iZettle Review

- 20th Aug, 2024

- | By Linda Mae

- | Reviews

iZettle, started in 2010 in Stockholm, Sweden, changed how we pay with phones by creating a small card reader and special software for taking payments on mobile devices. iZettle wants to help small businesses grow by giving them new ways to accept payments. The company became well-known in Europe and Latin America for offering easy-to-use tools that help small businesses handle payments, sales, and stock. Let’s delve deeper into the iZettle Review.

About the company | iZettle Review

iZettle was created by Jacob de Geer and Magnus Nilsson to give small businesses a fair chance against bigger ones. The company’s new way of handling payments on mobile devices made it a leader in the financial technology field. This attracted many different types of customers and showed that iZettle is trustworthy and simple to use.

In May 2018, PayPal acquired iZettle for $2.2 billion, marking its largest acquisition at the time. This decision aimed to improve PayPal’s ability to handle payments in stores and increase its presence in the market for small businesses. The acquisition allowed PayPal to integrate iZettle’s technology with its own, providing a comprehensive suite of services that cater to both online and offline sales.

iZettle’s goal is to help small businesses do well in a tough market. They offer easy-to-use and helpful ways to handle payments, which helps businesses work better and make more money. iZettle wants to keep making new things in the area of financial tech, so small businesses can have the right tools to do well in a world that’s getting more digital.

Product Overview

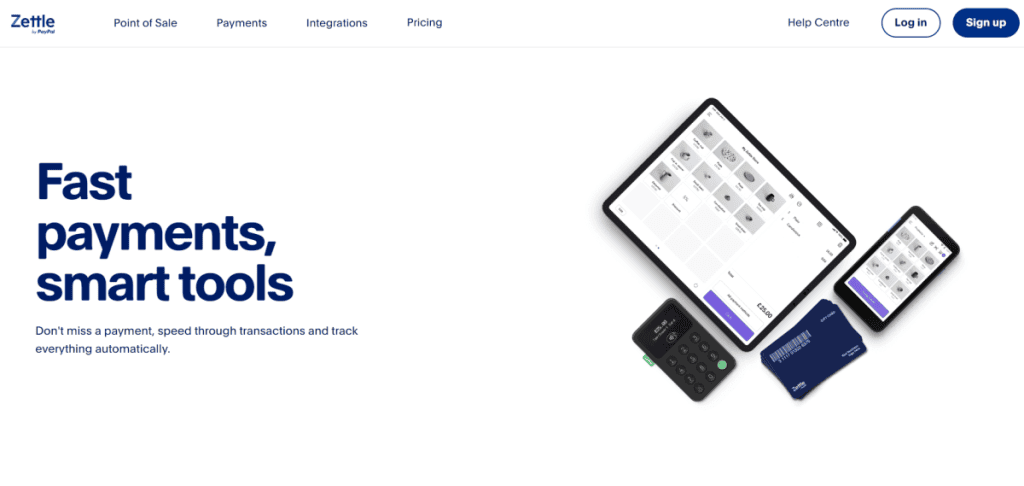

iZettle offers a comprehensive suite of products designed to simplify business operations, primarily for small and medium-sized enterprises. The main products include a mobile card reader and a versatile Point of Sale (POS) app, both of which integrate seamlessly to provide a robust payment processing solution.

Description of iZettle’s Main Products

Card Reader: The iZettle card reader is a compact, portable device that accepts a variety of payment methods, including chip and pin, contactless cards, and mobile payments like Apple Pay and Google Pay. The reader connects via Bluetooth to a mobile device, allowing businesses to process payments anywhere.

POS App: The iZettle POS app, which you can get for free on both iPhones and Android phones, does more than just handle payments. It provides features to help you control your sales, keep track of your stock, and oversee your employees. With this app, companies can see how much they’re selling as it happens, create thorough financial summaries, and even run several stores all from one application.

Zettle Terminal: This all-in-one device combines the card reader and POS app into a single, portable unit, enhancing mobility and convenience. It’s particularly useful for businesses that need to process payments quickly and efficiently on the go.

