Cornerstone Payment Systems Review

- 15th Aug, 2024

- | By Linda Mae

- | Reviews

Established in 2001, Cornerstone Payment Systems is a credit card processing company with a Christian focus dedicated to offering ethical business practices. The company values aligning services with Christian beliefs, ensuring that operations exhibit integrity, honesty, and moral standards. Cornerstone Payment Systems strives to assist businesses, non-profits, and religious organizations by providing a complete range of payment processing solutions aimed at reducing operational expenses and improving productivity. Let’s delve deeper into the Cornerstone Payment Systems Review.

Company Background

Cornerstone Payment Systems was established in 2001 and is based in Tustin, California. Throughout the years, it has grown its footprint by opening more sales offices in areas like Mobile, Alabama, and Alpharetta, Georgia. The company is a DBA of Providence Payment Systems, LLC, and once ran another DBA named Cornerstone Platinum.

The company is led by CEO Nick Logan and owner Nathan Logan, who have been instrumental in driving its growth and maintaining its ethical stance in the industry. Cornerstone Payment Systems is a registered ISO (Independent Sales Organization) and MSP (Merchant Service Provider) of Deutsche Bank AG, New York.

Since its founding, Cornerstone Payment Systems has experienced substantial growth and is now known as a trustworthy merchant services provider. The company’s dedication to ethical standards has earned favorable responses and a solid reputation among its clients, especially those in religious and non-profit fields. Cornerstone has established itself as a reliable ally for businesses looking for affordable and ethical payment processing services through personalized solutions and minimal customer complaints.

Services Offered | Cornerstone Payment Systems Review

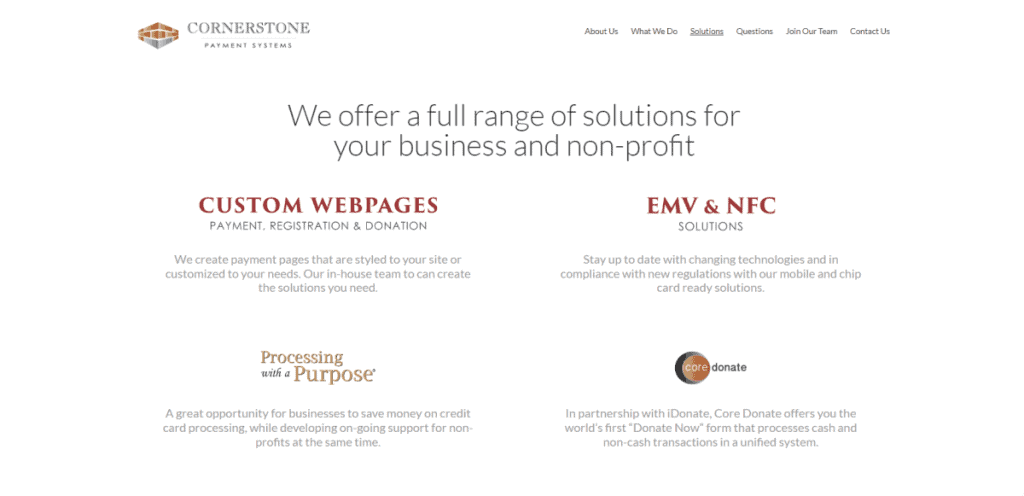

Cornerstone Payment Systems offers a comprehensive suite of merchant services designed to meet the diverse needs of businesses, non-profits, and religious organizations. The company focuses on providing cost-effective, secure, and efficient payment processing solutions tailored to each client’s unique requirements.

Credit and Debit Card Processing: Cornerstone Payment Systems facilitates the acceptance of various payment methods by merchants through credit and debit card processing. This service helps businesses accommodate their customers’ preferences, making transactions more efficient.

EBT Acceptance: The company also offers Electronic Benefits Transfer (EBT) acceptance, which is particularly beneficial for businesses that serve customers using government assistance programs.

EMV Chip and NFC Technology: Cornerstone offers EMV chip technology, improving security by encrypting cardholder data when making transactions. Moreover, Near Field Communication (NFC) technology allows for contactless payments, providing convenience and speed for merchants and customers alike.

