Merchant Management Group Review

- 05th Aug, 2024

- | By Linda Mae

- | Reviews

Merchant Management Group is a reputable name in the payment processing sector, providing a wide range of services customized for different types of businesses. This Merchant Management Group Review seeks to thoroughly assess MMG’s products, examining their past, management, and business reach. Merchant Management Group focuses on delivering safe, dependable, and effective credit card processing solutions. They serve a wide variety of industries such as retail, restaurants, petroleum, and e-commerce, allowing businesses to handle transactions efficiently. Let’s Dig deeper into the Merchant Management Group Review.

Company Overview | Merchant Management Group Review

Merchant Management Group was founded in 2004. It has grown to become a trusted name in the payment processing industry. The company’s strong reputation is built on their commitment to providing robust solutions over the years.

MMG is led by founder and CEO Rodney Friend, with Dave Zank serving as the director of business. Under their leadership, the company has maintained its focus on customer-centric services and innovative payment solutions.

The company’s headquarters is located at 538 Harmon Avenue, Panama City, Florida. As a registered Independent Sales Organization (ISO) of Wells Fargo Bank, NA, MMG has a significant presence across the United States, providing services to a wide array of businesses nationwide.

Features and Benefits

MMG stands out in the payment processing industry with its diverse array of features and benefits designed to support various business operations. Their offerings ensure efficient and secure transactions, tailored to meet specific industry needs.

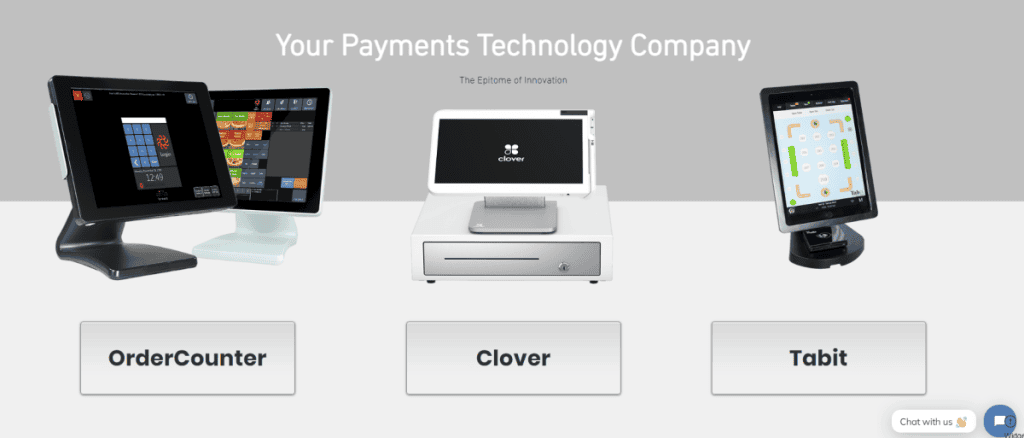

Point of Sale (POS) Solutions

Merchant Management Group provides a variety of POS systems through the Clover product line, including Clover Duo, Clover Solo, Clover Mini, Clover Go, and Clover Flex. Each system caters to different business requirements:

Clover Duo: This system is perfect for businesses needing a robust solution with a customer-facing display. It enhances customer interaction by providing real-time order and payment updates.

Clover Solo: A streamlined option for smaller businesses, offering essential POS features with a simplified interface.

Clover Mini: Compact yet powerful, it supports chip, swipe, and contactless payments, making it ideal for both retail and service businesses.

Clover Go: A mobile solution that enables businesses to process payments on the go, perfect for market vendors and mobile service providers.

Clover Flex: A versatile system that combines the functionalities of the other Clover products, suitable for businesses needing flexibility in their POS operations.

These POS systems are highly integrative, allowing seamless connection with various business applications and services, ensuring smooth operations across different business types.