Zettle Go and Zettle Pro: The Zettle Go app includes additional features like invoicing and multi-store management. For the hospitality industry, the Zettle Pro offers specialized features such as table management and integration with restaurant-specific software.

Key Features and Benefits

Ease of Use: iZettle’s intuitive interface makes it easy for businesses to set up and start accepting payments quickly. The system is designed to be user-friendly, minimizing the learning curve.

Flexibility: The card reader’s ability to be moved around and the full range of features in the POS app allow companies to take payments and handle their business activities from any location.

Integration: iZettle works smoothly with popular online store systems like Shopify and WooCommerce, and also with accounting programs such as Quickbooks and Xero. This connection helps companies make their operations more efficient by combining online and in-person sales and making record-keeping easier.

Cost-Effective: iZettle works on a system where you only pay for what you use, and it doesn’t have any monthly charges, which makes it a good choice for small businesses that want to save money. The fees for each transaction are clear and easy to understand, helping businesses keep their costs under control.

Advanced Features: The POS app offers advanced features such as real-time sales tracking, inventory management, and detailed reporting. These tools help businesses make informed decisions and optimize their operations.

iZettle Point of Sale (POS) System

iZettle’s Point of Sale (POS) system is designed to offer small businesses an all-in-one solution for managing sales and payments seamlessly. This system combines intuitive hardware with powerful software, making it a versatile choice for various business needs.

Overview of the POS System

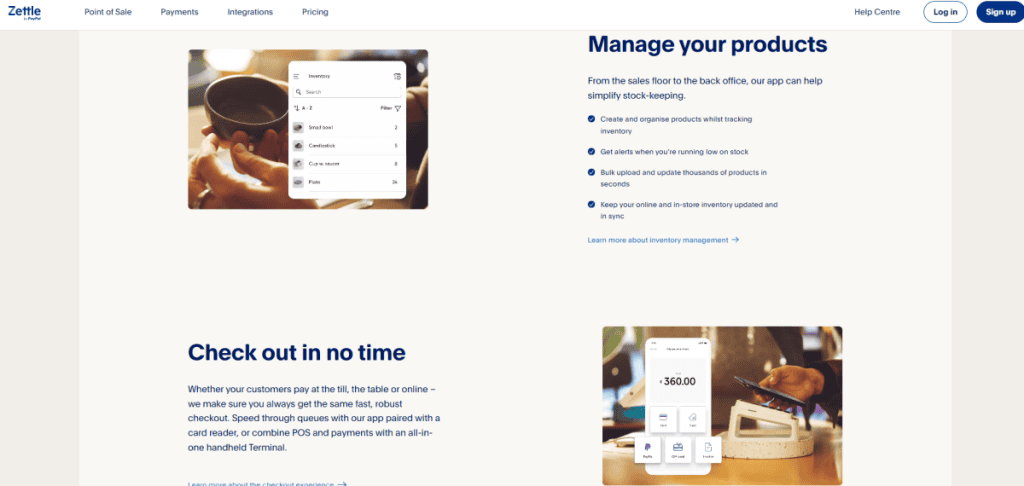

The iZettle point-of-sale system is popular for being easy to use and offering a wide range of features. It helps companies handle transactions, monitor sales, control stock, and create reports, all on one system. The setup is very mobile, letting businesses work effectively from anywhere.

Hardware Components

Card Readers: iZettle offers a compact, portable card reader that connects via Bluetooth to a mobile device. This card reader accepts a wide range of payment methods, including chip and pin, contactless cards, and mobile payments like Apple Pay and Google Pay. It ensures fast and secure transactions, making it ideal for businesses on the move.

Tablets and Terminals: The iZettle terminal combines the card reader and the point-of-sale app into one device, making payments smooth and easy. It’s made for moving around, letting businesses take care of sales in various places, whether it’s at the checkout counter inside the store or at events outside.

Software Features

Inventory Management: The iZettle POS app includes robust inventory management tools that help businesses keep track of stock levels in real-time, manage product details, and set up alerts for low inventory. This feature ensures businesses can maintain optimal stock levels and avoid running out of products.

