FreedomPay Review

- 09th Sep, 2024

- | By Linda Mae

- | Reviews

Established in 2000, FreedomPay is a top player worldwide in commerce solutions, focusing on secure, cutting-edge payment platforms. Initially known for mobile payments, It has transformed into a full-service provider of cutting-edge payment solutions for various sectors including retail, hospitality, healthcare, and finance. The main office of the company is in Philadelphia, Pennsylvania, and there are also offices in London and Las Vegas. Let’s delve deeper into the FreedomPay Review.

FreedomPay’s platform aims to improve the entire payment environment, offering a smooth experience for both merchants and customers. It provides various services such as mobile payments, contactless solutions, and data analytics, assisting businesses of every size in utilizing real-time insights to enhance their operations. Being one of the initial firms to obtain PCI-validated Point-to-Point Encryption (P2PE) in North America, It has positioned itself as a trustworthy and secure option for businesses desiring enhanced transaction security.

Market Positioning and Industry Reputation

FreedomPay is recognized as an innovation partner to some of the world’s most well-known commerce brands. The company’s reputation in the payment industry is built on its commitment to integrating cutting-edge technology with practical, secure payment solutions. By providing cloud-based, end-to-end services, FreedomPay ensures that merchants can connect in-store, online, and mobile transactions within one unified system. This capability makes it particularly appealing to large organizations looking for a scalable and flexible platform.

The company has garnered partnerships with global giants like Microsoft, JPMorgan, and Worldpay, which highlights its strong market position. These partnerships, along with its expansion into international markets, demonstrate FreedomPay’s influence and credibility in the payment technology industry.

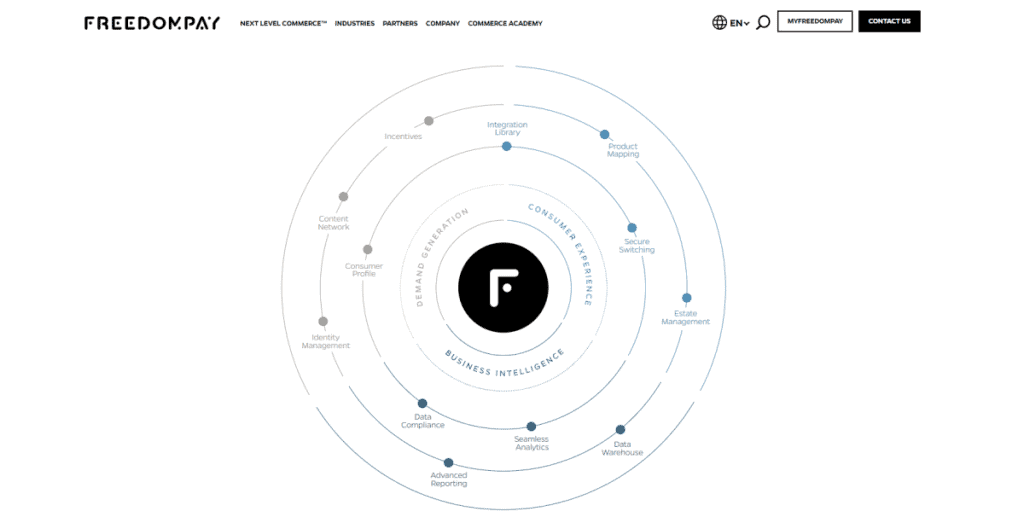

Key Features of FreedomPay’s Platform | FreedomPay Review

FreedomPay has established itself as a leader in payment technology by offering a platform that integrates security, flexibility, and data-driven insights. This combination of features makes it ideal for businesses looking for reliable and advanced payment solutions.

Integrated Payment Solution: FreedomPay’s platform offers a cohesive payment solution that effectively links in-person, web, and mobile transactions. This integration aids businesses in handling various payment methods, including traditional credit and debit cards as well as modern digital wallets and contactless payments. Businesses can enhance overall efficiency by consolidating payment infrastructure, which helps in streamlining operations and decreasing errors.

Omnichannel Capabilities: FreedomPay is really good at helping businesses interact with their customers on many different platforms. Whether customers are in a store, on a website, or using a mobile app, FreedomPay makes sure the payment process is easy and the same everywhere. This ability to work across many platforms makes customers happier because they can pay in different ways and easily keep track of their purchases no matter where they shop.

Security Features: Security is a major highlight of FreedomPay’s platform. It boasts advanced encryption, tokenization, and Point-to-Point Encryption (P2PE) features, which protect sensitive customer data and ensure compliance with Payment Card Industry (PCI) standards. Tokenization helps replace card information with unique tokens, minimizing the risk of fraud. By integrating these robust security protocols, FreedomPay provides peace of mind to businesses and their customers alike.

