Payments by Wave Review

- 02nd Jan, 2025

- | By Linda Mae

- | Reviews

Payments by Wave is an essential feature of Wave, a financial software platform aimed at supporting small businesses, freelancers, and entrepreneurs. Introduced to streamline payment handling, it provides a cohesive solution for overseeing invoices and collecting payments. The service is especially attractive to small businesses because of its user-friendly interface and affordable pricing. Lets read more about Payments by Wave Review.

At its core, Payments by Wave enables users to accept credit card payments, ACH transfers, and digital wallet transactions. With a built-in invoicing system, businesses can generate professional invoices and track payments seamlessly. Wave’s focus on small businesses means it caters to those with limited budgets who require reliable and efficient payment solutions.

The platform’s cost-effectiveness and user-friendliness have contributed to its popularity among business owners. Nonetheless, its straightforwardness might not be ideal for every business, particularly for those with intricate payment processing requirements. This review seeks to deliver an impartial evaluation of Payments by Wave, examining its characteristics, advantages, and possible disadvantages. Whether you’re a freelancer or a small business owner, knowing how this platform operates can assist you in determining if it suits your requirements.

Ease of Use and Interface | Payments by Wave Review

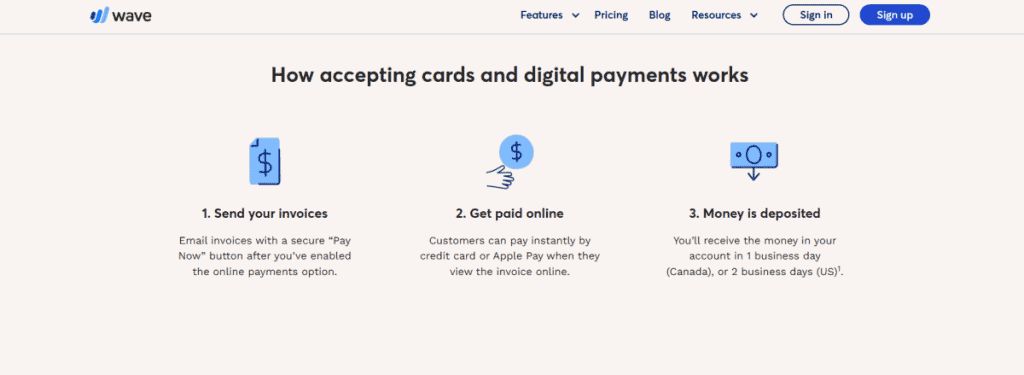

One of the standout features of Payments by Wave is its user-friendly interface. Designed with simplicity in mind, it ensures even non-technical users can navigate the platform with ease. Setting up payments involves a straightforward process: users link their bank accounts or payment methods, configure their invoicing preferences, and start accepting payments almost immediately.

The dashboard is user-friendly, showing all essential information at a quick glance. Users can access pending invoices, track payments, and oversee their cash flow without having to toggle between various tools. The platform’s simple design and straightforward guidance make it a great option for small business owners who might not have technical skills.

Both desktop and mobile versions of the software are optimized for smooth performance. This flexibility allows business owners to manage their accounts on the go, ensuring they never miss an important transaction. However, while the interface excels in simplicity, it may lack advanced customization options sought by larger enterprises.

In addition, Payments by Wave’s onboarding process is straightforward. New users are guided through each step, from linking bank accounts to customizing invoices. Tutorials and tooltips are available to help users make the most of the platform. Despite these strengths, users with specific workflow requirements might find the lack of advanced features limiting.

Payment Features and Functionality

Payments by Wave offers robust functionality tailored to the needs of small businesses. Users can accept a variety of payment methods, including credit cards and bank transfers. The platform supports Visa, Mastercard, American Express, and ACH payments, ensuring versatility for diverse customer preferences.

A highly appealing aspect is its smooth integration with Wave’s invoicing features. Users can generate professional invoices right on the platform, dispatch them to clients, and collect payments all in one location. Automated reminders for payments and real-time tracking of payments make the process even easier.

The invoicing system also supports partial payments and tips, adding flexibility for businesses in the service industry. For instance, a restaurant using Payments by Wave can accept gratuities directly through the platform, streamlining operations.

Mobile compatibility ensures that users can send invoices and accept payments on the go. This is particularly useful for freelancers and entrepreneurs who operate outside traditional office settings. However, while Payments by Wave covers most basic payment needs, it may not support international transactions or multi-currency options, which could limit its appeal for global businesses.

Transaction Fees and Pricing

Transaction fees are a crucial consideration when choosing a payment processor. Payments by Wave follows a transparent pricing model: 2.9% + $0.30 per transaction for credit cards and 1% for ACH bank transfers. While these rates are competitive compared to some industry standards, they may not be the lowest available.

Unlike many competitors, Wave does not charge setup fees, monthly fees, or hidden costs. This makes it a viable option for small businesses with tight budgets. However, larger businesses processing high volumes might find the per-transaction fees add up over time, making it less cost-effective.

