Moneris Review

- 30th Jun, 2025

- | By Linda Mae

- | Reviews

Moneris is one of the most well known names in Canadian payment processing. Founded in 2000 as a joint venture between the Royal Bank of Canada and the Bank of Montreal, they have built a reputation as a trusted and secure provider. They focus solely on the Canadian market, serving over 350,000 businesses in retail, hospitality, healthcare and services. As a Canadian owned company, they have a deep understanding of local banking regulations and market needs. They offer businesses a sense of familiarity and integration that international providers often lack. This focus on Canadian merchants allows Moneris to tailor their solutions for small business and enterprise clients. Lets read more about Moneris Review.

They offer a full range of payment solutions including in-store terminals, online payment gateways and mobile payment tools. Moneris also emphasizes customer service, fraud prevention and compliance with Canadian financial standards. They are for businesses looking for an all in one solution backed by big bank support. Despite their great reputation, Moneris isn’t without its challenges. Some users report that pricing and contract terms aren’t always as transparent as they’d like. For some small businesses, especially startups, more flexible or cost effective options may be available elsewhere. But for those looking for stability and integration with the big 5 Canadian banks, Moneris is often the top choice.

Payment Processing Services and Capabilities | Moneris Review

Moneris provides a wide range of payment processing services designed to meet the needs of Canadian businesses across industries. Whether a business operates a physical store, sells online, or takes payments on the go, It offers tailored solutions to manage transactions effectively. At the core of Moneris’ offering is its ability to accept a variety of payment methods. Merchants can accept credit and debit cards from all major networks, including Visa, Mastercard, Interac, American Express, and Discover. Moneris also supports digital wallets like Apple Pay and Google Pay, making it easy for customers to pay using their smartphones or smartwatches.

One of the strengths of Moneris is its integrated payment ecosystem. Businesses can manage in-person payments, e-commerce sales, and mobile transactions from a unified platform. This reduces the complexity that comes from juggling different service providers for each channel. Additionally, Moneris offers recurring billing, invoice payments, and support for gift cards. Its services are suitable for both small-scale retailers and large multi-location businesses. The platform provides tools to manage customer payments with efficiency and ensures compliance with Canadian standards for security and data protection.

While the range of services is extensive, businesses should be aware that Moneris’ pricing can vary depending on the type and volume of transactions. For those processing a high volume of sales, the costs can be competitive. However, smaller merchants may find better rates through more niche providers focused on leaner operations.

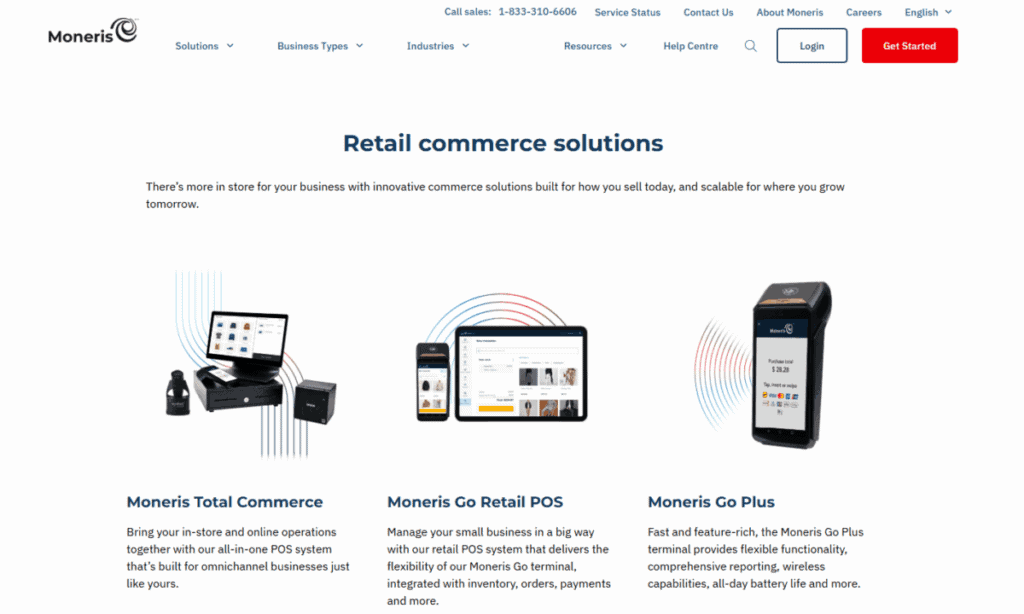

POS Solutions

Moneris offers a comprehensive suite of POS solutions that cater to the needs of both small businesses and large enterprises. The company’s POS systems include countertop terminals, wireless handheld devices, and integrated tablet-based solutions, each designed to streamline the checkout experience. The countertop terminals are ideal for traditional brick-and-mortar stores. These devices are reliable, fast, and capable of handling chip, swipe, and tap transactions. Wireless terminals offer flexibility, allowing staff to complete sales from anywhere within the store, which is especially useful for restaurants, cafes, and service providers.