Innovation in Data Analytics and Customer Insights: FreedomPay uses data analysis to provide instant information about customer behavior, transaction patterns, and business performance. Its system assists companies in examining customer data to improve marketing plans and loyalty programs. This advancement in data analysis enables businesses to make smart choices and tailor their services, boosting customer interaction and sales growth.

FreedomPay’s Technology Infrastructure

FreedomPay’s advanced technology infrastructure is designed to provide businesses with a flexible, secure, and efficient payment processing system. Its innovative solutions are built with scalability and integration in mind, ensuring that merchants can rely on the platform for both current and future needs.

Cloud-Based Architecture: The cloud-based architecture of FreedomPay’s technology is particularly noteworthy. This system enables the real-time handling and storage of transaction data without requiring physical equipment on the premises, offering a more effective and expandable option. The use of cloud infrastructure allows businesses to easily handle payments from any location, providing a smooth process for merchants and customers alike. Moreover, cloud-based options lower maintenance expenses and provide quicker upgrades and enhancements, guaranteeing the platform remains current.

Scalability and Reliability: FreedomPay’s platform is built to expand alongside businesses as they develop. FreedomPay provides the capability to manage rising transaction volumes and incorporate extra services, catering to businesses of all sizes from small retailers to large corporations. Businesses can expand operations easily thanks to its cloud architecture, avoiding infrastructure constraints. Merchants can rely on the platform to operate efficiently, even during peak transaction times, due to its high level of reliability, resulting in minimal downtime. Businesses rely on this high level of dependability, as any disruptions in payments could result in substantial financial consequences.

Integration with Existing Systems and APIs: FreedomPay provides seamless integration with a wide range of existing systems, from Point of Sale (POS) systems to eCommerce platforms. Its robust API framework enables businesses to connect FreedomPay’s payment processing capabilities with their existing software and hardware, ensuring smooth interoperability. This flexibility makes it easier for businesses to adopt FreedomPay without overhauling their current systems, reducing implementation time and costs.

Supported Payment Types

FreedomPay provides a variety of supported payment options, making it a versatile choice for businesses in need of comprehensive payment processing solutions. FreedomPay provides businesses with the ability to accept a wide range of both traditional and modern payment methods, allowing them to meet the diverse needs of their customers without compromising on the security and reliability of transactions.

Credit and Debit Card Processing: FreedomPay supports the processing of both credit and debit cards, including major card networks like Visa, Mastercard, and American Express. This functionality allows merchants to securely process card payments in-store, online, and via mobile devices. With integrated features like tokenization and encryption, card transactions are handled with a high level of security, reducing the risk of fraud.

Digital Wallets and Mobile Payments (Apple Pay, Google Pay): FreedomPay’s platform also works with digital wallets like Apple Pay, Google Pay, and Samsung Pay. As people use mobile payments more and more, adding these wallets helps businesses give their customers a quick and easy checkout process. Customers can finish transactions using their phones, making payments touch-free, safe, and efficient.

Contactless and EMV Payments: The shift towards contactless payments is supported by FreedomPay’s platform through Near Field Communication (NFC) technology, which enables contactless card payments. Additionally, EMV (Europay, Mastercard, Visa) chip card payments are also supported, ensuring secure transactions that meet global security standards. These options offer businesses and customers a safer, faster way to process payments, reducing physical contact and improving transaction speed.

Gift Cards, Loyalty Programs, and Other Non-Traditional Payment Methods: In addition to typical payment methods, FreedomPay enables companies to incorporate less common payment options such as gift cards and loyalty programs. Businesses can design personalized loyalty programs to reward repeat customers and provide gift cards as an alternative way to pay. These features help keep customers coming back and offer versatile payment choices that meet various consumer preferences.

Merchant Solutions and Services

FreedomPay offers a comprehensive suite of merchant solutions and services designed to streamline payment processing and enhance the overall customer experience. These services provide businesses with the tools they need to handle in-store, online, and mobile transactions effectively.

POS (Point of Sale) Systems: FreedomPay’s Point of Sale (POS) systems are highly adaptable, catering to various industries such as retail, hospitality, and healthcare. The systems allow merchants to process payments efficiently and securely at physical locations. It integrates modern features like contactless payments, mobile wallets, and EMV chip card support, making transactions faster and more secure. These POS solutions are flexible enough to work across different hardware platforms, enabling businesses to use FreedomPay’s systems with their existing hardware infrastructure.

eCommerce Payment Gateway: For companies that sell products or services online, FreedomPay provides a payment system that makes it easy to accept digital payments. This system can handle many types of payments, such as credit and debit cards, digital wallets, and other options like PayPal. FreedomPay’s online payment solution works well with different shopping cart systems, giving customers a quick and safe way to pay. Plus, the system has tools to stop fraud and uses strong security measures to protect all online transactions.

