Blackbaud Merchant Services Review

- 30th Sep, 2024

- | By Linda Mae

- | Reviews

Blackbaud Merchant Services is a full payment processing solution created specifically for non-profits, schools, and other mission-focused groups. It allows these groups to securely and effectively handle donations, oversee recurring gifts, and receive payments via methods such as credit cards, direct debit, and mobile wallets. The service effortlessly blends with other Blackbaud products, serving as a complete solution for organizations dependent on fundraising and donation management. Let’s delve deeper into the Blackbaud Merchant Services Review.

The platform is customized to address the specific requirements of the nonprofit industry, offering an efficient method for managing financial transactions with a focus on security and compliance. Blackbaud follows top standards for data protection as a Level 1 PCI-compliant service provider, making it a dependable option for organizations wishing to protect donor information.

Blackbaud Merchant Services is designed to help nonprofits maximize their revenue and enhance donor engagement by offering a range of features such as real-time reporting, fraud prevention, and easy-to-use interfaces. The platform’s integration with Blackbaud’s suite of products—such as Raiser’s Edge and eTapestry—provides a holistic view of the organization’s financial health and donor activities. This comprehensive view allows organizations to make data-driven decisions, optimize their fundraising strategies, and ultimately, increase their overall impact.

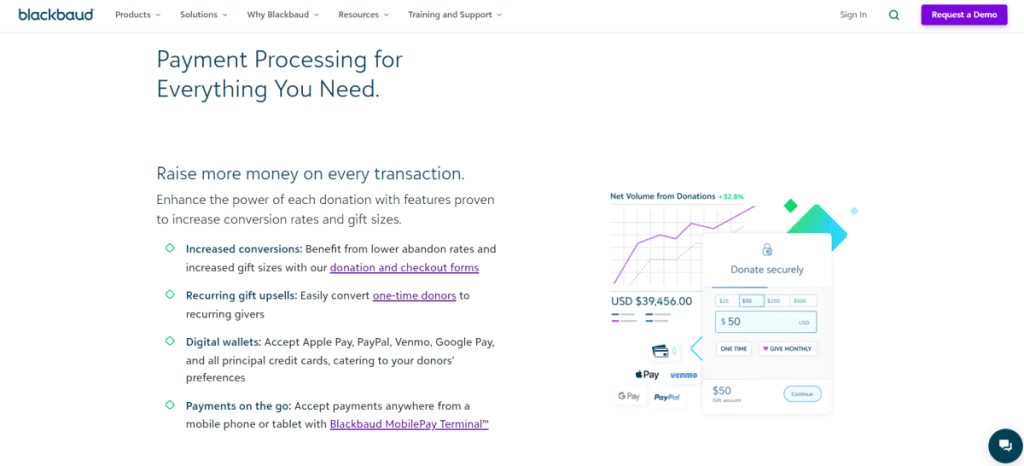

Blackbaud Merchant Services aids nonprofits in enhancing donation conversions and decreasing abandoned donations by offering features such as automated updates for recurring gifts and digital wallet choices. The platform also accommodates different payment methods, allowing donors to contribute with their preferred ways easily, which can lead to up to 20% more revenue from enhanced engagement and satisfaction.

Blackbaud Merchant Services is specifically designed for medium to large nonprofits, educational institutions, healthcare organizations, and other mission-driven entities that manage high volumes of donations and need robust, scalable solutions for payment processing. Its focus on fundraising and donor management makes it ideal for organizations that want to streamline their financial operations and enhance the overall donor experience.

Company Background and Overview | Blackbaud Merchant Services Review

Blackbaud is a leading provider of software solutions designed exclusively for the nonprofit sector, empowering organizations to maximize their social impact. Founded in 1981, Blackbaud started as a small venture developing a billing software system for private schools. Over the years, the company has expanded significantly, acquiring multiple platforms and enhancing its offerings to become a comprehensive service provider for nonprofits, educational institutions, and social enterprises.

The product lineup of the company consists of solutions for fundraising, grant management, financial management, donor management, and corporate social responsibility. A few of its top products are Raiser’s Edge NXT, a robust fundraising CRM for big nonprofits; Financial Edge NXT, a web-based accounting system; and eTapestry, a CRM for smaller nonprofits. Furthermore, Blackbaud provides JustGiving, a top peer-to-peer fundraising platform, as well as YourCause, which specializes in corporate giving and volunteering.

Blackbaud is well-known for its strong knowledge of the social good sector and dedication to advancing technology and data intelligence. Its system is created to blend effortlessly, enabling nonprofits to efficiently handle their operations while concentrating on their mission. Blackbaud’s dedication to social impact has established it as a reliable ally for almost 150,000 organizations around the globe, spanning from small local charities to big educational institutions and global nonprofits.

