LawPay Review

- 29th Aug, 2024

- | By Linda Mae

- | Reviews

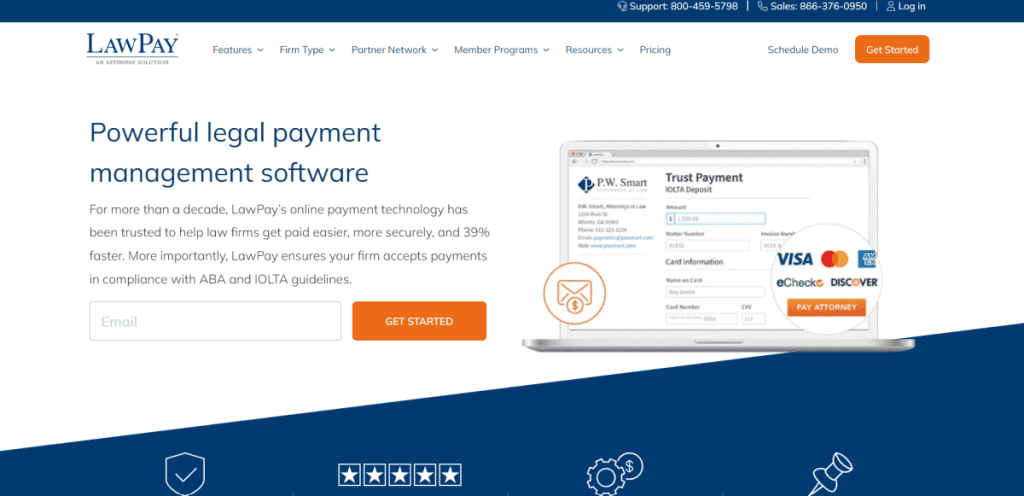

LawPay is a payment processing platform tailored to the requirements of legal professionals. Created by AffiniPay, this offers a strong and compliant solution customized to meet the distinct financial needs of law firms. It allows legal firms to receive different payment options like credit cards and eChecks, all the while maintaining compliance with industry rules, such as those established by the American Bar Association (ABA) and Interest on Lawyers’ Trust Accounts (IOLTA) guidelines. Furthermore, LawPay effortlessly combines with well-known legal practice management software such as Clio and MyCase, making it a vital resource for contemporary law firms. Let’s delve deeper into the LawPay Review.

Importance of Specialized Payment Processing for Legal Professionals

In the legal field, careful management of client funds necessitates close attention to detail and adherence to ethical standards. Conventional payment processors frequently fail to meet these specific needs, especially regarding the handling of trust accounts and ensuring legal compliance. LawPay tackles these obstacles by providing a payment processing solution that guarantees the protection of client funds and avoids mixing earned and unearned fees—a necessary aspect for legal adherence.

Specialized payment processing is extremely important in the legal field. Law firms need to make sure that client funds are managed accurately, maintaining distinct separation among various fee categories. LawPay’s system is created to streamline this process, lowering the chances of ethical violations. Moreover, functionalities such as timed payments, QR code payment choices, and thorough PCI adherence assist legal professionals in simplifying their financial processes, boosting security, and ultimately providing improved service to their clients.

Company Background and Overview | LawPay Review

LawPay was founded with a singular mission: to provide legal professionals with a payment processing solution that meets the specific needs and compliance requirements of the legal industry. The company was established by Amy Porter, who recognized the challenges law firms faced when handling client payments, particularly in maintaining compliance with the American Bar Association (ABA) and Interest on Lawyers’ Trust Accounts (IOLTA) regulations. With a background in payment processing and a keen understanding of the legal sector’s unique demands, Porter launched LawPay to bridge the gap between traditional payment systems and the stringent requirements of legal practices.