In-Store and Online Payment Integration: One of FreedomPay’s key strengths is its ability to integrate in-store and online payments into a single, unified platform. This omnichannel capability allows merchants to manage all transactions from one dashboard, providing insights into sales performance and customer behavior across different channels. Whether a customer is shopping in-store or online, FreedomPay’s integrated system ensures a seamless payment experience. The platform also supports customer loyalty programs, making it easier for businesses to track and reward their most frequent shoppers.

Hardware and Software Support: FreedomPay provides strong assistance for both hardware and software, guaranteeing that businesses can uphold seamless operations. The system works with a variety of POS hardware choices, such as tablets and conventional registers. It offers technical assistance and updates for merchants to guarantee they are using the most up-to-date technology. This hardware and software combination enables businesses to concentrate on providing excellent customer experience, instead of being concerned about payment infrastructure difficulties.

Global Reach and Regional Availability

FreedomPay has established itself as a global leader in commerce technology, with operations spanning across multiple regions and a growing international presence. Its platform is designed to serve businesses of all sizes, from local retailers to multinational corporations, ensuring seamless payment processing in diverse geographical markets.

Regions Where FreedomPay Operates: FreedomPay’s footprint extends across North America, Europe, and beyond. The company has a strong presence in the United States, with its headquarters in Philadelphia, and has expanded its operations to the United Kingdom and other parts of Europe. This global reach enables FreedomPay to support businesses in various industries, including retail, hospitality, and healthcare, across different countries. As it continues to grow, it is constantly expanding its regional availability, providing businesses with access to its cutting-edge payment solutions in an increasing number of markets worldwide.

Support for Multi-Currency Transactions: FreedomPay’s platform’s significant feature is its capability to process transactions in multiple currencies. This functionality enables businesses to receive payments in different currencies, simplifying the process of serving global customers. Regardless of whether a business is in a brick-and-mortar location or online, FreedomPay’s multi-currency support streamlines worldwide transactions by converting payments into the customer’s chosen currency. This feature is particularly beneficial for online retail businesses, as they frequently interact with clients from various nations.

Cross-Border Payment Support: In addition to multi-currency transactions, FreedomPay provides robust cross-border payment support. This feature allows businesses to process payments across international borders without complications, ensuring a smooth and secure payment experience for both merchants and customers. FreedomPay’s cross-border capabilities reduce the complexity of handling international payments, enabling businesses to expand their customer base globally. With built-in fraud detection and compliance tools, It ensures that cross-border transactions are not only efficient but also secure.

FreedomPay’s Security and Compliance

Security is a top priority for FreedomPay, and the platform is designed to provide comprehensive protection for both merchants and customers. By implementing advanced security measures and ensuring compliance with global standards, It delivers a secure payment experience across its entire platform.

End-to-End Encryption and Tokenization: FreedomPay employs end-to-end encryption to protect sensitive data throughout the transaction process. This encryption ensures that cardholder information and payment details are securely transferred and stored, safeguarding data from unauthorized access. In addition, FreedomPay utilizes tokenization, replacing sensitive data such as card numbers with unique tokens that cannot be used outside of the payment system. This dual-layered approach ensures that sensitive information is never exposed, significantly reducing the risk of fraud or data breaches.

Compliance with Global and Regional Security Standards: FreedomPay follows strict global and regional security rules, including the Payment Card Industry Data Security Standard (PCI-DSS). By staying PCI compliant, FreedomPay makes sure its platform meets the top security needs for handling credit card transactions. The company also follows regional laws, making sure its services fit the security and compliance needs of businesses in various countries. This dedication to compliance assures businesses that they are using a platform designed to safeguard both their operations and their customers.

Fraud Detection and Prevention Features: To further enhance security, FreedomPay incorporates advanced fraud detection and prevention features. The platform monitors transactions in real-time, identifying suspicious activity and potential security threats before they can cause damage. FreedomPay uses machine learning and artificial intelligence (AI) to analyze transaction patterns, detecting anomalies and flagging transactions that may be fraudulent. These proactive measures help businesses prevent fraud and minimize risk.

Data Privacy Policies: FreedomPay takes data privacy seriously and has implemented comprehensive data protection policies to ensure that customer information is handled responsibly. The platform adheres to data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe, to protect user data. Businesses using FreedomPay can trust that their customer data is secure and that privacy is a key focus in the platform’s operations.

Customer Support and Merchant Resources

FreedomPay focuses on offering dependable customer support and helpful resources to its merchants. The company knows that successful payment operations need not just advanced technology, but also easy-to-reach support to help businesses with their everyday issues.