Gift Card Management: Merchants can manage gift card programs through Cornerstone, helping to drive customer loyalty and increase sales.

POS Equipment and Solutions: Cornerstone offers a variety of Point of Sale (POS) equipment and solutions tailored to different business needs. This includes traditional POS systems, mobile POS options, and integrated software to streamline operations.

Virtual Terminal and Payment Gateway Services: Cornerstone offers virtual terminal and payment gateway services for businesses that are operating online or remotely. These solutions facilitate safe and effective handling of payments online or via phone calls.

Billing and Invoicing Services: The company’s billing and invoicing services include mobile payments, online payments, and recurring or subscription billing options. These features help businesses manage their cash flow effectively and provide convenient payment options for their customers.

Additional Services: Cornerstone Payment Systems provides various extra services to improve the merchant experience overall. One important service provided is the complimentary rate analysis, which assists companies in recognizing excessive charges from their existing vendors and realizing possible cost reductions with Cornerstone. The company offers personalized plans designed for the unique requirements of each merchant, guaranteeing that they get the most appropriate and cost-efficient solutions for their business.

Pricing Structure

Cornerstone Payment Systems adopts a customized pricing model, tailored to meet the unique needs of each merchant. This approach ensures that businesses receive the most cost-effective and relevant services based on their specific requirements and transaction volumes.

Explanation of the Customized Pricing Model: The pricing model of the company is tailored individually based on a thorough evaluation of a vendor’s existing payment processing costs, rather than being a generic one-size-fits-all approach. This tailor-made method assists companies in maximizing their payment processing expenses and preventing avoidable costs.

Information on Known Fees: While specific pricing details are not publicly disclosed, some known fees include a monthly fee of $21 and an annual PCI compliance fee of $50. These fees are relatively standard within the industry, with the PCI compliance fee being notably lower than average.

Monthly Fee ($21): The monthly fee charged by Cornerstone Payment Systems covers the cost of maintaining the merchant account and providing ongoing support and services.

PCI Compliance Fee ($50 per year): This annual fee ensures that merchants comply with the Payment Card Industry Data Security Standard (PCI DSS), which is crucial for maintaining the security of cardholder data.

Early Termination Fee (Undisclosed): The company does have an early termination fee, but the specific amount is not publicly revealed. This charge is enforced if a merchant opts to terminate their contract before the agreed upon term is completed.

Discussion on the Lack of Publicly Available Pricing Information: Cornerstone Payment Systems has room to enhance its pricing transparency. Potential clients need to ask for a personalized quote to know the total cost of services due to the limited public information on fees and rates. This practice emphasizes the importance of contacting the company directly to obtain a detailed and accurate pricing breakdown tailored to their specific needs.

Customer Support and Feedback

Customer support is a critical aspect of Cornerstone Payment Systems’ service offerings, ensuring that merchants receive the assistance they need to manage their payment processing effectively. The company provides multiple support options to address any issues or inquiries promptly.

Overview of Customer Support Options: Cornerstone Payment Systems offers customer support through various channels, including phone and email, allowing merchants to reach out for help whenever needed. This multi-channel approach ensures that clients can receive timely and efficient assistance.

Contact Information (Phone, Email): Cornerstone Payment Systems can be reached by merchants for assistance either by calling 1-888-399-3111 or emailing [email protected]. Existing customers and potential clients can easily access these contact points for additional information.

Maintenance and Service for Equipment: The company provides maintenance and service for all equipment purchased through them. This includes repairs and troubleshooting to ensure that merchants’ payment processing systems remain operational and secure.

Summary of Customer Feedback and Reviews: Customer feedback regarding Cornerstone Payment Systems is mostly positive, with numerous users commending the company for its outstanding customer service and reliable services. Feedback points out that the company’s quick response and supportive customer service team greatly enhance overall customer contentment.

Positive Reviews Highlighting Phenomenal Customer Support and Secure Services: Many reviews commend Cornerstone for its exceptional customer support, emphasizing the professionalism and promptness of the assistance provided. Users also appreciate the secure nature of the services, which helps to build trust and reliability.

