Electronic Merchant Systems Review

- 11th Mar, 2025

- | By Linda Mae

- | Reviews

EMS is a prominent provider of payment processing solutions catering to businesses of all sizes. Established over three decades ago, EMS has built a strong reputation in the financial technology sector, offering a comprehensive suite of services, including credit card processing, POS systems, mobile payment solutions, eCommerce payment gateways, and merchant funding options. The company’s focus on innovation, security, and customer support has positioned it as a competitive player in the payment processing industry. Lets read more about Electronic Merchant Systems Review.

EMS serves a wide range of industries, including retail, hospitality, healthcare, and eCommerce. The company prides itself on providing customizable payment solutions that integrate seamlessly with various business models. With a customer-first approach, EMS emphasizes reliability, efficiency, and affordability, ensuring that merchants can process transactions securely and efficiently.

EMS’s in-house customer support is one of its best features; it is available around-the-clock to help businesses with technical problems, payment disputes, and system troubleshooting. Furthermore, EMS places a high priority on security by implementing cutting-edge fraud prevention tools and complying with Payment Card Industry Data Security Standards to shield companies from possible threats.

Merchants have given EMS mixed reviews despite its advantages; some have praised its customer service and ease of use, while others have voiced concerns about contract terms and pricing transparency. In order to assist businesses in making an informed decision, this review attempts to present an objective and thorough analysis of EMS, encompassing its services, pricing, reputation, customer support, and general dependability.

Company Background: History, Headquarters, Ownership, and Mission | Electronic Merchant Systems Review

Electronic Merchant Systems is a well-established payment processing company that has been serving businesses since its founding in 1988. With over three decades of experience in the financial technology sector, Electronic Merchant Systems has grown into a reliable provider of payment solutions, helping merchants streamline transactions across multiple industries, including retail, hospitality, healthcare, and eCommerce.

Headquartered in Cleveland, Ohio, EMS operates nationwide, with a strong presence in various cities across the United States. The company supports businesses of all sizes by offering tailored payment processing solutions that integrate with different operational models. Over the years, Electronic Merchant Systems has expanded its reach through regional offices and a network of sales representatives, ensuring its services are accessible to businesses in diverse locations.

Electronic Merchant Systems operates as a privately held company under the ownership of its parent organization, Francis David Corporation. This corporate structure allows EMS to maintain control over its service offerings, technological advancements, and customer relationships without external shareholder influence. The company’s leadership focuses on continuous improvement and innovation to remain competitive in the rapidly evolving payment processing industry.

EMS’s goal is to give companies safe, effective, and user-friendly payment solutions that improve customer satisfaction and operational effectiveness. The company envisions a time when companies of all sizes can use cutting-edge payment technologies to expand and prosper. By putting security, innovation, and exceptional customer service first, EMS hopes to establish enduring relationships with retailers and give them access to dependable and reasonably priced payment processing solutions.

Services and Solutions Offered by Electronic Merchant Systems

Electronic Merchant Systems provides a comprehensive suite of payment processing solutions designed to meet the needs of businesses across various industries. Their services cater to retail, hospitality, healthcare, and eCommerce businesses, ensuring seamless transaction processing and enhanced customer experiences.

Payment Processing Services

Electronic Merchant Systems enables merchants to accept major credit and debit cards efficiently. Their payment processing services support EMV (Europay, MasterCard, and Visa) chip card transactions, offering increased security against fraud. Additionally, EMS provides NFC payment solutions, allowing businesses to accept contactless payments from digital wallets like Apple Pay and Google Pay, ensuring faster and more secure transactions.