Sales Tracking: The Point of Sale system offers thorough tracking of sales, allowing companies to watch their transactions as they happen. This capability assists in examining sales trends, pinpointing top-selling items, and guiding businesses to make smart choices.

Reporting: iZettle offers comprehensive reporting tools that generate detailed financial reports, sales summaries, and performance metrics. These reports help businesses understand their financial health and identify areas for improvement.

In general, iZettle’s point-of-sale system uses dependable hardware and sophisticated software to offer a complete package for small businesses. This helps them make their work easier, work more efficiently, and make customers happier.

Payment Processing

iZettle offers a versatile payment processing system tailored to meet the needs of small and medium-sized businesses. The system supports a variety of payment methods, ensuring that businesses can cater to a wide range of customer preferences.

Supported Payment Methods

iZettle’s card reader and point-of-sale system can handle many types of payments, such as credit and debit cards from big companies like Visa, Mastercard, American Express, and Discover. It also works with tap-and-pay services like Apple Pay, Google Pay, and Samsung Pay, plus one can use PayPal and Venmo too. This means businesses can make it easy for customers to pay, whether they’re in the shop or somewhere else.

Transaction Fees and Processing Times

The transaction fees for using iZettle are straightforward. For in-person transactions, iZettle charges a fee of 2.29% plus $0.09 per transaction. If card details are entered manually, the fee increases to 3.49% plus $0.09 per transaction. When you use a QR code to make a payment, you’ll be charged a fee of 2.29% plus an additional 9 cents for each transaction. These fees are reasonable, especially for small businesses because they don’t have to pay monthly fees or unexpected charges. Usually, the money from these transactions will be in the business’s PayPal account within a day, and they can choose to move it to their bank account.

Security Measures and Compliance

Security is a top priority for iZettle. The system is PCI-compliant, ensuring that all transactions meet stringent security standards to protect sensitive card information. iZettle’s card readers feature robust data encryption, and the POS software includes security measures to prevent unauthorized access. Additionally, the system undergoes regular security updates and compliance checks to maintain the highest level of protection for both businesses and their customers.

Overall, iZettle’s payment processing system combines flexibility, competitive pricing, and robust security, making it a reliable choice for businesses looking to streamline their payment operations.

Pricing Structure

The pricing structure of iZettle is designed to be straightforward and accessible for small and medium-sized businesses. It includes costs for hardware, transaction fees, and additional accessories, making it a cost-effective solution for many merchants.

Detailed Breakdown of Costs

Hardware Costs:

Card Reader: The initial card reader costs $29, and additional readers are priced at $79 each. The card reader is portable, supporting chip, contactless, and mobile payments (Apple Pay, Google Pay, etc.).

Zettle Terminal: This all-in-one device costs $199 for the basic model. The version with a built-in barcode scanner is priced at $239. For a complete setup, including a printer and dock, the cost starts at $269.

Accessories: Additional accessories like a charging dock are available for $49, and a rotating iPad stand costs $159.

Transaction Fees:

In-Person Transactions: The fee is 2.29% plus $0.09 per transaction.

Manual Card Entry: This incurs a higher fee of 3.49% plus $0.09 per transaction.

QR Code Transactions: Also priced at 2.29% plus $0.09 per transaction.

Invoicing: Fees vary; for PayPal payments, it’s 3.49% plus $0.49 per transaction, while card and alternative payment methods are charged at 2.99% plus $0.49 per transaction.

Comparison with Competitors

iZettle’s main competitors include Square, SumUp, and PayPal Here.

Square: Offers similar hardware and features but has a lower in-person transaction fee (2.6% plus $0.10). However, Square’s hardware costs are higher, and it offers more advanced features like employee management and email marketing.

SumUp: Charges a lower transaction fee of 1.69%, making it more cost-effective for high-volume businesses. SumUp’s hardware is slightly more expensive than iZettle’s.

PayPal Here: Integrates seamlessly with PayPal’s ecosystem but has higher transaction fees compared to iZettle (2.7% for in-person transactions).