Few Complaints Noted Online: While the majority of feedback is positive, there are few complaints noted online. These complaints are typically isolated incidents rather than recurring issues, indicating that the company maintains a high standard of service overall.

Overall Customer Satisfaction Ratings: Cornerstone Payment Systems has received positive reviews on several platforms, such as Indeed and other industry-specific websites. This excellent customer service and secure payment processing solutions contribute to the high ratings received by the company.

Sales and Marketing Practices

Cornerstone Payment Systems employs a variety of sales and marketing strategies to attract and retain clients. The company focuses on transparency and ethical practices, which align with its overall commitment to integrity.

Description of Cornerstone’s Advertising and Sales Strategies: Cornerstone uses a mix of traditional advertising, referral programs, and independent sales agents to promote its services. This multifaceted approach helps the company reach a diverse audience, including small businesses, non-profits, and religious organizations.

Use of Independent Sales Agents: Independent sales representatives are important contributors to Cornerstone’s marketing strategy. These representatives assist in expanding the company’s outreach and delivering tailored service to potential customers. Although the use of independent agents may occasionally result in varying experiences, Cornerstone typically upholds a favorable reputation in this regard.

Traditional Advertising and Referral Programs: Cornerstone also utilizes traditional advertising methods, such as print and online advertisements, to promote its services. Additionally, the company benefits from a strong referral program, where satisfied clients recommend its services to others. This word-of-mouth marketing is a testament to the company’s reliability and ethical practices.

Evaluation of Sales Practices: Cornerstone Payment Systems’ sales practices receive generally positive feedback from customers. The company is noted for its straightforward and honest approach, avoiding the aggressive or deceptive tactics that are sometimes seen in the industry.

Generally Positive Feedback with No Widespread Issues: Feedback from customers suggests that Cornerstone’s sales and marketing strategies are positively received, without any major problems noted. This approval shows the company’s dedication to ethical business behavior and making customers happy.

Transparency in Marketing Without Deceptive Rate Quotes: A key strength of Cornerstone’s sales approach is its transparency. The company avoids deceptive rate quotes and clearly communicates its pricing and terms to potential clients. This transparency helps build trust and ensures that clients fully understand the services they are purchasing.

Industries and Business Types Served

Cornerstone Payment Systems caters to a diverse range of industries and business types, making it a versatile choice for many merchants. The company’s customized solutions and ethical business practices make it particularly attractive to businesses seeking reliable and cost-effective payment processing.

List of Industries Served: Cornerstone Payment Systems serves a wide variety of industries, demonstrating its flexibility and broad appeal. Key industries include:

Clothing & Apparel: Retailers in the fashion industry benefit from secure and efficient payment processing.

Convenience Stores: Solutions tailored for quick transactions and high customer turnover.

Education: Schools and educational institutions can handle tuition payments and other fees seamlessly.

Electronics: Businesses dealing in electronics require robust and secure payment processing to protect against fraud.

Gas Stations: High-volume, rapid transactions are managed efficiently.

Healthcare: Medical professionals and clinics can handle patient payments securely.

Restaurants: Dining establishments benefit from quick and secure transactions, including tips and splits.

Professional Services: Lawyers, accountants, and consultants require reliable payment solutions for client billing.

Non-profits and Religious Organizations: Cornerstone’s ethical orientation and tailored solutions are a perfect fit for these sectors.

Business Types Served: Cornerstone Payment Systems also caters to a wide array of business types, ensuring that its solutions meet the needs of various operational models. These include:

Ecommerce: Online retailers benefit from secure, efficient, and flexible payment solutions that support various payment methods.

High Volume: Businesses with high transaction volumes need robust systems to handle peak loads without downtime.

Low Risk: Low-risk businesses can enjoy favorable terms and conditions tailored to their needs.

Mom & Pop Stores: Small, family-owned businesses receive personalized service and affordable solutions.

Non-profits: Organizations that rely on donations and membership fees can manage these transactions securely.

Online Businesses: Purely digital enterprises require secure, seamless online payment processing.

Retail/Card Present: Brick-and-mortar retailers need reliable systems for in-person transactions.

Small Businesses: Cornerstone’s solutions are designed to be cost-effective for smaller operations.