It was established in 2005 by Amy Porter as a subsidiary of AffiniPay. The notion originated from Porter’s recognition that conventional payment processing options were not fully prepared to meet the unique needs of law firms, especially in overseeing client trust accounts. It was created specifically to meet these requirements, guaranteeing adherence to legal industry regulations from the start. Over time, LawPay has experienced considerable growth and has established itself as a reliable ally for numerous law firms throughout the United States.

Since its inception, It has achieved several key milestones that have solidified its position as a leader in the legal payment processing industry. One of the most significant achievements was gaining endorsement from the American Bar Association, making LawPay the only payment solution offered through the ABA Advantage program. The platform has also been recommended by all 50 state bar associations, a testament to its reliability and compliance standards. Additionally, LawPay’s integration with over 70 legal practice management software solutions has further strengthened its appeal to law firms of all sizes.

LawPay is fundamentally committed to offering secure, dependable, and compliant payment processing solutions for legal professionals. The company aims to streamline the payment process for law firms while upholding the highest levels of ethical and regulatory compliance. LawPay prioritizes trust, integrity, and innovation, always working to improve its platform to address the changing demands of the legal sector.

Features and Services

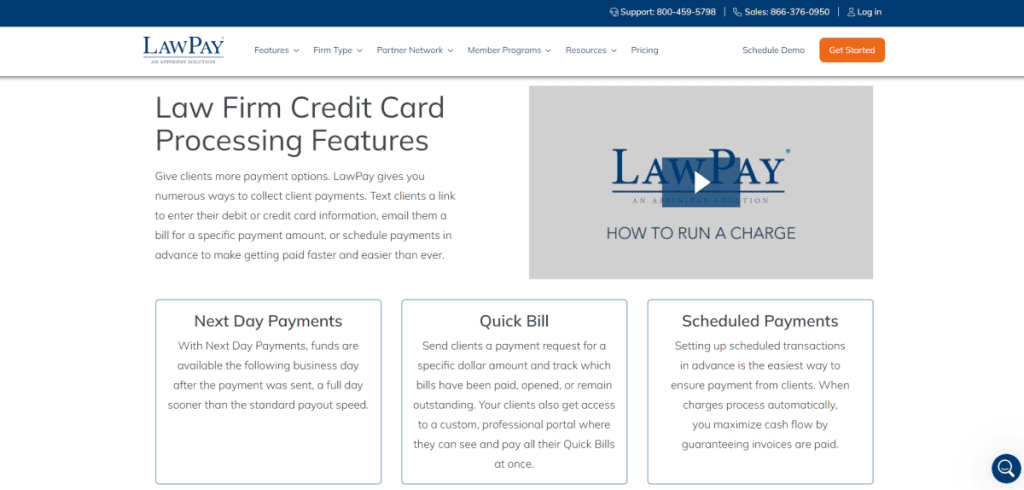

LawPay offers a comprehensive suite of features specifically designed to meet the unique needs of legal professionals. The platform’s robust feature set is tailored to simplify the payment process for law firms while ensuring compliance with legal industry standards. Whether it’s managing client payments or integrating with legal practice management software, it has built a solution that addresses the complexities of financial transactions in the legal field.

