flexibility and customization on a broader scale.

Pricing, Partnerships, and Integration Models

Ingenico’s pricing is typically not transparent to end-users, as it operates primarily through distributors, acquirers, and partners. Costs vary depending on region, device type, support package, and the software or value-added services bundled into the contract. This makes it difficult to offer a universal pricing range.

For businesses, It offers both purchase and leasing models, often structured through partners. The Terminal-as-a-Service model, which includes hardware, software, and servicing in a bundled fee, is becoming more popular, especially for enterprise clients who prefer predictable costs and lifecycle management.

Usually, APIs or SDKs are used to integrate with POS systems, payment gateways, and back-office platforms, though the level of complexity can vary. Smaller retailers seeking instant plug-and-play solutions might find Ingenico’s strategy unsuitable as it prioritises larger deployments with structured onboarding. A key component of Ingenico’s marketing strategy is partnerships. Wide adoption is made possible by its partnerships with banks, fintech firms, and ISVs; however, these partnerships also lead to differences in support quality, cost, and integration experience. Instead of dealing directly with Ingenico, merchants often deal with an intermediary.

The main trade-off here is between stability and flexibility. While Ingenico offers reliable, well-integrated payment solutions, it may not provide the pricing agility or customization that some smaller businesses or startups seek.

Strengths, Limitations, and Market Position

Ingenico’s reputation as a market leader is rooted in its dependable hardware, secure platforms, and broad international reach. For businesses seeking long-term reliability and compliance in payment acceptance, It remains a top-tier option. Its greatest strengths include a diverse terminal lineup, support for global and local payment schemes, strong security compliance, and partnerships that allow scalable deployment across industries. The Axium series adds modern functionality, helping bridge traditional POS and app-enabled commerce.

However, the platform does have limitations. Pricing opacity, reliance on partners for support, and a more rigid ecosystem can be hurdles for smaller merchants or rapidly evolving businesses. Its pace of innovation, while consistent, is cautious compared to startups driving trends in open commerce, digital wallets, and AI.

Ingenico continues to play an important role in the payment technology market. For businesses and financial institutions in need of high-volume, secure infrastructure, it is the preferred supplier. However, alternatives might provide greater flexibility for companies that value quick development cycles or specialised customisations. To put it simply, it is superior in terms of scale and robustness. It is still relevant, especially in situations where compliance and dependability are more important than the need for innovative experimentation.

FAQs

1. Is Ingenico compatible with third-party payment gateways?

Yes, Ingenico terminals can integrate with many third-party platforms through APIs and SDKs. However, specific compatibility depends on the terminal model and integration partner.

2. Does Ingenico support contactless and mobile wallet payments?

Yes. Most Ingenico terminals support contactless cards and digital wallets like Apple Pay, Google Pay, and Samsung Pay, using built-in NFC technology.

3. Can Ingenico terminals be used for unattended payment environments?

Yes. Ingenico offers specialized terminals for unattended use in kiosks, vending machines, and parking systems. These are ruggedized and certified for outdoor and high-traffic environments.