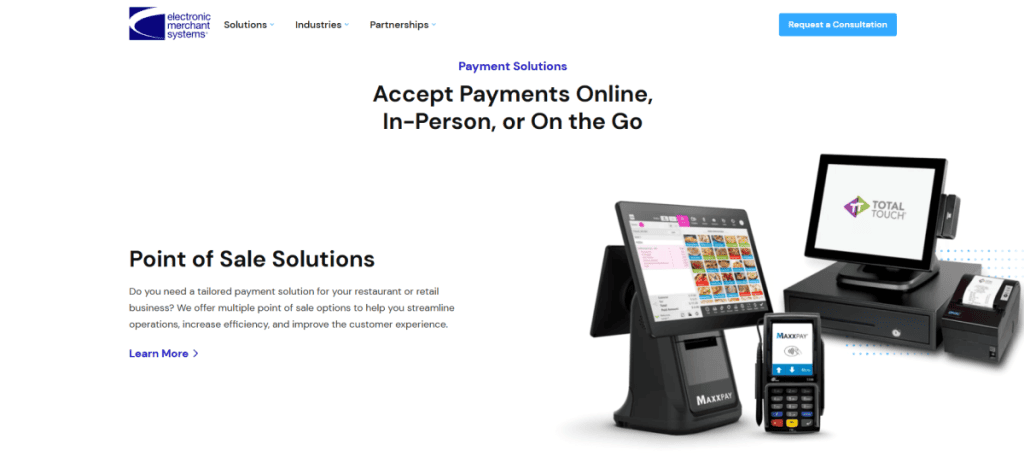

Point of Sale Systems

Electronic Merchant Systems offers MaxxPay POS solutions, an all-in-one system designed to streamline operations for small and medium-sized businesses. They also provide Total Touch POS systems, a specialized solution tailored for the restaurant industry, offering features such as table management, order tracking, and seamless payment integration.

Mobile Payment Solutions

Electronic Merchant Systems provides mobile processing apps for businesses that are always on the go, enabling retailers to take payments from smartphones and tablets. By integrating with mobile devices, these solutions give businesses that need to process transactions outside of traditional storefronts flexibility.

eCommerce Solutions

Electronic Merchant Systems supports online businesses with secure payment gateways that enable seamless transaction processing. They also provide shopping cart integrations, allowing businesses to connect their eCommerce platforms with EMS’s payment processing system.

Additional Services

Electronic Merchant Systems extends its offerings with gift and loyalty card programs, helping businesses attract and retain customers. They also offer merchant funding options, providing financial support for business expansion. Additionally, EMS prioritizes payment security and fraud prevention, ensuring compliance with PCI DSS standards to safeguard merchant transactions.

Technology and Infrastructure of Electronic Merchant Systems

Electronic Merchant Systems utilizes a robust technological infrastructure to deliver secure and efficient payment processing solutions. The company continuously invests in its platforms to ensure businesses can process transactions seamlessly across multiple channels, including in-store, mobile, and online environments.

Overview of EMS’s Technological Platforms

Credit and debit card transactions, EMV chip payments, NFC-enabled contactless payments, and eCommerce gateways are all supported by EMS’s integrated payment ecosystem. With the help of their proprietary MaxxPay POS system’s intuitive user interface, businesses can effectively manage transactions, inventory, and customer interactions. Furthermore, EMS’s mobile payment solutions give merchants flexibility by ensuring safe processing via smartphones and tablets.

Security Protocols and Compliance Standards

Security is a top priority for EMS. The company adheres to PCI DSS compliance, ensuring merchants’ payment data is encrypted and safeguarded against cyber threats. EMS employs end-to-end encryption and tokenization to enhance security and prevent unauthorized access to sensitive payment information. Advanced fraud prevention tools further protect merchants from chargebacks and fraudulent transactions.

Reliability and Uptime Statistics

Electronic Merchant Systems aims to provide high system reliability, minimizing downtime for merchants. While specific uptime statistics are not publicly disclosed, EMS claims to offer consistent payment processing with minimal service interruptions. Their cloud-based infrastructure helps maintain transaction continuity, even during peak business hours.

Integration Capabilities with Other Business Systems

Electronic Merchant Systems supports integration with accounting software, customer relationship management platforms, and eCommerce systems. Popular integrations include compatibility with QuickBooks, Shopify, WooCommerce, and other business applications, ensuring merchants can streamline operations without switching between multiple platforms. This flexibility enhances overall business efficiency while maintaining a seamless payment experience.

Customer Support and Service at Electronic Merchant Systems (EMS)

One of the main focuses of EMS service offerings is customer support. To help merchants fix technical problems, handle transactions seamlessly, and maximize the effectiveness of their payment systems for business purposes, the company offers a variety of support options.