Overview of Main Features Offered by LawPay

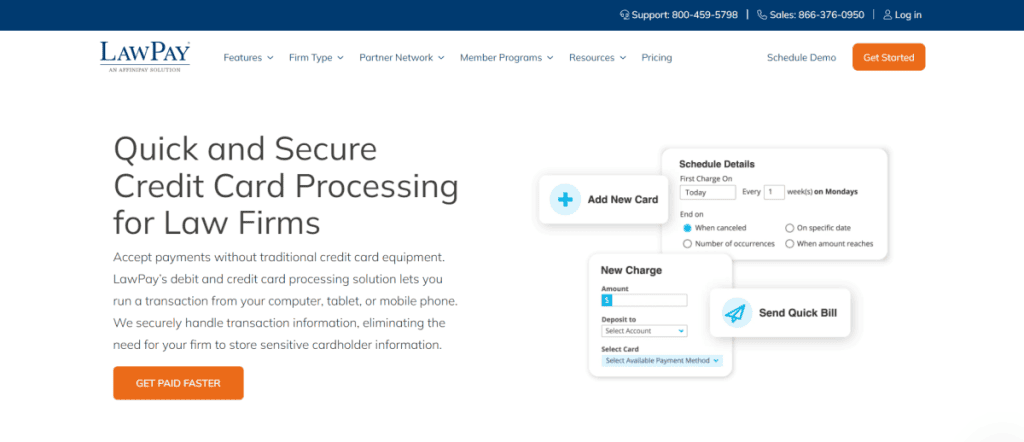

Payment Processing: At the heart of LawPay’s services is its secure and efficient payment processing system. Law firms can accept various forms of payment, including credit cards and eChecks, either online or in person. The system is designed to facilitate quick and easy transactions while maintaining compliance with the strict regulations governing legal payments. Additionally, LawPay supports recurring billing, making it easier for firms to manage ongoing client payments.

Client Billing and Invoicing: LawPay makes the billing process easier for legal professionals. The platform enables companies to create and send invoices to customers, who can then pay through a secure link within the invoice. This efficient procedure not only boosts cash flow but also enhances the client’s experience by offering a convenient and secure method for paying legal fees.

Trust Account Management: A key feature of LawPay is its ability to manage trust accounts in compliance with IOLTA guidelines. The platform is designed to keep earned and unearned fees separate, preventing the commingling of funds and ensuring that firms adhere to ethical and legal standards. This feature is crucial for law firms that need to manage client funds with the highest level of integrity.

Integration with Legal Practice Management Software: LawPay seamlessly integrates with over 70 legal practice management software solutions, including popular platforms like Clio, MyCase, and PracticePanther. This integration allows for a more streamlined workflow, as firms can manage their billing, invoicing, and payment processing all within one system. It also reduces the risk of errors and improves overall efficiency.

Mobile Payment Capabilities: LawPay provides a mobile application that enables legal professionals to receive payments while on the move. Attorneys can securely process payments from their smartphones, whether they are in the office or at a client meeting. The application allows for payment with credit cards and eChecks, offering flexibility and convenience.

Security Features and Compliance (PCI, ABA, and IOLTA Compliance): Security is a top priority for LawPay. The platform exceeds PCI Data Security Standards, ensuring that all transactions are protected against fraud and data breaches. LawPay is also compliant with ABA and IOLTA guidelines, providing law firms with peace of mind that their payment processing is in full compliance with legal and ethical standards.

User Interface and Ease of Use: LawPay is designed with the user in mind, offering a clean, intuitive interface that is easy to navigate. Both attorneys and clients can quickly understand and use the platform, reducing the learning curve and enhancing the overall user experience. The simplicity of the user interface, combined with the powerful features, makes LawPay a preferred choice for many legal professionals.

Pricing and Plans

It provides a clear and simple pricing system that is tailored to meet the needs of law firms regardless of their size. The platform is renowned for its transparent pricing, without any hidden charges, making it the top choice for legal professionals looking for a reliable payment processing solution. Having a good grasp of the cost consequences is essential for law firms, and LawPay’s pricing options are created to be both competitive and thorough.

Overview of Pricing Structure

It operates on a subscription-based pricing model, with a monthly fee that starts at $20. This fee covers access to the platform’s core features, including payment processing, client billing, and trust account management. One of the standout aspects of LawPay’s pricing is its flat-rate transaction fees, which provide predictability for law firms in managing their costs. The standard transaction fee is 1.95% plus $0.20 per transaction for most credit cards, with a slightly higher fee for specialty cards like American Express at 2.95% plus $0.20 per transaction.

Detailed Breakdown of Available Plans

LawPay’s pricing model includes a base plan that offers essential services for small to mid-sized law firms. For larger firms or those requiring additional features, it offers custom pricing options tailored to specific needs. These custom plans may include advanced integrations, higher transaction volumes, and enhanced support services. The flexibility in pricing allows firms to choose a plan that aligns with their operational requirements and budget.