Availability of Customer Support (24/7, Phone, Email, Live Chat): FreedomPay offers 24/7 customer support to ensure that businesses can receive assistance whenever they need it. Whether through phone, email, or live chat, merchants have multiple channels to connect with the support team. This around-the-clock availability is critical for businesses that operate in different time zones or those that experience high traffic during non-traditional business hours. The flexibility to reach customer support through various methods ensures that merchants can resolve issues quickly and efficiently, minimizing downtime.

Onboarding Process and Training for Merchants: FreedomPay simplifies and speeds up the process of getting new merchants started. The platform offers thorough training sessions to make sure merchants know how to use the system well, handle transactions, and take advantage of all its features. This training is usually customized to fit the unique needs of each business, giving a tailored onboarding experience. Whether a business is new to digital payment systems or switching from another provider, FreedomPay ensures that merchants are ready to succeed right from the beginning.

Technical Support and Troubleshooting: When it comes to technical support, FreedomPay provides merchants with the resources needed to address any technical issues that may arise. The technical support team is well-versed in the platform’s systems, offering quick troubleshooting solutions to ensure minimal disruption to business operations. Whether a merchant encounters issues with the point-of-sale system, online payment gateway, or any other aspect of the platform, FreedomPay’s technical support team is ready to assist.

Knowledge Base and Self-Help Resources: In addition to direct customer support, It provides a robust knowledge base filled with self-help resources. This includes detailed guides, FAQs, and tutorials that allow merchants to find answers to common questions and troubleshoot minor issues on their own. The knowledge base is regularly updated to reflect new features and common challenges, empowering merchants to resolve problems independently when needed.

Pricing and Contracts

FreedomPay’s pricing is set up to be flexible for businesses of any size, offering different options that work for various transaction amounts and types of businesses. Although the exact pricing can be customized for each business, FreedomPay typically uses common pricing models like flat rate, tiered, and interchange-plus pricing. This range of choices helps businesses pick a pricing plan that suits their specific transaction needs.

Overview of Pricing Models (Flat Rate, Tiered, Interchange-Plus): FreedomPay provides multiple pricing models to suit various business preferences. Under a flat-rate structure, businesses are billed a fixed fee for each transaction, enabling them to anticipate expenses with ease. Tiered pricing classifies transactions into various tiers that have different fees based on factors such as transaction type or level of risk. On the contrary, the interchange-plus system splits the expenses into the interchange fee established by card networks and a slight markup, providing clarity on the true expenses of handling transactions. This design is perfect for companies seeking in-depth information on their transaction costs.

Contract Terms and Conditions: FreedomPay typically offers contracts that are flexible, with terms designed to suit both short-term and long-term business needs. Merchants can expect clear contract terms regarding the services provided, fees, and support. The contracts are often customized depending on the size and scope of the business, allowing for tailored agreements that meet specific operational requirements.

Early Termination Fees or Additional Costs: FreedomPay has a reputation for having clear contracts, so it is crucial for merchants to thoroughly examine any clauses regarding ending the contract early. Certain agreements might contain penalties for terminating the contract early, particularly if done before the contract’s scheduled conclusion. Nonetheless, businesses can usually find out about these fees in advance, which can prevent any unexpected costs. It is transparent about any extra expenses that may arise, including fees for specialized hardware or premium services.

Transparency in Pricing: One of FreedomPay’s key strengths is its focus on pricing transparency. Businesses receive clear breakdowns of costs, ensuring that there are no hidden fees. This commitment to transparency is essential for maintaining trust and ensuring that merchants understand exactly what they are paying for, including the services, support, and features provided by FreedomPay.

Final Verdict

FreedomPay stands out in offering secure, scalable, and flexible payment solutions. Strong security features, omnichannel capabilities, and global reach are among its key advantages. Nevertheless, pricing information can differ, and certain agreements may have penalties for ending them early. Ideal for companies seeking seamless payment solutions, It competes effectively with major players in the industry through its focus on customization and innovation.

Frequently Asked Questions (FAQs)

What types of businesses can benefit the most from FreedomPay’s services?

Organizations of various sizes, ranging from small shops to big multinational businesses, can take advantage of the services provided by FreedomPay. It is especially well-suited for sectors such as retail, hospitality, and healthcare that need omnichannel payment solutions.

Is FreedomPay’s platform compatible with my existing POS system?

Yes, FreedomPay offers compatibility with a wide range of POS systems, allowing seamless integration with existing hardware and software setups.

What are the key security measures FreedomPay uses to protect transactions?

FreedomPay employs advanced security measures such as end-to-end encryption, tokenization, and compliance with PCI standards to protect transactions.