Cash Discount Program

MMG’s Cash Discount Program, known as cHooZ, helps merchants eliminate credit card processing fees by offering a discount to customers who pay with cash. When customers choose to pay by card, they cover the processing fee, which is around 4%. This program significantly benefits small businesses by increasing their profit margins and reducing overhead costs associated with card transactions.

Kitchen Display Solutions

For the foodservice industry, Merchant Management Group offers advanced kitchen display solutions like ChefTab and Fresh KDS. ChefTab is designed for high-paced kitchen environments, featuring a touchscreen and bump bars to manage multiple orders efficiently. Fresh KDS integrates with Clover to improve ticket times and order accuracy through detailed analytics and multi-screen displays.

Event Management

Through a partnership with Partywirks, Merchant Management Group provides comprehensive event management solutions. This includes online event bookings, payment processing, and customer information management. The system also allows businesses to display food and gift options, collect payments, and manage event details seamlessly.

Dunning Management

MMG’s dunning management services help businesses handle credit card payment declines efficiently. This service includes pre-dunning notifications to avoid failed payments and allows customers to update their payment information easily. It is particularly beneficial for businesses with recurring payments, ensuring continuous revenue flow and reducing the manual effort of follow-ups.

Overall, MMG’s diverse range of features and benefits make it a valuable partner for businesses looking to optimize their payment processing and operational efficiency.

Contract and Pricing

Merchant Management Group offers a structured approach to their contracts and pricing, designed to be transparent and straightforward. Here’s a detailed breakdown of what potential clients can expect.

Detailed Explanation of Contract Terms: MMG typically binds merchants to a three-year contract with Fiserv, their processing partner. This contract includes various terms and conditions aimed at ensuring both parties meet their obligations throughout the duration of the agreement. While the detailed terms are not always listed publicly, the standard industry practice includes specifics on service commitments, transaction processing standards, and compliance requirements.

Pricing Structure: MMG employs a tiered pricing model, which varies depending on the volume of transactions processed. For merchants processing up to $50,000 monthly, the typical rate is 2.69% plus $0.19 for swiped transactions and 3.69% plus $0.19 for keyed-in transactions. For higher volume merchants, rates may be reduced to 2.29% plus $0.19 for swiped and 3.29% plus $0.19 for keyed-in transactions. This tiered structure allows for some flexibility, catering to different business sizes and transaction volumes.

Additional Fees: In addition to the standard transaction fees, Merchant Management Group charges a PCI compliance fee of $19.95 per month. This fee covers the costs associated with maintaining secure transaction processing environments and adhering to the Payment Card Industry Data Security Standard (PCI DSS). An early termination fee of $495 is also applicable if a merchant decides to cancel the contract before the agreed term ends. This fee can be a significant consideration for businesses thinking about switching providers mid-contract.

Equipment Lease Terms: MMG’s equipment lease terms generally lock merchants into a three-year non-cancelable lease for the POS systems provided. While the exact terms of the equipment lease are not always disclosed upfront, it is important for merchants to understand that these leases typically include monthly payments and stipulations that the equipment cannot be returned or the lease terminated without fulfilling the financial obligations. The leased equipment often includes various Clover POS systems, which come with their own set of functionalities and benefits tailored to different business needs.

Overall, MMG’s contract and pricing structure is designed to provide a comprehensive and transparent service, though potential clients should carefully review all terms and conditions to fully understand their commitments.

Sales Practices

MMG employs strategic sales practices designed to foster transparency and integrity in its operations. Their marketing strategies, partnerships, and use of independent resellers are crafted to offer a reliable and straightforward service to merchants. Here’s an overview of their sales practices.

Marketing Strategies and Partnerships: Merchant Management Group primarily markets its services through strategic partnerships and traditional advertising. These partnerships often include collaborations with well-known entities like Comcast and Edward Johns, allowing MMG to extend its reach and credibility in the industry. This approach helps them tap into established customer bases and offer their comprehensive payment processing solutions to a wider audience.