Additional Fees and Charges

Along with the monthly subscription and transaction fees, it enforces several additional charges that firms need to know about. An example of this is the $2 charge for each eCheck transaction, which is significantly less than the typical fees for processing credit cards. LawPay does not have any charges for PCI compliance, which is a major benefit, however, firms that do not uphold PCI compliance may face a non-compliance fee of $19.95 per month. Moreover, there are costs associated with chargebacks, which typically adhere to industry norms.

Comparison with Competitors’ Pricing

When compared to competitors, LawPay’s pricing is competitive, particularly considering the specialized features it offers for legal professionals. While some general payment processors may offer lower transaction fees, they often lack the legal-specific features and compliance support that LawPay provides. This makes LawPay a cost-effective solution for law firms that require both robust payment processing and strict adherence to legal industry standards.

User Experience

It is designed with ease of use in mind, making it a go-to payment processing solution for legal professionals. From setup to daily operations, the platform is intuitive and user-friendly, ensuring that law firms can focus on their practice without getting bogged down by technical complexities.

Ease of Setup and Implementation

LawPay’s simple setup process is one of its standout features. Many users discover that they can set up the system easily with little effort. The platform provides straightforward, detailed guidance, and numerous legal firms can finish the setup in a single day. The integration of LawPay with well-known legal practice management software like Clio and MyCase further simplifies the process. This enables a seamless change without interrupting the company’s current operations.

Day-to-Day Use in Legal Practices

In day-to-day operations, it excels in providing a hassle-free experience. The platform is designed to handle the specific needs of legal practices, such as managing trust accounts and processing payments in compliance with IOLTA regulations. Users appreciate the convenience of features like scheduled payments and automated invoicing, which streamline the billing process and improve cash flow. The user interface is clean and intuitive, making it easy for both attorneys and administrative staff to navigate the system and manage transactions efficiently.

Customer Support and Service Quality

LawPay is also known for its high-quality customer support. The company offers multiple support channels, including phone, email, and online resources. Many users have praised LawPay’s customer service for being responsive and knowledgeable, especially when dealing with legal-specific queries. The support team’s understanding of the unique requirements of law firms helps ensure that issues are resolved quickly and effectively.

Feedback from Users

In general, the majority of user reviews for LawPay are positive. Numerous legal experts emphasize the platform’s dependability, user-friendliness, and the reassurance provided by its compliance features. Even though some users think the pricing could be better, most agree that LawPay’s unique features are worth the cost. Users often highlight the platform’s seamless integration with other legal software and excellent customer support as key advantages.

Integration and Compatibility

LawPay is designed to integrate seamlessly with a wide range of legal practice management software, making it a versatile solution for law firms of all sizes. The platform’s strong compatibility and robust integration capabilities are among its most significant advantages, allowing legal professionals to incorporate LawPay into their existing workflows with minimal disruption.

Compatibility with Popular Legal Software

One of LawPay’s standout features is its compatibility with over 70 legal practice management systems, including industry leaders like Clio, MyCase, PracticePanther, and Rocket Matter. These integrations enable law firms to streamline their billing and payment processes directly within the software they already use daily. For example, firms using Clio can sync client information, invoices, and payment records between the two platforms, ensuring a smooth and cohesive experience. This compatibility not only saves time but also reduces the risk of errors, making financial management more efficient and accurate.

API Availability and Customization Options

LawPay provides not only ready-made integrations but also an API that enables more customization and flexibility. This API is especially useful for bigger companies or those with particular requirements that may not be completely addressed by current integrations. By using the API, companies have the capability to create personalized solutions that closely match their internal operations, like constructing distinct workflows or connecting LawPay with their own software. This degree of personalization guarantees that LawPay can adjust to the specific needs of any law firm, regardless of its level of complexity.