Availability of Customer Support

EMS offers 24/7 customer support, ensuring that merchants can receive assistance whenever needed. This around-the-clock availability is particularly beneficial for businesses operating beyond standard business hours, including restaurants, retail stores, and eCommerce merchants.

Support Channels Offered

EMS provides multiple support channels, including phone, email, and live chat. Phone support allows merchants to quickly speak with a representative for urgent concerns, while email support is available for less time-sensitive inquiries. Live chat enables real-time assistance directly through the EMS website, offering a convenient option for quick troubleshooting.

Merchant Onboarding and Training Programs

To help businesses integrate EMS’s payment processing solutions, the company offers merchant onboarding and training programs. These programs guide new customers through the setup process, covering topics such as POS system usage, payment security measures, and transaction best practices. EMS also provides educational materials, including manuals and video tutorials, to ensure merchants fully understand their systems.

Account Management Services

Dedicated account managers are assigned by EMS to help merchants with their ongoing business requirements. By assisting with chargeback resolution, transaction monitoring, and system optimization, these managers make sure that companies process payments as efficiently as possible. EMS sets itself apart from rivals who might only use generic customer service models thanks to this individualized service.

Pricing and Contract Terms of Electronic Merchant Systems

EMS offers a range of pricing models and contract structures tailored to different business needs. However, like many payment processors, their pricing details are not fully transparent on their website, and merchants often need to request a custom quote to understand their specific costs.

Overview of Pricing Models

EMS reportedly offers flat-rate pricing and interchange-plus pricing, though the exact rates vary based on business type, transaction volume, and industry. Flat-rate pricing provides merchants with a consistent percentage fee for each transaction, making costs predictable. Interchange-plus pricing, on the other hand, separates the interchange fees charged by card networks from EMS’s processing markup, which can sometimes lead to more competitive rates for high-volume businesses.

Contract Length and Termination Policies

EMS typically requires merchants to sign a long-term contract, often spanning three to five years. Some agreements include an early termination fee if a merchant decides to cancel before the contract ends. Reports suggest that ETF charges vary, and merchants should carefully review the terms before signing.

Fees Associated with Services

Setup fees, monthly service fees, and per-transaction fees are all possible charges from EMS. Chargeback fees, gateway fees for online transactions, and PCI compliance fees are examples of additional expenses. However, merchants should ask for a complete breakdown before committing, as these fees are not made public.

Equipment Leasing or Purchasing Options

EMS provides POS systems and card readers, which merchants can either lease or purchase outright. Leasing may involve long-term commitments with additional costs, while purchasing equipment outright can be a more cost-effective option for businesses planning to use EMS’s services long-term.

Reputation and Reviews of Electronic Merchant Systems (EMS)

EMS has built a reputation as a longstanding payment processor serving businesses across various industries. However, customer and employee reviews reflect a mix of experiences, highlighting both strengths and areas of concern.

Customer Reviews

Summary of Positive Feedback

Many merchants appreciate EMS’s user-friendly payment solutions, 24/7 customer support, and secure transaction processing. Businesses often highlight the reliability of EMS’s POS systems, mobile payment solutions, and eCommerce integrations. Some customers also commend EMS for providing customized solutions tailored to specific business needs.

Summary of Negative Feedback

Some merchants have voiced concerns regarding pricing transparency, long-term contracts, and early termination fees, despite the positive aspects. A prevalent grievance pertains to concealed charges that might not be explicitly revealed during the onboarding process. Some users also complain about having trouble terminating services, pointing to complicated contracts or expensive termination fees. Customer service response times are generally good, but some reviews claim that they have also been erratic.

Employee Reviews

Work Environment and Culture

EMS receives mixed employee reviews. Some employees praise the company for providing growth opportunities, a collaborative work environment, and competitive benefits. However, others mention high-pressure sales tactics, job instability, and challenging sales quotas as potential downsides.

Employee Satisfaction and Retention

While some employees appreciate the structured training programs and team-oriented culture, turnover appears to be relatively high in sales roles, possibly due to performance-based compensation models.

Industry Recognition

Electronic Merchant Systems has earned various awards and certifications, reinforcing its credibility in the payment processing industry. It maintains PCI DSS compliance and has partnerships with major card networks, contributing to its reputation as a secure and reliable merchant service provider.