Transparency and Public Contract Disclosure: A key aspect of MMG’s sales practice is their commitment to transparency. Unlike many competitors, MMG has previously provided copies of its merchant agreement and program guide on its website, which is uncommon in the credit card processing industry. This transparency allows potential clients to review contract terms upfront, helping to build trust and avoid surprises regarding fees and conditions. However, it’s noted that the latest updates show that these documents have been removed, which might necessitate prospective clients to request them directly from the company.

Use of Independent Resellers: MMG’s use of independent resellers is minimal compared to other companies in the industry. They do not heavily rely on a large team of independently contracted sales agents. This strategy helps maintain control over their sales practices and ensures that the information provided to potential clients is consistent and accurate. Independent resellers, when used, are closely monitored to align with MMG’s values of transparency and customer-centric service.

Comparison with Industry Standards: When compared to industry standards, MMG stands out for its higher level of transparency and lower incidence of deceptive sales tactics. The credit card processing industry is often criticized for hidden fees and misleading marketing, but MMG has managed to avoid such pitfalls to a large extent. By not relying extensively on aggressive independent sales tactics and maintaining open communication about their contract terms, MMG aligns more closely with best practices in the industry. However, potential clients should still perform due diligence and compare MMG’s offerings with other top-rated providers to ensure they are getting the best value.

MMG’s sales practices reflect a strong commitment to ethical marketing, transparency, and strategic partnerships, positioning them favorably against industry standards.

Customer Reviews and Complaints

Merchant Management Group Review has received mixed feedback from customers with positive reviews and some complaints. Here’s an overview of the experiences shared by users.

Overview of Positive Feedback: MMG is generally well-regarded for its transparency and integrity in service delivery. Many customers appreciate the company’s straightforward approach to contract terms and the absence of hidden fees, which is a significant plus in the credit card processing industry. The company’s use of Clover POS systems is frequently highlighted as a beneficial feature, providing reliable and efficient payment solutions for various business types. The ease of integration and the support provided for different payment methods are commonly praised by satisfied customers. Additionally, the company’s customer support is often commended for being responsive and helpful in resolving issues.

Common Complaints and Issues: Despite the positive feedback, some customers have reported issues primarily related to contract terms and unexpected fees. A few users have expressed frustration with the early termination fees, which can be as high as $495. Others have mentioned dissatisfaction with the equipment lease terms, which lock merchants into a three-year non-cancelable lease. There have also been occasional reports of delays in resolving billing disputes and issues related to the removal of the merchant agreement and program guide from the company’s website, which has led to some concerns about transparency.

Analysis of Online Reviews from Multiple Sources: Reviews from various sources, including the Better Business Bureau (BBB) and industry-specific review sites, indicate that MMG maintains a strong reputation overall. The BBB rates MMG with an A+ and notes that the company has received minimal complaints over the past three years. Reviews on platforms like CardPaymentOptions and MerchantServicesUpdate highlight the company’s transparency and effective customer service, though they also point out areas for improvement, such as better clarity in contract terms and fee structures. These mixed reviews suggest that while MMG performs well in many aspects, there is room for improvement in terms of communication and contract flexibility.

Customer Support and Resolution of Complaints: MMG’s customer support is known for being responsive and effective in handling complaints. Many users are satisfied with the prompt resolution of complaints. However, some users have reported delays in resolving disputes, which indicates the need to improve their customer services. Customers must carefully read and review the contract terms and ask for a detailed explanation of fees before signing an agreement to avoid potential misunderstandings in the future.

Merchant Management Group Review receives positive feedback for being transparent and offering prompt and effective customer support. However, it is crucial for potential customers to be aware of the contract issues and fee-related complaints. Due diligence on the terms and conditions of the company can lead to a seamless experience with MMG.

Employee Reviews and Company Culture

MMG is known for creating a positive work environment and providing opportunities for growth. Here’s a detailed look into the employee experiences, sales tactics, and overall company culture.

Summary of Employee Experiences: Employees at MMG have reported a positive work environment with supportive management and a collaborative atmosphere. The transparency and integrity of the company is reflected in their daily operations. Many employees appreciate the clear communication channels and the professional yet friendly workplace of the company. MMG values their employees and provides the necessary tools and support to succeed.