When compared to platforms like PayPal or Stripe, Wave’s pricing structure holds its own. The lack of monthly fees is a significant advantage, though businesses with specific needs (such as recurring billing or advanced analytics) might find Wave less comprehensive than alternatives.

It’s important to mention that payment processing can take between 2 to 7 business days, depending on the method used. For companies requiring quick payouts, this schedule could be a disadvantage. Moreover, Wave’s restricted support for international transactions indicates that companies with worldwide customers might face extra expenses when utilizing third-party payment processors.

Security and Compliance

Security is a top priority for any payment processor, and Payments by Wave does not disappoint. The platform employs advanced encryption technologies to protect sensitive data, ensuring transactions are secure and customer information remains private.

Wave complies with PCI DSS requirements, a critical factor in safeguarding payment data. This compliance assures users that their transactions are processed following industry best practices.

Moreover, Wave’s strong fraud detection systems assist in recognizing and reducing possible risks. Although the platform’s security features are dependable, companies dealing with high-value transactions or working in high-risk sectors might require extra security measures alongside Wave.

Wave also provides transparency around its security policies, offering detailed documentation for users concerned about data protection. This commitment to transparency fosters trust among its users, particularly small business owners who may be wary of digital payment platforms.

Customer Support and Service

Customer support is an area where Payments by Wave receives mixed reviews. The platform offers several support channels, including email support, a comprehensive help center, and community forums. However, live chat and phone support are not readily available, which could be a drawback for users requiring immediate assistance.

Response times for email queries are typically quick, but complicated matters might require more time to address. The help center is neatly arranged, offering comprehensive guides and frequently asked questions to tackle common inquiries. For numerous users, these tools are adequate to maneuver through the platform efficiently.

While the customer support experience is adequate for basic troubleshooting, businesses that prioritize real-time support might find Wave’s offerings limited compared to competitors with 24/7 live support options. Users with unique needs or those encountering rare technical issues may feel underserved.

Integration with Accounting Tools

One of Wave’s biggest strengths is its seamless integration with its accounting tools. Payments by Wave synchronizes automatically with Wave’s accounting software, allowing users to manage payments, invoices, and bookkeeping in one place. This integration reduces the need for manual data entry, saving time and minimizing errors.

For small enterprises with restricted resources, this feature is essential. The automatic sorting of transactions simplifies financial reporting and tax filing. Nonetheless, although the integration with Wave’s ecosystem is outstanding, the platform’s compatibility with external tools is constrained. Individuals depending on third-party accounting applications may encounter difficulties.

Customization and Scalability

Customization options in Payments by Wave are relatively basic, reflecting its focus on simplicity. Users can personalize invoice templates, add logos, and configure payment reminders, but deeper customization features—such as custom workflows—are absent.

Scalability represents yet another limitation. Although the platform works effectively for small businesses, it might find it challenging to cater to the demands of expanding companies. Bigger companies with intricate payment needs or elevated transaction levels may notice the platform’s restrictions more clearly. Competitors providing scalable solutions could be more suitable for these users.

Pros and Cons of Payments by Wave

Pros:

User-friendly interface and straightforward setup

Competitive transaction fees with no monthly costs

Seamless integration with Wave’s accounting and invoicing tools

Mobile-friendly for on-the-go payment management

Robust security measures and PCI DSS compliance

Cons:

Limited international payment options

No live chat or phone support

May lack advanced features needed by larger businesses

Per-transaction fees can add up for high-volume users

Relatively basic analytics and reporting tools

Ideal Use Cases and Target Users

Payments by Wave is best suited for small businesses, freelancers, and entrepreneurs who need a simple, low-cost payment processing solution. It’s particularly advantageous for those already using Wave’s accounting and invoicing tools, as the integration creates a seamless financial management experience.

Nonetheless, companies needing sophisticated functionalities such as multi-currency capabilities, recurring billing, or comprehensive analytics may consider Wave’s services insufficient. Likewise, businesses with a worldwide clientele might require a system that facilitates global transactions and currencies.

To maximize its potential, users should leverage Wave’s invoicing features and maintain a clear understanding of its fee structure. Regularly monitoring transaction volumes can also help determine if Wave remains a cost-effective solution as the business grows.

Competitor Comparison

Wave competes with platforms like PayPal, Stripe, and Square, each offering unique strengths. PayPal is known for its global reach, supporting international transactions, while Stripe excels in developer-friendly APIs for custom integrations. Square stands out for its hardware solutions and in-person payment capabilities.

Wave’s advantage lies in its free accounting tools and competitive pricing. However, it lacks some of the advanced features its competitors provide, making it less suitable for larger businesses. When choosing between these platforms, consider your specific needs, such as support for global transactions or in-person payments.

Future Updates and Development

Wave regularly updates its platform based on user feedback. Recent enhancements include improved mobile functionality and streamlined invoicing features. Users have expressed interest in additional capabilities, such as recurring billing and multi-currency support, which may be included in future updates.