The company’s market position is reinforced by its dedication to providing robust, scalable solutions that meet the complex needs of its clients. Blackbaud’s reputation within the nonprofit sector is strong, largely due to its specialized offerings, commitment to data security, and ongoing support for organizations. Despite some challenges, such as past cybersecurity incidents, Blackbaud continues to be a preferred partner for organizations seeking to optimize their social impact and drive meaningful change.

Key Features of Blackbaud Merchant Services

Blackbaud Merchant Services is a comprehensive payment processing solution that integrates seamlessly with the Blackbaud suite of products. It is designed to support nonprofits, educational institutions, and other mission-driven organizations in managing their donations and payments effectively. The service offers a range of features that cater specifically to the needs of these organizations, making payment processing simpler, more secure, and more efficient.

Integration with Blackbaud Software Solutions: One of the key advantages of Blackbaud Merchant Services is its seamless integration with other Blackbaud products such as Raiser’s Edge and eTapestry. This integration provides a unified ecosystem where organizations can track donations, manage donor data, and process payments all within a single platform. By centralizing payment transactions and financial reconciliation in one place, Blackbaud helps reduce administrative burden, streamline operations, and improve overall financial transparency.

Payment Processing Options: Blackbaud Merchant Services offers various payment options such as credit and debit card processing, ACH payments, and mobile payment methods. It allows for the use of major credit cards and digital wallets such as Apple Pay, PayPal, and Google Pay, offering donors convenience and flexibility. This extensive variety of payment methods assists charities in appealing to a larger demographic, increasing donation levels and improving the overall donor journey.

Security and Compliance: Security is a top priority for Blackbaud Merchant Services. The platform is PCI Level 1 certified, meeting the highest industry standards for data security. Blackbaud uses advanced fraud prevention measures such as tokenization and real-time transaction monitoring to protect donor data and minimize the risk of fraudulent activities. This ensures that organizations can handle sensitive payment information with confidence.

Reporting and Analytics: Blackbaud provides real-time reporting and detailed analytics that help organizations track their donations and analyze donor behavior. The platform offers pre-reconciled bank deposits and automated updates for recurring gifts, making financial management simpler. With access to comprehensive insights, nonprofits can make data-driven decisions to optimize their fundraising strategies and maximize impact.

Pricing and Fee Structure

Blackbaud Merchant Services has a straightforward pricing structure designed specifically for nonprofits and mission-driven organizations. The platform typically charges 2.99% + $0.30 per transaction for most credit card payments, such as Visa, Mastercard, Discover, and JCB. However, for American Express transactions, the rate is slightly higher at 3.5% + $0.30 per transaction. ACH or direct debit transactions incur a fee of 1% + $0.30, with a maximum cap of $5 per transaction, and there is a $5 fee for returned transactions. For PayPal payments, Blackbaud charges 2.9% + $0.30 per transaction.

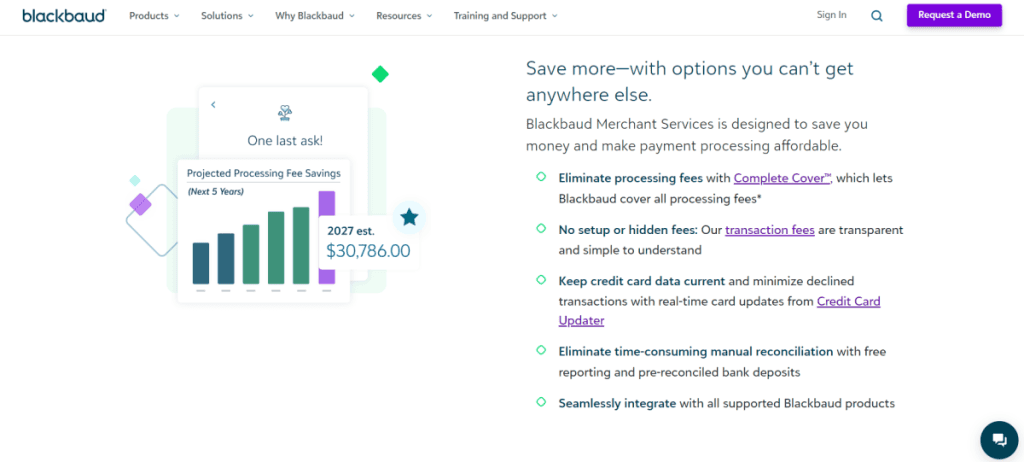

Blackbaud’s pricing structure stands out due to its lack of monthly fees, setup fees, or hidden costs, which is a significant benefit. This level of transparency simplifies predicting payment processing costs for nonprofits without the concern of surprise fees. Furthermore, Blackbaud provides options such as Complete Cover, enabling nonprofits to cover processing fees and minimize costs, ultimately increasing fundraising profits.