Integration Process and Support

The integration process with LawPay is designed to be straightforward and user-friendly. For most legal software, the setup involves just a few clicks, with detailed guidance provided by LawPay’s support team. LawPay also offers extensive resources, including tutorials and support documents, to assist firms in the integration process. Should any issues arise, LawPay’s customer support is readily available to provide expert assistance, ensuring that the integration is smooth and effective.

Security and Compliance

LawPay prioritizes security and compliance, acknowledging the crucial need to safeguard sensitive client data and follow legal industry regulations. The platform’s dedication to these areas makes it a reliable option for law firms seeking to guarantee top-notch data security and ethical financial handling.

Overview of Security Measures

LawPay employs advanced security measures to safeguard all transactions processed through its platform. This includes encryption protocols that protect data during transmission and storage, ensuring that sensitive information, such as credit card details and personal client data, remains secure from unauthorized access. Additionally, LawPay continuously monitors its systems for any potential vulnerabilities and regularly updates its security measures to counteract emerging threats. These robust security protocols provide law firms with the confidence that their payment processing is conducted in a safe and secure environment.

PCI Compliance and Data Protection

LawPay is fully compliant with the Payment Card Industry Data Security Standard (PCI DSS), a set of security standards designed to protect card information during and after a financial transaction. Compliance with PCI DSS means that LawPay meets or exceeds the stringent requirements for securing credit card transactions, reducing the risk of data breaches. This compliance is crucial for law firms, as it not only protects their clients’ data but also shields the firm from potential liabilities associated with data breaches.

Trust Account Management Features and IOLTA Compliance

LawPay can effectively handle trust accounts by following IOLTA regulations. LawPay’s system is created to make sure that client funds are managed ethically and adhere completely to these regulations. The platform ensures that earned and unearned fees are automatically segregated, which is crucial for maintaining the integrity of trust accounts. This important skill is crucial for law firms to comply with ethical standards in the legal profession, preventing possible legal and ethical problems.

How LawPay Ensures Adherence to Legal Ethical Standards

LawPay’s commitment to legal ethical standards extends beyond simple compliance. The platform is designed with the specific needs of legal professionals in mind, ensuring that every aspect of its service aligns with the ethical obligations that law firms must uphold. By offering features like comprehensive trust account management and PCI-compliant data security, LawPay helps legal professionals meet their ethical responsibilities while streamlining their payment processes. This alignment with legal ethics not only protects the firm’s reputation but also builds trust with clients, who can be assured that their funds are handled with the utmost care and integrity.

Advantages and Disadvantages

Key Strengths of LawPay:

Specialized Focus on Legal Industry: LawPay is specifically designed for the legal sector, offering features like trust account management that comply with IOLTA regulations. This specialization ensures that law firms can manage client funds ethically and legally, which is a critical requirement in the legal profession.

Seamless Integration: LawPay is compatible with more than 70 legal practice management platforms, such as Clio and MyCase. This integration streamlines billing and payment procedures, facilitating financial operations management for businesses using their current software environments.

User-Friendly Interface: The platform’s intuitive interface makes it easy for both legal professionals and their clients to navigate. This ease of use helps reduce the time spent on administrative tasks and enhances the overall user experience.

Robust Security and Compliance: LawPay’s dedication to security is clearly shown through its adherence to PCI compliance, guaranteeing that all transactions are secure and adhere to industry standards. Law firms can have peace of mind knowing their financial data and client information are well-protected due to the emphasis on security.

Highly Rated Customer Support: LawPay is known for its responsive and knowledgeable customer support team. Users frequently commend the support staff for their ability to resolve issues quickly and effectively, which is especially important for legal professionals who need reliable assistance.

Potential Weaknesses or Areas of Improvement:

Pricing Structure: Although LawPay’s pricing is competitive due to its unique features, it may be slightly higher compared to other standard payment processing platforms. This may be an issue for smaller companies or individuals working alone who could consider the expenses too high, especially if they are not making use of all the available features.