Value for Money Analysis

iZettle provides pricing that is good for businesses that handle a medium amount of sales. It doesn’t charge monthly fees and lets you pay only when you use it, which is great for small businesses and new companies. It works well with PayPal, which makes it more trustworthy and easier to use, especially if you already use PayPal for online sales. Although other services might have lower fees or more options, iZettle offers good quality hardware, clear fees, and strong features that make it a good deal for the money.

Overall, iZettle stands out as a reliable and cost-effective choice for small to medium-sized businesses looking for a comprehensive POS solution.

Integration and Compatibility

iZettle excels in integration and compatibility, making it a versatile choice for businesses that rely on various software and devices. The system is designed to seamlessly integrate with a range of accounting and e-commerce platforms, enhancing its functionality and ease of use.

Integration with Other Software

iZettle provides strong connections with well-known accounting programs like QuickBooks and Xero, making it easier for companies to handle their finances and record-keeping. This connection lets sales information sync automatically, cutting down on manual data entry and mistakes. Also, iZettle works with top online store platforms like Shopify, WooCommerce, and BigCommerce. This helps businesses combine their online and in-person sales, giving them a clear picture of their inventory and sales across all selling methods. By linking with these platforms, iZettle makes operations smoother and more efficient, simplifying financial management and online business for companies.

Compatibility with Various Devices and Operating Systems

The iZettle POS system is compatible with a wide range of devices and operating systems, ensuring flexibility and convenience for users. The iZettle app is available on both iOS and Android platforms, allowing businesses to use smartphones or tablets to manage their sales and payments. The system’s hardware, including the card reader and terminal, connects via Bluetooth, making it easy to set up and use with mobile devices. This compatibility ensures that businesses can operate efficiently regardless of the device or operating system they prefer, providing a seamless user experience across different platforms.

User Experience

iZettle offers a streamlined user experience, making it an attractive option for small and medium-sized businesses. The setup process, usability, interface design, and customer support are all designed to ensure that users can quickly and efficiently manage their payment and sales operations.

Setup Process

Setting up iZettle is simple and easy to use. First, you need to download the iZettle app onto your phone or tablet, make an account, and connect the card reader to your device using Bluetooth. The app will help you with every step, so it’s not hard even if you don’t know much about technology. This setup is fast, usually just taking a few minutes, so you can start taking payments very soon.

Usability and Interface Design

iZettle’s interface is intuitive and clean, designed with the user in mind. The dashboard is well-organized, providing easy access to essential features such as sales tracking, inventory management, and financial reporting. Users can navigate through the app with ease, thanks to its logical layout and simple design. The POS system is responsive and performs well on both iOS and Android devices, ensuring a smooth user experience across different platforms.

Customer Support and Service Quality

iZettle offers strong customer support to help users with any problems they might face. The main way to get help is through their online help center, which has a lot of helpful guides, frequently asked questions, and tips for fixing issues. Users can also reach out for help through live chat or email for more individual assistance. Although some users have mentioned that phone support is not as available, the overall quality of the service is very good, with quick and useful responses from the support team.

Online Reviews and Ratings

iZettle has garnered a mix of positive and negative reviews from users across various platforms, reflecting its strengths and areas for improvement. Overall, it is well-received for its functionality and ease of use, making it a popular choice for small and medium-sized businesses.

Overview of Customer Feedback from Various Platforms

Customers usually like how easy and quick it is to use iZettle’s card reader and point-of-sale system. On the Apple App Store, iZettle has a great average rating of 4.6 out of 5 stars, which shows that iPhone users are very happy with it. But on the Google Play Store, it has a lower average rating of 3.3 out of 5 stars, meaning Android users might have more problems, especially with connecting and how well the app works.

Analysis of Common Positive and Negative Comments

Positive Comments:

Ease of Use: Many users praise iZettle for its user-friendly interface and straightforward setup process. The app’s intuitive design allows businesses to quickly start processing payments without extensive training.

Reliability of Hardware: The card reader is frequently commended for its reliability and battery life. Users find it convenient for mobile transactions, especially in settings like markets and fairs.