In comparison with other payment processors, Blackbaud’s rates are competitive but may not be the lowest in the industry. Some payment processors like Stripe and PayPal may offer slightly lower transaction fees depending on the type of organization or volume of transactions. However, Blackbaud stands out due to its specialized services tailored for nonprofits, deep integration with Blackbaud’s ecosystem, and robust support for compliance and security.

Strengths and Benefits

Blackbaud Merchant Services offers several strengths and benefits that make it an ideal payment solution for nonprofits and mission-driven organizations. The platform is tailored specifically for organizations that rely heavily on fundraising and donation management, providing tools and features designed to optimize these processes.

Tailored for Nonprofits: Blackbaud Merchant Services is custom-built for fundraising and donation management, helping organizations streamline payment processes and boost donor engagement. The platform integrates seamlessly with other Blackbaud products like Raiser’s Edge, enabling nonprofits to have a unified system for managing donations, processing payments, and tracking donor data. This interconnected ecosystem saves time and simplifies financial management, allowing organizations to focus on their core mission rather than administrative complexities.

Reliable Customer Support: Blackbaud provides various options for assistance such as chat support, help guides, webinars, and training resources available from Blackbaud University. The company’s customer service is well-known for its responsiveness and expertise, receiving praise from users. Blackbaud’s customer support team helps with implementation, troubleshooting, and ongoing optimization to ensure organizations maximize their software solutions. Having training choices and a forum within the community enhances the level of support provided.

Ease of Use: Blackbaud Merchant Services is recognized for its user-friendly interface and simple setup process. The platform is easy to navigate, even for those without extensive technical expertise. It offers a range of features such as pre-reconciled bank deposits, detailed reporting, and automated updates of payment data for recurring gifts, which reduce the time and effort required for financial management. This makes it easier for nonprofits to manage disbursements and track transactions effectively, ensuring smooth operation of fundraising activities.

Limitations and Drawbacks

While Blackbaud Merchant Services offers several benefits for nonprofits, it does come with certain limitations and drawbacks that potential users should consider.

Restriction on Integrations: One of the primary limitations of Blackbaud Merchant Services is its restriction on integrations. The platform is designed to work exclusively within the Blackbaud ecosystem, meaning it integrates seamlessly with other Blackbaud products like Raiser’s Edge and eTapestry but offers limited compatibility with third-party software solutions. This lack of flexibility can be a disadvantage for organizations that use a mix of software solutions or prefer to maintain a multi-vendor environment. As a result, nonprofits that require more diverse integration capabilities may find Blackbaud Merchant Services limiting in its connectivity options.

Higher Costs, Especially for Smaller Nonprofits: Blackbaud Merchant Services may have higher costs than some other competitors, especially for smaller nonprofit organizations processing fewer transactions. Organizations on a tight budget may quickly accumulate costs with standard transaction fees, like 2.99% + $0.30 per transaction for credit cards and 3.5% + $0.30 for American Express. In addition, despite the lack of setup or monthly fees being attractive, the total cost structure may not be the most economical choice for small businesses with limited resources. This makes Blackbaud a better option for medium to large nonprofits that can more easily handle these expenses.

Reports of Unexpected Fees and Charges: There have been some reports from users regarding unexpected fees and charges. While Blackbaud positions itself as transparent and straightforward with its pricing, a few organizations have encountered additional fees that were not initially anticipated. For instance, extra fees can be applied for specific services or support requirements, which may not be clearly outlined at the beginning of the service agreement. This lack of clarity can be a source of frustration for some users who prefer a more predictable pricing model.

Who Should Use Blackbaud Merchant Services?

Blackbaud Merchant Services is specifically designed to meet the needs of mid-sized to large nonprofits, educational institutions, and other mission-driven organizations. With its deep integration into the broader Blackbaud ecosystem, it is ideal for organizations that already use other Blackbaud solutions such as Raiser’s Edge NXT for fundraising, Financial Edge NXT for accounting, or Luminate Online for campaign management. By leveraging these integrations, nonprofits can streamline operations, manage donor data more effectively, and optimize their fundraising strategies.

Blackbaud Merchant Services is a strong choice for organizations that deal with a large number of transactions, require advanced donor management, or want a platform with comprehensive reporting and analytics features. The security options of the system, such as PCI compliance and tools for preventing fraud, establish it as a dependable option for protecting sensitive donor data. Moreover, its capability to accept regular donations and multiple payment options, such as mobile wallets and credit cards, makes it user-friendly for donors and enhances donation rates.