Mobile App Limitations: The LawPay mobile app, while functional for basic payment processing, lacks some of the advanced features available on the desktop version. Users have expressed a desire for more comprehensive mobile capabilities, which could improve the flexibility and usability of the platform on the go.

Comparison with Other Payment Processing Solutions for Legal Professionals:

Legal Industry Focus vs. General Platforms: Compared to competitors like PayPal or Square, LawPay’s focus on the legal industry gives it an edge in terms of specialized features such as trust account management and IOLTA compliance. While general platforms might offer lower transaction fees, they do not provide the legal-specific tools that are crucial for compliance and ethical management in law firms.

Overall Value: LawPay is valuable because it can address the intricate requirements of lawyers, providing custom security and features. Nevertheless, companies that value affordability over specific features may find generic payment processors more attractive, despite possibly lacking LawPay’s essential compliance features.

In summary, LawPay’s strengths in specialization, integration, and security make it a top choice for legal professionals, despite some areas for improvement in pricing and mobile functionality.

Customer Feedback and Ratings

LawPay has received mostly positive reviews from lawyers, showcasing its solid standing in the legal payment processing sector. The platform has a good reputation on different review platforms, with users consistently complimenting its legal-focused tools, user-friendliness, and dependable customer service. Nevertheless, similar to other services, it has received some criticisms that the company is working on to enhance the user experience.

Summary of Customer Reviews and Ratings from Various Platforms: LawPay maintains high ratings across several review platforms, with many users giving it four or five stars. Legal professionals often commend the platform for its user-friendly interface, which simplifies the payment process and integrates smoothly with legal practice management software. On sites like Capterra and G2, LawPay is frequently highlighted as a top choice for legal payment processing due to its compliance with IOLTA and ABA regulations, which are critical for maintaining trust account integrity.

Common Praise and Criticisms: Common praise for LawPay revolves around its ease of integration with existing legal software, robust security features, and dedicated customer support. Users particularly appreciate the platform’s ability to handle trust accounts in a compliant manner, which is a significant advantage for law firms. The ability to automate billing and invoicing processes also receives positive feedback, as it reduces administrative burdens and improves cash flow management.

However, certain users have raised worries regarding the platform’s pricing, stating that it might be more expensive than regular payment processors not designed for the legal field. Moreover, although the desktop interface of the platform has received acclaim, there have been comments about restrictions in the mobile app, with some users believing it could offer more features.

How LawPay Has Responded to User Feedback: LawPay has demonstrated dedication to listening to user input and consistently enhancing its platform. The company regularly enhances its features and broadens its integrations with additional legal software tools as requested by users. LawPay’s customer service team is recognized for its proactive approach, frequently contacting customers in order to address problems and guarantee their satisfaction. This ability to react promptly has contributed to its solid standing and impressive ratings among legal professionals.

Conclusion

In summary, LawPay is a custom payment processing solution created to suit the specific requirements of legal professionals. It excels in adhering to legal rules, seamless integration, and strong customer assistance. Even though it may come with a higher price tag compared to regular processors, it provides considerable benefits for law firms. LawPay is a strongly recommended option for legal professionals in need of a secure, compliant, and user-friendly payment solution.

FAQs

Is LawPay suitable for small legal practices?

Yes, LawPay is suitable for small legal practices. Its flexible pricing plans and ease of use make it an ideal solution for firms of all sizes, including solo practitioners. The platform’s compliance features are especially beneficial for smaller firms that need to manage trust accounts efficiently.

How secure is LawPay for managing client payments?

LawPay meets and surpasses PCI compliance standards, ensuring high levels of security. It utilizes state-of-the-art encryption and data protection methods, guaranteeing the safety and compliance of all transactions with industry regulations.

Can LawPay integrate with my existing legal practice management software?

LawPay smoothly combines with more than 70 legal practice management software solutions, such as Clio, MyCase, and PracticePanther, improving workflow efficiency for law firms.