Sales Tactics and Training: MMG uses ethical sales tactics and stays away from misleading marketing practices. The company provides consistent and accurate information to potential clients and does not rely on independent resellers. The sales training at MMG ensures employees are well-equipped to explain the services and contract terms of the company clearly. This training focuses on building long-term relationships with clients rather than quick sales, which aligns with the company’s commitment to integrity.

Work Environment and Opportunities for Growth: The work environment at MMG is often described as dynamic and growth-oriented. Employees have access to ongoing professional development opportunities, which include training sessions, workshops, and mentorship programs. This focus on continuous learning helps employees advance their careers within the company. Additionally, the company promotes from within whenever possible, providing a clear path for career progression. The supportive culture and emphasis on personal development make MMG an attractive employer for those looking to build a long-term career in the payment processing industry.

Merchant Management Group is praised for its supportive work environment, ethical sales practices, and ample opportunities for growth. Employees generally feel valued and supported, contributing to a positive and productive company culture.

Awards and Recognitions

MMG has received numerous awards and accolades, showcasing its dedication to excellence and its prominent position in the payment processing sector.

Annual Awards and Recognitions

MMG has been acknowledged for its contributions to the payment processing sector through various awards over the years. The company has consistently demonstrated a high level of service quality and innovation, which has earned it accolades from industry peers and organizations. Though public domains don’t often focus on the specifics of annual awards, the company has built a strong reputation through its consistent performance and adherence to industry standards.

Industry Rankings and Ratings

MMG holds a commendable position in industry rankings and ratings, often highlighted for its transparency and customer-centric approach. The Better Business Bureau (BBB) has awarded MMG an A+ rating, indicating a high level of trustworthiness and minimal customer complaints. This rating reflects the company’s dedication to maintaining high standards in customer service and business practices.

Furthermore, MMG has solidified its reputation as a trustworthy service provider through its collaborations with industry leaders such as Fiserv and Wells Fargo. These collaborations not only prove MMG’s abilities but also boost its credibility in the field.

MMG’s recognition extends beyond just awards; it includes positive feedback from clients and industry analysts. The company’s approach to transparent contract terms and ethical sales practices has been positively reviewed by various sources, including industry review sites and consumer protection platforms.

Overall, MMG’s awards and industry rankings underscore its commitment to delivering high-quality payment processing solutions and maintaining a client-focused business model. These recognitions serve as a testament to the company’s consistent performance and its dedication to excellence in the payment processing industry.

Pros and Cons of MMG

MMG provides a range of payment processing services tailored to various business requirements. Although the company offers various benefits, there are also disadvantages that potential clients should take into account. Here is a summary of the advantages and disadvantages, taking into account the information at hand and feedback from customers.

Pros

Comprehensive Range of Services and Solutions: MMG provides a diverse array of services, including ACH and EBT acceptance, EMV processing, POS equipment, virtual terminals, and mobile payment solutions. Their additional offerings, such as merchant cash advances, loyalty programs, and business analytics, make them a versatile choice for various business types.

Transparent Contract Terms: One major benefit of MMG is its dedication to being transparent in its contract terms. The company is recognized for offering transparent and straightforward terms, minimizing the chance of surprise fees or conditions, a prevalent problem in the payment processing sector.

Strong Customer Support: MMG is praised for its responsive and helpful customer support. Clients often mention the ease of reaching customer service representatives and the effectiveness of resolving issues promptly. This strong support system contributes to a positive overall customer experience.

Minimal Negative Feedback: In comparison to numerous competitors, MMG has encountered very few negative comments from clients. This shows there is a fairly strong level of customer satisfaction and dependability in the services they offer.

Innovative Features Like the Cash Discount Program and Dunning Management: MMG offers innovative features such as the cash discount program, which helps merchants reduce credit card processing fees, and dunning management services, which assist in handling declined payments efficiently. These features add significant value to their service offerings.