Integration Capabilities: Customers like how PayPal, online stores like Shopify, and accounting tools like QuickBooks and Xero work together smoothly. This makes managing money and tracking sales easier.

Negative Comments:

Connectivity Issues: A common complaint among Android users is the inconsistent connectivity of the card reader with their devices. This problem often arises after app updates, leading to frustration and interrupted transactions.

Customer Support: Some customers are happy with the help they get from customer service, but others say it takes a long time to get a reply and that it’s hard to reach them on weekends and late at night. Customers would like better ways to get help, like being able to call them.

iZettle’s Overall Rating on Popular Review Sites

On TrustPilot, iZettle has a score of 2.9 stars out of 5, showing that people have different opinions about it. Some like that it’s affordable and can work well with other systems, but others think it needs better customer service and a more stable app. Overall, iZettle is seen as a useful and easy way to handle payments, but it still has some issues to address to fully satisfy all its customers.

Pros and Cons

iZettle is a widely-used mobile payment and point-of-sale (POS) system that offers numerous benefits and some limitations. This detailed list of pros and cons provides a balanced view to help businesses decide if iZettle meets their needs.

Detailed List of Advantages

Ease of Use: One of the most frequently mentioned benefits of iZettle is its user-friendly interface. The setup process is quick and simple, allowing businesses to start accepting payments within minutes. The app is intuitive, making it easy to navigate and use without extensive training.

Affordability:iZettle works on a system where you only pay when you use it, and there are no regular monthly charges. This makes it a good choice for small businesses because it saves money. The hardware costs are fair, and the fees for each sale are low, particularly when you accept payments with a card in your store.

Integration: iZettle integrates seamlessly with popular e-commerce platforms like Shopify and WooCommerce, as well as accounting software such as QuickBooks and Xero. This integration simplifies sales tracking and financial management across multiple channels.

Portability: The small and easy-to-carry iZettle card reader lets companies take payments from any location, which is perfect for businesses on the go, outdoor markets, and special events.

Comprehensive Features: The POS system includes features such as inventory management, sales tracking, and reporting tools, which help businesses manage their operations efficiently.

Potential Drawbacks and Limitations

Connectivity Issues: Some users, particularly those with Android devices, have reported connectivity issues with the card reader. These problems can disrupt transactions and cause frustration.

Customer Support: While iZettle offers customer support, some users have experienced delays in response times and limited availability, particularly during weekends and off-hours. This can be problematic for businesses that need immediate assistance.

Limited Advanced Features: iZettle has fewer advanced features than some of its rivals. For example, it doesn’t provide detailed customer relationship management (CRM) tools or sophisticated inventory management options. This might be a drawback for bigger companies that need more complex solutions.

Geographical Limitations: iZettle is not available globally, which can be a drawback for businesses operating in unsupported regions. This geographical limitation may restrict the expansion plans of some businesses.

Overall, iZettle provides a strong and easy-to-use point-of-sale system that has major benefits in terms of simplicity, cost-effectiveness, and the ability to connect with other systems. But it also has some drawbacks, mainly related to connection problems, customer service, and more complex features.

Final Verdict

iZettle is a dependable and easy-to-use point-of-sale system that is perfect for small businesses because it is inexpensive, can connect with other systems, and is easy to move around. Although it has a few small problems like connection troubles and not having many high-tech features, it still provides a lot of benefits. In general, iZettle is highly recommended for its strong features and simple operation.

FAQs

What is the main difference between iZettle and other POS systems?

iZettle stands out for its ease of use, affordability, and seamless integration with PayPal, making it particularly appealing for small businesses. Its pay-as-you-go model and competitive transaction fees also differentiate it from many competitors.

How secure are transactions processed through iZettle?

Transactions processed through iZettle are highly secure, adhering to PCI compliance standards. The system uses robust encryption methods to protect sensitive data and ensures secure payment processing.

Can iZettle be used for both online and offline businesses?

Yes, iZettle can be used for both online and offline businesses. It integrates well with e-commerce platforms like Shopify and WooCommerce, allowing for unified management of in-store and online sales.