Moneris Go, the company’s flagship smart terminal, combines payment processing with inventory and sales tracking features. It comes with a built-in receipt printer and touch screen, and it runs on Android. This modern terminal is especially appealing for businesses that want a sleek, all-in-one solution that supports both Wi-Fi and cellular connectivity.

For businesses looking to integrate POS systems with broader business operations, It also offers compatibility with inventory management and accounting tools. This integration helps reduce manual tasks and ensures real-time tracking of sales and performance metrics. The POS systems are generally easy to set up and come with Moneris’ customer support. However, one potential drawback is the hardware cost, which may be higher than some budget-friendly competitors. Additionally, contracts may lock businesses into long-term agreements, so it’s essential to assess whether the hardware meets current and future needs.

E-Commerce and Online Payment Gateway

Moneris has a range of solutions for online merchants through its e-commerce gateway. These are for businesses that have a web store, offer remote services or accept payments through invoices and digital forms. It has multiple integration options for both beginners and developers. Merchants can use Moneris’ hosted checkout page for a quick and secure way to accept payments online without any coding. This is perfect for small businesses or those without a technical team. For more advanced needs Moneris has APIs and SDKs to create custom checkout experiences and integrate with back-end systems.

The payment gateway accepts all major credit cards and digital wallets. It also integrates with popular e-commerce platforms like Shopify, WooCommerce, Magento and BigCommerce. This means merchants can plug Moneris into their existing online store without much rework. Security is top of mind for Moneris’ online offerings. Features like tokenization, fraud protection and 3D Secure ensure online transactions are safe for both the merchant and the customer. Businesses can also accept recurring payments and set up billing plans for subscription services.

While the e-commerce solutions are comprehensive they have a learning curve for advanced users. Some small businesses may prefer more user friendly options especially those offered by all-in-one platforms. But Moneris is still a good choice for Canadian merchants who need a secure, bank backed online payment gateway.

Mobile Payments and On-the-Go Solutions

For businesses that operate outside traditional storefronts or need payment flexibility, It offers several mobile payment solutions. These tools are particularly useful for service professionals, tradespeople, food trucks, and event vendors who require reliable and fast payment processing on the go. Moneris Go is the company’s main mobile payment device. It functions as a standalone smart terminal with built-in receipt printing and touch screen controls. It is capable of processing all types of transactions including tap, chip, and swipe. The terminal also supports digital wallets, enabling a smooth checkout experience for customers using mobile devices.

In addition to hardware, Moneris also provides a mobile app that can turn a smartphone or tablet into a payment terminal when paired with a compatible card reader. This solution is especially beneficial for businesses that need a portable or backup payment method without investing heavily in equipment.

Moneris’ mobile solutions are backed by the same data encryption and fraud protection standards as its traditional terminals. Transactions sync automatically with the merchant’s main Moneris account, allowing for centralized tracking and reporting across all payment channels. However, the cost of mobile hardware and transaction fees may not always be competitive compared to newer fintech apps. Businesses with very low transaction volumes might find more affordable options elsewhere. But for those looking for reliable service within the Canadian market, Moneris’ mobile payment tools offer security and functionality with strong institutional backing.

Payment Security and Fraud Prevention Tools

Security is a central part of Moneris’ value proposition. As a payment processor closely tied to major Canadian banks, It places a strong emphasis on keeping transaction data secure and helping merchants comply with industry standards such as PCI DSS. One of the key features is tokenization, which replaces sensitive payment information with unique identifiers that cannot be reused. This adds a significant layer of protection during transaction processing. In addition to tokenization, Moneris employs end-to-end encryption to secure data from the moment it is captured to when it is processed.

Moneris also offers fraud detection tools designed to monitor transactions for unusual patterns or high-risk behavior. These features are particularly important for online transactions where card-not-present fraud is more prevalent. AVS, CVV checks and 3D Secure authentication help prevent fraud.

The Moneris iGuard system has automated rules and filters that flag suspicious transactions so you can take action before chargebacks happen. This proactive approach can help reduce losses and protect both you and your customers. While Moneris has strong security, some of the most advanced fraud tools are for larger accounts or require setup. Smaller merchants may need help to configure or use these tools. But Moneris has got you covered if you’re concerned about customer data and fraud risks.