Competitor Comparison of Electronic Merchant Systems (EMS)

Alongside a number of other reputable companies, Electronic Merchant Systems competes in the payment processing market. Verifone, Ingenico, and TSYS are important rivals, each providing unique solutions to meet different business requirements.

Overview of Key Competitors

Verifone specializes in payment terminals and POS solutions, widely used by retailers and hospitality businesses. Their focus is on hardware innovation, offering secure payment devices.

Ingenico is a global leader in POS systems and contactless payment solutions, serving businesses in over 170 countries. Known for its secure payment technology, Ingenico is a preferred choice for enterprises.

TSYS (Total System Services) provides merchant services, card processing, and payment gateway solutions, catering to banks, large retailers, and small businesses alike. TSYS emphasizes customizable pricing and enterprise-level payment solutions.

Comparison of Services and Pricing

Electronic Merchant Systems competes by offering a comprehensive suite of payment solutions, including credit card processing, mobile payments, POS systems, and eCommerce gateways. Unlike Ingenico and Verifone, which focus on hardware, EMS provides end-to-end merchant services, including 24/7 customer support and business funding options. Compared to TSYS, EMS primarily targets small and mid-sized businesses, whereas TSYS serves a broader range, including financial institutions. Pricing transparency remains a concern for EMS, as many competitors disclose standard rates upfront.

Market Positioning and Differentiators

Electronic Merchant Systems differentiates itself with customized payment solutions, security features, and merchant support. Its PCI DSS compliance, fraud prevention tools, and integration capabilities help it stand out. However, concerns over contract terms and hidden fees may impact its competitive positioning against providers offering more transparent pricing models.

Pros and Cons of Electronic Merchant Systems (EMS)

A variety of payment processing options are available from EMS to assist companies in effectively handling transactions. Potential clients should weigh the company’s disadvantages before using its services, despite the fact that it offers a number of benefits.

Advantages of EMS

Comprehensive Service Offerings

Electronic Merchant Systems provides a full suite of payment solutions, including credit and debit card processing, mobile payments, eCommerce gateways, POS systems, and business funding options. This allows businesses to manage transactions across multiple channels seamlessly.

Technological Capabilities

EMS utilizes secure, PCI-compliant payment platforms with features like EMV chip card processing, NFC payments, and fraud prevention tools. Its POS systems (MaxxPay and Total Touch) offer flexibility and scalability, catering to both retail and restaurant businesses.

Customer Support Quality

EMS offers 24/7 customer support through phone, email, and live chat, which is a significant advantage over some competitors that provide only limited support hours. Additionally, EMS provides merchant training and onboarding assistance, helping businesses get started with their payment solutions.

Disadvantages of EMS

Potential Contract and Fee Concerns

One of the biggest criticisms of Electronic Merchant Systems is lack of pricing transparency. Merchants often need to request a custom quote, and some have reported hidden fees, long-term contracts (3-5 years), and high early termination fees.

Customer Complaints and Resolutions

Some customers have raised concerns about billing disputes, contract cancellation difficulties, and unexpected charges. While EMS does address complaints, the resolution process may take time, leading to frustration among some users.

Conclusion

Electronic Merchant Systems provides a wide range of payment options, robust technology, and round-the-clock customer service. Potential customers should, however, thoroughly go over the terms and costs of the contract before committing. EMS is ideal for companies looking for a full-service payment processor, but it should be approached with an eye toward price transparency.

FAQs

What industries does Electronic Merchant Systems serve?

EMS caters to a wide range of industries, including retail, hospitality, healthcare, eCommerce, and service-based businesses. Their payment solutions are designed to accommodate businesses of all sizes, from small shops to large enterprises, offering tailored transaction processing and POS systems.

How does EMS ensure the security of transactions?

EMS prioritizes payment security by adhering to PCI DSS compliance. It employs end-to-end encryption, tokenization, and fraud detection tools to protect sensitive cardholder data and prevent unauthorized transactions.

Can EMS’s payment solutions integrate with existing business systems?

Yes, EMS supports integration with accounting software, CRM platforms, and eCommerce solutions. Businesses using QuickBooks, Shopify, WooCommerce, and other applications can seamlessly connect EMS’s payment processing services for streamlined operations.