Cons

Potential Undisclosed Fees: Despite their commitment to transparency, there have been instances where clients have reported undisclosed fees. This can be a concern for businesses that prefer fully predictable expenses.

Lengthy Contract Terms: MMG usually requires clients to sign a three-year agreement, which could be perceived as extensive by certain businesses. Making long-term commitments can be difficult, particularly for businesses that are new or experiencing rapid change.

Early Termination Fees: The company imposes an early termination fee of $495, which can be a substantial cost for businesses that need to terminate their contract early. This fee can be a deterrent for potential clients who are unsure about committing long-term.

Limited Online Reviews and Feedback: Compared to some of its competitors, MMG has fewer online reviews and feedback. The limited information can make it hard for potential clients to fully evaluate the company’s performance and reliability.

Merchant Management Group offers a robust set of services with several advantages, including comprehensive solutions, transparency, and strong customer support. Nevertheless, potential customers should take into consideration possible hidden charges, extended contract durations, penalties for early termination, and the lack of substantial online reviews. Conducting thorough due diligence and comparing MMG with other providers can help businesses make an informed decision.

Comparison with Competitors

When evaluating MMG against its key competitors in the payment processing industry, several factors stand out. This comparison will help potential clients understand MMG’s strengths and weaknesses relative to other major players.

Key Competitors in the Payment Processing Industry: Some of the notable competitors in the payment processing industry include Square, Stripe, Helcim, National Processing, and Dharma Merchant Services. Each of these companies offers unique features and caters to different business needs.

Strengths and Weaknesses Relative to Competitors: MMG is recognized for its wide variety of services, which include accepting ACH and EBT payments, processing EMV transactions, providing POS equipment, and offering mobile payment solutions. It stands out for its distinct offerings like the cash discount program and dunning management services. MMG also focuses on clear contract terms and reliable customer service, giving them an edge over competitors with complicated or unclear pricing structures.

However, MMG has some weaknesses. The lengthy three-year contract terms and substantial early termination fees can be a drawback, especially for small or rapidly changing businesses. Additionally, the potential for undisclosed fees and limited online reviews make it harder for potential clients to gauge the company’s reliability fully.

Cost Comparison and Value Proposition: In terms of pricing, MMG offers a tiered pricing model. For businesses processing up to $50,000 monthly, the typical rate is 2.69% plus $0.19 for swiped transactions and 3.69% plus $0.19 for keyed-in transactions. Higher volume businesses may benefit from reduced rates of 2.29% plus $0.19 and 3.29% plus $0.19 for swiped and keyed-in transactions, respectively. MMG also charges a $19.95 PCI compliance fee and a $495 early termination fee.

In comparison, competitors such as Square and Stripe provide more straightforward pricing options that may be more appealing to small enterprises. For instance, Square’s basic service has a fixed fee of 2.6% and an additional charge of $0.10 per transaction, without any monthly fees. Stripe is also recognized for its superb e-commerce integrations and competitive rates, which make it a top pick for online businesses.

Helcim is another strong competitor, particularly for businesses looking for an all-in-one solution. Helcim offers interchange-plus pricing, which can be more cost-effective for businesses with higher transaction volumes. Their rates start at interchange plus 0.40% plus $0.08 per transaction, and they do not charge monthly fees, which can be advantageous for cost-conscious businesses.

MMG offers a strong value proposition with its comprehensive service offerings and commitment to transparency. However, potential clients should carefully consider the contract terms and compare the overall costs and benefits with those of competitors like Square, Stripe, and Helcim to ensure they choose the best fit for their business needs.

Conclusion

Merchant Management Group offers a range of payment processing services, transparent contract terms, and strong customer support. The cash discount program and dunning management further add to its appeal. However, clients must be aware of the undisclosed fees, long contract terms, and early termination fees to make an informed decision. MMG is ideal for businesses looking for robust and reliable payment solutions. It’s best to compare their service offerings with competitors to choose the right fit for your needs.