Reporting, Analytics, and Business Tools

Moneris provides merchants with access to a suite of reporting and analytics tools that help businesses make data-driven decisions. Through the MyMoneris portal, users can view real-time transaction data, analyze sales trends, and generate performance reports that offer visibility into their daily operations. The reporting dashboard allows merchants to track key metrics such as transaction volume, revenue by product category, time-of-day sales patterns, and customer payment preferences. These insights can be particularly valuable for businesses looking to optimize staffing, inventory, or marketing efforts.

In addition to standard sales reports, It also offers customizable filters and data exports, making it easier to sync with third-party tools or internal systems. Reports can be scheduled and delivered automatically via email, streamlining management tasks for busy merchants.

Moneris also includes some basic customer relationship tools. For example, businesses can view customer spending history and set up loyalty programs or gift card campaigns. These tools are designed to help increase repeat business and improve customer engagement. That said, the advanced analytics features may not be as deep or intuitive as those offered by some software-first competitors. Businesses that rely heavily on data analysis might prefer platforms with more detailed segmentation and predictive modeling. Still, for most users, Moneris offers sufficient reporting capabilities to support everyday business planning and performance tracking.

Customer Support and Service Experience

Customer support is a critical part of any payment processing relationship, and Moneris offers multiple channels to assist merchants. The company provides support through phone, email, and live chat, with service available seven days a week. Additionally, an online knowledge base offers self-help resources, including user guides, troubleshooting steps, and training videos.

For many Canadian businesses, Moneris’ domestic focus translates into local support teams that understand regional needs. This can be a significant advantage compared to global processors whose support may be located overseas. The onboarding process includes installation support and training, particularly for businesses adopting Moneris’ POS systems.

Moneris also has merchant account reps for larger businesses which offer more personalized support and business insights. For small and medium businesses response times are generally good but some users report inconsistent experiences depending on the support channel. The online portal has case tracking and service request options so you can follow up on issues easily. It is generally well reviewed for reliability but some users have had frustration with billing inquiries or hardware replacement timelines. Like any big provider, customer support will vary. Overall Moneris has a support structure that meets the needs of most businesses with added benefits if you want to have access to Canada based support staff who know the local challenges.

Pricing, Fees, and Contract Terms

Moneris’ pricing model includes a mix of monthly fees, hardware costs, and per-transaction charges. However, these costs are not always published in a fully transparent manner, making it important for prospective customers to request detailed quotes and read the contract terms carefully. Most Moneris accounts come with an initial setup fee, followed by a fixed monthly service fee that covers terminal rental, access to the merchant portal, and basic support. Transaction fees vary depending on the payment method. Interac debit typically has lower fees, while credit cards carry a percentage-based charge plus a per-transaction fee.

Moneris may also charge fees for chargebacks, PCI non-compliance, and early termination if a contract is canceled before the end of the agreed term. Contracts often run for three years, and early cancellation can result in penalty charges that surprise some business owners. For businesses with high transaction volumes or specific industry needs, Moneris may offer custom pricing or bundled packages. These deals can be competitive, especially when negotiated through bank relationships.

While the pricing can be manageable for established businesses, startups and micro-merchants may find the structure less appealing compared to providers offering flat-rate or pay-as-you-go options. Transparency remains an area where Moneris could improve to better support comparison shopping.

Pros and Cons of Choosing Moneris

Choosing Moneris as a payment processor comes with a mix of benefits and limitations. One of the most significant advantages is its strong institutional backing. With ownership by RBC and BMO, Moneris enjoys a high level of trust and stability, which is reassuring for Canadian businesses looking for a long-term partner. The company’s product suite is extensive, covering in-store, online, and mobile payments under one brand. This unified approach simplifies payment management and reporting. It also provides robust security features and compliance support, which are essential for protecting sensitive customer data.

Another plus is local support. Canadian businesses like to work with a provider that knows the local rules, payment preferences and language requirements. On the downside, pricing and contract flexibility are big concerns. Long term commitments and early termination fees will scare off newer or smaller businesses. And while Moneris offers a wide range of services, some of their tools may not be as feature rich or user friendly as software first competitors. Overall Moneris is good for businesses that value local expertise, integrated solutions and support. But not for merchants looking for super low fees or total flexibility.

FAQs

Q1. Is Moneris only in Canada?

Yes, Moneris is only in Canada. They focus on providing payment solutions to Canadian merchants and don’t serve international businesses directly.

Q2. Do Moneris offer month to month contracts for small business?

Moneris usually offers multi year agreements, 3 years to be exact. Some promotional packages may have flexible options but you should clarify before signing.

Q3. Can Moneris integrate with my existing e-commerce platform?

Yes, it integrates with Shopify, WooCommerce and Magento. They also have APIs for custom website integrations.