Wholesale: Businesses dealing in bulk transactions need systems that can handle large-scale payments efficiently.

Cornerstone Payment Systems shows dedication to meeting clients’ unique needs by providing customized solutions for a diverse range of industries and businesses, guaranteeing secure, efficient, and affordable payment processing services.

Ethical Considerations

Cornerstone Payment Systems stands out in the payment processing industry due to its strong commitment to ethical practices. This dedication is deeply rooted in the company’s alignment with Christian values, influencing its approach to business and its choice of clientele.

Commitment to Ethical Practices: Cornerstone Payment Systems prides itself on maintaining high ethical standards across all its operations. This commitment is evident in its transparent pricing, honest marketing practices, and the overall integrity with which it conducts business. The company ensures that all transactions are secure and that customer data is protected, fostering trust and reliability among its clients.

Avoidance of Servicing Morally Objectionable Businesses: One of the unique aspects of Cornerstone Payment Systems is its practice of steering clear of businesses it finds morally disagreeable. This covers industries like adult entertainment and other sectors that may go against its ethical and moral standards. Cornerstone aligns its business operations with its core values by carefully selecting its clients, making sure to support enterprises that follow similar ethical standards.

Alignment with Christian Values: The company’s Christian orientation is central to its identity and operations. This alignment with Christian values guides its business decisions and interactions with clients. It emphasizes honesty, integrity, and fairness, not just as business strategies but as fundamental principles. This approach appeals particularly to religious organizations and non-profits that share these values, making Cornerstone a preferred payment processor for these groups.

Impact of Ethical Orientation on Business Practices and Customer Base: The ethical orientation of Cornerstone Payment Systems has a significant impact on its business practices and customer base. By committing to ethical practices and aligning with Christian values, the company attracts clients who prioritize integrity and moral responsibility in their business dealings. This has enabled Cornerstone to establish a devoted customer foundation that comprises of small businesses, non-profits, and religious organizations. These customers value the company’s commitment to moral standards and its backing of businesses with strong values.

Pros and Cons

Assessing the advantages and disadvantages of Cornerstone Payment Systems offers a fair view of its services and general effectiveness. Here are the main pros and cons linked to the company:

Pros:

Zero Setup Fee: One significant advantage is the absence of a setup fee, reducing the initial cost burden for new clients.

Reduction in Charges for Merchants: The company focuses on lowering charges for merchants by offering free rate analysis and identifying savings opportunities.

Customized Solutions for Clients: Cornerstone provides tailored solutions to meet the specific needs of each client, optimizing their payment processing expenses.

EMV and NFC Technology Offerings: The availability of advanced EMV and NFC technology enhances transaction security and facilitates convenient, contactless payments.

Cons:

Lack of Public Pricing Information: A notable drawback is the absence of publicly available pricing details, making it challenging for potential clients to compare costs upfront.

Some Withholding of Terms and Conditions: There is some withholding of detailed terms and conditions, which may lead to uncertainty for potential clients.

Monthly Fees and PCI Compliance Charges: The company imposes monthly fees and an annual PCI compliance charge, adding to the overall cost of services.

Use of Independent Sales Agents: While beneficial for reach, the use of independent sales agents can sometimes result in inconsistent experiences for clients.

Conclusion

Cornerstone Payment Systems provides a strong option for many businesses with its customized solutions, advanced technology, and no setup fees. Nevertheless, the absence of public pricing and reliance on independent agents can be seen as disadvantages. In general, it is a reliable choice for individuals looking for personalized, affordable payment processing options.

FAQs

What is the cost of using Cornerstone Payment Systems?

Cornerstone Payment Systems does not publicly disclose its pricing. Interested customers need to request personalized quotes to understand the specific costs tailored to their business needs.

Can Cornerstone Payment Systems hardware be purchased without a merchant account?

Certainly, Cornerstone Payment Systems sells its hardware to anyone who is interested, regardless of whether they have a merchant account or not.

What happens if my Cornerstone Payment Systems equipment breaks?

The company provides free equipment maintenance and repair services, ensuring that any issues with the hardware are promptly addressed without additional cost.