However, Blackbaud Merchant Services may not be the best fit for small nonprofits or organizations with limited budgets. The pricing structure can be relatively high compared to other payment processors, which might be a concern for those with lower transaction volumes. Additionally, the platform’s exclusivity within the Blackbaud ecosystem can be a limitation for those seeking broader integration capabilities with third-party solutions. For small nonprofits that do not require advanced features or are looking for a more budget-friendly solution, options like PayPal or Stripe may be more suitable alternatives.

Alternatives to Blackbaud Merchant Services

Blackbaud Merchant Services is a robust solution for nonprofits, but there are several alternatives that may be better suited for certain organizations depending on their specific needs. Competitors such as Donorbox, iATS Payments, and Fundraising Report Card offer distinct features and pricing models that make them appealing options for nonprofits looking for flexibility and affordability.

Donorbox is an excellent option for organizations seeking a versatile donation platform with recurring donation management. It offers features like customizable donation forms, donor management, and fundraising tools, making it ideal for nonprofits focused on driving conversions. Donorbox is more cost-effective with a 1.5% platform fee on top of standard transaction fees, making it a strong competitor for small to medium-sized organizations.

iATS Payments caters specifically to nonprofit organizations, offering secure payment processing with tools like fraud prevention and PCI compliance. It is ideal for organizations in need of strong security measures and who desire a payment solution that easily connects with different CRM platforms, such as Blackbaud’s Raiser’s Edge. Even though it lacks the advanced fundraising tools of Donorbox, this platform is dependable for handling payments and managing donor information.

Fundraising Report Card is dedicated to offering analytical resources to assist nonprofits in assessing their fundraising effectiveness. Despite not being a primary payment processor, it enhances existing systems by providing valuable information to improve fundraising approaches. This is beneficial for companies wanting to improve their data analysis and donor interaction approaches.

When choosing between these options, organizations should consider their budget, integration needs, and specific fundraising goals. Donorbox is best for comprehensive fundraising tools, iATS for secure payment processing, and Fundraising Report Card for performance analytics. Each platform offers unique advantages that can cater to different organizational requirements.

Customer Reviews and Feedback

Blackbaud Merchant Services has garnered mixed feedback from its users, with both positive and negative reviews reflecting different experiences based on the organization’s size and specific needs.

Common Positive Themes: Many users appreciate the seamless integration of Blackbaud Merchant Services with other Blackbaud products, such as Raiser’s Edge and Financial Edge. This integration simplifies the donation management process and makes it easier for nonprofits to track financial data and donor information within a single system. Another frequently mentioned benefit is the platform’s ease of use, especially for organizations that are already familiar with Blackbaud’s suite of software. Users also value the security features, such as PCI compliance and fraud detection, which ensure that sensitive donor data is well-protected. Moreover, the availability of multiple payment options, including ACH, credit card, and mobile payments, makes it convenient for nonprofits to process donations in various formats.

Common Negative Themes: A frequent issue cited is the relatively steep price linked to Blackbaud Merchant Services. The cost may not be economical for smaller nonprofits with lower transaction volumes, as the pricing scheme consists of a standard rate of approximately 2.6% plus $0.26 per transaction. Some users have also voiced dissatisfaction with unanticipated fees, like extra costs for specific services or features that were not clearly stated in the original agreement. Additionally, a lot of users also discover that the platform’s ability to integrate with other Blackbaud products is limited, which hinders flexibility and creates difficulties for nonprofits trying to effectively manage their data and payments with third-party tools.

Conclusion

Blackbaud Merchant Services is a great choice for medium to large nonprofits looking for a unified payment solution in the Blackbaud ecosystem. While providing strong security and easy integration, it might not be economical for smaller companies. In general, it is perfect for well-established nonprofit organizations that value convenience and data management more than reduced expenses.

Frequently Asked Questions (FAQs)

What is the transaction fee for Blackbaud Merchant Services?

Blackbaud typically charges around 2.99% per transaction for U.S.-based customers. Additional fees may apply for specific services like ACH payments or PayPal integration.

Can Blackbaud Merchant Services be used without other Blackbaud software products?

No, Blackbaud Merchant Services is designed to integrate exclusively with other Blackbaud products, limiting its use for organizations that prefer third-party payment processors.

Does Blackbaud Merchant Services support mobile and recurring payments?

Yes, Blackbaud supports both mobile payments and recurring billing, making it suitable for managing regular donations or memberships.