Keeping updated on these changes allows users to maximize their experience on the platform. Wave’s dedication to enhancing its services demonstrates its focus on addressing the requirements of small businesses.

Payment Speed and Processing Times

The speed at which payments are processed can significantly impact cash flow for small businesses. Payments by Wave generally takes 2-7 business days to process transactions, depending on the payment method used. Credit card payments tend to be faster, typically clearing within two business days, whereas ACH bank transfers can take up to seven business days.

This processing time is comparable to other small business payment processors but may be slower than some of the larger platforms, such as Square or Stripe, which offer expedited payouts for an additional fee. Wave does not currently offer instant payment options, which might be a limitation for businesses requiring immediate access to funds.

The platform compensates for this delay through its clear reporting system, which updates users on the payment status. Alerts and information guarantee that companies are aware of incoming funds, reducing ambiguity. Nonetheless, the lag in payment receipt may create difficulties for companies functioning with limited cash flow.

To mitigate this, businesses can plan their invoicing and payment schedules around Wave’s processing times. Encouraging customers to pay invoices promptly and utilizing the platform’s automated reminders can help reduce delays. While the processing speed may not be ideal for all users, it aligns with industry standards for low-cost payment processors.

Mobile App Features

Payments by Wave offers a mobile app that complements its desktop platform, providing on-the-go access to key features. Available for both iOS and Android, the app enables users to manage invoices, track payments, and access reports from their mobile devices.

The mobile app is particularly beneficial for freelancers and small business owners who work remotely or need to handle transactions during client meetings. It allows users to send invoices directly from their smartphones, ensuring that billing is never delayed. Additionally, the app’s payment tracking feature provides real-time updates on the status of transactions, which is invaluable for maintaining cash flow visibility.

Although it offers convenience, the app has certain drawbacks. For instance, specific features present in the desktop version, like detailed reporting and sophisticated customization options, might not be entirely accessible on mobile. This might be a disadvantage for users who depend significantly on the app for complete financial management.

Overall, the mobile app enhances the usability of Payments by Wave, making it a versatile tool for business owners who need flexibility. Regular updates and user feedback have improved the app over time, though further enhancements could make it even more robust.

User Reviews and Community Feedback

User reviews provide valuable insights into the practical strengths and weaknesses of Payments by Wave. Many small business owners praise the platform for its simplicity and integration with Wave’s accounting tools. The lack of monthly fees and hidden costs is frequently highlighted as a major advantage, particularly for startups and solo entrepreneurs.

However, some users have expressed concerns about the platform’s limited customer support options and occasional delays in payment processing. The absence of phone support or live chat can be frustrating for users who encounter time-sensitive issues. Additionally, businesses with international clients often note the lack of multi-currency support as a significant limitation.

Community forums and online reviews likewise indicate areas for enhancement, including the addition of more advanced reporting features and broadening integration options. Wave has shown it is responsiveness to user feedback, implementing multiple updates to tackle frequent issues. This dedication to enhancement builds trust and loyalty within its user community, even with the platform’s constraints.

By considering user reviews and feedback, potential users can gain a balanced understanding of what to expect from Payments by Wave. While it excels in affordability and ease of use, businesses with specialized needs should evaluate whether its features align with their requirements.

Impact on Business Operations

Integrating Payments by Wave into daily operations can streamline workflows and improve financial management. The platform’s automated invoicing and payment tracking reduce the need for manual follow-ups, allowing business owners to focus on core activities. By synchronizing with Wave’s accounting tools, it minimizes errors and ensures accurate record-keeping.

For businesses that provide services, the option to receive partial payments or gratuities offers added flexibility. Retail companies, on the other hand, may view the absence of point-of-sale features as restrictive, particularly if they need hardware solutions for face-to-face transactions. Wave’s emphasis on digital payments makes it perfect for online or remote enterprises, yet less appropriate for physical storefronts.

Ultimately, Payments by Wave can significantly enhance efficiency for small businesses, provided it aligns with their operational needs. Regularly reviewing its impact on workflow can help businesses adapt and maximize its benefits.

FAQs About Payments by Wave

Q1: Are there any hidden fees with Payments by Wave?

A1: No, Wave’s pricing model is transparent, with no hidden fees. Users only pay transaction fees for credit card and ACH payments.

Q2: Does Payments by Wave support international payments?

A2: Payments by Wave primarily supports transactions in the United States and Canada. International payments are not widely supported, which may limit its use for global businesses.

Q3: Can Payments by Wave handle recurring billing?

A3: Currently, Payments by Wave does not offer recurring billing features. Users may need to explore third-party integrations for this functionality.

Q4: How long does it take to receive payments?

A4: Payments typically take 2-7 business days to process, depending on the payment method. Credit card payments are faster than ACH transfers.

Q5: Is Payments by Wave compatible with mobile devices?

A5: Yes, Wave offers mobile-friendly tools, allowing users to manage payments and invoices on the go.